City Developments Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

City Developments Bundle

Unlock the strategic potential of your city's development portfolio with our comprehensive BCG Matrix analysis. Understand which projects are your high-growth Stars, stable Cash Cows, underperforming Dogs, or promising Question Marks, guiding your investment decisions with precision.

This preview offers a glimpse into the powerful insights the full BCG Matrix provides. Purchase the complete report for a detailed quadrant breakdown, actionable strategies for each development type, and a clear roadmap to maximize your city's economic growth and resource allocation.

Don't miss out on the crucial data that will shape your city's future. Get the full BCG Matrix today to gain a competitive edge and make informed, impactful decisions about your urban development initiatives.

Stars

City Developments Limited's (CDL) Singapore residential development launches, exemplified by The Orie, are performing exceptionally well. In Q1 2025, The Orie achieved a remarkable sales rate, with a significant portion of its units sold shortly after launch, underscoring strong buyer interest and effective marketing.

This segment of CDL's portfolio represents a high market share within a growing Singaporean property market. The robust demand, fueled by favorable economic conditions and strategic land acquisitions, positions these developments as stars in the BCG matrix, indicating strong growth potential and market leadership.

Union Square Residences, with one-third of its units sold during its early sales phase, is positioned as a "question mark" in the City Developments BCG Matrix. This mixed-use development boasts a substantial Gross Floor Area uplift due to the Strategic Development Initiative (SDI) scheme, indicating high growth potential.

Its prime location and integrated concept are expected to drive significant future market share growth within a dynamic urban setting. As it matures, Union Square Residences is anticipated to become a key revenue generator for City Developments.

The Zion Road (Parcel A) JV Project is a prime example of a Star in the City Developments BCG Matrix. Scheduled for a H2 2025 launch, this mixed-use development boasts a direct MRT connection, tapping into the high-demand segment of integrated developments. CDL anticipates capturing a significant market share with this project.

With its substantial scale, including residential towers and serviced apartments, Zion Road (Parcel A) is poised for considerable future revenue generation. This makes it a critical growth driver for CDL, aligning with its strategy to capitalize on robust market segments.

Overseas Living Sector Portfolio (PRS & PBSA)

City Developments Limited (CDL) has strategically grown its overseas living sector portfolio, focusing on Private Rented Sector (PRS) and Purpose-Built Student Accommodation (PBSA) in major global hubs. This expansion reflects a commitment to a segment demonstrating robust growth potential.

CDL's investments span key markets including the UK, Japan, Australia, and the United States. For instance, by early 2024, CDL had secured a significant presence in the UK PBSA market, owning and managing over 10,000 beds. This substantial footprint positions CDL to capitalize on the increasing demand for student housing driven by international student mobility.

- UK PBSA Market Growth: The UK PBSA market alone was projected to grow by approximately 5% annually leading up to 2024, fueled by a consistent influx of domestic and international students. CDL's substantial bed count in this sector directly correlates with this trend.

- Diversification Across Geographies: CDL's presence in Japan and Australia further diversifies its risk and taps into different growth dynamics within the living sector. Japan's aging population and increasing demand for rental properties, alongside Australia's steady population growth, present distinct opportunities.

- Strategic Acquisitions: CDL actively pursues acquisitions to expand its PRS and PBSA footprint, aiming to achieve economies of scale and operational efficiencies. This proactive approach solidifies its market share in these expanding segments.

Strategic UK Residential-led Mixed-Use Schemes

City Developments (CDL) is making significant strides in strategic UK residential-led mixed-use schemes. A prime example is the recent approval for the substantial development on the former Stag Brewery site in Mortlake, London. This project, valued at an impressive £1.1 billion, will feature 1,068 homes, underscoring CDL's capability to secure and execute large-scale projects in key international markets.

This £1.1 billion Mortlake development, slated to deliver 1,068 homes, highlights CDL's strategic focus on high-growth overseas markets. Successfully navigating the approval process for such a significant undertaking in a competitive landscape like London demonstrates CDL's strong execution capabilities and its potential for capturing substantial future market share in the UK.

- Project Value: £1.1 billion

- Number of Homes: 1,068

- Location: Former Stag Brewery site, Mortlake, London

- Scheme Type: Residential-led mixed-use

CDL's Singapore residential launches, like The Orie, are performing exceptionally well, demonstrating high market share in a growing market. The Zion Road (Parcel A) JV Project, a mixed-use development with MRT connectivity, is also positioned as a Star, expected to capture significant market share and drive future revenue.

CDL's strategic expansion into overseas living sectors, particularly UK PBSA and PRS, further solidifies its Star status. By early 2024, CDL managed over 10,000 beds in the UK PBSA market, aligning with the sector's projected 5% annual growth. Their £1.1 billion Mortlake development in London, featuring 1,068 homes, exemplifies their capability in executing large-scale, high-growth international projects.

| Project/Sector | Market Position | Key Metrics/Facts |

| The Orie (Singapore Residential) | Star | Exceptional sales rate in Q1 2025, high market share in growing Singapore market. |

| Zion Road (Parcel A) JV Project (Singapore Mixed-Use) | Star | H2 2025 launch, direct MRT connection, anticipated significant market share capture. |

| UK PBSA (Purpose-Built Student Accommodation) | Star | Over 10,000 beds managed by early 2024, sector growth ~5% annually. |

| Mortlake Development (UK Residential-led Mixed-Use) | Star | £1.1 billion project value, 1,068 homes, significant future market share potential in London. |

What is included in the product

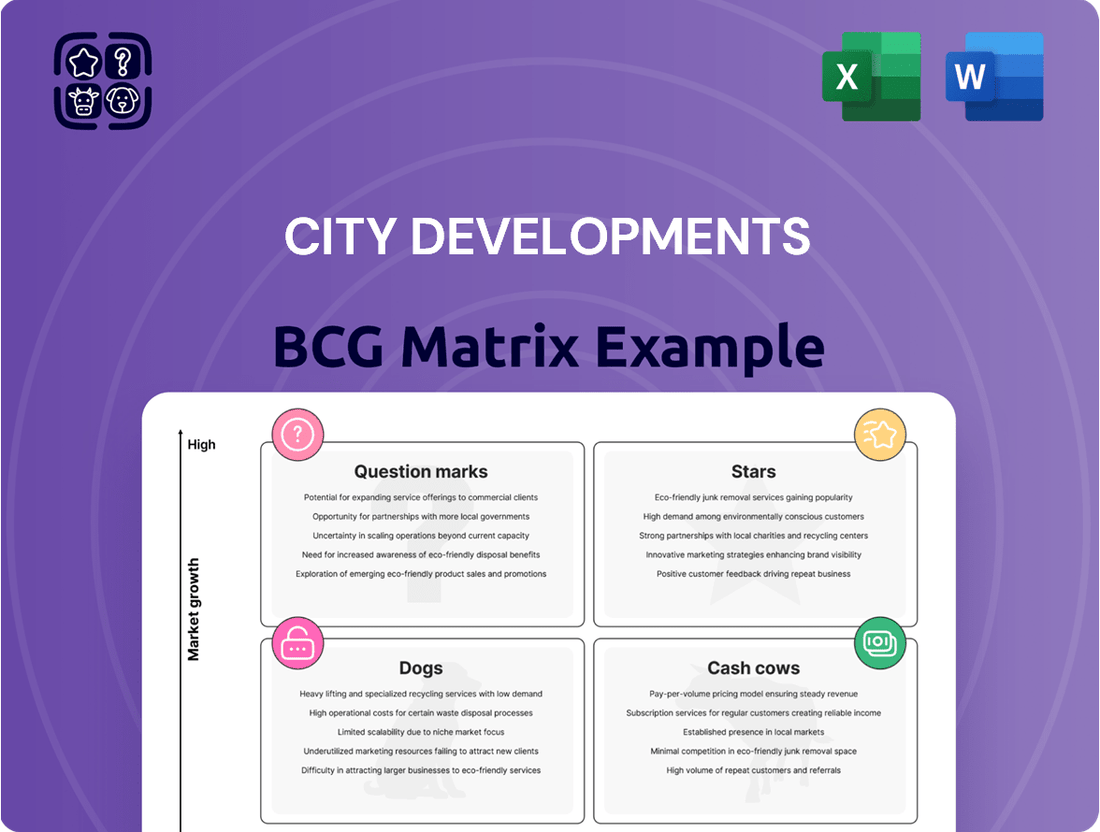

The City Developments BCG Matrix analyzes its portfolio, categorizing properties as Stars, Cash Cows, Question Marks, or Dogs based on market growth and share.

The City Developments BCG Matrix provides a clear, one-page overview, relieving the pain of complex portfolio analysis.

Cash Cows

City Developments Limited's (CDL) Singapore office portfolio stands as a prime example of a Cash Cow within its BCG Matrix. These properties consistently boast high committed occupancy rates, often exceeding the island-wide average. For instance, in the first half of 2024, CDL's Singapore office portfolio maintained a robust occupancy rate of 94.1%, a testament to its enduring appeal and strategic positioning.

Flagship assets such as Republic Plaza and City House are key contributors, showcasing strong occupancy and achieving positive rental reversions. This consistent performance ensures stable and substantial recurring income for CDL. In 2023, CDL's Singapore office segment reported a net property income of SGD 215.6 million, underscoring its reliable revenue generation capabilities.

This dominance in a mature and stable commercial real estate market signifies a significant market share, allowing CDL to generate consistent profits with relatively low reinvestment needs. The portfolio's ability to deliver steady cash flows, even amidst market fluctuations, solidifies its Cash Cow status.

City Developments' (CDL) Singapore retail portfolio, featuring assets like City Square Mall, consistently demonstrates robust committed occupancy rates, typically above 90%. This high occupancy translates into a predictable and steady stream of rental income, acting as a reliable cash cow for the company. For instance, in 2023, CDL reported stable rental income from its Singapore retail properties, underscoring their consistent performance.

While the retail sector's growth might be moderate compared to other industries, CDL's strategic approach, including ongoing asset enhancement initiatives and a strong market presence, ensures these properties continue to generate dependable cash flow. This consistent revenue generation is vital for funding other business ventures and maintaining financial stability.

Mature Singapore residential projects are City Developments' cash cows. Lumina Grand, for instance, was 98% sold as of early 2024, and Tembusu Grand reached 93% sold.

These developments are in the mature phase, meaning they are nearing full sell-through. This stage is characterized by efficient cash conversion as units are handed over and revenue is recognized.

The consistent sales and revenue from these projects provide City Developments with significant financial stability. They represent established products that have moved past their growth phase and are now reliably generating cash flow.

Established Hotel Operations in Australasia and Rest of UK/Europe

City Developments Limited's (CDL) established hotel operations in Australasia and the rest of the UK/Europe function as significant cash cows. These mature businesses consistently deliver strong financial performance, underpinning the group's overall profitability.

These regions demonstrate robust Revenue Per Available Room (RevPAR) growth. For instance, CDL's hotels in Australasia saw a notable uptick in RevPAR, fueled by both increased occupancy rates and higher average daily room rates. This consistent performance translates into stable and growing income streams for CDL's hospitality division.

- Australasia's RevPAR Growth: CDL's hotels in Australia and New Zealand have reported consistent RevPAR increases, reflecting strong demand and effective pricing strategies.

- UK/Europe Stability: Established properties in markets like the UK and Europe provide a reliable base of income, benefiting from established brand recognition and consistent tourist flows.

- Acquisition Impact: Recent strategic acquisitions, such as the Hilton Paris Opéra, are expected to further enhance the cash-generating capabilities of this segment, adding to the group's portfolio of high-performing assets.

Completed Overseas Residential Projects with High Sales

City Developments Limited (CDL) is seeing its completed overseas residential projects transition into strong cash-generating assets. These developments, having achieved substantial sales figures, now require minimal additional capital to yield returns, effectively functioning as cash cows within the company's portfolio.

For instance, CDL's Treetops at Kenmore in Australia reported a remarkable 99% sales completion. Similarly, Brickworks Park, another Australian development, reached 97% in sales. These high sell-through rates indicate a successful market reception and a swift path to revenue realization.

- Treetops at Kenmore, Australia: 99% sold, nearing completion and generating cash flow.

- Brickworks Park, Australia: 97% sold, demonstrating strong market demand and cash generation.

- Transition to Cash Cows: Projects with high sales absorption are now mature assets requiring little further investment.

- Return on Investment: These completed projects are actively contributing to CDL's earnings with minimal ongoing capital expenditure.

City Developments' (CDL) mature Singapore residential projects are reliably generating significant cash flow. Developments like Lumina Grand, at 98% sold by early 2024, and Tembusu Grand, at 93% sold, exemplify this. These projects are in their final sales stages, meaning cash is being efficiently converted as units are handed over, providing stable financial returns without substantial new investment.

| Project | Sales Status (Early 2024) | Cash Flow Contribution |

| Lumina Grand | 98% sold | High, nearing full cash conversion |

| Tembusu Grand | 93% sold | Strong, consistent revenue generation |

Preview = Final Product

City Developments BCG Matrix

The City Developments BCG Matrix preview you are viewing is the exact, fully formatted document you will receive upon purchase. This means no watermarks, no demo content, and no surprises – just a comprehensive strategic analysis ready for immediate implementation. You can be confident that the professional layout and detailed insights are precisely what you'll get to drive your urban development strategies forward.

Dogs

Certain hotel properties within City Developments, especially those located in Singapore, have seen a dip in their Revenue Per Available Room (RevPAR) during the first quarter of 2025. This underperformance, even within a generally growing hospitality sector, signals potential challenges for these specific assets.

These underperforming hotels could be categorized as dogs in the BCG matrix. Factors such as lower average room rates or reduced occupancy in particular markets are key indicators. For instance, if a Singaporean property saw its RevPAR drop by 8% in Q1 2025 compared to the previous year, while the city-state's overall hotel occupancy remained stable at 75%, it would highlight an issue specific to that asset.

The strategic decision for these underperforming properties involves a thorough evaluation of their long-term viability. This includes assessing the potential for a turnaround through strategic repositioning or operational improvements, or considering divestment to reallocate capital to more promising ventures.

The W Hotel Singapore's extensive room renovations, slated for completion in early 2026, have presented a temporary challenge for CDL Hospitality Trusts, impacting its Net Property Income (NPI). This strategic investment, while crucial for long-term competitiveness, means the hotel is currently a cash consumer with reduced revenue generation.

During this refurbishment phase, the W Hotel Singapore functions as a 'dog' within the BCG matrix for CDL Hospitality Trusts. Assets in this category require significant capital investment and offer low current returns, but they hold the potential for future growth once improvements are finalized.

Even with strong overall sales, City Developments (CDL) might have units in older or less desirable locations that are moving slowly. These could be considered dogs in their portfolio, especially if market conditions are generally good. For instance, if a project launched in 2022 is still showing low take-up rates in late 2024 despite a generally robust property market, those specific units would fit this category.

These slow-moving units are a drain on resources. They tie up capital that could be used for more profitable ventures and continue to accrue holding costs like property taxes and maintenance. CDL's 2023 annual report highlighted that while their revenue grew, managing inventory efficiently remains a key focus, especially for projects with longer sales cycles.

Strategically, CDL would need to assess these dog assets. This might involve offering incentives to speed up sales, like attractive pricing or bundled packages, or even considering a disposal if the holding costs outweigh potential future returns. The goal is to free up capital and reduce the burden of carrying underperforming inventory.

Development Projects on Hold Due to Cost Volatility

The 326-unit Toowong development in Brisbane, currently paused due to fluctuating construction expenses, represents a short-term 'dog' within City Developments' portfolio. This situation highlights how capital invested in land can become a liability when projects stall, offering no immediate returns and consuming resources.

This project exemplifies a 'dog' in the BCG matrix because it requires significant capital investment (the land) but generates no revenue or profit. As of early 2024, the Australian construction industry has faced persistent cost pressures, with material and labor expenses remaining elevated, impacting the viability of new projects.

- Project Status: Development on hold.

- Reason for Hold: Volatile construction costs.

- Unit Count: 326 units.

- Location: Toowong, Brisbane.

Non-Core or Divested Assets

City Developments Limited (CDL) strategically divests non-core assets to recycle capital, a move that often categorizes these properties as 'Dogs' within a BCG Matrix framework. These divested assets typically exhibit low returns on investment or are misaligned with CDL's evolving strategic direction. For instance, CDL's divestment of its stake in its former serviced apartment business, operating under the Ascott brand, prior to its full integration, could be seen as a move to shed underperforming or non-strategic units. This process helps optimize their property portfolio and strengthen their financial position.

The rationale behind divesting these 'Dog' assets is to unlock capital that can be reinvested into more promising ventures, thereby improving overall portfolio performance and reducing financial leverage. In 2023, CDL continued its active portfolio management, including the sale of certain properties. While specific figures for 'Dog' assets are not explicitly broken out, CDL's reported divestment activities underscore this strategy. For example, the group's focus on strengthening its balance sheet through strategic asset disposals aligns with managing a portfolio that may include underperforming assets.

- Divestment Strategy: CDL's practice of selling off non-core properties is a clear indicator of managing assets that may have previously functioned as 'Dogs' in their portfolio.

- Low Returns: These divested assets were likely characterized by low profitability or were not contributing significantly to the company's long-term growth objectives.

- Capital Recycling: The sale of these assets generates liquidity, enabling CDL to reinvest in higher-growth potential areas and improve overall portfolio efficiency.

- Portfolio Optimization: By shedding underperforming assets, CDL aims to streamline operations, reduce exposure to less profitable segments, and enhance its financial health, including reducing gearing.

Dogs in City Developments' portfolio are assets that generate low returns and have limited growth potential. These can include underperforming hotels, slow-moving property units, or stalled development projects. For example, CDL Hospitality Trusts experienced a dip in RevPAR for some Singapore hotels in Q1 2025, potentially marking them as dogs. Similarly, the paused Toowong development in Brisbane, due to construction cost volatility, represents capital tied up without generating income, a classic 'dog' characteristic.

The strategic approach to these 'dog' assets involves either significant turnaround efforts or divestment to free up capital. CDL's active portfolio management, including the divestment of non-core assets, demonstrates a commitment to shedding underperforming units. This capital recycling is crucial for reinvesting in more promising ventures and optimizing the overall portfolio performance.

CDL's 2023 annual report indicated a focus on inventory management, highlighting the ongoing challenge of slow-moving units in older or less desirable locations. These units, even in a generally robust market, consume resources and tie up capital. The strategic imperative is to either incentivize sales through pricing or packages or to divest if holding costs exceed potential future returns.

The W Hotel Singapore's extensive renovations, impacting its Net Property Income, illustrate how even strategic investments can temporarily position an asset as a 'dog'. While a cash consumer during refurbishment, its long-term competitiveness is expected to improve post-completion, a common scenario for 'dogs' with turnaround potential.

Question Marks

City Developments Limited's (CDL) new mixed-use joint venture in Shanghai's Xintiandi area, with construction slated for Q4 2025, positions it as a potential high-growth asset. This prime location in a major global city suggests significant upside, aligning with the characteristics of a question mark in the BCG matrix.

Despite ongoing challenges in China's broader property market, CDL's strategic investment in Xintiandi, a district known for its commercial vibrancy and desirability, signals confidence in its future performance. The development's success, however, remains to be seen, making it a crucial area for monitoring.

The residential component within Suzhou High-Speed Railway New Town, slated for its Q1 2026 debut, represents a classic question mark in the BCG matrix. This new market entry boasts high growth potential, a crucial factor for its classification.

However, as a nascent development, it currently holds a minimal market share. For instance, in 2024, the overall Suzhou residential market saw a 15% year-on-year increase in new home sales, reaching approximately 1.2 million square meters, indicating strong underlying demand that this new town aims to capture.

Significant capital investment is necessary to establish this project, and its future trajectory hinges on successful market penetration and operational efficiency. The project's success will be closely monitored, with early sales figures in 2026 being critical indicators of its potential to move towards a star or cash cow status, or conversely, to remain a question mark requiring continued strategic evaluation.

The M Social Hotel Sunnyvale, slated for a H2 2026 opening, is a new entrant in a saturated hotel market. As it is still under construction, it currently represents a cash drain without any revenue generation, placing it in the question mark category of the BCG matrix. Its future success hinges on capturing significant market share in a competitive landscape.

Strategic Fund Management Growth Initiatives

City Developments Limited (CDL) is strategically expanding its fund management capabilities, positioning this segment as a key growth driver. This initiative reflects a deliberate move into a high-potential market, aiming to capitalize on CDL's existing real estate expertise and network.

As a developing area for CDL, the fund management business currently represents a smaller portion of the company's overall revenue. However, its trajectory suggests significant future contributions, characteristic of a question mark in the BCG matrix, with substantial room for market share expansion and profitability growth.

CDL's fund management growth is supported by several factors:

- Strategic Partnerships: CDL has been actively forging alliances to enhance its fund management offerings and reach.

- Product Diversification: The company is broadening its range of investment products to cater to diverse investor needs.

- Market Expansion: CDL is exploring new geographical markets and investor segments to scale its fund management operations.

- Leveraging Existing Strengths: The growth strategy is built upon CDL's established reputation and deep understanding of the real estate sector.

Early-Stage Redevelopment Projects (e.g., Union Square)

Early-stage redevelopment projects, such as the Union Square initiative, are typically categorized as Question Marks within a City Developments BCG Matrix. This classification stems from their inherent characteristics: they require significant upfront investment and often face prolonged periods before generating substantial returns. The success of these ventures is heavily contingent on effective execution and prevailing market conditions once development is complete.

For instance, the Union Square redevelopment, while possessing the potential to become a Star, is currently navigating the uncertainties of its initial planning, demolition, and construction phases. These activities demand considerable capital outlay, with the payoff period being extended. The ultimate market reception and profitability remain speculative until the project reaches its mature stages.

More specifically, within the Union Square development, the residential component, Union Square Residences, exemplifies this Question Mark status. As of recent reports, only about one-third of its units have been sold, indicating ongoing market absorption challenges and reinforcing its position as a project with high potential but uncertain immediate returns.

- High Capital Outlay: Early-stage redevelopments demand substantial initial investment for planning, land acquisition, demolition, and construction.

- Delayed Returns: Revenue generation is typically deferred until later phases, often after project completion and unit sales or lease-ups.

- Market Uncertainty: Future market conditions, demand, and competitive landscapes at the time of completion are critical but difficult to predict accurately.

- Execution Risk: The success of these projects hinges on efficient project management, timely delivery, and effective marketing strategies.

Question Marks in City Developments Limited's portfolio represent ventures with high growth potential but currently low market share, requiring significant investment. These are projects in their nascent stages, where future success is uncertain but could lead to substantial returns if they capture significant market share.

For example, the M Social Hotel Sunnyvale, set to open in H2 2026, is a prime example. It's a new entrant in a competitive market, currently incurring costs without generating revenue, thus needing careful strategic evaluation to determine its future trajectory.

Similarly, the residential component of Union Square Residences, with only about a third of its units sold as of recent reports, also fits this category. Its success hinges on overcoming absorption challenges and achieving greater market penetration.

These Question Marks demand substantial capital and face execution risks, but their potential to evolve into Stars makes them critical for CDL's long-term growth strategy.

| Project/Segment | Status | Growth Potential | Market Share | Investment Needs |

| Shanghai Xintiandi JV | Under Construction (Q4 2025 completion) | High | Low (New Entry) | High |

| Suzhou High-Speed Railway New Town Residential | Pre-launch (Q1 2026 debut) | High | Low (New Entry) | High |

| M Social Hotel Sunnyvale | Pre-opening (H2 2026 opening) | Moderate to High | Low (New Entry) | High |

| Fund Management | Developing Segment | High | Low (Expanding) | Moderate to High |

| Union Square Residences | Under Development/Sales | High | Low (Approx. 33% sold) | High |

BCG Matrix Data Sources

Our City Developments BCG Matrix is built on comprehensive data, including municipal planning documents, real estate market reports, economic growth indicators, and demographic trends, ensuring a robust strategic foundation.