Chevron Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chevron Bundle

Chevron navigates a complex energy landscape, where the bargaining power of its suppliers and the intense rivalry among existing oil giants significantly shape its profitability. Understanding these dynamics is crucial for any stakeholder in the energy sector.

The complete report reveals the real forces shaping Chevron’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Chevron, deeply entrenched in the capital-intensive oil and gas sector, often finds itself dependent on a select group of specialized equipment and technology providers. This reliance is particularly pronounced in areas like advanced drilling technology and offshore production systems.

In 2024, the market for critical upstream technologies, such as deepwater drilling rigs and subsea processing equipment, is characterized by a high degree of consolidation. For instance, the top three global providers of subsea production systems collectively held over 60% of the market share, a figure that has remained relatively stable, indicating limited supplier alternatives for major oil companies like Chevron.

This concentrated supplier landscape grants these specialized firms considerable bargaining power. Consequently, Chevron may encounter elevated costs for essential equipment and services, alongside fewer options for sourcing these vital components, impacting project economics and operational flexibility.

The bargaining power of suppliers for Chevron is significantly amplified by the exceptionally high switching costs associated with advanced drilling technologies. These costs can range from $75 million to $125 million for a single technological transition, making it a substantial financial undertaking for Chevron to change providers.

The complexity and expense involved in replacing offshore drilling equipment, adopting new advanced extraction technologies, or upgrading intricate subsea production systems create considerable financial barriers. These substantial outlays reinforce the leverage held by incumbent suppliers, limiting Chevron's flexibility in seeking alternative solutions.

The bargaining power of suppliers is significantly influenced by the concentration of key players in the market. In the specialized oil and gas equipment sector, a few dominant suppliers control a substantial market share. For instance, the top three suppliers collectively hold 68.9% of the market for critical components such as drilling technologies, extraction systems, and subsea equipment.

This high degree of supplier concentration means Chevron has fewer alternative sources for these essential goods and services. Consequently, these concentrated suppliers can exert greater influence over pricing, contract terms, and delivery schedules, potentially increasing costs and reducing flexibility for Chevron.

Dependence on Reliable Suppliers for Quality

Chevron's reliance on specialized suppliers for critical drilling hardware, such as advanced sensors, directly impacts its operational performance and safety. The quality and reliability of these components are non-negotiable for efficient and secure extraction processes.

The market for these advanced drilling components is experiencing robust growth, with a projected Compound Annual Growth Rate (CAGR) of 15% from 2023 to 2028. This high demand strengthens the bargaining power of suppliers, as companies like Chevron are keen to adopt these cutting-edge solutions to boost operational efficiency.

- Supplier Dependence: Chevron's drilling operations are critically dependent on suppliers for high-quality sensors and advanced hardware.

- Market Growth: The demand for these specialized components is expected to grow at a 15% CAGR between 2023 and 2028.

- Pricing Power: This strong market demand enhances suppliers' pricing power, as Chevron seeks advanced operational solutions.

Impact of Increasing IoT Device Costs

The increasing cost of Internet of Things (IoT) devices directly impacts the bargaining power of suppliers in the oil and gas sector. With global average prices for IoT devices rising approximately 8% in 2023 due to persistent supply chain issues and higher raw material expenses, companies like Chevron face greater pressure from their technology vendors. This means suppliers can command higher prices for essential equipment used in upstream operations, potentially squeezing Chevron's profit margins.

- Increased Operational Expenses: Higher IoT device costs translate to elevated capital expenditure for Chevron's technological infrastructure.

- Supplier Leverage: Suppliers of specialized sensors and data transmission hardware can negotiate more favorable terms due to increased demand and their critical role in operational efficiency.

- Impact on Profitability: The 2023 price hikes necessitate that Chevron either absorbs these costs, reducing profitability, or passes them on, potentially affecting project economics.

Chevron's bargaining power with suppliers is constrained by the high concentration of specialized equipment providers in the oil and gas industry. This limited competition means a few key suppliers can dictate terms, especially for critical technologies like advanced drilling systems.

The substantial costs associated with switching suppliers for these complex technologies, often ranging from $75 million to $125 million per transition, further solidify supplier leverage. This financial barrier makes it difficult for Chevron to negotiate better pricing or terms, as changing vendors is a significant undertaking.

The market for essential upstream components, such as subsea production systems, is dominated by a few major players, with the top three holding over 60% market share. This consolidation grants these suppliers significant pricing power and control over delivery schedules, impacting Chevron's operational flexibility.

Furthermore, the robust 15% projected CAGR for advanced drilling components from 2023 to 2028, coupled with an approximate 8% rise in IoT device costs in 2023, amplifies supplier influence. These trends indicate rising demand and input costs, enabling suppliers to command higher prices for crucial hardware.

| Factor | Impact on Supplier Bargaining Power | Relevance to Chevron |

|---|---|---|

| Supplier Concentration | High (Top 3 hold >60% of subsea market) | Limits alternative sourcing options |

| Switching Costs | Very High ($75M-$125M per tech transition) | Discourages supplier changes, reinforces incumbent leverage |

| Market Growth (Advanced Drilling Components) | High (15% CAGR 2023-2028) | Increases demand, strengthening supplier pricing power |

| Input Cost Increases (IoT Devices) | Moderate (8% price rise in 2023) | Drives up equipment costs, benefiting suppliers |

What is included in the product

This analysis dissects the competitive forces impacting Chevron, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the oil and gas industry.

Quickly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces on a clear, interactive dashboard.

Customers Bargaining Power

Chevron's customer base is incredibly varied, ranging from everyday drivers filling up at the pump to massive industrial operations and government entities. This broad reach is a strength, as it means no single customer segment dictates terms entirely.

Individually, most gasoline consumers have very little sway over Chevron's pricing or product offerings; they are numerous and often have limited alternatives for immediate fueling needs. This low individual bargaining power is a significant factor in Chevron's favor.

However, the landscape shifts when looking at larger clients. Major industrial consumers or government contracts can represent substantial volumes of business. For instance, if a large fleet operator or a national government procures significant quantities of fuel or specialized petroleum products, they can indeed leverage their purchasing power to negotiate more favorable terms, potentially impacting Chevron's margins on those specific deals.

Chevron's customers, particularly those purchasing refined products like gasoline and diesel, often face prices influenced by global commodity markets rather than direct negotiation. For instance, crude oil prices, a primary input, are heavily swayed by supply and demand, geopolitical events, and OPEC+ production quotas. In 2024, Brent crude oil prices have fluctuated, impacting the cost of refined fuels.

While large industrial clients might have some leverage, the sheer volume and global nature of commodity trading significantly limit individual customer bargaining power. For many end-users, the price they pay is a reflection of broader market forces, including the cost of exploration, production, refining, and transportation, all of which are subject to external volatility.

While individual consumers typically face low switching costs for gasoline, enabling them to readily switch to competitors based on price, Chevron's robust brand recognition and loyal customer base offer a degree of insulation. This brand equity can reduce the immediate impact of price sensitivity for a significant portion of their retail market.

For Chevron's industrial and commercial clients, the bargaining power of customers is often tempered by higher switching costs. The intricate nature of fuel supply chains, coupled with existing long-term contracts and the potential for operational disruptions, makes it less feasible for these larger buyers to switch suppliers frequently, thereby diminishing their immediate leverage.

Large Customer Negotiating Power

Large customers, like major airlines and shipping conglomerates, wield considerable influence over Chevron. Their substantial purchase volumes mean they can negotiate for better pricing and more tailored supply contracts, directly affecting Chevron's profitability on these key accounts.

For instance, in 2023, the aviation industry, a significant consumer of jet fuel, faced fluctuating demand. Major carriers, by consolidating their purchasing power, could leverage this situation to secure more advantageous terms from suppliers like Chevron, potentially leading to reduced per-unit margins for the energy giant.

- Significant Volume Purchases: Large clients account for a substantial portion of Chevron's sales, giving them leverage.

- Demand for Favorable Terms: These customers often seek discounts and customized agreements.

- Impact on Margins: Successful negotiations by large customers can squeeze Chevron's profit margins.

- Industry Dependence: Sectors like aviation and shipping are heavily reliant on petroleum products, amplifying their bargaining strength.

Impact of Energy Transition on Customer Demand

The global shift towards renewable energy sources and technologies like electric vehicles and sustainable fuels is reshaping customer preferences. This transition directly influences demand for traditional oil and gas products.

Chevron, like other energy giants, feels this pressure. Customers are increasingly looking for cleaner alternatives, which can affect the demand and pricing power for Chevron's conventional offerings. For instance, by the end of 2023, global EV sales surpassed 13 million units, a significant jump from previous years, indicating a growing market share for electric transportation.

This evolving demand landscape forces Chevron to adapt its strategies and invest in new energy ventures. The company is actively pursuing investments in renewable fuels and hydrogen, aiming to meet future energy needs.

- Growing EV Adoption: Global electric vehicle sales are projected to reach over 16 million units in 2024, a substantial increase that directly impacts gasoline demand.

- Renewable Fuel Demand: The demand for renewable diesel and sustainable aviation fuel is on the rise, with the U.S. market alone expected to see significant growth through 2025.

- Consumer Preferences: Surveys in 2024 indicate that a growing percentage of consumers are willing to pay a premium for products and services with a lower carbon footprint.

- Chevron's Investment in New Energies: In 2024, Chevron announced further investments in renewable natural gas projects and EV charging infrastructure, signaling a strategic pivot to meet changing customer demands.

While individual consumers have minimal bargaining power due to low switching costs for gasoline, large industrial clients and government entities can negotiate more favorable terms due to their substantial purchase volumes. This leverage can impact Chevron's margins on specific deals, particularly in sectors like aviation and shipping which are heavily reliant on petroleum products. The growing demand for renewable energy and electric vehicles is also shifting customer preferences, forcing Chevron to adapt its strategies and investments to meet evolving market needs.

| Customer Segment | Bargaining Power Factors | Impact on Chevron | 2024 Data/Trend |

|---|---|---|---|

| Individual Retail Consumers | Low switching costs, price sensitivity | Limited individual impact; brand loyalty offers some insulation | Continued high gasoline prices influence consumer choices. |

| Large Industrial & Commercial Clients (e.g., Airlines, Fleet Operators) | High volume purchases, long-term contracts, potential for supply chain integration | Significant leverage to negotiate pricing and terms, potentially reducing margins | Aviation fuel demand recovery in 2024 continues, allowing major carriers to exert more influence. |

| Government Contracts | Volume, strategic importance, competitive bidding processes | Can secure favorable pricing, especially for specialized products or large-scale supply | Government entities often prioritize energy security and price stability in contracts. |

| Emerging Energy Consumers (EV charging, renewable fuel users) | Growing demand, preference for lower carbon footprint | Shifts demand away from traditional products, pressures pricing | Global EV sales projected to exceed 16 million units in 2024; renewable fuel demand increasing. |

What You See Is What You Get

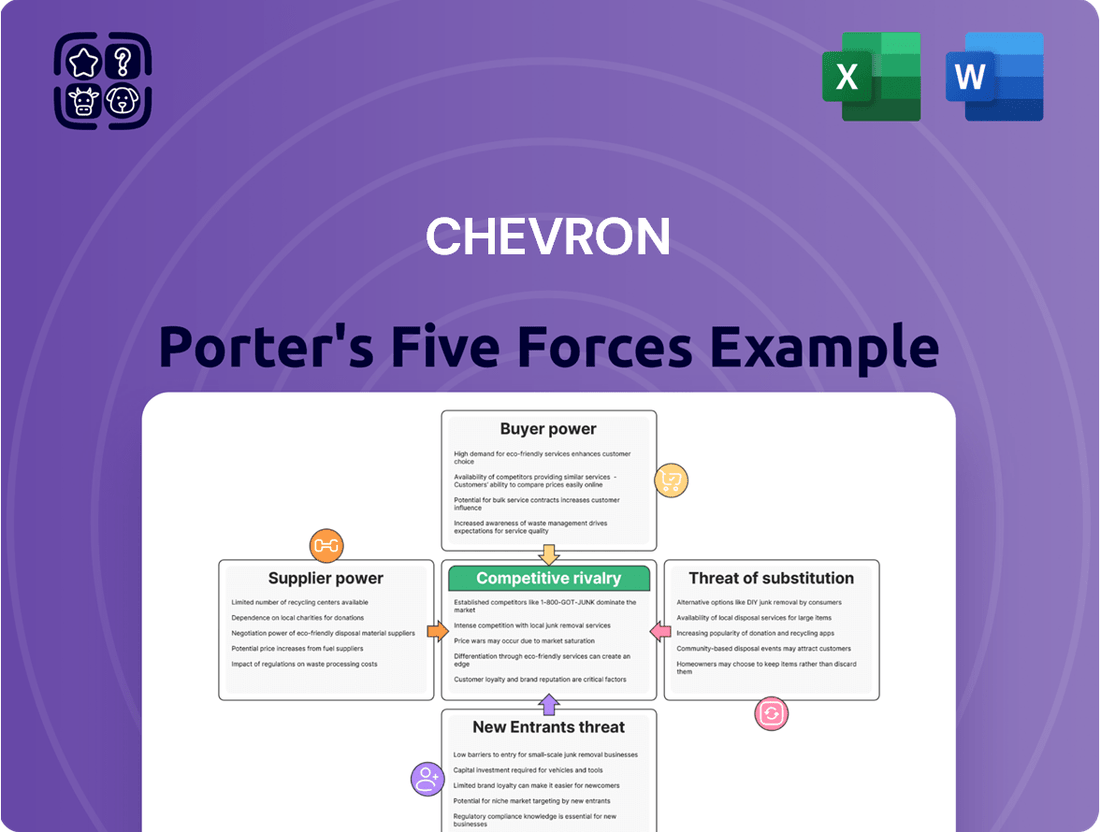

Chevron Porter's Five Forces Analysis

This preview displays the complete Porter's Five Forces analysis for Chevron, detailing the competitive landscape within the oil and gas industry. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact file, ready for your strategic planning needs.

Rivalry Among Competitors

Chevron faces fierce competition from global energy giants such as ExxonMobil, Shell, BP, and TotalEnergies, along with powerful national oil companies. This intense rivalry stems from their substantial market share, creating a perpetual struggle for crucial resources, production capacity, and overall market leadership.

In 2024, the energy sector's competitive landscape remains dynamic. For instance, in the upstream segment, major players are continually vying for exploration rights and production assets. Chevron's 2023 capital expenditures were around $14 billion, a figure comparable to its peers, highlighting the significant investment required to maintain competitive standing.

The oil and gas sector is inherently volatile, with global crude oil prices experiencing significant swings. For instance, West Texas Intermediate (WTI) crude oil averaged around $77.50 per barrel in 2024, a notable decrease from its 2023 average of approximately $77.87, but still subject to rapid fluctuations based on geopolitical events and supply-demand dynamics. This price instability fuels intense competition, often prompting aggressive pricing strategies among major players like Chevron to secure market share.

This constant flux in commodity prices directly impacts profitability, compelling companies to prioritize cost efficiency and rigorous capital discipline. Chevron, for example, has emphasized operational excellence and cost management to navigate these turbulent market conditions. Their focus on optimizing production and controlling expenses is crucial for maintaining a competitive edge and ensuring financial resilience amidst price volatility.

The oil and gas sector is characterized by exceptionally high capital investment requirements. Companies must pour billions into exploration, drilling, refining, and extensive infrastructure like pipelines and storage facilities to even participate. For instance, Chevron's 2024 capital and exploratory expenditures were projected to be around $14 billion, underscoring the sheer scale of investment needed to maintain and expand operations in this industry.

Technological Innovation and Efficiency

Technological innovation is a major battleground in the energy sector. Companies like Chevron must constantly invest in R&D to stay competitive. For instance, advancements in seismic imaging and horizontal drilling techniques have dramatically improved exploration success rates and extraction efficiency. In 2024, the industry continues to see significant investment in digital technologies like AI and machine learning to optimize operations and reduce downtime.

Chevron's commitment to efficiency is evident in its capital expenditure plans. The company allocated approximately $14 billion for capital and exploratory projects in 2024, with a significant portion directed towards enhancing existing operations and developing lower-carbon solutions. This focus on technological advancement directly impacts cost structures and the ability to bring new energy sources to market faster than competitors.

The drive for improved energy efficiency and the development of new technologies, particularly in the lower-carbon space, directly influences competitive rivalry. Companies that lead in these areas can achieve lower production costs and capture market share. For example, breakthroughs in carbon capture utilization and storage (CCUS) technology could redefine competitive advantages in the coming years.

- R&D Investment: Companies are pouring billions into developing next-generation exploration and extraction technologies.

- Efficiency Gains: New technologies are enabling significant reductions in operational costs and environmental impact.

- Lower-Carbon Solutions: Innovation in areas like hydrogen and CCUS is becoming a key differentiator.

- Digital Transformation: AI and data analytics are being deployed to optimize every stage of the energy value chain.

Market Consolidation and Strategic Acquisitions

The energy sector, including oil and gas, has experienced significant market consolidation. Companies are actively pursuing strategic acquisitions to bolster their asset portfolios, achieve greater economies of scale, and solidify their competitive positions. This trend is driven by the pursuit of operational efficiencies and enhanced market influence.

A prime example of this consolidation is Chevron's proposed acquisition of Hess Corporation. This significant deal, valued at approximately $53 billion as of late 2023/early 2024, aims to expand Chevron's operational footprint, particularly in key growth areas like Guyana. Such moves are critical for maintaining and improving a company's competitive standing in a dynamic global market.

- Market Consolidation Trend: The oil and gas industry has seen a notable increase in mergers and acquisitions as companies seek to optimize operations and market share.

- Chevron's Hess Acquisition: Chevron's $53 billion deal to acquire Hess Corporation highlights the scale of consolidation, aiming to boost assets and competitive advantage.

- Strategic Rationale: Acquisitions are driven by the need to gain economies of scale, enhance operational efficiency, and strengthen market positions in an evolving energy landscape.

Competitive rivalry within the energy sector is intense, driven by a few dominant global players and national oil companies. Chevron competes directly with giants like ExxonMobil, Shell, and BP, all vying for resources and market share. This rivalry is amplified by the sector's inherent volatility, with oil prices fluctuating significantly, impacting profitability and leading to aggressive strategies to secure market position.

The drive for efficiency and technological advancement is a key battleground. Companies are investing heavily in R&D, with Chevron planning around $14 billion in capital expenditures for 2024 to enhance operations and explore lower-carbon solutions. This focus on innovation, from AI in operations to advancements in carbon capture, directly influences cost structures and the ability to gain a competitive edge.

Market consolidation further intensifies rivalry, as companies merge to gain scale and efficiency. Chevron's proposed $53 billion acquisition of Hess Corporation exemplifies this trend, aiming to expand its asset base and competitive standing. Such strategic moves are crucial for navigating the dynamic global energy market and maintaining leadership.

| Competitor | 2023 Revenue (approx. USD billions) | 2024 Capital Expenditure (approx. USD billions) | Key Focus Areas |

|---|---|---|---|

| ExxonMobil | 344.6 | 23-25 | Upstream, Downstream, Lower-Emission Solutions |

| Shell | 316.7 | 22-25 | Integrated Gas, Renewables & Energy Solutions, Chemicals |

| BP | 214.7 | 16-18 | Convenience & Mobility, Gas & Low Carbon Energy, Oil & Gas |

| TotalEnergies | 237.1 | 16-18 | Multi-Energy, Refining & Chemicals, Integrated Gas, Renewables & Power |

SSubstitutes Threaten

The increasing availability and affordability of renewable energy technologies like solar and wind present a substantial threat to Chevron's core oil and gas operations. By 2023, global renewable energy capacity additions reached a record 510 gigawatts, a 50% increase from 2022, demonstrating a rapid shift in the energy landscape. This trend directly challenges the dominance of fossil fuels by offering viable alternatives for electricity generation and, increasingly, for transportation fuels.

The accelerating adoption of electric vehicles (EVs) presents a significant threat of substitution for Chevron's traditional fuel products. Despite a recent moderation in growth, global EV sales continued to climb, with approximately 13.6 million EVs sold worldwide in 2023, an increase from around 10 million in 2022. This growing EV fleet directly displaces demand for gasoline and diesel, impacting Chevron's downstream refining and marketing segments.

The rise of biofuels and alternative fuels presents a significant threat of substitution for Chevron's traditional fossil fuel products, especially in transportation. By 2024, the global biofuel market was valued at over $150 billion, demonstrating substantial growth and increasing consumer and regulatory acceptance.

Chevron's strategic response includes significant investments in renewable fuels, such as renewable diesel and sustainable aviation fuel, aiming to capture a share of this evolving market. For instance, Chevron announced plans in 2024 to expand its renewable fuels production capacity, recognizing the growing demand driven by environmental concerns and government mandates.

However, the continued technological advancements and cost reductions in hydrogen fuel cells and electric vehicle battery technology could further accelerate the shift away from internal combustion engines. This widespread adoption of cleaner alternatives directly challenges the long-term demand for gasoline and diesel, Chevron's primary revenue streams.

Increasing Focus on Energy Efficiency and Conservation

The increasing global focus on energy efficiency and conservation presents a significant threat of substitutes for traditional oil and gas companies like Chevron. As nations and industries prioritize reducing overall energy consumption, demand for fossil fuels naturally declines.

This shift is driven by both environmental concerns and economic incentives. For instance, the International Energy Agency (IEA) reported in 2024 that global energy efficiency improvements slowed slightly but remained a crucial factor in mitigating energy demand growth. This trend directly impacts the market share of energy providers.

- Reduced Demand: Improved efficiency in vehicles, buildings, and industrial processes directly lowers the need for gasoline, diesel, and natural gas.

- Technological Advancements: Innovations in areas like smart grids, energy-efficient appliances, and advanced insulation materials make it easier and more cost-effective for consumers and businesses to use less energy.

- Policy and Regulation: Government mandates and incentives promoting energy conservation and the adoption of energy-saving technologies further accelerate this shift, creating a less favorable market for traditional energy sources.

- Economic Benefits: Lower energy consumption translates to cost savings for end-users, making energy-efficient alternatives increasingly attractive compared to the fluctuating prices of oil and gas.

Investment in Carbon Capture and Storage (CCS) and Other Lower-Carbon Solutions

While not direct substitutes for the energy Chevron provides, emerging technologies like carbon capture and storage (CCS) and significant investments in lower-carbon solutions are indeed shaping the competitive landscape. These represent a strategic pivot for Chevron, acknowledging the growing demand for cleaner energy alternatives.

Chevron's commitment to these areas, including investments in power generation for data centers and other innovative technologies, directly addresses the fundamental pressures driving substitution away from traditional fossil fuels. By actively participating in and developing these lower-carbon solutions, Chevron aims to mitigate the threat of substitutes by evolving its own product and service offerings.

In 2024, the energy sector continued to see substantial investment in decarbonization technologies. For instance, global investment in energy transitions reached an estimated $1.7 trillion in 2023, with a significant portion allocated to areas like CCS and renewable energy infrastructure. Chevron itself has been actively pursuing projects aimed at reducing its operational emissions, such as its participation in the Gorgon carbon capture project in Australia, which has captured over 6 million tonnes of CO2 since its inception.

- Carbon Capture and Storage (CCS): Technologies designed to capture carbon dioxide emissions from industrial sources and store them underground, reducing atmospheric greenhouse gas concentrations.

- Lower-Carbon Solutions: Investments in areas like renewable energy (solar, wind), hydrogen production, biofuels, and electrification of transport, all aimed at reducing the carbon footprint of the energy sector.

- Data Center Power Generation: Increasing demand for reliable and increasingly lower-carbon energy sources to power energy-intensive data centers, driving innovation in power solutions.

- Strategic Response to Energy Transition: Chevron's proactive engagement in these areas is a direct strategy to adapt to evolving market demands and regulatory environments favoring decarbonization.

The threat of substitutes for Chevron is significant, driven by advancements in renewable energy and electric vehicles. The global renewable energy capacity additions in 2023 reached a record 510 GW, a 50% increase from the previous year, directly challenging fossil fuels. Furthermore, global EV sales in 2023 surpassed 13.6 million units, displacing demand for gasoline and diesel. Biofuels also represent a growing alternative, with the global market valued over $150 billion in 2024.

Chevron is actively investing in lower-carbon solutions, including renewable fuels and carbon capture technologies, to mitigate these substitution threats. For example, the company announced expansions in renewable fuels production capacity in 2024. Global investment in energy transitions reached approximately $1.7 trillion in 2023, highlighting the industry's shift toward cleaner alternatives.

| Substitute Type | 2023/2024 Data Point | Impact on Chevron |

|---|---|---|

| Renewable Energy Capacity | 510 GW added globally in 2023 (50% increase YoY) | Reduces demand for traditional power generation fuels. |

| Electric Vehicle Sales | 13.6 million units sold globally in 2023 | Directly displaces demand for gasoline and diesel. |

| Biofuel Market Value | Over $150 billion in 2024 | Offers an alternative to traditional transportation fuels. |

| Energy Transition Investment | ~$1.7 trillion globally in 2023 | Indicates a market shift away from fossil fuels. |

Entrants Threaten

The oil and gas sector, especially upstream exploration and production, demands enormous capital outlays for infrastructure, technology, and securing reserves. For instance, a single offshore oil platform can cost billions of dollars to construct and deploy. These substantial financial hurdles significantly deter new entrants, creating a formidable barrier to entry.

These high capital requirements mean that potential new competitors must secure massive funding just to get started, a feat that is incredibly challenging. Established giants like Chevron have the financial muscle and existing infrastructure to absorb these costs, making it exceedingly difficult for smaller, less capitalized firms to enter and compete effectively in the market.

Established energy giants like Chevron possess an almost insurmountable advantage due to their deeply entrenched access to vital resources and infrastructure. They've spent decades securing rights to prime energy reserves and building out complex, costly supply chains, including pipelines, refineries, and vast distribution networks. For instance, Chevron's 2023 capital expenditures were around $14 billion, a significant portion of which reinforces this existing infrastructure, making it incredibly difficult for newcomers to replicate.

Existing oil and gas giants like Chevron have poured immense capital, reportedly in the tens of billions, into developing proprietary technologies and securing patents for their exploration, extraction, and refining operations. This deep investment in specialized knowledge and advanced capabilities creates a formidable barrier for any potential new entrant. Without access to similar, cutting-edge technology and intellectual property, newcomers face a significant operating disadvantage, making it incredibly difficult to compete effectively.

Government Regulations and Environmental Policies

The oil and gas industry faces a formidable threat from new entrants due to extensive government regulations and dynamic environmental policies. These regulations, particularly those concerning climate change and emissions, create substantial hurdles. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to refine methane emission standards for the oil and gas sector, requiring significant capital investment for compliance from any new player.

Navigating this intricate regulatory web, securing essential permits, and adhering to increasingly strict environmental standards represent significant barriers to entry. These compliance costs can be prohibitive for smaller or less capitalized new companies, effectively limiting the influx of new competitors. The ongoing global push for decarbonization further intensifies this threat, as new entrants must anticipate and integrate future environmental mandates into their business models from inception.

- Regulatory Complexity: New entrants must contend with a dense web of federal, state, and local regulations governing exploration, production, transportation, and refining.

- Environmental Compliance Costs: Meeting stringent environmental standards, such as those for emissions control and water usage, requires substantial upfront and ongoing investment.

- Permitting Challenges: Obtaining necessary permits for operations can be a lengthy and uncertain process, often involving extensive environmental impact assessments.

- Policy Uncertainty: Evolving climate policies and international agreements create uncertainty for new entrants regarding long-term operational viability and investment returns.

Economies of Scale and Established Relationships

Chevron, as a global energy giant, leverages immense economies of scale across its exploration, production, refining, and marketing operations. This scale allows for significant cost advantages that new entrants, lacking the infrastructure and global reach, find exceptionally difficult to overcome. For instance, in 2024, Chevron's capital expenditures were projected to be around $14 billion, a figure that dwarfs the initial investment required for a new, smaller competitor to establish a comparable operational footprint.

Established relationships are another formidable barrier. Chevron has cultivated deep ties with key suppliers, ensuring preferential terms and reliable access to resources. Similarly, its long-standing customer base and intricate relationships with governments, particularly in regions where it operates, create a complex web of loyalty and regulatory familiarity that new entrants cannot easily penetrate. These established networks translate into greater market access and operational stability.

- Economies of Scale: Chevron's massive operational size leads to lower per-unit production costs, a significant hurdle for smaller, new entrants.

- Established Relationships: Long-term partnerships with suppliers, customers, and governments provide preferential terms and market access.

- Capital Intensity: The energy sector demands enormous upfront capital investment, making it challenging for new players to compete with established giants like Chevron.

- Regulatory Familiarity: Decades of operation have given Chevron deep understanding and experience navigating complex global energy regulations.

The threat of new entrants in the oil and gas sector, particularly for a company like Chevron, is generally considered low. This is primarily due to the immense capital requirements, estimated in the billions for exploration, extraction, and infrastructure development. For example, Chevron's 2024 capital expenditure budget was around $14 billion, underscoring the scale of investment needed to operate. Furthermore, established players benefit from proprietary technologies, extensive regulatory experience, and deeply entrenched relationships with suppliers and governments, all of which create significant barriers for newcomers.

| Barrier Type | Description | Impact on New Entrants | Chevron's Advantage |

|---|---|---|---|

| Capital Requirements | Enormous upfront investment needed for exploration, infrastructure, and technology. | Prohibitive for most new companies. | Financial strength and access to capital markets. |

| Technology & IP | Proprietary technologies and patents in exploration and extraction. | Operating disadvantage without similar capabilities. | Significant R&D investment and established expertise. |

| Regulatory Landscape | Complex and evolving environmental and operational regulations. | High compliance costs and lengthy permitting processes. | Decades of experience navigating global regulations. |

| Economies of Scale | Cost advantages from large-scale operations. | Difficulty competing on price. | Massive, integrated global operations. |

| Established Relationships | Strong ties with suppliers, customers, and governments. | Limited market access and unfavorable terms. | Long-standing partnerships and market presence. |

Porter's Five Forces Analysis Data Sources

Our Chevron Porter's Five Forces analysis leverages a comprehensive suite of data, including Chevron's own annual reports and investor presentations, alongside industry-specific market research from firms like Wood Mackenzie and IHS Markit. We also incorporate data from regulatory bodies such as the SEC and relevant government energy agencies to provide a robust assessment of competitive forces.