CCL Industries SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CCL Industries Bundle

CCL Industries, a global leader in specialty packaging and labels, boasts significant strengths in its diversified product portfolio and strong customer relationships. However, potential threats from evolving market trends and competitive pressures warrant a closer look.

Want the full story behind CCL Industries' competitive advantages, potential vulnerabilities, and strategic opportunities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

CCL Industries' status as the world's largest label company is a formidable strength, granting it significant economies of scale and a vast global footprint. This leadership position translates into substantial bargaining power with suppliers and efficient operational costs, which are crucial in the competitive packaging industry.

This market dominance is further solidified by its diverse portfolio, encompassing CCL Label, CCL Container, Avery, and Checkpoint. These segments allow CCL to serve a broad spectrum of industries, from consumer goods and healthcare to automotive and electronics, mitigating risks associated with over-reliance on any single sector. For instance, CCL Label's extensive product offerings cater to everything from beverage bottles to pharmaceutical packaging, showcasing its wide reach.

CCL Industries boasts a remarkably diversified product portfolio, encompassing everything from pressure-sensitive and extruded film materials to consumer packaging, healthcare and chemical products, and components for consumer electronics and automotive sectors. This broad offering is a significant strength, insulating the company from downturns in any single industry.

This strategic diversification extends to its end markets, serving critical sectors such as food and beverage, healthcare, electronics, and automotive. For instance, in 2023, CCL's specialty packaging segment, which includes many of these diverse end markets, demonstrated resilience, contributing significantly to the company's overall revenue stability.

CCL Industries has showcased impressive financial performance, highlighted by record earnings and sustained sales expansion. In the first quarter of 2025, the company achieved sales of $1,887.1 million, marking an 8.6% increase, driven by both organic growth and strategic acquisitions.

This robust financial standing provides CCL Industries with the capacity to fuel ongoing investments in its growth initiatives and innovative product development, positioning it well for future advancements.

Strategic Acquisitions and Global Footprint

CCL Industries has a proven track record of enhancing its market position and revenue streams through carefully selected strategic acquisitions. These acquisitions not only broaden its product offerings but also solidify its competitive advantage in key sectors.

The company's expansive global presence is a significant strength, boasting 213 production facilities strategically located in 42 countries. This extensive network allows for localized production and efficient distribution, catering to a diverse international clientele.

This vast operational footprint is crucial for serving its broad customer base effectively, ensuring timely delivery and responsiveness to regional market demands. It underpins CCL's ability to maintain strong relationships and capture market share worldwide.

- Strategic Acquisitions: CCL Industries has consistently leveraged acquisitions to drive growth and expand its market reach.

- Global Manufacturing Network: Operates 213 production facilities across 42 countries, providing a robust global manufacturing and distribution capability.

- Market Penetration: The extensive international footprint facilitates efficient service delivery to a diverse global customer base, enhancing market penetration.

Commitment to Sustainability and Innovation

CCL Industries demonstrates a strong commitment to sustainability, evidenced by its validated science-based targets for emissions reduction. This focus translates into the active development and promotion of eco-friendly packaging solutions, directly addressing growing consumer preference and regulatory mandates for environmental responsibility.

The company's dedication to innovation in sustainability is a key strength. For instance, in 2024, CCL continued to expand its portfolio of compostable and recycled-content materials, reporting a 15% year-over-year increase in sales for its sustainable product lines. This proactive approach positions CCL to capitalize on the expanding market for green packaging.

- Validated Science-Based Targets: CCL has established and is working towards clear, measurable goals for reducing its environmental impact.

- Eco-Friendly Product Development: The company actively innovates and offers packaging solutions that are compostable, recyclable, or made from recycled content.

- Market Alignment: CCL's sustainability focus aligns with increasing consumer demand and regulatory pressures for environmentally conscious products.

- Sales Growth in Sustainable Lines: A notable 15% year-over-year increase in sales for sustainable products in 2024 highlights market traction.

CCL Industries' position as the world's largest label manufacturer is a significant competitive advantage, underpinned by substantial economies of scale and a vast global operational network. This market leadership translates into strong purchasing power with suppliers and optimized cost structures, critical for success in the packaging sector.

The company's diversified product offerings across segments like CCL Label, Avery, and Checkpoint enable it to serve a wide array of industries, from consumer goods to healthcare and automotive, thereby reducing reliance on any single market. This broad market penetration, supported by its 213 production facilities in 42 countries, ensures efficient service delivery and market capture worldwide.

CCL Industries demonstrates robust financial health, evidenced by its consistent sales growth and profitability. For the first quarter of 2025, sales reached $1,887.1 million, an increase of 8.6%, driven by organic expansion and strategic acquisitions, providing capital for further investment and innovation.

| Metric | Q1 2025 | Year-over-Year Change |

| Sales | $1,887.1 million | +8.6% |

| Global Facilities | 213 | N/A |

| Countries of Operation | 42 | N/A |

What is included in the product

Analyzes CCL Industries’s competitive position through key internal and external factors, detailing its market strengths, operational weaknesses, growth opportunities, and potential threats.

Identifies potential market disruptions and internal weaknesses, enabling proactive risk mitigation for CCL Industries.

Weaknesses

CCL Industries' significant reliance on raw materials such as petrochemical commodities, particularly plastics, and pulp and paper, exposes it directly to price volatility. For instance, fluctuations in crude oil prices can directly impact the cost of plastics, a key input for many of CCL's products.

This vulnerability means that unexpected surges in raw material costs, which are often influenced by global supply and demand dynamics and geopolitical events, can squeeze profit margins. If CCL Industries is unable to fully pass these increased costs onto its diverse customer base across its segments, including specialty packaging and labels, its profitability could be negatively affected.

Global geopolitical tensions and economic fluctuations present a significant weakness for CCL Industries. These broader market dynamics, including slowing demand in specific regions or adverse currency movements, can directly impact the company's financial results. For example, the first quarter of 2025 saw the Food & Beverage segment facing profitability challenges due to slower markets and increased pricing pressures in Europe.

Launching new operational initiatives, like the RFID plant for CCL's Checkpoint segment in Mexico, can come with significant upfront costs. These investments, while crucial for future growth, often lead to a temporary dip in profitability and can strain operational efficiency during the ramp-up phase.

For instance, in the first quarter of 2024, CCL Industries reported that new plant start-ups and related initiatives contributed to a slight increase in operating expenses, impacting segment margins before the full benefits of these investments are realized.

Dependence on Specific Market Segments

CCL Industries' reliance on particular market segments presents a notable weakness. While the company operates across various sectors, a slowdown or contraction in a key area can significantly impact overall financial results. For instance, the Avery segment saw an organic sales decline in 2024, underscoring the vulnerability associated with specific product categories or market niches.

This dependence can lead to uneven performance across the business.

- Avery Segment Performance: Experienced organic sales decline in 2024.

- Market Sensitivity: Vulnerability to downturns in specific end markets.

- Growth Concentration: Potential for slower growth in mature or competitive segments.

Integration Risks of Acquisitions

CCL Industries' consistent strategy of expanding through acquisitions, while a key growth driver, inherently introduces integration risks. The complex process of merging new businesses, technologies, and operational frameworks can be challenging to execute smoothly, impacting the realization of anticipated synergies.

For instance, the acquisition of specific businesses in 2024 or early 2025 might face hurdles in aligning IT systems or harmonizing corporate cultures, potentially delaying cost savings or revenue enhancements. These integration challenges can manifest as:

- Operational Disruptions: Merging supply chains or manufacturing processes can lead to temporary inefficiencies or production slowdowns.

- Cultural Clashes: Differences in management styles and employee expectations can hinder collaboration and productivity post-acquisition.

- Failure to Achieve Synergies: Overestimating cost savings or revenue growth opportunities from an acquisition can lead to disappointment if integration is not executed effectively.

CCL Industries faces significant exposure to raw material price volatility, particularly for petrochemicals and pulp/paper. For example, the cost of plastics is directly tied to crude oil prices, and unexpected increases can pressure profit margins if not fully passed on to customers. This was evident in Q1 2025, where the Food & Beverage segment experienced profitability challenges due to slower markets and pricing pressures.

The company's reliance on specific market segments, such as the Avery segment which saw an organic sales decline in 2024, highlights a vulnerability to downturns in particular end markets or product categories. This can lead to uneven financial performance across its diverse business units.

Acquisitions, while a growth strategy, introduce integration risks. Challenges in merging systems, cultures, and operations can lead to temporary inefficiencies or a failure to realize anticipated synergies, as seen with potential hurdles in IT system alignment or cultural harmonization from recent acquisitions in 2024/early 2025.

New operational initiatives, like the RFID plant for the Checkpoint segment in Mexico, require substantial upfront investment. These investments, while strategic, can temporarily reduce profitability and strain operational efficiency during their ramp-up phase, as noted with increased operating expenses impacting segment margins in Q1 2024 due to new plant start-ups.

| Weakness | Description | Impact Example |

|---|---|---|

| Raw Material Volatility | Dependence on petrochemicals and pulp/paper exposes CCL to price fluctuations. | Q1 2025: Food & Beverage segment faced profitability challenges due to slower markets and pricing pressures. |

| Market Segment Reliance | Vulnerability to downturns in specific end markets or product categories. | 2024: Avery segment experienced an organic sales decline. |

| Acquisition Integration Risks | Challenges in merging new businesses, technologies, and operations. | Potential for IT system alignment issues or cultural clashes impacting synergy realization. |

| New Initiative Costs | Significant upfront investment for new operational projects. | Q1 2024: New plant start-ups increased operating expenses, impacting segment margins temporarily. |

Preview the Actual Deliverable

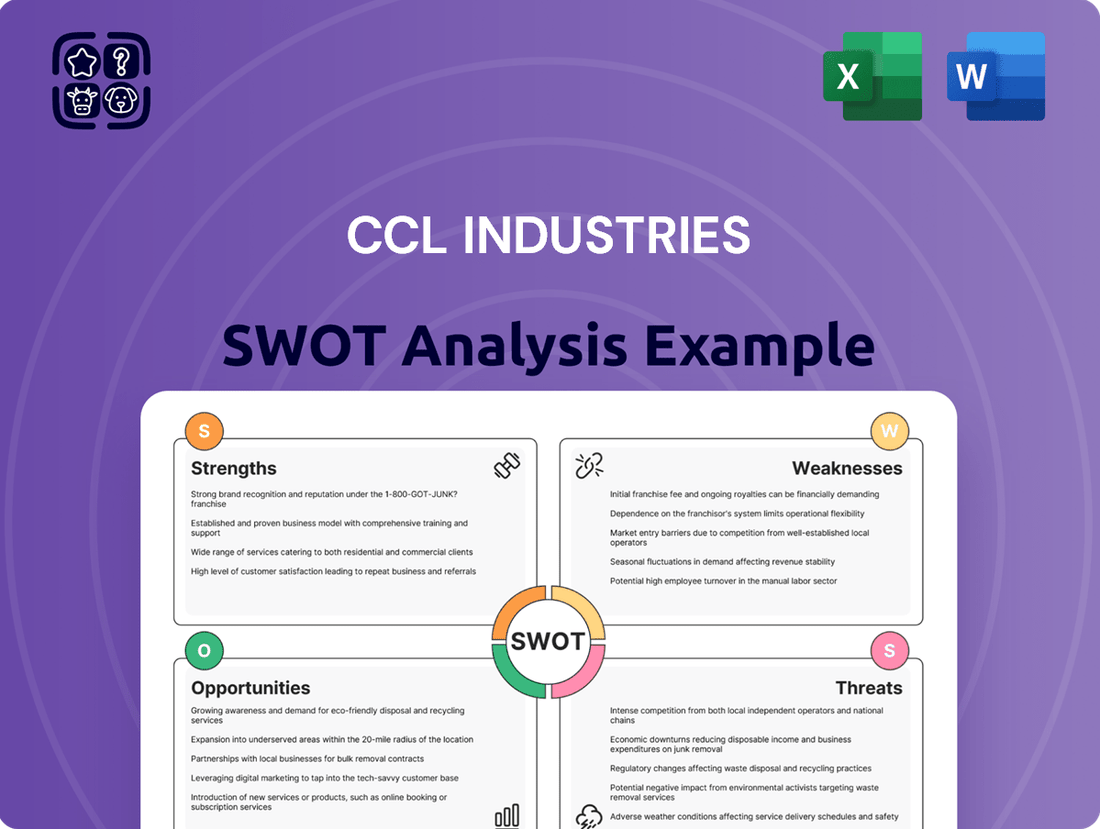

CCL Industries SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It details CCL Industries' Strengths, Weaknesses, Opportunities, and Threats, providing a comprehensive overview for strategic planning.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering actionable insights into CCL Industries' competitive landscape and future prospects.

Opportunities

The global market for sustainable packaging is experiencing robust growth, driven by heightened consumer awareness and stricter environmental regulations worldwide. This trend is a significant opportunity for CCL Industries, as it aligns with their strategic focus on developing and offering eco-friendly packaging solutions.

Consumers are increasingly prioritizing products with packaging that is recyclable, biodegradable, or compostable. This shift in preference is directly impacting purchasing decisions, creating a strong demand for sustainable alternatives. For instance, the sustainable packaging market was valued at approximately USD 280 billion in 2023 and is projected to reach over USD 450 billion by 2030, indicating a compound annual growth rate of around 7%.

CCL Industries' established expertise in specialty packaging, including their investments in innovative materials and processes, positions them favorably to capitalize on this expanding market segment. Their ability to offer a diverse range of sustainable packaging options, from recycled content to biodegradable films, allows them to meet the evolving needs of global brands and consumers alike, thereby capturing a greater share of this lucrative market.

The booming e-commerce sector is a significant tailwind for CCL Industries, directly fueling demand for their packaging labels and specialized solutions. This growth is driven by the need for product differentiation, enhanced traceability, and secure delivery in online retail environments. For instance, global e-commerce sales are projected to reach $7.4 trillion by 2025, a substantial increase from previous years, highlighting the scale of this opportunity.

Furthermore, the ongoing digital transformation within supply chains presents new avenues for CCL. The adoption of digital printing and smart labels, incorporating technologies like QR codes, RFID, and NFC, allows for improved customer engagement and greater supply chain efficiency. In 2024, the smart label market alone was valued at over $12 billion, with strong growth expected as businesses leverage these technologies.

Innovations like digital printing and AI are revolutionizing labeling and packaging. These advancements offer CCL Industries the chance to boost efficiency and cut costs. For instance, smart packaging with RFID tags can enhance inventory tracking and combat counterfeiting, a growing concern in many sectors.

CCL's strategic investments in serialization and RFID technologies position them well to capitalize on these opportunities. This proactive approach allows them to offer cutting-edge solutions that meet evolving market demands for traceability and security, potentially opening new revenue streams and strengthening customer relationships.

Growth in Emerging Markets and Specific End-Use Industries

Emerging markets, especially in Asia, are seeing significant growth due to rising urbanization and increased consumer spending power. This trend directly fuels demand for packaged goods, a core area for CCL Industries. For instance, by the end of 2024, the Asia-Pacific packaged food market was projected to reach over $300 billion, highlighting the vast potential.

Specific industries are also driving demand for CCL's specialized packaging and labeling. The healthcare sector, with its expanding pharmaceutical and medical device markets, requires high-quality, often regulated, labeling solutions. Similarly, the booming electronics industry demands sophisticated labeling for components and finished products.

- Asia-Pacific packaged food market projected to exceed $300 billion by end of 2024.

- Healthcare packaging market expected to grow substantially, driven by pharmaceutical advancements.

- Electronics sector's rapid expansion creates ongoing demand for advanced labeling technologies.

Strategic Partnerships and Collaborations

CCL Industries can significantly enhance its market standing by forming strategic partnerships with its customers. A key opportunity lies in collaborating to help clients achieve their sustainability objectives, a growing concern for many businesses. For instance, by working with customers on eco-friendly packaging solutions, CCL can solidify its role as a value-added partner.

Engaging suppliers to adopt science-based targets presents another avenue for strengthening CCL's position. This proactive approach not only supports CCL's own environmental commitments but also fosters innovation within its supply chain, potentially leading to more sustainable and cost-effective materials. This aligns with the increasing demand for transparent and responsible sourcing throughout the value chain.

Furthermore, CCL Industries can leverage participation in industry-wide initiatives and collaborations to drive growth and adapt to evolving market demands. By actively engaging in these partnerships, CCL can gain insights into emerging trends and develop solutions that address new challenges, such as the circular economy or digital integration in packaging.

- Customer Collaboration for Sustainability: Partnering with clients to meet their environmental, social, and governance (ESG) goals, thereby deepening relationships and creating a competitive advantage.

- Supplier Engagement on Science-Based Targets: Encouraging and supporting suppliers in setting and achieving science-based emissions reduction targets, enhancing supply chain resilience and environmental credentials.

- Industry Initiative Participation: Actively joining and contributing to industry associations and collaborative projects to stay ahead of market trends and regulatory changes, fostering innovation and market access.

CCL Industries is well-positioned to capitalize on the burgeoning demand for sustainable packaging solutions, a market projected to exceed $450 billion by 2030. Their expertise in eco-friendly materials and processes allows them to meet the growing consumer preference for recyclable and biodegradable options. Furthermore, the accelerating growth of e-commerce, expected to reach $7.4 trillion in sales by 2025, directly fuels the need for CCL's specialized labeling and packaging, particularly with advancements in digital printing and smart label technologies like RFID, which saw the market valued at over $12 billion in 2024.

Emerging markets, especially in Asia, present significant expansion opportunities, with the Asia-Pacific packaged food market alone projected to surpass $300 billion by the end of 2024. Key industries like healthcare and electronics are also driving demand for CCL's advanced labeling solutions. Strategic collaborations with customers to achieve sustainability goals and engaging suppliers on science-based targets are crucial for strengthening CCL's market position and fostering innovation.

Threats

CCL Industries operates within a packaging market characterized by fierce competition. This landscape includes a multitude of global corporations, regional specialists, and niche suppliers, all vying for market share. This intense rivalry often translates into significant pricing pressures, compelling companies like CCL to constantly innovate and optimize their offerings to remain competitive.

CCL Industries faces increasing regulatory pressure, particularly concerning environmental mandates like Extended Producer Responsibility (EPR) laws and anti-greenwashing regulations. These evolving rules necessitate substantial capital outlays for compliant materials and updated manufacturing processes, impacting operational costs.

The company must invest in sustainable packaging solutions and transparent reporting to meet these stricter environmental standards. For instance, the EU's Packaging and Packaging Waste Regulation, which aims for 100% recyclable packaging by 2030, presents a significant compliance challenge and opportunity for CCL.

Non-compliance with these growing regulatory frameworks, including those related to chemical usage and waste management, can lead to substantial fines and reputational damage, thereby diminishing CCL's market competitiveness in key regions.

CCL Industries faces ongoing risks from global supply chain disruptions, including shortages of key materials like corrugated cardboard and plastics. These issues, coupled with volatile raw material pricing, directly impact production schedules and the company's ability to maintain profitability. For instance, in late 2024, the cost of pulp, a key component for paper-based packaging, saw significant upward pressure due to increased demand and limited supply, directly affecting CCL's input costs.

Economic Slowdowns and Reduced Consumer Spending

Economic slowdowns and reduced consumer spending pose a significant threat to CCL Industries. A general economic downturn can directly dampen demand for packaged goods, impacting CCL's sales volumes and revenue streams. For instance, if consumers tighten their belts, they may purchase fewer discretionary items, which often rely on sophisticated packaging solutions.

This reduced consumer spending can translate into lower order volumes for CCL's various product segments, from specialty packaging to security printing. The company's financial performance is therefore sensitive to broader macroeconomic trends.

Key considerations include:

- Impact on Demand: A contraction in consumer spending directly reduces the need for packaging across diverse sectors.

- Revenue Sensitivity: CCL's revenue is closely tied to the purchasing power and confidence of consumers.

- Volume Reduction: Lower consumer demand leads to decreased production and sales volumes for CCL's products.

- Profitability Pressure: Reduced sales volumes can put pressure on profit margins due to fixed costs.

Technological Disruption and Rapid Innovation Cycles

The relentless pace of technological change poses a significant threat to CCL Industries. Competitors introducing novel printing techniques or entirely new packaging formats could quickly erode CCL's market share if the company cannot adapt swiftly. For example, advancements in digital printing technology are continuously improving quality and reducing costs, potentially disrupting traditional offset printing methods where CCL has a strong presence.

CCL must invest heavily in research and development to stay ahead of these innovation cycles. Failing to do so risks obsolescence, especially as emerging technologies like advanced material science could lead to entirely new packaging solutions that bypass current printing capabilities. The company's ability to integrate these new technologies into its operations will be crucial for maintaining its competitive edge.

- Rapid Advancements: Competitors are consistently developing new printing technologies, such as high-speed inkjet and advanced gravure, which could offer cost or quality advantages.

- Disruptive Packaging: The rise of sustainable and smart packaging materials, potentially incorporating embedded electronics or novel biodegradable components, presents a threat to traditional label and packaging formats.

- Innovation Lag: A failure to match the pace of innovation could see CCL lose market share to nimbler competitors who are quicker to adopt and scale new technological solutions.

Intense competition within the packaging sector, characterized by aggressive pricing strategies from global and regional players, directly impacts CCL Industries' profitability and market share. Furthermore, evolving environmental regulations, such as the EU's push for 100% recyclable packaging by 2030, necessitate significant capital investment in compliant materials and processes, increasing operational costs. Supply chain volatility, evidenced by the upward pressure on pulp prices in late 2024, coupled with potential economic slowdowns that reduce consumer spending, presents further challenges to revenue and sales volumes. Finally, the rapid pace of technological innovation, particularly in digital printing and advanced materials, threatens to disrupt existing market positions if CCL Industries fails to adapt swiftly.

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of robust data, drawing from CCL Industries' official financial reports, comprehensive market research, and insights from industry experts to provide a well-rounded perspective.