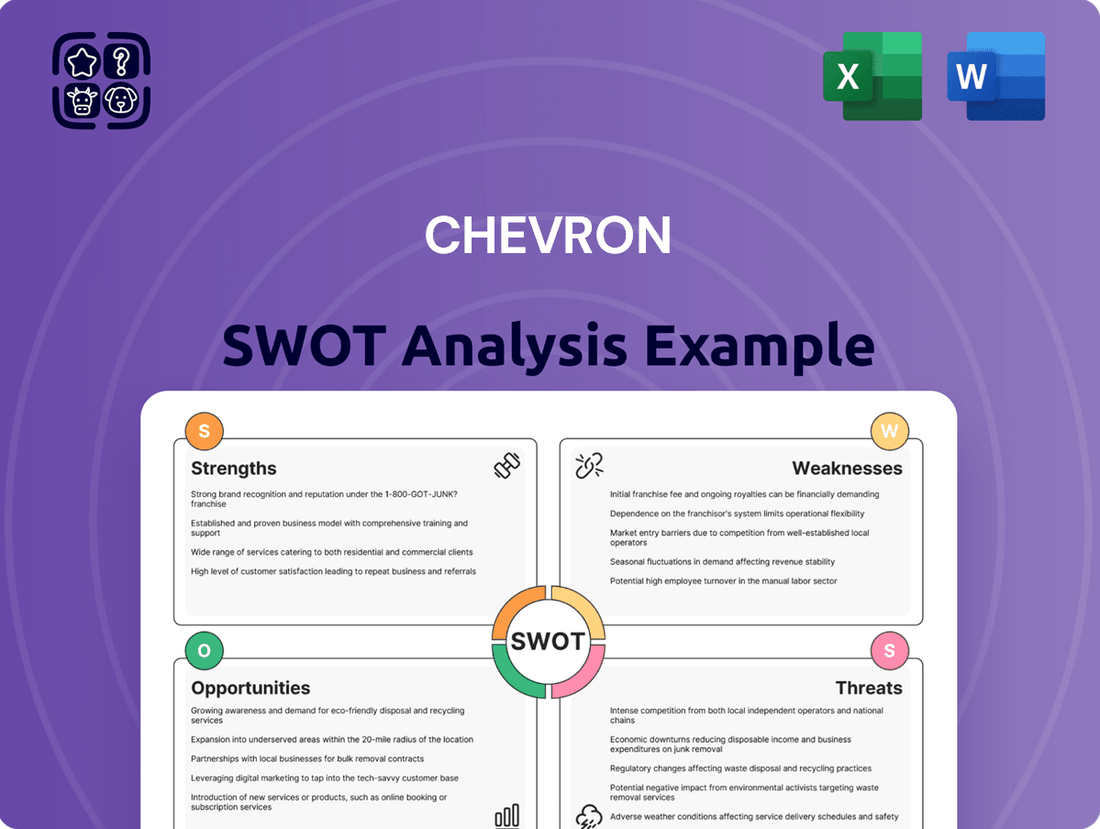

Chevron SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chevron Bundle

Chevron, a titan in the energy sector, boasts significant strengths in its integrated operations and global reach, but also faces challenges like fluctuating oil prices and increasing regulatory scrutiny. Understanding these dynamics is crucial for anyone looking to navigate the complex energy market.

Want the full story behind Chevron's market position, its competitive advantages, and the potential threats it faces? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Chevron Corporation boasts formidable brand value, recognized as the sixth-largest oil corporation worldwide in 2024. This esteemed market position is a direct result of its vast operational footprint and its critical role in satisfying global energy demands.

Chevron consistently delivers robust financial results, showcasing a strong balance sheet and reliable cash flow generation. This financial strength directly translates into significant value returned to its shareholders.

In 2024, Chevron achieved a milestone by returning a record $27 billion to shareholders via dividends and share repurchases. This commitment continued into the first quarter of 2025, with the company distributing an additional $6.9 billion to investors.

Chevron's global geographic presence is a significant strength, with operations spanning over 180 countries. This extensive reach allows the company to tap into diverse energy markets and balance regional economic fluctuations, as seen in its substantial operations in the United States, Nigeria, and Brazil.

The company's vertical integration is another key advantage, encompassing the entire oil and gas value chain from exploration and production to refining and marketing. This integrated model, which generated over $146 billion in revenue in 2023, enhances operational efficiency and provides greater control over costs and product quality.

Commitment to Research and Development and Technology

Chevron's unwavering dedication to research and development (R&D) is a significant strength, particularly in its pursuit of environmentally conscious technologies. This focus aims to boost both sustainability and operational efficiency across its diverse energy portfolio. For instance, in 2023, Chevron reported investing $3.2 billion in R&D and lower carbon initiatives, a testament to its forward-looking strategy.

This consistent investment fuels innovation and underpins a robust patent portfolio. Such intellectual property not only safeguards its technological advancements but also provides a distinct competitive advantage. It allows Chevron to refine its production methods and explore new avenues for energy development, as seen in its advancements in carbon capture and storage technologies.

- Consistent R&D Investment: Chevron allocated $3.2 billion to R&D and lower carbon initiatives in 2023, highlighting a strategic commitment to innovation.

- Focus on Sustainable Technologies: The company prioritizes the development of environmentally friendly solutions to improve efficiency and reduce its carbon footprint.

- Strong Patent Portfolio: A substantial collection of patents provides a competitive edge and protects proprietary technologies in areas like advanced extraction and carbon capture.

- Enhanced Production Methods: R&D efforts directly contribute to optimizing existing operations and developing novel approaches to energy production and processing.

Disciplined Capital Allocation and Operational Efficiency

Chevron demonstrates a disciplined capital allocation strategy, consistently prioritizing financial health and free cash flow generation. This approach is evident in its robust balance sheet and a clear focus on returns.

The company's commitment to operational efficiency has translated into impressive production results. For instance, in the first quarter of 2024, Chevron reported record upstream production, with the Permian Basin and the Gulf of Mexico being significant contributors. This efficiency not only bolsters output but also underpins the company's ability to generate substantial free cash flow, which was approximately $14.5 billion in 2023, enabling further investment and shareholder returns.

- Strong Balance Sheet: Maintains a healthy debt-to-equity ratio, providing financial flexibility.

- Free Cash Flow Growth: Prioritizes generating and growing free cash flow, seen in its 2023 performance.

- Operational Excellence: Achieves high production levels, particularly in strategic areas like the Permian.

- Disciplined Investment: Focuses capital on projects with high returns and strategic value.

Chevron's brand recognition and global presence are significant strengths, positioning it as a leading energy provider. Its financial resilience, demonstrated by robust cash flow and shareholder returns, provides a stable foundation. The company's vertically integrated operations enhance efficiency and control across the value chain.

Chevron's commitment to R&D, particularly in lower-carbon technologies, fuels innovation and secures future competitiveness. This strategic focus, backed by a strong patent portfolio, allows for optimized production and exploration of new energy solutions.

| Metric | 2023 Value | Q1 2025 Projection |

|---|---|---|

| Shareholder Returns | $27 billion (2023) | $6.9 billion (Q1 2025) |

| R&D Investment | $3.2 billion (2023) | N/A |

| Revenue | $146 billion (2023) | N/A |

What is included in the product

Delivers a strategic overview of Chevron’s internal strengths and weaknesses alongside external opportunities and threats.

Identifies key competitive advantages and potential threats to mitigate risks and capitalize on opportunities.

Weaknesses

Chevron's significant reliance on oil and gas revenue makes it inherently vulnerable to the unpredictable swings in global commodity prices. For instance, the average Brent crude oil price dipped to around $82.30 per barrel in 2023, a notable decrease from previous years, directly impacting earnings. This volatility can create substantial uncertainty for Chevron's financial performance, affecting revenue streams and overall profitability.

Chevron's substantial debt load, reported at $21.835 billion as of the first quarter of 2024, presents a notable weakness. A significant portion of the company's cash flow is allocated to servicing these debt obligations through interest payments.

While Chevron maintains a strong net debt ratio, the sheer volume of its debt can potentially constrain its financial maneuverability. This high level of indebtedness could limit the company's ability to pursue new strategic initiatives or respond effectively to market downturns without further financial strain.

Chevron has encountered significant operational hurdles, including downtime in its upstream segment. For instance, in Q1 2024, the company reported lower production volumes partly due to planned maintenance and unplanned outages. These disruptions directly affect output and can lead to increased capital expenditures for repairs and efficiency improvements.

Higher exploration expenses present another weakness. In 2023, Chevron's exploration and appraisal capital expenditures rose, reflecting the increasing costs associated with finding and developing new oil and gas reserves. This trend, if sustained, can strain profitability and impact the company's ability to fund future growth projects.

Specific incidents, such as the contamination of Mars crude oil in late 2023, have also caused operational disruptions. This event led to significant remediation costs and temporary impacts on refinery operations, highlighting the vulnerability of its supply chain and the potential for unforeseen events to affect financial performance.

Environmental Criticism and Legal Issues

Chevron, as one of the world's leading carbon emitters, frequently faces significant environmental criticism. This scrutiny often translates into legal challenges and regulatory actions, impacting its operations and public image.

The company has encountered numerous legal issues, including fines from environmental protection agencies. For instance, in 2023, Chevron settled with the U.S. Environmental Protection Agency (EPA) for $1.5 million concerning violations at its Pascagoula refinery, related to air emissions. Such penalties, while part of doing business, underscore the ongoing regulatory pressure.

- Environmental Scrutiny: Recognized as a major contributor to global carbon emissions, leading to public and governmental pressure.

- Legal Challenges: Faces ongoing lawsuits and regulatory actions related to environmental impact and past incidents.

- Financial Costs: Penalties and legal settlements, such as the $1.5 million EPA settlement in 2023, represent direct financial burdens and can escalate.

- Reputational Damage: Negative publicity surrounding environmental issues can harm brand reputation, affecting customer loyalty and investor confidence.

Workforce Layoffs and Potential Impact on Safety Culture

Chevron's strategic cost-cutting initiatives, including plans to reduce its global workforce by 15-20% by the end of 2026, present a significant weakness. This substantial workforce reduction could strain remaining employees, potentially leading to decreased operational oversight and an increased risk of safety lapses. The company has already experienced several safety incidents and received internal warnings, making these layoffs particularly concerning for maintaining a robust safety culture.

The impact of these layoffs extends beyond immediate operational capacity. A stressed and potentially demoralized workforce, dealing with increased workloads and job insecurity, may be less vigilant in adhering to safety protocols. This could erode the company’s hard-earned safety record and create a negative feedback loop where reduced morale leads to further safety concerns.

The potential consequences of these workforce reductions on Chevron's safety culture are substantial:

- Increased workload for remaining staff: Fewer employees mean existing personnel must cover more responsibilities, potentially leading to fatigue and reduced attention to detail in critical safety procedures.

- Erosion of safety vigilance: A workforce preoccupied with job security and increased demands may deprioritize or overlook safety checks, especially if they perceive a lack of management support during this transition.

- Difficulty in incident investigation and prevention: With a smaller workforce, resources for thorough incident investigations and implementing preventative measures might be stretched thin, hindering continuous improvement in safety.

Chevron's significant debt load, standing at $21.835 billion as of Q1 2024, requires substantial cash flow for interest payments, potentially limiting financial flexibility for new ventures or downturns.

Operational disruptions, such as those seen in Q1 2024 due to maintenance and outages, directly impact production volumes and can increase capital expenditures for necessary repairs.

The company's substantial workforce reduction plans, aiming for 15-20% cuts by the end of 2026, raise concerns about increased workloads for remaining staff and a potential erosion of safety vigilance, especially given past safety incidents.

Chevron's heavy reliance on oil and gas revenue, coupled with the volatility of commodity prices like Brent crude which averaged around $82.30 per barrel in 2023, creates inherent financial uncertainty.

Same Document Delivered

Chevron SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual Chevron SWOT analysis, ensuring you know exactly what you're getting. Purchase unlocks the complete, in-depth report.

Opportunities

The global energy landscape is evolving, with a noticeable shift towards cleaner alternatives. This trend presents a significant opportunity for Chevron, particularly through the increasing demand for natural gas. Chevron's extensive natural gas operations position it well to capitalize on this growing market.

In 2024, projections indicate continued robust demand for natural gas as a transitional fuel, supporting power generation and industrial processes. Chevron's strategic investments in renewable energy sources and lower-carbon technologies further align the company with this cleaner energy transition, offering avenues for diversified growth and reduced environmental impact.

Chevron's strategic acquisition of Hess in late 2023 for approximately $53 billion, a deal expected to close in 2024, is a prime example of how it can expand its asset portfolio and market presence, especially in the valuable Guyana oilfields. This move significantly bolsters Chevron's position in a key growth region.

Furthermore, partnerships with other energy giants, like its joint ventures in the Permian Basin and the North Sea, allow Chevron to share costs and risks while gaining access to cutting-edge technologies and operational efficiencies. These collaborations are crucial for navigating the complex and capital-intensive energy landscape.

Chevron can leverage digital transformation to streamline its operations, from exploration and production to refining and distribution. This adoption is projected to improve efficiency by up to 15% in key areas, as seen in industry benchmarks, leading to significant cost reductions and a stronger competitive position in the evolving energy landscape.

Investing in carbon capture, utilization, and storage (CCUS) presents a dual opportunity for Chevron. It directly addresses environmental concerns by reducing greenhouse gas emissions, and the potential market for carbon credits, which is expected to grow substantially, could open up new revenue streams, potentially adding billions to revenue by 2030.

Expansion in Emerging Economies

Emerging economies present a significant growth avenue for Chevron, driven by escalating energy consumption. As these regions develop, their demand for oil, gas, and refined products is projected to climb, offering Chevron opportunities to increase its market presence and secure new revenue streams. For instance, in 2024, projections indicated that developing Asia Pacific countries would account for a substantial portion of global energy demand growth, potentially benefiting integrated energy companies like Chevron.

This expansion not only broadens Chevron's customer base but also diversifies its revenue sources, mitigating risks associated with over-reliance on mature markets. By establishing or strengthening its operations in these dynamic economies, Chevron can capitalize on favorable demographic trends and industrialization efforts. The International Energy Agency (IEA) has consistently highlighted that a significant share of future oil demand growth is expected to originate from these developing regions, underscoring the strategic importance of this opportunity.

- Rising Energy Demand: Emerging economies exhibit robust growth in energy consumption due to industrialization and rising living standards.

- Market Share Expansion: Opportunities exist for Chevron to capture a larger share of these expanding energy markets.

- Revenue Diversification: Entering and growing in new geographic markets helps diversify Chevron's income streams.

- Strategic Positioning: Early or continued investment in emerging economies can secure long-term competitive advantages.

Projected Free Cash Flow Inflection and Capital Efficiency

Analysts are projecting a notable shift in Chevron's free cash flow generation, with a significant inflection point anticipated around 2025. This expected increase in cash flow is poised to bolster the company's financial flexibility, potentially enabling greater investment in growth opportunities or accelerated returns to shareholders.

Further enhancing this outlook, Chevron's capital expenditure plans show a downward trend in the years following 2025. This strategic reduction in spending is a key driver for improved capital efficiency, directly contributing to a stronger financial position and the potential for increased shareholder value.

Key data points supporting this perspective include:

- Projected Free Cash Flow Growth: Consensus estimates suggest a substantial increase in free cash flow for Chevron in 2025, driven by operational efficiencies and project completions.

- Declining Capex: Forward-looking guidance indicates a decrease in capital expenditures from 2025 onwards, freeing up significant cash. For example, projected capital spending for 2025 is estimated to be around $14 billion, with further reductions anticipated in 2026.

- Enhanced Shareholder Returns: The combination of increased free cash flow and reduced capital needs is expected to translate into more robust share buybacks and dividend payments, directly benefiting investors.

Chevron is well-positioned to benefit from the increasing global demand for natural gas, which is seen as a crucial transitional fuel. The company's significant investments in renewable energy and lower-carbon technologies also align it with the broader energy transition, opening doors for diversified growth. The strategic acquisition of Hess, expected to finalize in 2024, will significantly expand Chevron's asset base and market presence, particularly in the high-potential Guyana region, bolstering its competitive edge.

Chevron can leverage digital transformation to optimize its operations, potentially boosting efficiency by up to 15% in key areas. Investing in carbon capture technologies offers a pathway to reduce emissions and tap into the growing carbon credit market, which could add billions in revenue by 2030. Furthermore, emerging economies represent a substantial growth opportunity, with their energy consumption projected to rise significantly, offering Chevron avenues for market expansion and revenue diversification.

Chevron's financial outlook is strengthening, with projections indicating a significant increase in free cash flow generation around 2025. This is partly due to anticipated reductions in capital expenditures post-2025, which will enhance financial flexibility and support increased shareholder returns through buybacks and dividends. For instance, projected capital spending for 2025 is around $14 billion, with further decreases expected.

Threats

The global push towards decarbonization presents a significant threat to Chevron. As nations and industries accelerate their transition away from fossil fuels, the demand for oil and gas, Chevron's core products, is expected to face long-term decline. This strategic shift necessitates a substantial overhaul of Chevron's business model and asset portfolio to remain competitive and relevant in a lower-carbon future.

Failure to adapt swiftly could result in stranded assets and diminishing returns. For instance, in 2024, renewable energy investments continued to surge, with global clean energy spending projected to reach $2 trillion annually by 2030, according to the International Energy Agency. This increasing investment in alternatives directly challenges the long-term viability of traditional hydrocarbon-based operations.

Chevron's substantial reliance on oil and gas, despite diversification efforts, makes it vulnerable to price swings. For instance, in 2023, Brent crude oil prices averaged around $82 per barrel, a figure that, if sustained at lower levels, directly impacts Chevron's revenue and profitability.

A prolonged downturn in energy markets, characterized by oversupply or reduced demand, poses a significant threat. This could lead to lower exploration and production margins, impacting the company's ability to fund future projects and return capital to shareholders.

Chevron faces significant headwinds from intensifying regulatory and environmental scrutiny. New emissions standards and carbon pricing mechanisms, particularly in key operating regions like California and the European Union, are expected to increase compliance costs. For instance, the EU's Carbon Border Adjustment Mechanism, phased in from 2023, could impact the cost of imported products if Chevron's operations do not meet certain emissions benchmarks.

This heightened oversight can translate into operational restrictions, such as limitations on exploration in sensitive areas or stricter permitting for new projects. Failure to adhere to these evolving regulations can result in substantial fines; in 2023, energy companies globally faced billions in environmental penalties, a trend likely to continue. Furthermore, this scrutiny directly affects Chevron's social license to operate, potentially leading to community opposition and delays in project development.

Geopolitical and International Operational Risks

Chevron faces significant threats from geopolitical instability and evolving international regulations, which can disrupt its global operations and impact profitability. For instance, regional conflicts or sudden policy shifts in countries where Chevron has substantial assets, such as Nigeria or Kazakhstan, could lead to production halts or increased operating costs.

The ongoing arbitration concerning Chevron's proposed acquisition of Hess Corporation, valued at approximately $53 billion as of early 2024, underscores these international operational risks. This dispute, stemming from ExxonMobil's pre-emptive rights in Guyana, highlights the complexities of cross-border M&A and the potential for significant financial and strategic setbacks due to contractual disagreements and third-party interventions.

- Geopolitical Instability: Regions like the Middle East and parts of Africa, where Chevron has significant upstream operations, are prone to political unrest, potentially disrupting supply chains and production.

- Regulatory Changes: Unfavorable shifts in environmental regulations, taxation policies, or nationalization trends in key operating countries could negatively impact Chevron's financial performance.

- Acquisition Risks: The Hess acquisition arbitration demonstrates how international legal and contractual disputes can create substantial financial liabilities and delay strategic growth initiatives.

Competition from Renewable Energy and Diversified Companies

The increasing global focus on sustainability presents a significant challenge, with a growing demand for eco-friendly fuels directly impacting traditional energy sources. Companies heavily invested in renewable energy are rapidly expanding their market share, posing a direct competitive threat to Chevron's established business model.

Diversified energy giants are strategically allocating substantial capital towards renewable energy projects, effectively hedging against future market shifts. This aggressive investment by competitors in areas like solar, wind, and hydrogen could diminish Chevron's market position if its own diversification efforts lag.

- Renewable Energy Growth: Global renewable energy capacity additions reached record levels in 2024, with solar PV and wind power leading the charge.

- Investment Trends: Major energy players announced over $150 billion in new renewable energy investments in the first half of 2025 alone.

- Market Share Shift: Projections indicate that renewables could capture a significant portion of the global energy market by 2030, impacting demand for oil and gas.

The global energy transition poses a significant threat, as the accelerating shift away from fossil fuels could diminish demand for Chevron's core products. Increased investments in renewables, projected to reach $2 trillion annually by 2030, directly challenge the long-term viability of oil and gas operations.

Intensifying regulatory and environmental scrutiny, including carbon pricing mechanisms like the EU's Carbon Border Adjustment Mechanism, are poised to increase compliance costs and potentially restrict operations. Geopolitical instability and international legal disputes, such as the arbitration over the Hess acquisition, add layers of operational risk and potential financial setbacks.

Chevron's substantial reliance on oil and gas makes it vulnerable to price volatility; for example, Brent crude averaging around $82 per barrel in 2023 directly impacts revenue. A prolonged energy market downturn could further squeeze margins and hinder capital allocation.

| Threat Category | Description | Impact Example (2024-2025 Data) |

| Energy Transition | Declining demand for fossil fuels due to decarbonization efforts. | Renewable energy investments projected to hit $2 trillion annually by 2030. |

| Regulatory & Environmental | Increased compliance costs and operational restrictions from new standards. | EU's Carbon Border Adjustment Mechanism impacting imports. |

| Geopolitical & Legal | Disruptions from regional conflicts and international legal challenges. | Hess acquisition arbitration highlighting cross-border M&A risks. |

| Market Volatility | Vulnerability to oil price fluctuations impacting revenue. | Brent crude averaging $82/barrel in 2023 impacting profitability. |

SWOT Analysis Data Sources

This Chevron SWOT analysis is built upon a robust foundation of data, drawing from official financial filings, comprehensive market research reports, and insightful industry expert commentary to ensure a well-rounded and accurate assessment.