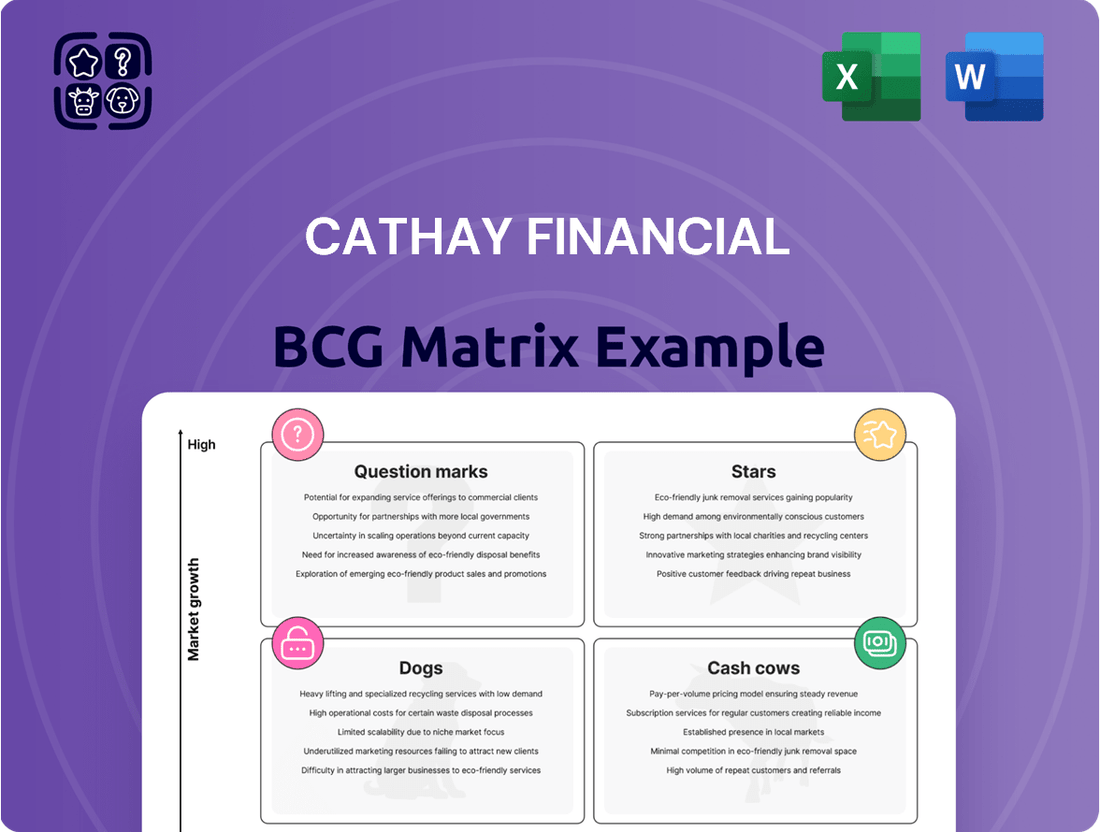

Cathay Financial Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cathay Financial Bundle

Curious about Cathay Financial's strategic product positioning? This glimpse into their BCG Matrix reveals potential Stars, Cash Cows, Dogs, and Question Marks, offering a strategic overview of their market share and growth potential.

Unlock the full potential of this analysis by purchasing the complete Cathay Financial BCG Matrix. Gain detailed quadrant placements, data-backed recommendations, and a clear roadmap to optimizing your investment and product strategies.

Don't miss out on the actionable insights that can drive Cathay Financial's future success. Get the full report now and transform your understanding of their competitive landscape.

Stars

Cathay United Bank's CUBE digital banking model is a standout performer, recognized globally for its innovative approach. Its core 'one card, one app, one account' philosophy simplifies customer interaction while enabling flexible rewards and deeply personalized experiences.

This modular design and parametric system are key to CUBE's agility, allowing Cathay United Bank to quickly adapt to evolving market demands and introduce new features. In 2023, Cathay Financial Holdings reported significant growth in its digital banking segment, with CUBE playing a pivotal role in attracting and retaining customers through its data-driven insights and user-centric design.

Cathay Life Insurance's emphasis on long-term regular-premium and protection-type products is a cornerstone of its financial strategy. These offerings are designed to generate robust new business margins, a critical factor for sustained profitability.

The company's commitment to these product lines is expected to translate into stable long-term earnings recognition, a benefit that will become even more pronounced with the implementation of IFRS 17 standards in 2026. For instance, in 2024, Cathay Life reported a significant portion of its new business value derived from these stable, recurring revenue streams.

Cathay United Bank is strategically pushing into Southeast Asia and India, targeting Singapore, Vietnam, and Cambodia for significant growth. This move is designed to capture the increasing investment flow from Taiwanese enterprises into these dynamic economies.

The recent approval for a new branch in Mumbai, India, underscores Cathay United Bank's commitment to building a robust cross-border financial service network. This expansion is crucial for supporting Taiwanese businesses and tapping into India's burgeoning financial landscape.

Cathay Financial Holdings' Sustainable Finance Initiatives

Cathay Financial Holdings is making significant strides in sustainable finance, underscored by its robust Task Force on Climate-related Financial Disclosures (TCFD) report and a clear commitment to achieving net-zero emissions. This dedication to environmental, social, and governance (ESG) principles is not just a statement but is actively integrated into its business operations.

The company's proactive engagement in the low-carbon economy and environmental sustainability, notably its membership in the RE100 initiative, places it advantageously within the rapidly expanding market for ESG-focused investments. This strategic positioning is crucial as investors increasingly prioritize companies demonstrating genuine commitment to sustainability.

Cathay Financial's sustainable finance initiatives are backed by tangible actions and recognized achievements:

- TCFD Reporting: Cathay Financial has consistently produced comprehensive TCFD reports, detailing climate-related risks and opportunities, aligning with global best practices.

- Net-Zero Commitment: The holding company has publicly committed to achieving net-zero greenhouse gas emissions, demonstrating a long-term vision for climate action.

- RE100 Membership: As a member of RE100, Cathay Financial is dedicated to sourcing 100% renewable electricity for its operations, a significant step towards decarbonization.

- ESG Investment Growth: The global ESG investment market continued its upward trajectory, with assets under management reaching new highs in 2024, reflecting strong investor demand for sustainable options.

Cathay Securities Investment Trust's Asset Under Management (AUM) Growth

Cathay Securities Investment Trust has solidified its leading position in Taiwan’s asset management industry, boasting the highest assets under management (AUM). This strong market standing is further underscored by its record-high earnings reported in 2024, reflecting robust financial performance.

The trust has strategically expanded its market share by focusing on an optimized, digital-first customer experience. This approach has been instrumental in attracting and retaining a broader customer base, demonstrating effective growth within the competitive asset management landscape.

- Leading AUM in Taiwan: Cathay Securities Investment Trust holds the top spot by assets under management in Taiwan.

- Record 2024 Earnings: The company achieved its highest-ever earnings in 2024, showcasing exceptional financial health.

- Digital-First Strategy: Market share gains are attributed to an optimized digital-only customer experience.

- Customer Base Expansion: The trust has successfully broadened its customer reach, contributing to its growth trajectory.

Cathay Securities Investment Trust, with its leading assets under management in Taiwan and record earnings in 2024, exemplifies a Star in the BCG matrix. Its success is driven by a digital-first strategy that has expanded its customer base and market share.

This focus on customer experience and digital innovation positions it for continued growth in the asset management sector. The trust’s strong financial performance and market leadership indicate high growth potential and a strong competitive position.

The trust's ability to generate significant earnings, as seen in its 2024 results, further supports its classification as a Star. This category represents business units with high market share and high growth potential, requiring substantial investment to maintain their position.

Cathay Securities Investment Trust's strategic initiatives and financial achievements align perfectly with the characteristics of a Star, suggesting it is a key driver of Cathay Financial Holdings' overall success.

What is included in the product

Highlights which units to invest in, hold, or divest for Cathay Financial.

The Cathay Financial BCG Matrix provides a clear, one-page overview of business unit performance, alleviating the pain of scattered data for strategic decision-making.

Cash Cows

Cathay Life Insurance, as Taiwan's largest life insurer, stands as a prime example of a Cash Cow within Cathay Financial Holdings. Its dominant market share, evidenced by leading positions in total assets and first-year premiums, translates into a steady and substantial profit stream for the parent company.

In 2023, Cathay Life Insurance reported a net profit after tax of NT$30.6 billion, underscoring its consistent profitability. This performance highlights its ability to generate significant cash flow from its established operations and mature market presence.

Cathay United Bank's traditional banking operations are a cornerstone of Cathay Financial's strength, firmly positioned as a Cash Cow. As Taiwan's second-largest private bank by assets, it demonstrates consistent performance. In 2023, Cathay United Bank reported a significant increase in net interest income, reflecting its robust loan growth and a stable, substantial cash flow generation from its vast customer base and established market presence.

Cathay Century Insurance stands as a robust Cash Cow within the Cathay Financial BCG Matrix. As Taiwan's second-largest property and casualty insurer, it commands a substantial market share, demonstrating impressive resilience and growth. In 2024, the company achieved double-digit year-over-year growth in premiums, a testament to its strong market penetration and consistent customer demand.

Its reliable underwriting profits and entrenched market position make Cathay Century Insurance a consistent and significant contributor to Cathay Financial's overall earnings. This stability allows the parent company to allocate resources to other ventures with greater growth potential, a hallmark of a successful Cash Cow.

Wealth Management Product Sales

Cathay Financial's wealth management product sales, primarily driven by Cathay United Bank, represent a significant Cash Cow within their BCG Matrix.

This segment has demonstrated robust performance, with annual net fee income experiencing over 30% growth. This expansion is a direct result of increased wealth management product sales, capitalizing on the bank's extensive and loyal client base.

The mature nature of the wealth management market means that while growth is steady, the investment required to maintain and expand this segment is relatively low. This allows for high profit margins, characteristic of a Cash Cow, providing a stable and substantial contribution to Cathay Financial's overall profitability.

- Over 30% annual net fee income growth

- Leverages established client base for sales

- Generates high profit margins

- Low investment needs in a mature market

Securities Brokerage Business

Cathay Securities' brokerage business functions as a Cash Cow within Cathay Financial's BCG Matrix. The company has significantly bolstered its digital offerings, which has allowed it to secure and maintain the leading market share in the sub-brokerage sector. This strong digital presence translates into a stable and predictable revenue stream.

The established customer base, coupled with efficient digital operations, ensures consistent fee income. This segment benefits from a relatively stable market environment, making it a reliable source of cash flow for the broader Cathay Financial group. For example, in 2023, Cathay Securities reported a net profit of NT$10.6 billion, underscoring its profitability.

- Market Dominance: Cathay Securities holds the largest market share in the sub-brokerage segment.

- Digital Reinforcement: Continuous investment in digital business models enhances operational efficiency and customer reach.

- Stable Cash Flow: The business generates consistent fee income due to its established customer base and recurring transaction volumes.

- Profitability: The segment contributes significantly to overall group profits, as evidenced by its substantial net profit figures.

Cathay Financial's Cash Cows are its mature, high-market-share businesses that generate consistent profits with low investment needs. These segments provide stable cash flow, enabling the group to fund growth in other areas.

Cathay Life Insurance and Cathay United Bank are prime examples, consistently contributing significant profits. Cathay Century Insurance also plays a vital role, showing strong premium growth in 2024.

The wealth management and securities brokerage businesses, bolstered by digital enhancements and established client bases, further solidify Cathay Financial's Cash Cow portfolio.

| Business Segment | Market Position | 2023 Profit (NT$ Billion) | Key Cash Cow Attributes |

| Cathay Life Insurance | Largest life insurer in Taiwan | 30.6 | Dominant market share, steady profit stream |

| Cathay United Bank | Second-largest private bank by assets | (Net interest income growth) | Robust loan growth, stable cash flow |

| Cathay Century Insurance | Second-largest P&C insurer in Taiwan | (Double-digit premium growth in 2024) | Reliable underwriting profits, entrenched market position |

| Wealth Management | Leverages bank's client base | (Over 30% net fee income growth) | High profit margins, low investment needs |

| Cathay Securities (Brokerage) | Leading market share in sub-brokerage | 10.6 | Consistent fee income, efficient digital operations |

What You’re Viewing Is Included

Cathay Financial BCG Matrix

The Cathay Financial BCG Matrix preview you're examining is the complete, unwatermarked document you will receive immediately after purchase. This detailed analysis, crafted by industry experts, is ready for immediate integration into your strategic planning and decision-making processes. You'll gain access to the full report, enabling you to leverage its insights for competitive advantage without any further editing or preparation required.

Dogs

Cathay Life, despite its market leadership, faces challenges with traditional savings products. These products, often a significant portion of their portfolio, are sensitive to spread gains. In 2024, the persistent low-interest-rate environment, even with slight upticks, continued to pressure the profitability of these cash-flow-generating, but potentially low-growth, offerings.

These traditional savings products may be positioned in a mature, low-growth market segment. Their susceptibility to market fluctuations and rising hedging costs in 2024 meant they could consume capital without delivering substantial returns, making them a potential cash drain if not actively managed or strategically repositioned.

While Cathay Financial is actively pursuing digital transformation, some of its older IT systems represent potential 'dogs' in a BCG-style analysis. These legacy infrastructures, often found in more traditional business segments, can demand substantial upkeep costs. For instance, maintaining outdated core banking systems or insurance policy administration platforms might consume a significant portion of IT budgets without yielding proportional returns or enabling agile responses to market shifts.

Cathay United Bank’s representative offices in Thailand and Indonesia are examples of specific, low-growth overseas operations. These entities, unlike full branches, are typically restricted in their revenue-generating activities and market penetration.

In 2024, while specific financial data for these representative offices isn't publicly itemized separately from broader Cathay United Bank international operations, their nature suggests they likely function near a break-even point, requiring continued investment without immediate high-growth potential. Their role is more about market presence and information gathering than significant profit contribution within the BCG framework.

Certain Niche, Low-Market Share Investment Offerings

Within Cathay Securities or Cathay Securities Investment Trust, certain niche investment offerings may fall into the dog category. These are products with low market share, meaning they attract minimal assets under management or trading volume. For instance, a specialized emerging market bond fund with very limited investor interest could be a candidate.

These offerings can become dogs if the resources needed to maintain them, such as compliance, reporting, and client support, outweigh the revenue they generate. In 2024, Cathay Securities might have several such products where the cost of keeping them operational exceeds their profitability. For example, a fund focused on a very specific, illiquid asset class might require significant due diligence and ongoing management, yet attract only a handful of investors.

- Low Assets Under Management (AUM): Products with AUM significantly below the average for their category, suggesting limited investor appeal.

- Infrequent Trading Volume: Securities or funds that see very little buying or selling activity, indicating a lack of market interest.

- High Maintenance Costs Relative to Revenue: The operational expenses for managing these niche products may exceed the fees collected.

- Limited Strategic Fit: Offerings that do not align with Cathay’s broader strategic goals or core competencies, making them less of a priority.

Outdated Physical Branch Networks in Declining Areas

Physical branch networks in areas experiencing population decline or low economic activity, particularly those not updated for digital services, can be considered "dogs" within Cathay Financial's portfolio. These locations represent low-growth, low-market share assets that consume capital without significant returns.

For instance, if Cathay United Bank or Cathay Life maintains numerous branches in regions with consistently negative population growth, such as certain rural areas in Taiwan, these could be prime examples. In 2023, Taiwan's overall population saw a slight decrease, highlighting the trend in specific locales where older, underutilized branches might exist.

- Underperforming Assets: Branches in declining areas with low foot traffic and limited digital integration are capital sinks.

- Digital Shift Impact: The increasing preference for online banking means these physical locations may become increasingly obsolete.

- Capital Reallocation Opportunity: Divesting or repurposing these branches could free up capital for more promising digital initiatives or growth markets.

Cathay Financial's "dogs" are business units or products with low market share and low growth potential. These often require significant investment to maintain but yield minimal returns. Examples include legacy IT systems, niche investment products with low investor interest, and underperforming physical branches in declining areas.

In 2024, traditional savings products, while cash-generating, faced pressure from low-interest rates, potentially categorizing them as dogs if growth stagnates. Similarly, representative offices in less developed markets may also fit this profile, serving more as market presence tools than profit centers.

These "dog" segments consume resources that could be better allocated to more promising growth areas. Identifying and managing these underperformers is crucial for optimizing Cathay Financial's overall portfolio and strategic direction.

| Category | Examples within Cathay Financial | Characteristics | 2024 Considerations |

| Products | Niche investment funds (e.g., specific emerging market bonds) | Low AUM, infrequent trading, high maintenance cost relative to revenue | May struggle to attract assets in a competitive market; cost of compliance can outweigh fees. |

| Operations | Legacy IT systems | High upkeep costs, low return on investment, hinders digital transformation | Ongoing maintenance budgets for outdated core banking or insurance platforms. |

| Physical Assets | Underutilized bank branches in declining rural areas | Low foot traffic, low market share, declining relevance due to digital shift | Branches in regions with negative population growth, like certain areas in Taiwan, may see reduced utility. |

| Services | Traditional savings products | Low growth potential, sensitive to interest rate spreads | Profitability pressured by persistent low-interest rate environment, despite slight upticks in 2024. |

Question Marks

Cathay Financial Holdings actively participates in venture capital through Cathay Venture Inc., a key supporter of Cathay Innovation. This strategic involvement positions them to identify and nurture emerging companies, particularly those focused on AI.

Cathay Innovation’s recent $1 billion fund closure for vertical AI investments underscores a commitment to high-growth areas like digital health and fintech. These sectors, while promising, inherently carry substantial risk and require significant capital outlay.

These venture capital investments, aligning with the 'question mark' category in a BCG matrix, represent potential future market leaders. However, their current stage involves considerable cash consumption and an uncertain path to profitability, reflecting the high-risk, high-reward nature of early-stage technology ventures.

Cathay Financial is strategically positioning itself within the burgeoning fintech and insurtech sectors, focusing on areas like smart wealth management, digital lending, and innovative insurance platforms. These emerging solutions, while operating in high-growth markets, represent Cathay's "Question Marks" in the BCG Matrix, characterized by their current low market share and the necessity for significant investment to foster growth and establish market presence.

New digital-only banking or insurance products, like Cathay Financial's potential foray into fully online savings accounts or specialized micro-insurance plans, represent question marks in the BCG matrix. These innovative offerings, while targeting a rapidly expanding digital customer base, are likely to start with a small market share, necessitating substantial investment in marketing and user acquisition to gain traction.

Expansion into New, Untapped Geographic Markets

Expanding into new, untapped geographic markets represents a potential "Question Mark" for Cathay Financial. These ventures into high-growth but less familiar international territories, where the company has minimal or no existing presence, demand significant upfront capital and involve substantial market entry risks. For instance, entering a market like Vietnam, which is projected by Statista to see its digital payments market grow to over $24 billion by 2027, would require extensive research and localized strategies.

Such expansion requires careful consideration of several factors:

- Market Research and Due Diligence: Thoroughly understanding the regulatory landscape, competitive environment, and consumer behavior in target markets is crucial.

- Investment and Resource Allocation: Significant financial resources and dedicated teams will be needed to establish operations, build brand awareness, and develop tailored financial products.

- Risk Mitigation Strategies: Developing robust plans to address political instability, economic volatility, and cultural differences is essential for navigating these new territories.

- Partnership Opportunities: Collaborating with local entities can help accelerate market penetration and reduce entry barriers.

AI-driven Wealth Management and Digital Assets (via Cathay Innovation investments)

Cathay Innovation's strategic investments in AI-driven wealth management and digital asset market-making highlight a forward-looking approach to financial technology. These ventures, while promising high growth, currently represent emerging opportunities for Cathay Financial, demanding substantial investment and careful development to establish market dominance.

These investments are categorized as question marks within the BCG matrix due to their nascent stage and significant growth potential. For instance, the global wealth management market is projected to reach $143.5 trillion by 2027, with AI expected to play a pivotal role in personalization and efficiency. Similarly, the digital asset market, despite its volatility, saw significant institutional interest and trading volume growth throughout 2024, with some estimates suggesting a market capitalization that could reach trillions in the coming years.

- AI-driven Wealth Management: Focuses on leveraging artificial intelligence to provide personalized financial advice and automated investment management, targeting a rapidly expanding market segment.

- Digital Asset Market-Making: Involves providing liquidity and facilitating trading for cryptocurrencies and other digital assets, capitalizing on the growing adoption of blockchain technology.

- High Growth Potential: Both sectors are characterized by rapid technological advancements and increasing customer adoption, suggesting substantial future revenue and market share opportunities.

- Capital Intensive and Unproven: These initiatives require significant upfront capital for technology development, regulatory compliance, and market entry, with their ultimate success and market leadership still to be determined.

Cathay Financial's ventures into new digital products and international markets, such as AI-driven wealth management and potential expansion into Vietnam's growing digital payments sector, are classic examples of Question Marks in the BCG matrix. These initiatives, while targeting high-growth areas, are currently characterized by low market share and substantial investment requirements, making their future success uncertain but potentially very rewarding.

These "Question Mark" investments, like Cathay Innovation's $1 billion fund for vertical AI, require significant capital to gain traction and establish market leadership. For instance, the global wealth management market is projected to reach $143.5 trillion by 2027, and Vietnam's digital payments market is expected to exceed $24 billion by 2027, indicating substantial growth potential for these nascent ventures.

The key challenge for these Question Marks lies in converting their potential into market dominance. This involves not only substantial financial investment but also rigorous market research, strategic partnerships, and effective risk mitigation to navigate the complexities of emerging technologies and new geographic territories, ultimately aiming to transform them into Stars.

Cathay Financial's strategic bets on AI-driven wealth management and digital asset market-making represent key Question Marks. These areas, while experiencing rapid growth, demand considerable capital for development and market penetration, with their ultimate success and market share still to be determined. The global wealth management market's projected growth to $143.5 trillion by 2027 highlights the significant upside if these ventures mature successfully.

BCG Matrix Data Sources

Our Cathay Financial BCG Matrix leverages a blend of internal financial statements, market research reports, and industry growth forecasts to provide a comprehensive view of its business units.