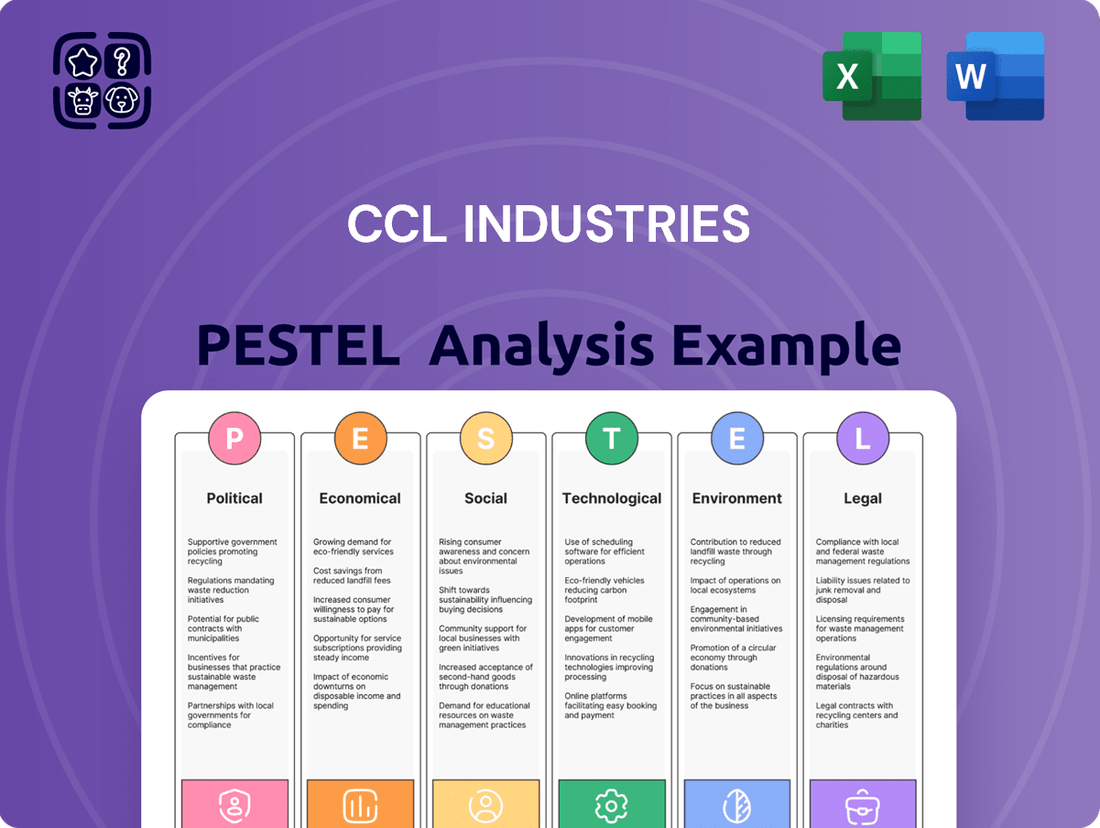

CCL Industries PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CCL Industries Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping CCL Industries's trajectory. Our expertly crafted PESTLE analysis provides actionable intelligence to navigate market complexities and identify strategic opportunities. Download the full version now to gain a competitive edge and make informed decisions.

Political factors

CCL Industries' extensive global footprint means it's constantly navigating a complex web of government regulations and trade policies. These can range from environmental standards to labeling requirements, all of which impact operational costs and market access. For instance, the ongoing discussions around potential tariffs in early 2025 could directly influence CCL's supply chain expenses and the competitiveness of its products, especially within its Avery division, which serves a broad consumer market.

However, this global presence also presents opportunities. As trade landscapes shift, CCL is well-positioned to help its clients adapt their own supply chains. This ability to provide solutions and mitigate disruptions can translate into stronger client relationships and potentially capture market share from less adaptable competitors, demonstrating the dual nature of regulatory and trade policy impacts.

CCL Industries operates within a decidedly tense geopolitical landscape, a reality they themselves have acknowledged. This volatility creates significant uncertainty in global business environments, directly impacting economic conditions and market stability.

The company's operations are susceptible to disruptions stemming from these geopolitical stress points. Such events can directly affect sales orders, leading to unpredictable fluctuations in demand and revenue streams.

Navigating complex international relations becomes paramount for CCL Industries. For instance, trade disputes or sudden policy shifts in key markets could materially alter their operational costs and market access, as seen in the ongoing trade tensions impacting global supply chains in 2024.

The growing implementation of Extended Producer Responsibility (EPR) laws, with notable examples including the UK's 2024 implementation and various US states, presents a significant political factor for packaging manufacturers like CCL Industries. These regulations are designed to minimize packaging waste, enhance recyclability clarity, and combat misleading environmental claims, pushing CCL to re-evaluate its packaging approaches and allocate capital towards more eco-friendly alternatives.

Local and Regional Government Initiatives

CCL Industries actively partners with local and regional governments on various initiatives. For example, its involvement in reforestation programs supported by the Mexican government demonstrates a commitment to environmental responsibility within specific operating areas. These collaborations are crucial for maintaining CCL's social license to operate and can lead to preferential treatment or regulatory advantages.

Such government engagement can translate into tangible benefits. In 2024, CCL Industries reported successful community projects in several Latin American regions, directly contributing to local sustainability goals. These partnerships often align with broader governmental objectives, potentially unlocking access to grants or tax incentives for environmentally conscious operations.

- Reforestation Support: CCL's participation in government-backed tree-planting programs, like those in Mexico, enhances its environmental credentials.

- Community Relations: Collaborations with local authorities strengthen CCL's social license to operate, fostering positive relationships.

- Regulatory Alignment: Engaging with regional governments ensures compliance and can lead to favorable regulatory outcomes.

Policy Support for Sustainable Practices

Governments globally are actively encouraging sustainable operations through various policies and financial incentives. CCL Industries' adherence to science-based emissions reduction targets, which are validated by the Science Based Targets initiative (SBTi), directly supports this worldwide movement towards environmental accountability. This alignment positions CCL to potentially benefit from future governmental support for businesses prioritizing green manufacturing.

For instance, as of early 2024, many nations are rolling out tax credits and subsidies for companies investing in renewable energy and energy-efficient technologies. CCL's own sustainability report for 2023 highlighted a 7% reduction in Scope 1 and 2 greenhouse gas emissions compared to their 2022 baseline, demonstrating tangible progress that aligns with these policy trends.

- Governmental Push: Increasing global policy focus on sustainability.

- SBTi Alignment: CCL's validated science-based targets resonate with environmental goals.

- Incentive Potential: Future policy support for green manufacturing practices is likely.

- Performance Data: CCL achieved a 7% GHG emission reduction in 2023.

Governmental policies worldwide are increasingly emphasizing sustainability and waste reduction, directly impacting CCL Industries. The implementation of Extended Producer Responsibility (EPR) laws in regions like the UK and various US states in 2024 and 2025 necessitates adjustments in packaging strategies to meet recyclability and waste management mandates.

Geopolitical instability creates significant uncertainty, affecting CCL's global operations and sales. Trade disputes and policy shifts in key markets, as seen with ongoing trade tensions in 2024, can alter operational costs and market access, requiring agile responses to maintain profitability.

CCL's proactive engagement with governments on environmental initiatives, such as reforestation programs in Mexico, strengthens its social license to operate. These collaborations, aligned with national sustainability goals, can unlock access to grants and tax incentives, as demonstrated by successful community projects in Latin America in 2024.

The global drive towards environmental accountability, supported by government incentives for green manufacturing, aligns with CCL's commitment to science-based emissions reduction targets. CCL's reported 7% reduction in Scope 1 and 2 GHG emissions in 2023 positions it favorably to capitalize on potential future policy support.

| Political Factor | Impact on CCL Industries | Example/Data (2024-2025) |

|---|---|---|

| Regulatory Compliance | Operational costs, market access, product design | EPR laws implementation (UK, US states) |

| Geopolitical Stability | Sales volatility, supply chain disruption | Global trade tensions impacting supply chains |

| Governmental Incentives | Cost savings, operational advantages | Tax credits for renewable energy investments |

| Environmental Policy | Investment in sustainable practices, brand reputation | CCL's 7% GHG emission reduction (2023) |

What is included in the product

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing CCL Industries, providing a comprehensive overview of the external forces shaping its operations and strategic direction.

A clear, actionable summary of CCL Industries' PESTLE factors, enabling rapid identification of opportunities and threats to inform strategic decision-making.

Economic factors

The global packaging market is on a strong growth trajectory, with projections indicating significant expansion driven by overall economic and demographic trends. Emerging markets, in particular, are expected to be key drivers as rising disposable incomes boost consumer spending on packaged goods.

CCL Industries' financial health is closely linked to these global economic dynamics. When economies are robust and consumers feel confident, they tend to spend more, which directly translates into higher demand for the various packaging solutions CCL provides for everyday products.

For instance, the International Monetary Fund (IMF) projected global growth to be around 3.2% in both 2024 and 2025, indicating a generally favorable environment for consumer-driven industries. This sustained growth underpins the demand for packaged consumer staples and discretionary items, benefiting companies like CCL.

Fluctuations in raw material prices, such as corrugated cardboard, petrochemicals for plastics, paper, and adhesives, directly influence CCL Industries' profitability. For instance, a significant surge in paper pulp costs throughout the latter half of 2024 presented a considerable hurdle, impacting production expenses.

These price increases can strain manufacturing timelines and escalate overall operational costs for CCL Industries. The volatility in commodity markets, particularly for petrochemical derivatives used in plastic films, creates an ongoing challenge for cost management and pricing strategies.

As a global player, CCL Industries' financial health is significantly shaped by fluctuations in foreign currency exchange rates. These movements can either boost or diminish the value of its international sales and profits when converted back to its reporting currency.

In the first quarter of 2025, CCL Industries experienced a positive impact from foreign currency translation on its sales, indicating that the currencies of countries where it operates strengthened relative to its reporting currency. This trend is expected to continue, with projections for 2025 suggesting a modest tailwind from currency translations, providing a slight uplift to overall financial performance.

Acquisitions and Capital Investments

CCL Industries consistently allocates substantial capital towards strategic acquisitions and investments in new technologies and expanded production capabilities. These moves are fundamental to their global growth strategy and aim to solidify their market position. For instance, the company has earmarked approximately $485 million for capital expenditures in 2025, reflecting a strong commitment to future expansion and innovation.

These significant capital outlays directly fuel CCL's ability to integrate new businesses and upgrade existing infrastructure. This proactive investment approach is designed to enhance operational efficiency, broaden their product offerings, and ensure they remain at the forefront of technological advancements within their industry. Such strategic financial commitments are vital for sustained competitive advantage and long-term value creation.

Key areas benefiting from these investments include:

- Global Expansion: Funding new facilities and market entry in emerging regions.

- Technology Enhancement: Upgrading manufacturing processes for greater efficiency and new product development.

- Capacity Building: Increasing production volumes to meet growing global demand.

- Strategic Acquisitions: Integrating complementary businesses to expand market reach and product portfolios.

Shareholder Returns and Financial Health

CCL Industries' financial health is a key indicator of its operational strength and its capacity to reward its investors. The company's ability to generate substantial free cash flows underpins its shareholder return strategies, including share repurchases and dividend increases.

In the first quarter of 2025, CCL Industries demonstrated this commitment by repurchasing a significant number of its shares and simultaneously raising its annual dividend. This move reflects a strong balance sheet and a clear strategy to enhance shareholder value through direct capital returns.

- Free Cash Flow Generation: CCL Industries consistently aims to produce robust free cash flows, which are crucial for funding operations, investments, and shareholder distributions.

- Share Repurchases: The company actively engages in share buyback programs, reducing the number of outstanding shares and potentially increasing earnings per share.

- Dividend Growth: CCL Industries has a history of increasing its annual dividend, signaling confidence in its ongoing profitability and commitment to providing income to shareholders.

- Financial Stability: These actions are supported by a solid financial foundation, allowing the company to navigate market fluctuations while prioritizing shareholder returns.

Economic factors significantly influence CCL Industries' performance, with global growth projections for 2024 and 2025, around 3.2% according to the IMF, creating a generally positive demand environment for packaged goods. However, volatility in raw material prices, such as paper pulp and petrochemicals, directly impacts CCL's profitability and operational costs. Fluctuations in foreign currency exchange rates also play a crucial role, with recent trends in early 2025 showing a positive translation impact on CCL's sales.

| Economic Factor | Impact on CCL Industries | 2024/2025 Data/Projection |

|---|---|---|

| Global Economic Growth | Drives demand for packaged goods, benefiting CCL. | IMF projects 3.2% global growth for 2024 and 2025. |

| Raw Material Prices | Affects profitability and operational costs. | Paper pulp costs surged in late 2024; petrochemical prices remain volatile. |

| Foreign Exchange Rates | Impacts international sales and profits. | Positive currency translation impact on Q1 2025 sales; modest tailwind projected for 2025. |

What You See Is What You Get

CCL Industries PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis for CCL Industries delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic outlook.

What you’re previewing here is the actual file—fully formatted and professionally structured, offering a detailed breakdown of the PESTLE elements relevant to CCL Industries. You'll gain insights into market trends, competitive landscapes, and potential challenges and opportunities.

Sociological factors

Consumers are increasingly scrutinizing the environmental footprint of products, with a growing preference for packaging that aligns with sustainability values. This shift directly impacts CCL Industries, necessitating a focus on innovative materials and design. For instance, a 2024 survey indicated that over 70% of consumers consider sustainability a key factor in their purchasing decisions, particularly for packaged goods.

This evolving demand compels CCL Industries to invest heavily in research and development for biodegradable, compostable, and high-recycled-content packaging solutions. The company's 2024 annual report highlighted a 15% increase in R&D expenditure dedicated to sustainable packaging technologies, aiming to meet this burgeoning market need across its label and packaging segments.

Modern consumers increasingly value convenience, driving a strong demand for products that are easy to use and transport. This trend is evident in the preference for smaller, more portable packaging formats across various consumer goods sectors. For CCL Industries, this means a significant influence on how their labeling and packaging solutions are designed and the materials used, particularly for everyday items.

The shift towards on-the-go lifestyles means that packaging must be not only functional but also user-friendly for consumers who are often multitasking. This has led to innovations in resealable packaging and single-serving options, areas where CCL's expertise in specialty labels and packaging is crucial. In 2024, the global market for convenient food packaging alone was projected to reach over $200 billion, highlighting the scale of this consumer preference.

Societal trends are increasingly emphasizing health and safety, especially within the pharmaceutical and food industries. This heightened awareness directly fuels the need for sophisticated labeling and packaging that guarantees product integrity and allows for thorough traceability. CCL Industries, through its specialized healthcare packaging and tamper-evident labeling solutions, is well-positioned to meet these evolving consumer and regulatory demands.

Digitalization of Consumer Experience

The increasing shift towards e-commerce, projected to reach over $7 trillion globally by 2025, is fundamentally reshaping consumer expectations for packaging. This digital transformation fuels a demand for more interactive and informative packaging solutions.

CCL Industries is responding by integrating technologies like QR codes and RFID into their products. These advancements not only enhance brand engagement, allowing for direct consumer interaction through AR experiences, but also bolster supply chain transparency, a critical factor in efficient online retail operations.

This trend is supported by data showing that 70% of consumers are more likely to purchase a product if the packaging offers additional information or interactive features. For CCL, this translates into opportunities to provide value-added services beyond traditional labeling and packaging.

- Global e-commerce sales are anticipated to surpass $7 trillion by 2025.

- 70% of consumers favor packaging with interactive elements or extra information.

- Integration of technologies like QR codes and RFID enhances consumer engagement and supply chain visibility.

Aging Population and Household Demographics

Demographic shifts are significantly reshaping packaging needs. In developed nations, the aging population is growing, with projections indicating that by 2030, over 20% of the population in many OECD countries will be aged 65 and over. This trend directly influences demand for packaging that is easier to handle, such as resealable and easy-open features. For instance, the global market for elder-friendly packaging is expected to reach approximately $120 billion by 2027, highlighting a substantial opportunity.

Simultaneously, there's a noticeable rise in single-person households across many regions. In the United States, for example, the number of single-person households has steadily increased, representing over 28% of all households as of 2022. This demographic change drives demand for smaller, single-serve packaging formats. CCL Industries needs to adapt its product portfolio to cater to these evolving consumer preferences, offering solutions that are convenient and suitable for smaller consumption units.

These demographic changes necessitate specific packaging innovations:

- Elder-friendly packaging: Features like easy-grip caps and tear-notches are becoming increasingly important.

- Resealable packaging: To maintain freshness and reduce waste for smaller households.

- Single-serve formats: Catering to individuals and smaller family units.

- Lightweight materials: Easier for older consumers to manage.

Societal shifts toward health and wellness are paramount, especially in food and pharmaceuticals, demanding packaging that ensures product safety and traceability. CCL Industries' expertise in tamper-evident seals and specialized healthcare packaging directly addresses this growing consumer and regulatory focus.

The increasing digitalization of consumer behavior, with global e-commerce sales projected to exceed $7 trillion by 2025, is driving demand for interactive packaging. CCL's integration of QR codes and RFID technologies enhances consumer engagement and supply chain visibility, a crucial element for online retail success.

Demographic changes, such as an aging population and a rise in single-person households, are reshaping packaging needs. By 2030, over 20% of the population in many OECD countries will be 65+, increasing demand for easy-to-open and handle packaging, while smaller households favor single-serve formats.

| Societal Factor | Impact on CCL Industries | Supporting Data/Trend (2024/2025 Focus) |

|---|---|---|

| Health & Wellness Emphasis | Demand for tamper-evident, traceable, and safe packaging solutions. | Increased scrutiny on product integrity in food and pharma sectors. |

| Digitalization & E-commerce | Need for interactive packaging (QR codes, RFID) for engagement and transparency. | Global e-commerce sales to surpass $7 trillion by 2025; 70% of consumers prefer interactive packaging. |

| Demographic Shifts (Aging Population) | Requirement for easy-open, easy-handle, and lightweight packaging. | Over 20% of OECD population to be 65+ by 2030; growing market for elder-friendly packaging. |

| Demographic Shifts (Single-Person Households) | Increased demand for smaller, single-serve, and resealable packaging formats. | Over 28% of US households were single-person in 2022; driving demand for convenient portioning. |

Technological factors

Advancements in digital printing technology are revolutionizing label manufacturing, offering CCL Industries unparalleled flexibility and cost-efficiency. This allows for significantly reduced lead times, a critical advantage in today's fast-paced consumer market.

The ability to produce short runs and highly customized labels quickly means CCL can precisely target niche consumer segments with bespoke packaging. For instance, in 2024, the demand for personalized consumer goods saw a notable uptick, a trend digital printing directly addresses.

Furthermore, digital printing facilitates rapid adaptation to evolving regulatory requirements across different regions. This agility ensures CCL remains compliant and competitive, especially as new labeling standards emerge, such as those related to sustainability and ingredient transparency being discussed for implementation in late 2024 and early 2025.

The increasing adoption of Radio Frequency Identification (RFID) and other smart label technologies is a significant technological factor impacting CCL Industries. These advancements are crucial for retailers aiming to improve loss prevention, streamline inventory management, and combat product counterfeiting. CCL's Checkpoint division is a prime example, experiencing growth by providing these RFID solutions across various retail sectors, from apparel to other consumer goods.

Technological advancements are driving the development of innovative, sustainable packaging materials, including biodegradable and compostable options. CCL Industries is actively investing in R&D, focusing on eco-friendly inks, recycled content, and mono-material packaging to help clients meet their environmental goals.

Automation and AI in Manufacturing

The packaging industry, including companies like CCL Industries, is increasingly adopting automation and AI to boost efficiency. These technologies are crucial for reducing errors and elevating quality control in production processes.

While the full impact of AI is still unfolding in packaging, significant investments are being made in smart warehousing and automated operations. These advancements are poised to make operations much smoother and more cost-effective.

For instance, the global industrial automation market was projected to reach over $300 billion in 2024, with AI playing an increasingly vital role. In 2023, a significant portion of manufacturing firms reported using AI for quality inspection, a key area for packaging.

- AI-powered vision systems are enhancing quality assessment in packaging lines, leading to fewer defects.

- Investments in intelligent warehouses are streamlining logistics and inventory management for packaging firms.

- Automation is reducing labor costs and improving operational speed, a trend expected to accelerate through 2025.

- The global AI in manufacturing market is anticipated to see substantial growth, with packaging being a key sector benefiting from these advancements.

Serialization and Traceability Technologies

The increasing global demand for product security and traceability, particularly within the pharmaceutical sector, is a significant technological driver. This trend fuels the adoption of advanced serialization and track-and-trace solutions to combat counterfeiting and ensure supply chain integrity. For instance, the pharmaceutical serialization market was valued at approximately $2.5 billion in 2023 and is projected to grow substantially in the coming years.

CCL Industries has strategically invested in serialization technologies, recognizing their importance for product authenticity and enhanced supply chain visibility. These investments position CCL to meet the stringent regulatory requirements and customer demands for secure product tracking across various industries. Their commitment extends to developing and implementing solutions that provide end-to-end visibility.

Key technological advancements supporting serialization include:

- Data Matrix Codes and QR Codes: Enabling unique product identification and rapid data capture.

- Blockchain Technology: Offering secure, immutable records for product provenance and supply chain transparency.

- IoT Sensors: Providing real-time monitoring of product conditions (e.g., temperature) throughout transit.

- AI and Machine Learning: Used for analyzing vast amounts of traceability data to identify anomalies and potential risks.

Digital printing's agility allows CCL to quickly adapt to evolving labeling standards, crucial for regulatory compliance, especially with sustainability mandates expected to tighten in late 2024 and early 2025.

The growing demand for smart labels, like RFID, is a significant growth area for CCL's Checkpoint division, enhancing inventory management and security for retailers. Global RFID market growth is projected to continue strongly through 2025.

CCL's investment in serialization technologies, including Data Matrix codes and blockchain, addresses the increasing need for product security and traceability, particularly in the pharmaceutical sector, a market valued at billions and growing.

| Technology Area | Impact on CCL Industries | Market Data/Projection (2024/2025) |

|---|---|---|

| Digital Printing | Increased flexibility, reduced lead times, cost-efficiency for short/custom runs | Global digital printing market expected to exceed $30 billion by 2025 |

| RFID/Smart Labels | Growth driver for Checkpoint division, enhanced retail inventory/security | Global RFID market projected to reach over $30 billion by 2025 |

| Serialization & Traceability | Meeting regulatory demands, combating counterfeiting, supply chain integrity | Pharmaceutical serialization market valued at ~$2.5 billion in 2023, with strong CAGR |

Legal factors

Product safety and labeling regulations are critical for CCL Industries, especially given their presence in sectors like healthcare and food. These rules demand precise and comprehensive information on labels, ensuring consumer safety and compliance. For instance, the U.S. Food and Drug Administration (FDA) mandates specific labeling for pharmaceuticals and food products, including ingredient lists, nutritional information, and warnings. In 2024, the global food labeling market was valued at approximately $30 billion, with stringent regulations driving innovation in tamper-evident and track-and-trace technologies, areas where CCL is actively involved.

Environmental and waste management legislation, including Extended Producer Responsibility (EPR) laws, directly shapes CCL Industries' operational footprint and innovation pipeline. These regulations, increasingly stringent in 2024 and projected to evolve further into 2025, compel companies like CCL to prioritize sustainable practices and circular economy principles.

CCL Industries actively integrates waste reduction strategies and focuses on designing packaging for enhanced recyclability to ensure compliance and foster environmental stewardship. For instance, in 2023, the company reported a 3% reduction in waste generated per ton of product, demonstrating a tangible commitment to these legislative drivers.

Global trade laws and tariffs directly impact CCL Industries' operational costs and market access. For instance, changes in import duties on raw materials or finished goods can affect profit margins. In 2024, ongoing trade disputes and the potential for new tariffs in key markets like the United States and the European Union present a significant challenge.

CCL Industries must navigate a complex web of international trade regulations, which can influence its sourcing decisions and manufacturing locations. Adapting to evolving trade agreements, such as potential revisions to existing free trade pacts, is crucial for maintaining supply chain efficiency and cost competitiveness in 2025.

Intellectual Property Rights

Protecting its intellectual property, particularly patents for innovative packaging and label technologies, is paramount for CCL Industries' sustained market leadership. These legal protections are the bedrock upon which the company builds and defends its competitive edge, preventing rivals from replicating its proprietary advancements.

The global landscape of intellectual property rights directly impacts CCL's ability to secure its innovations and pursue legal recourse against infringements. For instance, in 2023, CCL Industries continued to invest in its R&D pipeline, a significant portion of which is directly tied to patentable technologies in areas like advanced coatings and sustainable material applications for labels and packaging.

- Patent Portfolio Growth: CCL Industries actively manages and expands its patent portfolio, which is a key asset in safeguarding its technological innovations in specialty packaging and labeling.

- Enforcement and Defense: Legal frameworks empower CCL to enforce its patents against infringers, thereby protecting its market share and revenue streams derived from unique product offerings.

- Competitive Advantage: The strength of CCL's intellectual property rights directly translates into a tangible competitive advantage, allowing it to command premium pricing and foster customer loyalty based on differentiated technology.

- Global IP Strategy: Navigating diverse international intellectual property laws is critical for CCL's global operations, ensuring its innovations are protected across all key markets.

Labor Laws and Employment Regulations

CCL Industries, as a global entity, navigates a complex web of labor laws and employment regulations across its numerous operating regions. This necessitates strict adherence to varying standards concerning minimum wage, working hours, overtime pay, and employee benefits, which differ significantly from country to country. For instance, in 2024, the minimum wage in countries like Canada and the United States saw adjustments, impacting CCL's operational costs and HR policies in those territories.

Ensuring fair labor practices and upholding employee rights are paramount. This involves compliance with regulations on workplace safety, anti-discrimination, and collective bargaining agreements where applicable. CCL's commitment to these principles is reflected in its global HR strategies, aiming for consistency in ethical employment while respecting local legal frameworks.

Key areas of compliance for CCL Industries include:

- Compliance with country-specific minimum wage laws: For example, in 2024, minimum wage rates in several European countries where CCL operates, such as Germany and France, were subject to annual reviews and potential increases.

- Adherence to working hour regulations: This covers maximum daily and weekly working hours, mandatory rest periods, and overtime compensation rules, all of which vary by jurisdiction.

- Upholding employee rights: This encompasses protections against unfair dismissal, rights to unionize, and provisions for parental leave, which are legislated differently across CCL's global footprint.

- Workplace health and safety standards: Ensuring a safe working environment in line with national occupational health and safety legislation, with specific reporting and incident investigation requirements in many regions.

Regulatory compliance is a significant legal factor for CCL Industries, influencing everything from product design to market access. The company must adhere to a multitude of laws, including those concerning product safety, environmental impact, and intellectual property protection. In 2024, the increasing focus on data privacy regulations, such as GDPR and similar frameworks globally, also presents a key legal consideration for how CCL handles customer and operational data.

Environmental factors

CCL Industries is actively pursuing environmental stewardship through ambitious greenhouse gas (GHG) emission reduction goals. These targets are validated by the Science Based Targets initiative (SBTi), underscoring their scientific grounding.

Specifically, CCL Industries has committed to a 50% reduction in absolute Scope 1 and 2 GHG emissions by 2030. This is measured against a 2022 baseline year, demonstrating a concrete short-to-medium term objective.

Looking further ahead, the company aims for a substantial 90% reduction in Scope 1, 2, and 3 GHG emissions by 2050, also from the 2022 base year. This long-term vision highlights a deep commitment to sustainability across their entire value chain.

CCL Industries is actively pursuing ambitious waste reduction goals, targeting net-zero waste to landfill across North America and Europe by 2030. This commitment is being met through the implementation of comprehensive waste reduction strategies and the diversion of waste streams for recycling and incineration.

The company is also exploring innovative circular economy principles, notably through its liner recycling programs. These initiatives aim to transform waste materials into valuable resources, aligning with broader sustainability objectives and potentially reducing raw material costs.

CCL Industries is heavily invested in sustainable product development, particularly within its packaging segment. The company is championing biodegradable and compostable materials, alongside increasing the use of recycled content in its offerings. This focus is evident in new product introductions like EcoFloat® polyolefin sleeves, designed to improve PET recycling rates, a critical step in circular economy initiatives.

Energy Consumption and Clean Manufacturing

CCL Industries is actively investing in cleaner manufacturing and energy reduction across its global operations. This commitment is evident in their exploration of renewable energy sources, such as solar power, to fuel their facilities. For instance, in 2023, the company reported a 3% reduction in energy intensity compared to 2022, demonstrating tangible progress in optimizing manufacturing efficiency and minimizing their environmental impact.

These initiatives are crucial for reducing CCL's carbon footprint and aligning with increasing global environmental regulations and customer expectations. The company's focus on energy reduction not only contributes to sustainability but also offers potential cost savings through improved operational efficiency.

- Renewable Energy Adoption: CCL is actively assessing and implementing solar power solutions at various manufacturing sites.

- Energy Efficiency Programs: Ongoing optimization of production processes to lower overall energy consumption.

- Environmental Footprint Reduction: A strategic goal to minimize the company's impact on the environment through sustainable practices.

Responsible Supply Chain Management

CCL Industries is actively weaving responsible practices into its entire supply chain, from the initial sourcing of raw materials all the way to final customer delivery. This commitment extends to collaborating with suppliers, encouraging them to adopt science-based targets for emissions reduction, ensuring that the materials used and the processes employed align with the company's broader sustainability objectives.

In 2023, CCL Industries reported that 84% of its purchased paper and board came from certified sustainable sources, a significant step towards its 2025 goal of 100%. This focus on responsible sourcing is crucial for mitigating environmental impact and ensuring long-term supply chain resilience.

The company's efforts include:

- Supplier Engagement Programs: CCL Industries actively engages with its key suppliers to promote adherence to environmental and social standards.

- Sustainable Material Sourcing: Prioritizing materials with lower environmental footprints, such as recycled content and responsibly managed forest products.

- Traceability Initiatives: Enhancing the visibility of its supply chain to identify and address potential risks related to environmental and social governance.

- Circular Economy Principles: Exploring opportunities to incorporate circular economy principles, such as waste reduction and material reuse, within its operations and supply chain partnerships.

CCL Industries is making significant strides in environmental sustainability, focusing on emission reduction and responsible resource management. The company has set ambitious targets, including a 50% reduction in Scope 1 and 2 GHG emissions by 2030, validated by the Science Based Targets initiative (SBTi).

Further demonstrating their commitment, CCL aims for net-zero waste to landfill in North America and Europe by 2030, actively implementing waste reduction strategies and promoting circular economy principles through initiatives like their liner recycling programs.

In 2023, CCL Industries reported that 84% of its purchased paper and board came from certified sustainable sources, moving towards its 2025 goal of 100%.

| Environmental Target | Current Status/Action | Baseline Year | Target Year |

|---|---|---|---|

| Scope 1 & 2 GHG Emissions Reduction | Commitment to 50% reduction | 2022 | 2030 |

| Scope 1, 2, & 3 GHG Emissions Reduction | Commitment to 90% reduction | 2022 | 2050 |

| Waste to Landfill | Net-zero goal for North America & Europe | N/A | 2030 |

| Certified Sustainable Paper & Board Sourcing | 84% sourced in 2023 | N/A | 2025 (100% goal) |

PESTLE Analysis Data Sources

Our PESTLE Analysis for CCL Industries is built upon a robust foundation of data from reputable sources. This includes official government publications, reports from international organizations like the World Bank and IMF, and insights from leading market research firms and industry-specific journals.