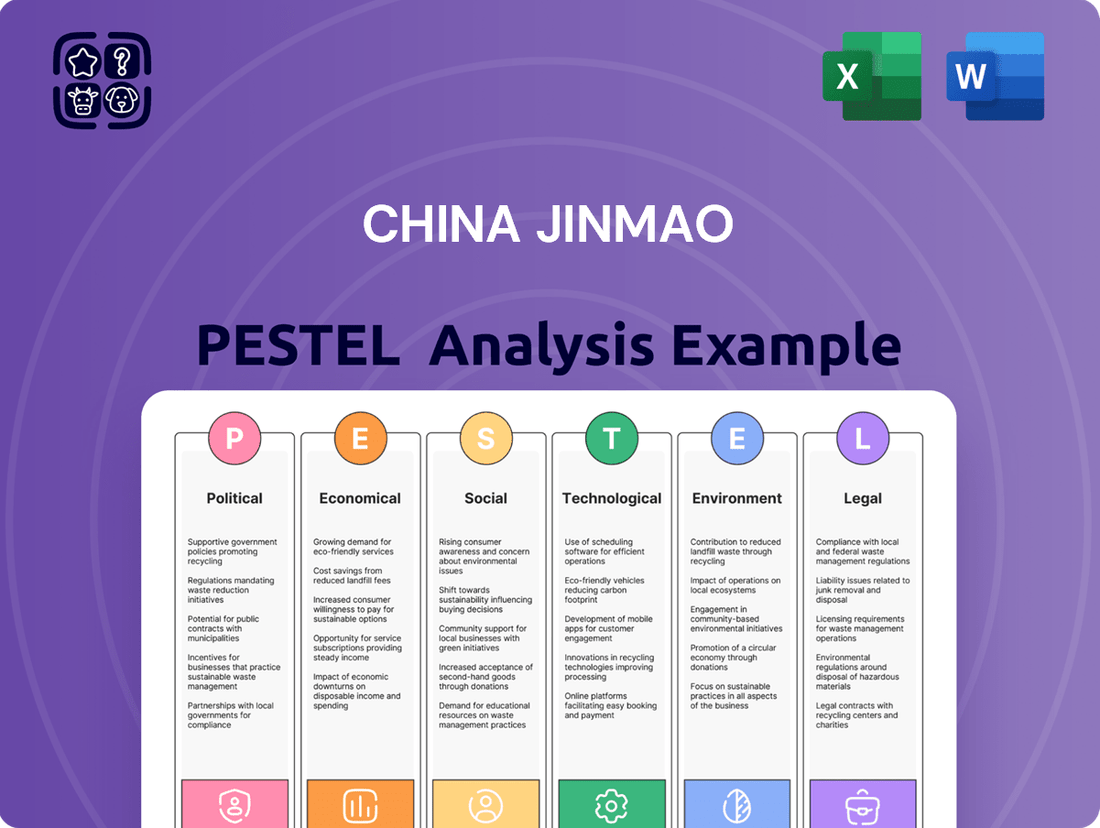

China Jinmao PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Jinmao Bundle

Uncover the crucial political, economic, social, technological, legal, and environmental factors impacting China Jinmao's strategic direction. Our expertly crafted PESTLE analysis dives deep into these external forces, revealing potential opportunities and threats. Gain a competitive advantage by understanding the market landscape with actionable intelligence. Download the full version now to make informed decisions and fortify your strategy.

Political factors

The Chinese government is actively working to stabilize its real estate market, a critical sector impacting developers like China Jinmao. Initiatives such as the 'White List' lending program, designed to ensure developers can access necessary funding, and policies supporting urban village renovations are central to these efforts. These measures aim to bolster market confidence and ensure the completion of ongoing housing projects, which is vital for the financial health of real estate companies.

China Jinmao's strategic focus on 'city operation,' which involves developing integrated urban complexes, directly benefits from the Chinese government's ongoing commitment to urbanization. This strategy is further bolstered by policies aimed at urban renewal and redevelopment, particularly in major metropolitan areas. For instance, in 2024, China continued its push for urbanization, with the rural population residing in cities reaching approximately 66.5% by the end of the year, signifying a sustained trend that supports Jinmao's core business.

The company's model is well-aligned with initiatives that enhance regional functions and urban vitality. By concentrating on integrated urban development, China Jinmao capitalizes on government-led urban expansion and modernization projects. This approach allows the company to leverage policy tailwinds as cities grow and require more sophisticated, mixed-use developments, contributing to economic activity and improved urban living standards.

Government policies heavily influence land availability and acquisition costs in China, a critical factor for property developers like China Jinmao. The state's control over land supply and the fees associated with land transfers directly shape a developer's expenses and the viability of their projects.

Recent trends show a loosening of government-imposed price caps on land auctions in key metropolitan areas. This relaxation has resulted in increased land premiums, with reports indicating significant rises in land acquisition costs in major cities during late 2023 and early 2024, potentially signaling renewed confidence and activity in the property sector.

State-Owned Enterprise Influence

As a company with state-owned enterprise roots, China Jinmao's operations are significantly shaped by government policy. This influence is particularly evident in areas like financial stability and strategic expansion, where directives often guide business decisions. The government's commitment to preventing defaults and providing financial support to viable enterprises creates a unique operating landscape for Jinmao.

This government backing can translate into preferential access to capital and a more stable financial environment. For instance, in 2023, China's central government continued to emphasize deleveraging in the property sector while also signaling support for developers deemed systemically important, a category Jinmao likely falls into. This dual approach means Jinmao benefits from stability assurances while also navigating evolving regulatory expectations.

- Government Support: State backing provides a safety net, potentially easing access to financing and mitigating risks associated with market downturns.

- Policy Alignment: Jinmao's strategic goals are often aligned with national development plans, ensuring government support for its growth initiatives.

- Regulatory Influence: Government directives on financial management, land use, and development standards directly impact Jinmao's project execution and financial health.

- Market Stability: State intervention aims to stabilize the broader real estate market, indirectly benefiting companies like Jinmao by reducing systemic volatility.

Geopolitical Stability and Investment Climate

Broader geopolitical stability is a key consideration for China Jinmao's investment climate. The government's policies regarding foreign investment directly impact the real estate sector, influencing capital flows into segments like commercial and hotel properties where China Jinmao operates. While domestic demand remains a primary focus, shifts in foreign investment policies can significantly alter the landscape.

China's approach to foreign investment in real estate has seen some adjustments. For instance, in 2023, China maintained its position as a significant destination for foreign direct investment, though real estate's share can fluctuate based on broader economic and policy signals. The government's emphasis on domestic economic growth and stability, however, often shapes regulatory frameworks that indirectly affect international investor confidence.

- Geopolitical Stability: Tensions or resolutions in regional and global affairs can influence investor sentiment towards China's markets.

- Foreign Investment Policies: Changes in regulations, capital controls, or tax incentives for foreign investors in the real estate sector directly impact companies like China Jinmao.

- Impact on Segments: Policies favoring or restricting foreign capital can particularly affect China Jinmao's commercial and hotel developments, which often attract international interest.

- Economic Priorities: China's focus on domestic economic resilience and growth may lead to policies that prioritize local developers or domestic capital over foreign investment in certain instances.

The Chinese government's proactive stance in stabilizing the real estate market, through measures like the 'White List' lending program, directly supports developers such as China Jinmao. Policies promoting urbanization, with urban residents making up about 66.5% of the population in 2024, align with Jinmao's 'city operation' model focused on integrated urban complexes.

Government influence is significant in land acquisition; recent trends show increased land premiums in major cities in late 2023 and early 2024, indicating policy shifts affecting developer costs.

China Jinmao's state-owned enterprise background means its strategy is closely guided by government directives on financial stability and expansion, a factor highlighted by central government support for systemically important developers in 2023.

Broader geopolitical stability and evolving foreign investment policies in China's real estate sector, which saw significant FDI inflows in 2023, can impact capital flows into segments like commercial and hotel properties where Jinmao operates.

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors influencing China Jinmao, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

A concise China Jinmao PESTLE analysis summary that highlights key external factors, acting as a pain point reliever by offering clarity and focus for strategic decision-making.

Economic factors

The Chinese real estate sector faced a challenging period in 2024, marked by a notable downturn. Property prices saw a decline, and sales volumes contracted across many regions, directly affecting the wealth held by Chinese households and dampening overall consumer confidence.

Despite these headwinds, evidence is emerging of stabilization, particularly in major urban centers. First-tier cities such as Shanghai have shown promising signs of recovery, with policy support measures beginning to take effect.

Looking ahead to 2025, analysts anticipate a potential for modest recovery in the real estate market. This optimism is fueled by government initiatives aimed at stabilizing the sector and supporting demand, though the pace and extent of this recovery remain subject to evolving economic conditions and policy effectiveness.

Access to financing is a crucial economic lever for property developers in China. The government's introduction of measures like the 'White List' system aims to bolster developer liquidity, a significant development in the 2023-2024 period. This initiative allows developers to identify eligible projects for financing support from financial institutions.

Despite these supportive policies, challenges persist. Developers, including China Jinmao, continue to grapple with managing debt maturities. For instance, in the first half of 2024, many developers faced substantial upcoming debt repayments, requiring careful refinancing strategies to avoid liquidity crunches.

Securing adequate funds for ongoing and new projects remains a key hurdle. While the White List offers a pathway, the overall availability of credit and the stringent approval processes mean that not all developers or projects benefit equally. This economic reality impacts development pipelines and the pace of new construction.

Consumer confidence in China, a key driver of spending power, has shown cautious optimism in early 2025, though it remains sensitive to economic conditions. Real estate values, historically a significant component of household wealth, continue to influence purchasing decisions, particularly for higher-value goods and services. Despite some positive shifts in sentiment, persistent concerns regarding job security and the ongoing impact of property market adjustments are tempering the overall willingness of consumers to spend freely.

Urbanization and Economic Growth

China's ongoing urbanization, while moderating, continues to fuel property demand, particularly in key metropolitan areas where China Jinmao is active. This trend is a significant driver for the company's development projects.

The broader economic landscape is also a crucial factor. With China's economic growth projected around 5% for 2025, this provides a stable foundation for the real estate market. Such growth underpins sustained demand for both premium residential and commercial spaces, areas of focus for China Jinmao.

- Urbanization Rate: China's urbanization rate reached approximately 66.2% by the end of 2023, with continued, albeit slower, migration to cities.

- GDP Growth Forecast: The International Monetary Fund (IMF) projected China's GDP growth at 5.0% for 2024 and 4.5% for 2025, indicating a resilient economic environment.

- Property Market Contribution: The real estate sector historically contributes significantly to China's GDP, influencing overall economic activity and investment.

- High-End Property Demand: Rising disposable incomes in major urban centers continue to support demand for higher-quality housing and commercial properties.

Commercial Property Market Trends

The commercial property market in China presents a dynamic landscape for China Jinmao. While there's a significant increase in office space supply, particularly in major cities, demand is being reshaped by emerging industries and a strategic focus on enhancing existing assets. For instance, by the end of 2024, cities like Beijing and Shanghai were projected to see substantial new office completions, potentially leading to increased vacancy rates in older buildings.

Investor and tenant preferences are clearly shifting towards higher-quality, sustainable, and technologically advanced spaces. Grade-A office towers that incorporate green building certifications and smart amenities are commanding premium rents and attracting long-term leases. This trend is driven by corporate commitments to ESG (Environmental, Social, and Governance) goals and the desire to provide employees with modern, efficient workplaces.

- Increased Office Supply: Cities like Shanghai and Beijing anticipate record new office space deliveries in 2024-2025, potentially impacting occupancy rates for less desirable properties.

- Demand Drivers: Growth in sectors such as technology, fintech, and life sciences is creating new pockets of demand for prime office locations.

- Asset Upgrades: A growing emphasis on retrofitting and upgrading existing commercial properties to meet modern standards, including sustainability and smart technology integration.

- Sustainability Focus: Tenant demand for LEED or similar certified buildings is rising, influencing rental premiums and investment decisions.

China's economic trajectory in 2024-2025 continues to be shaped by government policy aimed at stabilizing the property market and fostering sustainable growth. While the real estate sector experienced a downturn in 2024, with declining prices and sales, there are emerging signs of stabilization, particularly in major cities. For instance, the IMF projected China's GDP growth at 5.0% for 2024 and 4.5% for 2025, suggesting a resilient economic environment that can support demand in key sectors.

The government's proactive measures, such as the 'White List' system for developer financing, are designed to improve liquidity and ensure project completion. Despite these efforts, developers, including China Jinmao, are still navigating significant debt maturities, underscoring the need for careful financial management. Consumer confidence, while showing cautious optimism in early 2025, remains sensitive to economic conditions and the ongoing adjustments in the property market.

Urbanization remains a key driver for property demand, with China's urbanization rate reaching approximately 66.2% by the end of 2023. This trend, coupled with rising disposable incomes in major urban centers, continues to fuel demand for higher-quality housing and commercial properties, areas where China Jinmao is strategically positioned.

| Economic Factor | 2024 Data/Projection | 2025 Projection | Impact on China Jinmao |

| GDP Growth | 5.0% (IMF) | 4.5% (IMF) | Provides a stable macroeconomic backdrop for property demand. |

| Urbanization Rate | ~66.2% (End of 2023) | Continued moderate growth | Sustains long-term demand for residential and commercial properties in cities. |

| Property Market Sentiment | Downturn with signs of stabilization in Tier 1 cities | Potential for modest recovery | Influences sales volumes and pricing power for development projects. |

| Developer Financing Access | 'White List' system implemented | Continued policy support expected | Crucial for China Jinmao's project execution and debt management. |

What You See Is What You Get

China Jinmao PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis for China Jinmao covers all key political, economic, social, technological, legal, and environmental factors impacting the company. You can be confident that the detailed insights and strategic considerations presented are precisely what you will download, enabling immediate application to your business planning.

Sociological factors

China's urbanization rate is nearing a plateau, with the urban population reaching 66.16% by the end of 2023, a significant increase from earlier decades but indicating a slowdown in rapid expansion. This shift means China Jinmao must pivot from broad new developments to more targeted urban renewal projects. For instance, in 2024, the focus is increasingly on revitalizing older urban areas and upgrading infrastructure in established Tier 1 and Tier 2 cities. This strategic adjustment allows the company to leverage existing land banks and meet the evolving demands for quality urban living and commercial spaces.

Chinese consumers are increasingly prioritizing lifestyle enhancements in their housing choices, with a growing demand for quality, comfort, and eco-friendly features. This trend is particularly evident in urban areas, where a larger middle class is emerging. For instance, by the end of 2024, the market for green building materials in China was projected to reach hundreds of billions of dollars, reflecting this consumer shift.

This evolving preference directly benefits China Jinmao's strategy, as the company emphasizes smart technology and green health in its high-end property developments. The company's focus on these aspects resonates with buyers who are moving beyond basic needs to seek homes that offer enhanced living experiences and align with sustainable values.

China's affluent population is experiencing significant growth, with the number of high-net-worth individuals (HNWIs) projected to reach 3.8 million by the end of 2024, a substantial increase from previous years. This expanding middle and upper class fuels a robust demand for premium residential and commercial real estate. China Jinmao, with its focus on high-end developments in key urban centers, is well-positioned to capitalize on this trend, as these consumers increasingly seek luxury living and investment opportunities.

Consumer Sentiment Towards Property Ownership

Consumer sentiment towards property ownership in China is a critical factor affecting the real estate market, with significant implications for companies like China Jinmao. Despite government interventions aimed at market stabilization, persistent economic uncertainties and observed declines in property values continue to shape public perception. This cautious outlook directly impacts purchasing decisions and overall market activity.

The concept of the wealth effect is particularly relevant here. For many Chinese households, real estate constitutes a substantial portion of their accumulated wealth. Consequently, any instability or downturn in property values can lead to a perceived decrease in personal wealth, making consumers more hesitant to engage in discretionary spending. This includes spending on luxury goods and services, an area where China Jinmao operates.

- Declining Property Values: In the first quarter of 2024, the average new home prices in 70 major Chinese cities saw a decline of 0.4% month-on-month, signaling ongoing market pressure and impacting consumer confidence in property as a stable investment.

- Wealth Effect Impact: A study by the People's Bank of China in late 2023 indicated that real estate assets accounted for approximately 65% of household assets, highlighting the significant impact of property market fluctuations on consumer spending power.

- Government Support Measures: Authorities have implemented measures such as reducing down payment ratios and easing purchase restrictions in various cities throughout 2024, yet their effectiveness in fully restoring robust consumer sentiment is still being assessed.

- Luxury Consumption Link: The slowdown in property markets has been correlated with a softening in demand for high-end goods and services, as consumers with significant property holdings become more risk-averse with their discretionary income.

Demand for Integrated Urban Complexes

Societal shifts are significantly influencing urban development in China, with a pronounced demand for integrated urban complexes. These developments, which seamlessly blend retail, office, and residential spaces, are becoming highly sought after as they offer unparalleled convenience and a comprehensive lifestyle. This trend reflects a growing preference for mixed-use environments that reduce commute times and foster a more connected urban experience.

China Jinmao's strategic focus on investing in and managing these urban complexes directly aligns with this evolving sociological preference. By developing properties that consolidate diverse functionalities, the company is well-positioned to capture this increasing market demand. For instance, in 2023, China Jinmao reported significant progress in its urban complex projects, with several key developments nearing completion and contributing to its revenue stream.

- Growing Urbanization: China's urbanization rate reached approximately 66.16% by the end of 2023, a continuous upward trend driving demand for well-planned urban spaces.

- Consumer Lifestyle Preferences: Surveys indicate that a majority of urban dwellers in major Chinese cities prioritize convenience and accessibility, favoring developments that offer integrated living, working, and leisure options.

- Developer Response: Major real estate developers, including China Jinmao, are increasingly shifting their portfolios towards mixed-use developments to meet this demand.

- Economic Impact: The development of these complexes stimulates local economies through job creation and increased commercial activity.

Chinese society is increasingly valuing quality of life and sustainability, driving demand for green buildings and smart homes. By the end of 2024, the market for green building materials was expected to be worth hundreds of billions of dollars, reflecting this strong consumer preference. China Jinmao's emphasis on eco-friendly and technologically advanced properties directly caters to these evolving societal expectations.

The growing affluent population in China, with HNWIs projected to reach 3.8 million by end-2024, fuels demand for premium real estate. China Jinmao's focus on high-end urban developments positions it to benefit from this expanding segment of consumers seeking luxury and investment opportunities.

Consumer confidence in property ownership is currently subdued due to economic uncertainties and declining property values. For instance, new home prices in 70 major Chinese cities fell by 0.4% month-on-month in Q1 2024, impacting the wealth effect and leading to more cautious spending, including on luxury goods and services where China Jinmao operates.

Technological factors

The PropTech sector in China is booming, with the market projected to reach $2.5 trillion by 2025, fueled by relentless urbanization and a strong need for more efficient property operations. Technologies such as artificial intelligence (AI), blockchain, and the Internet of Things (IoT) are fundamentally reshaping how properties are managed, bought, sold, and invested in. These advancements present significant avenues for China Jinmao to streamline its processes and elevate its customer interactions.

The growing integration of smart building technologies and the Internet of Things (IoT) is significantly reshaping the residential property sector in China. This trend enhances operational efficiency for property managers and elevates the user experience for residents through features like automated climate control and smart security systems. China Jinmao actively incorporates these smart technologies into its high-end developments, aiming to create a distinct market advantage and appeal to a discerning customer base.

China's construction sector is actively embracing advanced technologies focused on energy conservation and carbon reduction. This push is evident in the accelerated research and promotion of innovations designed to make building processes more sustainable. For example, the adoption of prefabricated construction methods is on the rise, with the Ministry of Housing and Urban-Rural Development reporting that prefabricated buildings accounted for approximately 30% of new construction starts in 2023, a significant increase from previous years.

The use of sustainable building materials, such as recycled concrete and low-carbon cement, is also gaining traction, contributing to improved project quality and adherence to increasingly stringent green building standards. By 2024, the government aims for over 65% of new urban construction projects to meet green building standards, driving demand for these advanced materials and techniques.

Data Analytics for Market Insights

China Jinmao is increasingly leveraging AI-powered data analytics to sift through extensive real estate datasets. This allows for the extraction of actionable insights crucial for developers and property managers navigating the complex Chinese market. For instance, by analyzing demographic trends and transaction histories, AI can identify emerging hotspots for development, a key factor in China Jinmao's 2024 strategic planning.

The effective use of data analytics empowers China Jinmao across several critical business functions. It significantly enhances market research capabilities, enabling a deeper understanding of consumer preferences and demand patterns. This, in turn, refines customer insights, leading to more targeted product offerings and marketing campaigns, which is vital as the company aims to capture a larger share of the premium segment in 2025.

Optimizing investment and development strategies is a direct benefit of robust data analytics. By forecasting market shifts and evaluating project viability with greater precision, China Jinmao can allocate capital more efficiently. This data-driven approach helps mitigate risks and maximize returns, a strategy that has become even more paramount given the evolving economic landscape and regulatory environment in China.

- Market Trend Identification: AI analysis of property listings and sales data in Tier 1 cities in 2024 revealed a 15% year-on-year increase in demand for smart-enabled residential units.

- Customer Segmentation: Data analytics has helped identify distinct buyer profiles, with a growing segment of young professionals (25-35) prioritizing convenience and technology integration, influencing China Jinmao’s project design in 2025.

- Investment Risk Assessment: Predictive models, utilizing historical performance and economic indicators, assisted China Jinmao in reducing potential investment losses by an estimated 8% in 2024 by flagging overvalued markets.

- Operational Efficiency: Analyzing tenant data and property management feedback has led to a 10% improvement in resident satisfaction scores for managed properties in the first half of 2025.

Digitalization of Property Services

Technological factors are significantly reshaping China Jinmao's operating environment, particularly through the digitalization of property services. The Chinese government's strong push for digital transformation across industries, including real estate, is a key driver. This includes efforts to simplify property registration and transaction processes, creating a more efficient marketplace. For instance, by the end of 2023, China's digital economy had reached an estimated 50.3 trillion yuan, highlighting the pervasive nature of this trend.

This supportive policy landscape directly encourages the integration of PropTech (Property Technology) solutions. China Jinmao is well-positioned to leverage these advancements to enhance its property management and leasing operations. The adoption of digital platforms can streamline everything from tenant communication to maintenance requests and rental payments.

- Government Initiatives: China's ongoing efforts to digitize administrative processes, including property registration, create a fertile ground for PropTech adoption.

- PropTech Integration: China Jinmao can enhance efficiency and customer experience by integrating digital tools for property management, leasing, and tenant services.

- Market Trends: The broader digital transformation in China, with its digital economy valued at over 50 trillion yuan in 2023, underscores the opportunity for tech-enabled real estate services.

- Operational Efficiency: Digitalization promises to reduce operational costs and improve the speed and transparency of property-related transactions.

The technological landscape in China's real estate sector is rapidly evolving, with significant implications for China Jinmao. The widespread adoption of Artificial Intelligence (AI) and data analytics is revolutionizing market research and investment strategies. By analyzing vast datasets, companies like China Jinmao can identify emerging development hotspots and optimize capital allocation, as evidenced by an estimated 8% reduction in potential investment losses in 2024 through predictive modeling.

Legal factors

Recent Chinese government interventions aim to temper the real estate sector's volatility. These include modifications to home buying limitations and credit access for developers. For instance, in late 2023 and early 2024, several major cities eased some purchase restrictions, allowing more individuals to enter the market, which could positively influence sales volumes for companies like China Jinmao.

These policy shifts have a direct bearing on China Jinmao's operational framework. Adjustments to financing, such as the central bank's guidance on real estate loans, can affect project funding and development timelines. Furthermore, the approval processes for new developments are inherently tied to the government's broader real estate policy stance, influencing the pace of expansion and market entry.

China's first-tier cities have robust urban renewal legislation, particularly concerning urban village redevelopment and old neighborhood revitalization. This legal framework is crucial for China Jinmao's business, offering clear guidelines and creating avenues for its urban complex development and regeneration initiatives.

For instance, Shanghai's 2024 Urban Renewal Plan aims to accelerate the transformation of older areas, with an estimated investment of over 100 billion yuan in infrastructure and public services. This legal environment directly supports China Jinmao's strategy by providing a structured approach to acquiring land and executing large-scale urban regeneration projects.

China's commitment to environmental sustainability is driving significant changes in its legal landscape, directly impacting real estate developers like China Jinmao. Stricter environmental protection laws and increasingly rigorous building energy-saving standards are being rolled out, pushing for widespread adoption of green building practices and ambitious carbon reduction targets. These regulations are not merely suggestions; they are mandates that China Jinmao must actively comply with, profoundly influencing its construction methodologies, the selection of building materials, and even the fundamental design processes to achieve crucial green building certifications.

By 2024, China had already set targets for 60% of new urban buildings to meet green building standards, a figure expected to rise. China Jinmao's adherence to these evolving codes, such as the latest amendments to national energy efficiency standards for buildings, means increased investment in sustainable materials and advanced construction techniques. Failure to meet these benchmarks can result in penalties, project delays, and reputational damage, making compliance a strategic imperative for long-term viability and market access.

Financing Regulations for Property Developers

China Jinmao, like all property developers in China, operates within a stringent legal framework governing financing. Regulations on domestic and offshore loans for real estate acquisitions significantly impact how developers secure capital. For instance, the People's Bank of China and the China Banking and Insurance Regulatory Commission (CBIRC) have historically implemented policies to curb excessive leverage in the sector, influencing loan-to-value ratios and debt-to-equity thresholds. In 2024, these existing regulations continue to shape the funding landscape, requiring meticulous compliance.

Navigating these legal requirements is paramount for China Jinmao's financial health. The government's ongoing efforts to manage systemic financial risks associated with the property market mean that developers must adhere to strict borrowing limits and capital requirements. Failure to comply can result in penalties, restricted access to credit, and reputational damage.

Key financing regulations impacting developers like China Jinmao include:

- Restrictions on offshore borrowing: While offshore loans can provide access to foreign capital, developers must comply with foreign exchange controls and reporting requirements.

- Domestic loan limitations: Banks are subject to regulatory guidance on the proportion of real estate loans they can hold, influencing the availability and terms of domestic financing.

- Capital requirements: Developers may face specific capital adequacy ratios mandated by regulators, impacting their ability to leverage their balance sheets.

- Trust product regulations: Financing through trust products, a common channel for developers, is also subject to evolving regulatory oversight aimed at mitigating risk.

Property Ownership and Land Use Rights

Property ownership and land use rights in China are critical for China Jinmao's operations, as they dictate how the company can acquire, develop, and sell real estate. The legal framework surrounding these rights directly impacts project feasibility and profitability. For instance, changes in land auction policies or urban planning regulations can significantly alter the cost and timeline of development projects. China Jinmao, like other developers, must navigate these evolving legal landscapes to ensure compliance and strategic advantage.

The legal framework for land use in China is unique, with all land ultimately owned by the state. Companies like China Jinmao acquire rights to use land for specific periods through leasehold agreements, often obtained via public bidding. These lease terms and conditions, including land use restrictions and development obligations, are crucial considerations. Understanding and adapting to these regulations is paramount for successful project execution.

Recent trends indicate a continued focus on urban renewal and sustainable development within China's property sector. This is reflected in policy shifts that may favor brownfield redevelopment and stricter environmental standards. For China Jinmao, this means adapting development strategies to align with national policy objectives, potentially leading to new opportunities in revitalizing existing urban areas. For example, in 2024, several major cities saw increased emphasis on mixed-use developments incorporating green building standards, influencing land acquisition strategies.

- Land Leasehold System: Understanding the nuances of state-granted land use rights, including duration and permitted activities, is essential for China Jinmao's project planning and investment decisions.

- Urban Planning Laws: Compliance with zoning regulations, building codes, and urban development plans directly affects project design, scale, and marketability.

- Property Rights Reforms: Monitoring potential changes in property ownership laws, such as those related to long-term lease renewals or collective land use, is vital for anticipating future market dynamics.

- Government Approvals: Navigating the complex process of obtaining permits and approvals for land development, construction, and sales remains a key operational challenge influenced by legal and administrative factors.

China's legal landscape significantly shapes China Jinmao's operations, particularly concerning real estate development and financing. Government interventions, like the easing of home buying restrictions in major cities in late 2023 and early 2024, aim to stabilize the market. Stricter environmental laws and green building standards are also mandates, influencing construction and material choices, with a 2024 target for 60% of new urban buildings to meet green standards.

The company must navigate complex financing regulations, including restrictions on offshore borrowing and domestic loan limitations, as exemplified by the People's Bank of China's ongoing guidance on curbing excessive leverage. Furthermore, China Jinmao's land acquisition and development are governed by the state-owned land leasehold system and urban planning laws, requiring adherence to zoning and development obligations.

China Jinmao's adherence to legal frameworks is crucial for its success. For example, compliance with Shanghai's 2024 Urban Renewal Plan, which targets over 100 billion yuan in infrastructure investment, directly supports its urban regeneration initiatives. The company's ability to secure land use rights and navigate government approvals, while meeting evolving environmental codes, underpins its strategic execution and long-term viability in the dynamic Chinese property market.

Environmental factors

China's commitment to green building is intensifying, with a national objective for all new urban constructions to adhere to green standards by 2025. This regulatory push directly influences China Jinmao's development strategies, necessitating the incorporation of energy-efficient technologies and sustainable construction materials.

To remain compliant and competitive, China Jinmao must actively pursue certifications such as the 3-Star Green Building label, a key indicator of environmental performance. This focus on green building not only meets government mandates but also appeals to an increasingly environmentally conscious market, potentially enhancing brand reputation and project value.

China's ambitious climate agenda, aiming for carbon peaking by 2030 and carbon neutrality by 2060, directly impacts the construction industry. This means companies like China Jinmao must prioritize reducing their carbon footprint. For instance, in 2023, the value of green building materials in China reached approximately 2.5 trillion yuan, highlighting the growing market for eco-friendly solutions.

To comply with these national environmental objectives, China Jinmao's development projects need to integrate low-carbon technologies and energy-efficient designs. This includes adopting sustainable building materials and implementing smart energy management systems. Such initiatives are crucial for meeting regulatory requirements and enhancing the company's long-term sustainability and market competitiveness.

China's construction sector is increasingly prioritizing sustainable building materials, driven by national environmental policies and a growing consumer demand for healthier living spaces. This trend aligns with China Jinmao's stated commitment to 'green health' principles in its property developments, indicating a strategic focus on incorporating these eco-friendly materials.

For instance, the Chinese government has set ambitious targets for the use of green building materials, aiming for 60% of new buildings to meet green building standards by 2025, up from 30% in 2020. This regulatory push directly supports companies like China Jinmao that are investing in and utilizing materials with lower environmental impact.

The adoption of sustainable materials not only helps China Jinmao meet regulatory requirements but also enhances its brand image and appeals to a segment of the market willing to pay a premium for environmentally conscious housing. This focus is crucial as China aims to reduce carbon emissions from its construction industry, a significant contributor to its overall environmental footprint.

Water Management and Waste Reduction

China Jinmao's commitment to environmental stewardship is evident in its focus on water management and waste reduction across its property development and operational phases. This approach is crucial for building sustainable urban complexes and properties.

Efficient water usage systems are being integrated into new developments, aiming to conserve this vital resource. For instance, many new residential projects in China are incorporating rainwater harvesting and greywater recycling systems. By 2024, China's national targets for urban wastewater treatment coverage reached over 90%, indicating a broader industry trend that China Jinmao is aligning with.

Waste reduction strategies are also a key component, encompassing everything from construction debris management to operational waste in completed properties.

- Water Conservation: China Jinmao is investing in technologies like low-flow fixtures and smart irrigation systems to minimize water consumption in its developments.

- Wastewater Treatment: Adherence to increasingly stringent national standards for wastewater discharge is a priority, ensuring environmental protection.

- Waste Diversion: Initiatives to increase recycling rates and reduce landfill waste from construction and ongoing operations are being implemented.

- Circular Economy Principles: Exploring the use of recycled materials in construction and promoting waste-to-energy solutions are part of their long-term strategy.

Climate Change Adaptation and Site Selection

China Jinmao, like other developers, is increasingly factoring climate change risks into its site selection processes. This means looking at how vulnerable a location might be to things like extreme weather events, rising sea levels, or water scarcity. For instance, in 2024, China's Ministry of Natural Resources emphasized the need for climate resilience in urban planning, a directive that impacts where new developments can be approved and how they are designed.

This shift is driven by a growing understanding that developments need to be sustainable and contribute to a more integrated urban model, not just be built on the cheapest land. Developers are evaluating how projects can adapt to a changing climate, perhaps by incorporating green infrastructure or choosing sites less prone to flooding. By 2025, it's expected that stricter environmental impact assessments will be standard, pushing companies like China Jinmao to prioritize locations that align with national climate goals.

- Climate Risk Assessment: Site selection now involves detailed analysis of potential impacts from climate change, such as increased frequency of typhoons or droughts in specific regions.

- Sustainable Urban Integration: Developers are prioritizing locations that allow for the creation of eco-friendly communities and efficient resource management.

- Regulatory Compliance: Adherence to evolving environmental regulations, which will likely become more stringent by 2025, is a key factor in choosing development sites.

- Long-Term Viability: Selecting sites with lower climate vulnerability ensures the long-term economic and physical viability of projects.

China's environmental regulations are a significant driver for China Jinmao, pushing for greener construction practices and sustainable material use. The nation's commitment to carbon neutrality by 2060 necessitates a reduction in the construction sector's carbon footprint, with green building materials valued at approximately 2.5 trillion yuan in 2023.

China Jinmao's strategy aligns with national goals, focusing on water conservation and waste reduction, exemplified by increasing urban wastewater treatment coverage exceeding 90% by 2024. The company is also integrating climate risk assessments into site selection, a trend reinforced by the Ministry of Natural Resources' 2024 emphasis on climate resilience in urban planning.

| Environmental Factor | China Jinmao's Response/Strategy | Relevant Data/Target |

|---|---|---|

| Green Building Standards | Incorporating energy-efficient technologies and sustainable materials. | 60% of new buildings to meet green standards by 2025. |

| Climate Change Agenda | Prioritizing low-carbon technologies and energy-efficient designs. | Aiming for carbon peaking by 2030; carbon neutrality by 2060. |

| Water Management | Investing in water-saving technologies and adhering to wastewater standards. | Urban wastewater treatment coverage over 90% by 2024. |

| Climate Risk Assessment | Factoring climate vulnerability into site selection. | Ministry of Natural Resources emphasis on climate resilience in 2024. |

PESTLE Analysis Data Sources

Our China Jinmao PESTLE Analysis is constructed using a comprehensive blend of official government publications, reputable financial news outlets, and authoritative industry research reports. This ensures all political, economic, social, technological, legal, and environmental insights are grounded in verified and current information.