City Developments PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

City Developments Bundle

Unlock the hidden forces shaping City Developments's future with our comprehensive PESTLE analysis. From evolving political landscapes to crucial technological advancements, understand the external factors driving success or posing challenges. Equip yourself with actionable intelligence to refine your strategy and anticipate market shifts. Download the full PESTLE analysis now and gain the competitive edge you need.

Political factors

Government policies significantly shape Singapore's real estate landscape, directly impacting City Developments Limited (CDL). Measures such as the Additional Buyer's Stamp Duty (ABSD) and Loan-to-Value (LTV) limits, which were last adjusted in September 2022 with ABSD rates increasing by 5-15 percentage points, directly influence demand and affordability for residential properties, a core segment for CDL.

These regulatory levers can either stimulate or dampen sales and investment activity. For instance, the government's focus on housing affordability and market stability means that any shifts in these cooling measures, perhaps in response to inflation or economic growth projections for 2024-2025, will require CDL to remain agile in its strategic planning and project launches.

Geopolitical stability is a cornerstone for City Developments Limited (CDL) and its global real estate ventures. In 2024, ongoing geopolitical tensions, such as those in Eastern Europe and the Middle East, continue to create uncertainty, potentially impacting investor sentiment and cross-border capital flows. CDL's significant presence in markets like the UK and Australia means it's directly exposed to how these global dynamics influence international trade agreements and foreign direct investment in real estate.

Shifts in international trade policies, for instance, can disrupt construction material supply chains, a critical factor for CDL's development projects. The company's reliance on global sourcing for materials means that tariffs or trade disputes could increase costs and affect project timelines. CDL's ability to navigate these complex trade relations is vital for maintaining the profitability and viability of its overseas developments.

A stable political environment, particularly in its home market of Singapore, remains paramount for CDL's long-term strategic planning and investment decisions. Singapore's consistent political stability, reflected in its strong governance and predictable regulatory framework, underpins investor confidence. This stability is crucial for CDL to confidently commit to large-scale, long-term urban development projects and attract further investment into its Singaporean portfolio.

Government-led urban master plans, like Singapore's Urban Redevelopment Authority's (URA) long-term plans, directly shape development landscapes. For instance, the 2025 Master Plan emphasizes creating vibrant, sustainable, and inclusive communities, often earmarking areas for new residential and commercial projects. These plans are crucial for developers like City Developments Limited (CDL) as they identify future growth corridors and investment opportunities.

Major infrastructure projects significantly boost property values and attract investment. The ongoing expansion of Singapore's Mass Rapid Transit (MRT) network, with new lines such as the Cross Island Line (CRL) slated for completion in phases through 2030, enhances accessibility to previously less connected areas. This improved connectivity is a key driver for CDL's residential and commercial projects, increasing their appeal to a wider demographic and business base.

CDL's strategic alignment with national and regional development blueprints is paramount for sustained success. By integrating its development pipeline with government initiatives, such as the development of new economic hubs or the rejuvenation of existing districts, CDL can capitalize on government-supported growth. This proactive approach ensures that CDL's projects are well-positioned to benefit from enhanced infrastructure and evolving urban demand, as seen in the company's participation in mixed-use developments near key transport nodes.

Taxation Policies

Changes in corporate tax rates, property taxes, and capital gains taxes in jurisdictions where City Developments Limited (CDL) operates directly impact its profitability. For instance, a reduction in corporate tax rates, such as the adjustments seen in various Asian economies in late 2023 and early 2024, can boost CDL's net income. Conversely, an increase in property taxes in key markets like Singapore or the UK could elevate operational costs and reduce the attractiveness of new developments.

CDL must strategically navigate these fiscal policies. Favorable tax regimes, like those offering incentives for green building development, encourage investment and can enhance returns. For example, the Singapore government's enhanced Green Mark Incentive Scheme for Buildings, which continues to be a significant driver in 2024, can lower the effective tax burden on sustainable projects. Conversely, higher capital gains taxes could deter property disposals and impact investment strategies.

- Corporate Tax Impact: Fluctuations in corporate tax rates across CDL's operating regions, such as potential reforms in the UK or ongoing adjustments in Asian tax landscapes, directly influence net profit margins.

- Property Tax Considerations: Evolving property tax frameworks, including potential increases or adjustments to assessment methods in major markets like Singapore and the UK, affect CDL's holding costs and project viability.

- Capital Gains and Investment Returns: Changes in capital gains tax policies can alter the net proceeds from property sales, thereby influencing CDL's overall investment return calculations and capital allocation decisions.

Foreign Ownership Rules

Foreign ownership rules significantly shape City Developments Limited's (CDL) global real estate ventures. For instance, in Singapore, while foreign ownership is generally permitted for private properties, certain restrictions apply, such as higher stamp duties for non-residents, which can influence demand. As of early 2024, Singapore's Additional Buyer's Stamp Duty (ABSD) for foreigners stands at 60%, a substantial increase from previous years, directly impacting the affordability for international buyers.

These regulations directly affect CDL's ability to attract international capital for its developments. Countries worldwide implement diverse policies, from outright bans on foreign land ownership in some nations to more liberal approaches in others, creating a complex landscape for CDL's international sales and marketing strategies. CDL must meticulously adapt its approach to comply with varying legal frameworks, ensuring its global market reach is optimized while navigating these critical ownership regulations.

- Impact on Demand: Higher stamp duties for foreign buyers, like Singapore's 60% ABSD, can dampen demand for CDL's properties from international purchasers.

- Market Access: Varying national laws on foreign ownership dictate where and how CDL can effectively market and sell its real estate assets.

- Pricing Strategies: CDL must factor in the cost implications of foreign ownership restrictions when setting property prices in different international markets.

- Strategic Partnerships: Understanding and adapting to these rules may necessitate strategic partnerships with local entities in certain jurisdictions to facilitate foreign investment.

Government policies are a major force shaping City Developments Limited's (CDL) operations. Singapore's commitment to housing affordability, demonstrated by measures like the Additional Buyer's Stamp Duty (ABSD), directly influences CDL's residential sales. For instance, the ABSD rates, last adjusted in September 2022 with increases of 5-15 percentage points, continue to impact buyer sentiment in 2024-2025.

Geopolitical stability is crucial for CDL's global real estate investments. Ongoing international tensions in 2024 can affect investor confidence and capital flows, impacting CDL's ventures in markets like the UK and Australia. Trade policy shifts also pose risks to construction material supply chains, potentially increasing costs for CDL's development projects.

Stable political environments, like Singapore's, are vital for CDL's long-term planning. Predictable regulatory frameworks foster investor confidence, enabling CDL to undertake large-scale urban developments. Government urban master plans, such as Singapore's 2025 Master Plan, identify growth areas and opportunities for CDL.

Fiscal policies, including corporate and property taxes, directly affect CDL's profitability. For example, changes in corporate tax rates in Asia or property taxes in the UK can alter net profit margins and operational costs. CDL must also navigate capital gains tax policies, which influence investment return calculations and property disposal strategies.

What is included in the product

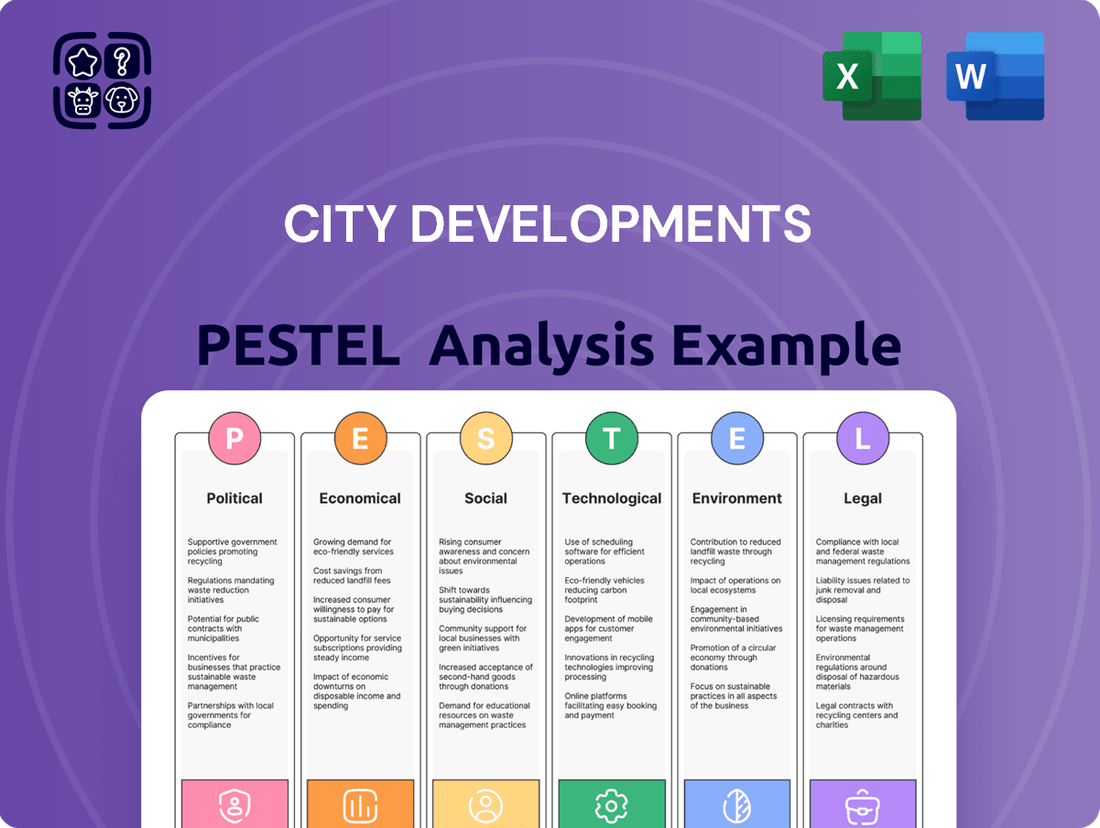

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors influencing City Developments, examining Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights to identify strategic threats and opportunities, supporting informed decision-making for stakeholders.

A PESTLE analysis for city developments provides a structured framework to identify and mitigate external risks, transforming potential challenges into actionable strategies for sustainable growth and enhanced market positioning.

Economic factors

Fluctuations in global and local interest rates significantly impact City Developments Limited's (CDL) borrowing costs for new developments and acquisitions, directly influencing capital expenditure and project viability. For instance, in early 2024, the US Federal Reserve maintained its benchmark interest rate, while the Monetary Authority of Singapore (MAS) continued its tightening monetary policy, leading to higher financing costs for CDL in its key markets.

Higher interest rates can also dampen property affordability for potential buyers, potentially leading to a slowdown in demand within the residential sector. This was evident in the Singapore residential market in late 2023 and early 2024, where rising mortgage rates contributed to a moderation in price growth.

CDL's financial strategy must therefore proactively account for interest rate volatility to effectively manage debt servicing expenses and ensure its property offerings remain competitively priced against market benchmarks.

Singapore's GDP is projected to grow between 1.0% and 3.0% in 2024, according to the Ministry of Trade and Industry. This moderate growth is expected to support demand for City Developments Limited's (CDL) diverse property portfolio, from residential to commercial spaces.

The United Kingdom, another key market for CDL, saw its GDP grow by 0.1% in the first quarter of 2024. While this indicates a slower pace, continued stability is crucial for the hospitality and commercial sectors where CDL has significant investments.

CDL's performance is closely tied to these macroeconomic trends; a robust economic outlook generally translates to increased property sales and rental income, bolstering the company's financial health.

Inflationary pressures are a significant concern for City Developments Limited (CDL). Rising costs for essential construction inputs like steel, lumber, and concrete, coupled with increased energy prices and wage demands, directly inflate project budgets. For instance, the Producer Price Index for construction materials saw a notable increase in late 2023 and early 2024, putting pressure on developers.

While inflation can theoretically boost property values, the immediate impact of escalating construction expenses can squeeze CDL's profit margins. If cost increases outpace the ability to pass them on to buyers or tenants, or if project timelines are extended due to material shortages exacerbated by inflation, profitability can be significantly eroded.

To navigate these challenges, CDL is focusing on proactive cost management. This includes strategic procurement of materials well in advance, exploring alternative suppliers, and optimizing labor utilization. Implementing efficient project management techniques and hedging against commodity price volatility are also crucial strategies to mitigate the adverse effects of persistent inflation on their development pipeline.

Consumer Spending and Disposable Income

Consumer spending and disposable income are crucial drivers for City Developments (CDL). In 2024, Singapore's GDP is projected to grow between 1% and 3%, indicating a generally stable economic environment that supports consumer confidence and spending. Higher disposable incomes directly fuel demand for CDL's residential properties, retail outlets, and hospitality ventures.

For instance, a rise in household disposable income, like the projected 2.5% increase in real terms for Singapore households in 2025, typically leads to increased property purchases and higher spending on leisure and travel. This benefits CDL by boosting sales, rental yields, and hotel occupancy rates.

- Consumer Spending Impact: Directly influences demand for residential, retail, and hospitality sectors.

- Disposable Income Correlation: Higher incomes boost purchasing power for homes and leisure.

- Economic Sensitivity: Downturns reduce spending, negatively affecting CDL's revenue streams.

- 2024/2025 Outlook: Stable economic growth projections in Singapore support continued consumer spending.

Currency Exchange Rates

For a multinational entity like City Developments Limited (CDL), currency exchange rate fluctuations significantly affect the value of its overseas assets, income streams, and ultimately, its profitability when converted back into Singapore Dollars (SGD). For instance, if the SGD strengthens against the Australian Dollar, CDL's earnings from its Australian properties would translate to fewer SGD, impacting reported profits. Conversely, a weaker SGD could boost the SGD value of foreign earnings.

CDL's financial performance is directly tied to its global operations. As of early 2024, CDL has substantial investments across various markets, including the UK, Australia, and China. The performance of the SGD against the British Pound (GBP) or the Australian Dollar (AUD) can therefore create substantial translation gains or losses. For example, a 5% appreciation of the SGD against the AUD could effectively reduce the SGD value of Australian rental income by that same margin, assuming all other factors remain constant.

To manage these inherent risks, CDL actively employs currency hedging strategies. These can include forward contracts, options, and other derivative instruments designed to lock in exchange rates for future transactions or to protect the value of foreign currency-denominated assets. This proactive approach is crucial for maintaining financial stability and predictability in its international earnings, especially given the volatility observed in global currency markets throughout 2023 and into 2024, with the SGD experiencing fluctuations against major trading currencies.

- Impact on Overseas Investments: A stronger SGD can devalue foreign assets when translated into the home currency, potentially affecting CDL's balance sheet.

- Revenue and Profit Translation: Fluctuations directly alter the SGD value of revenues earned and profits realized in foreign markets.

- Hedging Strategies: CDL utilizes financial instruments to mitigate the risk of adverse currency movements on its international earnings.

- Market Volatility: Recent currency market trends in 2023-2024 highlight the importance of robust currency risk management for global real estate firms.

Economic growth directly fuels demand for City Developments Limited's (CDL) diverse property portfolio. Singapore's projected GDP growth of 1.0% to 3.0% for 2024 provides a stable backdrop for residential and commercial sales. Similarly, the UK's modest 0.1% GDP growth in Q1 2024 underscores the need for continued stability in CDL's hospitality and commercial investments.

Interest rate environments significantly influence CDL's financing costs and buyer affordability. The MAS's tightening policy in early 2024 increased borrowing expenses, while higher mortgage rates in Singapore tempered residential demand in late 2023 and early 2024.

Inflationary pressures, seen in rising construction material costs in late 2023 and early 2024, directly impact CDL's project budgets and profit margins. Proactive cost management, strategic procurement, and hedging are key to navigating these challenges.

Consumer spending, supported by Singapore's stable economic outlook and projected household income growth for 2025, is vital for CDL's revenue streams across residential, retail, and hospitality sectors.

Currency fluctuations, particularly between the SGD and currencies like the AUD and GBP, materially affect CDL's overseas asset values and reported earnings, necessitating robust hedging strategies as observed in 2023-2024 market volatility.

What You See Is What You Get

City Developments PESTLE Analysis

The preview shown here is the exact City Developments PESTLE Analysis you’ll receive after purchase—fully formatted and ready to use. This comprehensive document delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting city development. It provides actionable insights for strategic planning and decision-making.

Sociological factors

Global urbanization continues at a rapid pace, with projections indicating that 68% of the world's population will live in urban areas by 2050, up from 57% in 2021. This sustained trend directly fuels demand for housing and commercial spaces in cities where developers like CDL operate, creating a consistent market for their projects.

Population growth, a key driver of urbanization, is also significant. For instance, the United Nations projects the global population to reach 9.7 billion by 2050. This expanding demographic base translates into a larger pool of potential buyers and tenants for CDL's residential and commercial offerings, as well as increased patronage for its hospitality ventures.

CDL's strategic planning must therefore remain closely attuned to these demographic shifts. Aligning its development pipeline with the evolving needs and locations of growing urban populations is crucial for capitalizing on these opportunities and ensuring long-term success in the property market.

City developments are increasingly shaped by evolving lifestyle preferences. There's a growing demand for integrated live-work-play environments, with a significant portion of the urban population seeking convenience and community within their residential areas. This trend is evident in the rise of co-living spaces and smart home technologies, which appeal to a younger, tech-savvy demographic.

City Developments Limited (CDL) must adapt its property designs to meet these modern demands. Incorporating flexible workspaces and wellness-oriented facilities is crucial. For instance, a 2024 survey indicated that over 60% of millennials prioritize access to amenities like gyms and communal areas when choosing a place to live, directly influencing CDL's development strategies to attract and retain this key demographic.

Demographic shifts, particularly the aging population seen in many developed nations, are reshaping urban development needs. For instance, Singapore's population is aging rapidly, with the proportion of residents aged 65 and above projected to reach 25% by 2030, up from 15.2% in 2022. This trend fuels demand for specialized housing, enhanced healthcare infrastructure, and universally accessible public amenities.

City Developments Limited (CDL) can strategically capitalize on these demographic changes by focusing on developing properties that cater to the senior demographic. This includes exploring opportunities in assisted living communities or designing multi-generational housing solutions that accommodate the evolving family structures and care needs of an older populace. Staying attuned to these demographic currents is crucial for CDL's sustained market presence and future growth.

Social Attitudes Towards Sustainability

There's a noticeable shift in how people view buildings, with a strong and growing demand for sustainability. Consumers and investors alike are actively seeking out properties that are environmentally friendly and promote healthy living. This isn't just a trend; it's a fundamental change in what's valued in real estate.

This growing consciousness directly impacts purchasing decisions. Buyers are increasingly factoring in green features, energy efficiency ratings, and the overall health of the living environment when choosing where to invest their money. For instance, a 2024 survey indicated that over 70% of potential homebuyers consider energy efficiency a key factor in their decision-making process.

City Developments Limited (CDL) is well-positioned to capitalize on this trend. Their established commitment to obtaining green building certifications, such as those from the Building and Construction Authority (BCA) in Singapore, and their ongoing sustainable development practices significantly boost their brand image and market appeal. CDL's portfolio includes numerous award-winning green buildings, reinforcing their reputation as a leader in sustainable urban development.

- Growing Consumer Demand: Over 70% of homebuyers in 2024 cited energy efficiency as a crucial factor.

- Investor Preferences: Sustainable investments are attracting significant capital, with ESG-focused funds seeing substantial inflows.

- CDL's Green Credentials: CDL has achieved Green Mark Platinum certification for a significant portion of its Singapore portfolio.

- Brand Enhancement: Sustainable practices directly contribute to CDL's marketability and competitive advantage.

Work-Life Balance and Hybrid Work Models

The societal shift towards prioritizing work-life balance is significantly impacting property markets. Hybrid work models, which became widespread during and after the COVID-19 pandemic, are a key driver of this change. For instance, a late 2023 survey indicated that over 60% of workers globally prefer a hybrid arrangement, influencing where and how they choose to live and work.

This evolving preference directly affects demand for commercial real estate. Traditional large office spaces might see reduced occupancy as companies adopt more flexible layouts and smaller footprints. Conversely, there's a growing demand for co-working spaces and adaptable business hubs that cater to this new work paradigm. City Developments (CDL) needs to consider this in its commercial portfolio to remain competitive.

Residential property demand is also being reshaped. The necessity of home offices means buyers are seeking larger living spaces with dedicated work areas. This trend is evident in rising sales of properties with extra rooms or flexible layouts. CDL's residential development strategy must adapt to incorporate these evolving living requirements to capture market share.

- Work-Life Balance Emphasis: A 2024 report by Mercer found that 70% of employees globally now expect flexible work options, a significant increase from pre-pandemic levels.

- Hybrid Work Prevalence: As of early 2025, approximately 45% of companies in major global cities offer hybrid work arrangements, impacting office space utilization rates.

- Residential Space Needs: Studies in 2024 showed a 15% increase in demand for three-bedroom or larger homes in suburban areas, often attributed to the need for home office space.

- Commercial Real Estate Adaptation: Flexible workspace providers reported a 25% year-over-year growth in membership in 2024, indicating a strong market shift.

Societal values are increasingly emphasizing health and well-being, driving demand for developments that promote active lifestyles and provide access to green spaces. This is evident in the growing popularity of urban parks and fitness amenities within residential complexes. City Developments Limited (CDL) can leverage this by incorporating more wellness features and accessible recreational areas into its projects.

Technological factors

The increasing adoption of Property Technology (PropTech) is a significant technological factor. Smart building solutions, including IoT sensors and advanced data analytics, are revolutionizing operational efficiency and tenant satisfaction. For instance, by 2024, the global smart building market was projected to reach over $100 billion, highlighting a substantial shift towards tech-enabled properties.

City Developments Limited (CDL) can capitalize on these advancements. Leveraging technologies like predictive maintenance can reduce operational costs by an estimated 15-20%, while energy optimization through smart systems can lead to significant savings, potentially cutting energy bills by up to 30% in commercial and residential buildings.

Furthermore, integrating these solutions allows CDL to enhance the tenant experience, offering personalized services in hotels and smart home features in residential developments. This technological integration provides a distinct competitive advantage in the evolving real estate landscape.

City Developments Limited (CDL) is leveraging advancements like Prefabricated Prefinished Volumetric Construction (PPVC), robotics, and Building Information Modeling (BIM) to boost efficiency. These technologies are crucial for improving construction speed, quality, and safety, with the potential to lower overall project expenses.

By integrating these innovative methods, CDL can expedite project delivery and promote sustainability. For instance, PPVC, a key component of Singapore's construction strategy, saw its adoption increase significantly, with projects utilizing it accounting for a growing percentage of new residential developments in recent years, helping to address labor constraints.

City Developments Limited (CDL) is increasingly leveraging data analytics and artificial intelligence (AI) to sharpen its competitive edge. By analyzing vast datasets, CDL can uncover nuanced market trends and understand customer desires more profoundly, impacting everything from product development to sales strategies. For instance, in 2024, CDL reported increased efficiency in its leasing operations, partly attributed to AI-driven tenant matching and predictive occupancy modeling, which helped reduce vacancy periods.

Digital Sales and Marketing Platforms

The real estate industry is increasingly leveraging digital sales and marketing platforms, with virtual tours and online booking systems becoming standard. This shift, amplified by technologies like VR and AR, allows companies like City Developments (CDL) to connect with a global customer base more effectively. For instance, in 2024, the global virtual reality market was projected to reach over $22 billion, indicating significant adoption in sectors like property. This digital transformation reduces reliance on physical sales galleries, thereby lowering operational costs and expanding CDL's market reach significantly.

CDL can capitalize on these technological advancements by implementing:

- Immersive Virtual Tours: Offering 3D walkthroughs of properties, accessible from anywhere in the world, enhancing buyer engagement.

- Streamlined Online Transactions: Facilitating secure online booking and payment systems for greater convenience, particularly for international investors.

- Targeted Digital Marketing: Utilizing data analytics to reach specific demographics and geographic locations with tailored advertising campaigns.

- Augmented Reality Showrooms: Allowing potential buyers to visualize furniture placement or property modifications in their own space, boosting pre-sales interest.

Cybersecurity and Data Privacy

City Developments Limited's (CDL) increasing reliance on digital platforms for operations, sales, and customer data management makes robust cybersecurity measures absolutely critical. This is to safeguard sensitive information and maintain customer trust, especially as cyber threats continue to evolve. For instance, the global cost of cybercrime is projected to reach $10.5 trillion annually by 2025, highlighting the significant financial risk involved.

Compliance with data privacy regulations, such as Singapore's Personal Data Protection Act (PDPA) and the European Union's General Data Protection Regulation (GDPR), is essential for CDL. Failure to comply can result in substantial legal penalties and severe reputational damage. In 2023, GDPR fines alone exceeded €1.5 billion across various sectors, underscoring the financial implications of non-compliance.

Investing in strong cybersecurity infrastructure is paramount for CDL's business continuity. A significant data breach could disrupt operations, halt sales, and erode stakeholder confidence. Companies that experience major breaches often face prolonged recovery periods and significant financial losses, making proactive investment a necessity rather than an option.

- Cybersecurity Investment: CDL must allocate resources to advanced threat detection, prevention, and response systems.

- Data Privacy Compliance: Adherence to PDPA, GDPR, and other relevant regulations is non-negotiable to avoid fines and reputational harm.

- Business Continuity: Robust cybersecurity is key to ensuring uninterrupted operations and maintaining customer trust in the face of digital threats.

- Talent Acquisition: Investing in skilled cybersecurity professionals is crucial to manage and mitigate evolving risks effectively.

Technological advancements are reshaping the real estate sector, with City Developments Limited (CDL) actively integrating innovations like PropTech and AI. The global smart building market, projected to exceed $100 billion by 2024, underscores the move towards tech-enabled properties, offering CDL opportunities for operational efficiency and enhanced tenant experiences. By embracing technologies such as PPVC and BIM, CDL can accelerate construction, improve quality, and manage costs more effectively, aligning with Singapore's construction strategies that favor such advancements.

CDL's strategic use of data analytics and AI is crucial for identifying market trends and customer preferences, as seen in their 2024 leasing operations where AI-driven tools improved tenant matching and reduced vacancy periods. Furthermore, the real estate industry's digital shift, including virtual tours and online transactions, expands CDL's global reach, with the VR market alone expected to surpass $22 billion in 2024. However, this digital reliance necessitates robust cybersecurity, especially given the projected $10.5 trillion annual cost of cybercrime by 2025, and strict adherence to data privacy regulations like GDPR and PDPA.

| Technology Area | Impact on CDL | Key Data/Projections |

|---|---|---|

| PropTech & Smart Buildings | Enhanced operational efficiency, improved tenant satisfaction, cost savings (e.g., 15-30% on energy) | Global smart building market > $100 billion (2024 projection) |

| AI & Data Analytics | Sharper competitive edge, deeper market insights, improved sales and leasing efficiency | Increased efficiency in leasing operations (2024) |

| Digital Sales & Marketing (VR/AR) | Expanded global reach, reduced reliance on physical sales galleries | Global VR market > $22 billion (2024 projection) |

| Construction Technologies (PPVC, BIM) | Increased construction speed, improved quality, potential cost reduction | Growing adoption in Singapore residential developments |

| Cybersecurity & Data Privacy | Safeguarding sensitive data, maintaining customer trust, avoiding legal penalties | Global cybercrime cost: $10.5 trillion annually by 2025; GDPR fines > €1.5 billion (2023) |

Legal factors

City Developments Limited (CDL) navigates a complex landscape of building and construction regulations across its global operations. These rules dictate everything from the foundational strength of a building to the fire safety measures and the very materials used, ensuring public safety and structural integrity. For instance, in Singapore, the Building and Construction Authority (BCA) sets rigorous standards, with new building projects needing to comply with the Building Control Act and its associated regulations, which are regularly updated to incorporate advancements in construction technology and safety protocols.

Failure to meet these stringent building codes, safety standards, and construction regulations can have severe repercussions for CDL. Project delays due to non-compliance can significantly impact timelines and budgets, while substantial fines can erode profitability. More critically, any breach can lead to severe reputational damage, affecting investor confidence and future development opportunities. CDL's commitment to adhering to these requirements, such as those mandated by the Health and Safety Executive (HSE) in the UK for its projects, is therefore paramount to its sustained success and operational continuity.

Land use and zoning laws are critical for city developments, dictating where and what can be built. These regulations directly influence CDL's capacity to secure land and execute its development plans, setting limits on density and building heights. For instance, in Singapore, the Urban Redevelopment Authority (URA) manages land use planning, with zoning maps updated periodically to reflect evolving urban needs and development strategies. Navigating these legal frameworks is paramount for successful project execution.

Environmental protection legislation is becoming more stringent, pushing companies like City Developments Limited (CDL) towards sustainable construction, better waste management, and reduced emissions. This means CDL needs to adhere to green building standards, conduct thorough environmental impact assessments, and meet regulations for energy and water efficiency, all of which can affect project timelines and budgets.

Tenant and Landlord Laws

Tenant and landlord laws are critical for City Developments Limited (CDL) across its diverse property portfolio. Regulations concerning lease agreements, rent control measures, and eviction processes directly influence rental income stability and operational costs. For instance, in Singapore, where CDL has a significant presence, rental income is subject to market fluctuations but generally benefits from a robust legal framework protecting property owners. However, evolving legislation, such as potential future rent stabilization policies in certain international markets CDL operates in, could impact revenue streams.

Compliance with these varying legal frameworks is paramount to avoid costly disputes and maintain positive tenant relationships. CDL must navigate a complex web of rules governing maintenance responsibilities, security deposit handling, and tenant rights in each jurisdiction. For example, in the UK, the Tenant Fees Act 2019 significantly altered what landlords can charge, impacting revenue models for residential properties. Adherence to these regulations ensures smooth property management and mitigates legal risks.

The impact of these laws is substantial, affecting CDL's ability to set rental rates, manage vacancies, and conduct timely evictions if necessary. Jurisdictions with stricter tenant protections might require longer notice periods for evictions or impose limitations on rent increases, directly influencing CDL's financial performance. Staying abreast of these legal shifts is essential for strategic planning.

- Lease Agreement Variations: CDL must adapt lease terms to comply with local regulations, affecting rental income predictability.

- Rental Cap Impact: Jurisdictions with rent control or stabilization policies can limit CDL's revenue growth potential.

- Eviction Procedure Compliance: Strict eviction laws necessitate careful adherence to legal processes, potentially delaying property turnover and income generation.

- Maintenance Responsibilities: Legal mandates for property upkeep impact CDL's operational expenses and tenant satisfaction.

Foreign Investment and Corporate Governance Laws

City Developments Limited (CDL), as a multinational entity, navigates a complex web of foreign investment laws, corporate governance standards, and anti-money laundering (AML) regulations across its global operations. These legal frameworks directly influence CDL's ability to acquire assets, establish foreign subsidiaries, and manage its financial transactions. For instance, in 2024, Singapore's Securities and Futures Act continues to mandate robust corporate governance practices, impacting CDL's board structure and disclosure requirements.

Adherence to these diverse international legal stipulations is paramount for CDL to maintain its operational licenses and secure the trust of its investors worldwide. Failure to comply can result in significant penalties and reputational damage. CDL's commitment to these regulations is demonstrated through its active participation in compliance programs and its regular reporting to regulatory bodies in key markets.

- Foreign Investment Restrictions: CDL must comply with varying foreign ownership limits and approval processes when acquiring property or businesses in countries like China and the UK, impacting its expansion strategies.

- Corporate Governance Standards: Adherence to principles like those outlined in the UK Corporate Governance Code influences CDL's board independence, executive remuneration, and shareholder rights.

- AML and KYC Compliance: CDL implements Know Your Customer (KYC) procedures and transaction monitoring to prevent financial crime, aligning with global standards like those set by the Financial Action Task Force (FATF).

City Developments Limited (CDL) operates within a framework of evolving legal requirements concerning property development, construction, and land use. In 2024, Singapore's Building and Construction Authority (BCA) continues to enforce strict building codes, with updates to the Building Control Act influencing energy efficiency standards for new projects. Similarly, in the UK, the Building Regulations 2010, including recent amendments focusing on fire safety, directly impact CDL's construction practices and material choices.

Compliance with environmental protection legislation is increasingly critical for CDL, with a growing emphasis on sustainability in 2024. This includes adherence to green building certifications like Singapore's Green Mark scheme and the UK's BREEAM standards, which influence material sourcing, waste management, and energy performance. Failure to meet these standards can affect project approvals and marketability.

Tenant and landlord laws significantly shape CDL's rental income and property management strategies. For instance, in 2024, jurisdictions like Australia are seeing ongoing reviews of rental tenancy laws, potentially impacting lease terms and eviction processes. CDL must remain agile in adapting its lease agreements and operational procedures to comply with these varying national and regional regulations, ensuring fair practices and mitigating legal risks.

Environmental factors

Climate change presents significant physical risks to City Developments Limited (CDL). Rising sea levels and more frequent extreme weather events like floods and heatwaves directly threaten CDL's properties and development sites, impacting their value and operational continuity. For instance, a 2024 report indicated that coastal cities, where many developments are located, face increasing costs from storm surges and flooding.

To counter these threats, CDL is integrating climate resilience into its operations. This involves incorporating flood mitigation strategies, such as elevated building designs and advanced drainage systems, and utilizing heat-resistant materials in new constructions. These measures are crucial for safeguarding assets and ensuring long-term viability in a changing climate.

The push for sustainability is reshaping the property sector, with a significant increase in demand for green buildings. This trend is fueled by stricter environmental regulations and a growing awareness among consumers and investors about ESG (Environmental, Social, and Governance) principles. For instance, in 2024, the global green building market was valued at approximately $1.2 trillion and is projected to reach over $2.5 trillion by 2030, highlighting a robust growth trajectory.

City Developments Limited (CDL) actively pursues green building certifications like BCA Green Mark and LEED for its projects. This strategy not only boosts market appeal but also translates into tangible operational savings through enhanced energy efficiency. CDL's commitment to these standards, evidenced by their portfolio of certified green buildings, directly supports their alignment with international ESG objectives and strengthens their corporate reputation.

The increasing scarcity of vital natural resources like water and energy, coupled with rising waste disposal expenses, directly impacts City Developments Limited (CDL). For instance, global freshwater stress is intensifying, with projections indicating that by 2040, over 5 billion people could experience water scarcity. This necessitates CDL to prioritize efficient resource management in its building projects and daily operations.

CDL's commitment to sustainability is evident in its strategies for water conservation and energy efficiency. In 2023, CDL achieved a 15.5% reduction in energy intensity and a 10.8% reduction in water intensity across its global portfolio compared to its 2019 baseline. These efforts not only curb operational expenditures but also significantly lessen the company's environmental impact, a vital component for long-term viability.

Biodiversity and Land Conservation

City Developments Limited (CDL) must carefully manage the environmental impact of its projects on local biodiversity and natural habitats. Large-scale developments, in particular, necessitate a strong focus on biodiversity conservation during land acquisition and planning phases. This commitment is crucial for maintaining ecological balance and aligning with broader global conservation goals.

Adhering to stringent environmental impact assessments and adopting responsible land use practices are key to minimizing ecological disruption. For instance, CDL's commitment to green building standards, such as those recognized by the Building and Construction Authority (BCA) Green Mark scheme in Singapore, often includes requirements for preserving existing green spaces and integrating biodiversity-friendly landscaping. In 2023, CDL reported that over 90% of its new developments achieved the highest Green Mark Platinum certification, underscoring their dedication to sustainable practices.

- Biodiversity Impact: Development activities can fragment habitats, displace wildlife, and reduce native plant species.

- CDL's Approach: CDL integrates biodiversity considerations into its land acquisition and development strategies, especially for significant projects.

- Regulatory Compliance: Meeting environmental impact assessment standards and implementing responsible land use are vital for ecological preservation.

- Global Alignment: These efforts support global conservation objectives and promote long-term ecosystem health.

Pollution and Emissions Control

City Developments Limited (CDL) faces stringent regulations concerning air, water, and noise pollution originating from both its construction projects and the ongoing operations of its completed buildings. To comply, CDL must actively implement robust pollution control measures, ensuring adherence to national and international environmental standards.

A significant environmental factor for CDL is the imperative to reduce greenhouse gas emissions. This aligns with Singapore's ambitious target of achieving net-zero emissions by 2050, a goal that necessitates a focus on energy efficiency and lower-carbon operational practices across CDL's portfolio.

- Regulatory Compliance: CDL must adhere to Singapore's Environmental Protection and Management Act, which sets limits for various pollutants from construction sites and operational buildings.

- Carbon Footprint Reduction: CDL's commitment to sustainability includes reducing the carbon intensity of its developments, contributing to national climate goals.

- Investment in Green Tech: CDL's strategy involves investing in cleaner construction technologies and sustainable building materials, such as low-VOC paints and recycled content, to minimize environmental impact.

- Energy Efficiency Targets: CDL aims to improve the energy efficiency of its buildings, with a goal of achieving higher Green Mark certifications for its properties, reflecting a commitment to reducing operational emissions.

Environmental factors significantly influence City Developments Limited (CDL), particularly concerning climate change and resource scarcity. CDL must navigate physical risks from extreme weather events and increasing demand for green buildings, as evidenced by the global green building market's projected growth to over $2.5 trillion by 2030. Furthermore, the company is actively managing water and energy efficiency, having achieved notable intensity reductions in 2023, and is committed to minimizing its impact on biodiversity.

| Environmental Factor | Impact on CDL | CDL's Response/Data (2023/2024 Projections) |

|---|---|---|

| Climate Change & Extreme Weather | Physical risks to properties, increased operational costs | Integrating climate resilience, flood mitigation, heat-resistant materials. Coastal cities face rising storm surge costs (2024 report). |

| Demand for Green Buildings | Market opportunity, investor preference | Pursuing BCA Green Mark & LEED certifications. Global green building market valued at ~$1.2 trillion (2024), projected to exceed $2.5 trillion by 2030. |

| Resource Scarcity (Water & Energy) | Increased operational expenses, regulatory pressure | Prioritizing efficient resource management. Achieved 15.5% energy intensity and 10.8% water intensity reduction (vs. 2019 baseline) in 2023. |

| Biodiversity & Habitat Impact | Reputational risk, regulatory compliance | Integrating biodiversity into land acquisition. Over 90% of new developments achieved Green Mark Platinum in 2023. |

| Pollution & Emissions | Regulatory compliance, carbon footprint reduction | Implementing pollution control. Singapore's net-zero target by 2050 drives focus on energy efficiency and lower-carbon practices. |

PESTLE Analysis Data Sources

Our City Developments PESTLE Analysis is built on a robust foundation of data from municipal planning documents, economic development reports, census bureaus, and environmental impact assessments. We also incorporate insights from local business surveys and urban planning journals to capture a comprehensive view.