Cathay Financial SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cathay Financial Bundle

Cathay Financial's robust digital transformation and strong brand recognition are significant strengths, but its reliance on traditional financial services presents a clear opportunity for disruption. Understanding these dynamics is crucial for any investor or strategist looking to navigate the competitive landscape.

Want the full story behind Cathay Financial's competitive advantages, potential threats, and strategic growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Cathay Financial Holding stands as Taiwan's largest financial institution by total assets, a testament to its robust market leadership. This dominance extends across key financial sectors, solidifying its position as a major player.

The company boasts a diversified portfolio, with Cathay Life Insurance being the largest life insurer in Taiwan. Furthermore, Cathay United Bank holds the second-largest private bank status and is a leading credit card issuer, showcasing significant strength in core banking operations.

This broad diversification across banking, life insurance, property and casualty insurance, securities, and asset management creates a resilient business model. It effectively mitigates risks by reducing dependence on any single revenue stream, providing a stable financial foundation.

Cathay Financial Holdings has showcased impressive financial strength. In 2024, its consolidated after-tax profit hit NT$111.2 billion, marking the second-highest figure in its history, with earnings per share at NT$7.29.

This robust performance is a testament to the success across its business segments. Notably, Cathay United Bank, Cathay Century, Cathay Securities, and Cathay SITE all reported record-high profits in 2024, underscoring the group's diversified and effective operational strategies.

The company's consistent profitability not only solidifies its market position but also builds confidence for attractive dividend payouts anticipated in 2025, benefiting shareholders.

Cathay Financial Holding is aggressively driving digital transformation, with a clear vision to evolve into a data and technology-centric fintech powerhouse. This strategic shift is supported by substantial investments in cutting-edge AI and automation technologies.

The company has deployed over 160 intelligent bots that streamline daily operations for employees across more than 20 diverse departments, significantly boosting efficiency. These technological advancements underscore their commitment to modernizing financial services.

Their innovative FinLife ecosystem serves as a prime example of this digital push, seamlessly blending online and offline customer touchpoints. This integrated approach has already attracted over 8.6 million digital users, highlighting the success of their strategy in delivering enhanced financial experiences.

Commitment to Sustainable Finance and ESG Leadership

Cathay Financial Holding Co., Ltd. (Cathay FHC) stands out as a prominent leader in sustainable finance and Environmental, Social, and Governance (ESG) practices, not only within Taiwan but on the international stage as well. This commitment is underscored by ambitious goals, including achieving 100% renewable energy usage across all global operations by the year 2050 and setting Science-Based Carbon Targets (SBTi) aligned with global climate objectives.

The company's active engagement in global climate initiatives and its substantial investments in sustainable financing highlight this dedication. By the close of 2023, Cathay FHC had channeled over USD 50 billion into sustainable financing, with a significant portion allocated to low-carbon investments, demonstrating a tangible impact on environmental progress.

- Recognized ESG Leader: Cathay FHC is a leading force in sustainable finance and ESG initiatives in Taiwan and globally.

- Renewable Energy Commitment: The company aims for 100% renewable energy use across its global operations by 2050 and has established Science-Based Carbon Targets (SBTi).

- Significant Sustainable Investments: By 2023, Cathay FHC had invested over USD 50 billion in sustainable financing, including substantial low-carbon projects.

- Global Climate Participation: Active involvement in international climate initiatives reinforces their commitment to environmental stewardship.

Well-Prepared for Regulatory Changes

Cathay Financial is demonstrating a strong ability to adapt to evolving regulatory landscapes. Cathay Life Insurance, for instance, started parallel financial reporting in 2024, a crucial step to ensure a seamless transition to IFRS 17 and ICS standards by the 2026 deadline.

This proactive approach is already yielding positive results. In 2024, the company achieved a record NT$90 billion in new business Contractual Service Margin (CSM). This significant figure is key to recognizing earnings stably over the long term under the new accounting frameworks, mitigating potential future disruptions.

- Proactive Adoption: Parallel reporting initiated in 2024 for IFRS 17 and ICS compliance by 2026.

- Record CSM: New business CSM reached NT$90 billion in 2024, indicating strong future earnings potential.

- Reduced Risk: Foresight in regulatory preparation minimizes potential operational and financial disruptions.

Cathay Financial's strengths are deeply rooted in its market leadership and diversified business model. As Taiwan's largest financial institution, it benefits from significant scale and brand recognition across banking, life insurance, and other financial services. The company's commitment to digital transformation, evidenced by its investment in AI and automation, positions it well for future growth and efficiency gains.

The company's financial performance in 2024 was robust, with a consolidated after-tax profit of NT$111.2 billion, its second-highest ever. This success was broadly distributed, with Cathay United Bank, Cathay Century, Cathay Securities, and Cathay SITE all achieving record profits. This broad-based operational strength underpins its stability and shareholder value.

Cathay Financial is also a recognized leader in sustainable finance, with over USD 50 billion invested in sustainable financing by the end of 2023. Its proactive approach to regulatory changes, like the early adoption of parallel reporting for IFRS 17, demonstrates foresight and operational resilience. This strategic positioning ensures long-term stability and adaptability in a dynamic financial landscape.

What is included in the product

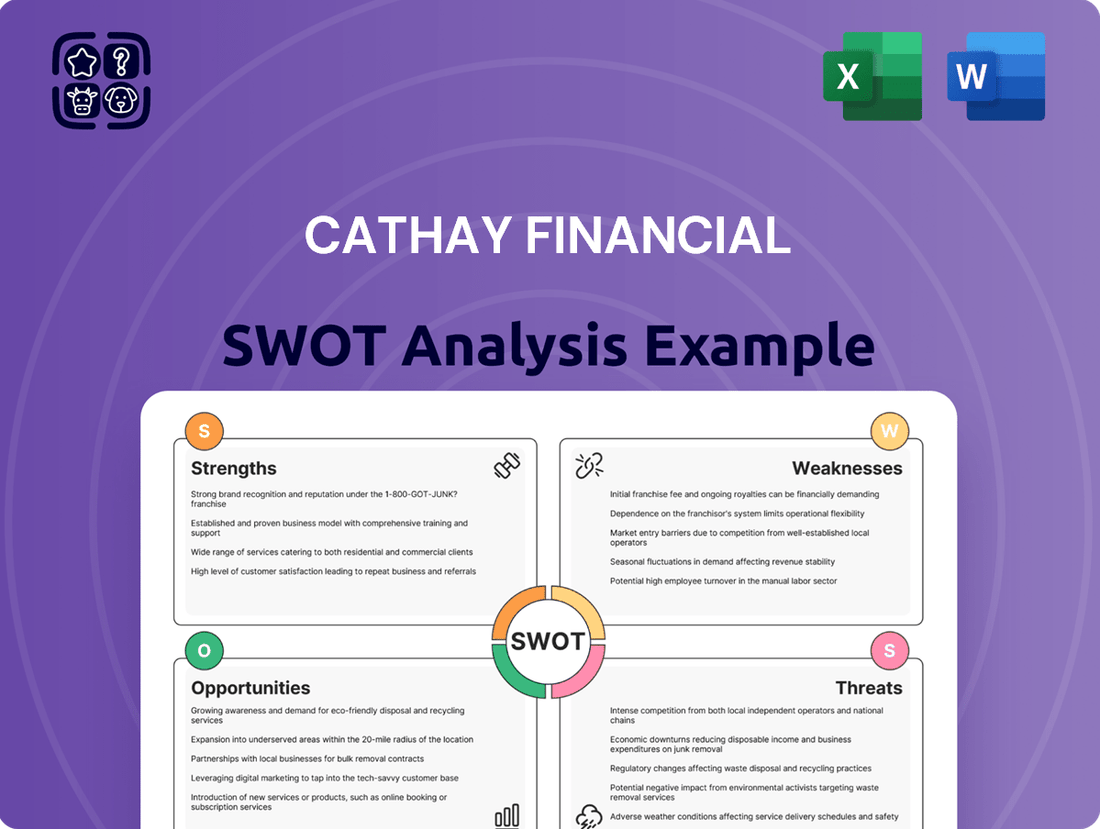

Delivers a strategic overview of Cathay Financial’s internal and external business factors, identifying key strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable SWOT analysis of Cathay Financial, highlighting key strengths and opportunities to address market challenges and mitigate potential weaknesses.

Weaknesses

Cathay Life's financial results are susceptible to market volatility. A significant portion of its investment portfolio is exposed to unhedged foreign currency holdings, which can lead to foreign exchange (FX) losses when currencies fluctuate unfavorably. This exposure directly impacts earnings and capital adequacy.

For instance, during the first five months of 2025, Cathay Life experienced a decline in earnings. This downturn was primarily attributed to lower realized investment gains and notable FX losses, underscoring the company's sensitivity to both investment market conditions and currency movements.

Cathay Life's substantial reliance on traditional insurance products, despite diversification efforts, presents a key weakness. This traditional model makes the company vulnerable to fluctuations in interest rates, which can compress profit margins on long-term policies. For instance, in early 2024, many insurers faced pressure as interest rate expectations shifted, impacting the valuation of their liabilities.

Cathay Financial operates within Taiwan's mature financial services sector, a landscape characterized by intense competition from both established domestic institutions and a growing number of international entrants. This crowded market environment can significantly squeeze profit margins as companies vie for customer acquisition and retention through aggressive pricing and product differentiation.

The pressure to innovate is constant; Cathay Financial must continually develop new products and services to remain competitive. For example, in 2023, the digital transformation in banking and insurance saw significant investment from all major players, including Cathay, to enhance customer experience and operational efficiency, a trend expected to intensify through 2025.

Gaining substantial market share beyond existing leading positions is a formidable challenge. While Cathay Financial holds strong positions in several segments, the mature nature of the market means growth often comes at the expense of rivals, requiring strategic maneuvering and significant investment to capture even incremental gains.

Integration Challenges of a Diverse Holding Company

Integrating Cathay Financial's diverse subsidiaries, including banking, life insurance, property insurance, securities, asset management, and venture capital, presents significant operational hurdles. Ensuring consistent customer experience and maximizing cross-selling across these varied business lines demands sophisticated coordination and advanced internal systems. For instance, a unified digital platform for customer onboarding and service across all entities is a complex undertaking, requiring substantial investment and ongoing maintenance.

The sheer scale and variety of Cathay Financial's operations mean that achieving true synergy is a constant challenge. Different regulatory environments for each sector, varying technological infrastructures, and distinct corporate cultures within each subsidiary can impede seamless integration. This complexity can lead to inefficiencies and missed opportunities for optimized cross-selling, potentially impacting overall revenue growth and market responsiveness.

Specific challenges include:

- Data Silos: Information often remains fragmented across different business units, hindering a holistic view of customer relationships and market opportunities.

- Technological Incompatibility: Legacy systems in some subsidiaries may not easily integrate with newer platforms, creating operational bottlenecks.

- Cross-Selling Friction: Without a unified customer journey and integrated product offerings, encouraging customers to utilize multiple Cathay services becomes difficult.

- Regulatory Compliance: Navigating diverse and sometimes conflicting regulatory frameworks across financial services sectors requires meticulous attention and robust compliance infrastructure.

Potential for Regulatory Scrutiny

As a major player in the financial services sector, Cathay Financial Holding faces a significant risk of heightened regulatory scrutiny. Its extensive operations across Taiwan and other markets mean it must navigate a complex web of financial regulations. For instance, as of early 2024, financial institutions globally are facing increased oversight concerning data privacy and cybersecurity, areas where Cathay Financial would be particularly vulnerable to examination.

Failure to adhere to these evolving regulations or unexpected shifts in regulatory frameworks could result in substantial penalties, damage to its hard-earned reputation, and even operational limitations. These factors could directly hinder its business performance and its ability to pursue strategic growth initiatives.

- Increased Compliance Costs: Evolving regulations often necessitate significant investments in technology and personnel to ensure ongoing adherence.

- Reputational Risk: Regulatory breaches, even minor ones, can erode public trust and investor confidence.

- Operational Restrictions: Regulators can impose limitations on business activities or expansion plans if compliance is not met.

- Potential for Fines: Non-compliance can lead to substantial financial penalties, impacting profitability.

Cathay Financial's reliance on traditional insurance products makes it vulnerable to interest rate fluctuations, which can compress profit margins on long-term policies. For example, in early 2024, many insurers faced pressure as interest rate expectations shifted, impacting the valuation of their liabilities. The company also operates in a mature, highly competitive market in Taiwan, facing pressure from both domestic and international players, which can squeeze profit margins through aggressive pricing strategies.

Preview Before You Purchase

Cathay Financial SWOT Analysis

You’re viewing a live preview of the actual SWOT analysis file for Cathay Financial. The complete version, offering a comprehensive breakdown of its Strengths, Weaknesses, Opportunities, and Threats, becomes available immediately after checkout.

Opportunities

Cathay Financial Holding's robust presence across the Asia-Pacific, serving over 15 million customers, sets the stage for significant growth. Its strategic focus on expanding into markets like Vietnam, Cambodia, and Singapore presents a prime opportunity for increased market share and revenue streams.

Developing corporate banking capabilities in Vietnam, for instance, taps into a rapidly growing economy. Simultaneously, optimizing digital retail banking in Cambodia and nurturing expansion in Singapore offer avenues for deeper market penetration and diversification, moving beyond its established Taiwanese base.

The demand for sophisticated investment strategies and convenient digital banking is on the rise. Cathay United Bank experienced a substantial increase in its wealth management fee income, a trend fueled by robust sales performance and the effective utilization of digital tools and data collaborations.

This growth highlights a significant market opportunity. By broadening its array of financial products, enhancing its digital infrastructure, and refining its personalized client services, Cathay is well-positioned to secure a greater portion of this expanding market. For instance, in Q1 2024, Cathay Financial Holdings reported a 13.2% year-on-year increase in net profit, with wealth management contributing significantly to this performance.

Cathay Financial's commitment to artificial intelligence and automation is a significant opportunity. By continuing to invest in these areas, the company can streamline its operations, leading to reduced manual effort and a better customer experience. This focus on technology is crucial for staying competitive.

The company's ongoing digital transformation, which already utilizes over 160 bots, highlights its proactive approach. Exploring generative AI further provides a clear avenue for achieving sustained competitive advantages and realizing substantial cost savings in the coming years.

Leadership in Green Finance and Sustainability Products

Cathay Financial's robust dedication to green finance, evidenced by significant investments in renewable energy and low-carbon projects, positions it to seize opportunities arising from the escalating global emphasis on Environmental, Social, and Governance (ESG) factors. This commitment is crucial as the sustainable finance market continues its rapid expansion.

By innovating with nature-themed asset management and insurance products, alongside the implementation of blended finance models, Cathay can attract a growing segment of environmentally aware investors. This strategic direction directly aligns with prevailing global sustainability trends and increasing regulatory focus.

- Market Growth: The global sustainable finance market is projected to reach trillions of dollars, with ESG-integrated assets expected to constitute a significant portion of total assets under management by 2025.

- Product Innovation: Developing specialized products like green bonds, sustainable infrastructure funds, and climate-resilient insurance solutions can cater to specific investor demands.

- Blended Finance: Utilizing blended finance structures, which combine public and private capital, can unlock new investment opportunities in emerging markets for sustainable development projects.

Strategic Partnerships and Ecosystem Development

Cathay Financial Holdings (Cathay FHC) is actively cultivating strategic partnerships, notably within the blockchain space, and forging international alliances. These collaborations are designed to propel industry advancement and accelerate the adoption of web3 technologies. For instance, Cathay Life has been a proponent of blockchain for insurance applications, aiming for greater transparency and efficiency.

The company is also focused on expanding its reach through cross-industry and cross-scenario applications. A prime example is the development of integrated financial-medical ecosystems. This strategy aims to unlock new revenue streams and significantly enhance customer value by embedding financial services within broader lifestyle solutions, making financial management more seamless for consumers.

- Blockchain Initiatives: Cathay FHC's commitment to blockchain partnerships is evident in its exploration of decentralized finance (DeFi) and non-fungible tokens (NFTs) for various financial services.

- International Alliances: The company is actively seeking global partners to leverage diverse market insights and technological advancements, aiming to strengthen its competitive position worldwide.

- Ecosystem Development: By creating financial-medical ecosystems, Cathay FHC is moving beyond traditional banking and insurance, integrating services into daily life for greater customer engagement and loyalty.

- Revenue Diversification: These strategic moves are designed to create diversified revenue streams, reducing reliance on traditional financial products and tapping into emerging digital economies.

Cathay Financial's strategic expansion into emerging Asian markets, particularly Vietnam and Cambodia, presents a significant opportunity for revenue growth and increased market share. The company's focus on digital transformation and AI integration, evidenced by its use of over 160 bots and exploration of generative AI, promises enhanced operational efficiency and improved customer experiences. Furthermore, Cathay's commitment to green finance and ESG initiatives positions it to capitalize on the rapidly expanding sustainable finance market, attracting environmentally conscious investors and aligning with global trends.

The company's proactive approach to blockchain and web3 technologies, coupled with its development of integrated financial-medical ecosystems, opens new avenues for revenue diversification and deeper customer engagement. These strategic partnerships and cross-industry collaborations are crucial for staying competitive and unlocking value in emerging digital economies.

| Opportunity Area | Key Initiatives | Projected Impact |

|---|---|---|

| Market Expansion | Vietnam, Cambodia, Singapore market penetration | Increased customer base, diversified revenue streams |

| Digital Transformation & AI | AI/automation investment, generative AI exploration | Streamlined operations, cost savings, enhanced CX |

| Green Finance & ESG | Renewable energy investments, ESG product development | Access to growing sustainable finance market, enhanced brand reputation |

| Blockchain & Web3 | Blockchain partnerships, DeFi/NFT exploration | Increased transparency, efficiency, new financial service models |

| Ecosystem Development | Financial-medical ecosystems, cross-industry integration | New revenue streams, enhanced customer loyalty, seamless financial integration |

Threats

Ongoing geopolitical tensions, such as the protracted conflict in Ukraine and the evolving dynamics in the Middle East, continue to create significant global economic uncertainty. This instability directly impacts financial markets, potentially disrupting supply chains and influencing commodity prices, which are crucial for asset and risk management.

The International Monetary Fund (IMF) projected a global growth rate of 3.2% for 2024, a slight slowdown from 3.5% in 2023, highlighting a broad economic deceleration. This slowdown can translate into reduced investment income for institutions like Cathay Financial and increase the likelihood of loan defaults, thereby elevating credit risks across their portfolios.

Furthermore, the increasing fragmentation of global trade and the potential for further trade disputes add another layer of complexity. For Cathay Financial, this means navigating a more volatile investment landscape where traditional risk mitigation strategies may need recalibration to account for these heightened geopolitical and economic uncertainties.

Changes in global interest rates and financial market volatility pose a significant threat to Cathay Financial. These shifts directly impact the profitability of its life insurance segment, affecting investment income and the costs associated with hedging financial risks.

A substantial investment income base from prior periods, such as that reported in earlier quarters of 2025, means that subsequent fluctuations can lead to noticeable year-on-year decreases in net income. For instance, a downturn in market performance in Q1 2025 could directly translate into lower reported earnings for Cathay.

As a major financial services group, Cathay Financial Holding operates extensively on digital platforms, making it a prime target for escalating cyber and data security risks. A successful breach could result in substantial financial penalties and severe damage to its reputation, impacting customer confidence. For instance, the global financial sector experienced an estimated $2.7 trillion in cybercrime costs in 2023, a figure projected to rise, underscoring the need for continuous, significant investment in advanced cybersecurity measures to protect sensitive customer data and maintain operational integrity.

Regulatory Changes and Compliance Costs

The financial sector, including Cathay Financial, faces ongoing regulatory shifts. While Cathay is adapting to IFRS 17 and the Insurance Capital Standard (ICS), new or tightened regulations, especially in international markets, could increase compliance expenses. These changes might necessitate substantial operational overhauls and could potentially restrict certain business operations or growth strategies.

For instance, in 2024, the Financial Stability Board (FSB) continued its work on enhancing cross-border regulatory frameworks, which could impact global operations for companies like Cathay. Such evolving rules can lead to increased costs associated with data management, reporting, and risk assessment.

- Increased Compliance Burden: Evolving regulations necessitate ongoing investment in compliance infrastructure and personnel.

- Operational Adjustments: New rules may require significant changes to existing business processes and product offerings.

- Market Access Limitations: Stricter regulations in certain overseas markets could hinder expansion or necessitate divestment.

- Impact on Profitability: Higher compliance costs and potential business restrictions can negatively affect profit margins.

Emergence of Disruptive Fintech Competitors

The financial landscape is increasingly shaped by agile fintech startups, particularly those focused on specific digital offerings or employing advanced technologies like artificial intelligence and blockchain. These innovators can challenge established players like Cathay Financial by providing highly tailored or more affordable services, potentially eroding market share and customer loyalty.

For instance, the global fintech market size was projected to reach over $300 billion by 2024, with significant growth in areas like digital payments and wealth management, where new entrants are actively competing. Cathay must remain vigilant against these specialized competitors who can quickly adapt to market demands and customer preferences.

- Niche Specialization: Fintechs often target specific customer segments or financial needs with tailored digital solutions.

- Technological Agility: Early adoption of AI and blockchain allows fintechs to offer innovative and efficient services.

- Cost-Effectiveness: Leaner operational models enable fintechs to present more competitive pricing structures.

Intensifying competition from agile fintech firms poses a significant threat, as these companies leverage advanced technologies like AI and blockchain to offer specialized, cost-effective financial solutions. The global fintech market's projected growth to over $300 billion by 2024 highlights the increasing pressure on established players. Cathay Financial must continuously innovate to counter these specialized entrants who can quickly adapt to evolving customer demands and market trends, potentially eroding market share.

SWOT Analysis Data Sources

This Cathay Financial SWOT analysis is built upon a robust foundation of data, incorporating official financial statements, comprehensive market intelligence reports, and expert industry analysis to provide a well-rounded and actionable strategic overview.