CCL Industries Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CCL Industries Bundle

CCL Industries operates in a dynamic market shaped by intense competition and evolving customer demands. Understanding the interplay of buyer power, supplier leverage, and the threat of substitutes is crucial for navigating this landscape.

The full Porter's Five Forces Analysis dives deep into each of these pressures, revealing the underlying forces that truly dictate CCL Industries's profitability and strategic options. Don't just scratch the surface; gain a comprehensive understanding of the competitive environment.

Ready to move beyond the basics? Get a full strategic breakdown of CCL Industries’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

The packaging and label sector, including companies like CCL Industries, is heavily dependent on raw materials such as plastics, paperboard, and various adhesives. These material costs are not static; they can swing significantly due to factors like global supply chain issues, international political situations, and the price of energy. For instance, in 2023, the average cost for plastic raw materials hovered near USD 1,200 per ton, paper materials were approximately USD 700 per ton, and aluminum prices settled around USD 2,500 per ton. These price variations directly affect CCL Industries' manufacturing expenses and overall profitability.

Supplier concentration significantly impacts bargaining power. When a few suppliers dominate the market for essential inputs, they can exert considerable influence over pricing and terms. For CCL Industries, this means that if a critical specialized material or technology is sourced from a limited number of providers, those suppliers hold a strong hand.

CCL Industries operates across diverse segments like labels, specialty packaging, and security solutions. This broad product range naturally involves sourcing a wide variety of raw materials. While this diversification might dilute the power of any single supplier group, the reliance on highly specialized components for certain advanced products could still present a vulnerability where supplier concentration is a notable concern.

CCL Industries faces significant supplier bargaining power due to the specialized nature of many of its materials, such as advanced films and adhesives. The cost and complexity involved in switching suppliers for these highly engineered components can be substantial, requiring significant investment in new machinery, production line re-tooling, and rigorous material re-qualification processes. This makes it difficult for CCL to easily change suppliers, thereby strengthening the suppliers' negotiating position.

Availability of Substitutes for Raw Materials

The growing emphasis on sustainability is spurring the development of eco-friendly and recycled material alternatives. However, the viability of these substitutes hinges on their availability, cost, and performance compared to traditional options, potentially limiting CCL Industries' flexibility in shifting suppliers without impacting product quality or expense.

For instance, while some recycled plastic resins saw price fluctuations in 2024, their adoption is still contingent on meeting stringent performance standards required for specialized packaging. This means traditional, virgin materials often remain the benchmark, giving suppliers of these materials continued leverage.

- Sustainability Drives Material Innovation: Increased demand for eco-friendly options is leading to new material development.

- Substitute Viability Varies: Availability, cost, and performance of substitutes can differ significantly.

- Impact on Supplier Power: Limitations in substitutes can maintain leverage for traditional material suppliers.

- 2024 Market Context: While recycled materials are gaining traction, their widespread adoption is still dependent on cost-competitiveness and performance parity with virgin materials.

Supplier's Forward Integration Threat

The threat of suppliers integrating forward into CCL Industries' core business of label and packaging manufacturing represents a significant potential shift in the competitive landscape. If raw material providers were to move into producing finished labels or packaging themselves, they would directly compete with CCL.

While this scenario is less probable for suppliers of common, commodity-like raw materials, it poses a more tangible risk when considering specialized material providers. These niche suppliers, particularly those possessing proprietary technologies or unique material formulations, could leverage their expertise to enter the manufacturing space and challenge CCL.

- Forward Integration Risk: Suppliers entering label and packaging manufacturing directly challenges CCL's market position.

- Niche Supplier Threat: Proprietary technology holders among suppliers present a greater forward integration risk.

- Competitive Landscape Shift: Such integration would transform suppliers into direct rivals, altering industry dynamics.

The bargaining power of suppliers for CCL Industries is a notable force, primarily driven by the specialized nature of many inputs and the concentration within certain supply markets. When suppliers provide unique or highly engineered materials, their leverage increases significantly, as switching costs for CCL can be substantial. This is particularly true for advanced films and adhesives critical for specialized packaging solutions.

In 2024, the market for specialty chemicals and advanced polymers, key inputs for CCL, continued to see price volatility influenced by global demand and production capacities. For example, while some commodity plastics saw minor price corrections, specialized polymer resins used in high-performance labels remained relatively firm, with average prices for certain grades in the range of USD 1,500-2,000 per ton depending on specific formulations and purity levels. This sustained cost pressure from specialized suppliers underscores their significant bargaining power.

| Factor | Impact on CCL Industries | Supplier Leverage |

| Specialized Materials (e.g., advanced films, adhesives) | High switching costs, need for re-qualification | Strong |

| Supplier Concentration (niche markets) | Limited alternatives for critical inputs | High |

| Raw Material Price Volatility (2024) | Impacts manufacturing costs, especially for specialized inputs | Moderate to High (for specialized inputs) |

What is included in the product

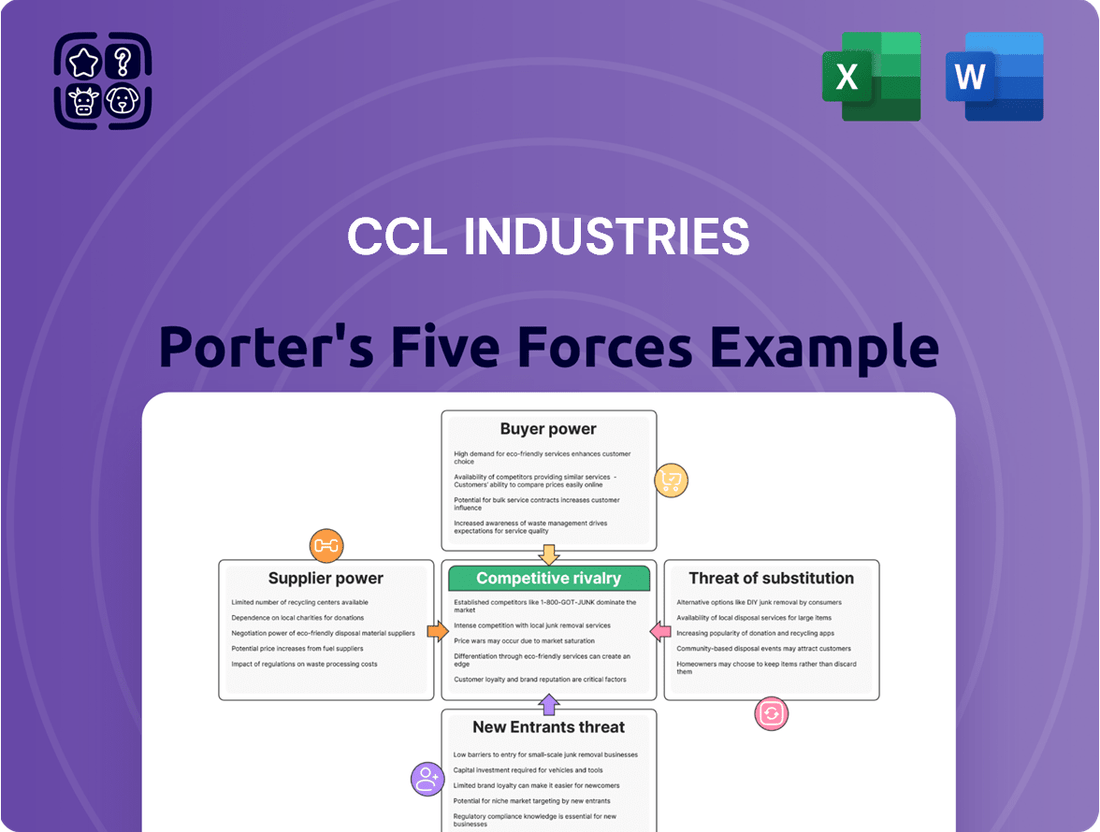

This analysis dissects CCL Industries' competitive environment by examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within its key markets.

Understand the competitive landscape of CCL Industries with a visual, easy-to-digest breakdown of each Porter's Five Force. This allows for rapid identification of strategic threats and opportunities, streamlining decision-making.

Customers Bargaining Power

CCL Industries' extensive global reach, serving a wide array of sectors from consumer packaging and healthcare to electronics and automotive, significantly dampens customer bargaining power. This diversification means no single customer, or even a small cluster of them, holds enough sway to dictate terms. For instance, in 2023, CCL's net sales reached $6.47 billion, spread across numerous clients and industries, underscoring the diluted influence of any individual buyer.

In mature segments of the label and packaging market, customers often exhibit high price sensitivity, particularly for standardized products. This means CCL Industries must remain highly competitive on pricing to retain business, which can put a strain on their profit margins. For instance, in 2023, the global packaging market saw intense competition, with many customers prioritizing cost-effectiveness for commodity-type packaging solutions.

For CCL Industries, customer switching costs can be a significant factor in their bargaining power. When customers rely on highly specialized or integrated packaging and labeling solutions, changing providers often involves substantial effort and expense. This can include the cost of retooling, redesigning packaging, re-qualifying suppliers, and ensuring continued regulatory compliance, all of which makes switching less attractive.

These high switching costs directly diminish the bargaining power of CCL Industries' customers. For example, a customer deeply embedded with CCL's custom-designed labels, which may be integrated into their automated production lines, would face considerable disruption and cost to switch to a new supplier. This integration reduces the customer's ability to easily demand lower prices or better terms, as the cost of switching outweighs the potential savings.

In 2023, CCL Industries reported that a substantial portion of its revenue came from long-term contracts and repeat business, indicating a degree of customer stickiness. This suggests that many of their clients are experiencing these higher switching costs, thereby supporting CCL's pricing power and reducing the immediate threat of customer defection.

Customer's Backward Integration Threat

Large consumer goods companies or major retailers could potentially bring packaging production in-house, particularly for high-volume, standardized items. This backward integration would reduce their reliance on suppliers like CCL Industries.

However, the significant capital outlay and the specialized technical knowledge needed for advanced printing and converting processes often deter such moves, especially for complex or customized packaging solutions. CCL Industries' focus on specialty products therefore mitigates this threat.

- Backward Integration Threat: Large buyers may consider producing their own packaging, especially for commodity products.

- Capital and Expertise Barriers: The high cost and specialized skills required for advanced packaging production limit this threat for complex solutions.

- CCL's Specialty Focus: CCL's concentration on niche and specialty packaging reduces the incentive for customers to integrate backward.

- Market Dynamics: For example, while a large beverage company might consider basic label production, advanced security features or unique material applications remain a supplier's domain.

Demand for Sustainable and Innovative Solutions

Customers are increasingly prioritizing packaging that is both environmentally friendly and technologically advanced. This trend, fueled by consumer awareness and governmental regulations, grants them more leverage. For instance, a significant portion of consumers globally express a willingness to pay more for sustainable packaging options, with surveys in 2024 indicating this preference is a key purchasing driver.

This demand for eco-conscious and smart packaging, which includes features like digital tracking and enhanced recyclability, compels companies like CCL Industries to innovate. Their ability to dictate these preferences means customers can influence product development and material sourcing, thereby shifting bargaining power.

- Increased Customer Leverage: Growing demand for sustainable and smart packaging grants customers greater influence over product specifications and material choices.

- Investment in R&D: CCL Industries must allocate resources to research and development to meet these evolving customer demands for eco-friendly and innovative solutions.

- Market Adaptability: The company's success hinges on its ability to adapt its product portfolio and manufacturing processes to align with these shifting customer preferences and regulatory landscapes.

CCL Industries' broad customer base across diverse sectors significantly dilutes the bargaining power of any single customer. With 2023 net sales of $6.47 billion, the company's revenue is spread across numerous clients, making it difficult for any one buyer to exert substantial influence on pricing or terms.

While price sensitivity is high for standardized products, CCL's focus on specialized and integrated solutions creates high switching costs for customers. This integration, often involving custom designs and automated production line compatibility, deters customers from easily seeking alternative suppliers, thereby limiting their bargaining power.

The growing demand for sustainable and technologically advanced packaging, a trend amplified in 2024, grants customers more leverage. This necessitates that CCL Industries invests in R&D and adapts its offerings to meet these evolving preferences for eco-friendly and smart solutions.

| Factor | Impact on CCL Industries | Customer Bargaining Power |

|---|---|---|

| Customer Diversification | Wide customer base across multiple industries | Low |

| Switching Costs | High for specialized/integrated solutions | Low |

| Price Sensitivity (Standardized Products) | Requires competitive pricing | Moderate to High |

| Demand for Sustainable/Smart Packaging | Drives innovation and product adaptation | Moderate to High |

| Threat of Backward Integration | Limited by capital and expertise for complex solutions | Low |

Preview Before You Purchase

CCL Industries Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces analysis for CCL Industries, offering a detailed examination of industry competitiveness and profitability. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, providing actionable insights without any placeholders or surprises. You're looking at the actual, ready-to-use analysis, ensuring you get precisely the strategic information you need to understand CCL Industries' competitive landscape.

Rivalry Among Competitors

The global pressure-sensitive label market, a significant arena for companies like CCL Industries, was valued at approximately $75 billion USD in 2024. This market is expected to grow at a compound annual growth rate of 5% over the next five years, indicating a robust expansion trajectory.

While the overall market presents a vast opportunity, certain segments exhibit moderate concentration. Leading players such as 3M and Avery Dennison command substantial market shares within these specific niches, intensifying competitive rivalry.

The label and specialty packaging sector is inherently capital-intensive, demanding substantial upfront investment in advanced machinery and cutting-edge technology. This high barrier to entry means that established players, like CCL Industries, must manage their operational scale effectively.

Companies operating with significant fixed costs, such as those in this industry, often engage in aggressive pricing strategies to ensure their production facilities are running at optimal capacity. This intense competition on price becomes particularly pronounced when market demand softens, as seen in periods of economic uncertainty.

For instance, CCL Industries reported capital expenditures of $272.3 million in 2023, highlighting the ongoing need for investment to maintain technological advantage and capacity. This significant outlay underscores the capital-intensive nature of the business and the pressure to utilize these assets efficiently.

CCL Industries thrives on product differentiation, offering advanced digital printing and smart labels with RFID/NFC technology. This focus on innovation, particularly in sustainable materials, is key to staying ahead. For instance, in 2023, CCL invested significantly in expanding its digital printing capabilities, aiming to capture a larger share of the growing demand for customized and agile packaging solutions.

Global Presence and Acquisitions

CCL Industries actively expands its global presence through strategic acquisitions, most recently strengthening its footprint in the Middle East. This approach is a vital competitive tactic, enabling the company to broaden its product offerings and reach new markets. For instance, in 2024, CCL Industries completed several acquisitions, integrating businesses that significantly bolster its specialty packaging and labeling segments in emerging economies.

These strategic moves directly impact competitive rivalry by consolidating market share and introducing new capabilities. Companies that can effectively integrate acquired businesses gain an advantage through economies of scale and diversified revenue streams. CCL’s acquisition strategy in 2024, which included the purchase of a leading flexible packaging producer in Saudi Arabia, demonstrates this commitment to expanding its competitive edge.

- Global Reach Expansion: CCL Industries' 2024 acquisitions in the Middle East significantly enhance its operational footprint and market access in a key growth region.

- Competitive Strategy: Acquisitions are a cornerstone of CCL's strategy to gain market share and diversify its product and service portfolio.

- Market Consolidation: By integrating new businesses, CCL strengthens its position against competitors through increased scale and operational synergies.

Sustainability as a Competitive Factor

CCL Industries faces intense competition where sustainability is increasingly a key differentiator. Companies offering truly eco-friendly, recyclable, or biodegradable packaging solutions are gaining an edge as consumer and regulatory pressure for sustainable practices mounts.

This shift is evident in market trends. For instance, the global sustainable packaging market was valued at approximately $274 billion in 2023 and is projected to reach over $400 billion by 2028, indicating a significant demand shift. CCL's ability to innovate and provide these solutions directly impacts its competitive standing.

- Growing Demand: Consumer preference for sustainable products is a significant driver, pushing companies to adopt eco-friendly packaging.

- Regulatory Push: Governments worldwide are implementing stricter regulations on packaging waste and promoting circular economy principles.

- Innovation Advantage: Companies investing in biodegradable materials, advanced recycling technologies, and reduced material usage can command premium pricing and market share.

- CCL's Position: CCL Industries' investment in sustainable technologies and materials, such as its acquisition of Checkpoint Systems and its focus on recyclable films, positions it to capitalize on this trend.

Competitive rivalry in the label and specialty packaging sector is fierce, driven by a few dominant players and the need for continuous innovation. CCL Industries operates in a market where established giants like 3M and Avery Dennison hold significant sway in specific niches, compelling CCL to differentiate through advanced technologies and strategic growth. The capital-intensive nature of the industry, with substantial investments in machinery, as evidenced by CCL's $272.3 million capital expenditure in 2023, fuels aggressive pricing strategies to maintain capacity utilization, especially during economic downturns.

Sustainability is a rapidly growing battleground, with companies that offer eco-friendly solutions gaining a distinct advantage. The global sustainable packaging market, valued at approximately $274 billion in 2023, underscores this trend, pushing firms like CCL Industries to invest heavily in recyclable materials and advanced printing technologies. CCL's strategic acquisitions, such as its 2024 expansion into the Middle East, are crucial for consolidating market share, enhancing scale, and diversifying its offerings to outmaneuver competitors.

| Key Competitor | 2023 Revenue (approx. USD billions) | Key Focus Areas |

|---|---|---|

| CCL Industries | 7.5 | Specialty labels, packaging solutions, RFID technology |

| 3M | 32.7 | Adhesives, films, consumer goods, industrial applications |

| Avery Dennison | 8.7 | Label and packaging materials, RFID solutions |

SSubstitutes Threaten

While pressure-sensitive labels, a core business for CCL Industries, remain dominant, alternative labeling technologies like glue-applied labels and shrink sleeves do pose a threat. These alternatives offer different application methods and material properties that can appeal to specific market needs.

However, pressure-sensitive labels continue to hold a strong market position due to their inherent flexibility, cost-effectiveness, and ability to deliver high-quality graphics. This combination of attributes makes them a preferred choice for a wide range of applications, limiting the immediate impact of substitutes.

Advancements in direct-to-container printing technologies present a potential threat to label manufacturers like CCL Industries. For instance, in the beverage industry, some brands are exploring direct printing onto aluminum cans, which could reduce the demand for traditional labels in those specific segments. This technology allows for graphics and branding to be applied directly to the product packaging.

However, labels retain significant advantages that limit the immediate impact of direct-to-container printing. Labels offer unparalleled flexibility for frequent design updates, crucial for seasonal promotions or product line extensions, a capability that direct printing struggles to match cost-effectively. Furthermore, regulatory compliance, including ingredient lists and nutritional information, is often more easily managed and updated on labels. In 2023, the global label market was valued at approximately $45 billion, demonstrating the continued demand for labeled products.

The increasing accessibility of digital information through QR codes, NFC, and RFID tags presents a threat by potentially reducing the need for extensive physical printing on labels. For instance, by mid-2024, many consumer packaged goods companies are integrating QR codes that link to detailed product information, ingredient lists, and even interactive content, thereby lessening the reliance on densely printed label real estate.

Reusable Packaging Solutions

The increasing adoption of reusable and refillable packaging solutions poses a significant threat to CCL Industries. This trend, fueled by widespread sustainability efforts, directly impacts the demand for single-use labels and packaging components, which are core to CCL's business. For instance, the global reusable packaging market was valued at approximately $10.5 billion in 2023 and is projected to grow substantially, indicating a material shift away from disposable options.

This shift represents a fundamental change in consumer and industry behavior, moving towards circular economy principles. As more companies and consumers prioritize environmental impact, the reliance on traditional, disposable packaging, and by extension, the labels and materials CCL produces for them, is likely to diminish. This could lead to a reduction in the volume of business for CCL in certain segments.

- Growing Demand for Reusable Packaging: The global reusable packaging market is expanding, with projections indicating continued strong growth through 2030.

- Sustainability Initiatives: Consumer and corporate pressure for eco-friendly solutions is driving the adoption of reusable alternatives.

- Impact on Single-Use Materials: The shift to reusables directly reduces the need for single-use labels and packaging components, a key revenue stream for CCL.

- Long-Term Behavioral Change: This trend signifies a lasting alteration in market dynamics, potentially impacting CCL's market share in traditional packaging segments.

In-house Packaging Solutions by Customers

The threat of customers bringing packaging and labeling solutions in-house is a notable concern for companies like CCL Industries. Very large clients, particularly those dealing with high-volume, standardized products, might consider vertical integration to control costs and supply chains more directly. This move would reduce their need for external suppliers, impacting CCL's market share for those specific segments.

However, establishing in-house capabilities demands substantial capital expenditure for machinery, technology, and skilled labor. For instance, a state-of-the-art printing and converting facility can cost tens of millions of dollars to set up and maintain. Furthermore, keeping up with evolving printing technologies, sustainability requirements, and specialized labeling needs requires continuous investment and expertise that many companies may find prohibitive compared to outsourcing to specialists like CCL Industries.

While some customers might explore this for basic packaging, it's less likely for complex or high-value applications. CCL Industries' focus on specialty products and innovative solutions, such as advanced security features or unique material applications, creates a barrier to entry for in-house operations. The company's 2024 revenue of approximately CAD 7.5 billion highlights its scale and the breadth of its offerings, making it difficult for individual customers to replicate such a diverse and technologically advanced portfolio internally.

- Significant Capital Investment: Setting up in-house packaging operations requires millions in machinery and technology.

- Expertise and Technology Gap: Customers may lack the specialized knowledge and access to cutting-edge printing and material science that CCL Industries possesses.

- Focus on Core Competencies: Many large businesses prefer to concentrate on their primary products and services rather than managing complex packaging production.

- CCL's Scale and Specialization: CCL's broad product range and innovation in areas like specialty labels and advanced materials present a high barrier for internal replication.

The threat of substitutes for CCL Industries is multifaceted, encompassing alternative labeling technologies and evolving packaging formats. While pressure-sensitive labels remain strong, advancements like direct-to-container printing and the growing demand for reusable packaging present significant challenges. The global reusable packaging market, valued at approximately $10.5 billion in 2023, underscores a material shift away from single-use materials that are central to CCL's business.

Furthermore, the increasing integration of digital information via QR codes and NFC tags can reduce the need for extensive printed content on labels. For example, by mid-2024, many consumer packaged goods are incorporating QR codes to link to detailed product information, lessening reliance on densely printed label real estate. This trend, alongside the potential for customers to bring labeling solutions in-house—a move requiring substantial capital investment, estimated in the tens of millions for advanced facilities—shapes the competitive landscape.

| Substitute Type | Impact on CCL Industries | Key Factors | Market Data/Trends |

|---|---|---|---|

| Glue-Applied Labels & Shrink Sleeves | Moderate | Different application methods, material properties | Pressure-sensitive labels dominate due to flexibility and cost-effectiveness. |

| Direct-to-Container Printing | Growing | Reduced demand for labels in specific segments (e.g., beverage cans) | Brands exploring direct printing for branding and graphics. |

| Digital Information Integration (QR, NFC) | Emerging | Less reliance on physical print for information | Mid-2024: widespread integration of QR codes for product details. |

| Reusable Packaging | Significant | Reduced demand for single-use labels and packaging | Global reusable packaging market valued at $10.5 billion in 2023, with strong growth projected. |

| In-house Labeling Capabilities | Potential | Cost control, supply chain management for large clients | Requires substantial capital investment (tens of millions) and specialized expertise. |

Entrants Threaten

The packaging and label manufacturing sector demands significant upfront capital for specialized machinery and advanced technology, creating a formidable barrier for potential new entrants. For instance, state-of-the-art printing presses and sophisticated finishing equipment can easily cost millions of dollars, making it challenging for startups to compete with established players who have already amortized these investments.

Established players like CCL Industries leverage significant economies of scale, enabling them to achieve substantially lower per-unit production costs. For instance, CCL's extensive global manufacturing footprint allows for bulk purchasing of raw materials and optimized production runs, creating a cost advantage that is difficult for newcomers to replicate.

New entrants would face immense challenges in matching these cost efficiencies. Without comparable production volumes, they would likely incur higher per-unit costs for materials and manufacturing, making it exceedingly difficult to compete on price against incumbents like CCL.

CCL Industries benefits from deeply entrenched customer relationships and strong brand loyalty, making it difficult for new entrants to gain a foothold. These long-standing partnerships, often built over decades, are characterized by trust and a proven track record of quality and innovation. For instance, CCL's commitment to developing specialized solutions for major consumer brands in sectors like beverages and personal care creates significant switching costs for their clients.

Regulatory and Compliance Complexities

The packaging industry, including companies like CCL Industries, faces significant hurdles for new entrants due to complex regulatory and compliance requirements. These regulations cover crucial areas such as material safety, evolving recyclability standards, and detailed labeling mandates, all of which demand substantial upfront investment and specialized knowledge.

Navigating this intricate web of rules requires new players to dedicate considerable time and financial resources to ensure adherence, particularly concerning sustainability practices. For instance, the European Union's Packaging and Packaging Waste Regulation (PPWR), which aims for 100% reusable or recyclable packaging by 2030, presents a formidable barrier to entry for those not already equipped with the necessary infrastructure and expertise.

- Stringent Regulations: Packaging materials must meet strict safety and environmental standards, impacting product design and manufacturing processes.

- Sustainability Focus: Increasing demand for eco-friendly packaging necessitates investment in recyclable and biodegradable materials, a costly undertaking for newcomers.

- Compliance Costs: Adhering to diverse national and international regulations, such as those related to food contact materials or chemical restrictions, adds significant operational expenses.

Access to Distribution Channels and Supply Chains

New companies entering the specialty packaging and label market must overcome significant hurdles in establishing robust global supply chains and distribution networks. These are not easily replicated assets, requiring substantial investment and time to build.

Existing leaders like CCL Industries have spent years cultivating these complex logistical capabilities, giving them a distinct advantage. For instance, CCL's extensive network allows for efficient sourcing of raw materials and timely delivery of finished products across diverse geographical markets, a feat that would be prohibitively expensive and time-consuming for a newcomer to match.

The threat of new entrants is therefore moderated by the sheer difficulty and cost associated with replicating these established distribution channels and supply chain efficiencies.

- High Capital Investment: Building global supply chains requires immense upfront capital for warehousing, transportation, and technology.

- Established Relationships: Existing players have long-standing relationships with suppliers and logistics providers, offering better terms and reliability.

- Economies of Scale: CCL Industries benefits from economies of scale in its logistics operations, making it difficult for smaller new entrants to compete on cost.

- Regulatory Compliance: Navigating international trade regulations and compliance for supply chains adds another layer of complexity for new entrants.

The threat of new entrants in the packaging and label sector, where CCL Industries operates, is significantly low due to substantial barriers. These include the immense capital required for advanced manufacturing equipment, estimated in the millions for state-of-the-art printing presses, and the need to establish extensive global supply chains and distribution networks, which are costly and time-consuming to replicate.

Furthermore, established players benefit from economies of scale, lower per-unit production costs, and deeply entrenched customer relationships, creating high switching costs for clients. Stringent regulatory and compliance requirements, particularly around material safety and evolving sustainability mandates like the EU's PPWR aiming for 100% reusable or recyclable packaging by 2030, add further complexity and expense for potential newcomers.

| Barrier Type | Description | Example for CCL Industries |

|---|---|---|

| Capital Requirements | High cost of specialized machinery and technology. | Investment in advanced printing and finishing equipment costing millions. |

| Economies of Scale | Lower per-unit costs due to large-scale production. | Bulk purchasing of raw materials and optimized global production runs. |

| Customer Relationships | Long-standing partnerships and brand loyalty. | Developing specialized solutions for major consumer brands, increasing client switching costs. |

| Regulatory Compliance | Meeting safety, environmental, and labeling standards. | Adherence to evolving recyclability standards and chemical restrictions. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for CCL Industries is built upon a robust foundation of data, including their annual reports and SEC filings, alongside industry-specific market research reports and trade publications.