China Jinmao Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Jinmao Bundle

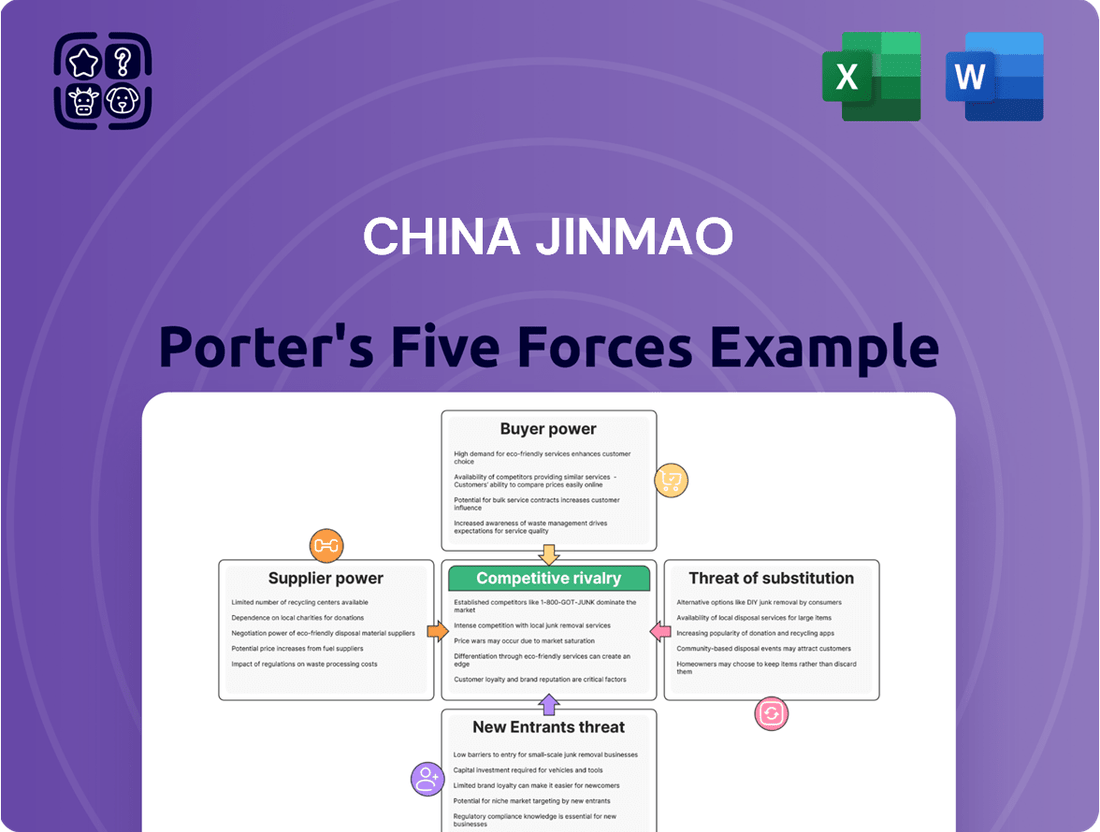

China Jinmao navigates a complex landscape shaped by intense industry rivalry and the significant bargaining power of buyers. Understanding these forces is crucial for any stakeholder. The threat of new entrants, while present, is somewhat mitigated by capital requirements. However, substitute products pose a moderate challenge, requiring continuous innovation.

The complete report reveals the real forces shaping China Jinmao’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Supplier concentration for China Jinmao is a significant factor in its bargaining power. If there are few dominant suppliers for critical inputs like construction materials, specialized components, or even skilled labor, these suppliers gain considerable leverage. This concentration means Jinmao has fewer alternatives, making it more susceptible to price increases or unfavorable terms.

For instance, in 2024, the Chinese construction materials market saw consolidation, with several large cement and steel producers holding a significant market share. China Jinmao, as a major property developer, relies heavily on these materials. A limited number of key suppliers can dictate terms, potentially driving up project costs and impacting Jinmao's profitability.

The uniqueness of inputs significantly shapes the bargaining power of suppliers for China Jinmao. If suppliers provide highly specialized or proprietary materials, like advanced green building technologies or unique architectural designs that are difficult to replicate, China Jinmao faces limited alternatives.

This lack of readily available substitutes for crucial inputs grants these suppliers greater leverage. For instance, if a specific supplier holds patents for a novel, eco-friendly construction material that is integral to China Jinmao's projects, that supplier can command higher prices or more favorable terms.

In 2024, the demand for sustainable and technologically advanced building materials in China's real estate sector has been on the rise, further amplifying the power of suppliers offering such unique inputs. Companies like China Jinmao, aiming to differentiate their offerings, may find themselves more reliant on these specialized providers.

For China Jinmao, high switching costs can significantly bolster supplier bargaining power. If a supplier’s components require specialized integration or if retraining staff for new materials is costly and time-consuming, China Jinmao faces a deterrent to changing providers. For instance, if a key supplier provides proprietary software or highly customized building materials, the expense of re-engineering processes or sourcing new, compatible inputs becomes substantial. This inertia means suppliers can potentially dictate terms, knowing that switching would incur significant financial and operational disruption for China Jinmao.

Threat of Forward Integration

The threat of forward integration by suppliers poses a significant concern for China Jinmao. If suppliers, such as construction material providers or land developers, were to enter property development or hospitality operations themselves, they could directly compete with China Jinmao. This capability would grant them considerably more leverage in price negotiations and contract terms, as they could choose to capture more value by integrating forward rather than simply supplying inputs. For instance, a major construction materials supplier with the financial capacity and industry knowledge could potentially develop its own real estate projects, thereby becoming a rival.

This dynamic is particularly relevant in the Chinese property market. Consider the scenario where a large-scale concrete supplier, having built significant expertise in construction processes, decides to develop its own residential complexes. Such a move would mean that China Jinmao would not only lose a supplier but also gain a competitor that understands the cost structure of its own operations intimately. In 2024, the construction sector in China saw continued investment, with significant players exploring diversification strategies, underscoring this potential threat.

- Supplier Integration Risk: Suppliers moving into property development or hospitality operations strengthens their bargaining power against China Jinmao.

- Competitive Threat: Forward integration by suppliers transforms them into direct competitors, impacting market share and pricing.

- Market Dynamics: The Chinese property market in 2024 shows a trend of diversification, increasing the likelihood of suppliers exploring integration.

- Leverage in Negotiations: The credible threat of becoming a competitor enhances suppliers' ability to dictate terms and prices to China Jinmao.

Importance of Supplier to China Jinmao

The bargaining power of suppliers for China Jinmao is a key consideration, particularly for its high-end property developments and hotel operations where material and service quality are paramount. If Jinmao relies heavily on specialized suppliers whose products or services are critical and difficult to substitute, these suppliers can exert significant influence over pricing and terms.

For example, in the construction of luxury hotels, the sourcing of premium finishes, specialized HVAC systems, or bespoke interior design elements can involve a limited number of highly skilled suppliers. If these suppliers' contributions are indispensable to achieving the desired brand standards and guest experience, their leverage over Jinmao increases substantially.

Consider the 2024 real estate market in China, where supply chain disruptions and increased demand for high-quality building materials can amplify supplier power. Jinmao's ability to secure favorable terms depends on its relationships with key suppliers and its strategic sourcing capabilities.

- Critical Inputs: Suppliers of specialized construction materials, high-end fixtures, and advanced building technologies are crucial for China Jinmao's premium property portfolio.

- Limited Substitutability: If unique or proprietary components are required, the lack of readily available alternatives empowers these specific suppliers.

- Supplier Concentration: A market with few dominant suppliers for essential inputs naturally grants them greater bargaining leverage.

- Jinmao's Dependence: The degree to which Jinmao's product quality and operational efficiency hinge on a particular supplier's offerings directly impacts that supplier's power.

The bargaining power of suppliers for China Jinmao is influenced by the concentration of suppliers, the uniqueness of their inputs, and the switching costs involved. When few suppliers dominate the market for critical materials like specialized steel or advanced smart home technology, they can dictate terms, impacting Jinmao's project costs and timelines. In 2024, the demand for sustainable building materials in China increased, giving suppliers of these unique inputs more leverage.

High switching costs further empower suppliers. If Jinmao invests heavily in proprietary systems or requires specialized training for its workforce to utilize a supplier's product, changing providers becomes prohibitively expensive and disruptive. This reliance can lead to suppliers demanding higher prices or less favorable contract terms.

The threat of forward integration, where suppliers might enter property development themselves, also strengthens their hand. For instance, a major construction materials provider could leverage its expertise and financial backing to develop its own projects, becoming a direct competitor. This risk was highlighted in 2024 by continued investment and diversification strategies within China's construction sector.

| Factor | Impact on China Jinmao | 2024 Context |

|---|---|---|

| Supplier Concentration | Increases supplier leverage, potentially raising input costs. | Consolidation in cement and steel markets noted. |

| Uniqueness of Inputs | Empowers suppliers of specialized or patented materials. | Rising demand for sustainable and advanced building materials. |

| Switching Costs | Creates supplier stickiness, limiting Jinmao's flexibility. | Proprietary systems and specialized training increase these costs. |

| Forward Integration Threat | Transforms suppliers into potential competitors. | Diversification trends in Chinese construction sector observed. |

What is included in the product

This analysis dissects the competitive forces impacting China Jinmao, revealing how supplier and buyer power, the threat of new entrants and substitutes, and existing rivalry shape its strategic environment.

Gain immediate clarity on competitive pressures within China's Jinmao sector, allowing for agile strategic adjustments and proactive risk mitigation.

Customers Bargaining Power

Customer price sensitivity is a significant factor influencing China Jinmao's bargaining power of customers. In 2024, many Chinese cities experienced a cooling property market, with reports indicating price declines in certain segments. This trend can heighten buyer sensitivity to price increases for high-end residential, commercial, and hospitality properties.

When potential buyers are less willing or able to absorb higher costs, their leverage increases. This means China Jinmao faces greater pressure to offer competitive pricing or concessions to attract and retain customers. For instance, if comparable luxury properties are readily available at lower price points, customers will naturally gravitate towards those options, diminishing Jinmao's pricing power.

The availability of substitutes significantly impacts the bargaining power of customers for China Jinmao. In major Chinese cities, customers seeking luxury residential, commercial, or hospitality services have a wide array of choices. This competitive landscape means they can easily switch to another developer or hotel if China Jinmao's offerings are not perceived as offering sufficient value or are priced too high.

For instance, in 2024, the real estate market in tier-one cities like Shanghai and Beijing saw numerous high-quality developments from both domestic and international competitors. Similarly, the hospitality sector is robust, with many international and local hotel brands vying for market share. This abundance of alternatives gives customers leverage to negotiate better terms, demand premium amenities, or seek lower prices, directly impacting China Jinmao's pricing power and profitability.

China Jinmao's customers, particularly those in the premium property market, possess significant bargaining power due to readily available information. As of early 2024, extensive online portals and real estate agencies provide detailed insights into property prices, recent transaction data, and comparable offerings from competitors. This transparency empowers buyers to negotiate more effectively, pushing for better terms and pricing, especially when multiple developers offer similar luxury units.

Switching Costs for Customers

The bargaining power of customers for China Jinmao is significantly influenced by switching costs. When it's easy and inexpensive for customers to switch to a competitor, their power increases. For instance, finding another luxury apartment complex or hotel chain often requires minimal effort and financial outlay, which can empower customers to demand better terms.

In 2024, the hospitality and real estate sectors continue to see increased competition, making customer loyalty a key challenge. Consider the ease of booking a hotel; online travel agencies and readily available reviews mean a dissatisfied customer can quickly find an alternative. This low barrier to switching directly amplifies customer leverage.

For China Jinmao, this means that maintaining high customer satisfaction and offering unique value propositions are crucial. If customers perceive little difference between developers or hotel brands, they will gravitate towards the option that offers the best price or most convenient terms. This dynamic intensifies the pressure on Jinmao to differentiate and retain its customer base.

- Low Switching Costs: Customers can easily find alternative luxury apartment developers or hotel chains.

- Increased Customer Power: Minimal effort and cost to switch enhances the customer's ability to negotiate.

- Competitive Landscape: The 2024 market often presents numerous comparable options, further empowering customers.

- Value Proposition Importance: China Jinmao must offer superior value to mitigate the impact of low switching costs.

Volume of Purchases

The volume of purchases significantly influences customer bargaining power. For China Jinmao, individual residential buyers generally have limited leverage due to the sheer number of potential buyers. However, large corporate clients seeking commercial leases or substantial blocks of residential units can wield considerable influence. For instance, a major company signing a long-term lease for significant office space in one of Jinmao's developments can negotiate more favorable terms, such as rent reductions or tenant improvement allowances. This is particularly relevant in 2024, where market saturation in certain commercial segments might increase the importance of securing anchor tenants.

Consider the impact of bulk purchases on China Jinmao's revenue streams and pricing strategies. While smaller, individual residential sales contribute to overall volume, the negotiating power of a single entity acquiring multiple units or a substantial commercial property can be far greater. This is especially true when dealing with institutional investors or large corporations looking to establish a significant presence.

- Large commercial leases: These can involve negotiating terms for thousands of square meters, giving the corporate tenant substantial bargaining power.

- Bulk residential purchases: Investors buying entire floors or multiple apartment blocks can command discounts and preferential treatment.

- Hotel bookings: Major corporate travel accounts can negotiate special rates for room blocks and event spaces.

- Impact on profitability: Higher volume purchases, while boosting revenue, can also compress profit margins if not managed strategically.

China Jinmao's customers, particularly those purchasing premium residential or commercial properties, exhibit significant bargaining power. This is driven by factors like price sensitivity, the availability of numerous substitutes, and low switching costs, all amplified by the transparency of information in the 2024 market. While individual buyers have limited leverage, large corporate clients or bulk purchasers can negotiate substantial concessions.

| Factor | Impact on China Jinmao | 2024 Context |

| Price Sensitivity | Heightened sensitivity due to cooling property markets increases customer negotiation power. | Reports of price declines in certain Chinese city segments in 2024 pressured developers. |

| Availability of Substitutes | Abundance of luxury property and hospitality options empowers customers to switch easily. | Tier-one cities in 2024 featured numerous high-quality developments from domestic and international competitors. |

| Switching Costs | Low costs to switch to competing developers or hotel chains amplify customer leverage. | Ease of booking and readily available reviews in 2024 mean dissatisfied customers can quickly find alternatives. |

| Volume of Purchases | Large corporate leases or bulk residential purchases give significant negotiating power. | Securing anchor tenants in potentially saturated commercial segments in 2024 is crucial, leading to negotiated terms. |

Full Version Awaits

China Jinmao Porter's Five Forces Analysis

This preview showcases the complete China Jinmao Porter's Five Forces Analysis, offering a detailed examination of the competitive landscape within its industry. You're viewing the exact document you'll receive immediately after purchase, ensuring no surprises or hidden placeholders. This professionally written analysis delves into the bargaining power of buyers and suppliers, the threat of new entrants and substitute products, and the intensity of rivalry among existing competitors. Once you complete your purchase, you’ll get instant access to this exact, fully formatted, and ready-to-use file for your strategic planning needs.

Rivalry Among Competitors

The competitive rivalry within China's high-end real estate sector is intense, driven by a substantial number of formidable domestic developers. Major players like Evergrande, Country Garden, and Vanke, alongside many other well-capitalized firms, actively vie for market share. This crowded landscape means that China Jinmao faces constant pressure from rivals who possess significant resources and established market presences.

The growth rate within China's high-end real estate and hospitality sectors significantly influences competitive rivalry. As of 2024, several reports indicate a slowdown in China's property market, with some regions experiencing price corrections. This contraction means companies like China Jinmao face a more challenging environment, as they must vie for a reduced pool of customers and investment opportunities.

China Jinmao distinguishes itself in a competitive market by concentrating on high-end residential properties and integrated urban complexes. This strategic focus allows for significant product differentiation through unique architectural designs, premium amenities, and sophisticated service offerings. For instance, in 2023, China Jinmao's sales performance in its flagship projects often outpaced the market average, reflecting strong customer preference for its differentiated products.

The company’s emphasis on creating comprehensive living and commercial environments, rather than just standalone residential units, provides a distinct advantage. This approach can lessen the intensity of direct price competition, as customers are often willing to pay a premium for the integrated lifestyle and convenience offered. The success of projects like the Jinmao International City in various tier-1 cities illustrates this strategy, with these developments often commanding higher per-square-meter prices compared to competitors with less integrated offerings.

Exit Barriers

Exit barriers in China Jinmao's operating sectors, particularly real estate and hospitality, are substantial. These include high sunk costs associated with property development, extensive land use rights, and long-term leases or construction commitments. For instance, the sheer scale of infrastructure investment required in Chinese real estate development means that selling off assets or ceasing operations can incur significant losses.

These high exit barriers force companies to remain operational even when market conditions are unfavorable, leading to prolonged periods of intense competition. In 2023, the Chinese real estate sector experienced significant challenges, with property sales volume declining. Despite this, many developers, including those with substantial legacy projects, continued to operate to avoid the steep penalties and asset write-downs associated with exiting.

The hospitality sector similarly presents challenges for exiting players. Investments in hotel infrastructure, brand building, and long-term management contracts create significant hurdles. Companies may find it difficult to recoup their initial investments if they attempt to divest prematurely.

- High Sunk Costs: Significant capital is tied up in land acquisition, construction, and development projects, making divestment financially punitive.

- Long-Term Commitments: Leases, joint ventures, and ongoing development pipelines create contractual obligations that are costly to break.

- Regulatory Hurdles: Exiting the market may involve complex approvals and compliance procedures that add time and expense.

- Brand and Reputation: A forced or distressed exit can severely damage a company's brand and reputation within China, impacting future business prospects.

Brand Identity and Loyalty

China Jinmao's brand identity and loyalty are crucial differentiators in the competitive real estate market, particularly within the high-end segment. A well-established brand can foster trust and preference among discerning buyers.

The company's focus on premium developments and a commitment to quality contribute to strong brand recognition. This loyalty can translate into more consistent sales and a reduced susceptibility to price wars initiated by competitors.

- Brand Strength: China Jinmao has cultivated a reputation for luxury and quality, which is a significant asset.

- Customer Loyalty: Repeat buyers and positive word-of-mouth referrals indicate a loyal customer base.

- Competitive Edge: Strong brand loyalty can mitigate the intensity of rivalry by creating a dedicated customer segment.

- Market Position: In 2024, China Jinmao continued to be recognized for its premium offerings, reinforcing its brand equity.

Competitive rivalry in China's high-end real estate is fierce, with numerous well-capitalized developers like Evergrande, Country Garden, and Vanke constantly vying for market share. China Jinmao differentiates itself by focusing on premium residential properties and integrated urban complexes, offering unique designs and amenities that foster customer loyalty. This strategy, evident in projects like Jinmao International City, allows them to command higher prices and reduces direct price competition, especially as the market faces a slowdown in 2024.

| Developer | Primary Focus | 2023 Sales (Approx. RMB billions) | Market Segment |

|---|---|---|---|

| China Jinmao | High-end Residential, Urban Complexes | 160-170 | Premium |

| Evergrande | Residential (various tiers) | (Challenged due to financial issues) | Mass Market to Premium |

| Country Garden | Residential (mass market focus) | (Challenged due to financial issues) | Mass Market |

| Vanke | Residential (various tiers) | 370-380 | Mass Market to Premium |

SSubstitutes Threaten

The threat of substitutes for China Jinmao's core business, primarily property development and sales, is amplified by the growing availability of alternative living and working solutions. For residential needs, high-end rental apartments offer flexibility and reduced commitment compared to outright ownership, a trend gaining traction. In the commercial sector, the rise of co-working spaces and the normalization of remote work arrangements present viable alternatives to traditional office leases, impacting demand for new commercial developments.

The threat of substitutes for China Jinmao's luxury residential properties is influenced by the price-performance trade-off. Serviced apartments, for instance, can offer comparable luxury amenities and services but often at a more flexible and potentially lower price point, especially for shorter stays or specific needs. In 2024, the serviced apartment market in major Chinese cities continued to grow, with average daily rates for premium units sometimes falling below the prorated cost of comparable luxury residential units, making them an attractive alternative for certain demographics.

Customer propensity to substitute for China Jinmao's offerings is influenced by evolving lifestyle preferences and economic conditions. For instance, in 2024, the rising demand for flexible living arrangements, such as co-living spaces or shorter-term rentals, could present a substitute for traditional long-term property ownership, a core business for Jinmao. Economic uncertainty may also drive consumers towards more affordable housing options or rental markets, diverting demand from developers like China Jinmao.

Technological Advancements

Technological advancements present a significant threat of substitutes for China Jinmao's core businesses in property and hospitality. New technologies can offer alternative ways for customers to experience or interact with services, potentially bypassing traditional offerings. For instance, virtual reality (VR) and augmented reality (AR) are increasingly sophisticated, enabling immersive property tours that could reduce the necessity for physical site visits, a crucial step in the sales process. This directly impacts the demand for traditional sales channels and the associated customer engagement.

Furthermore, the rise of smart home technology, often integrated by non-traditional tech providers, offers enhanced living experiences that might be perceived as superior to standard offerings, creating a substitute for the overall value proposition of a new property. The increasing adoption of these technologies means that consumers' expectations for convenience and digital integration in their living and travel experiences are evolving rapidly. In 2024, the global proptech market was valued at over $10 billion, with significant growth expected as these technologies become more mainstream.

The threat is amplified as these technological substitutes often come with lower overheads compared to traditional property development and hospitality management. This cost advantage can allow substitute providers to offer competitive pricing or enhanced features.

Key technological advancements impacting China Jinmao include:

- Virtual and Augmented Reality (VR/AR): Enabling remote property viewings and virtual hotel experiences, reducing the need for physical interaction.

- Smart Home and IoT Integration: Offering enhanced living experiences through connected devices, potentially substituting traditional property features.

- Online Travel Agencies (OTAs) and Digital Platforms: Providing alternative booking and experience platforms for hospitality, often with personalized offerings.

- Co-living and Co-working Spaces: These flexible accommodation models, often enabled by technology platforms, offer an alternative to traditional long-term leases.

Regulatory Changes

Regulatory shifts can significantly alter the competitive landscape by favoring alternative offerings. For example, government initiatives aimed at increasing affordable housing availability in China could reduce demand for premium residential developments, acting as a substitute. In 2024, China's continued focus on urbanization and housing affordability, as seen in policies like the "Housing is for living in, not for speculation" directive, directly impacts the demand for certain types of real estate. Furthermore, evolving regulations around commercial property use, such as those encouraging flexible office spaces or mixed-use developments, can present alternatives to traditional, large-scale commercial projects.

These regulatory drivers can indirectly bolster the viability of substitute solutions by making them more attractive or accessible. For instance, policies promoting the development of modular or prefabricated construction methods could offer a quicker and potentially more cost-effective alternative to traditional building practices. China's emphasis on green building standards and energy efficiency also encourages the adoption of new materials and technologies, which can sometimes serve as substitutes for conventional approaches. The government's push for innovation in construction technologies is a key factor to monitor.

- Government policies promoting affordable housing

- Regulations encouraging flexible commercial spaces

- Incentives for modular and prefabricated construction

- Emphasis on green building standards and new materials

The threat of substitutes for China Jinmao's property developments is notable, especially with the rise of flexible living arrangements like serviced apartments and co-living spaces. These alternatives offer comparable amenities, often at a more attractive price point or with greater flexibility, appealing to a segment of the market that might otherwise consider traditional ownership. In 2024, the serviced apartment market in tier-1 Chinese cities saw continued demand, with daily rates for premium units often providing a cost-effective alternative to long-term residential leases.

Technological advancements further enhance the substitute threat. Virtual tours via VR/AR can diminish the need for physical property viewings, while smart home technology integrated by tech firms offers competitive value propositions. The global proptech market, valued at over $10 billion in 2024, underscores this trend, with new entrants leveraging technology to offer novel solutions that bypass traditional real estate models.

| Substitute Type | Key Features | Impact on China Jinmao | 2024 Market Trend Highlight |

|---|---|---|---|

| Serviced Apartments | Flexibility, amenities, potentially lower cost | Reduces demand for long-term residential sales | Steady growth in major Chinese cities |

| Co-living/Co-working | Community, flexibility, shared resources | Alternative to traditional office leases and residential rentals | Increasing adoption, especially among younger professionals |

| VR/AR Property Tours | Remote viewing, immersive experience | Reduces necessity of physical site visits, impacting sales process | Growing sophistication and adoption in real estate marketing |

| Smart Home Technology | Enhanced living experience, convenience | Offers alternative value proposition to new property features | Increasing consumer expectations for digital integration |

Entrants Threaten

Entering China's high-end property development and hospitality markets demands substantial financial backing. For instance, acquiring prime land in Tier 1 cities like Shanghai or Beijing can cost billions of yuan, a sum that immediately deters smaller players. Construction costs for luxury hotels and premium residential complexes also run into hundreds of millions, if not billions, creating a significant hurdle.

China Jinmao benefits significantly from economies of scale, a major barrier to new entrants. Its extensive operations allow for bulk purchasing of materials and more efficient project management, leading to lower per-unit costs. For instance, in 2023, China Jinmao's total assets reached approximately RMB 1.09 trillion, demonstrating its substantial operational size.

New companies entering the real estate market would find it challenging to match these cost advantages. Without the established infrastructure and high-volume purchasing power of a company like China Jinmao, new entrants would likely face higher production costs, making it difficult to compete on price and attract customers.

For new entrants in China's high-end property and hospitality sectors, securing access to effective distribution channels presents a significant hurdle. Established companies, like China Jinmao, have cultivated robust sales networks and strong brand recognition over years of operation. This existing infrastructure makes it difficult for newcomers to reach their target customer base efficiently.

Established players benefit from long-standing relationships with travel agencies, corporate clients, and online travel platforms. For instance, major hotel chains often secure preferential rates and prominent placement on booking sites, a privilege not readily available to new entrants. This advantage is compounded by the loyalty of existing customer bases who trust established brands for their high-end experiences.

In 2024, the digital landscape further solidifies this barrier. While online platforms offer reach, the cost of digital marketing and the competition for visibility are substantial. New entrants must invest heavily to break through the noise and attract discerning customers, often facing higher customer acquisition costs compared to incumbents who leverage their established brand equity and existing customer relationships.

Government Policy and Regulations

Government policy and regulations significantly shape the threat of new entrants in China's real estate sector. Stringent land policies, including zoning laws and land use restrictions, can limit available development opportunities, acting as a substantial barrier. For instance, the complex and often lengthy approval processes for new projects can deter smaller or less experienced players.

Furthermore, China's approach to foreign investment in real estate, while evolving, can still present hurdles for international companies seeking to enter the market. Restrictions on capital flows and ownership percentages can increase the cost and complexity of market entry. In 2024, the government continued to emphasize stability and controlled development, with policies aimed at deleveraging the property market and preventing systemic risks, which further tightens the environment for new developers.

- Land Use Policies: Government control over land supply and pricing directly impacts the cost of entry for new real estate developers.

- Development Approvals: The intricate and time-consuming process of obtaining permits and licenses creates significant operational barriers.

- Foreign Investment Restrictions: Limits on foreign ownership and capital repatriation can deter international entrants and increase their risk profile.

- Economic Stability Measures: Policies focused on market stability, such as those implemented in 2024 to manage developer debt, indirectly raise the bar for new participants by increasing scrutiny and capital requirements.

Brand Loyalty and Differentiation

Brand loyalty is a significant barrier for new entrants in China's real estate market. Established developers like China Jinmao have cultivated strong brand recognition and trust over years of operation, particularly in the high-end segment. This loyalty makes it challenging for newcomers to attract customers who may perceive existing brands as more reliable and of higher quality. For instance, in 2024, the continued demand for premium properties within major urban centers, where China Jinmao actively develops, underscores the enduring appeal of established developers.

China Jinmao's strategy of focusing on high-end and urban complex developments inherently creates a degree of differentiation. These projects often involve prime locations, superior design, and comprehensive amenities, which are difficult for new entrants to replicate quickly. Building a reputation for quality and reliability in this segment requires substantial investment and a proven track record, creating a hurdle for aspiring competitors seeking to gain market share.

- Brand loyalty among Chinese consumers for established property developers remains a strong deterrent to new entrants.

- China Jinmao's differentiation strategy through high-end and urban complex developments creates a competitive advantage.

- Acquiring prime land and developing a comparable reputation for quality and trust takes considerable time and capital for any new player.

- The perceived risk associated with unproven developers in the premium segment further solidifies the position of established brands.

The threat of new entrants in China's high-end property and hospitality sectors is significantly moderated by substantial capital requirements. Acquiring prime land in Tier 1 cities alone can cost billions of yuan in 2024, a prohibitive sum for many aspiring developers. High construction costs for luxury projects further escalate this barrier, demanding deep financial reserves that only established players like China Jinmao typically possess.

Economies of scale enjoyed by incumbents like China Jinmao, whose total assets neared RMB 1.1 trillion in 2023, present a formidable cost advantage. Without this scale, new entrants face higher per-unit costs due to less efficient procurement and project management, making it challenging to compete on price in the premium market segments where China Jinmao operates.

| Barrier Type | Description | Impact on New Entrants (2024) |

|---|---|---|

| Capital Requirements | High cost of land acquisition and construction. | Significant deterrent, especially for smaller or unproven entities. |

| Economies of Scale | Cost efficiencies from large-scale operations. | New entrants struggle to match price competitiveness. |

| Distribution Channels & Brand Loyalty | Established networks and customer trust. | Difficult for newcomers to gain visibility and attract discerning customers. |

| Government Policy & Regulations | Land use, approvals, and investment restrictions. | Complex processes and potential limitations on market access. |

Porter's Five Forces Analysis Data Sources

Our China Jinmao Porter's Five Forces analysis is built upon a foundation of publicly available financial reports, official company disclosures, and reputable real estate industry research. We also incorporate data from economic indicators and market intelligence platforms to provide a comprehensive view of the competitive landscape.