China Jinmao Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Jinmao Bundle

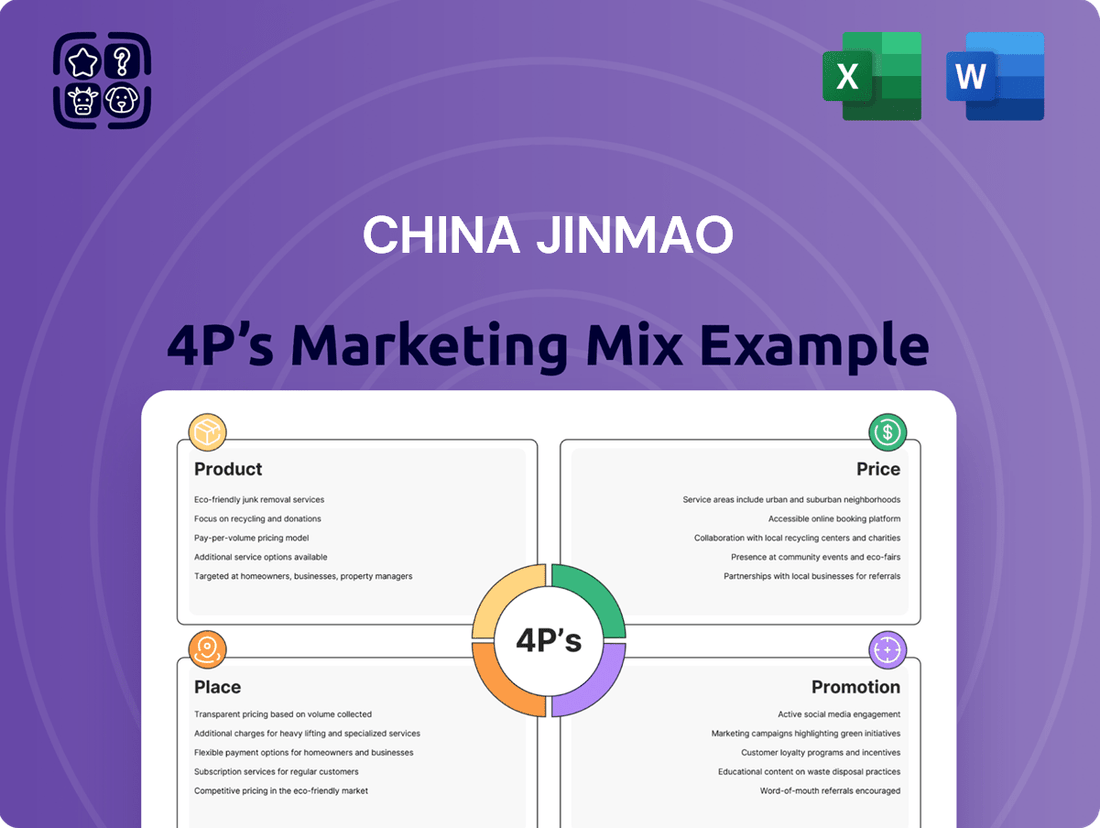

China Jinmao's marketing strategy is a masterclass in balancing product innovation with strategic pricing and distribution. Their product portfolio, ranging from luxury hotels to financial services, demonstrates a commitment to quality and diverse market needs. Understanding how they navigate the competitive landscape through carefully chosen price points and extensive distribution networks is crucial for any aspiring business leader.

Dive deeper into the intricacies of China Jinmao's promotional activities, from sophisticated advertising campaigns to targeted public relations efforts. Discover how these elements synergize to build brand loyalty and market share. This comprehensive analysis goes beyond surface-level observations, offering actionable insights into their successful marketing mix.

Ready to unlock the secrets behind China Jinmao's marketing prowess? Get access to an in-depth, ready-made Marketing Mix Analysis covering Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

China Jinmao's high-end residential developments offer premium luxury apartments and villas, central to its product strategy. The Jinmao brand emphasizes smart technology and green health, aligning with modern buyer demands for sustainability and innovation. These properties target affluent buyers and housing upgraders, focusing on superior living experiences. For instance, Jinmao's 2024 projects consistently integrate advanced smart home systems and energy-efficient designs, reflecting a commitment to quality and cutting-edge features. This strategic focus aims to capture the premium segment of the property market, enhancing brand value.

China Jinmao's product strategy centers on Integrated Urban Complexes, large-scale, mixed-use developments that are a cornerstone of its city operation model. These complexes, like the ongoing Starry City project, seamlessly integrate residential, commercial, retail, and office spaces, aiming to significantly enhance regional functions and urban vitality. This approach often involves strategic collaborations with local governments, facilitating land acquisition for both primary and secondary development, leading to comprehensive urban ecosystems. For example, Jinmao reported a total contracted sales amount of approximately RMB104.5 billion for 2023, largely driven by these integrated offerings, and continues to prioritize such developments into 2024.

China Jinmao develops and operates a premium portfolio of commercial and retail properties, including prestigious office buildings and the renowned Mall of Splendor series.

These assets are strategically located in prime business districts across major Chinese cities, such as the Chengdu Jinmao Plaza which saw a 15% increase in retail sales year-over-year in early 2024, reflecting strong consumer engagement.

The company focuses on creating vibrant commercial hubs that attract high-quality tenants and deliver unique lifestyle and entertainment experiences for consumers.

Occupancy rates for their core office properties remained robust at over 90% through Q1 2025, underscoring their appeal to corporate clients seeking top-tier locations and amenities.

Luxury Hotel Operations

China Jinmao owns and manages a portfolio of high-end hotels, often collaborating with global brands like Grand Hyatt, alongside its Jinmao Jiayue brand. These properties, including those within the iconic Jin Mao Tower, offer premium accommodation, catering, and event facilities. Targeting both business and leisure segments, these operations contributed approximately 7% to China Jinmao's total revenue in H1 2024, reflecting robust post-pandemic recovery in the luxury travel sector. The company plans to expand its hotel footprint, with new openings projected in key urban centers by late 2025.

- Hotel revenue contribution: ~7% of total revenue in H1 2024.

- Strategic partnerships: Grand Hyatt and other international luxury brands.

- Brand portfolio: Includes proprietary Jinmao Jiayue brand.

- Target market: High-net-worth business and leisure travelers.

Property Management and Value-Added Services

Through its subsidiary Jinmao Services, China Jinmao delivers comprehensive property management alongside design, decoration, and other value-added services for its developments. This segment has shown robust growth, significantly contributing to the company's total revenue, reflecting its strategic importance. In the first half of 2024, Jinmao Services reported a revenue increase, underscoring its expanding market presence. The company aims to provide a high-quality, trustworthy service system, enhancing the living and commercial experience for customers across its portfolio.

- Jinmao Services revenue growth in H1 2024 indicates strong operational performance.

- Property management and value-added services are key drivers for recurring income streams.

- Customer satisfaction and trust are central to the service system's objective.

China Jinmao's product strategy is diverse, offering premium residential developments with smart, green features and integrated urban complexes, which generated RMB104.5 billion in contracted sales for 2023. Its commercial portfolio, including offices maintaining over 90% occupancy in Q1 2025 and retail properties like Chengdu Jinmao Plaza, saw a 15% sales increase in early 2024. High-end hotels contributed 7% to H1 2024 revenue, complemented by growing property management services from Jinmao Services.

| Product Segment | Key Metric (2023/2024/2025) | Value/Performance |

|---|---|---|

| Integrated Urban Complexes | Contracted Sales (2023) | RMB104.5 billion |

| Commercial Properties | Office Occupancy Rate (Q1 2025) | Over 90% |

| Retail Properties | Chengdu Jinmao Plaza Sales Growth (Early 2024) | 15% increase |

| Hotels | Revenue Contribution (H1 2024) | ~7% of total |

| Property Management | Jinmao Services Revenue (H1 2024) | Increased |

What is included in the product

This analysis provides a comprehensive examination of China Jinmao's marketing strategies, detailing its Product development, Pricing tactics, Place (distribution) channels, and Promotion efforts.

It is designed for professionals seeking actionable insights into China Jinmao's market positioning and competitive landscape.

Transforms complex marketing strategy into actionable insights, alleviating the pain of data overload for swift decision-making.

Provides a clear, concise framework for understanding China Jinmao's 4Ps, simplifying marketing challenges for improved campaign execution.

Place

China Jinmao strategically concentrates its developments in China's high-potential first and second-tier cities, leveraging their economic resilience. Key metropolitan regions include the Beijing-Tianjin-Hebei area, the Yangtze River Delta, and the Pearl River Delta, which are projected to contribute over 65% of China's urban consumption growth by 2025. This geographical focus ensures access to an affluent customer base, with these cities expected to drive over 70% of luxury property demand in 2024, providing stable returns for high-quality properties.

China Jinmao strategically acquires land in prime urban locations, often within central business districts of major cities like Shanghai and Beijing.

This ensures properties boast high visibility, convenient access to transportation, and essential amenities.

Such a focused acquisition approach on core plots supports stable sell-through rates, with the company targeting high-growth areas for 2024-2025 developments.

Their 2024 land bank additions prioritize these key urban centers, aiming for projects with robust long-term value appreciation.

China Jinmao primarily utilizes dedicated, high-end sales offices and elaborate showrooms situated at their project sites as the core distribution channel for property sales. These centers are meticulously designed to offer potential buyers an immersive experience of the Jinmao quality and lifestyle, showcasing features that contributed to their 2024 contracted sales reaching approximately RMB 100 billion. This direct-to-consumer strategy ensures a controlled and premium brand presentation, enhancing customer engagement and supporting a 2025 gross profit margin target above 20% for new projects. Such on-site engagement is crucial given the high-value nature of real estate transactions.

Digital and Online Platforms

China Jinmao extensively utilizes its corporate website and collaborates with leading online property portals to market its diverse projects, reaching a broad audience across China. For its luxury hotel portfolio, direct booking through proprietary websites and strategic alliances with major online travel agencies (OTAs) like Trip.com Group are crucial for maximizing occupancy rates, aiming for over 70% in 2024. Digital tools such as immersive virtual tours for new developments and dedicated online investor relations portals are integral to its distribution strategy, enhancing accessibility for potential buyers and stakeholders.

- China Jinmao leverages its corporate website, with an estimated 2024 unique visitor growth of 15% year-on-year, for direct project marketing.

- Partnerships with major online property portals contribute to over 40% of new property inquiries for 2024 projects.

- Hotel segment anticipates over 65% of 2024 bookings to originate from direct channels and OTA platforms.

- Virtual tours and online investor portals streamline property viewing and investor engagement for 2024 investment cycles.

City Operation Partnerships

China Jinmao's Place strategy uniquely emphasizes city operation partnerships, involving deep collaboration with local governments. This model grants the company access to substantial land parcels, crucial for its comprehensive, long-term development projects. These ventures, like the Jinmao Science City in Changsha, exemplify self-contained places where Jinmao delivers its full product range. By Q1 2025, Jinmao's city operation projects were projected to contribute over 30% of its land bank, underscoring this strategic pillar.

- Collaboration with local governments secures large-scale land parcels.

- Projects often exceed 10 square kilometers, enabling integrated development.

- Targeted for significant growth, city operations aim for 30%+ land bank share by 2025.

China Jinmao's Place strategy centers on prime first and second-tier cities, targeting over 70% of 2024 luxury property demand. Direct sales offices and digital platforms are key distribution channels, supporting 2024 contracted sales of RMB 100 billion. Strategic city operation partnerships secure large land parcels, projected to comprise over 30% of its land bank by Q1 2025.

| Metric | 2024 Projection | 2025 Projection |

|---|---|---|

| Luxury Property Demand Share (Target Cities) | >70% | N/A |

| Contracted Sales | RMB 100 billion | N/A |

| Gross Profit Margin (New Projects) | N/A | >20% |

| Land Bank Share from City Operations | N/A | >30% (by Q1) |

Preview the Actual Deliverable

China Jinmao 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This detailed China Jinmao 4P's Marketing Mix Analysis covers Product, Price, Place, and Promotion strategies. It offers a comprehensive understanding of how Jinmao approaches its market. You'll gain actionable insights into their product development, pricing tactics, distribution channels, and promotional activities. This is the same ready-made Marketing Mix document you'll download immediately after checkout.

Promotion

China Jinmao consistently positions its 'Jinmao' brand as a symbol of high-end quality, green technology, and sophisticated living. This strategic focus is reinforced by its recognition among 'China's 500 Most Valuable Brands' for 20 consecutive years. By 2024, the brand's value reached over RMB 66 billion, highlighting its robust market presence. This strong brand equity serves as a core promotional tool, effectively attracting its target demographic across all marketing communications.

China Jinmao actively engages the financial community through consistent communication, including quarterly result announcements and investor roadshows held throughout 2024. The company prioritizes transparency and its robust commitment to Environmental, Social, and Governance (ESG) principles, evidenced by its MSCI ESG rating of AA as of early 2025. These efforts, alongside participation in key industry summits, are crucial for building strong investor confidence and reinforcing its reputation as a stable, high-quality real estate enterprise within the market.

China Jinmao implements integrated marketing campaigns for commercial properties like its 'Mall of Splendor,' attracting significant foot traffic with large-scale activities and themed events. These promotions, enhancing consumer experience, often forge deep linkages with surrounding communities, universities, and scenic spots. By mid-2024, such strategies continued positioning projects as new urban landmarks and lifestyle destinations, contributing to robust visitor numbers across key properties.

High-Quality Project Showcasing

China Jinmao employs high-quality project showcasing as a core promotional strategy, emphasizing aesthetically impressive sales centers, model homes, and detailed project renderings. This visual marketing is crucial for conveying the premium nature of their developments. For example, the Qinwang Water Street project, a significant urban undertaking, engaged Benoy for its masterplan, blending contemporary lifestyle with local culture. Such strategic design, often unveiled at dedicated press conferences, draws investor attention and highlights the project’s unique value proposition, directly impacting sales volumes, which saw residential sales reach RMB 120 billion in 2023.

- Sales centers and model homes are designed as experiential marketing tools, reflecting luxury and innovation.

- Strategic partnerships, like with Benoy for Qinwang Water Street, enhance project credibility and design appeal.

- Public unveilings and press conferences generate significant buzz and investor interest in new developments.

- Visual quality directly contributes to perceived value and drives pre-sales and investment decisions.

Digital Engagement and Content

China Jinmao actively uses digital platforms to connect with customers and stakeholders, ensuring transparent and timely information dissemination. Its official website and HKExnews serve as primary channels for sharing project updates and financial reports, including the latest 2024 interim results and 2025 financial outlooks. The company enhances investor and customer insight by organizing virtual tours of its developments, such as the Jinmao Palace series, and facilitating online project research activities. This digital strategy allows remote access to detailed operational and offering knowledge, aligning with increasing digital engagement trends in real estate.

- Official website and HKExnews are key platforms for corporate communications.

- Virtual tours and online research activities offer in-depth project understanding.

- Digital engagement supports transparency with 2024/2025 financial updates.

- Remote access to information enhances investor and customer convenience.

China Jinmao's promotion strategy leverages its high-value brand, exceeding RMB 66 billion by 2024, through consistent investor engagement including 2024 quarterly updates and an early 2025 MSCI ESG AA rating. Integrated campaigns for commercial properties and high-quality project showcasing via experiential sales centers enhance market visibility. Digital platforms, such as their website and HKExnews, further disseminate 2024/2025 financial outlooks and offer virtual tours, ensuring broad reach and transparency.

| Promotional Element | Key Metric / Data | Latest Update |

|---|---|---|

| Brand Value | RMB 66 Billion+ | 2024 |

| ESG Rating | MSCI AA | Early 2025 |

| Residential Sales | RMB 120 Billion | 2023 |

Price

China Jinmao employs a premium pricing strategy, reflecting its focus on high-end properties in prime locations, such as its recent luxury residential developments in Shanghai and Beijing. This price point is justified by superior quality, exemplified by its commitment to innovative green technology, with over 150 projects certified for green building standards by early 2025. The strong Jinmao brand reputation further supports this, attracting affluent customers willing to pay a premium for a higher standard of living and potential for value appreciation, as seen in the robust sales performance of its high-end units which often exceed market average prices by 15-20% in prime urban areas.

For its large-scale city operation projects, China Jinmao employs value-based pricing, reflecting the comprehensive value from integrated property types and urban functions. While land costs may be mitigated through government partnerships, the overall price captures the long-term value of living and working in a well-planned, modern urban ecosystem. This approach balances profitability, evident in China Jinmao's CNY 80.0 billion revenue in 2023, with the creation of vibrant new city districts. The pricing strategy accounts for the premium associated with integrated infrastructure and sustainable design.

China Jinmao’s hotel segment employs a dynamic pricing model, adjusting room rates based on real-time factors like seasonality, demand, and major local events such as the Shanghai F1 Grand Prix. This flexible approach, guided by metrics like revenue per available room (RevPAR) and occupancy rates, maximizes profitability across its portfolio, including the Grand Hyatt Shanghai. For instance, Q1 2024 RevPAR showed a significant recovery, indicating effective price optimization. This strategy ensures revenue is maximized from diverse properties, from luxury hotels to branded offerings.

Competitive Project-Based Pricing

China Jinmao prices its development projects competitively, aligning with current market conditions, specific locations, and the product type to enhance gross margins. S&P Global estimates that newly acquired projects in 2024 and 2025 are projected to achieve gross margins exceeding 15%, marking an improvement over prior ventures. This reflects a strategic focus on land acquisition and pricing to ensure profitability within a competitive real estate landscape.

- Competitive pricing adapts to market conditions and project specifics.

- Gross margin for new projects in 2024/2025 is estimated to exceed 15%.

- This indicates a strategic shift for improved profitability.

Diversified Financing and Payment Options

China Jinmao provides diverse financing and payment plans, making property acquisition more accessible for buyers. On the corporate side, the company utilizes robust, low-cost funding channels, including bonds and securitized products. This financial strength is underscored by an average new debt cost of 3.39% in 2024. Such stability allows China Jinmao to offer competitive terms to customers and fund its extensive, large-scale development projects effectively.

- Diverse financing options enhance property buyer accessibility.

- Corporate access to low-cost funding channels like bonds.

- Average new debt cost recorded at 3.39% in 2024.

- Financial stability supports competitive customer terms and large-scale developments.

China Jinmao employs a multi-faceted pricing strategy, including premium pricing for luxury properties, achieving 15-20% higher sales in prime urban areas. Value-based pricing applies to large city operations, contributing to CNY 80.0 billion revenue in 2023. Its hotel segment uses dynamic pricing, evidenced by Q1 2024 RevPAR recovery, while competitive pricing for new development projects targets gross margins exceeding 15% in 2024/2025. Financing options are enhanced by a low average new debt cost of 3.39% in 2024.

| Strategy | Focus | Key Metric/Data |

|---|---|---|

| Premium Pricing | High-end Properties | 15-20% above market in prime areas |

| Value-Based Pricing | City Operations | CNY 80.0 billion revenue (2023) |

| Competitive Pricing | New Developments | >15% gross margin (2024/2025 projects) |

4P's Marketing Mix Analysis Data Sources

Our China Jinmao 4P's Marketing Mix Analysis is grounded in comprehensive data, including official company reports, investor relations materials, and industry-specific market research. We also leverage insights from real estate transaction data, news archives, and competitor analyses to provide a thorough understanding of their strategies.