City Developments Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

City Developments Bundle

City Developments faces a dynamic competitive landscape, with the threat of new entrants and the bargaining power of buyers presenting significant challenges. Understanding the intensity of these forces is crucial for strategic planning.

The full Porter's Five Forces Analysis reveals the real forces shaping City Developments’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Suppliers of essential construction materials such as steel, concrete, and various building components hold considerable sway over City Developments (CDL). These suppliers' pricing power directly influences CDL's project expenditures.

Volatility in worldwide commodity markets and disruptions within local supply networks can significantly impact CDL's development expenses. For example, while steel reinforcement bar prices have seen a notable decrease, reaching their lowest point since December 2019, copper prices are on an upward trajectory, driven by robust global demand and existing supply limitations.

The bargaining power of suppliers, particularly concerning labor, significantly impacts City Developments Limited (CDL). The availability and cost of skilled labor in Singapore's construction sector are paramount. For instance, the increase in minimum qualifying salaries for Employment Pass holders to S$2,200 per month, effective from September 2023, directly escalates project expenses for developers like CDL.

Furthermore, rising levy rates for S Pass holders in Singapore, a common source of skilled labor for construction, also contribute to higher operational costs. These factors collectively strengthen the bargaining power of labor suppliers, as CDL faces increased expenses to secure the necessary workforce for its development projects.

Land is a crucial element for City Developments Limited (CDL) as it forms the foundation for all its real estate projects. The availability and cost of land directly impact CDL's ability to develop new properties and maintain its profitability. In 2024, Singapore's land market remained competitive, with government land sales and private en bloc transactions dictating acquisition costs.

The bargaining power of land owners is significant, especially for prime locations in Singapore. Scarcity of suitable land in these sought-after areas means owners can command higher prices, directly affecting CDL's development costs. For instance, successful en bloc sales in 2024 often saw premiums paid well above market valuations, underscoring this power.

CDL's success hinges on its capability to secure land parcels at economically viable prices. This ability is vital for sustaining its project pipeline and ensuring healthy profit margins. Acquiring land at competitive rates in 2024 was a key strategic objective for CDL amidst a dynamic property market.

Financiers and Lenders

Financiers and lenders hold significant bargaining power over real estate developers like City Developments. Access to capital is paramount for undertaking large-scale projects, and banks or other financial institutions are the primary suppliers of this crucial resource. Their influence is felt through the interest rates they set and the specific conditions attached to loans, directly impacting the cost and feasibility of development.

For instance, in 2023, global interest rates saw a general upward trend, which would have translated into higher financing costs for developers. This increased cost of capital can significantly affect the profitability and even the viability of new projects, giving lenders considerable leverage in negotiations.

- Interest Rate Impact: Higher interest rates directly increase the cost of borrowing, reducing profit margins for developers.

- Loan Covenants: Lenders can impose strict covenants on developers, dictating how funds are used or requiring certain financial performance metrics.

- Access to Capital: In tighter credit markets, developers may face more difficulty securing necessary funding, empowering lenders.

- Project Financing: The ability of financiers to approve or deny funding for specific projects gives them substantial control over which developments proceed.

Specialized Contractors and Consultants

For intricate projects like those undertaken by City Developments Limited (CDL), specialized contractors and consultants hold significant bargaining power. Their unique expertise in areas such as mechanical and electrical systems, architecture, and engineering is often not easily replicated.

This scarcity of specialized talent can translate into higher costs for CDL. For instance, projections for 2024 indicate a continuing upward trend in construction costs for mechanical and electrical components, directly impacting project budgets.

- High Demand for Niche Skills: Specialized contractors possess technical knowledge that is difficult to substitute, giving them leverage in negotiations.

- Cost Escalation in 2024: The construction sector, particularly for complex M&E systems, has seen cost increases, with some estimates suggesting a 5-8% rise in material and labor costs for such specialized services in 2024 compared to the previous year.

- Impact on Project Profitability: Increased contractor costs directly squeeze profit margins for developers like CDL, especially for large-scale, multi-year developments.

Suppliers of essential construction materials like steel and concrete, along with specialized labor, exert significant influence over City Developments (CDL). Fluctuations in global commodity markets, as seen with copper price increases in 2024 driven by demand, and the rising cost of skilled labor due to salary adjustments, directly impact CDL's project expenditures and profit margins.

The scarcity of prime land in Singapore also empowers landowners, leading to higher acquisition costs for CDL, as evidenced by en bloc sales premiums in 2024. Similarly, financiers and lenders hold considerable sway through interest rates and loan covenants, affecting the cost and feasibility of CDL's developments, with global interest rates generally trending upward in 2023.

| Supplier Type | Impact on CDL | Key Factors (2023-2024) |

|---|---|---|

| Construction Materials | Increased project costs | Copper price surge due to demand; steel prices at multi-year lows (Dec 2019) |

| Skilled Labor | Higher operational expenses | Minimum qualifying salaries for Employment Pass (S$2,200 from Sep 2023); rising S Pass levy rates |

| Land Owners | Elevated acquisition costs | Competitive land market; en bloc sales premiums exceeding valuations (2024) |

| Financiers/Lenders | Increased cost of capital, project feasibility | Upward trend in global interest rates (2023); loan covenants |

| Specialized Contractors | Higher project budgets | Demand for niche skills; projected 5-8% cost increase for M&E components (2024) |

What is included in the product

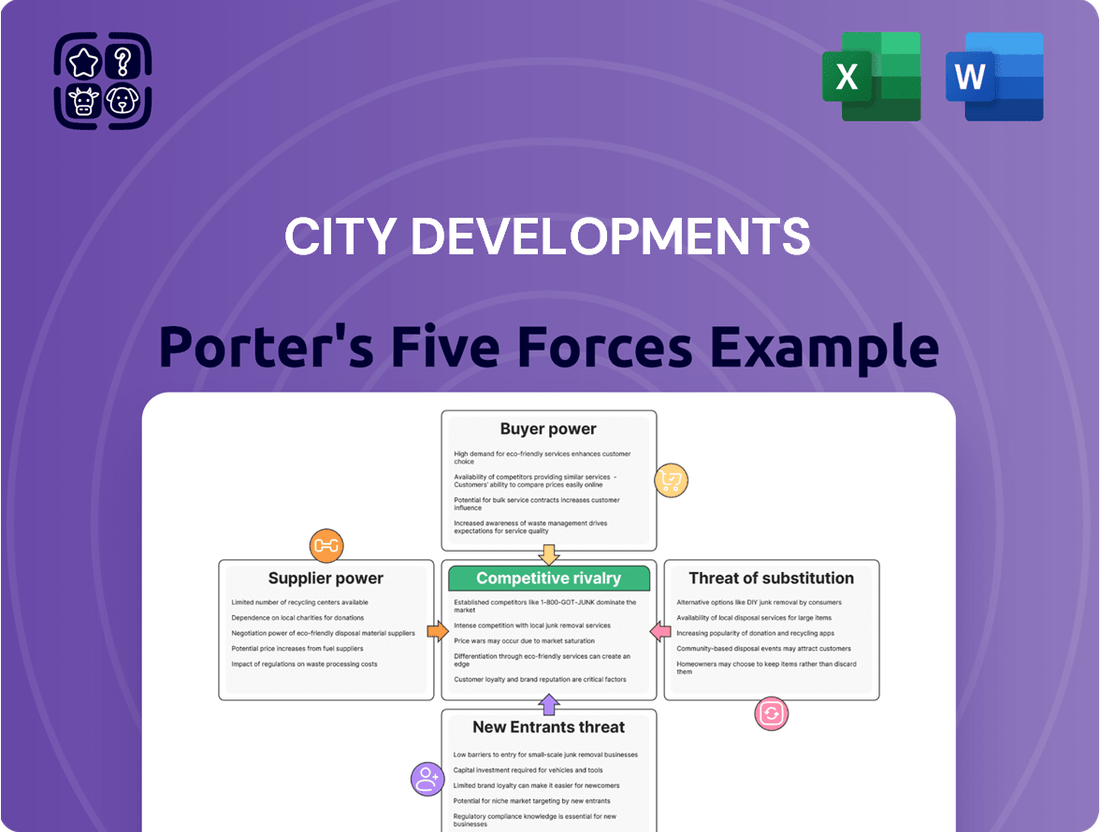

This analysis dissects the competitive landscape for City Developments by examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the availability of substitutes.

Easily visualize competitive intensity and identify strategic vulnerabilities with a dynamic Porter's Five Forces dashboard.

Pinpoint and address specific competitive threats with actionable insights derived from a structured analysis.

Customers Bargaining Power

The bargaining power of residential property buyers can fluctuate significantly. In 2024, a moderating market with increased housing supply and stable prices generally empowers buyers. This improved affordability and wider selection, encompassing both new Build-to-Order (BTO) flats and resale units, give them more leverage in negotiations.

The bargaining power of commercial and retail tenants for City Developments (CDL) is significantly shaped by prevailing market vacancy rates and broader economic conditions. When vacancy rates are high, tenants gain leverage, allowing them to negotiate more favorable lease terms, including rent adjustments and shorter lease durations.

In Singapore's office market, while pricing has demonstrated a degree of stability, a noticeable trend of subdued expansionary demand from occupiers, driven by ongoing cost pressures, is evident. This environment grants tenants greater influence to negotiate lease agreements, potentially impacting CDL's rental income and occupancy levels.

Hotel guests wield considerable bargaining power, a direct result of the vast number of accommodation options available and the ease with which they can compare prices, reviews, and amenities online. This accessibility allows travelers to readily identify the best value, putting pressure on hotels to offer competitive rates and superior service. For instance, in 2024, online travel agencies (OTAs) continued to dominate booking channels, with platforms like Booking.com and Expedia facilitating price transparency and empowering consumer choice. The ability for guests to easily switch between providers based on perceived value is a constant force shaping hotel pricing strategies and service delivery.

Institutional Investors (for investment properties)

Institutional investors, like large real estate funds, wield significant bargaining power when considering investment properties from City Developments. These sophisticated buyers perform extensive due diligence, scrutinizing every aspect of a potential acquisition to ensure it aligns with their precise return on investment targets. For instance, in mid-2024, with many major global cities experiencing tight capitalization rates, institutional investors were particularly adept at negotiating favorable terms, as the pool of high-yield, prime assets remained limited.

Their ability to walk away from a deal, or to leverage alternative investment opportunities, further amplifies their influence. This is especially true when they are evaluating a portfolio of properties or a significant single asset. The sheer volume of capital they manage allows them to dictate terms and demand specific pricing structures, putting pressure on sellers like CDL to offer competitive valuations.

- High Due Diligence Standards: Institutional investors meticulously analyze property financials, market trends, and tenant profiles, giving them a strong negotiating position.

- Return Thresholds: Their investment mandates require specific internal rates of return (IRR), making them sensitive to pricing and potential upside.

- Alternative Investment Options: Access to a broad range of global real estate and other asset classes empowers them to seek the best opportunities, increasing their leverage.

Government Policies and Regulations

The Singapore government's active involvement in the housing sector significantly shapes the bargaining power of customers. Policies such as cooling measures, the introduction of Build-To-Order (BTO) flats, and various grants directly influence buyer affordability and behavior. These interventions manage demand and supply, thereby altering the leverage individual buyers possess in the market.

For instance, in 2024, the Housing & Development Board (HDB) continued to offer a substantial supply of BTO flats, aiming to keep prices accessible and manage demand. This consistent supply, coupled with targeted grants for eligible buyers, empowers them by providing more choices and reducing their reliance on private developers.

- Government Intervention: Singapore's government actively manages the housing market through policies like cooling measures and BTO launches.

- Buyer Affordability: Policies such as grants and BTO availability directly impact how much buyers can afford and their negotiating power.

- Demand and Supply Dynamics: Government actions influence the balance of housing supply and demand, which in turn affects customer bargaining power.

- Market Influence: These governmental actions collectively empower buyers by offering more options and influencing price points, especially in the public housing segment.

The bargaining power of customers for City Developments is multifaceted, influenced by market conditions and government policies. In residential markets, increased housing supply in 2024, particularly from BTO launches, has given buyers more leverage. For commercial and retail tenants, high vacancy rates in the office sector empower them to negotiate favorable lease terms, a trend exacerbated by subdued expansionary demand in 2024. Hotel guests benefit from extensive online comparison tools, driving competitive pricing and service improvements.

| Customer Segment | Bargaining Power Drivers | 2024 Market Influence |

|---|---|---|

| Residential Buyers | Housing supply, BTO availability, grants | Increased leverage due to ample supply and government support. |

| Commercial/Retail Tenants | Vacancy rates, economic conditions, occupier demand | Stronger negotiation power due to subdued office demand and cost pressures. |

| Hotel Guests | Online price transparency, numerous options, reviews | High power due to easy comparison and switching facilitated by OTAs. |

| Institutional Investors | Due diligence, return targets, alternative investments | Significant leverage, especially in tight capitalization rate environments. |

Same Document Delivered

City Developments Porter's Five Forces Analysis

This preview showcases the complete City Developments Porter's Five Forces Analysis, offering an in-depth examination of competitive forces impacting the industry. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, ensuring you get the full, actionable insights without any alterations or missing sections.

Rivalry Among Competitors

City Developments Limited (CDL) operates within a fiercely competitive Singapore real estate market. The sheer number of developers actively seeking limited land parcels and development opportunities intensifies this rivalry. As of early 2024, the market sees a robust presence of both established local giants and increasingly active international firms, all vying for market share across residential, commercial, and hospitality segments.

While Singapore's property market is projected to show resilience with steady growth, a potential slowdown in price increases compared to earlier periods could heighten rivalry among developers. This intensified competition means companies like City Developments will likely fight harder for each sale, potentially impacting profit margins.

In 2023, Singapore's private property price index rose by 6.8%, a notable increase but potentially moderating from the 8.4% seen in 2022. This trend suggests that while demand remains, the pace of appreciation might be slowing, forcing developers to be more aggressive in their marketing and pricing strategies to secure market share.

Developers fiercely compete by making their projects stand out. This differentiation often comes through unique designs, desirable amenities, prime locations, and increasingly, a commitment to sustainability. CDL, for instance, strategically leverages mixed-use developments and integrated projects, combining residential, commercial, and retail spaces to create attractive, self-contained communities. Their emphasis on sustainable building practices, such as achieving Green Mark Platinum certification for projects like the upcoming Piccadilly Grand, further sets them apart in a crowded market.

Exit Barriers

High capital investment and lengthy development cycles in real estate act as significant exit barriers for companies like City Developments. Developers are often locked into projects for years, requiring substantial upfront capital and facing prolonged timelines before realizing returns. This commitment means that even when market conditions deteriorate, companies are compelled to continue, leading to intense competition as they strive to recoup their investments.

For instance, the average development cycle for a large residential project in major Asian cities can span 3 to 5 years, with initial investments often running into hundreds of millions of dollars. This long-term commitment discourages new entrants who may not have the financial fortitude or patience to navigate such extended periods. It also means existing players, including City Developments, must remain competitive and manage their portfolios strategically, even during economic slowdowns.

- High Capital Outlay: Real estate development necessitates massive initial investments in land acquisition, planning, construction, and marketing, creating a substantial financial hurdle for exiting.

- Long Development Cycles: Projects can take several years from conception to completion, meaning capital is tied up for extended periods, making it difficult to divest quickly without significant losses.

- Specialized Assets: Real estate assets are often illiquid and cannot be easily converted to cash, further increasing the difficulty and cost of exiting the market.

- Contractual Obligations: Developers often have long-term contracts with suppliers, contractors, and buyers, which are costly and complex to terminate prematurely.

Strategic Land Replenishment

Competition for prime development land is intense, directly impacting City Developments (CDL). In 2024, Singapore's government land sales saw significant interest, with developers bidding aggressively for parcels. For instance, the tender for a residential site at Tampines North saw 10 bids, demonstrating the high demand.

CDL's proactive land replenishment strategy is therefore vital. By securing new sites through tenders and acquisitions, CDL ensures a consistent pipeline of projects, which is essential for sustained growth and market share. This approach helps them maintain a competitive edge, especially in a market where available land is a scarce resource.

- Intense Land Bidding: In 2024, government land sales in Singapore, such as the Tampines North GLS site, attracted multiple bids, underscoring fierce competition among developers.

- Strategic Replenishment: CDL's ongoing efforts to acquire land parcels are critical for maintaining its development pipeline and securing future revenue streams.

- Market Position: Consistent land acquisition allows CDL to solidify its position in a market characterized by limited land availability, thereby mitigating competitive pressures.

The competitive rivalry within Singapore's real estate sector, where City Developments Limited (CDL) operates, is notably high due to numerous developers vying for limited land and market share. This intense competition is further fueled by a mix of established local players and increasingly active international firms across residential, commercial, and hospitality segments.

As of early 2024, the market is characterized by developers differentiating themselves through design, amenities, location, and sustainability, with CDL emphasizing integrated projects and green building certifications. The high capital outlay and long development cycles, often spanning 3-5 years and requiring hundreds of millions in investment, create significant barriers to entry and exit, compelling existing players to maintain competitive strategies even in slower markets.

Competition for prime land is particularly fierce; for example, a residential site at Tampines North in early 2024 received 10 bids, highlighting aggressive developer interest. CDL's strategic land replenishment is crucial for maintaining its project pipeline and market position amidst this scarcity.

| Metric | 2023 Value | 2024 Trend Indication | Competitive Impact |

|---|---|---|---|

| Singapore Private Property Price Index Growth | 6.8% | Moderating | Increased pressure on margins, driving aggressive sales tactics. |

| Number of Bids for GLS Sites (e.g., Tampines North) | 10 bids | High demand | Intensifies land acquisition costs and competition for prime locations. |

| Average Development Cycle | 3-5 years | Consistent | Requires substantial capital commitment and long-term strategic planning, limiting agility. |

SSubstitutes Threaten

The threat of substitutes for private residential properties in Singapore is notably high due to the prevalence and affordability of public housing, specifically Housing Development Board (HDB) flats. For many Singaporeans, particularly first-time homebuyers and those looking to upgrade, HDB flats represent a practical and accessible alternative to private condominiums and apartments. This is further amplified by consistent government support through various schemes.

Government initiatives play a crucial role in bolstering the attractiveness of HDB flats. The Build-To-Order (BTO) program, which offers new flats directly from the government, and the availability of enhanced housing grants for eligible buyers significantly reduce the financial barrier to entry. For instance, in 2024, the CPF Housing Grant for first-time buyers of resale HDB flats can be as high as S$80,000, making these public housing options considerably more budget-friendly than comparable private market offerings.

For individuals and families needing housing, the rental market offers a significant substitute for property ownership, providing flexibility and lower upfront costs. City Developments Limited (CDL) itself recognizes this by operating serviced apartments within its portfolio, directly competing with traditional rental offerings.

The attractiveness of renting as an alternative to buying is influenced by factors like interest rates and property prices. In 2024, with ongoing economic shifts, the rental sector continues to be a viable option for many consumers seeking adaptable living arrangements.

Alternative investment vehicles present a significant threat to direct property ownership for investors. For instance, Real Estate Investment Trusts (REITs) allow individuals to invest in real estate portfolios without the complexities of direct property management. In 2024, the global REIT market continued its robust growth, with many markets experiencing increased investor interest due to their liquidity and income-generating potential, thereby offering a viable substitute for direct real estate investments.

Co-living and Serviced Apartments

The growing popularity of co-living spaces and serviced apartments presents a significant threat of substitutes for traditional housing and short-term accommodations. These alternatives offer flexibility and often a more budget-friendly option, especially appealing to younger demographics and those on temporary assignments. City Developments Limited (CDL) has strategically increased its exposure to this evolving market.

In 2024, the global co-living market was projected to reach approximately USD 15 billion, with a compound annual growth rate (CAGR) expected to exceed 10% through 2030. Serviced apartments also saw robust demand, with occupancy rates in major cities often surpassing those of traditional hotels. This trend directly impacts the demand for CDL's conventional rental properties and hotel operations.

- Market Penetration: Co-living and serviced apartments are capturing market share from traditional rentals and hotels, offering a compelling value proposition.

- Cost-Effectiveness: These substitutes often provide bundled services, reducing ancillary costs for residents and travelers.

- CDL's Response: CDL's investment in its living sector portfolio, including co-living and serviced apartments, aims to mitigate this threat and capitalize on new demand patterns.

- Competitive Landscape: The ease of entry for new operators in the co-living and serviced apartment sectors intensifies competition, further pressuring traditional real estate models.

Refurbishment and Renovation of Existing Properties

The threat of substitutes for new property developments by City Developments is significant, particularly from the refurbishment and renovation of existing properties. Customers, both for residential and commercial use, may opt to extensively upgrade their current spaces rather than acquire new ones.

This trend is amplified by rising new property prices. For instance, in major global cities, the cost of new commercial real estate can be prohibitive, pushing businesses towards cost-effective renovation solutions. In 2024, the global construction market saw a notable increase in renovation and refurbishment projects, driven by sustainability goals and the desire to maximize the utility of existing built assets.

- Rising Property Values: Increased costs for new builds encourage investment in existing structures.

- Cost-Effectiveness: Refurbishment often presents a lower upfront cost compared to purchasing and developing new sites.

- Asset Leverage: Property owners can enhance the value and functionality of their current holdings through renovation.

- Sustainability Focus: The environmental benefits of reusing existing buildings are increasingly appealing to both developers and end-users.

The threat of substitutes for City Developments Limited (CDL) is substantial, stemming from various alternatives that meet similar needs. Public housing, like HDB flats in Singapore, remains a primary substitute due to affordability and government support, with grants in 2024 potentially reaching S$80,000 for eligible buyers. The rental market also presents a flexible alternative, especially with economic shifts in 2024 making it a viable option for many. Furthermore, investment vehicles such as REITs offer diversification into real estate without direct ownership, a sector that saw robust growth and investor interest in 2024.

The rise of co-living and serviced apartments directly challenges traditional housing and short-term accommodations. In 2024, the global co-living market was projected to reach approximately USD 15 billion, indicating strong growth. These alternatives offer bundled services and flexibility, appealing particularly to younger demographics. CDL's strategic investments in this sector aim to address this competitive pressure and capture emerging demand.

Refurbishment and renovation of existing properties also pose a significant threat to new property developments. With rising new property prices, customers may opt to upgrade their current spaces, a trend supported by a global increase in renovation projects in 2024 driven by sustainability goals and asset utility. This approach offers cost-effectiveness and leverage of existing assets, making it an attractive substitute for new builds.

| Substitute Type | Key Characteristics | Impact on CDL | 2024 Data Point |

|---|---|---|---|

| Public Housing (HDB Flats) | Affordability, Government Grants | Reduces demand for private residential properties | CPF Housing Grant up to S$80,000 |

| Rental Market | Flexibility, Lower Upfront Costs | Competes with ownership and CDL's rental operations | Viable option amidst economic shifts |

| REITs | Liquidity, Diversification, Income | Attracts investors away from direct property investment | Robust global market growth |

| Co-living & Serviced Apartments | Flexibility, Bundled Services, Cost-Effectiveness | Challenges traditional rentals and hotels; CDL investing in this sector | Global co-living market projected at USD 15 billion |

| Refurbishment & Renovation | Cost-Effectiveness, Asset Leverage, Sustainability | Reduces demand for new property developments | Increased global renovation projects |

Entrants Threaten

The real estate development sector, including companies like City Developments, is inherently capital-intensive. Significant upfront investment is needed for land acquisition, design, construction, and ongoing operational expenses. For instance, in 2024, major urban development projects often require hundreds of millions, if not billions, of dollars in capital, making it difficult for smaller or less-established players to enter the market.

These substantial capital requirements serve as a formidable barrier to entry. New companies often struggle to secure the necessary financing, as financial institutions typically demand a robust balance sheet, proven track record, and substantial liquidity before approving large loans for development projects. This financial hurdle effectively limits the number of potential new competitors for established firms like City Developments.

New property developers face significant hurdles in acquiring prime land, particularly in land-scarce urban environments. For instance, in 2024, Singapore's land supply remains tight, with government land sales being a primary source for new projects.

Established players like City Developments Limited (CDL) benefit from substantial existing land banks, often accumulated over decades. CDL's robust portfolio, built through strategic acquisitions and development, provides a competitive edge that new entrants struggle to match in securing desirable development sites.

The real estate sector, particularly for large-scale developments like those undertaken by City Developments, faces significant barriers to entry due to stringent regulatory hurdles. Obtaining the necessary approvals, permits, and licenses is a complex and often protracted process, requiring new entrants to navigate intricate planning, environmental, and construction regulations. For instance, in Singapore, major commercial developments can take several years from initial concept to final occupancy, involving multiple government agencies and detailed impact assessments.

Brand Reputation and Track Record

Established companies like City Developments Limited (CDL), with over six decades of experience and a deeply diversified portfolio, command significant brand recognition and a solid track record. This history of successful development and management builds crucial trust with buyers, tenants, and investors alike.

New entrants face a substantial hurdle in replicating this established credibility. Building a reputation that instills confidence in the market takes considerable time and consistent performance, making it difficult for newcomers to compete directly with the established trust CDL enjoys.

- Brand Recognition: CDL's long-standing presence and numerous successful projects contribute to a widely recognized and respected brand in the real estate sector.

- Proven Track Record: Over 60 years of operation have allowed CDL to demonstrate consistent delivery and value, a difficult benchmark for new entities to match.

- Trust and Credibility: The established reputation directly translates into higher trust levels, which is vital for securing financing, attracting top talent, and securing prime development sites.

Expertise and Experience

Real estate development is a complex field demanding specialized knowledge. Newcomers often lack the foundational expertise in market analysis, project management, construction, and sales that established players like City Developments possess. This expertise gap makes it difficult for new entrants to compete effectively on large-scale projects.

City Developments, for instance, has a long history of successful project execution, building a deep bench of experienced professionals. This accumulated experience translates into better risk management and more efficient operations, creating a significant barrier for those just starting out in the industry.

- Specialized Knowledge: Market analysis, project management, construction, and sales are critical skills.

- Experienced Teams: Established firms have seasoned professionals, unlike many new entrants.

- Project Execution: Successfully managing large-scale developments requires proven capabilities.

The threat of new entrants for City Developments is generally low due to significant capital requirements, as major urban development projects in 2024 often demand hundreds of millions to billions of dollars. This financial barrier makes it challenging for smaller, less-established firms to enter the market and secure the necessary financing. Additionally, established players like City Developments benefit from decades of accumulated expertise and a strong brand reputation, which new entrants struggle to replicate quickly.

| Barrier to Entry | Impact on New Entrants | Relevance to City Developments |

|---|---|---|

| Capital Intensity | High; requires substantial funding for land, construction, and operations. | CDL's established financial strength and access to capital mitigate this. |

| Land Acquisition | Difficult; prime locations are scarce and competitive. | CDL's extensive land bank provides a significant advantage. |

| Regulatory Hurdles | Complex and time-consuming; requires navigating multiple permits and approvals. | CDL's experience streamlines this process. |

| Brand Reputation & Trust | Challenging to build; takes years of consistent performance. | CDL enjoys high trust and recognition from decades of successful projects. |

| Specialized Expertise | Requires deep knowledge in market analysis, project management, and construction. | CDL possesses a seasoned team with extensive industry experience. |

Porter's Five Forces Analysis Data Sources

Our City Developments Porter's Five Forces analysis is built upon a robust foundation of data, including municipal planning documents, real estate market reports, economic development agency publications, and demographic databases. This multi-faceted approach ensures a comprehensive understanding of the competitive landscape.