Chevron Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chevron Bundle

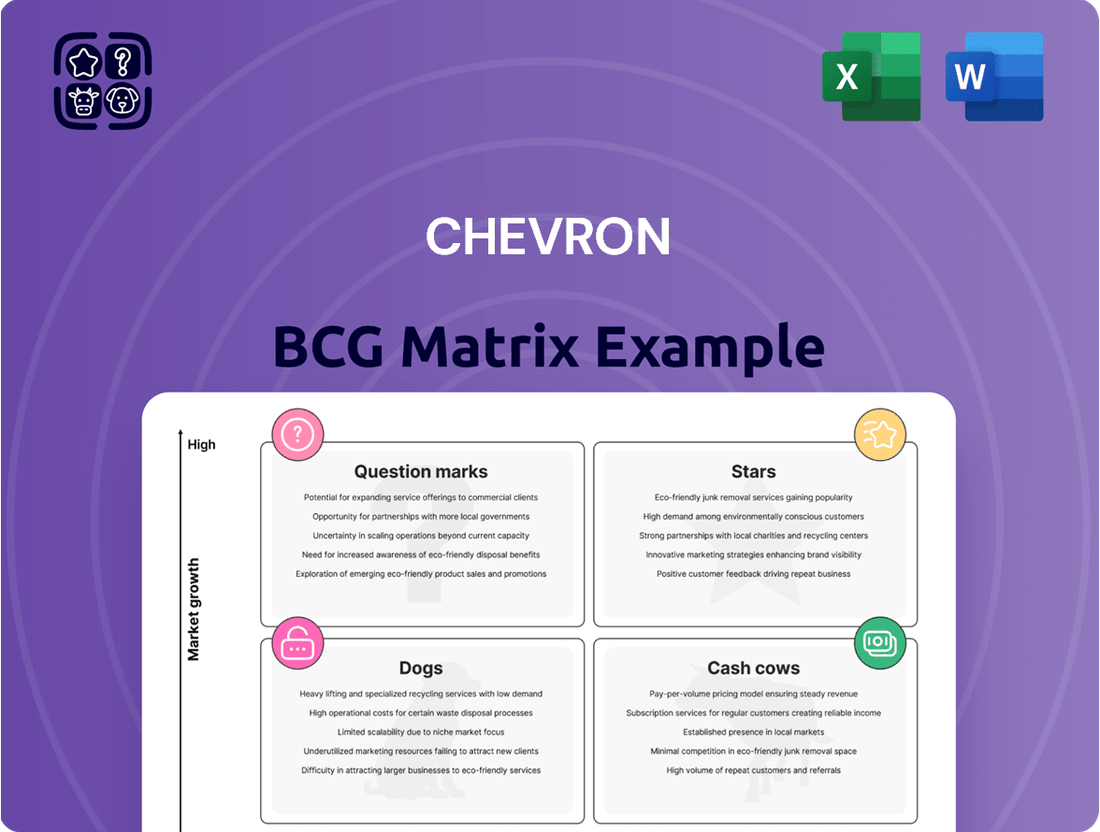

The Chevron BCG Matrix provides a powerful framework for understanding your product portfolio's market share and growth potential. By categorizing products into Stars, Cash Cows, Dogs, and Question Marks, you can identify areas of strength and weakness. Unlock the full strategic potential by purchasing the complete BCG Matrix report for detailed insights and actionable recommendations to optimize your business strategy.

Stars

Chevron's Permian Basin operations are a cornerstone of its growth strategy. Production in this prolific region saw an impressive 18% surge in 2024, and the company anticipates a further 9-10% increase in 2025.

This substantial output from the Permian is a critical component of Chevron's U.S. production portfolio. The company's ability to drive this growth, even with a disciplined approach to capital allocation, highlights operational efficiencies.

Chevron's deepwater projects in the Gulf of Mexico, like Anchor and Ballymore, are prime examples of its Stars in the BCG Matrix. These ventures represent significant investments due to their substantial production potential and the deployment of cutting-edge technology.

The Anchor project, achieving first oil in August 2024, is a groundbreaking development, being the first ultra-high-pressure deepwater project globally to operate at 20,000-psi. This technological leap positions it as a high-growth, high-market-share asset.

Ballymore, which commenced production in April 2025, is projected to contribute up to 75,000 gross barrels of oil per day. This project is a crucial step in Chevron's strategy to reach 300,000 net barrels of oil equivalent per day from the Gulf of Mexico by 2026.

Chevron's acquisition of Hess Corporation, finalized in July 2025 after its October 2023 announcement, marks a pivotal expansion into Guyana's prolific oil reserves. This strategic move is expected to double Chevron's production in the region within the next few years, tapping into high-margin, low-cost oil resources. The deal is poised to significantly bolster Chevron's global oil and gas portfolio, promising extended and enhanced production capabilities.

Carbon Capture, Utilization, and Storage (CCUS) Initiatives

Chevron is strategically positioning its Carbon Capture, Utilization, and Storage (CCUS) initiatives as a significant growth area, aligning with its vision for a lower-carbon energy landscape. The company's commitment is underscored by a planned $1.5 billion investment in 2025 specifically targeting projects that reduce carbon intensity, with CCUS technologies at the forefront.

This investment reflects a dual objective: contributing to environmental goals while capitalizing on the emerging CCUS market. Chevron is actively developing key projects to achieve this, demonstrating tangible progress in its CCUS strategy.

- Bayou Bend CCS in Texas: This project is a cornerstone of Chevron's CCUS portfolio, aiming to provide large-scale carbon storage solutions.

- Pascagoula CCS project in Mississippi: Further expanding its storage capacity, this initiative targets significant carbon sequestration in the Gulf Coast region.

- Technology Partnerships: Collaborations with companies like Svante and ION Clean Energy are crucial for advancing and scaling innovative carbon capture technologies, ensuring Chevron remains at the technological forefront.

Hydrogen Production Projects

Chevron is strategically expanding into hydrogen production, a key area for clean energy growth. This move positions the company to capitalize on future energy demands and decarbonization efforts.

The company's initial direct investment in a hydrogen project is a solar-to-hydrogen facility in California. This facility is anticipated to produce 2.2 tons of hydrogen daily, with operations commencing in 2025.

Further demonstrating its commitment, Chevron is planning a substantial blue hydrogen and ammonia facility in Port Arthur, Texas, known as Project Labrador. This ambitious project, with an estimated investment of $5 billion, is slated for commercial operation by 2032.

- California Solar-to-Hydrogen Facility: Expected to produce 2.2 tons of hydrogen per day starting in 2025.

- Project Labrador (Port Arthur, Texas): A $5 billion blue hydrogen and ammonia facility targeting commercial operation by 2032.

- Strategic Importance: These projects represent Chevron's significant entry into the burgeoning hydrogen market.

Chevron's Stars, in the context of the BCG Matrix, represent high-growth, high-market-share assets that require significant investment to maintain their leading positions. These are typically new ventures or established products in rapidly expanding markets. The company's investments in deepwater projects and its strategic expansion into new energy sectors like CCUS and hydrogen exemplify its Star assets.

The Anchor project in the Gulf of Mexico, operational since August 2024, is a prime example. Its status as the first ultra-high-pressure deepwater project globally at 20,000-psi signifies a technological advantage and substantial production potential, fitting the Star profile. Ballymore, commencing production in April 2025 and expected to yield up to 75,000 gross barrels of oil per day, further solidifies Chevron's position in a high-growth deepwater segment.

Chevron's strategic initiatives in Carbon Capture, Utilization, and Storage (CCUS) and hydrogen production are also being cultivated as future Stars. The planned $1.5 billion investment in CCUS in 2025, alongside projects like Bayou Bend CCS and Pascagoula CCS, aims to capture a significant share of a growing market. Similarly, the company's entry into hydrogen, with a solar-to-hydrogen facility in California starting operations in 2025 and the ambitious Project Labrador, positions these as potential future Stars in the evolving energy landscape.

| Asset Category | Key Projects/Initiatives | Growth Potential | Market Share Position | Investment Focus |

|---|---|---|---|---|

| Deepwater Oil & Gas | Anchor (Gulf of Mexico) | High (Ultra-high pressure technology) | Leading | Operational, technological advancement |

| Deepwater Oil & Gas | Ballymore (Gulf of Mexico) | High (Projected 75,000 bpd) | Leading | Production ramp-up |

| New Energy - CCUS | Bayou Bend CCS (Texas) | High (Emerging market) | Developing | $1.5 billion investment in 2025 |

| New Energy - Hydrogen | California Solar-to-Hydrogen | High (Clean energy demand) | Developing | Operational in 2025 |

What is included in the product

The Chevron BCG Matrix analyzes business units based on market share and growth, guiding investment decisions.

Clear visual representation of business unit performance, reducing confusion and enabling strategic decision-making.

Cash Cows

Chevron's established global oil and gas production, outside of its high-growth Permian Basin and deepwater Gulf of Mexico assets, functions as a classic Cash Cow within the BCG framework. These mature operations boast a significant market share and reliably produce substantial cash flow, even with relatively stable output levels. In 2023, Chevron's upstream segment, which heavily features these established assets, generated over $60 billion in revenue, underscoring their consistent contribution.

Chevron's refining and marketing operations form a cornerstone of its business, transforming crude oil into essential products like gasoline and jet fuel, and distributing them globally. This segment is a classic cash cow, benefiting from established infrastructure and consistent demand in mature markets, which translates into reliable revenue and healthy profit margins. For instance, in 2023, Chevron's downstream segment, which includes refining and marketing, generated approximately $12.5 billion in earnings, highlighting its significant contribution to the company's overall profitability.

Chevron's petrochemicals business serves as a significant contributor to its diversified revenue streams. This segment typically operates within mature markets characterized by relatively stable demand, which translates into consistent cash flow generation for the company. In 2023, Chevron's downstream segment, which includes petrochemicals, reported an operating profit of $6.1 billion, underscoring its role as a reliable cash generator.

Dividend Payouts and Share Repurchases

Chevron's classification as a Cash Cow within the BCG Matrix is strongly supported by its robust shareholder returns. The company has a well-established history of not only paying but also consistently increasing its dividends, a clear signal of a mature, cash-generating business. This financial discipline provides a reliable income stream for investors.

In 2024, Chevron demonstrated its strong cash-generating capabilities by returning a record $27 billion to shareholders. This significant figure underscores the company's ability to convert its operations into substantial free cash flow, allowing for generous distributions back to its owners.

- Dividend Growth: Chevron achieved its 37th consecutive year of increasing annual dividend payouts in 2024, highlighting sustained financial strength and commitment to shareholders.

- Share Repurchases: Significant share repurchase programs further enhance shareholder value by reducing the number of outstanding shares, thereby increasing earnings per share.

- Cash Flow Generation: The substantial cash returned to shareholders in 2024, totaling $27 billion, is a direct reflection of Chevron's capacity to generate considerable free cash flow from its mature business segments.

Mature International Oil & Gas Fields

Chevron's mature international oil and gas fields, especially those beyond high-growth regions, represent significant cash cows. These established assets, benefiting from existing infrastructure, require less capital to maintain production, allowing for consistent cash flow generation.

The strategic approach for these fields is to maximize their cash-generating potential while accounting for their natural production decline. For instance, in 2024, Chevron continued to leverage its extensive portfolio of mature fields to fund investments in new growth areas and shareholder returns.

- Mature assets contribute steadily to cash flow.

- Established infrastructure lowers operational costs.

- Strategy focuses on maximizing yield and managing decline.

- These fields are crucial for funding new ventures and dividends.

Chevron's established upstream assets, excluding high-growth areas, function as classic cash cows. These mature operations hold significant market share and reliably generate substantial cash flow with stable output. In 2023, Chevron's upstream segment, including these established assets, generated over $60 billion in revenue.

Chevron's refining and marketing segment is a prime example of a cash cow, benefiting from established infrastructure and consistent demand in mature markets. This translates to reliable revenue and healthy profit margins. In 2023, Chevron's downstream segment, encompassing refining and marketing, contributed approximately $12.5 billion in earnings.

Chevron's petrochemicals business also acts as a significant cash cow, operating in mature markets with stable demand, ensuring consistent cash flow. In 2023, this segment reported an operating profit of $6.1 billion, reinforcing its role as a reliable cash generator.

Chevron's commitment to shareholder returns, including a 37th consecutive year of dividend increases in 2024, highlights the cash-generating power of its mature business segments. The company returned a record $27 billion to shareholders in 2024, underscoring its robust free cash flow generation.

| Segment | BCG Classification | 2023 Revenue (Approx.) | 2023 Earnings (Approx.) |

| Established Upstream Assets | Cash Cow | > $60 Billion (Upstream Segment) | N/A |

| Refining & Marketing | Cash Cow | N/A | $12.5 Billion (Downstream Segment) |

| Petrochemicals | Cash Cow | N/A | $6.1 Billion (Operating Profit, Downstream Segment) |

Preview = Final Product

Chevron BCG Matrix

The BCG Matrix analysis you are previewing is the complete, unwatermarked document you will receive immediately after purchase. This comprehensive report, designed for strategic decision-making, will be delivered in its entirety, ready for immediate application in your business planning. You can trust that the file presented here is the final, polished version, offering actionable insights into your product portfolio's strategic positioning.

Dogs

Chevron has been strategically divesting non-core assets to streamline its operations and focus on higher-return opportunities. This initiative is part of a broader portfolio optimization strategy with a target to raise between $10 billion and $15 billion by 2028.

Recent divestitures include stakes in Canadian oil sands and shale plays, along with its Alaskan oil fields. Additionally, Chevron has sold off assets in the Republic of Congo and East Texas, signaling a clear move away from less strategic or underperforming ventures.

Certain legacy shale positions, like the Kaybob Duvernay in Canada, have been divested by Chevron. This move reflects a strategic portfolio optimization, as these assets faced challenges competing with more robust holdings within the company's broader portfolio.

These divested assets, while historically productive, likely presented lower growth potential or incurred higher operational expenses when contrasted with Chevron's more strategically prioritized investments. The sale of such positions underscores a deliberate shift away from less competitive or underperforming assets, allowing for a sharper focus on core strengths and future growth opportunities.

Exploration ventures that don't discover commercially viable reserves after substantial investment would be classified as Dogs in Chevron's BCG Matrix. These projects are capital drains, offering little to no return and failing to build market share. Chevron's focus on disciplined capital allocation seeks to prevent these ventures from becoming a significant drag on resources.

Aging Infrastructure with High Maintenance Costs

Aging infrastructure, especially in mature oil fields and older refining plants, presents a significant challenge for Chevron. These assets, while historically productive, are becoming less efficient and require increasingly high maintenance expenditures. This situation can lead to these operations becoming cash drains if the cost of upkeep exceeds the revenue they generate, a classic characteristic of a Dog in the BCG matrix.

For instance, older refining units might struggle to meet current environmental standards or produce higher-value products, making substantial upgrades financially unviable. Chevron's ongoing investment in modernizing its facilities aims to mitigate this, but some legacy assets may inevitably fall into the Dog category without a major, cost-prohibitive overhaul.

- Aging Assets: Older infrastructure, particularly in mature oil and gas fields, faces declining productivity and increasing operational costs.

- High Maintenance: As infrastructure ages, the cost to maintain its functionality and safety escalates significantly.

- Economic Viability: In 2024, the economic viability of maintaining older, less efficient assets is under scrutiny, especially when compared to newer, more cost-effective technologies.

- Potential Cash Drains: Without substantial, often uneconomical, investment in upgrades, these aging assets can become financial burdens, draining resources that could be allocated to more promising ventures.

Certain Conventional Oil & Gas Assets in Decline

Certain conventional oil and gas assets globally, particularly those with naturally steep decline curves and limited remaining upside, may be considered Dogs within Chevron's BCG Matrix. These assets, while still generating some production, offer low growth potential and are experiencing declining market share, making them less appealing for substantial new investment. Chevron's strategy for these assets typically involves optimizing their remaining value or considering divestment.

For example, older, mature fields in established basins often fall into this category. These fields might have seen peak production years ago and now require significant capital for enhanced recovery techniques with uncertain returns. In 2024, the focus for such assets is on maximizing cash flow through operational efficiencies rather than growth initiatives.

Key characteristics of these Dog assets include:

- High Decline Rates: Production volumes decrease significantly year-over-year without substantial new investment.

- Limited Exploration Upside: The potential for discovering new, large reserves within these existing fields is minimal.

- Mature Infrastructure: Existing facilities may require costly upgrades or replacements to maintain operations.

- Lower Profit Margins: As production costs per barrel rise relative to output, profit margins can shrink, especially in a volatile commodity price environment.

Chevron's "Dogs" are assets with low market share and low growth potential, often representing underperforming ventures or aging infrastructure. These can include exploration projects that fail to yield commercially viable reserves or mature oil fields with steep decline rates and high maintenance costs. In 2024, the company actively manages these by optimizing their remaining value or considering divestment to reallocate capital to more promising areas.

The company's strategic divestments, targeting $10 billion to $15 billion by 2028, directly address the "Dog" category by shedding non-core or underperforming assets. For example, divesting legacy shale positions like the Kaybob Duvernay in Canada reflects a move away from assets that struggled to compete within the broader portfolio, thereby reducing potential cash drains.

Aging infrastructure, such as older refining plants, also falls into this "Dog" classification. These assets require substantial, often uneconomical, investment for modernization, making them potential financial burdens. Chevron's focus on modernizing facilities aims to mitigate this, but some legacy assets may inevitably become cash drains.

Mature oil and gas fields with limited upside and high decline rates are also considered "Dogs." These assets offer low growth and declining market share, with profit margins shrinking due to rising operational costs per barrel, especially in volatile price environments.

| Asset Type | BCG Category | Key Characteristics | Chevron's 2024 Strategy |

|---|---|---|---|

| Unsuccessful Exploration Projects | Dog | No commercially viable reserves, capital drain, no return | Disciplined capital allocation to prevent drag |

| Aging Refining Infrastructure | Dog | High maintenance costs, declining efficiency, potential environmental compliance issues | Modernization efforts, potential divestment if uneconomical |

| Mature Oil & Gas Fields (Steep Decline) | Dog | Low growth potential, declining market share, high decline rates, limited upside | Optimize remaining value, maximize cash flow, consider divestment |

Question Marks

Chevron's Emerging Energy Technologies Fund (Future Energy Fund III), launched in April 2024 with a substantial $500 million commitment, is strategically positioned within the Stars quadrant of the BCG Matrix. This fund targets high-growth potential but currently low-market-share renewable energy technologies and climate tech startups.

The fund's investment thesis centers on areas like industrial decarbonization, low-carbon fuels, advanced materials, and CO2 upcycling. These are sectors experiencing rapid technological advancement and increasing demand, aligning with the characteristics of Stars – businesses with high growth and high relative market share, though in this case, the market share is nascent but poised for significant expansion.

Chevron is strategically investing in geothermal energy, viewing it as a key player in the energy transition. Their involvement includes a significant joint venture with Baseload Capital in the United States, alongside partnerships in Japan and Indonesia. These ventures are designed to harness geothermal power for consistent, baseload electricity and to potentially fuel green hydrogen production facilities.

While the long-term growth potential for geothermal energy is substantial, its current footprint within Chevron's broader energy mix remains modest. This positioning, characterized by high growth prospects but a small current market share, places geothermal energy projects squarely in the Question Mark category of the BCG matrix for Chevron.

Chevron is venturing into power generation for data centers, specifically by integrating natural gas with carbon capture and storage (CCS) technology. This strategic move aims to meet the escalating energy needs of AI-driven data centers while offering a more environmentally conscious power source.

This represents a nascent market for Chevron, characterized by substantial growth potential driven by the burgeoning demand for AI infrastructure. However, the company's current market penetration and the established scalability of its CCS-integrated power solutions are still in their formative stages, placing it in the question marks quadrant of the BCG matrix.

Advanced Biofuels and Renewable Diesel

Chevron's commitment to advanced biofuels and renewable diesel, including sustainable aviation fuel, is a key component of its long-term strategy to reduce carbon emissions. These fuels are significant because they can leverage existing infrastructure, making them a practical solution for decarbonization in transportation sectors.

While the renewable fuels market is expanding, its current size compared to Chevron's core fossil fuel operations means these ventures are positioned in the Question Mark quadrant of the BCG matrix. This classification highlights the need for substantial investment to increase their market presence and achieve greater scale.

- Market Growth: The global renewable diesel market was valued at approximately USD 35.5 billion in 2023 and is projected to grow significantly, with estimates reaching over USD 60 billion by 2030.

- Chevron's Investment: Chevron announced plans to invest billions in its renewable fuels business, aiming to increase its renewable diesel production capacity.

- Infrastructure Advantage: Renewable diesel can utilize existing diesel pipelines, storage tanks, and refueling stations, offering a distinct advantage over some other alternative fuels.

- Strategic Importance: These fuels are crucial for meeting regulatory mandates and corporate sustainability goals in hard-to-abate sectors like heavy-duty transport and aviation.

Lithium Extraction Ventures

Chevron's recent entry into the domestic lithium sector positions its lithium extraction ventures as a Question Mark in the BCG Matrix. This move into battery materials is a high-growth market, reflecting the increasing demand for energy storage solutions. For example, the global lithium market was valued at approximately $28.9 billion in 2023 and is projected to reach $77.4 billion by 2030, growing at a CAGR of 15.1%.

While the market's growth potential is significant, Chevron's current market share in this nascent area is low. This aligns with the characteristics of a Question Mark, where substantial investment is needed to capture market share and potentially develop into a Star. The company's strategy aims to bolster U.S. energy security by securing domestic supply chains for critical minerals.

- High Market Growth: The lithium market is experiencing rapid expansion due to the electric vehicle and renewable energy storage sectors.

- Low Market Share: Chevron is a new entrant, meaning it has a small current footprint in this specialized industry.

- Significant Investment Required: Developing lithium extraction operations demands substantial capital expenditure and technological expertise.

- Strategic Importance: The venture aligns with broader goals of energy independence and supporting the transition to cleaner energy technologies.

Question Marks represent business units or ventures with low relative market share but operating in high-growth markets. For Chevron, these are new initiatives requiring significant investment to determine their future potential.

These ventures, while promising, need careful management and strategic decisions to either grow into Stars or potentially be divested if they fail to gain traction.

Chevron's focus on these areas reflects a deliberate strategy to explore and invest in future energy solutions, acknowledging the inherent risks and rewards.

The company is actively evaluating these opportunities, with the aim of identifying which ones can achieve significant market share and contribute to its long-term growth.

| Chevron Venture | Market Growth Potential | Current Market Share | BCG Quadrant | Strategic Consideration |

|---|---|---|---|---|

| Geothermal Energy | High | Low | Question Mark | Requires investment to scale operations and increase market penetration. |

| CCS-Integrated Data Center Power | High | Low | Question Mark | Needs to prove scalability and market acceptance of the technology. |

| Advanced Biofuels & Renewable Diesel | High | Low (relative to core business) | Question Mark | Investment focused on increasing production capacity and market adoption. |

| Lithium Extraction | High | Low | Question Mark | Substantial capital and technological development needed to establish market presence. |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, competitor analysis, and industry growth rates, to accurately position business units.