City Developments Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

City Developments Bundle

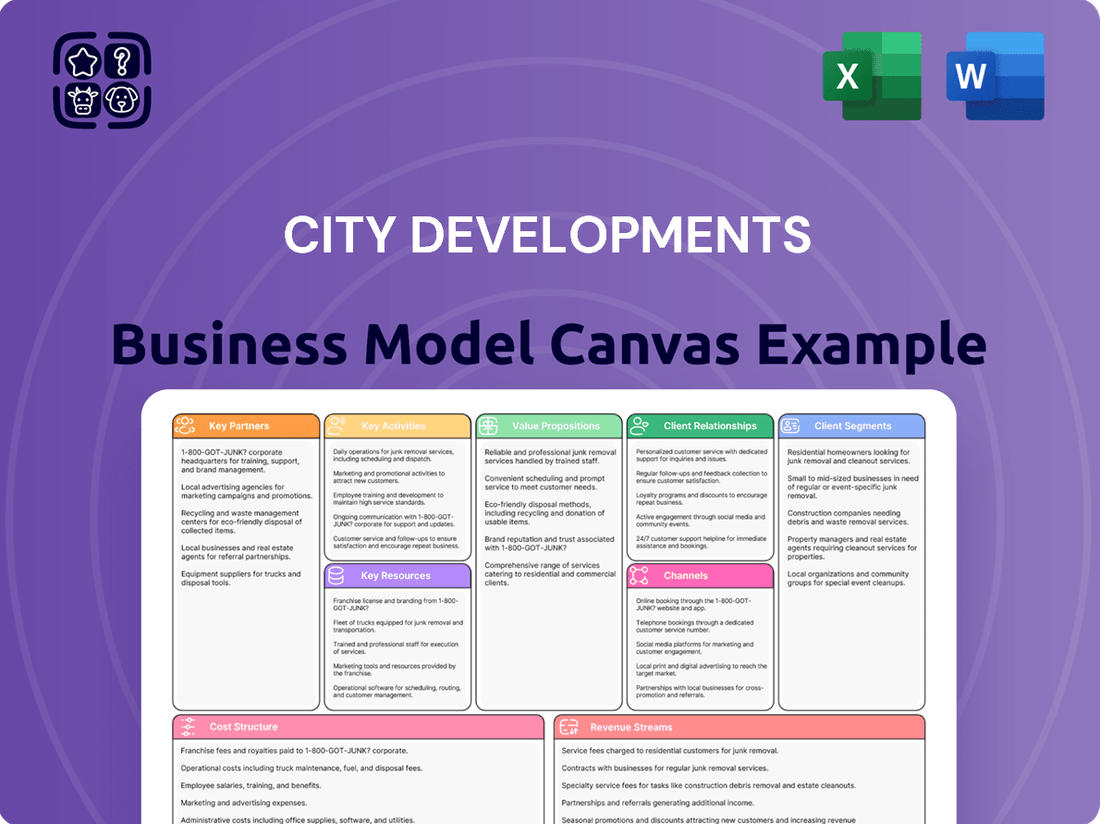

Unlock the complete strategic blueprint of City Developments's business model. This comprehensive Business Model Canvas offers a detailed look at their customer relationships, revenue streams, and key resources, providing invaluable insights for anyone looking to understand their success.

Partnerships

City Developments Limited (CDL) actively pursues joint ventures with other developers and investment firms to share capital, expertise, and risk across various projects. This collaborative approach allows CDL to leverage external resources and mitigate financial exposure on large-scale developments. For example, CDL partnered with Frasers Property and Sekisui House for The Orie, and with Mitsui Fudosan for the Zion Road GLS site, demonstrating a strategic use of partnerships to achieve project goals.

City Developments Limited (CDL) actively cultivates relationships with banks and financial institutions to ensure robust access to capital for its extensive development projects and strategic acquisitions. These partnerships are fundamental for securing essential financing, loans, and credit facilities, enabling CDL to undertake large-scale ventures.

A testament to CDL's commitment to sustainability and financial innovation, the company secured Singapore's inaugural net zero-aligned loan. This significant financial instrument, a 1.5°C sustainability-linked loan from OCBC Bank, underscores the crucial role financial partners play in supporting environmentally conscious growth strategies.

City Developments Limited (CDL) relies heavily on collaborations with established construction companies and contractors to ensure the successful delivery of its diverse real estate projects. These partnerships are crucial for translating architectural visions into tangible structures, maintaining high standards of quality, and adhering to project timelines.

In 2024, CDL continued to leverage its network of trusted construction partners, who are instrumental in managing the complexities inherent in large-scale urban developments. For instance, the successful completion of projects like the redevelopment of the former Fuji Xerox Towers into a mixed-use development in Singapore, expected to be completed by 2025, underscores the importance of these collaborations.

Government Agencies and Urban Planners

Collaborating with government agencies and urban planners is crucial for City Developments Limited (CDL) to navigate the complexities of urban development. This partnership facilitates land acquisition, securing essential permits, and aligning projects with broader urban planning strategies. For instance, CDL's involvement with Singapore's Urban Redevelopment Authority (URA) highlights this synergy.

CDL's ability to secure prime locations and gain regulatory approvals is significantly bolstered by these relationships. The URA's Strategic Development Incentive Scheme, which CDL's Union Square project leveraged, demonstrates how government initiatives can directly support and enhance large-scale urban projects. Such collaborations ensure that CDL's developments contribute positively to the city's long-term vision.

- Land Acquisition and Approvals: Essential for securing development sites and obtaining necessary permits, streamlining the project lifecycle.

- Alignment with Urban Planning: Ensures projects fit within the city's strategic development goals, fostering sustainable urban growth.

- Access to Incentives: Partnerships can unlock government schemes, like Singapore's Strategic Development Incentive Scheme, providing financial and regulatory advantages.

- Facilitating Large-Scale Projects: Government cooperation is key to the successful execution of major urban regeneration and development initiatives.

Hospitality Management Partners

City Developments Limited (CDL) leverages strategic alliances within the hospitality sector to bolster its market presence and service offerings. Beyond its core ownership of Millennium & Copthorne Hotels, CDL actively seeks collaborations with other prominent hospitality entities. These partnerships are designed to broaden its international footprint and elevate the overall guest experience through shared resources and expertise.

A prime example of this strategy in action is Millennium Hotels and Resorts’ recent collaboration with a German hospitality group. This alliance is focused on developing a unified global loyalty program, aiming to attract and retain a wider customer base by offering integrated benefits across multiple brands. Such partnerships are crucial for navigating the competitive landscape and enhancing brand value.

These collaborations can manifest in various forms, including:

- Joint Venture Hotel Developments: Partnering with other developers or hotel operators for new property constructions, sharing risks and capital outlay.

- Co-Branded Loyalty Programs: Integrating loyalty schemes to offer reciprocal benefits, thereby increasing customer engagement and retention across partner brands.

- Management Agreements with Third-Party Brands: CDL might manage properties for other hotel brands, leveraging its operational expertise and extending its management portfolio.

- Strategic Alliances for Market Entry: Collaborating with local partners in new geographical regions to navigate regulatory environments and tap into established customer networks.

City Developments Limited (CDL) actively engages with other property developers and investment firms through joint ventures. This approach allows CDL to share capital, expertise, and risk, particularly on large-scale projects. CDL has also partnered with financial institutions, securing vital financing and credit facilities, such as a 1.5°C sustainability-linked loan from OCBC Bank in 2024, demonstrating a commitment to sustainable growth supported by strong financial partnerships.

What is included in the product

A structured framework detailing key aspects of a city development project, from customer segments and value propositions to revenue streams and cost structures.

It provides a holistic view of how a city development initiative creates, delivers, and captures value, serving as a strategic tool for planning and execution.

The City Developments Business Model Canvas effectively addresses the pain point of fragmented urban planning by providing a structured, visual framework to align stakeholders and resources towards common development goals.

Activities

City Developments Limited (CDL) actively engages in real estate development, encompassing the full spectrum from acquiring land and envisioning projects to designing, constructing, and ultimately selling or leasing the completed properties. This core activity leverages CDL's extensive experience.

With a history spanning over six decades, CDL has established a robust track record in property development. This includes the successful completion of more than 53,000 homes across various international markets, demonstrating significant global reach and expertise in delivering diverse residential projects.

City Developments Limited (CDL) actively engages in acquiring and managing a wide array of income-producing properties. This includes residential, commercial, and hospitality assets strategically chosen to bolster consistent revenue generation.

As of early 2024, CDL's global living sector portfolio boasts a significant gross development value of $2.6 billion. This substantial figure encompasses both residential properties designated for lease and student accommodation units, underscoring CDL's commitment to diversifying its income base.

City Developments Limited (CDL), through its subsidiary Millennium & Copthorne Hotels (M&C), actively manages and operates a vast global portfolio of hotels and serviced apartments. This core activity is crucial for generating revenue and enhancing the value of CDL's real estate assets.

As of early 2024, M&C oversees a network of over 160 hotels strategically located across the globe. Many of these properties are situated in prime gateway cities, ensuring high occupancy rates and strong brand visibility.

The operational management encompasses everything from guest services and property maintenance to revenue management and marketing. This hands-on approach allows CDL to maintain high standards and adapt to evolving market demands in the hospitality sector.

Capital Recycling and Divestment

Capital recycling and divestment are crucial for City Developments Limited (CDL) to maintain a healthy financial position and fuel future growth. This involves strategically selling off properties or business units that no longer align with their long-term vision or have reached their optimal value.

By doing so, CDL can unlock capital, reduce debt, and improve its gearing ratio, which is a key financial metric. This proactive approach ensures they have the necessary liquidity to pursue new investment opportunities and adapt to market dynamics. For fiscal year 2025, CDL has set an ambitious target to divest assets totaling at least $600 million, demonstrating a clear commitment to portfolio optimization and financial prudence.

- Strategic Asset Sales: CDL actively identifies and divests non-core or mature assets to enhance portfolio efficiency and generate cash.

- Financial Health Management: Divestments are a primary tool for managing the company's gearing ratio, aiming to keep it within prudent levels.

- FY2025 Divestment Target: The company plans to divest a minimum of $600 million in assets during fiscal year 2025.

- Value Unlocking: This process allows CDL to realize the embedded value in its assets and redeploy capital into higher-growth areas.

Sustainability and ESG Integration

City Developments Limited (CDL) actively integrates Environmental, Social, and Governance (ESG) principles across its entire business. This involves embedding sustainability into every facet, from the initial design of green buildings to fostering strong community relationships and ensuring responsible use of resources.

CDL's commitment to sustainability is globally recognized. Notably, it was the first company in Singapore to publish disclosures aligned with the Taskforce on Nature-related Financial Disclosures (TNFD). This proactive approach demonstrates a deep-seated commitment to managing and reporting on nature-related risks and opportunities.

- Green Building Design: CDL prioritizes eco-friendly construction, aiming for high green building certifications for its properties.

- Community Engagement: The company invests in social initiatives and community development programs to foster positive impact.

- Responsible Resource Management: CDL implements strategies for efficient water and energy usage, alongside waste reduction in its operations.

- TNFD Alignment: CDL's early adoption of TNFD disclosures sets a benchmark for transparent reporting on nature-related impacts.

City Developments Limited (CDL) focuses on developing, investing in, and managing a diverse portfolio of real estate. This includes residential, commercial, and hospitality sectors, with a strong emphasis on creating sustainable and high-value properties. Their strategy involves actively managing their assets to generate consistent income and capital appreciation.

CDL's key activities revolve around property development, from land acquisition to sales, and the strategic management of income-producing assets. They also operate a significant global hotel portfolio through Millennium & Copthorne Hotels (M&C). Furthermore, CDL actively engages in capital recycling through asset divestments to optimize its portfolio and financial health.

The company's commitment to Environmental, Social, and Governance (ESG) principles is integrated into all operations, from green building design to community engagement and responsible resource management. CDL's proactive approach to sustainability is highlighted by its early adoption of frameworks like the Taskforce on Nature-related Financial Disclosures (TNFD).

| Activity | Description | Key Data/Metrics (Early 2024) |

|---|---|---|

| Property Development | Acquisition, design, construction, and sale/lease of properties. | Over 53,000 homes completed globally. |

| Investment & Asset Management | Acquiring and managing income-producing properties. | Global living sector portfolio GdV: $2.6 billion. |

| Hotel Operations | Managing and operating hotels and serviced apartments. | M&C oversees over 160 hotels globally. |

| Capital Recycling & Divestment | Strategic sale of assets to unlock capital. | FY2025 divestment target: $600 million. |

| ESG Integration | Embedding sustainability and responsible practices. | First Singapore company with TNFD disclosures. |

What You See Is What You Get

Business Model Canvas

The City Developments Business Model Canvas you are previewing is the actual document you will receive upon purchase. This isn't a mockup or a sample; it's a direct snapshot of the complete, ready-to-use file. You'll gain full access to this professionally structured and formatted document, allowing you to immediately apply its insights to your city development strategies.

Resources

City Developments Limited (CDL) leverages its substantial land bank and a diverse global property portfolio as a cornerstone of its business model. This extensive collection of assets spans residential, commercial, hospitality, and student accommodation sectors, providing a robust foundation for revenue generation and strategic growth.

As of December 31, 2024, CDL's commitment to real estate is evident in its ownership of approximately 23 million square feet of gross floor area. This vast footprint encompasses income-generating residential for lease, commercial, and hospitality properties located across key international markets.

Financial capital is the lifeblood of City Developments (CDL), enabling the execution of ambitious projects and strategic acquisitions. CDL's robust financial standing, demonstrated by substantial cash reserves and readily available credit lines, is a cornerstone of its business model.

As of March 31, 2025, CDL maintained healthy cash reserves totaling $2 billion. This significant liquidity is further bolstered by an additional $3.8 billion in combined cash and undrawn committed bank facilities, providing ample capacity to fund large-scale developments and pursue growth opportunities.

A strong brand reputation and a solid track record are crucial for City Developments Limited (CDL) within its Business Model Canvas. This builds significant trust with customers, investors, and partners, fostering confidence in CDL's ability to deliver value.

CDL's commitment to excellence is evident in its consistent recognition. For instance, the company was awarded Top Developer at the EdgeProp Singapore Excellence Awards for an impressive eight consecutive years, underscoring its proven history of successful developments and investments.

Human Capital and Expertise

City Developments Limited (CDL) relies heavily on its human capital and expertise, a cornerstone of its Business Model Canvas. This includes a highly skilled workforce encompassing real estate professionals, experienced architects, meticulous engineers, astute financial experts, and adept hospitality management teams. These individuals are critical for ensuring operational excellence across CDL's diverse portfolio, from property development and investment to hotel operations.

The company's leadership and management team are invaluable assets, steering strategic direction and fostering a culture of innovation and execution. Their collective experience in navigating complex market dynamics and identifying growth opportunities is paramount to CDL's sustained success and competitive advantage.

- Skilled Workforce: CDL employs professionals across real estate, architecture, engineering, finance, and hospitality, crucial for project execution and management.

- Leadership and Management: The expertise of CDL's leadership team is vital for strategic decision-making and operational oversight.

- Talent Development: Investments in training and development ensure the workforce remains at the forefront of industry best practices and technological advancements.

- Employee Engagement: Fostering a motivated and engaged workforce contributes directly to higher productivity and service quality in all business segments.

Technology and Innovation

City Developments Limited (CDL) actively leverages technology across its operations. This includes using digital tools for streamlined design and construction processes, enhancing efficiency and reducing waste. For instance, CDL has been a proponent of Building Information Modeling (BIM) to improve project coordination and visualization.

In property management and customer engagement, CDL employs smart building solutions. These technologies aim to improve tenant experience and operational efficiency, often incorporating data analytics to understand usage patterns and optimize building performance. CDL’s commitment to sustainability is reflected in its focus on low carbon and energy-efficient technologies throughout the lifecycle of its properties.

CDL's strategic approach to technology and innovation is evident in its pursuit of smart city initiatives and digital integration. This focus not only enhances the functionality and appeal of its developments but also supports its environmental, social, and governance (ESG) goals. By integrating these advanced technologies, CDL aims to deliver greater value to stakeholders and maintain a competitive edge in the real estate market.

- Smart Building Integration: CDL is implementing smart technologies in its properties to enhance user experience and operational efficiency, often utilizing IoT devices for building management.

- Digital Construction Tools: The company utilizes advanced software and platforms for design, planning, and construction management, aiming for greater precision and reduced project timelines.

- Data Analytics for Insights: CDL employs data analytics to gain market insights, understand customer behavior, and optimize property performance, informing future development strategies.

- Sustainability Tech: A core focus is the integration of low-carbon and energy-efficient technologies in building design, construction, and management to meet environmental targets.

City Developments Limited (CDL) relies on a robust network of strategic partnerships and alliances to expand its reach and enhance its offerings. These collaborations span joint ventures for large-scale developments, partnerships with technology providers for smart building solutions, and alliances with hospitality brands to manage its hotel properties effectively.

For example, CDL's joint venture with IOI Properties Group for the sale of its stake in the South Beach development in Singapore, finalized in 2024, highlights its strategic approach to portfolio management and capital recycling. Furthermore, CDL's ongoing collaborations with various government agencies and urban planning bodies are crucial for navigating regulatory landscapes and securing prime development sites.

CDL's commitment to sustainability is a key differentiator, integrating environmental considerations into its core business strategy. This includes a focus on green building technologies and a proactive approach to managing its carbon footprint, aligning with global ESG standards.

The company's sustainability performance is regularly reported, with CDL aiming for ambitious targets. For instance, by 2030, CDL aims to reduce its Scope 1 and 2 carbon emissions intensity by 43% from a 2016 baseline. As of the end of 2024, CDL had achieved a 39% reduction in carbon emissions intensity, demonstrating significant progress towards its goals.

| Key Resource | Description | Impact |

| Strategic Partnerships | Joint ventures, technology collaborations, hospitality alliances. | Expanded market access, shared risk, enhanced service offerings. |

| Sustainability Focus | Green building technologies, carbon footprint management. | Brand reputation, regulatory compliance, long-term value creation. |

| Brand Reputation | Consistent awards and recognition. | Customer trust, investor confidence, competitive advantage. |

| Human Capital | Skilled workforce and experienced leadership. | Operational excellence, strategic execution, innovation. |

Value Propositions

City Developments Limited (CDL) is renowned for its high-quality, sustainable developments. Their properties consistently feature superior construction, intelligent design, and a strong emphasis on environmental responsibility, integrating green building practices and energy-saving technologies.

CDL's dedication to sustainability is further underscored by their Integrated Sustainability Report 2025. This report details CDL's proactive approach to fostering and advancing sustainable ecosystems within their projects, reflecting a deep commitment to long-term environmental stewardship.

City Developments Limited (CDL) offers a robust value proposition through its diverse portfolio and extensive global reach. They provide a wide array of property types, including residential, commercial, retail, and hospitality, ensuring they cater to a broad spectrum of needs and investment preferences.

This diversification is a key strength, allowing CDL to mitigate risks associated with any single property sector. Their strategic presence in multiple key gateway cities worldwide further enhances this appeal, offering investors access to dynamic and growing markets.

As of early 2024, CDL's impressive network spans 168 locations across 29 countries and regions, demonstrating a significant global footprint. This broad reach allows them to capitalize on international growth opportunities and serve a global client base.

We create dynamic urban environments by blending residential, commercial, retail, and hospitality spaces into cohesive, mixed-use developments. This approach fosters convenience and vibrancy, making city living more engaging and accessible.

Union Square in Singapore exemplifies this strategy, offering a comprehensive urban ecosystem where residents and visitors can live, work, shop, and dine seamlessly. Such integrated projects are key to enhancing city life.

In 2024, the demand for well-connected, amenity-rich urban living continues to grow, with mixed-use developments often commanding premium rental yields and experiencing higher occupancy rates compared to single-use properties.

Strong Investment Returns and Capital Appreciation

For investors, City Developments Limited (CDL) is focused on generating enduring value. This is achieved by boosting the performance of its diverse property portfolio and building reliable income streams. CDL's strategic push into fund management is designed to amplify its existing capabilities and unlock further growth opportunities.

CDL's commitment to strong investment returns is underscored by its consistent performance. For instance, in 2023, the company reported a net profit attributable to shareholders of S$1.03 billion, a significant increase from S$226 million in 2022, demonstrating its ability to drive capital appreciation and deliver value.

- Enhanced Portfolio Performance: CDL continuously optimizes its property assets to maximize returns and capital growth.

- Recurring Income Streams: The company prioritizes developing and acquiring properties that generate stable rental income.

- Fund Management Growth: CDL actively expands its fund management business to leverage its expertise and scale.

- Sustainable Value Creation: The overarching goal is to deliver long-term, sustainable returns for all stakeholders.

Premium Hospitality and Guest Experience

City Developments Limited (CDL), through its Millennium & Copthorne Hotels (M&C) division, delivers a premium hospitality experience. M&C operates a varied portfolio of hotels, all emphasizing high-quality service and aiming to create lasting memories for guests. These properties are strategically situated in key global destinations.

M&C actively cultivates guest loyalty and enhances their stays through personalized benefits and well-structured loyalty programs. These initiatives are designed to foster repeat business and ensure a superior guest journey.

- Diverse Hotel Portfolio: M&C manages a broad spectrum of hotel brands catering to different traveler needs.

- Prime Global Locations: CDL's hotels are situated in sought-after urban centers and tourist destinations worldwide.

- Personalized Guest Perks: Loyalty programs offer tailored benefits to reward and engage returning guests.

- Focus on Memorable Experiences: The core value proposition centers on delivering exceptional service that creates positive and lasting impressions.

City Developments Limited (CDL) offers a compelling value proposition by focusing on enhancing portfolio performance and generating recurring income streams. Their strategic expansion into fund management further amplifies their capabilities, aiming for sustainable value creation across their diverse global assets.

CDL's commitment to strong investment returns is evident in their financial performance. For instance, in 2023, the company achieved a net profit attributable to shareholders of S$1.03 billion, a substantial increase from S$226 million in 2022, highlighting their effectiveness in driving capital appreciation and delivering stakeholder value.

The hospitality division, Millennium & Copthorne Hotels (M&C), provides a premium guest experience through a diverse hotel portfolio in prime global locations, enhanced by personalized guest perks and a focus on creating memorable stays.

| Value Proposition Area | Key Offering | Supporting Data/Examples (as of early 2024) |

|---|---|---|

| Enhanced Portfolio Performance | Maximizing returns and capital growth through asset optimization. | Consistent delivery of value across residential, commercial, and retail segments. |

| Recurring Income Streams | Developing properties that generate stable rental income. | Focus on high-occupancy, amenity-rich mixed-use developments. |

| Fund Management Growth | Leveraging expertise and scale to expand fund management business. | Strategic initiatives to unlock further growth opportunities. |

| Sustainable Value Creation | Delivering long-term, sustainable returns for stakeholders. | Commitment to environmental responsibility and integrated sustainability reporting. |

Customer Relationships

City Developments Limited (CDL) maintains strong customer relationships through specialized sales and leasing teams. These teams directly engage with both individual buyers and institutional clients, offering personalized experiences through dedicated sales galleries, property viewings, and one-on-one consultations.

This direct approach was evident in CDL's 2024 performance, where they successfully launched four residential projects in Singapore. These developments collectively offered 1,502 units, demonstrating the teams' capacity to connect with a significant number of customers and facilitate sales.

City Developments provides extensive post-sale support, property maintenance, and tenant services across its residential, commercial, and hospitality portfolios. This focus on customer satisfaction and retention is crucial for long-term value. For instance, in 2024, the company continued to invest in its property management capabilities, aiming to enhance resident and tenant experiences through efficient facilities management and responsive service delivery.

City Developments Limited (CDL) can cultivate strong customer relationships through well-designed loyalty programs for its hospitality segment. Implementing tiered loyalty programs, like MyMillennium by Millennium Hotels and Resorts, incentivizes repeat stays by offering exclusive perks and discounts.

These programs foster a sense of belonging and reward loyal guests, encouraging them to choose CDL's properties over competitors. For instance, MyMillennium offers benefits such as room upgrades, late check-outs, and bonus points redeemable for free nights or other experiences, directly driving repeat business and increasing guest lifetime value.

Investor Relations and Shareholder Engagement

City Developments (CDL) prioritizes robust investor relations and shareholder engagement. This involves maintaining transparent and regular communication with shareholders and the broader investment community. CDL achieves this through various channels, including annual reports, financial briefings, and dedicated investor calls.

CDL actively provides a wealth of investor information, ensuring accessibility to key data. This includes detailed financial results, offering insights into the company's performance. Furthermore, CDL publishes comprehensive sustainability reports, reflecting its commitment to environmental, social, and governance (ESG) principles.

- Transparent Communication: CDL regularly updates stakeholders through annual reports, financial briefings, and investor calls.

- Information Accessibility: The company provides easy access to financial results and sustainability reports on its investor relations portal.

- Shareholder Value Focus: Engagement strategies aim to foster trust and long-term relationships with investors, supporting sustained shareholder value.

Community Engagement and CSR Initiatives

City Developments Limited (CDL) actively cultivates strong ties with the communities where it operates. This is achieved through dedicated corporate social responsibility (CSR) programs, a commitment to environmental stewardship, and impactful community development projects.

CDL's approach emphasizes social inclusivity, fostering engagement within its operational areas. A key aspect of this is nurturing youth sustainability champions, recognizing the importance of empowering the next generation.

- Community Investment: CDL's commitment to community well-being is evident in its ongoing support for local initiatives. In 2024, the company continued its focus on enhancing social infrastructure and supporting vulnerable groups.

- Environmental Stewardship: Beyond community programs, CDL champions environmental sustainability. Initiatives like green building practices and waste reduction efforts contribute to healthier local environments.

- Youth Development: CDL's dedication to nurturing future leaders is highlighted by its programs aimed at developing young sustainability advocates. These programs equip youth with the knowledge and skills to drive positive environmental change.

CDL fosters customer relationships through direct engagement via specialized sales and leasing teams, offering personalized experiences at sales galleries and through consultations.

In 2024, CDL launched four Singapore residential projects with 1,502 units, showcasing their ability to connect with and serve a large customer base.

The company also prioritizes investor relations through transparent communication and accessibility to financial and sustainability reports, aiming to build long-term trust.

Channels

City Developments Limited (CDL) leverages its own dedicated sales teams and meticulously designed showflats and sales galleries to directly connect with prospective buyers for its residential and commercial developments. This hands-on approach allows for immediate feedback and a personalized sales experience, crucial for high-value property transactions.

The company's official website, cdl.com.sg, acts as a central digital platform, offering comprehensive details on all ongoing and upcoming projects. It also serves as a vital channel for investor relations, providing access to financial reports and corporate news, which is increasingly important for transparency and investor confidence in 2024.

City Developments leverages external real estate agencies and brokers to significantly expand its market reach and drive property sales and leasing. These partnerships are crucial for penetrating diverse market segments and achieving substantial sales volumes.

In 2024, the global real estate brokerage market was valued at approximately $150 billion, underscoring the significant role these intermediaries play in facilitating transactions. For developers like City Developments, collaborating with established agencies provides access to a broad network of potential buyers and renters, thereby accelerating the sales cycle and increasing overall revenue.

City Developments Limited (CDL) actively leverages online property portals and sophisticated digital marketing strategies to showcase its diverse portfolio. This approach is crucial for reaching a broad spectrum of potential buyers, from first-time homeowners to seasoned investors, both domestically and internationally. For instance, CDL's recent launches, such as Kassia and Norwood Grand, have benefited immensely from targeted online campaigns, driving significant interest and lead generation.

Digital advertising, including search engine marketing and social media campaigns, plays a pivotal role in CDL's customer acquisition strategy. By utilizing platforms like Google Ads and Meta, CDL can precisely target demographics interested in specific property types and locations. In 2024, the real estate sector saw continued growth in digital ad spend, with property portals often being the first point of contact for property searches, indicating the effectiveness of this channel for CDL.

Hotel Booking Platforms and Travel Agencies

Hotel booking platforms and travel agencies are crucial distribution channels for M&C hotels. These channels allow the company to reach a broad customer base, from individual travelers booking directly to those using the services of a travel agent. In 2024, the online travel agency (OTA) segment continued to dominate hotel bookings, with platforms like Booking.com and Expedia handling a significant portion of global reservations.

M&C hotels leverage a wide network of these channels to ensure maximum visibility and accessibility for their room inventory. This multi-channel approach is vital for capturing diverse market segments and optimizing occupancy rates. Global distribution systems (GDS) also play a key role, connecting travel agents worldwide to M&C's offerings.

- Online Travel Agencies (OTAs): Platforms like Booking.com and Expedia are primary revenue drivers, facilitating direct bookings from a vast online audience.

- Global Distribution Systems (GDS): Systems such as Amadeus, Sabre, and Travelport are essential for reaching traditional travel agents and corporate travel planners globally.

- Traditional Travel Agencies: These agencies continue to serve a segment of travelers who prefer personalized service and expert advice for their bookings.

- Direct Bookings: While not an external channel, driving direct bookings through the M&C website is a key strategy to reduce commission costs and build customer loyalty.

Corporate and Institutional Sales

Corporate and Institutional Sales directly targets businesses for significant transactions. This involves selling residential units in bulk, leasing commercial office spaces, or arranging extended hotel accommodations for corporate clients. These relationships are vital for generating substantial revenue streams and ensuring predictable income for the company.

This channel is particularly effective for City Developments in securing large-scale agreements that provide a stable income base. For instance, in 2024, the company continued to leverage these relationships to fill its extensive commercial and residential portfolios. Such direct engagements are key to achieving high occupancy rates and predictable cash flows, underpinning the company's financial stability.

Key aspects of this sales channel include:

- Direct Engagement: Building and maintaining relationships with corporate decision-makers for property acquisitions and leases.

- Bulk Purchases: Facilitating the sale of multiple residential units to corporations for employee housing or investment purposes.

- Commercial Leasing: Securing long-term leases for office buildings and retail spaces within the company's developments.

- Hospitality Partnerships: Offering corporate rates and packages for extended stays at the company's hotels, ensuring consistent occupancy.

City Developments Limited (CDL) utilizes a multi-faceted channel strategy to reach its diverse customer base. This includes direct engagement through its own sales teams and showflats, alongside leveraging external real estate agencies to broaden market penetration.

The company's digital presence, primarily through its official website and online property portals, is a critical channel for information dissemination and lead generation. Targeted digital marketing campaigns in 2024, including social media and search engine marketing, were instrumental in driving interest for new property launches.

For its hospitality arm, M&C hotels, Online Travel Agencies (OTAs) and Global Distribution Systems (GDS) are paramount for reaching global travelers and travel agents, with OTAs accounting for a significant share of bookings in 2024.

Corporate and institutional sales represent another key channel, focusing on bulk residential sales, commercial leasing, and hospitality partnerships to secure substantial, stable revenue streams.

| Channel | Description | Key Activities/Platforms | 2024 Relevance/Data Point |

|---|---|---|---|

| Direct Sales | CDL's internal sales force and physical showrooms. | Showflats, sales galleries, dedicated sales teams. | Facilitates personalized buyer experience for high-value property transactions. |

| Real Estate Agencies | Partnerships with external brokers and agencies. | Broker networks, agency collaborations. | Expands market reach, crucial in a global real estate brokerage market valued at ~$150 billion in 2024. |

| Digital Channels | Online platforms and marketing efforts. | CDL website, property portals, social media, SEM. | Essential for reaching broad demographics; digital ad spend in real estate grew in 2024. |

| Hospitality Channels | Distribution for M&C hotels. | OTAs (e.g., Booking.com), GDS, direct bookings. | OTAs dominated bookings in 2024, highlighting their importance for hotel visibility. |

| Corporate & Institutional | Direct engagement with businesses. | Bulk sales, commercial leases, hospitality partnerships. | Secures stable income; key for filling commercial and residential portfolios in 2024. |

Customer Segments

City Developments Limited (CDL) serves a broad spectrum of residential homebuyers, encompassing both the mass market and luxury segments. This includes individuals and families looking for properties to live in themselves, spanning a wide range of affordability.

CDL's strategic approach is evident in its recent residential developments in Singapore. For instance, Lumina Grand, launched in 2024, targets the executive condominium market, appealing to a significant portion of the population. Additionally, Union Square Residences, also a 2024 launch, caters to a more premium segment of the market.

City Developments Limited (CDL) actively courts both individual and institutional real estate investors, including funds and corporations. These investors are primarily interested in acquiring properties for both capital appreciation and consistent rental income. CDL's portfolio spans residential, commercial, and hospitality sectors, catering to diverse investment strategies. In 2023, CDL reported a significant increase in its property portfolio value, reflecting strong market demand and successful asset management.

Corporate clients and businesses are a key customer segment for City Developments Limited (CDL), primarily seeking office spaces, retail units, and serviced apartments. These entities utilize CDL's properties for their operational needs, including headquarters, branch offices, and retail outlets, as well as for accommodating their employees, especially expatriates and traveling staff.

CDL's extensive portfolio includes a substantial gross floor area in commercial assets worldwide. As of December 31, 2023, CDL's global portfolio comprised approximately 19.9 million square meters of gross floor area, with a significant portion dedicated to commercial properties, underscoring its capacity to cater to diverse corporate demands.

Leisure and Business Travelers

Millennium & Copthorne Hotels (M&C) caters to a broad spectrum of travelers, encompassing both leisure tourists and business professionals. This segment is crucial for occupancy rates and revenue generation, especially in M&C's strategically located properties. In 2024, M&C's extensive global portfolio, boasting over 160 hotels, positions it well to capture demand from these diverse groups in major gateway cities.

- Leisure Travelers: Individuals and families seeking accommodation for vacations and sightseeing.

- Business Travelers: Professionals on corporate trips, attending meetings, or participating in conferences.

- Event Attendees: Guests traveling for weddings, conferences, or other organized events hosted at M&C properties.

- Global Reach: M&C's presence in key international hubs facilitates access for both domestic and international travelers.

Government and Public Sector

Government agencies and public sector entities are key partners for City Developments Limited (CDL). These bodies often engage CDL for large-scale urban development projects, urban regeneration initiatives, and the creation of essential public infrastructure. CDL's participation in Government Land Sale (GLS) tenders underscores this relationship, as these tenders are a primary mechanism for acquiring land for development, often with specific public interest objectives.

CDL's strategic engagement with governments extends to fulfilling specific infrastructure needs and contributing to urban planning. For instance, in 2024, CDL continued to actively bid on GLS tenders, demonstrating its commitment to collaborating with public authorities on shaping urban landscapes. The company's ability to undertake complex projects aligns with government mandates for sustainable and well-planned urban environments.

- Government Land Sales (GLS): CDL regularly participates in GLS tenders, a crucial channel for land acquisition and urban development partnerships.

- Urban Regeneration: Collaborating with public bodies on revitalizing existing urban areas and creating new community hubs.

- Infrastructure Development: Contributing to the planning and execution of public infrastructure projects that enhance city living.

- Public-Private Partnerships: Engaging in joint ventures and collaborations that leverage both public sector goals and private sector expertise.

City Developments Limited (CDL) targets a diverse range of residential buyers, from those seeking affordable mass-market homes to individuals and families interested in luxury properties. This broad appeal is demonstrated by their 2024 launches like Lumina Grand, which tapped into the executive condominium market, and Union Square Residences, catering to a more upscale clientele.

CDL also actively engages with both individual and institutional investors, including funds and corporations, seeking capital appreciation and rental income across residential, commercial, and hospitality sectors. Their global portfolio, valued significantly in 2023, reflects strong market demand and effective asset management, attracting a wide array of investment strategies.

Corporate clients represent another vital segment, with businesses requiring office, retail, and serviced apartment spaces for operational needs and employee accommodation. CDL's substantial global commercial asset base, encompassing approximately 19.9 million square meters of gross floor area as of December 31, 2023, highlights their capacity to meet these diverse business demands.

Beyond direct property sales and leases, CDL collaborates with government agencies on urban development and regeneration projects, actively participating in Government Land Sale tenders. This strategic engagement, evident in their continued bidding on GLS tenders in 2024, showcases a commitment to public-private partnerships and shaping urban environments.

Cost Structure

A substantial part of the cost structure involves securing desirable land and covering the direct expenses for building, designing, and putting in essential infrastructure. For instance, City Developments Limited (CDL) allocated $2.2 billion in 2024 specifically to bolster its development pipeline and expand its presence in the living sector.

Construction and project management expenses are a significant cost driver for City Developments (CDL). These costs encompass everything from raw materials and skilled labor to the fees paid to project managers and supervisors who oversee the building process. CDL is actively engaged in numerous construction projects, with several expected to reach their Temporary Occupation Permit (TOP) status in 2026 and 2028, indicating continued substantial expenditure in this category.

City Developments Limited (CDL) invests significantly in sales, marketing, and distribution to effectively promote and sell its properties. These expenses encompass a broad range of activities, from large-scale advertising campaigns and direct sales efforts to the operational costs of showflats and sophisticated digital marketing strategies.

In 2024, CDL's commitment to robust marketing is evident in its support for residential launches. For instance, the launch of the Piccadilly Grand project in Singapore saw substantial marketing efforts, including digital campaigns and roadshows, contributing to strong initial sales performance.

Operating Expenses for Investment Properties and Hotels

Operating expenses for investment properties and hotels are substantial and ongoing. These include essential costs like utilities, property taxes, and staff salaries, all crucial for maintaining the functionality and appeal of commercial buildings, retail malls, and hotels. City Developments Ltd. (CDL), through its subsidiary Millennium & Copthorne Hotels, places a strong emphasis on implementing robust cost control measures to manage these expenditures effectively.

For example, in 2023, CDL reported that its group operating expenses were S$3.9 billion. This figure encompasses a wide array of costs, including those related to its extensive property portfolio and hotel operations. The company’s strategy often involves optimizing energy consumption and streamlining staffing models to enhance efficiency.

- Utilities: Costs for electricity, water, and gas, which can fluctuate based on usage and energy prices.

- Property Taxes: Annual levies imposed by local authorities on the value of the properties.

- Staff Salaries and Benefits: Compensation for hotel staff, property managers, maintenance crews, and administrative personnel.

- Maintenance and Repairs: Regular upkeep of buildings, including structural repairs, landscaping, and interior renovations to preserve asset value.

Financing Costs and Interest Expenses

Financing costs represent a significant component of City Developments' (CDL) expense structure. This primarily includes the interest paid on capital borrowed to fund land acquisitions and ongoing development projects. These expenses are crucial as they directly impact the profitability of CDL's ventures.

As of December 31, 2024, CDL's net gearing was reported at 117%. This figure highlights the company's reliance on debt financing, meaning its total debt significantly outweighs its equity. Consequently, interest expenses are a substantial and ongoing cost for CDL.

- Cost of Borrowing: Interest payments on loans secured for land purchases and project development.

- Financing Charges: Other fees and expenses associated with securing and managing debt.

- Impact of Gearing: CDL's net gearing of 117% at the end of 2024 underscores the scale of its interest obligations.

- Profitability Influence: High financing costs can reduce net profit margins, especially in fluctuating interest rate environments.

The cost structure for City Developments (CDL) is heavily influenced by land acquisition and development expenses. In 2024, CDL dedicated $2.2 billion to its development pipeline, underscoring the significant capital outlay required for new projects.

Construction and project management are major cost centers, encompassing materials, labor, and oversight. CDL has multiple projects slated for completion in 2026 and 2028, indicating sustained investment in these areas.

Sales, marketing, and distribution costs are also substantial, supporting property launches through advertising, sales efforts, and digital strategies. For instance, the Piccadilly Grand launch in Singapore in 2024 involved extensive marketing to drive initial sales.

Ongoing operating expenses for investment properties and hotels, including utilities, taxes, and staff, are managed with a focus on efficiency. CDL reported group operating expenses of S$3.9 billion in 2023, reflecting the breadth of these costs.

Financing costs, particularly interest on debt, are significant given CDL's net gearing of 117% at the end of 2024, highlighting the impact of borrowing on profitability.

| Cost Category | Description | 2024/2023 Data Points |

|---|---|---|

| Land Acquisition & Development | Securing land and initial project setup costs. | $2.2 billion allocated in 2024 for development pipeline. |

| Construction & Project Management | Materials, labor, and management of building processes. | Projects with expected TOP in 2026 and 2028 indicate ongoing expenditure. |

| Sales, Marketing & Distribution | Promotional activities, sales efforts, and showflat operations. | Significant marketing for 2024 residential launches like Piccadilly Grand. |

| Operating Expenses (Investment Properties & Hotels) | Utilities, property taxes, staff, maintenance. | S$3.9 billion in group operating expenses reported for 2023. |

| Financing Costs | Interest on loans for land and development. | Net gearing of 117% as of Dec 31, 2024, implies substantial interest obligations. |

Revenue Streams

Revenue streams from property development sales are a core component of City Developments' (CDL) business model. This involves generating income from the sale of properties that CDL has developed, including homes, offices, and mixed-use projects.

For example, CDL announced that in the first quarter of 2025, its Singapore property development segment alone generated $1.9 billion in sales revenue. This figure highlights the significant contribution of property sales to the company's overall financial performance.

City Developments Limited (CDL) generates substantial recurring revenue through its rental income from a diverse portfolio of investment properties. This includes leasing out commercial office spaces, vibrant retail malls, and desirable residential properties designed for lease.

As of early 2024, CDL commands a significant real estate footprint, managing approximately 23 million square feet of gross floor area. This extensive portfolio spans various asset classes, including residential for lease, commercial, and hospitality, providing a stable and predictable income stream.

This stream captures income from guests staying at hotels, enjoying meals and drinks, and hosting events. Millennium & Copthorne Hotels, a key player, saw its total hotel revenue reach £899 million in 2024, demonstrating the significant contribution of these services.

Asset Management and Fund Management Fees

City Developments Limited (CDL) generates revenue through asset and fund management fees, capitalizing on its expertise in managing real estate portfolios for external investors and its own real estate funds. This segment is a key component of CDL's growth strategy, aiming to expand its recurring income base.

CDL is actively growing its fund management business, a strategic move to enhance its revenue streams beyond direct property development and ownership. This involves leveraging its extensive experience and market knowledge to attract and manage assets for a broader investor base.

- Asset Management Fees: CDL earns fees for managing real estate assets on behalf of third-party owners, providing services such as property operations, leasing, and financial reporting.

- Fund Management Fees: Revenue is derived from managing real estate investment funds, which includes management fees and potentially performance fees based on fund returns.

Divestment Gains and Capital Recycling

City Developments Limited (CDL) strategically divests assets to enhance its portfolio and free up capital. This process involves selling off non-core or mature properties that no longer align with the company's long-term vision. These divestments are crucial for maintaining a dynamic and profitable asset base.

In 2024, CDL actively pursued its capital recycling strategy, realizing significant gains. The company divested over $600 million in assets during this period. This proactive approach allows CDL to reinvest in growth opportunities and strengthen its financial position.

- Divestment Gains: Profits generated from selling assets.

- Capital Recycling: Redeploying capital from sold assets into new investments.

- 2024 Performance: Over $600 million in assets divested.

- Strategic Optimization: Enhancing portfolio value and flexibility.

City Developments Limited (CDL) diversifies its revenue through strategic asset divestments, selling properties to optimize its portfolio and generate capital. This capital recycling allows for reinvestment into new ventures and strengthens the company's financial flexibility.

In 2024, CDL's commitment to this strategy was evident, with the company divesting over $600 million in assets. This active management of its real estate holdings ensures a dynamic and profitable asset base, contributing significantly to its overall financial performance.

| Revenue Stream | Description | 2024 Data/Impact |

|---|---|---|

| Property Development Sales | Income from selling developed properties (residential, commercial, mixed-use). | $1.9 billion in sales revenue from Singapore development segment in Q1 2025. |

| Rental Income | Recurring revenue from leasing commercial, retail, and residential properties. | Manages ~23 million sq ft of gross floor area across various asset classes. |

| Hotel Operations | Revenue from hospitality services including accommodation, F&B, and events. | Millennium & Copthorne Hotels reported £899 million in total hotel revenue for 2024. |

| Asset & Fund Management Fees | Fees earned from managing real estate portfolios for third parties and funds. | Strategic growth focus to expand recurring income base. |

| Asset Divestments | Profits generated from selling non-core or mature properties. | Over $600 million in assets divested in 2024 as part of capital recycling. |

Business Model Canvas Data Sources

The City Developments Business Model Canvas is built upon a foundation of comprehensive market research, detailed financial projections, and extensive urban planning reports. These diverse data sources ensure each component of the canvas accurately reflects current market conditions and future growth potential.