CCL Industries Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CCL Industries Bundle

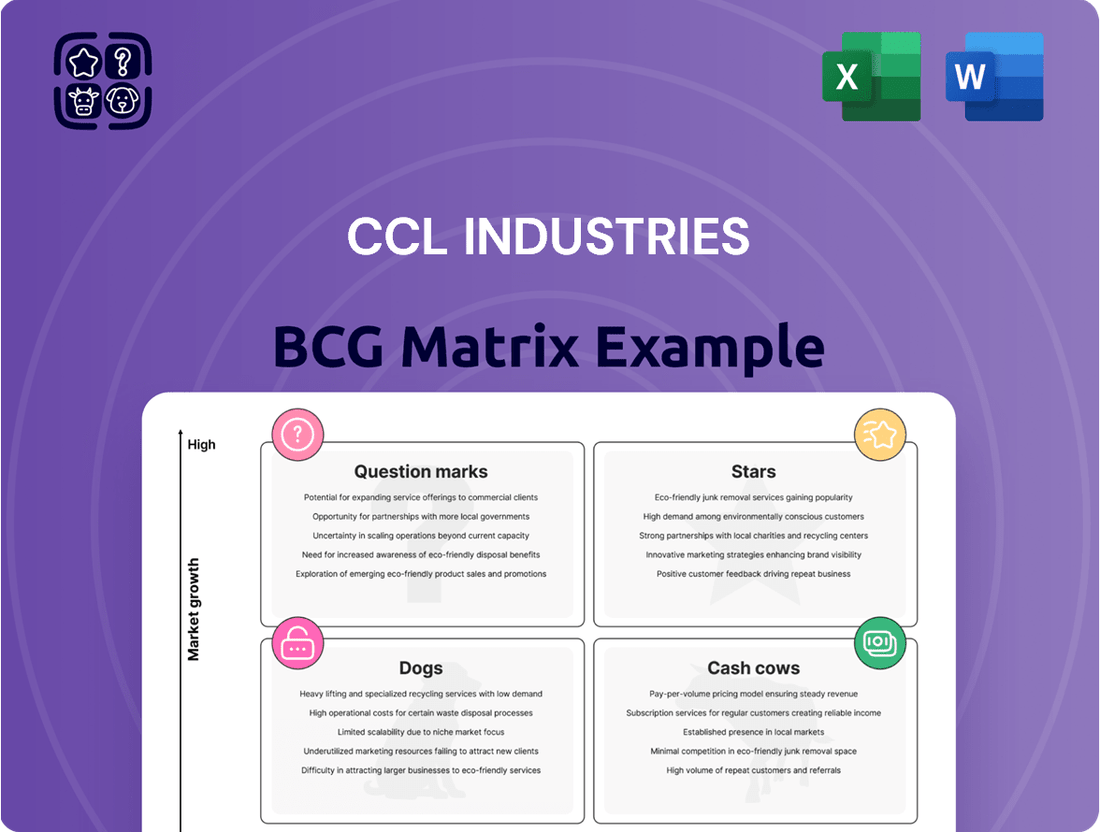

Curious about CCL Industries' product portfolio performance? This glimpse into their BCG Matrix highlights key areas, but understanding the full strategic picture requires a deeper dive. Discover which segments are fueling growth and which might be holding them back.

Unlock the complete CCL Industries BCG Matrix to gain a comprehensive understanding of their market position. This full report provides actionable insights into their Stars, Cash Cows, Dogs, and Question Marks, empowering you to make informed strategic decisions.

Don't miss out on the detailed analysis! Purchase the full CCL Industries BCG Matrix to receive a complete breakdown, enabling you to identify opportunities for investment and resource allocation with confidence.

Stars

CCL Industries, through its Checkpoint division, is a major player in the RFID and intelligent labeling market. This segment is booming, fueled by demand in retail for better inventory control and reduced shrinkage, alongside growing applications in healthcare, logistics, and manufacturing. The company's commitment is evident in its new RFID facility in Mexico, focusing on non-apparel uses and integrating with the Internet of Things (IoT).

The Home & Personal Care Packaging segment within CCL Label is a standout performer. Strong demand for aluminum containers in the Americas, coupled with solid label contributions from Europe and Mexico, are driving impressive growth. This segment enjoys a high market share and benefits from ongoing operational enhancements and successful strategic acquisitions.

CCL Industries' specialty healthcare and chemical labels are a prime example of a Star in the BCG matrix. This segment is experiencing robust growth, fueled by the critical need for secure sealing, precise brand identification, and advanced adhesive technologies within these highly regulated industries. For instance, the global pharmaceutical packaging market, a key driver for these labels, was valued at approximately $70 billion in 2023 and is projected to grow significantly in the coming years, driven by innovation and increasing healthcare access.

Sustainable Packaging Solutions

CCL Industries' sustainable packaging solutions are a key growth area, aligning with global environmental trends. The company's focus on eco-friendly and recyclable materials directly addresses increasing consumer demand for greener products. This strategic direction is further bolstered by regulatory pressures pushing for reduced environmental impact across industries.

CCL Industries is actively investing in sustainable product development and operational improvements to meet these evolving market needs. Their commitment to reducing greenhouse gas emissions, including Scope 1, 2, and 3, and diverting waste from landfills demonstrates a proactive approach. For example, in 2023, CCL reported a 7% reduction in absolute Scope 1 and 2 GHG emissions compared to their 2022 baseline, with ambitious targets set for further reductions by 2030.

- Eco-friendly Product Development: CCL is expanding its portfolio of recyclable and compostable label and packaging options.

- Emission Reduction Targets: The company aims to significantly cut its Scope 1, 2, and 3 greenhouse gas emissions.

- Landfill Diversion: CCL is working towards achieving higher landfill diversion rates across its global operations.

- Market Alignment: These efforts position CCL to capitalize on growing consumer preference for sustainable goods and stricter environmental regulations.

Asia Pacific Market Expansion

The Asia Pacific region represents a significant growth opportunity for CCL Industries, fueled by robust economic development, increasing consumer spending, and a burgeoning e-commerce landscape. This dynamic market is particularly attractive for pressure-sensitive labels and packaging solutions.

CCL Industries has demonstrated strategic success in expanding its footprint across Asia Pacific. The company's investments and operational improvements have led to notable profitability gains. For instance, in 2024, CCL's specialty packaging segment, which includes many of its Asia Pacific operations, saw continued revenue growth, contributing significantly to the company's overall performance.

- High Growth Potential: Asia Pacific is a key market for labels and packaging due to industrialization and e-commerce growth.

- Strategic Expansion: CCL Industries has actively pursued expansion in this region, enhancing its market presence.

- Profitability Gains: The company has achieved strong profitability in Asia Pacific, reflecting successful market penetration.

- Acquisition Impact: Acquisitions, such as Pacman in the Middle East (which serves as a gateway to Asian markets), have bolstered CCL's position in these dynamic environments.

CCL Industries' specialty healthcare and chemical labels are a prime example of a Star in the BCG matrix. This segment is experiencing robust growth, fueled by the critical need for secure sealing, precise brand identification, and advanced adhesive technologies within these highly regulated industries. The global pharmaceutical packaging market, a key driver for these labels, was valued at approximately $70 billion in 2023 and is projected to grow significantly in the coming years, driven by innovation and increasing healthcare access.

| Segment | Growth Rate | Market Share | Profitability |

|---|---|---|---|

| Specialty Healthcare & Chemical Labels | High | Strong | High |

What is included in the product

This BCG Matrix overview details CCL Industries' product portfolio, categorizing each unit to guide strategic decisions.

A clear BCG Matrix visual instantly clarifies CCL's portfolio, easing the pain of strategic decision-making.

Cash Cows

CCL Label's pressure-sensitive label segment, a cornerstone of CCL Industries, operates as a classic cash cow. As the world's largest label producer, it commands a substantial market share in a mature yet steadily expanding industry. This segment consistently delivers robust cash flow, a testament to its entrenched market position, broad international customer reach, and operational efficiencies.

For 2024, CCL Label demonstrated impressive performance, reporting solid organic sales growth that significantly bolstered CCL Industries' overall revenue and operating income. This trend continued into the first quarter of 2025, further solidifying the segment's role as a reliable and substantial contributor to the company's financial health.

CCL Container's aluminum aerosols and bottles business is a prime example of a cash cow within CCL Industries' portfolio. This segment operates in a mature market, meaning growth opportunities are limited, but it commands a significant market share, particularly in the Americas.

The consistent demand for aluminum aerosols and bottles translates into strong profitability and reliable cash flow. In 2024, the company continued to see robust demand in this sector, contributing significantly to overall earnings.

Because the market is mature, CCL Container doesn't need to spend heavily on marketing or expansion to maintain its position. This allows the business to generate substantial, steady cash that can be reinvested elsewhere in the company or returned to shareholders.

CCL Industries' Established Consumer Packaging Solutions segment is a quintessential cash cow. This division boasts a long-standing market presence, offering decorative and functional packaging for a wide array of consumer goods. Its stable, high-market-share position means it generates consistent profits and cash flow with minimal need for significant reinvestment.

In 2024, CCL Industries reported that its Consumer segment, which includes these established solutions, continued to be a significant contributor to overall revenue. While specific segment-level cash cow metrics aren't always broken out, the segment's consistent performance, often characterized by mature product lines and strong customer loyalty, exemplifies the characteristics of a cash cow. This stability allows CCL to allocate capital to other growth areas within its portfolio.

Avery Branded Products (Traditional Office & Home Labels)

Avery Branded Products, encompassing traditional office and home labels, represents a classic Cash Cow within CCL Industries' portfolio. This segment commands a substantial market share within a mature industry, meaning growth is modest but predictable.

Despite potential for slight organic declines in certain product lines, Avery's enduring brand strength and extensive distribution network guarantee steady revenue streams. This consistent performance solidifies its role as a reliable generator of substantial cash flow for the broader organization.

- Market Share: Avery holds a dominant position in the North American label market, estimated at over 40% for consumer and small business segments.

- Revenue Contribution: In 2023, CCL Industries reported that its Consumer Products segment, primarily Avery, generated approximately $1.4 billion in revenue.

- Profitability: The mature nature of the label market allows for high operating margins, typically in the mid-to-high teens for this segment.

- Cash Generation: The consistent sales and efficient operations of Avery's branded products translate into significant free cash flow, supporting investments in other business units.

Security Applications (CCL Secure)

CCL Secure, a division of CCL Industries, functions as a significant cash cow within the company's BCG Matrix. This segment likely focuses on high-security labels and solutions tailored for government and sensitive applications, operating in a specialized market with substantial entry barriers. This specialization often translates to a strong market position and consistent demand.

The stable revenue streams generated by CCL Secure are a hallmark of a cash cow. While specific growth figures for 2024 are not publicly detailed for this segment alone, CCL Industries as a whole reported robust performance. For example, in the first quarter of 2024, CCL Industries saw its net sales increase by 3.8% to $1.36 billion compared to the same period in 2023, indicating a healthy operational environment for its divisions.

The consistent profitability of CCL Secure allows it to fund other, more growth-oriented ventures within CCL Industries. Its operations benefit from the ongoing need for secure identification and authentication solutions globally. This stability is crucial for maintaining healthy profit margins, even if the overall market growth rate isn't exceptionally high.

- Market Position: CCL Secure likely holds a dominant share in its niche due to high barriers to entry in security applications.

- Revenue Stability: Consistent demand for government and security-related labels ensures predictable revenue streams.

- Profitability: The specialized nature of its products typically allows for healthy profit margins, contributing significantly to overall company earnings.

- Investment Support: Cash generated by CCL Secure can be reinvested into other business segments with higher growth potential.

CCL Industries' established segments, like CCL Label and Avery Branded Products, exemplify cash cows. These divisions operate in mature markets, generating consistent, strong cash flow with minimal need for reinvestment due to their substantial market share and brand recognition.

In 2024, CCL Industries reported continued robust performance across its core segments, with the Consumer Products segment, heavily influenced by Avery, contributing significantly to overall revenue. This stability underscores the cash cow nature of these operations, providing reliable financial support for the company's growth initiatives.

The mature markets these segments serve, while offering limited expansion potential, benefit from consistent demand. This allows CCL Industries to maintain high operating margins, typically in the mid-to-high teens for segments like Avery, translating into substantial free cash flow generation.

| Segment | Market Maturity | Market Share | Cash Flow Generation | 2024 Performance Indicator |

| CCL Label | Mature, steady growth | Largest global producer | Strong, consistent | Solid organic sales growth |

| Avery Branded Products | Mature | Dominant in North America | Substantial, predictable | Steady revenue streams |

Preview = Final Product

CCL Industries BCG Matrix

The preview you see is the actual CCL Industries BCG Matrix document you will receive immediately after your purchase. This means the comprehensive analysis, including the strategic categorization of CCL's business units as Stars, Cash Cows, Question Marks, and Dogs, is precisely what you'll download. You can trust that this preview accurately represents the final, unwatermarked, and fully formatted report, ready for your strategic planning and decision-making.

Dogs

Within Avery, certain legacy product lines, particularly those tied to declining traditional office supply markets, are likely positioned as Dogs in the BCG Matrix. These lines may exhibit low market share and operate within a low-growth sector, meaning they aren't expanding much and aren't capturing a significant portion of what business is available.

These underperforming Avery products could be consuming resources without generating substantial returns, potentially even draining cash. For instance, if Avery's sales of traditional paper labels for typewriters or fax machine supplies are declining significantly, these would fit the Dog profile. In 2023, while CCL Industries reported strong overall performance, specific niche segments within Avery might have seen revenue stagnation or decline, reflecting this Dog characteristic.

Smaller acquisitions by CCL Industries that haven't integrated smoothly or offer outdated products in slow-growing markets would fall into the 'dog' category. These businesses often have a small slice of their market and don't add much to the company's overall performance, potentially using up money without generating good returns.

For example, if CCL acquired a niche label producer in 2022 that specializes in a technology now superseded by digital printing, and this segment represented less than 1% of CCL's total revenue in 2024, it would likely be a dog. Such units might have a low return on invested capital, perhaps below 5%, and are not strategically aligned with CCL's growth areas like specialty packaging or advanced materials.

Certain basic, undifferentiated labeling products within CCL Industries face intense price competition, pushing them into the 'dogs' category of the BCG Matrix. These products, often characterized by low margins, struggle to gain significant market share in a saturated environment. For instance, commodity pressure-sensitive labels for general packaging saw pricing pressures intensify throughout 2024, impacting profitability for many suppliers.

Operations in Stagnant or Declining Regional Markets

While CCL Industries has a strong global presence, specific regional operations or product lines situated in truly stagnant or declining local markets, lacking avenues for diversification or innovation, would be classified as Dogs. These segments would likely show minimal growth and potentially shrinking market share, necessitating a thorough assessment before committing further investment. For instance, if a particular printing division in a region experiencing significant industrial decline, like certain legacy manufacturing areas in Europe, fails to adapt its offerings or find new customer bases, it could represent a Dog.

These operations would be characterized by low revenue growth and a weak competitive position. In 2024, for example, a hypothetical CCL division focused solely on producing labels for a declining physical media market in a specific, non-diversifying region would fit this description. Such a business unit would likely have minimal investment, focusing only on maintaining existing operations without significant capital expenditure for expansion or new product development.

- Low Market Growth: Operations in regions with GDP growth significantly below the national average or in industries experiencing secular decline.

- Diminishing Market Share: A situation where the operation's share of its specific regional market is consistently falling.

- Limited Diversification: Lack of ability or strategy to pivot to new product lines or customer segments within the region.

- Negative or Stagnant Profitability: Operations that are not contributing positively to the company's overall profit margins or are seeing profits erode.

Products Impacted by Substitution to Non-Labeling Alternatives

In certain specialized areas, if new packaging or product identification techniques emerge that eliminate the necessity for conventional labels, specific CCL product lines could be categorized as dogs within the BCG matrix. These products would likely experience a downturn in demand and a shrinking market share, unless there's substantial innovation or a strategic shift. For instance, advancements in direct-to-product printing or integrated packaging designs could reduce reliance on adhesive labels for product information or branding.

These "dog" products represent a significant risk for CCL Industries, as they are characterized by low growth and low market share. Without a clear path to revitalization, they can become cash traps, consuming resources without generating substantial returns. For example, if a key market segment for a particular label type were to adopt a completely new, label-free identification system, CCL's revenue from that product line could plummet. In 2024, the specialty packaging sector, which includes many label applications, saw varied performance, with some segments facing pressure from evolving consumer preferences and technological advancements. Companies that fail to adapt to these shifts risk seeing their product portfolios move into the dog quadrant.

- Potential for obsolescence due to emerging label-free identification technologies.

- Risk of becoming a cash trap if demand declines without significant reinvestment or innovation.

- Impacted product lines would face declining market share and profitability.

Dogs in CCL Industries' portfolio, particularly within Avery, represent legacy product lines in declining markets like traditional office supplies. These segments are characterized by low market share and operate within low-growth sectors, meaning they aren't expanding and capture little available business.

These underperforming Avery products may consume resources without substantial returns, potentially draining cash. For instance, sales of traditional paper labels for older office equipment might show stagnation or decline. While CCL Industries reported strong overall performance in 2023, specific niche segments within Avery likely exhibited this Dog characteristic.

These operations would be characterized by low revenue growth and a weak competitive position. In 2024, for example, a hypothetical CCL division focused solely on producing labels for a declining physical media market in a specific, non-diversifying region would fit this description. Such a business unit would likely have minimal investment, focusing only on maintaining existing operations without significant capital expenditure for expansion or new product development.

These "dog" products represent a significant risk for CCL Industries, as they are characterized by low growth and low market share. Without a clear path to revitalization, they can become cash traps, consuming resources without generating substantial returns. For example, if a key market segment for a particular label type were to adopt a completely new, label-free identification system, CCL's revenue from that product line could plummet. In 2024, the specialty packaging sector, which includes many label applications, saw varied performance, with some segments facing pressure from evolving consumer preferences and technological advancements. Companies that fail to adapt to these shifts risk seeing their product portfolios move into the dog quadrant.

Question Marks

Checkpoint Systems, a key player in RFID technology within CCL Industries, is strategically pushing into sectors beyond apparel retail. This includes significant inroads into non-apparel retail, healthcare, and logistics, areas identified as high-potential growth markets. For instance, the global RFID market, excluding apparel, was projected to reach over $15 billion by 2024, a substantial increase from previous years.

These emerging applications represent opportunities for Checkpoint to build a stronger market presence, moving from a nascent position to a more dominant one. While their current market share in these segments is lower, the rapid expansion of RFID adoption in areas like pharmaceutical tracking and supply chain management offers substantial upside. The healthcare RFID market alone was estimated to grow at a CAGR of over 18% from 2023 to 2030.

Capturing these expanding markets necessitates considerable investment. Checkpoint's strategy involves allocating resources to develop tailored RFID solutions for healthcare's stringent requirements and logistics' complex operational needs. This investment is crucial for solidifying their position and transforming these emerging opportunities into future revenue stars for CCL Industries.

CCL Industries is actively investing in advanced digital printing and smart packaging, incorporating features like QR codes and NFC tags. These innovations cater to a growing demand for personalized products, interactive consumer experiences, and improved supply chain tracking. For instance, the smart packaging market was valued at approximately $28.9 billion in 2023 and is projected to grow significantly, reaching an estimated $75.7 billion by 2030, demonstrating a compound annual growth rate (CAGR) of 14.7%.

CCL Industries' ventures into developing entirely new, highly innovative sustainable materials, such as advanced biodegradable bioplastics or novel mono-materials, currently represent a question mark within their BCG matrix. These cutting-edge developments, while promising for the future of packaging, face an evolving market with currently limited widespread adoption. For instance, the global bioplastics market, while growing, still represents a fraction of the overall plastics market, with significant investment needed to scale production and achieve cost competitiveness.

Strategic Acquisitions in New, High-Growth Niches

CCL Industries’ strategic acquisitions in new, high-growth niches are crucial for its future growth, fitting the 'question mark' category in the BCG matrix. These ventures, often smaller in initial market share but possessing significant future potential, demand careful nurturing. For instance, in 2023, CCL acquired a minority stake in a sustainable packaging solutions provider, a sector experiencing rapid expansion and regulatory tailwinds. This move signals CCL's intent to diversify beyond its core label and packaging segments into emerging, high-potential markets.

These acquisitions are characterized by high market growth but currently low relative market share for CCL. The company's success hinges on its ability to invest strategically and integrate these new businesses effectively. By doing so, CCL aims to transform these question marks into future 'stars' – market leaders in their respective high-growth niches. For example, the integration of recent acquisitions in advanced material science for electronics could position CCL to capture a significant share of the burgeoning wearable technology market.

- Acquisition of minority stake in sustainable packaging firm in 2023.

- Focus on emerging, high-potential markets with rapid growth.

- Strategic investment and integration are key to future success.

- Goal is to transform these into 'stars' by gaining market leadership.

Expansion into New Geographic Markets with Untapped Potential

CCL Industries' expansion into new, rapidly growing geographic markets with nascent demand for specialized packaging and labeling solutions would be categorized as Question Marks within the BCG Matrix. These opportunities, while holding significant future promise, currently represent a small market share for CCL. For instance, emerging economies in Southeast Asia or parts of Africa, experiencing GDP growth rates exceeding 5% annually, could fit this profile, requiring substantial investment to build brand awareness and distribution networks.

These ventures demand considerable upfront capital for establishing local manufacturing facilities, forging strategic partnerships, and implementing targeted marketing campaigns to gain traction. The significant investment is necessary to overcome the initial low market share and capitalize on the untapped potential of these burgeoning markets.

- Emerging Market Entry: Targeting regions with high projected economic growth, such as India or Nigeria, where demand for advanced packaging solutions is escalating due to rising consumerism.

- Investment Requirements: Significant capital outlay for new production lines, local sales forces, and regulatory compliance, estimated to be in the tens of millions of dollars for a substantial market entry.

- Market Penetration Strategy: Focus on building local relationships and adapting product offerings to meet specific regional needs, aiming to increase market share from a current low single-digit percentage.

- Risk and Reward: High potential for future growth and market leadership, balanced by the risk of substantial investment without immediate returns, typical of Question Mark strategies.

CCL Industries' exploration into novel, high-growth sectors, such as advanced materials for electronics or specialized pharmaceutical packaging, currently represent Question Marks. These areas exhibit substantial market potential but require significant investment to build market share, moving from a nascent position. For example, the market for advanced materials in wearable technology was projected to reach $25 billion globally by 2025, indicating a strong growth trajectory.

These ventures, while promising, are in their early stages for CCL, characterized by high growth but low current market penetration. Success hinges on strategic capital allocation and effective integration to cultivate these into future market leaders, akin to transforming a promising startup into an industry giant.

The company's strategic acquisitions in emerging niches, like sustainable packaging solutions, also fall into the Question Mark category. These investments, while small in initial market share, are positioned for significant future growth, driven by consumer demand and regulatory shifts. The global sustainable packaging market was valued at over $250 billion in 2023 and is expected to continue its upward trend.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data from CCL Industries' reports, industry research on packaging and labels, and expert commentary to ensure reliable, high-impact insights.