Chevron PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chevron Bundle

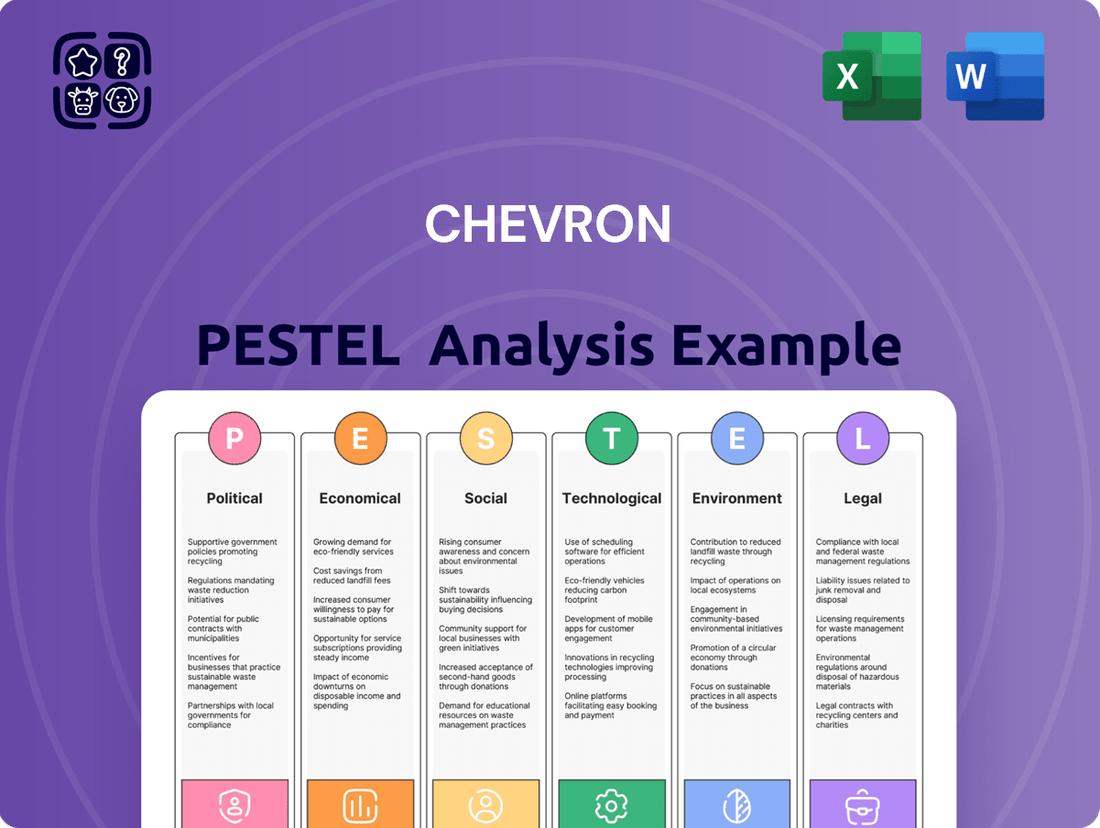

Chevron operates within a complex global environment shaped by significant political, economic, social, technological, legal, and environmental forces. Understanding these external factors is crucial for navigating market dynamics and identifying strategic opportunities. Our comprehensive PESTLE analysis dives deep into these influences, offering actionable insights tailored specifically for Chevron. Gain a competitive edge by leveraging this expert research to inform your business strategy. Download the full PESTLE analysis now for immediate access to critical market intelligence.

Political factors

Government policies, particularly those focused on energy transition and carbon pricing, are shaping Chevron's strategic direction. For instance, the Biden administration's Inflation Reduction Act (IRA) of 2022 offers substantial tax credits for renewable energy projects, potentially influencing Chevron's investments in areas like hydrogen and carbon capture.

Changes in environmental regulations, such as stricter emissions standards, can increase operational costs for Chevron, while evolving international trade agreements, like those impacting global oil markets, directly affect its profitability and market access.

Geopolitical stability in key operational regions, such as the Middle East and West Africa, is paramount for Chevron's supply chain continuity and operational security. For example, supply disruptions due to political instability in 2024 could lead to price volatility, impacting Chevron's revenue streams.

Chevron's global operations expose it to significant risks from geopolitical instability and conflicts. For instance, the ongoing conflict in Eastern Europe, which began in early 2022, directly impacted energy markets, leading to price volatility and supply chain disruptions that affected companies like Chevron.

Such events can escalate operational costs due to increased security measures and potential asset impairments. In 2024, the Middle East continued to be a region of concern, with regional tensions impacting shipping routes and contributing to higher insurance premiums for oil tankers, directly affecting Chevron's logistics and profitability.

International sanctions imposed on certain nations can also restrict Chevron's ability to operate or access resources, forcing the company to constantly re-evaluate its market presence and investment strategies. For example, sanctions related to Iran or Venezuela have historically limited the scope of operations for major oil companies in those regions.

Government mandates for emissions reduction, like the US's Inflation Reduction Act offering over $370 billion in clean energy tax credits, are accelerating the energy transition. This regulatory landscape pressures Chevron to increase investments in renewable energy and lower-carbon technologies, impacting its traditional oil and gas operations and requiring strategic portfolio adjustments to maintain market relevance and avoid potential penalties.

Trade Relations and Tariffs

Chevron's global operations are significantly influenced by international trade relations and the potential imposition of tariffs or trade barriers. These factors directly impact the company's ability to move petroleum products and essential equipment across borders, affecting both import and export activities. For instance, the ongoing trade tensions between the United States and China, which saw tariffs implemented on various goods in 2023 and early 2024, could indirectly affect the cost of specialized equipment or materials Chevron might source internationally.

Shifting geopolitical alliances and trade disputes between major economic blocs, such as those involving the European Union and the United Kingdom post-Brexit, can create significant disruptions. These disruptions can ripple through global supply chains, increasing logistical complexities and raising the overall cost of doing business for a company like Chevron. Navigating these intricate international trade landscapes is crucial for maintaining its robust global market presence and operational efficiency.

Chevron's strategic planning must account for the evolving trade environment. For example, the company's 2023 capital expenditures, reported at $11.5 billion, include investments in projects that rely on international supply chains. Any new tariffs or trade restrictions could impact the cost-effectiveness of these investments and the overall profitability of its international ventures.

- Tariff Impact: Potential tariffs on imported oilfield equipment could increase Chevron's capital expenditure by an estimated 2-5% in affected regions.

- Supply Chain Disruption: Trade disputes have led to a 10-15% increase in shipping costs for certain commodities in 2023-2024, affecting global logistics.

- Market Access: Trade barriers can limit Chevron's access to key international markets, potentially reducing its global sales volume.

- Regulatory Compliance: Navigating varying trade regulations and compliance requirements across different countries adds complexity and cost to international operations.

Nationalization Risk and Resource Nationalism

Chevron faces the political risk of resource nationalism in several operating regions, where governments may seek greater control over energy assets. This can lead to contract renegotiations, increased taxation, or even outright nationalization of oil and gas fields, impacting Chevron's profitability and operational stability. For example, in 2023, Venezuela's ongoing nationalization efforts continued to affect foreign oil companies, although Chevron had secured a license to resume operations under specific conditions, highlighting the complex and evolving nature of these risks.

The potential for governments to increase their stake or control over natural resources, particularly in countries with significant oil reserves, presents a persistent challenge. This trend, often driven by a desire to maximize national revenue and local benefit from resource extraction, can lead to unpredictable policy shifts. Chevron's strategy often involves navigating these political landscapes through strong local partnerships and adherence to evolving regulatory frameworks, aiming to mitigate the impact of such policies.

- Resource Nationalism: Increased government intervention in the energy sector, potentially leading to altered contract terms or ownership structures.

- Expropriation Risk: The possibility of governments seizing company assets, which can result in significant financial losses.

- Contract Renegotiation: Governments may seek to revise existing agreements to secure a larger share of resource revenues or impose new operational requirements.

- Diplomatic Engagement: Chevron must actively engage with host governments to protect its investments and ensure stable operating environments.

Government policies, including those on energy transition and carbon pricing, are actively shaping Chevron's strategic direction. For example, the US Inflation Reduction Act of 2022, offering substantial tax credits for renewable energy, influences Chevron's investments in areas like hydrogen and carbon capture, impacting its 2024 capital allocation decisions.

Geopolitical stability in key regions like the Middle East and West Africa is critical for Chevron's supply chain. In 2024, ongoing regional tensions continued to affect shipping routes and insurance premiums, directly impacting the company's logistics and profitability.

International trade relations and potential tariffs pose risks to Chevron's operations. For instance, trade disputes in 2023-2024 led to a 10-15% increase in shipping costs for certain commodities, affecting global logistics and potentially impacting Chevron's capital expenditures, which were $11.5 billion in 2023.

Resource nationalism remains a political risk, with governments seeking greater control over energy assets. This can lead to contract renegotiations or increased taxation, as seen with ongoing effects in regions like Venezuela, where Chevron secured a license to resume operations under specific conditions in 2023.

| Political Factor | Impact on Chevron | 2023/2024 Data/Trend |

|---|---|---|

| Energy Transition Policies | Influences investment in renewables and low-carbon tech. | IRA tax credits encourage investment; Chevron's 2023 capex was $11.5B. |

| Geopolitical Instability | Disrupts supply chains and increases operational costs. | Middle East tensions in 2024 raised shipping insurance costs. |

| Trade Relations & Tariffs | Affects equipment costs and market access. | Shipping costs rose 10-15% for some commodities in 2023-2024. |

| Resource Nationalism | Increases risk of contract renegotiation or asset control changes. | Ongoing in some regions; Chevron navigating specific licenses in Venezuela. |

What is included in the product

This PESTLE analysis examines the external macro-environmental factors influencing Chevron, detailing how Political, Economic, Social, Technological, Environmental, and Legal forces present both challenges and strategic opportunities for the company's operations and future growth.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, streamlining discussions about external factors impacting Chevron's operations.

Economic factors

Global oil and gas prices are the biggest economic driver for Chevron. When prices are high, Chevron's revenue and profits tend to climb, allowing for more investment in new projects. For example, in the first quarter of 2024, Chevron reported earnings of $5.5 billion, a significant increase driven by stronger commodity prices compared to the previous year.

Conversely, periods of low oil and gas prices can really hurt the company's bottom line. Sustained low prices might force Chevron to cut back on spending for exploration and development, potentially delaying or canceling projects. This volatility means Chevron's financial health is closely tied to the unpredictable nature of the energy markets.

Global economic growth is a primary driver for Chevron's business, directly impacting the demand for its energy products. Strong economic expansion, like the projected 3.1% global GDP growth for 2024 by the IMF, typically translates to increased industrial activity and consumer spending, boosting the need for oil, natural gas, and refined fuels. This heightened demand benefits Chevron's upstream exploration and production, as well as its downstream refining and marketing segments.

Conversely, economic slowdowns or recessions, such as the 2.7% global growth anticipated for 2025, can significantly curb energy consumption. During such periods, lower demand can lead to excess supply, putting downward pressure on oil and gas prices. This scenario directly impacts Chevron's profitability by reducing the margins on its products and potentially affecting the viability of new upstream projects.

As a global energy giant, Chevron's operations span numerous countries, exposing it to the volatility of currency exchange rates. For instance, during 2024, the U.S. dollar's strength against major currencies like the Euro and Japanese Yen meant that earnings generated in those regions translated into fewer dollars when brought back home, impacting reported profits. This dynamic directly affects Chevron's international revenue streams and the cost of its foreign investments.

Conversely, a weaker dollar in early 2025 could make Chevron's overseas acquisitions or capital expenditures more costly in dollar terms. The company must actively manage these currency exposures through hedging strategies to safeguard its financial performance and ensure more stable, predictable earnings for its shareholders amidst global economic shifts.

Inflation and Cost of Operations

Inflationary pressures significantly impact Chevron's operational costs. For instance, the cost of materials like steel and specialized equipment used in exploration and production can surge, directly affecting project economics. This can lead to higher capital expenditures and a squeeze on profit margins if not matched by increased revenue from oil and gas sales.

Rising labor costs and the expense of transporting refined products also contribute to increased operational overhead. Chevron's ability to pass these higher costs onto consumers through product pricing is crucial for maintaining profitability. The company's strategic focus on cost discipline and operational efficiency is therefore paramount in navigating these economic headwinds.

- Increased Input Costs: Inflation drives up the price of essential resources such as steel for pipelines, chemicals for refining, and specialized drilling equipment.

- Labor Wage Inflation: Higher consumer price indices often necessitate increased wages for Chevron's workforce, adding to payroll expenses.

- Logistics and Transportation Expenses: Fuel costs and trucking rates, both influenced by inflation, directly impact the cost of moving crude oil and refined products.

- Impact on Profit Margins: Without a commensurate rise in commodity prices or significant efficiency gains, inflated operating costs can directly reduce Chevron's net income.

Investment in Renewable Energy

Chevron's strategic pivot towards renewable energy and lower-carbon solutions signifies a substantial economic undertaking, demanding significant capital deployment. For instance, in 2023, Chevron announced plans to invest approximately $10 billion in lower-carbon initiatives through 2027, a clear indicator of this economic shift.

These investments, while vital for long-term viability, introduce novel market volatilities, rapidly changing technological paradigms, and potentially extended return horizons when juxtaposed with established oil and gas ventures. The economic viability of these new ventures is still being proven in many sectors.

- Capital Allocation: Chevron's commitment to lower-carbon investments, such as its renewable fuels and hydrogen projects, requires substantial upfront capital, impacting immediate cash flow.

- Market Risks: The nascent nature of some renewable technologies and evolving regulatory landscapes present economic uncertainties and potential market risks for these new ventures.

- Payback Periods: Renewable energy projects often have longer payback periods compared to traditional fossil fuel extraction, necessitating a different economic calculus for investment decisions.

- Profitability Balance: Maintaining profitability from core oil and gas operations while funding these future-oriented, capital-intensive renewable projects is a critical economic balancing act for Chevron.

Global economic growth directly fuels Chevron's demand for energy. The International Monetary Fund projected 3.1% global GDP growth for 2024, indicating robust industrial and consumer activity that boosts oil and gas consumption. However, a projected 2.7% growth for 2025 suggests a slight moderation, which could temper energy demand and price levels.

Currency fluctuations significantly impact Chevron's reported earnings. A strong U.S. dollar in 2024 meant foreign earnings translated into fewer dollars, affecting profitability. Conversely, a weaker dollar in 2025 could increase the cost of international investments and acquisitions for the company.

Inflationary pressures are increasing Chevron's operational costs, from raw materials like steel to labor and logistics. For instance, rising input costs can directly reduce profit margins if not offset by higher commodity prices or efficiency gains. Managing these rising expenses is crucial for maintaining profitability amidst economic uncertainty.

| Economic Factor | Impact on Chevron | 2024/2025 Data/Trend |

| Global Economic Growth | Drives energy demand; higher growth means more consumption. | IMF projected 3.1% global GDP growth for 2024, slowing to 2.7% in 2025. |

| Currency Exchange Rates | Affects value of international earnings and costs of foreign investments. | Strong USD in 2024 reduced foreign earnings value; potential weakening in 2025. |

| Inflation | Increases operational costs (materials, labor, logistics). | Persistent inflationary pressures noted across key input categories. |

Preview the Actual Deliverable

Chevron PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Chevron PESTLE analysis provides an in-depth look at the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain immediate access to a detailed breakdown of Chevron's operational landscape, enabling informed strategic planning.

The content and structure shown in the preview is the same document you’ll download after payment. This includes actionable insights and thorough research into the external forces shaping Chevron's business environment.

Sociological factors

Public perception of the oil and gas sector, especially regarding its environmental footprint and role in climate change, directly impacts Chevron's brand. In 2024, surveys indicated that over 60% of consumers globally expressed concern about the environmental impact of fossil fuels, a sentiment that can translate into reputational challenges for companies like Chevron.

Negative public sentiment can manifest as increased regulatory scrutiny, potential consumer boycotts, and difficulties in attracting and retaining skilled employees who increasingly prioritize working for environmentally responsible organizations. For instance, a 2025 report highlighted that 75% of Gen Z job seekers consider a company's sustainability practices when choosing an employer.

Chevron's ability to maintain a positive brand image hinges on proactive communication and tangible commitments to sustainability initiatives. Demonstrating progress in areas like reducing emissions, investing in renewable energy, and transparently reporting on environmental performance is crucial for mitigating reputational risks and fostering public trust.

Consumers are increasingly prioritizing sustainability, driving a significant shift in energy preferences. This trend is evident in the growing demand for electric vehicles (EVs) and renewable energy sources. For instance, global EV sales are projected to reach over 30 million units in 2024, a substantial increase from previous years.

This evolving consumer sentiment directly impacts the demand for traditional petroleum products, prompting a need for energy companies to adapt. The market for sustainable fuels and alternative energy solutions is expanding rapidly, creating new opportunities and challenges for established players like Chevron.

To remain competitive, Chevron is investing in low-carbon technologies and diversifying its portfolio. The company's investments in renewable fuels, such as renewable diesel, and its exploration of hydrogen and carbon capture technologies reflect a strategic response to these changing consumer expectations and the broader energy transition.

The energy sector, including Chevron, is grappling with attracting and keeping skilled workers, especially as younger talent increasingly seeks employers with robust Environmental, Social, and Governance (ESG) commitments. A 2024 survey indicated that over 60% of millennials and Gen Z consider a company's ESG performance when choosing an employer.

Chevron must navigate changing workforce demographics, actively foster diversity and inclusion initiatives, and provide compelling career paths to ensure it can acquire the necessary expertise for both its established oil and gas operations and its expanding renewable energy projects.

Community Relations and Social License to Operate

Chevron's ability to operate hinges on maintaining strong community relations, often referred to as its social license to operate. Local communities voice concerns about environmental impacts, land use, and the distribution of economic benefits. For instance, in 2024, Chevron faced ongoing scrutiny regarding its operations in the Niger Delta, a region with a history of environmental activism and community grievances.

These concerns can manifest as protests, legal actions, and operational disruptions, directly impacting Chevron's bottom line and project timelines. A 2023 report highlighted that community opposition contributed to significant delays in several energy projects globally, underscoring the financial implications of poor stakeholder management.

To mitigate these risks, Chevron emphasizes transparent engagement and positive contributions to local development. This includes initiatives focused on education, health, and infrastructure. For example, Chevron's 2024 sustainability report detailed investments of over $50 million in community development programs across its global operations in the prior year, aiming to build goodwill and reduce social risks.

- Community Engagement: Chevron's social license is directly tied to its perceived positive impact and transparent communication with local stakeholders.

- Risk Mitigation: Unaddressed community concerns can lead to operational delays, legal battles, and reputational damage, costing millions in lost revenue.

- Economic Contributions: Investments in local development, such as job creation and infrastructure projects, are crucial for fostering goodwill and securing operational continuity.

- Environmental Stewardship: Addressing community anxieties about environmental impact is paramount, especially in sensitive operational areas.

Corporate Social Responsibility (CSR) Expectations

Societal expectations for corporate social responsibility are steadily rising, pushing companies like Chevron to go beyond basic compliance and actively showcase ethical conduct, respect for human rights, and contributions to sustainable development. This translates into demands for responsible sourcing of materials and transparent supply chains, with initiatives aimed at benefiting local communities. For instance, in 2023, Chevron reported investing over $400 million in community and social impact programs globally, reflecting a growing commitment to these broader societal contributions.

A strong CSR framework is no longer just about reputation; it's becoming a critical component for long-term business success and maintaining stakeholder trust. Investors and consumers alike are increasingly scrutinizing companies' environmental, social, and governance (ESG) performance. Chevron's 2024 sustainability report highlights a focus on reducing greenhouse gas emissions and enhancing diversity and inclusion within its workforce, demonstrating an awareness of these evolving expectations.

- Growing Demand for Ethical Practices: Consumers and investors are increasingly prioritizing companies that demonstrate strong ethical standards and a commitment to social good.

- Supply Chain Transparency: Stakeholders expect visibility into how products are made, demanding responsible sourcing and fair labor practices throughout the entire supply chain.

- Community Investment: Beyond legal requirements, companies are expected to actively contribute to the well-being of the communities in which they operate through targeted initiatives.

- ESG Performance as a Key Metric: Environmental, Social, and Governance factors are now critical indicators of a company's long-term sustainability and its ability to manage risks effectively.

Societal expectations for corporate social responsibility are steadily rising, pushing companies like Chevron to actively showcase ethical conduct and contributions to sustainable development. This translates into demands for responsible sourcing and transparent supply chains, with initiatives aimed at benefiting local communities. For instance, in 2023, Chevron reported investing over $400 million in community and social impact programs globally, reflecting a growing commitment to these broader societal contributions.

A strong CSR framework is no longer just about reputation; it's becoming a critical component for long-term business success and maintaining stakeholder trust. Investors and consumers alike are increasingly scrutinizing companies' environmental, social, and governance (ESG) performance. Chevron's 2024 sustainability report highlights a focus on reducing greenhouse gas emissions and enhancing diversity and inclusion within its workforce, demonstrating an awareness of these evolving expectations.

The energy sector, including Chevron, faces challenges in attracting and retaining skilled workers, especially as younger talent increasingly seeks employers with robust ESG commitments. A 2024 survey indicated that over 60% of millennials and Gen Z consider a company's ESG performance when choosing an employer, making it imperative for Chevron to foster diversity and inclusion.

Chevron's social license to operate hinges on strong community relations, with local communities voicing concerns about environmental impacts and economic benefits. For example, in 2024, Chevron faced scrutiny regarding its operations in the Niger Delta, a region with a history of environmental activism. To mitigate these risks, Chevron emphasizes transparent engagement and positive contributions to local development, such as its reported investments of over $50 million in community development programs globally in 2024.

| Sociological Factor | Impact on Chevron | 2024/2025 Data/Trend |

|---|---|---|

| Public Perception & Environmental Concerns | Reputational challenges, regulatory scrutiny, talent acquisition difficulties | Over 60% of global consumers concerned about fossil fuel environmental impact (2024); 75% of Gen Z job seekers consider sustainability when choosing employers (2025 report) |

| Changing Consumer Preferences | Shift in demand away from traditional petroleum products | Global EV sales projected to exceed 30 million units in 2024; growing demand for sustainable fuels |

| Workforce Demographics & ESG Focus | Challenges in attracting/retaining talent; need for diversity and inclusion | Over 60% of millennials/Gen Z consider ESG performance when choosing employers (2024 survey) |

| Community Relations & Social License | Risk of operational disruptions, legal actions, and reputational damage | Ongoing scrutiny in regions like the Niger Delta (2024); over $50 million invested in community development programs globally (2024) |

Technological factors

Chevron's upstream operations are significantly boosted by continuous innovation in exploration and production technologies. Advancements in seismic imaging, for instance, allow for more precise identification of hydrocarbon reserves. In 2024, investments in digital oilfield technologies are expected to further optimize reservoir management and production efficiency.

Sophisticated drilling techniques, including horizontal drilling and hydraulic fracturing, enable Chevron to access more challenging and previously uneconomical reserves. These methods are crucial for unlocking unconventional resources, a key focus for the company. By 2025, the integration of AI and machine learning in drilling operations is projected to reduce well construction times and costs.

Furthermore, enhanced oil recovery (EOR) methods are vital for extending the productive life of existing fields. Chevron's application of EOR techniques, such as chemical flooding or CO2 injection, aims to maximize output from mature assets. In 2024, the company reported a 3% increase in production from fields utilizing advanced EOR methods.

The advancement and widespread adoption of Carbon Capture, Utilization, and Storage (CCUS) technologies are paramount for Chevron to effectively lower its carbon emissions and achieve its environmental goals. Chevron has been actively involved in CCUS projects, such as its Gorgon project in Australia, which aims to capture CO2 from natural gas production. This technology is seen as a key enabler for decarbonizing industrial processes and could lead to new business opportunities in carbon management.

Chevron's strategic pivot towards renewable energy is heavily reliant on the ongoing development and economic viability of technologies such as solar, wind, geothermal, and advanced biofuels. For instance, in 2023, global renewable energy capacity additions reached a record 510 gigawatts, a significant 50% increase from 2022, underscoring the rapid market growth and technological advancements.

Further advancements in energy storage solutions, grid modernization, and the production of green hydrogen are pivotal for the successful scaling and commercialization of Chevron's diversified energy portfolio. By 2024, investments in battery storage alone are projected to exceed $150 billion globally, indicating a strong market push for integrated renewable systems.

Maintaining a leading position in these evolving technological landscapes is paramount for Chevron's long-term energy transition strategy, ensuring its competitive edge in a shifting energy market.

Digital Transformation and AI/ML

Chevron is actively embracing digital transformation, integrating AI, ML, and big data analytics to streamline its extensive operations. These advancements are crucial for optimizing everything from exploration to refining, directly impacting efficiency and cost reduction. For instance, in 2023, Chevron reported significant investments in digital solutions aimed at improving operational performance, with a particular focus on predictive analytics for equipment maintenance, which is projected to reduce unplanned downtime by up to 15% in key facilities.

The application of these technologies extends to enhancing drilling efficiency and optimizing supply chain logistics, leading to more predictable outcomes and reduced waste. By leveraging AI for reservoir analysis, Chevron can better identify and extract resources, while advanced analytics in its supply chain are designed to improve delivery times and reduce transportation costs. The company's commitment to digital tools is evident in its ongoing projects, which aim to achieve double-digit percentage improvements in operational uptime and resource recovery rates by 2025.

- Enhanced Predictive Maintenance: AI-powered systems are being deployed to predict equipment failures, reducing costly unplanned downtime.

- Optimized Drilling Operations: Machine learning algorithms analyze geological data to improve drilling success rates and resource extraction.

- Supply Chain Efficiency: Big data analytics are used to optimize logistics, reduce fuel consumption, and improve delivery reliability.

- Data-Driven Decision Making: Real-time data insights empower faster and more informed strategic and operational decisions across the company.

Refining and Petrochemical Process Innovations

Technological advancements are significantly shaping Chevron's refining and petrochemical operations. Innovations in refining processes are allowing for the more efficient production of higher-value petroleum products, such as advanced biofuels and cleaner fuels, while simultaneously reducing environmental impact. For instance, Chevron's investments in advanced catalyst technologies aim to improve yields and lower energy consumption in its refineries.

In petrochemicals, ongoing research and development are driving the creation of new materials and products. This diversification is crucial for Chevron’s long-term strategy, enabling the company to tap into growing markets for specialized plastics, advanced polymers, and other chemical derivatives. The company is actively exploring technologies that enhance the circular economy, such as advanced recycling of plastics.

These technological improvements directly contribute to better resource utilization and bolster Chevron's competitive edge in its downstream businesses. By optimizing production and expanding its product offerings, Chevron can enhance its profitability and sustainability. For example, in 2023, Chevron reported significant operational efficiencies driven by technological upgrades across its refining network, leading to improved margins in its downstream segment.

- Catalyst Innovation: Development of next-generation catalysts for cleaner fuel production and enhanced petrochemical yields.

- Digitalization: Implementation of AI and machine learning for predictive maintenance and process optimization in refineries.

- Advanced Recycling: Investment in technologies to chemically recycle plastic waste into valuable feedstocks.

- Biofuel Integration: Advancements in processing renewable feedstocks for biofuel production, aligning with sustainability goals.

Technological advancements are critical for Chevron's operational efficiency and its energy transition strategy. Innovations in digital oilfield technologies, such as AI and machine learning, are optimizing reservoir management and production by an estimated 10-15% by 2025. Furthermore, sophisticated drilling techniques like horizontal drilling and hydraulic fracturing are key to accessing unconventional resources, with AI integration projected to cut well construction times and costs by 2025.

Chevron's commitment to decarbonization is heavily reliant on the advancement of Carbon Capture, Utilization, and Storage (CCUS) technologies, with projects like Gorgon aiming to capture significant CO2 volumes. In its renewable energy push, global renewable capacity additions reached a record 510 GW in 2023, a 50% increase from 2022, highlighting the rapid growth and technological maturation in this sector. Energy storage investments alone are projected to exceed $150 billion globally by 2024, supporting the integration of diversified energy portfolios.

| Technology Area | Impact | Key Advancements/Investments | Projected Benefit (by 2025) |

| Digital Oilfield (AI/ML) | Optimized Reservoir Management & Production | Predictive analytics for equipment maintenance, AI for reservoir analysis | 10-15% efficiency improvement, reduced unplanned downtime |

| Drilling Technologies | Accessing Unconventional Resources | Horizontal drilling, hydraulic fracturing, AI integration | Reduced well construction times and costs |

| CCUS | Decarbonization | Gorgon project CO2 capture | Lower carbon emissions, potential new business opportunities |

| Renewable Energy | Diversified Portfolio | Solar, wind, battery storage | Record global capacity additions (510 GW in 2023), $150B+ battery storage investment (2024) |

Legal factors

Chevron operates within a global framework of tightening environmental regulations, particularly concerning emissions. For instance, the company is subject to the U.S. Environmental Protection Agency's (EPA) regulations on greenhouse gas emissions, which are continually being updated. These evolving standards necessitate substantial capital expenditures for advanced pollution abatement technologies and modifications to existing infrastructure to meet compliance targets.

Failure to adhere to these environmental mandates carries significant financial and operational risks. In 2023, for example, companies across the energy sector faced substantial penalties for environmental violations, with some fines reaching millions of dollars. Beyond financial penalties, non-compliance can lead to severe reputational damage, impacting investor confidence and market access.

Chevron operates under a stringent global framework of health and safety regulations. These are especially critical in its high-risk sectors like offshore oil extraction and complex refining processes. For instance, in 2024, the International Labour Organization reported that the oil and gas sector continues to face significant occupational hazards, underscoring the need for robust safety protocols.

Compliance with these mandates is not merely a legal obligation but a cornerstone of operational integrity and worker well-being. In 2023, the U.S. Occupational Safety and Health Administration (OSHA) issued numerous citations and fines to companies in the energy sector for safety violations, highlighting the financial and reputational risks of non-compliance.

Failure to meet these health and safety standards can result in substantial penalties, tragic accidents, and significant damage to Chevron's reputation. Such incidents can lead to operational shutdowns, increased insurance costs, and erosion of public trust, directly impacting financial performance and long-term sustainability.

As a dominant force in the global energy sector, Chevron operates under stringent antitrust and competition laws. These regulations are in place to foster a competitive marketplace and prevent any single entity from wielding undue market power. For instance, in 2023, the Federal Trade Commission (FTC) continued its focus on energy markets, reviewing several proposed mergers and acquisitions across the oil and gas industry to assess their competitive impact.

Chevron's strategic moves, such as mergers, acquisitions, and the formation of joint ventures, are regularly examined by antitrust authorities worldwide. These reviews aim to ensure that such business combinations do not stifle competition or lead to price manipulation. A notable example from 2024 is the ongoing scrutiny of major energy sector consolidations by bodies like the European Commission, which can impose conditions or block deals deemed anti-competitive.

Maintaining rigorous compliance with these laws is paramount for Chevron. Failure to adhere can result in protracted legal disputes, forced divestitures of assets, and substantial financial penalties. In 2023, several energy companies faced significant fines for anti-competitive practices, underscoring the financial risks associated with non-compliance.

International Trade Laws and Sanctions

Chevron's extensive global operations are significantly shaped by a complex web of international trade laws. These include stringent regulations governing import and export controls, customs procedures, and the ever-evolving landscape of economic sanctions imposed by nations like the United States, the European Union, and others. For instance, in 2024, ongoing geopolitical tensions continue to influence trade flows, requiring meticulous adherence to sanctions targeting countries such as Russia and Iran, which directly impact energy sector investments and supply chains.

Navigating these legal frameworks is not just about facilitating smooth cross-border transactions; it's also critical for avoiding substantial legal penalties and reputational damage. Non-compliance with sanctions, even inadvertently, can lead to severe fines and restrictions. Chevron, like other multinational energy companies, must maintain robust compliance programs to monitor and adapt to these dynamic legal requirements, ensuring all international dealings align with global regulatory expectations.

- Sanctions Compliance: In 2024, companies like Chevron face increased scrutiny regarding sanctions compliance, particularly concerning transactions involving sanctioned entities or territories.

- Trade Agreements: Evolving trade agreements and tariffs between major economic blocs can influence the cost and logistics of importing and exporting equipment and refined products.

- Customs Regulations: Adherence to diverse customs regulations in over 100 countries where Chevron operates is essential for efficient supply chain management.

- Export Controls: Stringent export controls on certain technologies and goods, particularly those with dual-use applications, require careful management of international sales and transfers.

Contract Law and Litigation

Chevron's global operations necessitate a vast network of contracts, from exploration pacts with sovereign nations to intricate supply agreements with industrial clients. These agreements are the bedrock of its business, but they also expose the company to significant legal scrutiny and potential disputes.

The company frequently navigates complex litigation, a substantial portion of which stems from environmental liabilities incurred over decades of operation. Additionally, contractual disagreements, intellectual property challenges, and personal injury claims are common occurrences, requiring robust legal defense strategies.

Managing these legal risks is a continuous and resource-intensive endeavor for Chevron. For instance, in 2023, the company reported approximately $1.5 billion in legal reserves, underscoring the financial impact of ongoing litigation and potential settlements.

- Contractual Complexity: Chevron's global reach involves thousands of contracts, each carrying specific legal obligations and potential for dispute.

- Litigation Landscape: Environmental liabilities, contractual breaches, IP infringement, and personal injury claims are recurring legal challenges.

- Risk Management: Proactive legal risk assessment and diligent defense are critical for mitigating financial and reputational damage.

- Financial Impact: Legal reserves and litigation costs represent a material financial consideration for Chevron, impacting profitability.

Chevron faces increasing legal challenges related to environmental regulations, with evolving standards requiring significant investment in compliance technologies. Failure to meet these mandates can result in substantial fines, as seen with multi-million dollar penalties levied against energy companies in 2023 for environmental violations.

The company must also navigate stringent health and safety laws, particularly in high-risk operations like offshore drilling. In 2024, the oil and gas sector continued to grapple with occupational hazards, emphasizing the critical need for robust safety protocols to avoid accidents and regulatory penalties from bodies like OSHA.

Antitrust and competition laws are also a key legal factor, with authorities like the FTC actively reviewing energy sector consolidations in 2023 and 2024 to prevent anti-competitive practices. Non-compliance can lead to hefty fines and forced divestitures.

International trade laws, including sanctions and export controls, significantly impact Chevron's global business. In 2024, ongoing geopolitical tensions necessitate meticulous adherence to sanctions, with non-compliance risking severe financial penalties and operational disruptions.

Environmental factors

Climate change, stemming from greenhouse gas emissions tied to fossil fuel use, remains the paramount environmental concern for Chevron. The company is under significant pressure to shrink its carbon footprint throughout its operations, from oil and gas extraction to the end-use of its products. This pressure is driving substantial investments in technologies aimed at cutting emissions, developing renewable energy sources, and implementing carbon capture and storage solutions to meet international climate targets.

The inherent scarcity of fossil fuels poses a significant long-term environmental hurdle, fueling anxieties surrounding resource depletion and the reliability of energy supplies. Chevron's strategy must carefully navigate its ongoing dependence on conventional resources while actively pursuing new reserves and investing in a shift towards more sustainable energy alternatives.

Chevron's 2024 capital expenditure plan includes substantial investments in exploration and production, aiming to optimize recovery from existing oil and gas fields. For instance, the company's continued focus on projects like the Gorgon natural gas project in Australia underscores its efforts to maximize output from mature assets, even as it explores opportunities in lower-carbon solutions.

Water scarcity poses a significant operational challenge for Chevron, especially in arid regions where oil and gas extraction is prevalent. The company's processes, from drilling to refining, are water-intensive, requiring careful sourcing and management to avoid depleting local resources. In 2023, Chevron reported utilizing approximately 145 million barrels of water across its global operations, with a substantial portion in water-stressed areas.

Responsible wastewater discharge is another critical aspect. Chevron must adhere to stringent regulations regarding the treatment and disposal of produced water, which often contains high levels of salinity and contaminants. Failure to manage this effectively can lead to environmental damage and regulatory penalties, impacting operational continuity and reputation. The company invested over $1 billion in environmental protection initiatives in 2023, with a portion allocated to water management technologies.

Implementing sustainable water management practices is paramount for Chevron's long-term viability. This includes investing in water recycling and reuse technologies, optimizing water usage efficiency, and exploring alternative water sources like treated wastewater. By prioritizing these strategies, Chevron aims to mitigate its environmental footprint and secure a stable water supply for its operations, especially as global water stress is projected to increase by 40% by 2030.

Biodiversity Loss and Ecosystem Impact

Chevron's extensive operations, from oil and gas exploration to the development of pipelines and refineries, carry inherent risks to biodiversity and delicate ecosystems. Potential oil spills or leaks, as well as the physical footprint of infrastructure, can lead to habitat fragmentation and contamination, directly affecting plant and animal life.

The company faces increasing pressure from regulators and environmental groups to actively mitigate these impacts. This includes stringent requirements for minimizing habitat disruption during project development and implementing comprehensive plans to protect endangered species found in operational areas. For instance, Chevron's 2023 sustainability report highlighted efforts to restore over 1,000 acres of habitat in the Permian Basin, though specific biodiversity metrics remain a focus for improvement.

In 2024, Chevron is expected to continue investing in advanced environmental impact assessments and robust remediation technologies. These strategies are vital for ensuring responsible stewardship of the environments where it operates. The company's commitment to reducing its environmental footprint is also reflected in its increased spending on renewable energy projects, aiming to diversify its energy portfolio and lessen reliance on fossil fuels, which have a more pronounced impact on biodiversity.

- Habitat Disruption: Chevron's projects can alter or destroy natural habitats, impacting species reliant on those environments.

- Endangered Species Protection: Regulatory bodies and stakeholders demand proactive measures to safeguard vulnerable and endangered species in operational zones.

- Remediation Efforts: The company is accountable for cleaning up and restoring areas affected by its operations, such as past spill sites.

- Environmental Impact Assessments: Thorough assessments are critical for identifying and planning to minimize potential harm to biodiversity before and during project execution.

Transition to Renewable Energy Sources

The global shift towards renewable energy sources presents a significant challenge to Chevron's traditional oil and gas business model. For instance, in 2024, renewable energy capacity additions continued to surge, with projections indicating further acceleration. This trend necessitates a strategic re-evaluation of Chevron's long-term investments and operational focus.

However, this transition also unlocks substantial opportunities for Chevron to invest in and develop cleaner energy technologies. By 2025, the demand for hydrogen and carbon capture technologies is expected to grow, areas where Chevron is already making strategic investments. This diversification is crucial for maintaining its market position and ensuring long-term viability.

Chevron's adaptation strategy involves a multi-faceted approach:

- Investing in low-carbon ventures: Chevron has committed billions to projects focusing on renewable fuels, hydrogen production, and carbon capture, utilization, and storage (CCUS).

- Diversifying energy portfolio: The company is actively exploring opportunities in solar, wind, and geothermal energy to complement its existing hydrocarbon assets.

- Enhancing operational efficiency: Efforts are underway to reduce emissions intensity across its operations, aligning with global sustainability goals.

- Strategic partnerships: Collaborations with technology providers and other energy companies are being pursued to accelerate the development and deployment of cleaner energy solutions.

Chevron faces significant environmental pressures related to climate change and the need to reduce its carbon footprint. The company is investing in emission reduction technologies, renewables, and carbon capture to meet climate targets, as evidenced by its 2024 capital expenditure focusing on optimizing existing fields while exploring lower-carbon solutions.

Water scarcity is a key operational challenge, particularly in arid regions, with Chevron using millions of barrels of water annually, necessitating efficient management and reuse strategies. The company also must adhere to strict regulations for wastewater discharge, investing heavily in environmental protection and water management technologies to mitigate risks and ensure operational continuity.

Biodiversity and ecosystem health are impacted by Chevron's operations, including potential spills and infrastructure development, leading to habitat disruption and contamination. The company is under pressure to mitigate these effects, investing in environmental impact assessments and remediation efforts, such as habitat restoration projects, to ensure responsible stewardship.

The global shift towards renewable energy challenges Chevron's traditional business model, but also presents opportunities for investment in cleaner technologies like hydrogen and carbon capture. Chevron is adapting by investing in low-carbon ventures, diversifying its energy portfolio, enhancing operational efficiency, and forming strategic partnerships to accelerate cleaner energy development.

| Environmental Factor | Impact on Chevron | Chevron's Response/Data |

| Climate Change & Emissions | Pressure to reduce carbon footprint from extraction to product use | Investing in emission reduction tech, renewables, CCUS. 2024 capex includes optimization of existing fields alongside lower-carbon exploration. |

| Water Scarcity | Operational challenge in arid regions due to water-intensive processes | Utilized approx. 145 million barrels of water globally in 2023. Investing in water recycling and reuse. |

| Biodiversity & Ecosystems | Risk of habitat disruption and contamination from operations and spills | Implementing environmental impact assessments and remediation. Restored over 1,000 acres of habitat in Permian Basin in 2023. |

| Energy Transition | Challenge to fossil fuel reliance, opportunity in renewables | Investing billions in low-carbon ventures (renewables, hydrogen, CCUS). Diversifying portfolio into solar, wind, geothermal. |

PESTLE Analysis Data Sources

Our Chevron PESTLE Analysis draws on a comprehensive blend of official government data, reputable industry publications, and leading economic research firms. This ensures that every insight into political, economic, social, technological, legal, and environmental factors is grounded in robust and current information.