Chevron Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chevron Bundle

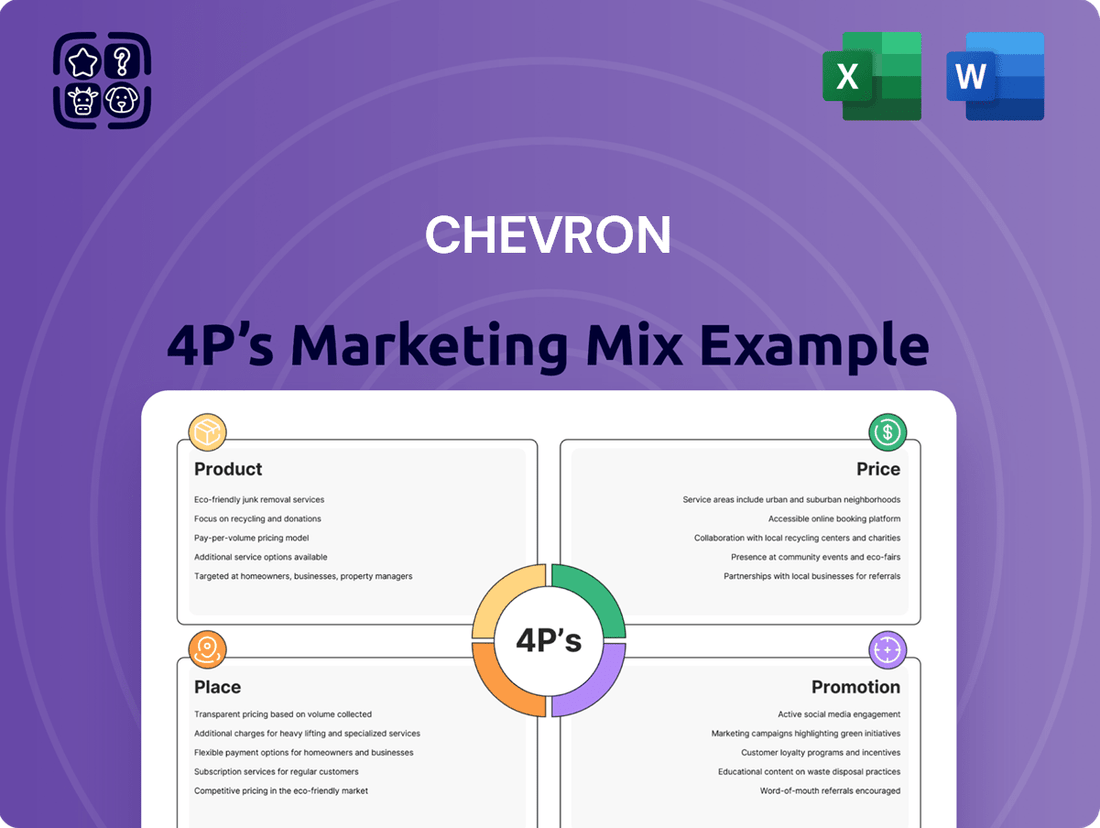

Chevron's marketing strategy is a masterful blend of product innovation, competitive pricing, strategic distribution, and impactful promotion. This analysis delves into how each element of their 4Ps works in synergy to maintain their market leadership.

Discover the intricacies of Chevron's product portfolio, their dynamic pricing strategies, their extensive distribution network, and their targeted promotional campaigns. This comprehensive breakdown is essential for anyone seeking to understand their success.

Unlock a complete, ready-to-use 4Ps Marketing Mix Analysis for Chevron. Save valuable time and gain actionable insights, perfect for business professionals, students, and consultants aiming for strategic advantage.

Product

Chevron's traditional energy products form the bedrock of its market offering, encompassing crude oil, natural gas, gasoline, diesel, and jet fuel. These essential commodities directly address the world's ongoing need for transportation, industrial processes, and electricity generation, making them critical components of the global economy.

In 2024, Chevron continued to emphasize the efficient production and refining of these core products. The company's commitment to optimizing its supply chain for traditional energy sources is crucial for meeting demand reliably. For instance, Chevron's upstream production in 2024 averaged 3.1 million barrels of oil equivalent per day, showcasing its significant role in supplying these vital resources.

Chevron's lubricants and petrochemical segment extends its reach far beyond gasoline, offering a diverse portfolio including high-performance lubricants, coolants, and specialized petrochemicals. These products are engineered for optimal efficiency and reliability, serving critical roles in sectors ranging from automotive and industrial manufacturing to marine operations.

The company typically adopts a premium pricing strategy for these advanced offerings, a reflection of the superior quality, technological innovation, and specialized performance they deliver to demanding industrial clients. For instance, Chevron's Havoline and Delo brands are recognized for their advanced formulations, contributing to extended equipment life and reduced maintenance costs for customers.

In 2024, the global lubricants market was valued at over $160 billion, with Chevron holding a significant share, particularly in North America. The petrochemical segment also plays a crucial role in Chevron's integrated business model, supplying essential building blocks for plastics, synthetic fibers, and other industrial materials, further diversifying its revenue streams.

Chevron is actively expanding its renewable fuels business, focusing on renewable diesel and Sustainable Aviation Fuel (SAF). This strategic move addresses the growing demand for lower-carbon transportation options and supports global decarbonization efforts.

The company has set an ambitious target to reach a renewable fuels production capacity of 100,000 barrels per day by 2030. This significant investment underscores Chevron's commitment to diversifying its energy portfolio and meeting future energy needs sustainably.

Lower-Carbon Technologies and Solutions

Chevron is actively broadening its offerings to encompass lower-carbon solutions, a key element of its evolving marketing mix. This expansion includes investments in hydrogen, both blue and green varieties, alongside advancements in carbon capture, utilization, and storage (CCUS) and geothermal energy projects.

These initiatives are spearheaded by Chevron New Energies, a dedicated division focused on tackling industrial decarbonization and promoting energy decentralization. The company's strategic focus is on sectors characterized by significant, hard-to-abate emissions, aiming to provide viable alternatives for these challenging areas.

Chevron's commitment to this space is underscored by significant investments. For instance, in 2023, the company announced plans to invest approximately $5 billion in lower-carbon initiatives through 2028, with a substantial portion allocated to CCUS and hydrogen projects. This strategic pivot reflects a growing market demand for sustainable energy solutions and positions Chevron to capitalize on future energy trends.

- Hydrogen Production: Investing in both blue and green hydrogen to meet growing demand.

- Carbon Capture: Developing CCUS projects to reduce industrial emissions.

- Geothermal Energy: Exploring and investing in geothermal power generation.

- Chevron New Energies: A dedicated division driving the company's lower-carbon strategy.

Power Generation for Data Centers

Chevron is strategically expanding its product offering to include power generation for the burgeoning data center market, particularly hyperscale AI facilities. This move acknowledges the significant and growing energy requirements of digital infrastructure. By leveraging its established natural gas capabilities, Chevron is positioning itself to meet this emerging demand. For instance, the International Energy Agency (IEA) reported in its 2024 update that data centers, AI, and other digital services could account for over 10% of global electricity consumption by 2026, a substantial increase from current levels.

This new product focuses on supplying reliable and efficient natural gas as a fuel source for the power generation needs of these critical digital hubs. Chevron’s involvement signifies a direct response to the escalating energy consumption driven by artificial intelligence and cloud computing. The company's investment in this sector aims to secure a vital role in powering the backbone of the digital economy. In 2023, the global data center market size was valued at approximately $242 billion, with projections indicating continued robust growth throughout the forecast period.

- Market Demand: Data centers, especially those supporting AI, require massive and consistent power.

- Chevron's Role: Supplying natural gas as a fuel for power generation to meet this demand.

- Strategic Alignment: Leverages existing natural gas infrastructure and expertise.

- Growth Opportunity: Addresses the rapidly expanding digital infrastructure sector.

Chevron's product strategy spans traditional energy, lubricants, petrochemicals, and a growing portfolio of lower-carbon solutions. This includes renewable fuels like diesel and SAF, alongside investments in hydrogen, CCUS, and geothermal energy, all managed by Chevron New Energies. The company is also strategically entering the data center power market, supplying natural gas for these energy-intensive facilities.

| Product Category | Key Offerings | 2024/2025 Data/Focus | Strategic Importance |

| Traditional Energy | Crude oil, natural gas, gasoline, diesel, jet fuel | Avg. 3.1 million boe/day production (2024) | Core business, global economic backbone |

| Lubricants & Petrochemicals | High-performance lubricants, coolants, petrochemicals | Global lubricants market >$160 billion (2024) | Diversified revenue, serves industrial sectors |

| Renewable Fuels | Renewable diesel, Sustainable Aviation Fuel (SAF) | Target 100,000 bpd capacity by 2030 | Addresses decarbonization, future energy needs |

| Lower-Carbon Solutions | Hydrogen, CCUS, Geothermal | ~$5 billion investment in lower-carbon initiatives (2023-2028) | Tackles hard-to-abate emissions, energy transition |

| Data Center Power | Natural gas for power generation | Data centers may exceed 10% of global electricity by 2026 (IEA 2024) | Capitalizes on digital infrastructure growth |

What is included in the product

This analysis provides a comprehensive breakdown of Chevron's marketing mix, examining its Product offerings, Pricing strategies, Place distribution, and Promotion efforts to understand its market positioning.

Simplifies complex marketing strategies by presenting Chevron's 4Ps in a clear, actionable framework, alleviating the pain of strategic ambiguity.

Place

Chevron's global exploration and production (E&P) network is a cornerstone of its operations, spanning continents and securing diverse energy sources. This extensive reach is crucial for maintaining a consistent supply of oil and natural gas.

Significant U.S. operations are centered in the Permian Basin and the Gulf of Mexico, areas known for their substantial reserves. Internationally, Chevron has a strong foothold in regions like Kazakhstan, demonstrating its commitment to a broad geographical footprint.

In 2023, Chevron's upstream segment reported a production of 3.1 million barrels of oil equivalent per day (boepd), a testament to the scale of its global E&P activities. This diverse portfolio mitigates risks associated with any single region's output.

Chevron boasts an extensive downstream infrastructure, crucial for its marketing efforts. This includes a significant refining capacity, with its five U.S. refineries processing approximately one million barrels of crude oil each day as of recent reports. This robust refining capability ensures a steady supply of refined products for its extensive retail network.

The company's marketing presence is amplified by its global chain of retail and service stations, operating under well-recognized brands such as Chevron, Texaco, and Caltex. These outlets are strategically positioned in high-traffic locations to ensure maximum consumer visibility and convenient access, directly supporting product sales and brand reinforcement.

Chevron's place strategy is deeply rooted in its integrated supply chain and logistics, a critical component for moving vast quantities of petroleum products. This sophisticated system includes a significant own shipping business, operating a fleet of vessels that are essential for transporting oil, gas, and chemical goods. This robust infrastructure ensures efficient movement from extraction points to refineries and then to various markets, underscoring their commitment to timely and dependable delivery.

Strategic Investments in Emerging Energy Markets

Chevron's strategic investments in emerging energy markets are a key component of its diversification efforts, aiming to build out infrastructure and forge partnerships for renewable and lower-carbon initiatives. This proactive approach is evident in its exploration of offshore wind projects, development of biofuel facilities, and entry into the domestic lithium sector to bolster U.S. energy security.

These moves are designed to position Chevron advantageously in evolving energy landscapes. For instance, by 2023, Chevron had committed billions to lower-carbon projects, including a significant portion allocated to renewable fuels and hydrogen. The company's acquisition of Renewable Energy Group (REG) in 2023 for approximately $3.15 billion further solidified its commitment to the biofuels sector.

- Offshore Wind Exploration: Chevron is actively evaluating opportunities in offshore wind, recognizing its potential to contribute significantly to a lower-carbon energy future.

- Biofuel Facility Development: Investments in biofuel production, exemplified by the REG acquisition, demonstrate a direct push into renewable liquid fuels.

- Lithium Sector Entry: By entering the domestic lithium market, Chevron is securing a critical component for battery technology, essential for electric vehicles and energy storage.

- U.S. Energy Security Focus: These investments are strategically aligned with enhancing domestic energy production and security, particularly in sectors critical for the energy transition.

Digital Platforms and Partnerships

Chevron actively utilizes digital platforms, exemplified by its CaltexGO mobile app, to foster deeper customer connections and streamline convenience at its service stations. This digital integration is crucial for modern retail operations, allowing for loyalty programs and easier payment methods.

Strategic alliances are a cornerstone of Chevron's market expansion, particularly in new energy sectors. Partnerships with agricultural businesses and technology innovators are key to distributing and encouraging the use of emerging energy solutions, broadening their reach.

- CaltexGO App Usage: Over 1 million downloads by early 2024, indicating significant customer adoption of digital convenience.

- Partnership Focus: In 2024, Chevron announced a new collaboration with a leading agritech firm to pilot bio-based fuel distribution in select markets.

- Market Access Optimization: The combined physical and digital approach aims to increase market share for new energy products by 15% in target regions by the end of 2025.

Chevron's place strategy is defined by its extensive global network of physical assets and its strategic positioning within evolving energy markets. This includes a robust upstream and downstream infrastructure, ensuring efficient production and distribution of traditional energy sources. The company is also actively expanding its physical presence in emerging energy sectors to secure future growth and market share.

The company's retail footprint, featuring brands like Chevron, Texaco, and Caltex, is strategically located for maximum consumer access. This physical presence is increasingly augmented by digital platforms, enhancing customer convenience and engagement. Chevron's commitment to securing key resources, such as lithium for battery technology, further solidifies its strategic placement in the future energy landscape.

Chevron's integrated logistics, including its own shipping fleet, are vital for moving products efficiently across its global operations. This ensures a reliable supply chain from extraction to market. The company's investments in new energy infrastructure, like biofuel facilities and offshore wind exploration, are designed to establish a strong physical foothold in these growing sectors.

Chevron's strategic placement in emerging energy markets is underscored by significant investments. By 2023, the company had allocated billions to lower-carbon projects, including a substantial portion for renewable fuels. The acquisition of Renewable Energy Group (REG) in 2023 for approximately $3.15 billion is a prime example of establishing a physical presence in the growing biofuel sector.

Full Version Awaits

Chevron 4P's Marketing Mix Analysis

The preview you see here is the exact same comprehensive Chevron 4P's Marketing Mix Analysis you'll receive instantly after purchase. This document is fully complete and ready for your immediate use, offering a detailed breakdown of Chevron's strategies across Product, Price, Place, and Promotion. There are no surprises, just the valuable insights you need.

Promotion

Chevron positions itself as a premier energy provider, deeply invested in innovation and a sustainable future. Its brand messaging consistently highlights a dedication to environmental stewardship and the creation of accessible, dependable, and cleaner energy solutions. This strategic approach aims to cultivate strong trust and widespread recognition across its entire stakeholder base.

In 2024, Chevron continued to emphasize its role in developing lower-carbon technologies, investing billions in projects like renewable fuels and hydrogen. For instance, their Gorgon carbon capture project in Australia, a significant undertaking, aims to sequester millions of tonnes of CO2 annually, underscoring their commitment to environmental responsibility in their operational scope.

Chevron actively engages in digital marketing, leveraging its website and targeted online campaigns to connect with stakeholders. Social media platforms such as LinkedIn, Twitter, and Facebook are crucial for disseminating brand values and strategic objectives.

These digital channels are instrumental in showcasing Chevron's commitment to reducing carbon emissions and its significant investments in new energy technologies. For instance, in 2023, Chevron reported a 20% increase in digital engagement across its key social media platforms, reaching over 50 million users globally.

Chevron actively promotes its commitment to community engagement and Corporate Social Responsibility (CSR) as a key part of its promotional strategy. This involves highlighting initiatives focused on health, education, and economic development in the areas where it operates.

The company utilizes print advertisements and various communication channels to share its community-focused messages. These efforts aim to showcase Chevron's dedication to supporting local businesses and contributing to community development projects.

In 2023, Chevron invested $47 million in communities worldwide, supporting over 700 organizations. This demonstrates a tangible commitment to its CSR pillars, reinforcing its image as a responsible corporate citizen.

Targeted B2B Marketing and Account-Based Marketing (ABM)

Chevron leverages targeted B2B marketing, including Account-Based Marketing (ABM), to connect with key business clients. This approach focuses resources on specific high-value accounts, ensuring more relevant and impactful communication. For example, in their lubricants division, Chevron crafts personalized campaigns to educate fleet operators about the vital role of engine oil in enhancing fuel efficiency and reducing emissions. This direct engagement builds stronger partnerships with commercial customers.

This strategy is particularly effective in sectors where customer relationships are paramount. Chevron's ABM efforts in 2024 and early 2025 aim to deepen engagement with industrial clients by providing tailored solutions and insights. For instance, by demonstrating how advanced lubricants can extend equipment life and minimize downtime, Chevron directly addresses critical operational concerns for businesses. This focus on specific customer needs, rather than broad outreach, drives loyalty and repeat business.

- Targeted Engagement: ABM allows Chevron to focus marketing efforts on specific companies with high potential value.

- Personalized Education: In lubricants, Chevron educates operators on how engine oil impacts efficiency and emissions through tailored content.

- Relationship Building: This direct, personalized approach fosters deeper, more meaningful relationships with business clients.

- Value Proposition Clarity: Chevron highlights how its products solve specific operational challenges for B2B customers.

Sponsorships and Partnerships

Chevron leverages sponsorships and partnerships as key promotional tools, aiming to boost brand recognition and reinforce its corporate image. These collaborations are strategically chosen to resonate with target audiences and support Chevron's broader business goals.

While specific 2024-2025 partnership details are not readily available, major energy companies like Chevron frequently invest in high-profile events and organizations. For instance, in 2023, Chevron continued its long-standing support for initiatives like the FIRST Robotics Competition, engaging with over 1 million students and educators globally. This type of partnership aligns with their commitment to STEM education and future workforce development.

These strategic alliances allow Chevron to:

- Enhance Brand Visibility: Associating with popular events or causes exposes the Chevron brand to a wider audience.

- Align with Strategic Objectives: Partnerships often focus on areas like sustainability, technology, or community development, mirroring Chevron's corporate priorities.

- Build Stakeholder Relationships: Collaborations foster goodwill and strengthen connections with customers, employees, and the communities where Chevron operates.

- Demonstrate Industry Leadership: Sponsoring innovation or sustainability efforts positions Chevron as a forward-thinking leader in the energy sector.

Chevron's promotional efforts in 2024-2025 focus on digital engagement, community investment, and targeted B2B marketing. They leverage social media and online campaigns to highlight their commitment to lower-carbon technologies and sustainability, exemplified by a reported 20% increase in digital engagement in 2023. Their substantial community investments, totaling $47 million in 2023 across over 700 organizations, reinforce their image as a responsible corporate citizen.

Price

Chevron's pricing for its core commodities, including crude oil, natural gas, and refined products, is intrinsically linked to the ebb and flow of global market forces. The company actively monitors supply and demand balances, the impact of geopolitical developments, and evolving regulatory landscapes to inform its pricing strategies.

For instance, as of early 2024, crude oil prices have seen volatility, with Brent crude averaging around $80 per barrel, influenced by production cuts by OPEC+ and ongoing geopolitical tensions in Eastern Europe and the Middle East. Natural gas prices in the US, particularly Henry Hub, have also experienced fluctuations, trading in the range of $2-$3 per million British thermal units (MMBtu) due to factors like weather patterns and inventory levels.

This dynamic market-based approach allows Chevron to adjust its prices strategically, ensuring competitiveness across its product portfolio. The company's ability to adapt to these shifting conditions is crucial for maintaining profitability and market share in the energy sector.

Chevron navigates highly competitive retail fuel markets by strategically pricing its products, often aligning with or slightly exceeding competitor prices. This approach is underpinned by the company's strong brand reputation, which customers associate with superior quality and service, thereby justifying a premium perception.

This pricing strategy is crucial for maintaining Chevron's market share in a dynamic environment. For instance, in 2024, average gasoline prices across the US fluctuated significantly, with regional variations impacting competitive positioning. Chevron's ability to command prices that reflect its brand value, even in the face of intense competition, highlights the effectiveness of its 4Ps marketing mix.

By carefully balancing competitive pricing with perceived value, Chevron aims to ensure sustained profitability. This delicate act allows the company to invest in its network and customer experience, further reinforcing its brand equity and competitive advantage in the retail fuel sector through 2025.

Chevron typically employs a premium pricing strategy for its specialized product lines, such as high-performance lubricants and coolants. This approach aligns with the superior quality, established brand trust, and cutting-edge technology that these offerings provide.

Customers, particularly in industrial and commercial sectors, are willing to pay a premium for products that deliver enhanced performance, greater efficiency, and extended equipment life. For instance, Chevron's Delo® heavy-duty engine oils are often priced higher due to their advanced additive technology designed to reduce wear and extend drain intervals, a key value proposition for fleet operators.

In 2024, the global industrial lubricants market, where Chevron is a significant player, was valued at approximately $180 billion, with specialized and high-performance segments commanding higher price points due to their critical role in operational efficiency and asset protection.

Geographical and Dynamic Pricing Models

Chevron utilizes geographical pricing, adjusting prices to align with local economic conditions, consumer purchasing power, and regulatory frameworks in different markets. This approach acknowledges that a one-size-fits-all pricing strategy is ineffective across its global operations.

Furthermore, Chevron employs dynamic pricing for its refined products, enabling rapid adjustments in response to real-time market shifts. This agility is crucial in the volatile energy sector, where factors like supply disruptions, demand surges, and geopolitical events can significantly impact commodity prices.

- Regional Price Variations: Chevron's pricing strategies reflect differences in fuel taxes, environmental regulations, and local market competition, which can lead to substantial price disparities between countries or even within regions of a single country. For instance, fuel prices in Western Europe often differ significantly from those in North America due to these factors.

- Dynamic Adjustment Factors: For refined products, dynamic pricing models consider variables such as crude oil futures prices, refinery operating costs, inventory levels, and competitor pricing. This allows Chevron to optimize margins by responding swiftly to market signals.

- Impact of Geopolitics: Geopolitical events, such as conflicts or trade disputes, can directly influence crude oil supply and, consequently, refined product prices. Chevron's dynamic pricing mechanisms are designed to absorb or capitalize on these fluctuations.

- Economic Sensitivity: The purchasing power of consumers and businesses in different geographical areas directly influences demand elasticity. Chevron's geographical pricing aims to capture optimal value in markets with higher disposable incomes while remaining competitive in price-sensitive regions.

Value-Based Pricing for Renewable Energy and Sustainability Premiums

As Chevron pivots towards renewable energy and sustainability, its pricing strategy will likely reflect the inherent value these solutions offer. This means moving beyond traditional cost-plus models to a value-based approach that captures the environmental benefits and potential long-term economic advantages for customers. For instance, by highlighting reduced carbon emissions and potential operational savings, Chevron can justify higher price points for its renewable energy offerings.

Chevron might implement sustainability premiums on products that demonstrably contribute to environmental conservation or meet stringent ESG criteria. This could translate into differentiated pricing for fuels with lower lifecycle emissions or for investments in carbon capture technologies. For example, the company's investments in renewable fuels, like sustainable aviation fuel (SAF), could command a premium reflecting their environmental performance, a trend already observed in the aviation sector where SAF prices can be significantly higher than conventional jet fuel.

- Value-Based Pricing: Focuses on the perceived benefits and value to the customer, not just production costs.

- Sustainability Premiums: Additional charges for products or services with superior environmental attributes.

- Market Trends (2024-2025): Growing demand for low-carbon solutions and increasing investor pressure for ESG performance are key drivers for this pricing approach.

- Example: Chevron's potential pricing for SAF could reflect its lower carbon footprint compared to traditional jet fuel, capturing a premium from environmentally conscious airlines.

Chevron's pricing strategy is multifaceted, adapting to global market dynamics, brand perception, and product specialization. The company leverages market-based pricing for commodities, premium pricing for specialized products, and geographical adjustments for diverse markets. This dynamic approach ensures competitiveness and profitability across its vast portfolio.

4P's Marketing Mix Analysis Data Sources

Our Chevron 4P's Marketing Mix Analysis is grounded in comprehensive data, including official financial reports, press releases, and detailed product information. We also leverage insights from industry analyses, competitive intelligence, and consumer behavior studies to provide a holistic view.