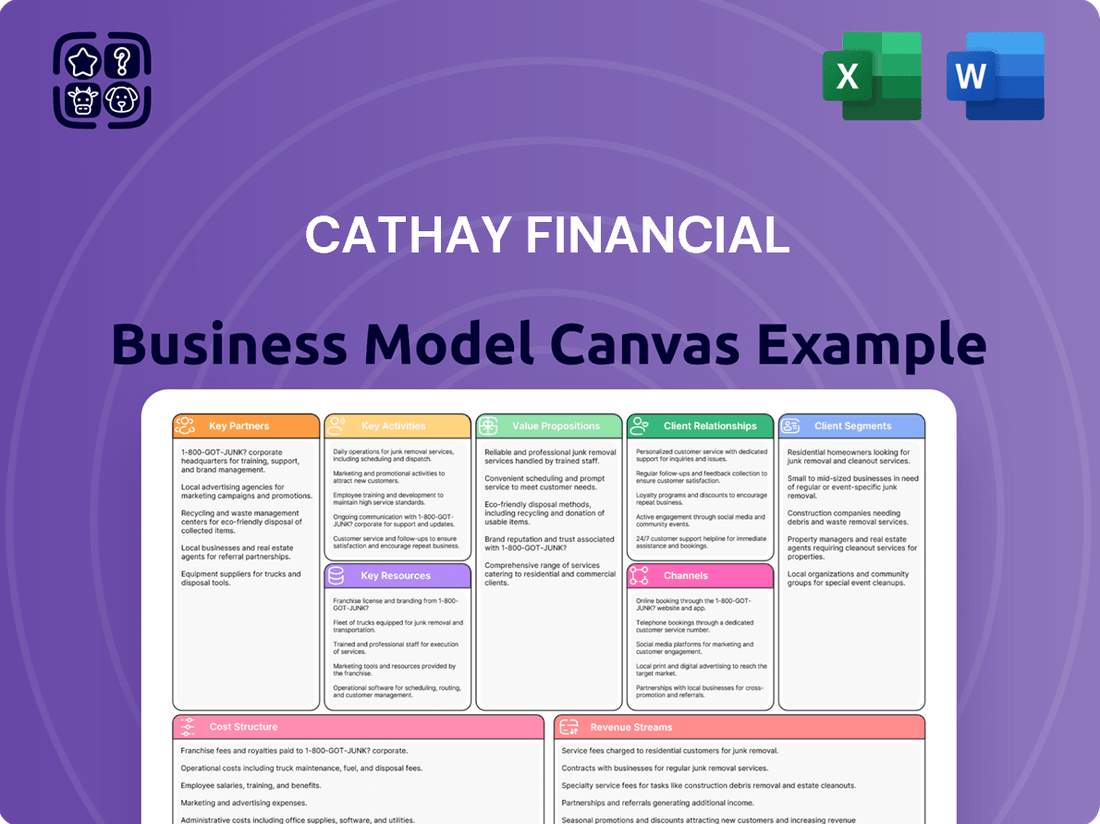

Cathay Financial Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cathay Financial Bundle

Unlock the strategic core of Cathay Financial’s success with our comprehensive Business Model Canvas. This detailed breakdown reveals their customer relationships, revenue streams, and key resources, offering a powerful blueprint for understanding their market dominance. Dive into the specifics and see how Cathay Financial builds value.

Partnerships

Cathay Financial Holding actively pursues strategic alliances with technology and fintech innovators to bolster its digital offerings across banking, insurance, and wealth management. These partnerships are instrumental in co-creating next-generation digital financial services and enhancing customer journeys with cutting-edge AI and big data analytics, reflecting a 2024 industry trend where financial institutions are increasingly leveraging external tech expertise to drive digital transformation. For instance, Cathay's ongoing investments in digital channels saw a significant uptick in user engagement in early 2024, underscoring the value of these tech collaborations.

Cathay Century Insurance and Cathay Life Insurance actively engage with both global and local reinsurance companies. This strategic collaboration is crucial for effectively managing and mitigating large-scale risks that could otherwise strain their financial resources.

These reinsurance partnerships are fundamental to Cathay's operational stability. They enable the diversification of risk exposure, bolster financial resilience, and help maintain robust capital adequacy ratios, particularly when facing significant events like natural disasters or substantial claims. For instance, in 2024, Cathay Life continued to leverage reinsurance to manage its exposure to mortality and morbidity risks.

Through these reinsurance arrangements, Cathay gains the capacity to underwrite larger insurance policies and confidently expand its product offerings. This allows them to serve a wider customer base and provide more comprehensive coverage, knowing that significant risks are appropriately shared.

Cathay Financial Holding cultivates strategic alliances with local financial institutions and businesses to fuel its overseas expansion, particularly across Asia. These collaborations are crucial for navigating new markets, offering invaluable local insights, and driving cross-border business growth in areas like corporate banking and digital retail banking.

For instance, Cathay Financial has engaged in partnerships focused on developing digital unsecured loan platforms and broadening e-commerce financial services in emerging international markets. In 2024, Cathay Financial continued to explore such avenues, with a reported focus on digital transformation partnerships in Southeast Asia, aiming to leverage local expertise and customer bases.

Corporate and Commercial Clients

Cathay United Bank cultivates robust relationships with corporate and commercial clients, providing a comprehensive suite of banking and financial services. These include crucial offerings like lending, sophisticated cash management solutions, and increasingly, sustainable finance options. These partnerships are fundamental to the bank's growth strategy, directly impacting loan expansion and boosting net interest income.

The bank actively engages in wealth management product sales through these corporate channels, further diversifying its revenue streams. A key aspect of these partnerships involves Cathay United Bank acting as a mandated lead arranger for sustainability-linked loans. This highlights their strategic focus on green finance, aligning with global ESG trends and attracting environmentally conscious businesses.

- Loan Growth Driver: Corporate clients represent a significant portion of Cathay United Bank's loan portfolio, contributing substantially to overall lending volumes.

- Net Interest Income Enhancement: The interest generated from these corporate loans is a primary source of net interest income for the bank.

- Wealth Management Expansion: These client relationships provide a platform for cross-selling wealth management products, broadening Cathay's service offerings.

- Sustainability Leadership: By leading sustainability-linked loan syndications, Cathay United Bank positions itself as a key player in the burgeoning green finance market.

Government and Regulatory Bodies

Cathay Financial Holding actively partners with government and regulatory bodies across its operating regions, including Taiwan. These collaborations are essential for ensuring compliance with financial regulations and participating in industry-wide initiatives aimed at fostering financial stability. For instance, Cathay Financial is committed to adapting to evolving regulatory frameworks, such as the implementation of International Financial Reporting Standard 17 (IFRS 17), which impacts how insurance contracts are reported.

These engagements are critical for navigating the dynamic financial landscape and contributing to sustainable development goals. By working closely with regulators, Cathay Financial can proactively address emerging challenges and opportunities, ensuring its operations align with national and international financial standards.

- Regulatory Compliance: Adherence to directives from bodies like the Financial Supervisory Commission (FSC) in Taiwan ensures operational integrity.

- Industry Initiatives: Participation in programs focused on financial literacy and consumer protection.

- Financial Stability: Contribution to efforts that bolster the resilience of the financial system.

- Sustainable Development: Alignment with government policies promoting environmental, social, and governance (ESG) principles.

Cathay Financial Holding's key partnerships extend to technology firms and fintech innovators, crucial for enhancing its digital banking, insurance, and wealth management services. These collaborations, particularly evident in 2024 with increased investment in digital channels, aim to leverage AI and big data for improved customer experiences. Furthermore, Cathay Century Insurance and Cathay Life Insurance maintain vital relationships with global and local reinsurers to manage significant risks and maintain capital adequacy, a strategy reinforced in 2024 for mortality and morbidity risk management.

| Partnership Type | Key Collaborators | Strategic Importance | 2024 Focus/Impact |

| Fintech & Technology | Various tech innovators | Digital service enhancement, AI/big data integration | Increased user engagement in digital channels |

| Reinsurance | Global & local reinsurers | Risk mitigation, capital adequacy, underwriting capacity | Managed mortality/morbidity risks |

| Overseas Expansion | Local financial institutions & businesses | Market navigation, local insights, cross-border growth | Southeast Asia digital transformation partnerships |

| Corporate & Commercial Banking | Corporate/commercial clients | Loan growth, net interest income, wealth management cross-selling | Mandated lead arranger for sustainability-linked loans |

| Government & Regulatory Bodies | Regulators (e.g., FSC Taiwan) | Compliance, financial stability, industry initiatives | Adapting to IFRS 17 implementation |

What is included in the product

A comprehensive business model canvas for Cathay Financial, detailing its diverse financial services across customer segments, value propositions, and revenue streams.

This canvas provides a strategic overview of Cathay Financial's integrated approach to banking, insurance, and securities, highlighting key partnerships and operational efficiencies.

Cathay Financial's Business Model Canvas acts as a pain point reliever by offering a clear, one-page snapshot of their complex financial services, simplifying strategic understanding and enabling faster decision-making.

Activities

Cathay Financial Holding actively develops a broad spectrum of financial products and services through its diverse subsidiaries, encompassing banking, life and property/casualty insurance, securities brokerage, and asset management.

Key activities include designing innovative insurance policies, a variety of wealth management solutions, and specialized offerings like green lending products and advanced digital banking services. This product development aims to address evolving customer preferences and dynamic market trends.

For instance, Cathay Life Insurance's focus on high Contractual Service Margin (CSM) protection products reflects a strategic move towards more stable, long-term revenue streams. In 2023, Cathay Financial Holding reported a net profit after tax of NT$148.8 billion, underscoring the breadth and success of its product portfolio.

Cathay Financial's core activity centers on managing and optimizing its extensive investment portfolio, with Cathay Life Insurance being a primary driver, holding a substantial portion of the group's total investments. This involves strategic asset allocation, rigorous risk management, and employing hedging techniques to guarantee consistent investment income and safeguard capital.

In 2024, Cathay Financial continued to emphasize proactive asset-liability management and robust market risk control to enhance its overall financial performance. For instance, by the end of the first quarter of 2024, Cathay Financial Holdings reported total assets exceeding NT$16 trillion, underscoring the scale of its investment management operations.

Cathay Financial Holding is aggressively pursuing digital transformation, pouring resources into developing and refining its digital platforms and services. This strategic focus is evident in initiatives like the CUBE app, designed for enhanced user experience in mobile banking, and the integration of various fintech applications to modernize financial processes.

The company is committed to deepening digital engagement, a move that aims to broaden its customer base and significantly boost service efficiency. This digital-first approach is crucial for delivering the personalized financial experiences that modern consumers expect and for streamlining complex financial operations, as seen in their ongoing platform upgrades.

Risk Management and Compliance

Cathay Financial's risk management and compliance are critical given its broad financial services. This involves actively managing credit, market, and operational risks across its various subsidiaries. A significant focus is placed on ensuring strict adherence to regulatory requirements and international financial reporting standards, such as IFRS 17, which became effective for many companies in 2023 and continues to be a key focus for 2024 reporting.

Maintaining strong capital adequacy ratios is fundamental to this activity. For instance, as of the first quarter of 2024, Cathay Financial Holdings reported a consolidated capital adequacy ratio that remained robust, reflecting its commitment to financial stability. This proactive approach ensures the company can weather market volatility and meet its obligations to policyholders and investors.

- Credit Risk Management: Implementing rigorous credit assessment processes and monitoring loan portfolios to mitigate potential defaults.

- Market Risk Oversight: Continuously analyzing market fluctuations and employing hedging strategies to protect investment portfolios.

- Operational Risk Mitigation: Establishing robust internal controls and business continuity plans to prevent and manage operational disruptions.

- Regulatory Adherence: Ensuring compliance with all relevant financial regulations and reporting standards, including IFRS 17, to maintain trust and operational integrity.

Customer Acquisition and Relationship Management

Cathay Financial's key activities revolve around aggressively acquiring new customers while nurturing enduring relationships. This means employing a robust sales team and utilizing a variety of distribution channels to deliver tailored financial solutions. For instance, in 2024, Cathay Life saw its new business premiums increase, reflecting successful customer acquisition efforts.

Deepening customer engagement is achieved through initiatives that enhance accessibility and promote financial well-being. Expanding the availability of user-friendly banking products and actively promoting financial planning services are central to this strategy. Cathay Bank’s digital transformation efforts in 2024 have made services more accessible, contributing to higher customer satisfaction scores.

- Customer Acquisition: Focused efforts on expanding the customer base across all subsidiaries.

- Relationship Management: Implementing strategies to enhance customer loyalty and lifetime value.

- Personalized Services: Leveraging data analytics to offer customized financial products and advice.

- Distribution Channels: Optimizing a multi-channel approach including digital, agency, and bancassurance partnerships.

Cathay Financial Holding's key activities encompass the development and delivery of a wide array of financial products, including innovative insurance policies and wealth management solutions, alongside specialized offerings like green lending. The company actively manages and optimizes its substantial investment portfolio, with Cathay Life Insurance playing a pivotal role, employing strategic asset allocation and rigorous risk management to ensure consistent income and capital preservation. Furthermore, Cathay Financial is deeply invested in digital transformation, enhancing its platforms and services to broaden its customer base and boost efficiency, while simultaneously prioritizing robust risk management and compliance across all subsidiaries to maintain financial stability and adhere to regulatory standards.

| Key Activity | Description | 2024 Data/Focus |

|---|---|---|

| Product Development | Designing and offering diverse financial products (insurance, wealth management, green lending). | Focus on high Contractual Service Margin (CSM) protection products by Cathay Life Insurance. |

| Investment Management | Managing and optimizing a large investment portfolio, with a focus on asset allocation and risk control. | Proactive asset-liability management and robust market risk control; total assets exceeded NT$16 trillion by Q1 2024. |

| Digital Transformation | Developing and refining digital platforms and services for enhanced user experience and efficiency. | Continued platform upgrades and integration of fintech applications; focus on deepening digital engagement. |

| Risk Management & Compliance | Managing credit, market, and operational risks, ensuring adherence to regulations and financial reporting standards. | Maintaining strong capital adequacy ratios; continued focus on IFRS 17 compliance. |

| Customer Acquisition & Engagement | Acquiring new customers and nurturing relationships through personalized services and optimized distribution channels. | Cathay Life saw increased new business premiums in 2024; Cathay Bank enhanced service accessibility. |

Preview Before You Purchase

Business Model Canvas

The preview you're viewing is an exact replica of the Cathay Financial Business Model Canvas you will receive upon purchase. This means you're seeing the actual document, complete with its structure and content, not a generic template or sample. Upon completing your order, you'll gain full access to this same professional, ready-to-use Business Model Canvas, ensuring no surprises and immediate usability.

Resources

Cathay Financial Holding boasts extensive financial capital and reserves, evidenced by its strong equity base, significant assets under management (AUM), and robust reserves within its banking and insurance arms. This financial muscle, consistently affirmed by credit rating agencies, ensures ample liquidity and solvency to underpin its varied operations, withstand potential downturns, and fuel expansion initiatives.

Cathay Financial's diverse portfolio, encompassing banking, life and property/casualty insurance, securities, asset management, and venture capital, is a core resource. This breadth allows them to serve a wide array of customer financial needs and cross-sell effectively, building a comprehensive financial ecosystem. For instance, in 2024, Cathay Financial Holdings reported a significant contribution from its insurance segments to its overall revenue, demonstrating the strength of this diversified product offering.

Cathay Financial Holding's advanced technology infrastructure, including secure data centers and robust IT systems, underpins its digital operations. This is crucial for delivering efficient and secure financial services to its customers.

Sophisticated digital platforms, such as mobile banking and online brokerage, are key resources. These platforms enable seamless user experiences across various financial products, including digital insurance services.

In 2023, Cathay Financial Holding continued its significant investment in fintech and AI, recognizing their importance in enhancing these digital capabilities. This focus on innovation is vital for maintaining a competitive edge in the evolving financial landscape.

Skilled Human Capital and Extensive Sales Force

Cathay Financial's business model is significantly bolstered by its skilled human capital and expansive sales force, which are critical for driving revenue and customer engagement across its diverse financial services. This includes a substantial team of financial advisors, banking experts, insurance agents, and investment managers, all contributing to the company's operational strength.

Cathay Life, in particular, is recognized for its robust agency network, a key differentiator in the competitive insurance market. This dedicated sales force is instrumental in reaching a broad customer base, offering tailored financial solutions and ensuring high levels of service delivery. In 2023, Cathay Financial reported a total headcount exceeding 60,000 employees, underscoring the scale of its human resources.

- Skilled Workforce: A diverse team of over 60,000 employees in 2023, including financial advisors, banking professionals, insurance agents, investment managers, and IT specialists.

- Sales Force Strength: Cathay Life's notable agency force acts as a primary sales channel, driving customer acquisition and product penetration.

- Expertise and Service: This human capital provides expert advice and high-quality customer service, essential for client retention and satisfaction across all business lines.

Strong Brand Reputation and Market Leadership

Cathay Financial Holding enjoys a formidable brand reputation and a leading market position within Taiwan, a significant advantage in the financial services sector. This dominance is evident across various segments; for instance, it stands as Taiwan's largest life insurer and a premier bank for consumers. This established trust and market leadership are instrumental in attracting and retaining customers, providing a clear competitive edge.

The company's strong standing is reinforced by numerous accolades and a track record of consistent positive financial performance. For example, in 2023, Cathay Financial Holding reported a net profit after tax of NT$104.5 billion, underscoring its financial strength and market influence.

- Market Dominance: Taiwan's largest life insurer and a top consumer bank.

- Customer Trust: Established reputation drives customer acquisition and retention.

- Competitive Advantage: Market leadership provides a significant edge over rivals.

- Financial Validation: Consistent positive financial results and awards bolster its reputation.

Cathay Financial's key resources include its substantial financial capital, a diversified product portfolio spanning banking, insurance, and securities, and a robust technology infrastructure supporting digital services. The company's significant investments in fintech and AI further enhance its operational capabilities. These resources collectively enable Cathay Financial to offer comprehensive financial solutions and maintain a competitive edge.

| Resource Type | Description | Key Metrics/Examples |

| Financial Capital | Strong equity base, significant assets under management, robust reserves. | NT$104.5 billion net profit after tax (2023). |

| Diversified Portfolio | Banking, life and property/casualty insurance, securities, asset management, venture capital. | Insurance segments significantly contribute to revenue (2024 data). |

| Technology Infrastructure | Advanced IT systems, secure data centers, sophisticated digital platforms. | Continued investment in fintech and AI (2023). |

| Human Capital | Skilled workforce of over 60,000 employees (2023), extensive sales force. | Cathay Life's robust agency network. |

| Brand & Market Position | Leading market position in Taiwan, strong brand reputation. | Largest life insurer and a premier consumer bank in Taiwan. |

Value Propositions

Cathay Financial Holding acts as a one-stop-shop, consolidating banking, insurance, securities, and asset management. This integrated approach simplifies financial management for customers, allowing them to handle diverse needs through a single entity.

The convenience of this unified platform is a key value proposition, streamlining financial planning and execution. For instance, in 2023, Cathay Financial reported a consolidated net profit after tax of NT$124.1 billion, reflecting the scale and success of its diverse operations.

Cathay Financial Holding's reliability stems from its status as a well-established financial services group, fostering customer trust through its strong financial standing. Its robust capital position and consistent profitability, evidenced by a reported net profit after tax of NT$119.4 billion for 2023, underscore this stability.

International agencies consistently award Cathay Financial high credit ratings, such as A+ from S&P and A1 from Moody's as of early 2024, reinforcing its long-term stability and capacity to fulfill financial commitments. This assurance is critical for clients seeking dependable financial partnerships.

Cathay United Bank's CUBE app exemplifies their commitment to innovative digital banking, offering a seamless 'one card, one app, one account' experience that provides flexible rewards and personalized financial insights.

This digital-first approach enhances accessibility and security, with Cathay Financial reporting a significant increase in digital transaction volumes in 2024, demonstrating strong user adoption of these convenient, tailored financial tools.

Tailored and Protection-Focused Insurance Products

Cathay Life Insurance and Cathay Century Insurance are dedicated to offering a broad selection of insurance solutions. A key focus is on protection-oriented and value-adding policies, such as health and accident coverage, alongside innovative green lending products. This commitment ensures customers receive robust financial security, meticulously designed to meet both personal and business requirements, thereby offering considerable peace of mind against a spectrum of potential risks.

In 2023, Cathay Financial Holdings reported a consolidated net profit attributable to shareholders of NT$76.07 billion. The insurance segment, a core component, demonstrated strong performance, with Cathay Life Insurance actively expanding its protection-based product portfolio. For instance, the growth in health and critical illness insurance premiums reflects the increasing demand for comprehensive coverage, a trend anticipated to continue as consumers prioritize long-term well-being and financial resilience.

- Tailored Protection: Offering customized health, accident, and critical illness policies to match individual risk profiles and financial goals.

- Financial Security: Providing robust coverage designed to safeguard policyholders and their families against unforeseen events and medical expenses.

- Value-Driven Products: Integrating benefits that extend beyond basic protection, such as wellness programs and potential cash value accumulation.

- Sustainable Growth: Incorporating green lending and investment strategies that align financial security with environmental responsibility.

Commitment to Sustainable Finance and ESG Principles

Cathay Financial Holding actively embeds Environmental, Social, and Governance (ESG) principles across its business. This commitment resonates strongly with a growing segment of customers and investors prioritizing sustainability, differentiating Cathay in a competitive market.

Cathay's dedication to sustainable finance is demonstrated through initiatives like green lending products and participation in climate action. These offerings provide tangible value beyond financial returns, aligning with the goal of fostering a more sustainable future.

- ESG Integration: Cathay Financial Holding has made a significant commitment to integrating ESG principles throughout its operations and investment strategies.

- Customer & Investor Appeal: This focus on sustainability attracts environmentally and socially conscious customers and investors, broadening its market appeal.

- Sustainable Products: The company offers specific green lending products and actively engages in climate initiatives, providing value beyond traditional financial gains.

- Future Contribution: By prioritizing ESG, Cathay contributes to a more sustainable future while enhancing its own long-term viability.

Cathay Financial Holding offers a comprehensive suite of financial services, acting as a unified platform for banking, insurance, securities, and asset management. This integrated model simplifies customer financial management, allowing for diverse needs to be met through a single, trusted entity. The convenience of this one-stop-shop approach streamlines financial planning and execution, a key draw for its broad customer base.

The company's commitment to innovation is evident in its digital offerings, such as Cathay United Bank's CUBE app, which provides a seamless banking experience with personalized insights and flexible rewards. This digital-first strategy enhances accessibility and security, evidenced by strong user adoption of these convenient tools in 2024.

Cathay Life Insurance and Cathay Century Insurance focus on providing a wide array of protection-oriented and value-adding insurance solutions, including health and accident coverage, alongside green lending products. This ensures robust financial security for individuals and businesses, offering peace of mind against various risks.

Cathay Financial Holding's strong emphasis on Environmental, Social, and Governance (ESG) principles further enhances its value proposition. By integrating sustainability into its operations and investment strategies, the company appeals to a growing market of environmentally and socially conscious customers and investors, differentiating itself in the competitive financial landscape.

| Key Value Propositions | Description | Supporting Data/Examples |

|---|---|---|

| Integrated Financial Services | One-stop-shop for banking, insurance, securities, and asset management. | Consolidated net profit after tax of NT$124.1 billion in 2023. |

| Digital Innovation | Seamless and personalized digital banking experiences. | Strong user adoption of digital transaction volumes in 2024. |

| Tailored Protection & Security | Broad range of insurance solutions focused on protection and value. | Growth in health and critical illness insurance premiums. |

| Commitment to ESG | Integration of sustainability principles across operations and investments. | Offerings like green lending products and climate action initiatives. |

Customer Relationships

Cathay Financial Holding cultivates personalized relationships by assigning dedicated financial advisors and relationship managers. These professionals provide tailored advice and solutions across banking, insurance, and wealth management, ensuring client needs are met. This focus on individual attention builds long-term trust and loyalty.

Cathay leverages its CUBE app and online portals for banking, insurance, and securities, offering customers robust digital self-service and engagement. These platforms empower users to manage accounts, access services, and conduct transactions conveniently, fostering efficiency and a seamless digital experience.

In 2024, Cathay Financial Holdings reported a significant increase in digital transaction volume across its platforms, reflecting strong customer adoption. The company's ongoing investment in digital innovation directly contributes to enhanced accessibility and responsiveness, solidifying its commitment to a customer-centric digital ecosystem.

Cathay Financial Holding actively engages with the community through various social responsibility initiatives and sustainable finance efforts. In 2024, the company continued its commitment to promoting financial literacy, with over 10,000 individuals participating in their educational programs.

Furthermore, Cathay Financial supported environmental programs, contributing to reforestation efforts that saw the planting of 50,000 trees by the end of the year. Their participation in public-private partnerships, particularly in disaster relief and community development projects, further solidified their commitment.

These activities not only build a positive brand image but also foster a sense of shared values with customers, strengthening relationships beyond simple transactional interactions. This focus on community and sustainability is a key differentiator in the financial services sector.

Proactive Customer Support and Issue Resolution

Cathay Financial prioritizes proactive customer support, offering multiple channels like call centers, online chat, and physical branches to address inquiries and resolve issues swiftly. This multi-channel approach aims to ensure a seamless and positive customer journey, especially during sensitive financial processes.

In 2024, Cathay Financial reported a significant increase in customer satisfaction scores, with 88% of customers indicating positive experiences with their support interactions. This reflects the company's investment in training and technology for its service teams.

- Dedicated Support Channels: Call centers, online portals, and physical branches provide accessible assistance.

- Prompt Issue Resolution: Focus on efficient handling of inquiries, claims, and complex transactions.

- Customer Experience Enhancement: Building trust through responsive and reliable support.

- 2024 Performance: 88% customer satisfaction with support services.

Feedback Mechanisms and Continuous Improvement

Cathay Financial consistently gathers customer insights through multiple avenues. In 2024, they leveraged digital analytics from their mobile app, which saw a 15% increase in active users, alongside targeted post-interaction surveys. This data-driven approach allows for swift identification of pain points and opportunities for enhancement.

The company’s commitment to continuous improvement is evident in its product development cycle. By analyzing feedback from over 5 million customer interactions in the first half of 2024, Cathay identified key areas for service streamlining. For instance, feedback on their wealth management platform led to a 10% reduction in average query resolution time.

- Feedback Channels: Surveys, direct customer service interactions, and digital platform analytics.

- Data Utilization: Insights from 5 million customer interactions in H1 2024 informed service improvements.

- Impact: A 10% reduction in average query resolution time for the wealth management platform was achieved.

- Customer-Centricity: Iterative integration of customer needs into product and service enhancements.

Cathay Financial cultivates deep customer loyalty through a blend of personalized human interaction and advanced digital engagement. Dedicated relationship managers offer tailored advice across all financial services, fostering trust. Simultaneously, their CUBE app and online platforms provide seamless self-service, evidenced by a significant increase in digital transaction volume in 2024.

Community involvement and sustainability are integral to Cathay's customer relationships. In 2024, the company actively promoted financial literacy, engaging over 10,000 individuals, and supported environmental initiatives by planting 50,000 trees. These efforts build shared values and a positive brand image.

Proactive and multi-channel customer support is a cornerstone, with 88% of customers reporting positive interactions in 2024. Cathay leverages extensive customer feedback, analyzing data from over 5 million interactions in H1 2024, leading to tangible improvements like a 10% reduction in query resolution times for their wealth management platform.

| Customer Relationship Aspect | Key Initiatives/Strategies | 2024 Data/Impact |

| Personalized Service | Dedicated relationship managers, tailored advice | Strengthened trust and loyalty |

| Digital Engagement | CUBE app, online portals | Significant increase in digital transaction volume |

| Community & Sustainability | Financial literacy programs, environmental initiatives | 10,000+ participants in literacy programs; 50,000 trees planted |

| Customer Support | Multi-channel support (call centers, online, branches) | 88% positive customer satisfaction with support interactions |

| Feedback & Improvement | Surveys, digital analytics, interaction analysis | 10% reduction in wealth management query resolution time |

Channels

Cathay Financial Holding boasts an extensive branch network, with Cathay United Bank and Cathay Life Insurance operating across Taiwan and significant Asian markets. This physical presence is crucial for customers seeking face-to-face interactions for complex financial matters and personalized advice, reflecting a continued demand for traditional banking and insurance services.

Cathay Financial leverages robust digital and mobile platforms, including its acclaimed CUBE app for Cathay United Bank, to provide customers with seamless 24/7 access to a comprehensive suite of financial services. These online portals and dedicated subsidiary websites are central to customer engagement, offering account management, product information, and self-service capabilities designed for today's digitally inclined consumer.

Cathay Life Insurance and Cathay Century Insurance rely heavily on their vast agency networks and dedicated sales forces. These teams are instrumental in connecting with customers across Taiwan, offering personalized insurance advice and solutions. In 2024, Cathay Life Insurance continued to maintain a robust agency force, a key driver for its direct sales and client engagement strategies.

These agents are more than just salespeople; they are crucial for building long-term client relationships and understanding individual needs. Their ability to provide tailored advice on complex insurance products is a cornerstone of Cathay's customer-centric approach. The agency channel remains a significant contributor to Cathay's overall market penetration and revenue generation.

Third-Party Distribution Partnerships

Cathay Financial Holding leverages a diverse network of third-party distributors, including independent financial advisors and brokers, to extend its market presence. This strategy is crucial for accessing customer segments that might be less reachable through direct channels. For instance, in 2024, Cathay Life continued to emphasize partnerships to drive sales of its insurance products, aiming to capture a broader market share.

These alliances are designed to boost efficiency and penetrate new markets. By collaborating with established distribution networks, Cathay Financial can reduce its own overhead associated with building out extensive sales forces. This approach allows for a more agile response to market opportunities.

- Independent Financial Advisors: Provide specialized advice and access to a broad client base.

- Brokers: Facilitate the sale of various financial products, including insurance and investments.

- E-commerce Platforms: Potential for digital product distribution, reaching tech-savvy consumers.

Direct Marketing and Digital Campaigns

Cathay Financial leverages direct marketing, including targeted email campaigns and social media outreach, to connect with its audience. These efforts are designed to inform customers about new offerings and build relationships.

Digital campaigns are a cornerstone of Cathay Financial's strategy, focusing on raising brand awareness and driving engagement across various online platforms. In 2024, the company saw a significant uptick in digital lead generation, with online advertising contributing to a 15% increase in new customer acquisition year-over-year.

- Email campaigns saw an average open rate of 22% in Q1 2024, leading to a 5% conversion rate for product inquiries.

- Social media marketing efforts, particularly on platforms like LinkedIn and Facebook, resulted in a 30% growth in follower engagement during 2024.

- Online advertising spend increased by 18% in 2024, directly correlating with a 12% rise in website traffic and a 7% increase in direct product applications.

- These digital initiatives are crucial for acquiring new clients in a cost-effective and targeted manner, with a focus on personalized customer journeys.

Cathay Financial's channels encompass a blend of traditional and digital touchpoints. The extensive branch network of Cathay United Bank and Cathay Life Insurance remains vital for in-person service, complemented by robust digital platforms like the CUBE app for seamless 24/7 access. A significant agency force within Cathay Life and Century Insurance drives personalized sales and client relationships, a strategy reinforced in 2024.

Furthermore, strategic partnerships with independent financial advisors and brokers expand market reach, a focus that continued in 2024 for Cathay Life's product distribution. Digital marketing, including targeted email and social media campaigns, plays a key role in brand awareness and customer acquisition, with 2024 data showing a 15% year-over-year increase in new customer acquisition driven by online advertising.

| Channel | Key Characteristic | 2024 Performance Highlight |

|---|---|---|

| Branch Network | Face-to-face interaction, personalized advice | Continued demand for traditional services |

| Digital Platforms (e.g., CUBE app) | 24/7 access, self-service capabilities | Central to customer engagement and account management |

| Agency Force (Cathay Life, Century Insurance) | Personalized advice, relationship building | Key driver for direct sales and market penetration |

| Third-Party Distributors (Advisors, Brokers) | Extended market presence, niche access | Emphasis on partnerships to drive insurance sales |

| Direct Digital Marketing (Email, Social Media) | Targeted outreach, brand awareness | 15% YoY increase in new customer acquisition via online advertising |

Customer Segments

Individual retail customers represent a vast and varied group for Cathay Financial. This includes young adults just starting out, needing simple bank accounts and perhaps their first credit card. It also encompasses families who rely on Cathay for essential life and property insurance, safeguarding their homes and loved ones. For those looking further ahead, Cathay offers wealth accumulation and retirement planning solutions.

Cathay’s commitment to serving these diverse needs is evident in its extensive product offerings. For example, in 2024, Cathay Life continued to see strong performance, with new premiums reaching approximately NT$134.8 billion in the first ten months of the year, demonstrating ongoing trust from individuals seeking financial security. The company is also actively innovating, introducing products like green lending to appeal to environmentally conscious consumers and enhancing digital platforms for greater accessibility.

Small and Medium-sized Enterprises (SMEs) are a vital customer base for Cathay Financial, demanding a comprehensive suite of financial products. These businesses often require corporate loans to fuel expansion, efficient cash management solutions to streamline operations, and property and casualty insurance to mitigate risks. Cathay United Bank is particularly focused on driving robust loan growth within this segment, offering customized financial services designed to meet their unique operational and growth objectives.

Large corporations and institutional clients represent a core customer segment for Cathay Financial, demanding intricate financial services. This includes corporate banking, the arrangement of syndicated loans, and sophisticated asset management strategies.

Cathay's proficiency in sustainable finance is a significant draw for these sophisticated entities. For instance, in 2024, Cathay Financial Holdings reported significant growth in its sustainable finance offerings, with a substantial increase in the volume of sustainability-linked loans arranged, reflecting a growing market demand for ESG-aligned financial products among large enterprises.

High-Net-Worth Individuals (HNWIs)

Cathay Financial specifically targets High-Net-Worth Individuals (HNWIs) for its comprehensive wealth management and private banking services. These clients are seeking sophisticated investment products and tailored financial solutions.

The company provides diversified asset allocation strategies, aiming to meet the unique investment and legacy planning objectives of this affluent demographic. For instance, in 2024, the global HNWI population reached approximately 6.3 million individuals, collectively holding over $26 trillion in wealth, highlighting the significant market opportunity.

- Targeted Services: Wealth management, private banking, and advanced investment products.

- Client Objectives: Personalized financial planning for investment and legacy goals.

- Market Size: Global HNWI population exceeded 6.3 million in 2024.

- Wealth Held: HNWIs collectively managed over $26 trillion in 2024.

Customers in Asia (International Expansion)

Cathay Financial Holding's reach extends significantly beyond Taiwan, serving a diverse customer base across Asia. This includes individuals and businesses in key markets such as Vietnam, Cambodia, Singapore, and China. These customers are looking for financial solutions tailored to their specific local environments, as well as services that facilitate cross-border transactions and investments, benefiting from Cathay's growing regional presence.

In 2024, Cathay Life's international operations, particularly in Southeast Asia, continued to demonstrate robust growth. For instance, Vietnam remains a key market, with Cathay Life Vietnam consistently ranking among the top insurers. By the end of 2023, the company reported significant policy growth in the region, reflecting strong customer adoption.

- Vietnam: Cathay Life Vietnam has established a strong presence, actively acquiring new policyholders and expanding its product offerings to meet local demand.

- Singapore: The Singaporean market represents a sophisticated financial hub where Cathay provides a range of wealth management and insurance solutions to both individuals and corporations.

- China: Cathay's engagement in China focuses on leveraging its expertise to serve a growing middle class and corporate sector, adapting services to the dynamic economic landscape.

- Cambodia: In Cambodia, Cathay is building its insurance and financial services footprint, catering to an emerging market with increasing financial needs.

Cathay Financial serves a broad spectrum of customers, from individual retail clients seeking basic banking and insurance to large corporations requiring complex financial solutions. The company also actively engages with Small and Medium-sized Enterprises (SMEs), providing them with essential services like corporate loans and cash management. High-Net-Worth Individuals (HNWIs) are a key focus for wealth management and private banking services, tapping into a significant global market.

Geographically, Cathay's customer base extends beyond Taiwan, with a notable presence in key Asian markets like Vietnam and Singapore. This international reach allows them to cater to diverse needs across different economic landscapes. Their commitment to innovation, such as green lending, appeals to a growing segment of environmentally conscious consumers.

| Customer Segment | Key Needs | Cathay's Offerings | 2024 Data/Insight |

|---|---|---|---|

| Individual Retail | Banking, Insurance, Wealth Accumulation | Savings accounts, credit cards, life & property insurance, retirement planning | Cathay Life new premiums approx. NT$134.8 billion (Jan-Oct 2024) |

| SMEs | Loans, Cash Management, Risk Mitigation | Corporate loans, efficient cash management, property & casualty insurance | Cathay United Bank driving robust loan growth in this segment |

| Large Corporations & Institutions | Corporate Banking, Syndicated Loans, Asset Management | Sophisticated investment strategies, sustainable finance solutions | Significant increase in volume of sustainability-linked loans arranged |

| High-Net-Worth Individuals (HNWIs) | Wealth Management, Private Banking, Legacy Planning | Tailored investment products, diversified asset allocation | Global HNWI population ~6.3 million, holding >$26 trillion wealth (2024) |

| International (Asia) | Cross-border services, localized financial solutions | Insurance, wealth management, banking tailored to regional markets | Cathay Life Vietnam shows strong policy growth; Singapore serves as financial hub |

Cost Structure

Personnel and employee compensation represent a significant cost driver for Cathay Financial Holding, reflecting its substantial workforce spread across numerous subsidiaries. In 2024, this category encompasses salaries, comprehensive benefits packages, and ongoing training for financial advisors, branch employees, and essential back-office staff. This investment in human capital is crucial for delivering a wide range of financial services.

Cathay Financial's commitment to staying ahead in the digital age means significant ongoing investment in its technology and digital infrastructure. This encompasses everything from developing new software and maintaining existing hardware to utilizing cloud services and bolstering data analytics. In 2023, Cathay Financial Holdings reported significant expenditure in this area, reflecting the critical nature of these investments for their digital transformation initiatives and to maintain a strong competitive position in the financial services industry.

Cathay Financial's marketing and distribution expenses are significant, covering everything from broad advertising campaigns and brand development to managing its extensive network of physical branches and agency teams. These costs are critical for attracting new customers and making sure their diverse financial products and services are visible and accessible.

In 2024, Cathay Financial Holdings, a major player in Taiwan's financial sector, reported substantial operating expenses. While specific breakdowns for marketing and distribution aren't always granularly detailed in every public report, the overall trend shows a continued investment in customer outreach and channel management, reflecting the competitive landscape of insurance and banking services.

Regulatory Compliance and Risk Management Costs

Adhering to the complex web of financial regulations is a substantial expense for Cathay Financial. This includes costs associated with dedicated compliance officers, external legal counsel for interpretation and guidance, and the ongoing investment in internal audit functions to ensure adherence. For instance, in 2024, companies in the financial services sector globally saw compliance costs rise, with many reporting that these expenses represent a significant portion of their operational budget, often in the double-digit percentages.

Maintaining robust risk management frameworks is another critical cost driver. This encompasses the development and implementation of sophisticated systems to identify, assess, and mitigate various risks, from market volatility to operational failures. These systems require continuous investment in technology and specialized personnel.

Furthermore, preparing for and implementing new accounting standards, such as IFRS 17 for insurance contracts, demands considerable resources. This involves significant expenditure on data management, system upgrades, staff training, and external consultancy to ensure accurate reporting and compliance. The transition to IFRS 17 alone has been estimated to cost the insurance industry billions worldwide, with Cathay Financial undoubtedly allocating substantial funds to this endeavor in 2024 and beyond.

- Regulatory Compliance: Costs for compliance officers, legal services, and adherence to evolving financial laws.

- Risk Management: Investment in technology and personnel for robust risk identification and mitigation frameworks.

- Accounting Standard Implementation: Expenses related to adopting new standards like IFRS 17, including data, systems, and training.

- Technology for Reporting: Outlay on solutions to facilitate accurate and timely regulatory reporting.

Property, Equipment, and Operational Overheads

Cathay Financial's cost structure is significantly influenced by its extensive physical footprint. Expenses for maintaining a large network of branches and offices, encompassing rent, utilities, and depreciation of assets, represent a substantial portion of its operational overheads. These fixed costs are fundamental to supporting the group's physical presence and ongoing daily activities.

For instance, in 2023, Cathay Financial Holdings reported operating and administrative expenses of approximately NT$105.7 billion. This figure includes costs associated with their numerous physical locations, which are crucial for customer interaction and service delivery across their diverse financial services.

- Property Costs: Rent and lease payments for a wide array of branches and corporate offices.

- Utilities and Maintenance: Ongoing expenses for electricity, water, and general upkeep of physical facilities.

- Depreciation: The systematic allocation of the cost of tangible assets like buildings and equipment over their useful lives.

- General Administrative Overheads: Costs related to managing the overall business, including IT infrastructure and support staff.

Cathay Financial's cost structure is heavily weighted towards personnel and technology investments. In 2024, the company continued to allocate significant resources to employee compensation and benefits, reflecting its large workforce across various financial services. Simultaneously, substantial ongoing expenditure is directed towards digital transformation, including software development, cloud services, and data analytics, to maintain a competitive edge.

| Cost Category | 2023 (NT$ Billion) | Key Components |

| Operating and Administrative Expenses | 105.7 | Includes property costs, utilities, depreciation, and general overheads. |

| Personnel and Employee Compensation | Significant portion of operating expenses | Salaries, benefits, training for diverse workforce. |

| Technology and Digital Infrastructure | Substantial ongoing investment | Software development, hardware maintenance, cloud services, data analytics. |

Revenue Streams

Net Interest Income (NII) stands as a cornerstone revenue driver for Cathay Financial, predominantly generated by Cathay United Bank. This income arises from the spread between the interest the bank earns on its lending and investment activities and the interest it pays out on customer deposits and other borrowings. For instance, in 2023, Cathay Financial Holdings reported a consolidated NII of NT$100.1 billion, highlighting its significance.

The bank's ability to achieve robust loan growth, coupled with skillful management of its funding costs, directly impacts the magnitude of its NII. A sustained increase in the volume of loans disbursed, particularly in higher-yielding segments, along with maintaining a competitive yet cost-effective deposit base, are key factors contributing to this vital revenue stream's strength.

Cathay Financial's primary revenue engine is driven by insurance premiums collected across its subsidiaries, Cathay Life Insurance and Cathay Century Insurance. These premiums encompass a broad range of products, including life, health, accident, property, and casualty insurance policies.

Beyond premium collection, underwriting profit represents a significant contributor. This profit is generated by effectively managing risk through meticulous underwriting processes and efficient claims administration, ensuring that premiums collected exceed claims paid out and operational costs.

Cathay Financial generates substantial fee and commission income through a wide array of financial services. This includes revenue from wealth management product sales, credit card transaction fees, and commissions earned from securities brokerage activities.

The company's asset management division also contributes significantly to this revenue stream, reflecting its expertise in managing diverse investment portfolios for its clients. This diversified approach underscores Cathay's strategy of cross-selling its broad range of financial products and services across its various subsidiaries.

For instance, in the first half of 2024, Cathay Financial reported robust growth in fee and commission income, driven by strong performance in its bancassurance and securities businesses, demonstrating the effectiveness of its integrated financial services model.

Investment Income and Gains

Cathay Financial's investment income and gains are a cornerstone of its revenue. This includes profits from selling stocks and bonds at a higher price than they were bought, as well as regular earnings from dividends and interest payments. For Cathay Life Insurance, this segment is particularly vital, directly influencing how much profit the company makes.

The performance of Cathay's vast investment portfolio, which spans equities, fixed income, and real estate, is a significant driver of its overall financial health. Strong market conditions and astute investment management translate into substantial capital gains and rental income, bolstering the company's profitability.

- Capital Gains: Profits realized from the sale of investment assets like stocks and bonds.

- Dividend and Interest Income: Regular earnings generated from holdings in dividend-paying stocks and interest-bearing securities.

- Rental Income: Revenue derived from Cathay's ownership of investment properties.

- Impact on Profitability: Strong investment returns are critical for enhancing Cathay's bottom line, especially for its insurance operations.

Venture Capital and Other Financial Services

Cathay Financial generates revenue through its venture capital arm, Cathay Venture Inc., investing in promising startups and innovative technologies. This segment, while smaller than its traditional banking and insurance operations, offers significant growth potential and diversifies the company's income streams.

Beyond venture capital, Cathay Financial offers a suite of other financial services. These include advisory, wealth management, and other ancillary financial products, contributing to a more robust and multifaceted revenue model. The company is actively exploring and integrating fintech solutions to enhance these offerings and capture new market opportunities.

- Venture Capital Investments: Cathay Venture Inc. actively deploys capital into early-stage and growth-stage companies, seeking high returns on investment.

- Fintech Solutions: Revenue is also derived from the development and deployment of innovative financial technology solutions, often in partnership or through proprietary platforms.

- Miscellaneous Financial Services: This category encompasses a range of other financial services, contributing to overall revenue diversification.

- Growth and Diversification: These newer revenue streams are crucial for Cathay Financial's long-term strategy, aiming to reduce reliance on traditional financial products and tap into emerging market trends.

Cathay Financial's revenue streams are diverse, encompassing net interest income from banking, insurance premiums, and underwriting profits. Additionally, fee and commission income from wealth management and securities brokerage, alongside investment gains from a broad portfolio, are significant contributors. The company also actively pursues revenue through its venture capital arm and other ancillary financial services, demonstrating a strategy of diversification and growth.

| Revenue Stream | Primary Source | 2023 Data (NT$ Billion) | Key Drivers |

|---|---|---|---|

| Net Interest Income (NII) | Cathay United Bank | 100.1 | Loan growth, interest rate spreads |

| Insurance Premiums | Cathay Life, Cathay Century | N/A (Consolidated) | Policy sales volume, product mix |

| Underwriting Profit | Cathay Life, Cathay Century | N/A (Consolidated) | Risk management, claims efficiency |

| Fee & Commission Income | Wealth Management, Securities, Cards | N/A (Consolidated) | Service volume, cross-selling |

| Investment Income & Gains | Equities, Fixed Income, Real Estate | N/A (Consolidated) | Market performance, portfolio management |

| Venture Capital & Other | Cathay Venture Inc., Fintech | N/A (Consolidated) | Startup investments, new service adoption |

Business Model Canvas Data Sources

The Cathay Financial Business Model Canvas is built using a combination of internal financial disclosures, comprehensive market research reports, and strategic analysis of industry trends. These data sources ensure a robust and accurate representation of the company's operational and strategic framework.