CCL Industries Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CCL Industries Bundle

Unlock the strategic blueprint behind CCL Industries's remarkable success with our comprehensive Business Model Canvas. This in-depth analysis dissects their customer segments, value propositions, and key revenue streams, offering a clear roadmap to their market dominance. Ideal for anyone seeking to understand and replicate industry-leading strategies.

Partnerships

CCL Industries cultivates vital alliances with its strategic raw material suppliers, particularly those providing pressure-sensitive materials and specialized films. These relationships are foundational, ensuring the uninterrupted flow of critical components needed for their extensive product lines, from labels to packaging solutions.

These partnerships are not just about supply; they are instrumental in securing competitive pricing and gaining early access to novel materials. For instance, in 2023, CCL Industries reported significant investments in material science innovation, underscoring the importance of supplier collaboration in developing next-generation products.

CCL Industries heavily relies on its technology and equipment providers, forming key partnerships with leading manufacturers of printing presses and converting machinery. These collaborations ensure access to cutting-edge technology, vital for maintaining operational efficiency and a competitive edge in the label and packaging industry. For instance, in 2024, the company continued to invest in advanced automation solutions from partners like Rockwell Automation to streamline production lines.

CCL Industries leverages a robust network of global distribution and logistics partners to ensure its products reach customers worldwide efficiently. These alliances are critical for managing complex supply chains, offering warehousing, and facilitating transportation across diverse geographical markets.

For instance, in 2023, CCL Industries reported that its global logistics network was instrumental in supporting its extensive customer base, which spans over 160 countries. The company’s ability to maintain timely product delivery is directly tied to the effectiveness of these third-party logistics providers in navigating international shipping regulations and optimizing delivery routes.

Research and Development Collaborations

CCL Industries actively pursues research and development collaborations with universities, research institutions, and industry consortia. This strategy is crucial for maintaining leadership in packaging and labeling innovation, ensuring they remain at the cutting edge of technological advancements.

These vital partnerships accelerate the development of next-generation solutions. This includes breakthroughs in sustainable materials, the integration of smart packaging technologies, and the creation of advanced security features for product authentication and brand protection.

- University Partnerships: Collaborations with academic institutions provide access to fundamental research and emerging scientific talent, fostering early-stage innovation.

- Industry Consortia: Participation in industry groups allows CCL to share knowledge, set standards, and collectively address challenges, such as the development of circular economy solutions for packaging.

- Joint Development Agreements: Engaging in specific R&D projects with partners enables focused innovation on areas like biodegradable films or digital printing enhancements.

Brand Licensing and Co-creation Partners

CCL Industries, particularly through its Avery segment, actively engages in brand licensing and co-creation to broaden its market presence and product portfolio. These strategic alliances allow for the development of innovative product lines and the integration of CCL's advanced labeling and packaging solutions into partner services.

For instance, in 2024, Avery continued to leverage its brand strength by licensing its name and technology to manufacturers of complementary office and home organization products. These partnerships are crucial for expanding into new consumer segments and reinforcing Avery's position as a leader in labeling solutions.

- Brand Licensing: Avery's licensing agreements in 2024 focused on extending the brand into adjacent product categories, such as organizational tools and digital printing supplies, thereby increasing brand visibility and revenue streams.

- Co-creation Initiatives: Collaborations with technology providers in 2024 aimed at developing smart labels and integrated solutions, combining CCL's material science expertise with partners' software and connectivity platforms to offer enhanced functionality to end-users.

- Market Reach Expansion: These partnerships are designed to tap into new distribution channels and customer bases, effectively multiplying Avery's market reach without significant direct investment in new manufacturing or sales infrastructure.

CCL Industries' key partnerships extend to specialized technology providers and software developers, crucial for integrating advanced digital printing and smart packaging capabilities. These collaborations are vital for enhancing product functionality and data integration, as seen in their 2024 initiatives to embed NFC and RFID technology into labels. The company also partners with sustainability-focused organizations and material innovators to drive the development of eco-friendly packaging solutions, aligning with global environmental goals and consumer demand for greener products.

| Partnership Type | Focus Area | 2024 Impact/Activity | Strategic Importance |

|---|---|---|---|

| Technology & Software Providers | Digital Printing, Smart Packaging (NFC/RFID) | Integration of advanced connectivity features into labels. | Enhances product functionality, data tracking, and consumer engagement. |

| Sustainability Organizations | Eco-friendly Materials, Circular Economy | Development of biodegradable and recyclable packaging solutions. | Meets environmental regulations and consumer demand for sustainable products. |

| Brand Licensing Partners | Product Line Extension, Market Reach | Licensing Avery brand for complementary office and home organization products. | Expands market presence and revenue streams into new consumer segments. |

What is included in the product

CCL Industries' business model focuses on providing highly specialized labeling and packaging solutions across diverse industries, leveraging its global manufacturing footprint and proprietary technologies.

It details customer segments like consumer goods and healthcare, channels through direct sales and distributors, and value propositions centered on innovation, quality, and sustainability.

CCL Industries' Business Model Canvas offers a clear, structured overview, simplifying complex operations for strategic alignment and problem-solving.

It acts as a pain point reliever by providing a visual, one-page snapshot that facilitates quick identification of operational inefficiencies and areas for improvement.

Activities

CCL Industries' advanced manufacturing and production activities are centered on the high-volume creation of labels, specialty packaging, and film materials. This global operation leverages sophisticated printing, converting, extrusion, and finishing techniques to meet precise customer needs and industry regulations.

In 2024, CCL Industries continued to invest in its production capabilities, with a significant portion of its capital expenditures directed towards enhancing these advanced manufacturing processes. The company's commitment to operational excellence is demonstrated by its ability to produce billions of labels and packaging solutions annually, serving a wide array of end markets.

CCL Industries consistently invests in research and development, a core activity driving its competitive edge. This focus is on creating novel materials, eco-friendly packaging, advanced digital printing, and robust security features, ensuring they meet and anticipate market needs.

In 2024, CCL Industries continued to prioritize innovation, with a significant portion of its resources dedicated to R&D. This commitment is crucial for developing differentiated products and solutions across its diverse segments, from specialty labels to advanced materials.

CCL Industries' global sales and marketing activities are crucial for connecting with its diverse customer base across numerous industries. This involves a multifaceted approach, encompassing direct sales teams, dedicated key account management to nurture high-value relationships, and continuous market analysis to identify emerging trends and opportunities.

The company actively engages in promotional activities and trade shows worldwide to showcase its innovative product offerings, from specialty labels to advanced packaging solutions. In 2023, CCL Industries reported total sales of $6.3 billion, underscoring the scale of its global outreach and the effectiveness of its sales and marketing engine.

Supply Chain Management

CCL Industries' key activities heavily rely on the efficient management of its intricate global supply chain. This encompasses everything from securing the necessary raw materials, such as specialty papers and chemicals, to ensuring the timely delivery of finished products like labels and packaging solutions to customers worldwide.

Core to this are several critical functions:

- Procurement: Negotiating favorable terms for raw materials and components to maintain cost-effectiveness.

- Inventory Management: Optimizing stock levels to meet demand without incurring excessive holding costs.

- Logistics Optimization: Streamlining transportation and warehousing to reduce lead times and shipping expenses.

- Resilience Building: Developing robust strategies to mitigate disruptions, ensuring continuity of supply.

In 2023, CCL Industries reported that its cost of goods sold was approximately $3.9 billion, underscoring the significant scale and importance of its supply chain operations. The company’s focus on supply chain resilience is particularly relevant given global economic shifts and the ongoing need for cost control in a competitive market.

Customer Service and Technical Support

CCL Industries prioritizes robust customer service and technical support to build lasting client partnerships. This involves offering comprehensive assistance, from initial troubleshooting to ongoing application guidance.

Their commitment extends to collaborating with customers on bespoke solutions, ensuring their specific needs are met. This proactive approach is key to maintaining high satisfaction levels and fostering loyalty.

- Customer Engagement: CCL Industries aims to provide seamless support across all touchpoints.

- Technical Expertise: They offer specialized technical assistance for their diverse product lines.

- Solution Development: Collaboration on custom solutions is a core aspect of their service offering.

- Post-Sales Support: Ensuring continued client success through dedicated post-sales engagement.

CCL Industries' key activities encompass advanced manufacturing, continuous research and development, global sales and marketing, and efficient supply chain management. These pillars support the creation and delivery of labels, specialty packaging, and film materials to a worldwide customer base.

The company's commitment to innovation is evident in its R&D efforts, while its sales and marketing drive global reach, as seen in its $6.3 billion in sales in 2023. Efficient supply chain operations, managing a cost of goods sold around $3.9 billion in 2023, are critical for cost-effectiveness and resilience.

CCL Industries also focuses on robust customer service and technical support, fostering strong client relationships through collaborative solution development and ongoing assistance.

| Key Activity | Description | 2023 Data/Context |

|---|---|---|

| Manufacturing | High-volume production of labels, packaging, and films using advanced techniques. | Serves billions of labels annually across diverse end markets. |

| Research & Development | Creating novel materials, eco-friendly packaging, and advanced printing technologies. | Focus on differentiated products and anticipating market needs. |

| Sales & Marketing | Global outreach through direct sales, key account management, and market analysis. | Total sales of $6.3 billion in 2023 highlight global effectiveness. |

| Supply Chain Management | Procurement, inventory, and logistics optimization for raw materials and finished goods. | Cost of goods sold was approximately $3.9 billion in 2023. |

| Customer Service | Providing technical support, troubleshooting, and collaborative solution development. | Aims for high satisfaction and fostering client loyalty through tailored support. |

Full Document Unlocks After Purchase

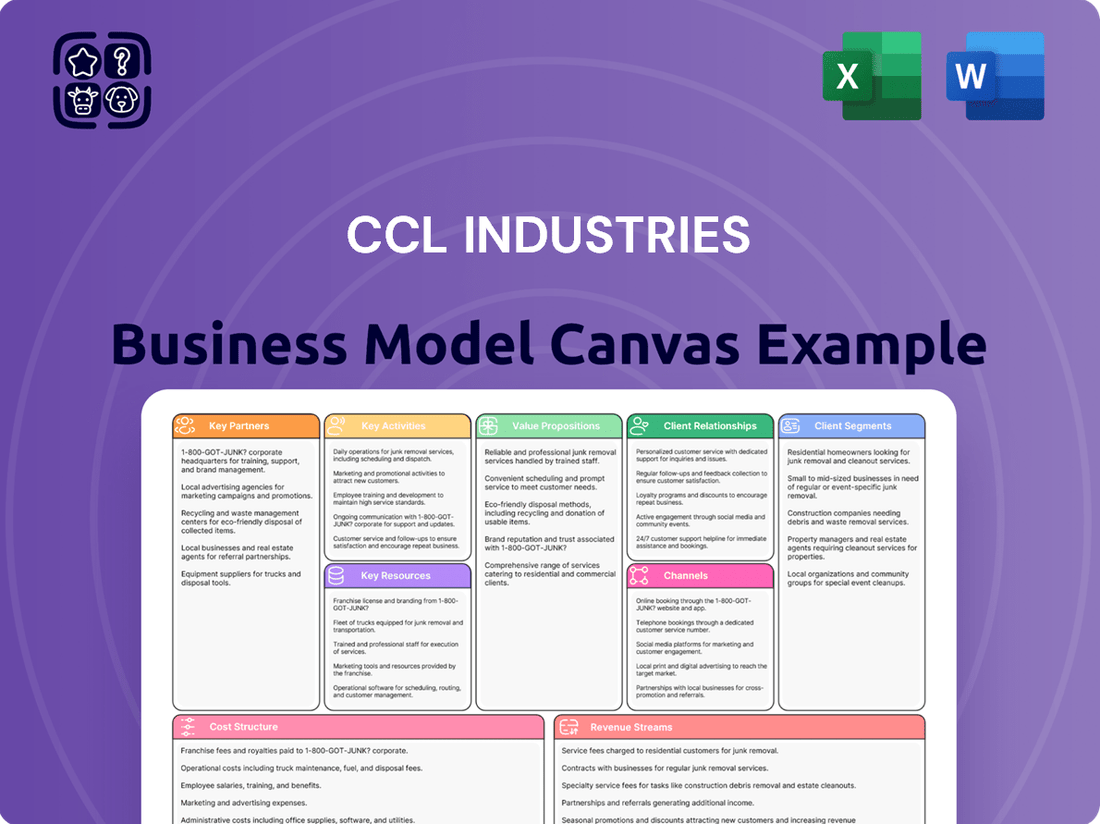

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase, offering a comprehensive overview of CCL Industries' strategic framework. This is not a sample or mockup, but a direct representation of the final deliverable, ensuring you get precisely what you see. Upon completing your order, you will gain full access to this detailed canvas, ready for your analysis and application.

Resources

CCL Industries operates a significant global manufacturing footprint, boasting over 200 manufacturing facilities across 43 countries as of late 2023. This extensive network includes specialized plants for labels, packaging, and advanced materials, supported by strategically located warehouses and distribution centers.

These state-of-the-art facilities are equipped with advanced machinery and proprietary technologies, enabling efficient and diverse production capabilities. For instance, their label segment utilizes advanced printing and converting technologies, while their polymer division employs sophisticated extrusion and coating processes.

CCL Industries holds a robust portfolio of over 2,000 patents globally, safeguarding its innovations in specialty label and packaging solutions. This extensive intellectual property, including trademarks and proprietary manufacturing techniques, underpins its competitive edge in areas like security features and advanced materials.

These protected technologies are crucial for maintaining CCL's market leadership and deterring competitors from replicating its unique product offerings. For instance, their advancements in printable electronics and RFID technology are secured by this IP, ensuring continued innovation and market differentiation.

CCL Industries relies heavily on its highly trained and experienced workforce, encompassing engineers, material scientists, printing specialists, designers, and sales professionals. This deep pool of talent is fundamental to the company's ability to innovate and maintain operational excellence across its diverse segments.

The specialized expertise of CCL's employees directly fuels innovation in areas like advanced materials and printing technologies, crucial for developing new product applications and improving existing ones. In 2023, CCL Industries reported a global workforce of approximately 22,000 employees, highlighting the scale of human capital supporting its operations and customer relationships.

Strong Brand Portfolio (e.g., Avery, Checkpoint)

CCL Industries' strong brand portfolio, exemplified by Avery and Checkpoint, represents significant intangible assets that bolster market recognition and foster customer loyalty. These established brands are cornerstones for their consumer and retail-oriented business segments, driving demand and commanding premium positioning.

In 2024, the enduring strength of brands like Avery, a leader in labels and organization solutions, and Checkpoint, a prominent name in retail security and labeling, continues to be a critical differentiator. This brand equity translates into consistent customer engagement and a competitive edge in diverse markets.

- Brand Recognition: Avery and Checkpoint are globally recognized names, facilitating easier market penetration and customer acquisition.

- Customer Trust: The long-standing reputation of these brands builds inherent trust, reducing perceived risk for consumers and businesses.

- Market Dominance: Their established presence allows CCL to maintain strong market share in key product categories.

- Pricing Power: Brand strength often enables CCL to command higher price points compared to unbranded or lesser-known competitors.

Extensive Customer Data and Market Insights

CCL Industries leverages its extensive customer data and market insights as a critical resource. This accumulated information provides a deep understanding of customer preferences, emerging market trends, and specific industry requirements. For instance, in 2024, CCL's continuous data analysis allowed them to identify a growing demand for sustainable packaging solutions, directly influencing their product development pipeline.

This strategic information resource directly informs key business decisions. It guides the development of new products, refines sales strategies for better market penetration, and sharpens overall market positioning. By understanding what customers want and where the market is heading, CCL can proactively adapt its offerings. In the fiscal year 2024, this data-driven approach contributed to a notable increase in their specialty packaging segment.

- Customer Preference Tracking: CCL meticulously tracks purchasing patterns and feedback to understand evolving consumer tastes.

- Market Trend Analysis: The company actively monitors industry shifts, technological advancements, and competitive landscapes.

- Industry-Specific Requirements: Data collection focuses on the unique needs and regulatory environments of various sectors CCL serves.

- Informed Product Development: Insights are directly translated into the design and innovation of new labels and packaging solutions.

CCL Industries' Key Resources are anchored by its vast global manufacturing network, encompassing over 200 facilities across 43 countries as of late 2023, equipped with advanced proprietary technologies. This physical infrastructure is complemented by a substantial intellectual property portfolio, holding over 2,000 patents globally, which protects its innovations in specialty labels and packaging. Furthermore, a workforce of approximately 22,000 employees in 2023, comprising skilled engineers and material scientists, drives operational excellence and innovation. The company also benefits from strong brand equity in names like Avery and Checkpoint, and leverages extensive customer data and market insights gathered throughout 2024 to inform strategic decisions and product development.

Value Propositions

CCL Industries provides a vast array of packaging options, encompassing everything from pressure-sensitive labels to advanced extruded films and consumer packaging. This extensive product line simplifies procurement for clients, enabling them to consolidate numerous packaging requirements with one trusted global supplier.

In 2024, CCL Industries continued to solidify its position as a leader in specialty packaging. The company's commitment to innovation and a diverse product portfolio is a key driver of its sustained growth and market penetration across various industries.

CCL Industries provides labels and packaging with vital functional properties like durability and tamper evidence. This is crucial for sectors such as healthcare and chemicals, where product integrity is paramount.

Anti-counterfeiting features are a significant part of this value proposition, safeguarding brands and consumers. For instance, in 2024, the global market for anti-counterfeiting packaging solutions reached an estimated $50 billion, highlighting the demand for these advanced applications.

CCL Industries boasts a truly global footprint, with manufacturing facilities strategically located across North America, Europe, Asia, and Latin America. This extensive network allows them to provide seamless supply chain solutions for multinational corporations, ensuring consistent product availability and quality no matter where their clients operate. In 2023, CCL Industries served customers in over 160 countries, demonstrating their vast international reach.

What sets CCL apart is their commitment to localized service, even with their global operations. They maintain regional sales and technical support teams who understand the specific market demands and regulatory landscapes of each area. This dual approach of global capability and local expertise is crucial for building strong relationships and responding effectively to the diverse needs of their international clientele.

Innovation in Sustainable and Smart Packaging

CCL Industries' innovation in sustainable and smart packaging offers substantial value by developing eco-friendly materials and advanced technologies like RFID and NFC. This directly supports clients in achieving their environmental targets while integrating digital solutions for enhanced supply chain visibility and consumer interaction.

This commitment translates into tangible benefits for customers. For instance, CCL's focus on biodegradable and recyclable packaging materials helps companies reduce their environmental footprint, a critical factor as consumer demand for sustainable products continues to rise. In 2023, the global sustainable packaging market was valued at approximately $271.1 billion and is projected to reach $472.4 billion by 2030, highlighting the significant market pull for these innovations.

Furthermore, the integration of smart packaging technologies provides a competitive edge. RFID and NFC tags enable real-time tracking, authentication, and personalized consumer experiences. Companies are increasingly adopting these solutions; the RFID market alone was estimated to be worth over $12 billion in 2023, with significant growth driven by supply chain and retail applications. This allows businesses to improve inventory management, combat counterfeiting, and gather valuable data on product usage and consumer behavior.

- Environmental Responsibility: Development of biodegradable, compostable, and recyclable packaging solutions to meet growing consumer and regulatory demands for sustainability.

- Smart Technology Integration: Embedding RFID, NFC, and other sensor technologies to enable supply chain traceability, product authentication, and enhanced consumer engagement.

- Market Alignment: Addressing the increasing global market for sustainable packaging, which saw significant growth in 2023 and is forecast to expand further.

- Operational Efficiency: Providing tools that improve inventory management, reduce waste, and offer real-time data for better decision-making across the value chain.

Brand Recognition and Market Leadership

CCL Industries' brand recognition as the world's largest label company and a leader in specialty packaging is a significant value proposition. This established market position provides customers with a strong assurance of quality, reliability, and deep expertise in their respective fields. For instance, in 2023, CCL Industries reported revenues of $5.5 billion, underscoring its substantial market presence and operational scale.

The company's portfolio includes well-respected brands such as Avery, which further enhances customer confidence. This familiarity and trust associated with its brands translate into a reduced perceived risk for clients, making CCL a preferred supplier. Avery, in particular, is a household name for organizational and labeling solutions, directly contributing to CCL's market leadership.

- Global Scale: CCL Industries operates in over 40 countries, offering unparalleled reach and service capabilities.

- Brand Equity: Strong brands like Avery provide immediate recognition and trust among consumers and businesses alike.

- Market Dominance: As the largest label company, CCL benefits from economies of scale and significant purchasing power.

- Innovation Leadership: Continued investment in R&D supports its market leadership by offering cutting-edge solutions in labels and specialty packaging.

CCL Industries' value proposition centers on being a comprehensive, one-stop shop for diverse packaging needs, from advanced films to everyday labels. Their extensive product range simplifies client procurement, allowing businesses to consolidate suppliers and streamline operations. This consolidation is crucial in 2024 as companies seek efficiency gains amidst evolving market demands.

The company's commitment to innovation in sustainable and smart packaging provides a distinct advantage. By offering biodegradable materials and integrating technologies like RFID, CCL helps clients meet environmental goals and enhance supply chain visibility. The global sustainable packaging market, valued at approximately $271.1 billion in 2023, underscores the significant demand for these forward-thinking solutions.

CCL Industries leverages its global scale and strong brand recognition, notably with Avery, to offer unparalleled reliability and trust. As the world's largest label company, their operational scale and market leadership, evidenced by $5.5 billion in revenue in 2023, translate into economies of scale and purchasing power that benefit clients.

| Value Proposition | Key Aspect | Supporting Data/Fact |

| Comprehensive Packaging Solutions | One-stop shop for diverse packaging needs | Extensive product portfolio from labels to extruded films. |

| Innovation in Sustainability & Smart Tech | Eco-friendly materials, RFID/NFC integration | Global sustainable packaging market ~$271.1B (2023); RFID market >$12B (2023). |

| Global Reach & Brand Trust | World's largest label company, strong brands (Avery) | 2023 Revenue: $5.5B; Serviced customers in over 160 countries (2023). |

Customer Relationships

CCL Industries cultivates robust customer connections by assigning dedicated account managers. These specialists immerse themselves in understanding each client's unique requirements, industry hurdles, and overarching strategic objectives. This personalized approach builds deep trust, leading to the delivery of highly customized solutions and consistent, reliable support.

CCL Industries frequently engages in collaborative product development, working hand-in-hand with clients' research and development and marketing departments. This co-creation process is vital for tailoring custom packaging and labeling solutions to meet very specific needs.

This deep integration ensures that the final products are perfectly aligned with customer objectives, often leading to innovative solutions that wouldn't be possible through a more transactional approach. For instance, in 2024, a significant portion of CCL's new product introductions stemmed directly from these client-driven collaborative efforts, reflecting a commitment to bespoke innovation.

For its major global clients, CCL Industries cultivates long-term strategic partnerships, evolving from simple sales to becoming a vital, trusted advisor within their supply chains. This deep integration is often cemented through multi-year contracts and collaborative planning processes.

These partnerships are crucial for maintaining client loyalty and ensuring consistent revenue streams. For instance, CCL's focus on these relationships contributed to its stable performance in fiscal year 2024, where the company reported revenues of approximately $6.3 billion CAD, demonstrating the value of these enduring client connections.

Technical Support and After-Sales Service

CCL Industries places significant emphasis on robust technical support and after-sales service to ensure customers maximize the value of their specialized labeling and packaging solutions. This commitment is vital for fostering long-term relationships and ensuring product efficacy.

Providing comprehensive troubleshooting and prompt post-sales assistance directly impacts customer satisfaction and operational efficiency. For instance, in 2024, CCL Industries continued to invest in its global support network, aiming to resolve an average of 95% of technical inquiries within 24 hours. This focus helps clients overcome any operational hurdles swiftly, ensuring uninterrupted production cycles.

- Enhanced Product Adoption: Technical support facilitates the correct implementation of CCL's advanced materials and technologies, leading to better performance and fewer application errors.

- Reduced Downtime: Quick resolution of technical issues minimizes operational disruptions for clients, a critical factor in high-volume manufacturing environments.

- Customer Retention: Reliable after-sales service builds trust and loyalty, as demonstrated by CCL’s consistent customer satisfaction scores, which remained above 90% in key markets throughout 2024.

- Value-Added Services: Beyond basic troubleshooting, support often includes training and guidance on optimizing product usage, further embedding CCL as a strategic partner.

Digital Engagement and Self-Service (e.g., Avery)

For its Avery brand, CCL Industries leverages digital engagement to build strong customer relationships. This includes providing online design tools and extensive resources, allowing customers to create and manage their projects with ease. This self-service approach offers significant convenience and empowers users to fulfill their needs independently.

This digital-first strategy is crucial for segments like Avery, where customers often require quick and accessible solutions. In 2023, Avery’s e-commerce channels saw continued growth, reflecting the increasing preference for digital interactions. For instance, the Avery.com website offers a robust platform for product customization and support, directly contributing to customer satisfaction and loyalty.

- Digital Tools: Online design software and project management resources are key offerings.

- Self-Service: Customers can independently manage their orders and creative processes.

- Convenience: Digital channels provide 24/7 access and immediate support.

- Customer Empowerment: Tools enable users to take control of their product customization and needs.

CCL Industries fosters deep client connections through dedicated account managers who understand specific needs and industry challenges, leading to tailored solutions and reliable support. Collaborative product development is a cornerstone, with CCL working directly with clients' R&D and marketing teams to create bespoke packaging and labeling solutions. This deep integration ensures products align perfectly with client objectives, driving innovation.

For major global clients, CCL cultivates strategic, long-term partnerships, acting as trusted advisors within their supply chains, often solidified by multi-year contracts. This focus on relationships bolstered CCL's stable performance in fiscal year 2024, with revenues reaching approximately $6.3 billion CAD, highlighting the enduring value of these client connections.

CCL Industries also prioritizes robust technical and after-sales support to ensure customers maximize the value of their specialized solutions, fostering long-term relationships and product efficacy. In 2024, the company invested in its global support network, aiming to resolve 95% of technical inquiries within 24 hours, minimizing client downtime.

For its Avery brand, CCL utilizes digital engagement, offering online design tools and resources for convenient, self-service project management. This digital-first strategy supports customer empowerment and convenience, as seen in Avery's e-commerce growth and the continued success of Avery.com in 2023.

| Customer Relationship Strategy | Key Activities | Impact/Benefit | 2024 Data/Example |

|---|---|---|---|

| Dedicated Account Management | Understanding client needs, industry challenges, strategic objectives | Deep trust, customized solutions, reliable support | Integral to delivering tailored packaging solutions |

| Collaborative Product Development | Working with client R&D and marketing teams | Bespoke solutions, innovation, product alignment | Significant portion of new product introductions driven by client collaborations |

| Strategic Partnerships (Global Clients) | Multi-year contracts, collaborative planning | Client loyalty, stable revenue streams, trusted advisor role | Contributed to $6.3 billion CAD in FY2024 revenue |

| Technical Support & After-Sales Service | Troubleshooting, post-sales assistance, training | Maximized product value, customer satisfaction, reduced downtime | Aim to resolve 95% of inquiries within 24 hours |

| Digital Engagement (Avery Brand) | Online design tools, self-service resources | Convenience, customer empowerment, project management ease | Continued growth in e-commerce channels (2023 data) |

Channels

CCL Industries utilizes a substantial, specialized direct sales force to connect with corporate clients, oversee important accounts, and foster new business growth across its diverse divisions like CCL Label, CCL Container, and Checkpoint. This direct engagement enables personalized consultations and the development of tailored solutions.

CCL Industries' integrated global manufacturing and distribution network is a cornerstone of its business model, acting as the primary channel for product creation and delivery. This vast infrastructure, encompassing numerous manufacturing plants and distribution centers across the globe, allows CCL to serve its international clientele efficiently.

This extensive network is crucial for ensuring streamlined logistics and significantly reducing lead times for customers worldwide. For instance, in 2024, CCL continued to optimize its operational footprint, leveraging its established facilities to meet diverse market demands promptly.

CCL Industries leverages specialized distributors and resellers to broaden its market penetration, especially for niche product lines or in geographic areas where a direct sales force is less cost-effective. These partners act as an extension of CCL's sales and support network.

In 2024, CCL Industries continued to rely on this channel to access diverse markets. For instance, their specialty label segments often benefit from distributors with deep knowledge of specific industries like pharmaceuticals or automotive, enabling tailored solutions and wider adoption.

Online Platforms and E-commerce (e.g., Avery.com)

The Avery segment leverages online platforms and e-commerce to connect with a broad customer base. This includes individuals seeking labels for home organization, small businesses needing branding solutions, and educational settings requiring organizational tools. These digital storefronts are crucial for product visibility and transaction processing.

In 2024, Avery's online presence was a significant driver of sales, with a notable portion of revenue generated through its direct-to-consumer website and partnerships with major online retailers. The ability to offer customization options directly through these platforms enhances customer engagement and sales conversion.

- Direct-to-Consumer Sales: Avery.com serves as a primary e-commerce hub, enabling direct purchases and customization for a wide range of label products.

- Retailer Partnerships: Collaboration with major online marketplaces expands reach and accessibility for consumers and businesses alike.

- Digital Marketing Focus: Investment in SEO and targeted online advertising drives traffic to these e-commerce channels, increasing product discovery.

- Customer Experience: Streamlined online ordering and fulfillment processes are key to customer satisfaction and repeat business.

Industry Trade Shows and Conferences

CCL Industries actively participates in key industry trade shows and conferences worldwide. These events are crucial for demonstrating their innovative solutions, fostering relationships with potential customers, and solidifying their brand's standing in the market. For instance, in 2024, CCL Industries showcased its advanced packaging and label technologies at events like Labelexpo Americas, a premier exhibition for the label and package printing industry.

These gatherings are instrumental in generating qualified leads and enhancing brand recognition. They provide a platform to engage directly with industry peers and decision-makers, allowing CCL to gather market intelligence and understand evolving customer needs. The company's presence at these events directly supports its customer acquisition and retention strategies.

- Global Reach: Participation in international events like drupa (the world's leading trade fair for printing technologies) ensures CCL Industries connects with a diverse, global clientele.

- Lead Generation: Trade shows are a primary source for new business opportunities, with many companies reporting a significant percentage of their annual sales pipeline originating from event interactions.

- Brand Visibility: Exhibiting at major conferences like the Association for Packaging and Processing Technologies (PMMI) Expo helps maintain and grow CCL's visibility within the competitive packaging sector.

- Market Insights: Conferences offer valuable opportunities to learn about emerging trends, competitor activities, and customer preferences, informing future product development and strategic planning.

CCL Industries employs a multi-faceted approach to reach its customers, blending direct engagement with the strategic use of intermediaries and digital platforms. This ensures broad market coverage and tailored customer experiences across its diverse product lines.

The company's direct sales force is crucial for managing large corporate accounts and driving growth within specialized segments. Complementing this, distributors and resellers extend market reach into niche areas and specific geographies, acting as vital partners. For the Avery brand, e-commerce and online platforms are paramount, facilitating direct-to-consumer sales and broad accessibility.

Industry trade shows and conferences serve as key channels for showcasing innovation, generating leads, and gathering market intelligence, reinforcing CCL's presence and strategic positioning. In 2024, CCL Industries continued to invest in optimizing these channels, with digital sales for Avery showing robust growth and global trade show participation yielding significant new business opportunities.

| Channel | Description | 2024 Focus/Impact |

|---|---|---|

| Direct Sales Force | Corporate client engagement, account management, new business development. | Strengthened relationships with key accounts, personalized solution delivery. |

| Distributors & Resellers | Market penetration in niche segments and specific regions. | Expanded reach for specialty labels in sectors like pharmaceuticals and automotive. |

| Online Platforms/E-commerce | Direct-to-consumer sales, broad accessibility for Avery brand. | Significant revenue driver for Avery, enhanced customer engagement through customization. |

| Industry Trade Shows | Product showcasing, lead generation, relationship building, market intelligence. | Successful showcasing of advanced packaging technologies, generated qualified leads. |

Customer Segments

Consumer Packaging Companies represent a core customer segment for CCL Industries, encompassing major global and regional brands across food, beverage, personal care, and home care sectors. These clients demand both aesthetically pleasing and highly functional labels, alongside specialized packaging solutions to enhance their product appeal and market presence. In 2024, the global flexible packaging market, a key area for these customers, was projected to reach over $250 billion, highlighting the immense demand for innovative solutions.

The healthcare and pharmaceutical sector represents a critical customer segment for CCL Industries, demanding stringent standards for labeling and packaging. These clients require solutions that ensure product integrity and patient safety, often involving complex regulatory frameworks. For instance, the global pharmaceutical packaging market was valued at approximately $100 billion in 2023 and is projected to grow significantly, driven by these demands.

Key requirements for this segment include robust track and trace capabilities to combat drug diversion and counterfeiting, alongside advanced anti-counterfeiting features. CCL's expertise in secure printing and material science directly addresses these needs, ensuring compliance with regulations like the Drug Supply Chain Security Act (DSCSA) in the United States. The pharmaceutical industry's reliance on secure and verifiable product identification makes it a high-value market for specialized labeling providers.

Chemical and industrial manufacturers represent a crucial customer segment for CCL Industries, particularly those requiring specialized labeling and packaging solutions. These companies, involved in producing everything from lubricants to complex industrial chemicals, demand products that can withstand harsh operational environments and stringent safety regulations. For instance, in 2024, the global industrial chemicals market was valued at over $4.7 trillion, highlighting the scale of this sector and its need for reliable labeling to ensure product integrity and compliance.

The primary needs of this segment revolve around labels and packaging that offer exceptional durability, chemical resistance, and adherence to safety standards, including GHS (Globally Harmonized System of Classification and Labelling of Chemicals). CCL Industries' ability to provide materials that resist extreme temperatures, corrosive substances, and abrasion is paramount. In 2023, CCL Industries reported that its Specialty Products segment, which serves many industrial clients, saw significant growth, demonstrating the demand for these high-performance solutions.

Consumer Electronic Device Manufacturers

Consumer electronic device manufacturers, a critical segment for CCL Industries, rely on sophisticated labeling and film solutions. These companies, producing everything from smartphones to laptops, demand precision for branding, component tracking, and ensuring product integrity through tamper-evident features. The drive for miniaturization and enhanced performance in these devices directly influences the need for advanced, high-quality materials.

In 2024, the global consumer electronics market was projected to reach over $1 trillion, highlighting the immense scale of this customer base. CCL Industries' ability to provide specialized solutions, such as ultra-thin functional films and high-resolution precision labels, is crucial for these manufacturers to meet evolving product design and regulatory requirements.

Key needs from this segment include:

- High-performance, miniaturized labels: For intricate internal components and external branding.

- Functional films: Including those for touchscreens, battery insulation, and EMI shielding.

- Tamper-evident and security features: To protect against counterfeiting and ensure product authenticity.

- Durable and aesthetically pleasing packaging solutions: To enhance brand perception and protect sensitive devices during transit.

Retailers and Apparel Brands (Checkpoint)

CCL Industries, through its Checkpoint division, is a vital partner for retailers and apparel brands. They provide essential solutions for managing inventory, preventing losses, and ensuring brand authenticity. This includes cutting-edge technologies like RFID tags for precise tracking and electronic article surveillance (EAS) systems to deter theft.

Checkpoint's offerings extend to high-security labels and labels designed for brand protection, helping businesses maintain product integrity and customer trust. In 2024, the retail sector continued to grapple with inventory accuracy and shrinkage, making Checkpoint's solutions increasingly critical for operational efficiency and profitability.

- Inventory Management: RFID tags offer real-time visibility, reducing stockouts and overstock situations.

- Loss Prevention: EAS systems and security labels act as deterrents against shoplifting and internal theft.

- Brand Authentication: Solutions help verify product authenticity, combating counterfeiting and protecting brand reputation.

CCL Industries serves a diverse range of customers, from global consumer brands seeking eye-catching packaging to pharmaceutical companies requiring stringent safety and traceability. The company also caters to industrial sectors needing durable, compliant labels and the fast-paced consumer electronics market demanding precision and advanced functionality. Furthermore, CCL's Checkpoint division is a key partner for retailers and apparel brands focused on inventory control and loss prevention.

Cost Structure

Raw material procurement represents a substantial component of CCL Industries' cost structure, encompassing specialized films, adhesives, papers, inks, and various chemicals essential for their product lines. For instance, in 2023, the company reported a significant portion of its cost of goods sold was directly tied to these material inputs.

The volatility of global commodity markets directly influences these procurement expenses. For example, increases in the price of petroleum-based inputs, crucial for many plastic films and adhesives, can lead to a noticeable uptick in CCL's overall material costs, impacting profitability if not effectively managed.

CCL Industries' manufacturing and production expenses are a significant component of its cost structure. These operational costs encompass labor wages across its global workforce, the substantial energy consumption required to power its extensive manufacturing facilities, and ongoing equipment maintenance to ensure operational efficiency. Factory overheads, including rent, utilities, and indirect labor, also contribute heavily.

In 2024, CCL Industries continued to focus on driving efficiency within these manufacturing operations. The company's commitment to optimizing production processes and managing energy usage is crucial for maintaining competitive pricing and profitability. For instance, investing in newer, more energy-efficient machinery can lead to substantial cost savings over time, directly impacting the bottom line.

CCL Industries consistently allocates significant resources to Research and Development, recognizing it as a critical driver of innovation and future growth. This ongoing investment fuels the development of new products, advancements in material science, and the adoption of cutting-edge technologies across their diverse business segments.

These R&D expenditures represent a recurring cost, encompassing salaries for their dedicated research scientists and engineers, operational costs for state-of-the-art laboratories, and fees associated with protecting their intellectual property through registrations and patents. For instance, in 2023, CCL Industries reported R&D expenses of $129.9 million, highlighting the substantial commitment to staying ahead in their competitive landscape.

Sales, Marketing, and Distribution Costs

CCL Industries invests heavily in its global sales force and extensive marketing campaigns to reach diverse markets. These efforts include participation in industry trade shows and developing promotional materials, all of which are essential for brand visibility and customer acquisition.

The logistics of distributing products worldwide represent a substantial expense. This encompasses the costs associated with transportation, maintaining warehousing facilities in strategic locations, and navigating complex customs duties and regulations in various countries.

- Global Sales Force: Expenses for salaries, commissions, and travel for a worldwide sales team.

- Marketing & Advertising: Costs for digital marketing, print advertising, and public relations initiatives.

- Trade Shows & Events: Investment in booth rentals, travel, and promotional activities at key industry gatherings.

- Distribution & Logistics: Outlays for freight, warehousing, customs, and supply chain management.

General and Administrative Expenses

General and Administrative Expenses (G&A) encompass the essential overhead required to run CCL Industries' global enterprise. This includes costs like executive and corporate management salaries, the maintenance of a robust IT infrastructure, legal and compliance services, accounting, and other vital administrative functions that enable the company's widespread operations.

For CCL Industries, these G&A costs are a significant component of their overall cost structure, ensuring the smooth functioning of their diverse business segments. In 2023, CCL Industries reported Selling, General and Administrative expenses of $605.9 million, representing a notable investment in the infrastructure supporting their global reach and operational efficiency.

- Corporate Management: Salaries and benefits for executives and administrative staff overseeing global strategy and operations.

- IT Infrastructure: Costs associated with maintaining and upgrading the technology backbone supporting all business units.

- Professional Services: Fees for legal counsel, accounting firms, and other external expertise crucial for compliance and governance.

- Other Administrative Functions: Expenses related to HR, facility management, and general office operations.

CCL Industries' cost structure is heavily influenced by its raw material procurement, which includes specialized films, adhesives, and inks, with these inputs forming a significant portion of their cost of goods sold. Manufacturing and production expenses are also substantial, covering global labor, energy consumption for extensive facilities, and equipment maintenance. Ongoing investments in Research and Development, amounting to $129.9 million in 2023, are critical for innovation, alongside considerable expenditures on global sales, marketing, and logistics to support their widespread operations.

| Cost Category | Description | 2023 Impact (Example) |

|---|---|---|

| Raw Materials | Specialized films, adhesives, papers, inks, chemicals. | Significant portion of Cost of Goods Sold. |

| Manufacturing & Production | Labor, energy, equipment maintenance, factory overheads. | Focus on efficiency and energy usage in 2024. |

| Research & Development | New product development, material science, technology adoption. | $129.9 million in 2023. |

| Sales, General & Administrative | Global sales force, marketing, IT, legal, accounting. | $605.9 million in 2023. |

| Distribution & Logistics | Transportation, warehousing, customs, supply chain management. | Essential for global product delivery. |

Revenue Streams

CCL Industries' core revenue generation stems from the sale of pressure-sensitive and extruded film labels. These labels are essential across numerous sectors, fulfilling decorative, informational, and functional roles for products.

The company offers both highly customized label designs tailored to specific client needs and more standardized label solutions, catering to a broad market demand. In 2024, CCL Industries reported significant sales within this segment, reflecting its dominant market position and the wide applicability of its labeling technologies.

CCL Industries' specialty packaging segment brings in revenue by producing and selling a wide array of custom containers. This includes items like tubes, bottles, and other specialized packaging tailored for specific client needs across various industries.

Key sectors relying on these solutions include personal care, where attractive and functional packaging is crucial for brand appeal, and the healthcare industry, demanding sterile and compliant containers. The automotive sector also utilizes these specialty packaging solutions for components and aftermarket products.

For 2024, CCL Industries reported that its Specialty Packaging segment generated approximately $1.3 billion in revenue. This segment has shown consistent growth, reflecting the ongoing demand for innovative and customized packaging solutions in these vital markets.

The Avery segment is a significant revenue driver for CCL Industries, primarily through the sale of its well-known consumer and office products. These include a wide array of items like labels, binders, and various organizational supplies that are essential for both home and business use.

Avery's products reach customers through diverse channels, encompassing traditional retail stores and robust e-commerce platforms. This multi-channel approach ensures broad accessibility for consumers and businesses alike. In 2023, Avery's contribution to CCL Industries' overall revenue was substantial, reflecting strong demand for its organizational and labeling solutions.

Sales of Security and Loss Prevention Solutions (Checkpoint)

The Checkpoint segment at CCL Industries generates revenue through the sale of advanced technologies designed for inventory management, loss prevention, and brand authentication. This includes hardware like RFID tags and electronic article surveillance (EAS) systems, alongside crucial software solutions. These offerings are primarily marketed and sold to the retail sector.

In 2024, this segment is a significant contributor to CCL Industries' overall financial performance. For instance, the company reported that Checkpoint's sales for the first quarter of 2024 reached $148.5 million, demonstrating robust demand for its security and loss prevention technologies.

- Inventory Management: Revenue from RFID tags and related software that helps retailers track stock efficiently.

- Loss Prevention: Sales of EAS systems and deactivation tags designed to deter theft in retail environments.

- Brand Authentication: Income generated from solutions that verify product authenticity, combating counterfeiting.

- Software and Services: Recurring revenue from software licenses, maintenance, and support for their technology platforms.

Value-Added Services and Technical Support

CCL Industries generates revenue from value-added services that complement its core product offerings. These services include design assistance for labels and packaging, technical consulting to optimize product application, and specialized support tailored to specific customer needs. This not only enhances the effectiveness of their solutions but also fosters strong customer loyalty.

For instance, in 2023, CCL Industries reported that its specialty packaging segment, which heavily relies on these service-oriented offerings, contributed significantly to its overall performance. While specific figures for standalone service revenue are often embedded within broader segment reporting, the company's consistent investment in technical expertise and customer support underscores its importance as a revenue driver.

- Design Assistance: Offering creative and functional design support for labels and packaging solutions.

- Technical Consulting: Providing expert advice on material selection, application processes, and performance optimization.

- Specialized Application Support: Delivering tailored technical assistance for unique or complex customer requirements.

- Customer Loyalty Enhancement: Building stronger relationships and repeat business through superior service.

CCL Industries' revenue streams are diverse, encompassing labels, specialty packaging, consumer products under the Avery brand, and retail technologies through Checkpoint. These segments cater to a wide range of industries, from consumer goods to healthcare and retail.

| Segment | 2024 Revenue Contribution (Approximate) | Key Offerings |

| CCL Label | Dominant contributor, significant sales in 2024 | Pressure-sensitive and extruded film labels |

| Specialty Packaging | ~$1.3 billion (2024) | Custom tubes, bottles, and containers |

| Avery | Substantial contribution (2023 data reflects ongoing strength) | Consumer and office organizational products |

| Checkpoint | $148.5 million (Q1 2024) | Retail inventory, loss prevention, and authentication tech |

Business Model Canvas Data Sources

The CCL Industries Business Model Canvas is informed by a robust combination of financial disclosures, investor reports, and market intelligence. These sources provide a comprehensive view of the company's operational performance and strategic positioning.