City Developments Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

City Developments Bundle

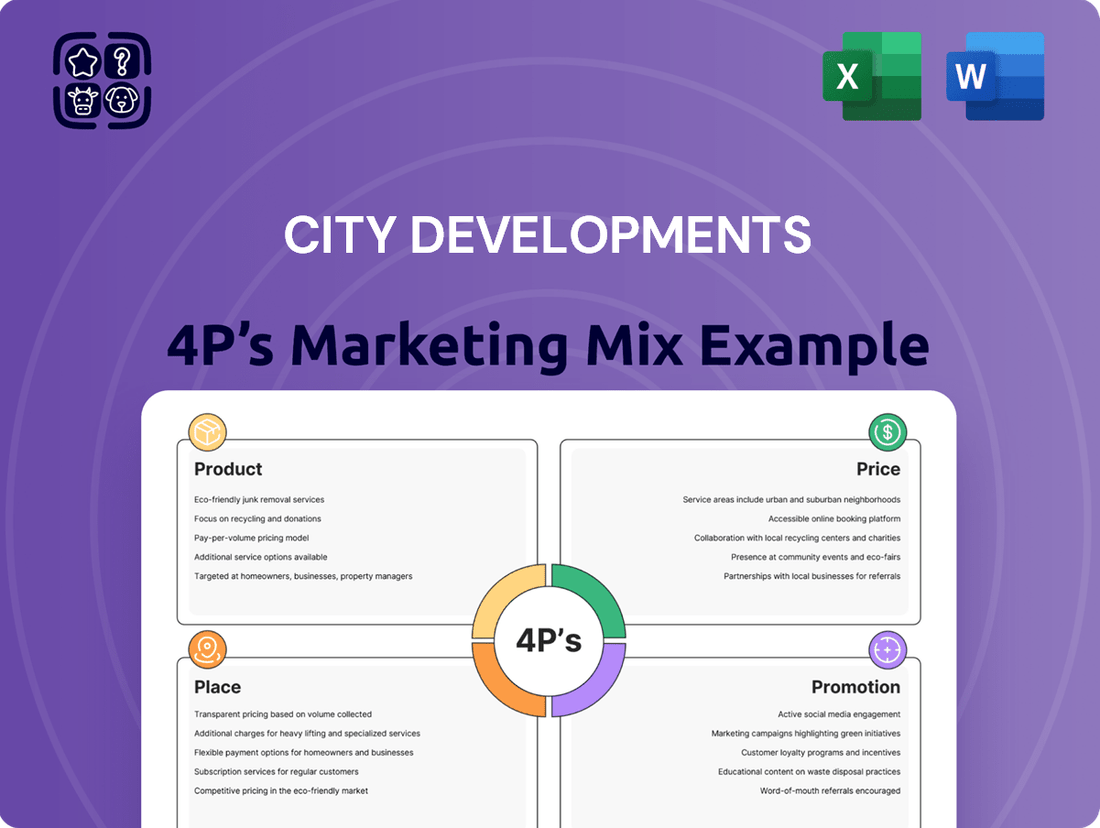

Uncover the strategic brilliance behind City Developments' market dominance by dissecting their Product, Price, Place, and Promotion. This analysis reveals how their offerings, pricing models, distribution networks, and communication strategies create a powerful market presence.

Dive deeper than the surface and gain a comprehensive understanding of City Developments' marketing blueprint. Our full 4Ps analysis provides actionable insights, ready for your strategic planning or academic research.

Save valuable time and gain expert-level insights. This editable, presentation-ready report offers a detailed breakdown of City Developments' 4Ps, empowering you with a competitive edge.

Product

City Developments Limited (CDL) showcases a diverse real estate portfolio, a key element of its marketing strategy. This includes a wide array of residential developments, catering to homeowners and investors alike.

Beyond homes, CDL's product offering extends to commercial properties, encompassing modern office buildings and bustling retail malls. This broadens their market reach and appeal to different customer needs.

Furthermore, CDL maintains a substantial hospitality segment, featuring hotels and serviced apartments. This diversification across residential, commercial, and hospitality sectors underscores their commitment to a comprehensive real estate presence.

As of late 2024, CDL's portfolio spans over 24 million square feet of gross floor area globally, with a significant portion representing these diverse property types, demonstrating their extensive market penetration.

City Developments Limited (CDL), through its subsidiary Millennium & Copthorne Hotels (M&C), boasts a significant global hospitality presence with over 160 hotels and serviced apartments. This extensive network operates in prime gateway cities worldwide, offering a diverse range of quality accommodation and services.

The hospitality segment is a crucial component of CDL's strategy, contributing substantially to its recurring income. For instance, in 2023, CDL's hospitality segment reported a revenue of SGD 1.05 billion, demonstrating its consistent financial contribution and operational strength.

Integrated mixed-use developments, such as CDL's Union Square in Singapore, represent a key product strategy. These projects strategically blend residential, commercial, and hospitality components on a single site to create vibrant urban hubs. This approach caters to a modern demand for convenience and a seamless live-work-play lifestyle.

The Union Square development exemplifies this product offering, aiming to inject new life into urban landscapes. By consolidating diverse functionalities, CDL is not just building structures but fostering integrated communities. This strategy is particularly relevant in 2024 and 2025 as urban regeneration and sustainable living become increasingly prioritized by city planners and residents alike.

Living Sector Expansion

City Developments Limited (CDL) is actively broadening its reach within the living sector, moving beyond conventional property sales. This strategic shift involves a significant investment in Private Rented Sector (PRS) assets and Purpose-Built Student Accommodation (PBSA). This diversification is key to building a more robust and predictable recurring income stream.

CDL's expansion into these alternative living segments is particularly notable in key international markets. The company has a growing presence in the UK, Japan, Australia, and the United States, territories known for their strong demand in PRS and PBSA.

This expansion strategy is designed to capitalize on evolving housing needs and demographic trends. For instance, the UK PBSA market alone saw a significant increase in student numbers, with international student enrollment reaching record highs in recent years, underscoring the demand for purpose-built accommodation.

- Diversification: CDL is expanding its living sector beyond traditional residential sales into PRS and PBSA.

- Geographic Focus: Key expansion markets include the UK, Japan, Australia, and the US.

- Recurring Income: This strategy aims to strengthen CDL's recurring income base through rental yields.

- Market Trends: The move aligns with growing demand for rental housing and student accommodation globally.

Sustainable and Quality Design

City Developments Limited (CDL) embeds sustainability and quality design as fundamental product attributes, embodying their principle of 'Conserving as We Construct.' This dedication is clearly demonstrated through their consistent pursuit of Green Mark certifications, a testament to their focus on energy efficiency and environmental stewardship.

CDL's developments align with rigorous global Environmental, Social, and Governance (ESG) standards. For instance, in 2023, CDL achieved a significant milestone by being recognized as one of the Global 100 Most Sustainable Corporations in the World by Corporate Knights for the fifth consecutive year, underscoring their commitment to long-term value creation through responsible practices.

- Green Building Leadership: CDL has a strong track record of achieving Green Mark Platinum certifications for its projects, reflecting superior environmental performance.

- ESG Integration: The company actively integrates ESG principles into its development lifecycle, from design and construction to operations and maintenance.

- Innovation in Design: CDL prioritizes innovative design solutions that enhance occupant well-being, reduce environmental impact, and ensure long-term quality and durability.

- Market Recognition: Their commitment to sustainability and quality design has earned them numerous accolades, reinforcing their brand reputation and market appeal.

City Developments Limited (CDL) offers a multifaceted product portfolio, strategically balancing residential, commercial, and hospitality assets. This diversification is key to their market penetration and revenue generation, with a growing emphasis on recurring income streams.

CDL is actively expanding into the Private Rented Sector (PRS) and Purpose-Built Student Accommodation (PBSA) in markets like the UK, Japan, Australia, and the US. This move targets evolving housing needs and aims to bolster their stable income base.

Sustainability and quality design are core product differentiators for CDL, evidenced by their consistent pursuit of Green Mark certifications and recognition as a Global 100 Most Sustainable Corporation. This commitment enhances brand value and appeals to environmentally conscious stakeholders.

| Product Segment | Key Offerings | 2023 Revenue Contribution (SGD Billion) | Global Footprint (Approx.) |

|---|---|---|---|

| Residential | Homes, apartments | N/A (Integrated in overall revenue) | Millions of sq ft developed |

| Commercial | Office buildings, retail malls | N/A (Integrated in overall revenue) | Millions of sq ft owned/managed |

| Hospitality | Hotels, serviced apartments | 1.05 | 160+ properties |

| Alternative Living (PRS/PBSA) | Rental housing, student accommodation | Emerging segment | Growing presence in UK, Japan, Australia, US |

What is included in the product

This analysis provides a comprehensive breakdown of City Developments' marketing mix, examining their Product offerings, Pricing strategies, Place (distribution) channels, and Promotion tactics.

It's designed for professionals seeking to understand City Developments' market positioning and competitive advantages through a detailed, data-driven exploration of their 4P strategies.

Alleviates the pain of complex market analysis by providing a clear, actionable framework for understanding city development strategies.

Simplifies the often overwhelming process of urban planning and marketing by offering a structured approach to the 4Ps.

Place

City Developments Limited (CDL) boasts an impressive global reach, operating in 168 locations across 29 countries and regions as of early 2024. This extensive network is a cornerstone of its marketing strategy, enabling access to a broad international customer base and diverse investment opportunities. The company's presence in key international markets allows for effective market penetration and diversification.

City Developments Limited (CDL) strategically concentrates its efforts on key global markets, including Singapore, the UK, China, Japan, the US, and Australia. This deliberate regional focus ensures its developments are situated in areas with robust demand and significant growth prospects. For instance, CDL's substantial presence in Singapore, a prime financial hub, continues to drive its revenue, with the company actively participating in land tenders and project launches throughout 2024 and into early 2025.

City Developments Limited (CDL) leverages direct sales for its residential projects, often enhanced by dedicated online platforms such as CDL Homes. These digital spaces serve as a crucial touchpoint for potential buyers, offering detailed information on upcoming and recently launched properties, facilitating inquiries and streamlining the purchasing journey.

Hotel Distribution Channels

City Developments Limited (CDL) utilizes a multi-pronged approach to hotel distribution, ensuring broad reach for its properties. This includes partnering with major Online Travel Agencies (OTAs) like Booking.com and Expedia, leveraging Global Distribution Systems (GDS) such as Amadeus and Sabre for travel agent bookings, and driving direct reservations through the Millennium & Copthorne Hotels brand website and its associated mobile app.

This strategy is crucial for maximizing occupancy and revenue. For instance, in 2024, OTAs continued to be a significant booking source for hotels globally, with revenue generated through these channels often representing a substantial portion of a hotel's total bookings. CDL's direct booking channels aim to capture a higher margin by reducing commission fees.

Key distribution channels for CDL's hotel portfolio include:

- Online Travel Agencies (OTAs): Platforms like Booking.com, Expedia, and Agoda provide extensive visibility to a global audience.

- Global Distribution Systems (GDS): Critical for reaching travel agents and corporate travel managers, ensuring inclusion in travel itineraries.

- Direct Bookings: CDL's own brand websites and mobile applications, fostering customer loyalty and reducing reliance on intermediaries.

- Wholesalers and Tour Operators: Partnerships that facilitate bulk bookings and package deals, particularly for specific markets.

Asset Management and Partnerships

City Developments Limited (CDL) actively manages its diverse portfolio of investment properties, encompassing office spaces and retail malls, to maximize their value and market presence. This strategic approach involves close collaboration with property management teams and the cultivation of strategic partnerships to ensure operational efficiency and broad market access for its commercial assets.

CDL's commitment to effective asset management is evident in its ongoing efforts to enhance property performance. For instance, as of the first half of 2024, CDL's retail segment, including properties like Republic Plaza and Quayside Isle, continues to focus on tenant mix optimization and experiential retail to drive footfall and sales. Their office portfolio, such as Republic Plaza, maintains a strong occupancy rate, reflecting successful asset management strategies in a competitive market.

- Portfolio Optimization: CDL continuously reviews and enhances its property portfolio, ensuring assets are well-positioned for current market demands.

- Partnership Development: The company actively seeks and nurtures partnerships with retail tenants and service providers to create synergistic value and improve customer experience.

- Operational Efficiency: Through diligent property management, CDL aims to reduce operational costs and improve the overall functionality and appeal of its commercial spaces.

- Market Reach: Strategic alliances and collaborations are key to expanding the market reach and visibility of CDL's office and retail properties.

Place, as a component of CDL's marketing mix, refers to the accessibility and strategic positioning of its developments. CDL's global footprint, spanning 168 locations in 29 countries by early 2024, ensures its properties are situated in high-demand, growth-oriented markets. This extensive network facilitates broad customer access and diverse investment opportunities.

Preview the Actual Deliverable

City Developments 4P's Marketing Mix Analysis

The preview you see here is the actual, comprehensive City Developments 4P's Marketing Mix Analysis document you’ll receive instantly after purchase. This means you're viewing the exact, fully completed content, ensuring no surprises and immediate usability. You can be confident that the detailed breakdown of Product, Price, Place, and Promotion for city developments is precisely what you'll download.

Promotion

City Developments Limited (CDL) leverages its comprehensive sustainability reporting as a significant promotional element within its marketing mix. The company's annual Integrated Sustainability Reports, including the 17th edition in 2024 and the upcoming 18th edition in 2025, serve as a powerful communication tool, detailing CDL's dedication to Environmental, Social, and Governance (ESG) principles. These reports effectively showcase CDL's advancements and leadership in sustainable development, resonating strongly with investors and stakeholders who prioritize corporate responsibility.

City Developments Limited (CDL) actively engages its stakeholders through a robust investor relations program. This includes detailed financial results, operational updates, and investor presentations, ensuring transparency for financially-literate decision-makers.

CDL's consistent communication via official announcements and annual general meetings fosters trust and provides crucial insights into the company's performance and strategic trajectory. For instance, CDL reported a net profit attributable to shareholders of S$236.5 million for the fiscal year ended December 31, 2023, demonstrating its financial health and operational efficiency.

City Developments Limited (CDL) leverages a robust digital presence, prominently featuring its corporate website and specialized property portals like CDL Homes. These platforms are crucial for showcasing their diverse residential and commercial projects, reaching a wide audience of potential buyers and tenants.

These digital channels go beyond simple listings, offering immersive experiences through artist impressions, detailed project specifications, and engaging virtual tours. This comprehensive digital approach, particularly evident in their 2024 and 2025 marketing efforts, aims to provide a clear and compelling view of their offerings.

For instance, CDL's commitment to digital engagement was highlighted in their 2024 campaign for the Piccadilly Grand project, which saw significant online interest and virtual tour participation, underscoring the effectiveness of their digital strategy in driving engagement and inquiries.

Public Relations and Media Engagement

City Developments Limited (CDL) actively manages its public relations and media engagement to foster a strong brand presence. This involves strategically issuing press releases to inform stakeholders about key developments such as new project unveilings, significant property acquisitions, and important corporate achievements. For instance, CDL's robust communication around its FY2023 results, which showed a net profit of S$1.3 billion, highlights their commitment to transparency and market confidence.

This proactive approach ensures CDL maintains a positive and authoritative image across both the real estate sector and the broader financial community. Their consistent media outreach generates crucial awareness for their diverse portfolio and strategic direction. CDL’s commitment to sustainability, often a key theme in their public relations, resonates with investors and the public alike, as evidenced by their consistent inclusion in sustainability indices.

CDL's public relations efforts are crucial for:

- Generating buzz and anticipation for new property launches.

- Communicating financial performance and strategic growth initiatives.

- Reinforcing the company's commitment to corporate social responsibility and sustainability.

- Building and maintaining trust with investors, customers, and the wider public.

Industry Recognition and Awards

City Developments Limited (CDL) actively utilizes its consistent industry recognition and strong ESG ratings as a key component of its marketing strategy. This recognition bolsters its brand image and reinforces its commitment to responsible business practices.

Awards and accolades serve as tangible proof of CDL's quality and leadership in the real estate sector. For instance, CDL has been consistently recognized for its sustainability initiatives, which are crucial for attracting environmentally conscious investors and tenants.

The company's dedication to environmental, social, and governance (ESG) principles is frequently highlighted through prestigious awards. In 2024, CDL received several accolades, including the BCA Green Mark Platinum Award for multiple projects, underscoring its leadership in sustainable building practices.

- Industry Accolades: CDL has been a recipient of numerous awards, including being named one of the Top 100 Global Most Sustainable Corporations by Corporate Knights in 2024.

- ESG Leadership: The company's commitment to ESG is further validated by its strong performance in ESG ratings, such as achieving an A rating from MSCI ESG Ratings for 2024.

- Brand Enhancement: These recognitions directly contribute to CDL's brand reputation, differentiating it in a competitive market and attracting stakeholders who prioritize sustainability and good governance.

- Market Differentiation: Awards for corporate governance and sustainability, like the Singapore Corporate Governance Excellence Award in 2023, provide a competitive edge and build trust with investors and the public.

City Developments Limited (CDL) effectively utilizes its strong digital presence, including its corporate website and property portals like CDL Homes, to showcase its diverse range of projects. This digital strategy, enhanced in 2024 and continuing into 2025, provides immersive experiences through virtual tours and detailed project information, aiming to attract potential buyers and tenants.

CDL's public relations efforts are crucial for generating excitement around new property launches and communicating financial performance, such as the S$1.3 billion net profit reported for FY2023. Their proactive media engagement reinforces their commitment to sustainability and corporate social responsibility, building trust with stakeholders.

The company leverages industry recognition and strong ESG ratings, like the BCA Green Mark Platinum Awards received in 2024 and an A rating from MSCI ESG Ratings for 2024, as key promotional tools. These accolades enhance brand reputation and differentiate CDL in the competitive real estate market.

CDL's investor relations program, featuring transparent financial results and operational updates, is a vital promotional aspect. For example, their net profit attributable to shareholders was S$236.5 million for the fiscal year ended December 31, 2023, demonstrating financial stability and operational efficiency.

Price

City Developments Limited (CDL) employs a value-based pricing strategy, aligning property prices with the distinct perceived value of its diverse offerings, from premium residential developments to essential commercial and hospitality assets. This approach ensures that pricing accurately reflects the unique benefits and market positioning of each segment, optimizing revenue generation across its varied portfolio.

For instance, CDL's residential projects often command premium pricing based on location, amenities, and design, reflecting strong buyer demand. In 2024, CDL reported a significant pipeline of residential projects, with average selling prices in prime districts demonstrating robust market acceptance of their value proposition. This differentiated pricing strategy allows CDL to capture maximum value from each market segment, whether it's high-net-worth individuals for luxury homes or businesses seeking prime office space.

City Developments Limited (CDL) strategically prices its residential properties by closely monitoring current market conditions, the desirability of the development's location, and the unique features of each unit. This approach ensures that their offerings are competitive and appealing to potential buyers.

For instance, CDL's recent launch of The Orie in Singapore exemplifies this market-driven pricing strategy. The development achieved an average selling price of approximately $2,704 per square foot, a figure directly influenced by robust market demand and the specific attributes of the property itself.

City Developments Limited (CDL) strategically uses acquisitions and divestments to shape its portfolio and manage its financial leverage, directly impacting its pricing strategy. For instance, CDL's successful bid for the Zion Road GLS site in Singapore for S$1.142 billion in early 2024 demonstrates a commitment to acquiring prime assets that can command premium pricing and generate strong returns.

This approach to capital management, including the acquisition of the Hilton Paris Opéra for approximately S$400 million in late 2023, allows CDL to invest in properties with significant upside potential. These strategic moves are designed to optimize the company's gearing and ensure it has the financial flexibility to pursue value-enhancing opportunities, which in turn supports its pricing decisions across its diverse real estate holdings.

Revenue Optimization in Hospitality

City Developments Limited (CDL) actively pursues revenue optimization within its hospitality segment by focusing on key performance indicators like Revenue Per Available Room (RevPAR). This strategy involves employing dynamic pricing models, implementing stringent cost controls, and investing in asset enhancements to ensure properties remain attractive and profitable. CDL's commitment to this approach is evident in its financial performance, with hotel operations achieving an 8.2% revenue increase in FY2024, demonstrating the effectiveness of these revenue-driving initiatives.

Key elements of CDL's revenue optimization strategy include:

- Dynamic Pricing: Adjusting room rates in real-time based on demand, seasonality, and competitor pricing to capture maximum revenue.

- Cost Controls: Implementing efficient operational procedures and supply chain management to minimize expenses and boost profitability.

- Asset Enhancement: Continuously upgrading and maintaining hotel properties to enhance guest experience and justify premium pricing.

Financial Performance and Gearing Considerations

City Developments Limited (CDL) balances its pricing strategies with a keen eye on financial performance, particularly its net profit and gearing ratio. While FY2024 saw a dip in revenue and profit, attributed to construction delays and increased financing costs, CDL's pricing remains focused on achieving sustainable sales and healthy returns.

The company's financial health, bolstered by strong cash reserves and liquidity, underpins its ability to navigate market fluctuations. This robust financial footing allows CDL to maintain a strategic pricing approach, even amidst challenging economic conditions.

- Net Profit Decline: CDL reported a net profit of S$177.8 million for FY2024, a decrease from S$237.3 million in FY2023, reflecting the impact of market headwinds.

- Gearing Ratio: The gearing ratio stood at a manageable 0.56 times as of December 31, 2024, indicating a sound leverage position.

- Cash Reserves: CDL maintained substantial cash and cash equivalents, providing financial flexibility for its pricing and development strategies.

- Pricing Objective: Pricing decisions are geared towards long-term value creation and market competitiveness, supported by the company's financial stability.

City Developments Limited (CDL) employs a value-based pricing strategy, aligning property prices with the distinct perceived value of its diverse offerings. This approach ensures that pricing accurately reflects the unique benefits and market positioning of each segment, optimizing revenue generation across its varied portfolio, with residential projects often commanding premium pricing based on location and amenities.

CDL's strategic pricing is heavily influenced by market conditions and development attributes, as seen with The Orie's launch achieving an average selling price of approximately $2,704 per square foot in 2024. This demonstrates a direct correlation between market demand, property features, and CDL's pricing decisions.

Furthermore, CDL's acquisitions, such as the Zion Road GLS site for S$1.142 billion in early 2024, are chosen for their potential to command premium pricing and generate strong returns. This capital management directly supports their pricing strategy by investing in assets with significant upside potential.

In its hospitality segment, CDL focuses on revenue optimization through dynamic pricing models, evident in the 8.2% revenue increase in hotel operations for FY2024. This strategy aims to capture maximum revenue by adjusting room rates based on real-time demand and market factors.

| Property Segment | Pricing Strategy Basis | Key 2024/2025 Data Points |

|---|---|---|

| Residential | Value-based, Location, Amenities, Market Demand | The Orie average selling price: ~$2,704 psf; Zion Road GLS acquisition: S$1.142 billion |

| Commercial | Market Value, Location, Tenant Demand | Not explicitly detailed for 2024/2025, but acquisition of prime assets supports premium pricing. |

| Hospitality | Dynamic Pricing, RevPAR Optimization | Hotel revenue increase: 8.2% in FY2024; Hilton Paris Opéra acquisition: ~S$400 million |

4P's Marketing Mix Analysis Data Sources

Our City Developments 4P's Marketing Mix Analysis is built upon a foundation of robust data, including official municipal planning documents, real estate market reports, and publicly available sales data. We also incorporate insights from local news archives and developer press releases to capture a comprehensive view of the market.