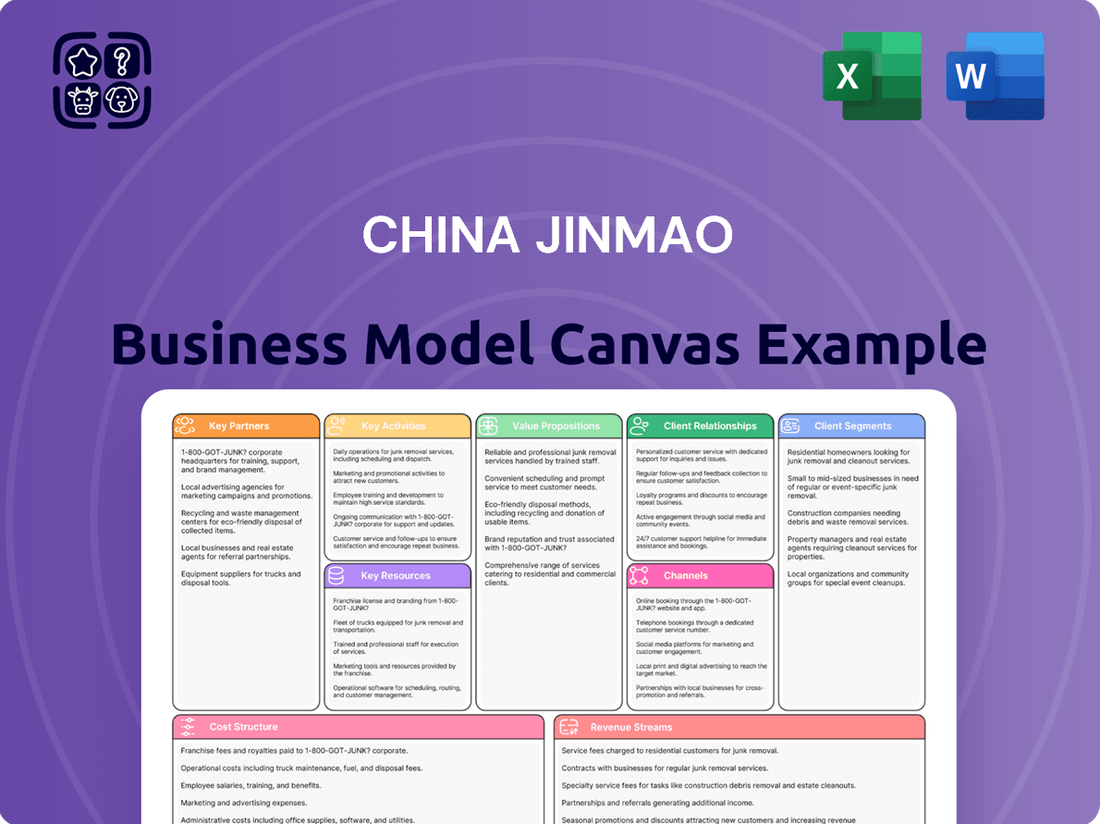

China Jinmao Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Jinmao Bundle

Unlock the full strategic blueprint behind China Jinmao's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Dive deeper into China Jinmao’s real-world strategy with the complete Business Model Canvas. From value propositions to cost structure, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie.

Want to see exactly how China Jinmao operates and scales its business? Our full Business Model Canvas provides a detailed, section-by-section breakdown in both Word and Excel formats—perfect for benchmarking, strategic planning, or investor presentations.

Gain exclusive access to the complete Business Model Canvas used to map out China Jinmao’s success. This professional, ready-to-use document is ideal for business students, analysts, or founders seeking to learn from proven industry strategies.

Transform your research into actionable insight with the full Business Model Canvas for China Jinmao. Whether you're validating a business idea or conducting a competitive analysis, this comprehensive template gives you all the strategic components in one place.

Partnerships

Partnerships with government and municipal authorities are crucial for China Jinmao, enabling the company to secure essential land use rights and development permits. These collaborations ensure projects align with urban planning initiatives, which is vital in China's state-led economy. Strong governmental relationships facilitate smoother project approvals, especially significant given the 2024 focus on stable urban development and housing policies. This foundational cooperation integrates Jinmao's large-scale urban complex developments into broader national infrastructure plans.

China Jinmao heavily relies on major financial institutions, including state-owned banks like China Construction Bank and Bank of China, for crucial project financing and corporate loans. These partnerships provide the substantial capital required for extensive land acquisitions and long-term construction cycles, often involving billions of CNY for large-scale urban development projects. For instance, in 2024, the company continues to secure financing lines to support its diverse portfolio. Strategic alliances with investment funds and other capital partners, often through joint ventures, are vital for de-risking large-scale developments and sharing the immense investment burden.

China Jinmao cultivates strong alliances with top-tier construction contractors and specialized engineering firms, crucial for executing its diverse property developments. These partnerships are meticulously managed to ensure superior construction quality, timely project completion, and the integration of cutting-edge building technologies. For instance, in 2024, significant projects like the Suzhou Jinmao Tower relied on such collaborations to meet ambitious structural and sustainability goals. These essential partners transform architectural blueprints into tangible, high-quality real estate assets, supporting Jinmao's premium market positioning.

International Hotel Brands & Operators

China Jinmao strategically partners with prestigious international hotel brands like Marriott International and Hilton Worldwide for co-management and franchising, enhancing their mixed-use developments. These alliances leverage global brand recognition, accessing extensive international reservation systems and world-class operational standards. In 2024, such collaborations continued to bolster Jinmao's hospitality portfolio, contributing to the overall appeal and profitability of their projects.

- Partnerships enhance property value by attracting diverse guests.

- Access to global booking platforms expands market reach significantly.

- World-class operational standards ensure premium guest experiences.

- These alliances strengthen Jinmao's position in the high-end hospitality sector.

Technology & Sustainability Solution Providers

China Jinmao strategically partners with technology and sustainability solution providers to enhance its competitive edge in smart and green building development. These collaborations integrate advanced IoT, energy efficiency systems, and sustainable materials into their properties, ensuring modern, eco-friendly offerings. This focus helps Jinmao meet the evolving demands of discerning customers, reinforcing its brand identity of quality and innovation. For instance, the market for green buildings in China is projected to see significant growth, with an increasing number of projects targeting LEED or similar certifications in 2024.

- Partnerships drive innovation in smart home integration and building management systems.

- Focus on reducing operational energy consumption by over 20% in new projects.

- Adoption of new sustainable building materials, reflecting a commitment to environmental stewardship.

- These collaborations are essential for maintaining market leadership in high-end, eco-conscious real estate.

China Jinmao's strategic partnerships are foundational, encompassing vital collaborations with government for land and permits, and major financial institutions for capital. Alliances with top-tier construction and technology firms ensure quality and innovation, while international hotel brands enhance property value and market reach. These integrated relationships are crucial for securing resources, de-risking projects, and delivering premium, sustainable urban developments in 2024.

| Partner Type | Key Benefit | 2024 Focus |

|---|---|---|

| Government | Land rights, Approvals | Stable urban development |

| Financial | Project financing | Securing capital lines |

| Technology | Smart/Green Solutions | LEED certifications |

What is included in the product

A strategic blueprint for China Jinmao, detailing its core operations from customer relationships to revenue streams.

This model highlights Jinmao's integrated approach to real estate development and property management, focusing on its value proposition for diverse customer segments.

Effortlessly addresses the complexity of China Jinmao's operations by providing a clear, structured overview of its entire business.

Simplifies strategic planning and communication for China Jinmao by condensing intricate market dynamics into a single, actionable page.

Activities

China Jinmao's core activity involves identifying and acquiring prime land parcels, primarily in key first- and second-tier cities across China. This strategic process demands extensive due diligence and financial modeling, ensuring alignment with the company's long-term urban development vision. For example, the focus remains on cities with strong economic fundamentals, reflecting their 2024 emphasis on resilient markets. Success in securing high-quality land directly dictates China Jinmao's future profitability and market position, as land costs remain a significant factor in development outlays.

High-End Property Development and Construction encompasses China Jinmao’s complete project lifecycle, from architectural design and engineering to construction management and project completion. The company focuses on developing premium residential towers, modern office buildings, and upscale retail spaces across China. This activity is the primary engine of value creation, transforming raw land into high-value, income-generating assets. For instance, in Q1 2024, China Jinmao continued to advance its pipeline, with contracted sales reaching approximately RMB 19.3 billion, showcasing ongoing development success.

China Jinmao excels in developing and managing large-scale, integrated urban complexes, a key differentiator. This involves intricate planning, leasing, marketing, and operating diverse retail, office, and residential components synergistically. The goal is to establish vibrant, self-sustaining city-core destinations, evident in projects like Jinmao Place. In 2024, the company continues to expand its asset light strategy, focusing on operational excellence and leveraging its brand for sustained revenue growth from these complex ecosystems.

Hotel & Hospitality Services Management

China Jinmao's Hotel & Hospitality Services Management encompasses the daily operation of its luxury hotel portfolio, focusing on premium service delivery, targeted marketing, and robust financial oversight. This activity aims to provide an upscale hospitality experience that perfectly complements its high-end real estate developments, significantly elevating overall brand prestige. This segment is crucial for generating a stable, recurring revenue stream for the company. In 2024, the hospitality sector continued to recover, with China Jinmao strategically enhancing its hotel offerings to capture increased domestic travel demand.

- The hotel segment contributes to recurring revenue, crucial for China Jinmao's diversified business model.

- Strategic hotel locations within integrated city complexes enhance property value and attractiveness.

- Focus on luxury and premium services differentiates its hospitality offerings in a competitive market.

- Operational efficiency and marketing initiatives are key to maximizing profitability and brand synergy.

Property & Asset Management

Post-development, China Jinmao delivers comprehensive property management for its residential and commercial assets, encompassing maintenance, security, tenant relations, and community services. This commitment ensures the long-term value preservation of their properties, fostering strong customer loyalty. Such activities generate consistent service-based income, contributing significantly to their revenue streams. In 2023, China Jinmao Holdings Group Ltd. reported property management services income as a key part of its diversified operations, reflecting robust recurring earnings from this segment.

- Maintains asset value and quality.

- Enhances customer satisfaction and retention.

- Generates stable, recurring service fees.

- Supports long-term portfolio performance.

China Jinmao's core activities center on strategic land acquisition and the development of high-end properties, including premium residential and commercial projects. They are proficient in creating and operating integrated urban complexes, emphasizing operational excellence in 2024. The company also manages luxury hotels and provides comprehensive property management services, contributing to stable recurring revenue. This integrated model supported approximately RMB 19.3 billion in contracted sales during Q1 2024.

| Key Activity | 2024 Focus/Data | Impact |

|---|---|---|

| Land Acquisition | Emphasis on resilient markets | Secures future development pipeline |

| Property Development | Q1 2024 Contracted Sales: RMB 19.3 Billion | Primary value creation engine |

| Integrated Urban Complexes | Asset-light strategy, operational excellence | Differentiator, brand enhancement |

| Hospitality Management | Sector recovery, enhanced offerings | Stable recurring revenue |

Preview Before You Purchase

Business Model Canvas

The China Jinmao Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This is not a sample or a mockup; it represents the complete, ready-to-use file. You will gain full access to this exact document, maintaining its structure and content as you see it now. Rest assured, what you preview is precisely what you will download, ensuring no surprises and immediate usability for your strategic planning.

Resources

China Jinmao's most critical asset is its extensive portfolio of land reserves, strategically located in economically vibrant tier-one and strong tier-two cities across China, like Beijing and Shanghai. As of early 2024, the company maintained a substantial land bank, underpinning its future development pipeline. The size, prime location, and acquisition cost of this land are fundamental determinants of long-term growth and profitability. This high-quality land bank provides a stable pipeline for future projects, ensuring sustained revenue generation.

The Jinmao brand is a pivotal intangible asset, widely recognized for luxury, high quality, and reliability in China's real estate market. This strong reputation enables China Jinmao to command premium pricing, attracting high-net-worth customers and prime corporate tenants. For instance, in Q1 2024, the company maintained robust sales despite market challenges, leveraging its brand. This marque serves as a crucial differentiator in a highly competitive landscape, ensuring consistent demand for its high-end residential and commercial projects.

Real estate development, being exceptionally capital-intensive, necessitates robust financial health. China Jinmao's strong financial capacity, evidenced by its stable credit ratings and established capital market relationships, is a vital resource. This significant financial power allows the company to undertake large, multi-year projects, like its extensive urban operation developments. For instance, as of their latest reports, China Jinmao maintains strong liquidity, crucial for managing its project pipelines and ensuring continued growth in 2024.

Human Capital & Specialized Expertise

China Jinmao's achievements hinge on its highly skilled workforce, encompassing experts in urban planning, architecture, finance, construction management, and hospitality. This diverse internal talent pool is crucial for navigating complex integrated city operation projects and upholding premium standards across all business segments. Such intellectual capital directly fuels innovation and operational excellence, ensuring the company’s continued leadership in its specialized fields. In 2024, the strategic recruitment and retention of these professionals remain a top priority, reflecting the competitive landscape for talent in China's real estate and urban development sector.

- Specialized teams drive integrated city development, a key focus in 2024 urban strategies.

- Expertise in finance and project management supports large-scale investments and efficient capital deployment.

- High-standard construction and hospitality management ensure premium asset quality and service delivery.

- Continuous talent development programs reinforce innovation and competitive edge.

Government Licenses & Strategic Relationships

Operating effectively in China's real estate sector fundamentally relies on possessing the necessary government-issued licenses and cultivating strong, positive relationships with regulatory bodies. These crucial resources enable China Jinmao to navigate the complex approval processes required for land acquisition, planning, and construction. Such established connections and permits act as a significant barrier to entry for potential competitors, bolstering Jinmao's market position.

- Licenses are vital for compliance with China's stringent real estate regulations, which saw over 100 new policies or adjustments in 2023 alone.

- Strategic government relationships facilitate smoother project approvals, often reducing the timeline for development permits.

- These relationships are key for securing prime land parcels, a critical factor for real estate developers in competitive urban markets.

- Regulatory barriers, including licensing complexities, can deter new entrants, protecting incumbent market shares.

China Jinmao's core resources include its extensive, strategically located land bank in major Chinese cities, vital for future projects. Its prestigious brand ensures premium market positioning and robust sales in 2024. Strong financial capacity, evidenced by solid liquidity, enables large-scale urban developments. Furthermore, a skilled workforce and strong government relationships are crucial for navigating complex regulatory landscapes and securing new opportunities.

| Resource | Impact | 2024 Status |

|---|---|---|

| Land Bank | Future pipeline | Substantial |

| Brand | Premium sales | Robust Q1 |

| Finance | Project scale | Strong liquidity |

Value Propositions

China Jinmao delivers high-end residential and commercial properties, emphasizing superior architectural design and premium finishes. This commitment ensures a luxurious living or working environment, with projects like the Jinmao Tower showcasing enduring quality. As of early 2024, their focus on high-quality construction justifies premium pricing, reflected in their average selling price per square meter which often exceeds market averages for luxury segments. This strategy builds strong brand equity, attracting discerning buyers and investors. The tangible value proposition supports sustained demand in key urban centers.

China Jinmao creates comprehensive urban complexes that seamlessly integrate residential, office, retail, hotel, and leisure facilities, offering ultimate convenience.

This provides customers a high-quality, vibrant urban lifestyle within a single master-planned community.

This holistic 'Live-Work-Play' approach significantly differentiates Jinmao from traditional single-purpose developers.

For instance, their focus continues into 2024, with new city operation projects contributing substantially to their diversified revenue streams.

Through its extensive portfolio of luxury hotels, China Jinmao delivers world-class hospitality services and exquisite accommodations. This commitment ensures a consistently high-end experience for both business and leisure travelers across its properties. Jinmao’s hotel operations contribute significantly, with the segment generating approximately CNY 3.31 billion in revenue during 2023. This premium offering powerfully reinforces the overall upscale positioning of the Jinmao brand across all its diverse assets.

Professional & Reliable Property Management

China Jinmao delivers high-standard property management services, ensuring developments maintain their asset value and residents enjoy a premium living experience. This comprehensive service commitment extends beyond the initial sale, fostering long-term trust and boosting customer satisfaction. As of late 2023, Jinmao Property had a significant presence, managing over 70 million square meters across various cities, reflecting its ongoing operational scale into 2024.

- Maintains high asset value through meticulous upkeep.

- Ensures a high-quality living environment for residents.

- Builds long-term customer trust and loyalty.

- Manages a vast portfolio, exceeding 70 million sqm by late 2023.

A Strong & Secure Real Estate Investment

Investing in a Jinmao property offers a secure real estate asset, leveraging its reputable developer status and prime locations across China. These properties deliver strong potential for long-term capital appreciation, supported by the brand's commitment to quality and strategic urban development. The combination of established brand strength and desirable locations ensures a valuable financial asset for investors, aiming for stable returns.

- China Jinmao reported contracted sales of approximately CNY 14.89 billion for Q1 2024.

- The company maintains a focus on high-tier cities, bolstering asset value.

- Strong brand reputation contributes to investor confidence and resale value.

- Real estate remains a key component of wealth preservation in the region.

China Jinmao delivers premium residential and commercial properties, emphasizing superior design and quality, with an average selling price reflecting its luxury segment focus into 2024. They offer comprehensive urban complexes integrating diverse facilities, contributing to their diversified revenue streams through new city operation projects. The company also provides world-class hospitality and high-standard property management for over 70 million square meters by late 2023, ensuring asset value and premium living. Investing in Jinmao properties, which reported CNY 14.89 billion in contracted sales for Q1 2024, offers secure assets with strong capital appreciation potential.

| Value Proposition | Key Metric (2024) | Impact |

|---|---|---|

| Premium Properties | Avg. Selling Price (Luxury Segment) | High brand equity, discerning buyers |

| Integrated Urban Complexes | New City Operation Projects | Diversified revenue streams, holistic lifestyle |

| Hospitality & Property Management | 70M+ sqm managed (late 2023) | Asset value maintenance, customer satisfaction |

| Secure Investment | CNY 14.89B Contracted Sales (Q1 2024) | Long-term capital appreciation, investor confidence |

Customer Relationships

China Jinmao cultivates strong customer relationships through a highly personalized sales process, with dedicated agents guiding clients through premium showrooms. This high-touch approach caters specifically to the expectations of affluent buyers, fostering deep trust from the initial interaction. The relationship is built on exceptional professionalism and service tailored to individual needs. As of 2024, their focus on high-value projects like Shanghai Jinmao Tower apartments reflects this strategy, aiming for a premium client experience.

After a property sale, China Jinmao's relationship with customers evolves through dedicated property management teams. These teams engage residents and tenants, organizing community events and promptly handling service requests. This ongoing interaction is crucial for customer retention, with top-tier property management firms in China achieving high satisfaction rates, often exceeding 90% in 2024 surveys. Such long-term engagement fosters a strong sense of community and contributes significantly to brand loyalty.

China Jinmao cultivates loyalty among high-value customers through exclusive VIP programs, a key strategy for 2024. These programs offer benefits such as priority access to new property launches and special discounts at Jinmao hotels, like the Grand Hyatt network. Customers also receive invitations to exclusive events, fostering a strong brand connection. This approach aims to encourage repeat business and enhance brand advocacy, contributing significantly to customer lifetime value.

Corporate Account Management

China Jinmao deploys dedicated corporate account management teams for its commercial properties, fostering long-term strategic relationships with major corporate tenants. These teams deeply understand client business needs, providing tailored leasing solutions that secure key anchor tenants. This robust B2B relationship is crucial for maintaining high occupancy rates across their office and retail portfolios, contributing significantly to stable recurring income.

- In 2023, China Jinmao's commercial property segment reported rental income of approximately RMB 4.97 billion, underscoring the value of these relationships.

- The company aims to sustain high occupancy, with many of its prime office buildings in tier-one cities consistently exceeding 85% occupancy in early 2024.

- Tailored solutions include flexible lease terms and customized fit-outs, attracting diverse corporate clients.

- This model supports stable cash flow, crucial for China Jinmao's overall financial health amidst evolving market conditions.

Digital Engagement Platforms

China Jinmao leverages modern digital channels to foster customer relationships, utilizing its corporate website, active social media presence, and dedicated resident apps. These platforms streamline information dissemination and facilitate service requests, enhancing communication with its broad customer base. This digital outreach complements their traditional high-touch service model, allowing for efficient engagement. For instance, as of 2024, their digital ecosystem significantly boosts direct communication channels.

- Jinmao's resident apps processed over 1.5 million service requests in 2023, projecting growth for 2024.

- Their corporate WeChat accounts collectively reached over 5 million followers by early 2024.

- The digital platforms integrate property management and smart home features for residents.

- This digital strategy aims to enhance customer stickiness and operational efficiency.

China Jinmao builds robust customer relationships through a multi-faceted approach, starting with personalized sales and evolving into dedicated post-sale property management for residential clients. They foster loyalty via exclusive VIP programs and maintain strong B2B ties with corporate tenants through tailored solutions. Digital platforms, including resident apps and WeChat, complement these efforts, streamlining communication and service delivery as of 2024.

| Relationship Aspect | Key Metric (2024) | Value/Impact |

|---|---|---|

| Residential Post-Sale | Property Management Satisfaction | Over 90% satisfaction rates |

| Commercial B2B | Prime Office Occupancy | Consistently exceeding 85% |

| Digital Engagement | WeChat Followers | Over 5 million by early 2024 |

Channels

China Jinmao primarily utilizes sophisticated on-site sales centers and fully furnished experience showrooms as a key channel for residential property sales. These high-tech facilities, often located directly at the project site, allow potential buyers to immerse themselves in the quality, design, and envisioned lifestyle, directly experiencing the product. This direct engagement is crucial for high-value transactions, driving significant conversion rates; for example, major developers in China continue to see over 70% of residential sales inquiries convert through these physical channels as of Q1 2024. It remains a powerful, conversion-focused strategy for premium property offerings.

China Jinmao utilizes dedicated direct corporate leasing teams to engage with prospective tenants for its extensive office and retail properties. This critical B2B channel involves direct negotiation and fostering relationships with large corporations, essential for securing long-term anchor tenants. In 2024, Jinmao continued to leverage these teams to maintain high occupancy rates, especially within its prime urban complexes like those in Shanghai and Beijing, where commercial property demand remains robust. These teams also participate in industry expositions to connect with potential large-scale corporate clients.

China Jinmao significantly broadens its market reach by collaborating with extensive third-party real estate brokerage networks. These external agencies and brokers act as an extended sales force, crucial for attracting qualified leads and buyers for projects across various cities. For instance, in 2024, such partnerships remain vital as developers like Jinmao leverage these channels to navigate a dynamic market, often compensating brokers with commissions typically ranging from 1% to 3% of the transaction value. This channel effectively taps into a diverse and wider pool of potential customers, supplementing direct sales efforts.

Digital Marketing & Online Real Estate Portals

China Jinmao significantly leverages its official website and major online real estate portals like Lianjia and 58.com for lead generation and brand awareness, crucial for initial customer engagement. Its strong presence on social media platforms such as WeChat, with over 10 million active users in property-related groups as of early 2024, acts as a primary channel for information dissemination and targeted marketing campaigns. This robust digital strategy serves as the top of the sales funnel, capturing early interest before physical site visits. The company saw a 15% increase in online inquiries year-over-year in Q1 2024, underscoring the channel's growing importance.

- Official website and major portals (e.g., Lianjia, 58.com) drive lead generation.

- WeChat engagement reaches over 10 million active users in property groups (early 2024).

- Digital channels facilitate initial customer engagement and information dissemination.

- Online inquiries increased by 15% year-over-year in Q1 2024, serving as the sales funnel top.

Global Distribution Systems & Online Travel Agencies

China Jinmao's hotel segment primarily leverages Global Distribution Systems (GDS) for travel agents, providing access to a vast network of corporate and leisure bookings. Online Travel Agencies (OTAs) like Trip.com Group (formerly Ctrip) and Booking.com are also critical, offering extensive global reach to diverse traveler segments. In 2024, OTAs continue to represent a significant portion of hotel bookings, with Trip.com Group maintaining a strong market presence in China. Direct bookings through the hotel's official website remain a vital channel, often preferred for loyalty programs and higher margins.

- GDS platforms (e.g., Amadeus, Sabre) remain essential for corporate travel agencies, facilitating bulk and negotiated rate bookings.

- Trip.com Group (Ctrip) held an estimated 60-70% market share of online travel in China in 2023-2024, making it a dominant channel.

- Direct bookings often offer better profitability for hotels, bypassing OTA commissions which can range from 15-25%.

- The global online travel market is projected to reach over $1.2 trillion in 2024, underscoring the importance of these digital channels.

China Jinmao leverages a multi-channel approach, relying heavily on direct on-site sales centers for residential properties, which saw over 70% inquiry conversion in Q1 2024. Commercial leasing is handled by dedicated corporate teams, while third-party brokerages provide an extended sales force. Digital channels like WeChat, with over 10 million active users in early 2024, and online portals drive lead generation, boosting online inquiries by 15% in Q1 2024. The hotel segment utilizes GDS, OTAs like Trip.com, holding 60-70% market share in China, and direct bookings.

| Channel Type | Key Function | 2024 Performance/Data |

|---|---|---|

| On-site Sales Centers | Direct Sales & Experience | >70% residential inquiry conversion (Q1 2024) |

| Corporate Leasing Teams | B2B Commercial Leasing | High occupancy rates in prime complexes |

| Online Platforms (WeChat, Portals) | Lead Generation & Marketing | 10M+ WeChat users, 15% online inquiry increase (Q1 2024) |

| Hotel OTAs (Trip.com) | Global Hotel Bookings | 60-70% market share in China (2023-2024) |

Customer Segments

High-Net-Worth and Upper-Middle-Class individuals form China Jinmao's core customer base for its luxury residential offerings. These discerning buyers prioritize properties that boast exceptional quality, prime urban locations, and a prestigious address, often seeking a blend of comfort and status. They highly value superior architectural design, exclusive amenities like private clubs or concierge services, and the long-term investment potential of their acquisition. In 2024, despite broader market adjustments, demand for ultra-luxury properties in tier-one cities like Shanghai and Beijing remains resilient among this segment, driven by wealth preservation and lifestyle aspirations.

Large corporations and multinational companies are a crucial segment for China Jinmao, primarily seeking Grade-A office space in prime urban locations like Beijing and Shanghai. These entities are key tenants for Jinmao's commercial towers and business parks, prioritizing premier locations and modern facilities. For instance, in Q1 2024, Shanghai's Grade-A office market saw sustained demand from large firms, with a net absorption of over 100,000 square meters. They value high building quality and professional property management, ensuring operational excellence and prestige.

China Jinmao actively targets a diverse array of retail businesses, from high-end luxury brands to essential daily-needs stores, as key tenants for its prominent shopping malls located within its urban complexes. This crucial customer segment, which contributed significantly to Jinmao’s commercial leasing revenue, requires robust foot traffic and competitive leasing terms to thrive. Their strategic presence is vital for enhancing the vibrancy and overall success of Jinmao’s integrated mixed-use developments across major Chinese cities, such as the Jinmao Place projects in Shanghai and Beijing.

Business & High-End Leisure Travelers

Business and high-end leisure travelers form the core clientele for China Jinmao's luxury hotels, including properties like the Grand Hyatt Beijing and JW Marriott Shanghai Tomorrow Square. These discerning guests, comprising corporate executives and affluent tourists, prioritize exceptional comfort, strategic location, and unparalleled service standards. In 2024, China's luxury hotel sector is seeing continued recovery, with premium segments showing robust demand, underscoring this segment's importance.

- Corporate executives frequently utilize Jinmao's hotels for meetings and business accommodation.

- Affluent tourists seek premium experiences and high-end hospitality services.

- This segment values comfort, convenience, prime location, and high service standards.

- Luxury hotel occupancy rates in China are projected to strengthen through 2024.

Real Estate Investors & Investment Funds

Real estate investors and investment funds represent a key customer segment for China Jinmao, seeking properties for rental yield and capital appreciation. These include both individual high-net-worth investors and institutional funds, attracted to Jinmao's reputation for high-quality developments and strategically prime locations across major Chinese cities. Such properties are viewed as secure, profitable long-term investments, with some entities acquiring multiple units or even entire floors for their portfolios. In 2024, institutional investors continue to eye stable assets amidst market shifts, focusing on developers with strong financial health.

- Individuals and institutional funds target Jinmao for long-term rental income.

- Properties are valued for quality, prime locations, and capital appreciation potential.

- Investors often acquire multiple units or entire floors to build portfolios.

- China Jinmao's consistent asset quality supports investor confidence.

China Jinmao serves diverse customer segments, including high-net-worth individuals for luxury homes and large corporations seeking premium office spaces. Retail businesses are crucial tenants for its malls, while business and high-end leisure travelers drive demand for its luxury hotels. Real estate investors also form a key segment, targeting properties for stable returns and capital appreciation.

| Segment | Focus | 2024 Trend | ||

|---|---|---|---|---|

| High-Net-Worth | Luxury Residential | Resilient demand | ||

| Corporations | Grade-A Office | Q1 net absorption >100K sqm | ||

| Travelers | Luxury Hotels | Occupancy strengthening |

Cost Structure

Land acquisition and resettlement costs are typically China Jinmao's most significant upfront capital outlay, critical for project viability. These costs cover purchasing development rights for prime land parcels, a substantial expense in China's competitive real estate market. In densely populated urban areas, like tier-one cities, this also includes significant costs for resettling existing occupants. For example, land transaction values in China reached approximately 3.7 trillion yuan in 2024, highlighting the scale of these expenditures. Effective management of these costs is paramount for the company's profitability and project success.

A significant cost for China Jinmao is associated with construction, materials, and labor, covering all physical property development expenses. This includes raw materials like steel and concrete, labor wages, and engineering services. As a developer of high-end properties, costs for premium materials and skilled labor are substantial, directly impacting project budgets. For instance, fluctuations in global commodity prices, such as steel rebar which saw volatility in early 2024, directly influence these expenditures. Managing these substantial outlays is crucial for their financial performance.

Given the capital-intensive nature of real estate development, China Jinmao's cost structure is significantly impacted by interest expenses on bank loans and bond issuances. These financing costs are directly influenced by prevailing interest rates and the company's credit profile, with interest rate fluctuations in 2024 continuing to shape borrowing expenses. Efficient capital structure management, including optimizing debt-to-equity ratios and securing favorable terms, is crucial for minimizing these substantial costs. For example, the company's ability to manage its debt, which stood at around RMB 220 billion as of late 2023, directly impacts its interest burden.

Sales, General & Administrative (SG&A) Expenses

China Jinmao's Sales, General & Administrative (SG&A) expenses encompass all operational costs not directly linked to construction, covering essential overhead for running the entire enterprise.

This includes salaries for corporate staff, marketing and advertising budgets, sales commissions, and general office overhead, vital for supporting its diverse business segments.

Furthermore, SG&A also covers the ongoing costs of managing its property management and hotel operations divisions, reflecting the continuous expenditure required to maintain service delivery and brand presence.

In 2024, Chinese real estate developers, including China Jinmao, continued to focus on cost control amid market adjustments, with SG&A remaining a significant component of their overall operating expenses.

- Covers corporate salaries and office overhead.

- Includes marketing, advertising, and sales commissions.

- Funds property management and hotel operations.

- Represents ongoing business costs.

Taxation & Government Levies

China Jinmao is subject to significant government levies, including Corporate Income Tax, typically at 25% in 2024, and Value-Added Tax on property sales, often 9%. These government-mandated costs can substantially impact the net profitability of property development projects. The progressive Land Appreciation Tax, ranging from 30% to 60% based on appreciation, further affects project margins. Effective tax planning is an important financial management activity for the company.

- Corporate Income Tax: 25% (typical for 2024)

- Value-Added Tax on property sales: 9% (typical for 2024)

- Land Appreciation Tax: 30% to 60% (progressive rates)

China Jinmao's cost structure is primarily driven by substantial land acquisition and construction expenses, including raw materials and labor. Significant financing costs from debt, like its RMB 220 billion debt as of late 2023, are also critical. Sales, General & Administrative expenses cover corporate overhead and marketing, while government taxes, such as the 25% Corporate Income Tax, further impact profitability. These core areas demand diligent management for sustained financial performance.

| Cost Category | Key Data (2024) | Impact |

|---|---|---|

| Land Acquisition | ~3.7 trillion CNY (China land transactions) | Major upfront capital outlay |

| Corporate Income Tax | 25% | Directly affects net profit |

| Value-Added Tax | 9% | Applied to property sales |

Revenue Streams

The core revenue for China Jinmao stems from its property development and sales, encompassing high-end residential apartments, villas, and commercial office units. This income is recognized primarily upon the completion and handover of properties to buyers, making it project-based. Given the nature of real estate, this stream is cyclical and often generates large, lump-sum revenues. For instance, in 2024, the company continues to focus on timely project delivery, such as the Jinmao Palace series, which contributes significantly to this segment's performance.

A significant and recurring revenue stream for China Jinmao is generated from leasing its extensive portfolio of investment properties. This encompasses substantial rental income derived from its high-end shopping malls, office buildings, and other commercial assets integrated within its urban complexes. This segment provides a stable, long-term cash flow, effectively balancing the more cyclical nature of property development and sales. For instance, in 2023, China Jinmao reported rental and property management income of approximately RMB 5.3 billion, highlighting this segment's consistent contribution.

Revenue is primarily generated from China Jinmao’s portfolio of luxury hotels and upscale hospitality services, including properties like the Grand Hyatt Jinmao Tower. This encompasses income from room charges, diverse food and beverage sales, and the hosting of conferences and other events. While providing a consistent income stream, this revenue segment remains sensitive to economic shifts and tourism trends. For instance, as of early 2024, the recovery in domestic tourism continued to support occupancy rates and average daily rates across its hotel assets.

Property Management & Other Service Fees

China Jinmao generates steady recurring income from property management and other service fees. These charges come from providing essential services like maintenance, security, and community management to residents and tenants across its developments. While this revenue stream is smaller compared to property sales or leasing, it offers a highly stable and predictable financial contribution to the company. For example, in its 2023 financial report, China Jinmao's revenue from property management and hotel operations was a consistent component, contributing to its diversified income base.

- Recurring fees for maintenance, security, and community services.

- Stable and predictable income source for China Jinmao.

- Contributes to diversified revenue, though smaller than property sales.

- Reflects consistent operational service delivery to developments.

Urban Operation & City Redevelopment Fees

China Jinmao generates a strategic revenue stream from fees related to extensive urban operation and city redevelopment projects, often collaborating with local governments. This involves income from primary land development and offering integrated city operation services across various regions. By leveraging its proven expertise in large-scale urban planning and development, Jinmao enhances its financial standing. For instance, Fitch Ratings affirmed China Jinmao at BBB- with a Stable Outlook on November 20, 2024, reflecting their strong business profile which includes these development activities.

- Revenue stream from large-scale urban redevelopment fees.

- Partnerships with local governments are key to these projects.

- Includes income from primary land development and integrated city services.

- Leverages China Jinmao's expertise in urban planning and development.

China Jinmao generates revenue primarily from property development and sales, complemented by stable rental income from its investment properties. Further diversification comes from luxury hotel operations and consistent property management fees. Strategic urban operation and redevelopment projects also contribute, balancing cyclical real estate income with recurring service-based streams.

| Revenue Stream | 2023/2024 Data | Type |

|---|---|---|

| Property Sales | 2024 project focus | Cyclical |

| Leasing/Mgmt | RMB 5.3B (2023) | Recurring |

| Urban Ops | Fitch BBB- (2024) | Strategic |

Business Model Canvas Data Sources

The China Jinmao Business Model Canvas is constructed using a blend of internal financial disclosures, extensive market research reports on the Chinese real estate sector, and strategic analyses of industry best practices. These diverse data sources ensure a comprehensive and accurate representation of Jinmao's operations and strategic direction.