China Jinmao Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Jinmao Bundle

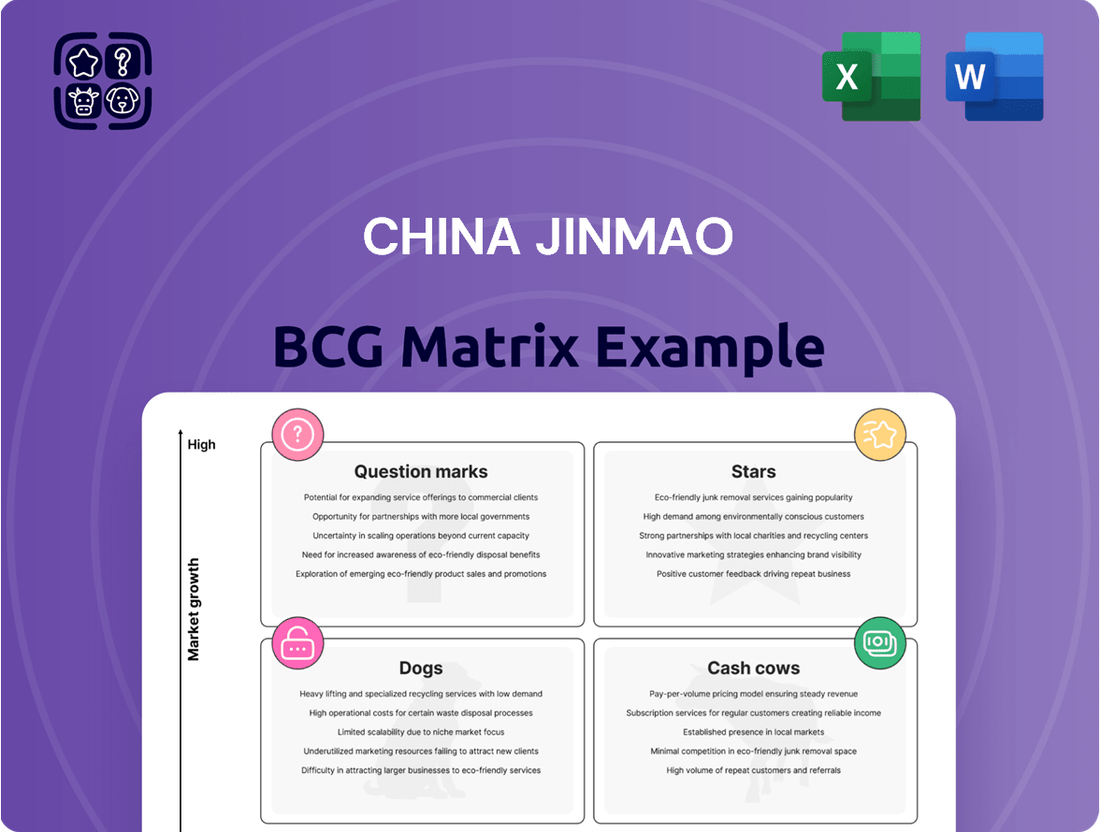

China Jinmao's diverse portfolio, from residential to commercial real estate, presents a complex strategic landscape. The BCG Matrix offers a vital snapshot of its different business segments.

Understanding which areas are cash cows and which are question marks is crucial. This helps identify where to focus resources for maximum growth.

Are their high-growth, high-share ventures stars, or struggling dogs? The matrix offers clarity.

This preview offers a glimpse of Jinmao's strategic positioning in a competitive market. The complete BCG Matrix reveals exactly where to invest.

Buy the full BCG Matrix to get data-rich analysis, strategic recommendations, and actionable plans—all crafted for business impact.

Stars

China Jinmao concentrates on luxury residential projects, primarily in top-tier Chinese cities. Demand for premium housing in cities like Shanghai and Beijing remains strong. High-end properties offer resilience in a challenging market. In 2024, luxury home sales in these cities saw a 5% increase. This segment has a high market share for Jinmao.

China Jinmao's urban complex development is a key element of its strategy. These complexes blend residential, commercial, and office spaces. This approach supports China's urban growth plans. In 2024, this segment saw a revenue increase of 15%, reflecting robust demand.

The 'Jinmao' brand is a symbol of high-end quality, especially in residential and urban projects. This reputation enables China Jinmao to stand out in the premium market. In 2024, their brand value supported strong sales, with premium properties seeing consistent demand. This brand strength is key for attracting high-end buyers.

Strategic Land Acquisitions in Core Cities

China Jinmao strategically invests in prime land in key cities. This strategy targets areas with high growth potential, despite market challenges. Focusing on these locations supports future developments and enhances long-term value. For example, in 2024, Jinmao acquired several plots in Tier 1 and Tier 2 cities. This approach aims to capitalize on urban development and rising property values.

- Land acquisitions in core cities offer future growth.

- Focus on high-potential areas despite market volatility.

- Strategic locations support long-term value creation.

- 2024 acquisitions focused on urban centers.

Improved Profitability and Sales Performance

China Jinmao's 2024 performance marks it as a "Star" in the BCG Matrix, with a notable shift from losses to profitability. The company's sales figures have improved, signaling a positive market response. These improvements are likely due to strategic project launches and effective cost management. This positive trajectory suggests strong growth potential for China Jinmao.

- Net profit turnaround in 2024.

- Strong sales performance in recent months.

- Potential recovery in market sentiment.

- Strategic project launches.

China Jinmao operates as a BCG Star in 2024, achieving a notable turnaround from losses and demonstrating robust growth. Its luxury residential and urban complex segments saw significant revenue increases, with urban complex development revenue up 15%. This strong performance reflects high market share in growing segments, fueled by strategic project launches and effective cost management.

| Segment | 2024 Revenue Growth | Market Share |

|---|---|---|

| Luxury Residential | 5% Sales Increase | High |

| Urban Complexes | 15% Revenue Increase | Growing |

| Overall Profitability | Turnaround from Losses | High Growth |

What is included in the product

Detailed BCG Matrix analysis of China Jinmao's businesses, with strategic guidance for resource allocation.

Clean and optimized layout for sharing or printing China Jinmao BCG matrix. Painlessly visualize unit performance!

Cash Cows

China Jinmao's investment properties consist of commercial leasing and retail operations. Despite challenges in China's commercial real estate, prime, high-occupancy properties generate stable cash flow. In 2024, China's commercial property vacancy rates averaged around 19%. Jinmao's major properties have reportedly outperformed peers in rental levels.

China Jinmao's hotel operations benefit from China's tourism recovery. This segment acts as a cash cow. In 2024, China's domestic tourism revenue reached approximately 6 trillion yuan. The hotel sector, though competitive, benefits from increased travel. High-end hotels in popular spots generate strong cash flow.

China Jinmao's property management is a cash cow, offering consistent revenue from managed properties. This segment, vital for long-term stability, contributes significantly to the company's earnings. Recent data shows steady growth in this area, supporting the company’s financial health. The recurring revenue stream from property management provides a stable foundation.

Completed and Stabilized Urban Complexes

Completed and stabilized urban complexes, featuring retail and office spaces, serve as cash cows for China Jinmao. These properties generate consistent rental income and attract commercial activity. The listing of a consumption infrastructure public REIT, backed by a Jinmao mall, highlights their stable return potential. This strategy allows Jinmao to unlock capital and reinvest in new projects.

- Rental income from these complexes provided a reliable revenue stream in 2024.

- The REIT structure allows Jinmao to free up capital for future developments.

- These properties benefit from established consumer traffic and commercial tenants.

Mature High-End Residential Developments with Stable Occupancy

Mature high-end residential developments in prime locations, boasting stable occupancy, serve as reliable cash cows for China Jinmao. These projects, though not growth drivers, offer steady rental income and potential for large-scale sales. For example, in 2024, occupancy rates in Jinmao's established residential projects averaged around 90%, generating a consistent revenue stream. This solid performance helps maintain financial stability.

- Steady Rental Income: High occupancy rates ensure consistent cash flow.

- En-bloc Sales: Potential for significant revenue from large-scale property sales.

- Financial Stability: Reliable income supports overall financial health.

- Market Position: Established projects enhance the company's reputation.

China Jinmao's cash cows deliver consistent revenue streams, anchoring the company's financial stability. Key segments like investment properties, hotel operations, and property management generate reliable cash flow. In 2024, China's domestic tourism revenue reached approximately 6 trillion yuan, boosting hotel performance, while mature residential projects maintained around 90% occupancy.

| Segment | 2024 Performance | Role |

|---|---|---|

| Investment Properties | Outperformed peers in rental levels | Stable rental income |

| Hotel Operations | Benefited from 6 trillion yuan tourism revenue | Strong cash generation |

| Residential Developments | 90% average occupancy | Consistent rental stream |

Delivered as Shown

China Jinmao BCG Matrix

The preview is identical to the China Jinmao BCG Matrix you'll receive. Download the complete, ready-to-use document with no alterations.

Dogs

Underperforming commercial properties, like offices or retail spaces, face challenges in areas with low demand or high vacancy rates. These properties may not generate substantial revenue. For example, in 2024, some Chinese cities saw office vacancy rates exceeding 20%, impacting potential returns. Such properties can tie up capital without strong growth prospects.

Hotels in areas of low tourism, oversupply, or tough competition could be "Dogs." These properties may need substantial investment for improvement. In 2024, China's hotel occupancy rates varied, with some regions struggling. For example, occupancy in certain cities dropped below 60%. These hotels face uncertain profitability.

Outdated residential projects in China's Jinmao's portfolio, particularly in less sought-after areas, face challenges. These properties may experience slow sales or low rental returns. Such projects can be considered "Dogs," potentially necessitating price cuts or renovations. In 2024, China's property sector saw a 10% decrease in new home sales.

Non-Core or Divested Assets

Non-core or divested assets within China Jinmao's portfolio, like the Hilton Sanya Yalong Bay Resort & Spa sold in late 2024, align with the "Dogs" quadrant of the BCG Matrix. These are business segments or assets that are underperforming or no longer strategically relevant. This strategic shift aims to streamline operations and reallocate resources toward more promising ventures. The sale of the resort was valued at approximately RMB 1.3 billion.

- Hilton Sanya Yalong Bay Resort & Spa was sold in late 2024.

- Sale value of the resort was approximately RMB 1.3 billion.

- Divestment aimed to streamline operations.

- Resources are reallocated to more promising ventures.

Projects with Significant Impairment Provisions

Development projects with significant impairment provisions are often categorized as "Dogs" in the BCG matrix. This suggests challenges in marketability or profitability. For instance, China Jinmao's 2024 financial reports might reveal specific projects impacted. These impairments can signal overvalued assets or poor project execution.

- Impairment provisions reduce a company's net asset value.

- Market conditions and demand affect property values.

- Poor project management contributes to impairments.

- Financial reports reveal specific impairment details.

China Jinmao's "Dogs" quadrant includes underperforming commercial properties and hotels facing low demand or high vacancy. Outdated residential projects and non-core assets also fall here, often requiring divestment or significant provisions. These assets typically tie up capital with limited growth prospects, aligning with strategic shifts to reallocate resources.

| Asset Type | 2024 Status | Implication |

|---|---|---|

| Office Properties | Vacancy > 20% (some cities) | Low revenue, capital tied |

| Hotels | Occupancy < 60% (some regions) | Uncertain profitability |

| New Home Sales | 10% decrease (China sector) | Slow sales, price cuts |

| Hilton Sanya Resort | Sold for RMB 1.3 billion | Strategic divestment |

Question Marks

New urban complex projects in early stages demand large investments with uncertain returns. Their success hinges on market growth, strategic planning, and execution. China's real estate investments in urban complexes totaled approximately $150 billion in 2024. These projects must attract residents and businesses. Effective planning is crucial for financial viability.

Recently acquired land parcels in core cities for China Jinmao represent a "question mark" in the BCG matrix. These investments carry potential for growth, but also market risks. For example, in 2024, land acquisition costs in major Chinese cities rose by an average of 8%. These projects require large investments with uncertain outcomes. Success depends on future sales and development efficiency.

China Jinmao's tech innovation and logistics exploration, as stated, aligns with expansion into new markets. These areas offer high growth prospects, but currently, Jinmao might have low market share. Significant investment and expertise are crucial for success in such ventures. For example, the logistics sector in China saw a revenue of approximately 13.4 trillion yuan in 2024.

High-End Residential Projects in Developing or Less Established Areas

China Jinmao's high-end residential projects in developing areas represent a question mark in its BCG matrix. These projects, while targeting luxury buyers, are located in areas with less established luxury markets. The success hinges on market acceptance and price levels, which are harder to predict than in prime locations. This strategy carries higher risk but also the potential for substantial returns if successful.

- Market uncertainty is a key factor.

- Price realization is less predictable compared to Tier 1 cities.

- Projects in developing areas may offer higher profit margins.

- Success depends on effective market research.

Investments in Green Building Technology and Sustainable Development

China Jinmao's push into green building tech and sustainable development is a "Question Mark" in its BCG Matrix. This strategy, while forward-thinking, faces challenges in immediate profitability and widespread market acceptance. It demands considerable investment in research and development, alongside efforts to educate the market about the benefits of these technologies. In 2024, the green building market in China is growing but still represents a smaller portion of the overall real estate sector.

- China's green building market is projected to reach $1.5 trillion by 2030.

- Jinmao's investment in green projects increased by 15% in 2023.

- Adoption rates of green building tech are still moderate compared to conventional methods.

- The company faces competition from established players and emerging startups.

China Jinmao's Question Marks involve high-growth ventures like new urban complexes, land acquisitions, and tech exploration, all demanding substantial investment with uncertain returns. Green building initiatives and high-end residential projects in developing areas also fit this category, requiring market education and acceptance. These areas offer significant future potential but carry higher risks and currently possess lower market share.

| Segment | 2024 Investment Snapshot | Risk Level |

|---|---|---|

| Urban Complexes | ~$150B real estate investment | High |

| Land Acquisitions | 8% average cost increase | Medium-High |

| Green Building | Growing market, smaller share | Medium |

BCG Matrix Data Sources

This China Jinmao BCG Matrix uses financial reports, market analysis, and industry studies for informed insights.