Cathay Financial PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cathay Financial Bundle

Cathay Financial operates within a dynamic global landscape, influenced by evolving political stability, economic fluctuations, and rapid technological advancements. Understanding these external forces is crucial for strategic planning and risk mitigation. Our comprehensive PESTLE analysis delves deep into these factors, providing you with actionable intelligence to navigate the complexities of the financial sector. Gain a competitive edge by unlocking these critical insights – download the full analysis now!

Political factors

Taiwan's government, via the Financial Supervisory Commission (FSC), is actively fostering fintech advancements and aiming to establish Taiwan as a key Asian hub for asset management. A significant goal is to boost annual non-cash payment transactions, with a target of NT$3 trillion by 2025, and to increase mobile payment penetration to 80% by the same year.

These forward-looking policies cultivate a favorable regulatory landscape for Cathay Financial Holding, supporting its ongoing digital transformation efforts and the strategic expansion of its diverse financial services.

Geopolitical tensions, especially concerning cross-strait relations between Taiwan and mainland China, remain a significant political factor impacting Cathay Financial Holding. These tensions can inject considerable uncertainty into Taiwan's financial markets, affecting investor sentiment and capital flows.

While Cathay Financial's core business is in Taiwan and other Asian markets, the broader regional stability and how the international community perceives Taiwan's political standing directly influence investor confidence. For instance, in 2024, heightened military exercises by China near Taiwan have historically led to short-term dips in Taiwan's stock market, illustrating the direct correlation between cross-strait relations and market volatility.

Taiwan's financial sector is characterized by its stability and resilience, a key political factor for Cathay Financial Holding. The Financial Supervisory Commission (FSC) actively works to fortify mechanisms against financial fraud, improve risk management practices, and bolster cybersecurity for financial institutions. This commitment to a stable regulatory framework creates a predictable environment, which is crucial for Cathay Financial's ongoing growth and profitability.

ESG Policy Integration

Taiwan's government is actively pushing for enhanced sustainability disclosures, mandating listed companies, including financial giants like Cathay Financial Holding, to submit ESG reports by 2025. This regulatory push directly supports Cathay Financial's existing dedication to sustainable development.

The emphasis on ESG reporting and the promotion of green finance initiatives by the Taiwanese authorities will undoubtedly shape Cathay Financial's future investment strategies and bolster its corporate governance practices. For instance, as of early 2024, Taiwan's Financial Supervisory Commission (FSC) has been refining the specific metrics for these ESG reports, aiming for greater standardization and comparability across the financial sector.

- Mandatory ESG Reporting: Listed companies, including financial institutions, must submit ESG reports by 2025.

- Government Support for Green Finance: Initiatives to encourage sustainable investments are being actively promoted.

- Impact on Investment Strategy: Cathay Financial's investment decisions will increasingly align with ESG principles.

- Enhanced Corporate Governance: The focus on ESG will drive improvements in how Cathay Financial is managed and overseen.

Anti-Money Laundering (AML) Regulations

Taiwan has bolstered its anti-money laundering (AML) defenses, enacting significant amendments to the Money Laundering Control Act in July 2024. These changes, coupled with more stringent registration mandates for Virtual Asset Service Providers (VASPs) starting November 2024, signal a heightened regulatory environment. For Cathay Financial Holding, a major player in the financial services sector, rigorous adherence to these updated AML and counter-terrorism financing (CTF) rules is paramount to sidestep substantial penalties and safeguard its market standing.

Taiwan's government is actively promoting digital payments, targeting NT$3 trillion in non-cash transactions and 80% mobile payment penetration by 2025, creating a fertile ground for Cathay Financial's digital strategies.

Geopolitical tensions, particularly concerning cross-strait relations, introduce market uncertainty, with past events in 2024 showing stock market dips linked to heightened military exercises. The government's commitment to financial stability through robust anti-money laundering measures, including July 2024 amendments to the Money Laundering Control Act and November 2024 VASP regulations, necessitates strict compliance from Cathay Financial.

| Policy Area | Target/Regulation | Impact on Cathay Financial |

| Digital Payments | NT$3T non-cash transactions by 2025; 80% mobile payment penetration by 2025 | Supports digital transformation and expansion |

| Geopolitics | Cross-strait tensions | Potential market volatility and investor sentiment impact |

| Financial Regulation | AML Act amendments (July 2024); VASP registration (Nov 2024) | Requires strict compliance to avoid penalties and maintain market standing |

| Sustainability | Mandatory ESG reporting by 2025 | Drives alignment of investment strategies with ESG principles and enhances corporate governance |

What is included in the product

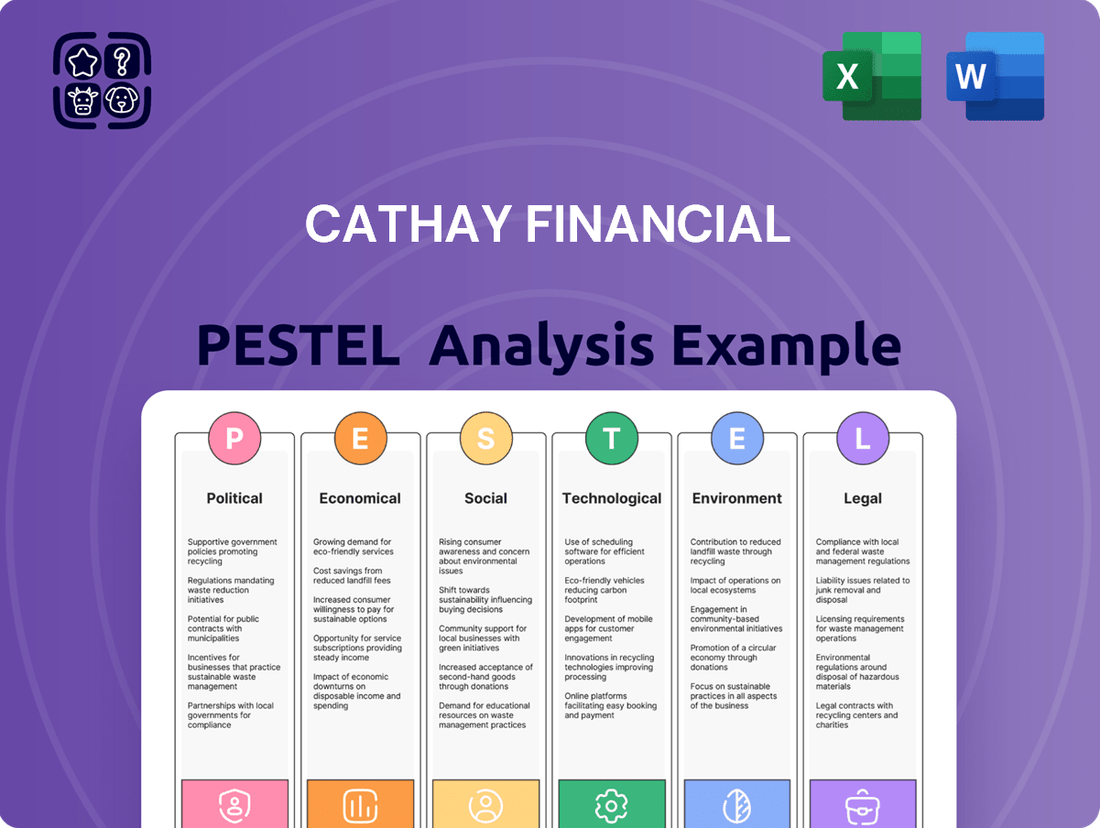

This Cathay Financial PESTLE analysis meticulously examines the Political, Economic, Social, Technological, Environmental, and Legal forces shaping its operating landscape.

It provides actionable insights into how these external factors present both strategic opportunities and potential risks for the company.

A concise Cathay Financial PESTLE analysis that highlights key external factors, providing clarity and direction for strategic decision-making by simplifying complex market dynamics.

Economic factors

Taiwan's economy is projected to experience robust growth, significantly boosted by the burgeoning AI industry and its established strength in technology manufacturing. This economic vitality is a key factor for Cathay Financial.

The Taiwanese stock market demonstrated remarkable resilience and strength throughout 2024. By mid-2024, the Taiwan Stock Exchange Capitalization Weighted Stock Index (TAIEX) had seen substantial gains, reflecting increased investor confidence and a growing market capitalization, with trading volumes also showing a notable uptick.

This positive economic trajectory and the vibrant performance of its capital markets create a highly conducive operating environment for Cathay Financial Holding. The company's securities brokerage and asset management divisions, in particular, stand to benefit from increased market activity and investor participation.

The Asia-Pacific region is projected to maintain robust economic expansion, with its financial sector anticipating a surge in transaction volumes, especially within fintech. This upward trend is a significant tailwind for Cathay Financial Holding's extensive regional operations.

While global demand and ongoing trade tensions might lead to a slight moderation in growth in 2025, the region is still expected to experience positive overall growth. This, coupled with stable employment figures, should bolster profitability and the quality of assets within the banking sectors across Asia.

While inflation has eased in many Asian economies, potentially leading to gradual interest rate cuts by central banks, Taiwanese banks like Cathay Financial might experience pressure on their asset yields. For instance, the weighted average lending rate in Taiwan stood at 3.72% as of Q1 2024, a slight decrease from previous periods, indicating a potential softening.

However, these anticipated rate cuts could simultaneously boost demand for offshore lending and lower overall funding expenses for institutions like Cathay Financial. This dual effect presents an interesting dynamic for the financial sector.

Cathay United Bank, a significant part of Cathay Financial, is strategically focusing on strengthening its corporate banking segment and expanding its presence in international markets. This approach aims to achieve a more balanced profit growth by effectively navigating these evolving interest rate conditions.

Consumer Spending and Wealth Management

Taiwan's consumer spending remains robust, evidenced by increasing demand in key financial sectors. In 2024, the mortgage segment saw a notable uptick, with new mortgage approvals rising by 8% year-on-year by Q3. Similarly, personal finance and credit card spending have shown consistent growth, reflecting increased consumer confidence and disposable income.

The government is actively fostering wealth management, particularly for high-net-worth individuals. By the end of 2024, an estimated 20% increase in assets under management for wealth management services is projected, driven by supportive policies and a growing affluent population. This creates a fertile ground for financial institutions to expand their services.

- Mortgage approvals in Taiwan increased by 8% year-on-year by Q3 2024.

- Personal finance and credit card spending continue to show upward trends.

- Projected 20% growth in wealth management assets under management by end of 2024.

- Government initiatives aim to boost wealth management for high-asset customers.

Competition and Market Saturation

Taiwan's financial services sector is characterized by significant fragmentation and fierce competition. Cathay Financial Holding operates within this dynamic landscape, facing numerous domestic and international players across its core businesses, including life insurance, banking, and asset management. This crowded market environment puts pressure on margins and demands constant strategic adaptation.

The intense competition necessitates continuous innovation and differentiation for Cathay Financial to sustain its market leadership. For instance, as of early 2024, the Taiwanese banking sector alone comprises over 30 banks, each vying for market share. This competitive intensity means Cathay Financial must invest heavily in digital transformation, customer service enhancements, and new product development to stand out.

- Fragmented Market: Taiwan's financial services industry features a large number of institutions, leading to intense competition.

- Profitability Pressure: High competition can limit profit margins for established players like Cathay Financial.

- Innovation Imperative: Continuous innovation is crucial for Cathay Financial to maintain its competitive edge and market share.

- Diversified Offerings: Cathay Financial's presence across insurance, banking, and asset management means it faces competition in multiple segments.

Taiwan's economic outlook for 2024-2025 remains strong, propelled by its leadership in technology and the booming AI sector. This economic vitality directly benefits Cathay Financial Holding, particularly its securities and asset management arms, as evidenced by the Taiwan Stock Exchange's significant gains and increased trading volumes observed through mid-2024.

While global economic headwinds and trade tensions might slightly temper growth in 2025, the Asia-Pacific region is still set for positive expansion. This regional strength, coupled with stable employment, supports the financial sector's profitability and asset quality, creating a favorable environment for Cathay Financial's diverse operations.

Anticipated interest rate cuts in Asia, including Taiwan where lending rates saw a slight dip to 3.72% in Q1 2024, could pressure asset yields but also reduce funding costs. Cathay United Bank is strategically navigating this by strengthening corporate banking and international markets to ensure balanced profit growth.

| Economic Factor | 2024 Projection/Observation | 2025 Outlook |

|---|---|---|

| Taiwan GDP Growth | Robust growth driven by AI and tech manufacturing | Continued positive growth, potentially moderated by global factors |

| Taiwan Stock Market (TAIEX) | Substantial gains and increased trading volumes by mid-2024 | Expected to remain strong, reflecting investor confidence |

| Asia-Pacific Economic Growth | Strong expansion anticipated | Projected positive overall growth, despite potential moderation |

| Interest Rates (Taiwan) | Weighted average lending rate at 3.72% in Q1 2024, indicating potential easing | Anticipated gradual rate cuts by central banks |

| Consumer Spending (Taiwan) | Robust, with 8% YoY increase in mortgage approvals by Q3 2024 | Continued strength expected, supporting financial services demand |

Preview the Actual Deliverable

Cathay Financial PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This Cathay Financial PESTLE analysis provides a comprehensive overview of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It's designed to offer actionable insights for strategic planning.

Sociological factors

Taiwan's demographic landscape is undergoing significant transformation, with a rapidly aging population. This trend directly influences the demand for specialized financial products. For instance, there's a growing need for retirement planning solutions, long-term care insurance, and sophisticated wealth management services tailored to older individuals.

Cathay Life Insurance, a major player in the insurance sector, must proactively adapt its product portfolio to meet these shifting consumer needs. By understanding the evolving requirements of an older demographic, Cathay can develop and market offerings that resonate with this growing segment, ensuring continued relevance and market share.

The Financial Supervisory Commission (FSC) in Taiwan is making significant strides in boosting financial literacy and inclusion. Their focus is on expanding access to digital financial services and reinforcing consumer safeguards. For instance, by the end of 2023, Taiwan's digital payment penetration rate reached approximately 75%, a clear indicator of growing adoption driven by such initiatives.

Cathay Financial Holding is well-positioned to leverage these societal shifts. By creating intuitive products and services, the company can reach a broader demographic, including individuals who may have previously faced barriers to traditional banking. This aligns with the FSC's goal of ensuring more Taiwanese citizens can participate effectively in the digital economy, potentially unlocking new customer segments for Cathay.

Taiwan boasts a high smartphone penetration rate, exceeding 90% as of early 2024, which has significantly accelerated consumer comfort with digital financial solutions and mobile-first banking. This trend is further amplified by the growing popularity of super apps and digital wallets across Asia, fundamentally altering how people manage their money and access financial services.

Cathay Financial Holding's strategic emphasis on digitalization, notably through Cathay United Bank's CUBE app, directly addresses these shifting consumer preferences. By offering a seamless, integrated digital experience, Cathay Financial aims to meet evolving customer expectations and bolster user engagement across its diverse financial product offerings.

Demand for Sustainable and Ethical Investments

Societal expectations are increasingly pushing companies to prioritize environmental, social, and governance (ESG) factors. This translates into a strong demand for investments that align with these values, with shareholders and stakeholders actively seeking transparency in ESG reporting and corporate strategies. For instance, by the end of 2023, global sustainable investment assets reached an estimated $37.4 trillion, demonstrating a significant market shift.

This growing societal consciousness directly influences investment preferences, prompting financial institutions to develop and promote green and sustainable financial products. Cathay Financial Holding's proactive stance on ESG, including its commitment to net-zero emissions by 2050 and significant investments in renewable energy projects, resonates with this trend. This focus helps attract a growing segment of socially conscious investors who are looking to align their financial goals with their ethical considerations.

- Growing ESG Investment: Global sustainable investment assets were approximately $37.4 trillion by the end of 2023.

- Stakeholder Pressure: Shareholders and stakeholders are demanding greater ESG accountability from corporations.

- Product Innovation: Financial institutions are responding by offering more green and sustainable financial products.

- Cathay's Alignment: Cathay Financial Holding's ESG initiatives attract socially conscious investors.

Talent Pool and Interdisciplinary Professionals

The financial sector's evolution, particularly in fintech and digital transformation, hinges on a robust supply of professionals with diverse skill sets. Cathay Financial Holding's success is directly tied to its capacity to secure and nurture talent in critical fields such as artificial intelligence, cybersecurity, and data analytics. This ensures ongoing innovation and maintains a competitive edge in a rapidly changing market.

For instance, the demand for AI specialists in financial services saw a significant increase. By late 2024, job postings for AI and machine learning roles in finance were up by an estimated 30% compared to the previous year, according to industry reports. This highlights the growing need for individuals who can bridge technological expertise with financial acumen.

Cathay Financial's strategic focus on developing these interdisciplinary professionals is paramount. The company's investment in training programs and partnerships with educational institutions aims to build a pipeline of talent capable of navigating complex digital landscapes. This proactive approach is essential for staying ahead of technological curves and meeting evolving client needs.

- Growing Demand: The global fintech market is projected to reach over $30 trillion by 2025, necessitating a corresponding increase in skilled professionals.

- Key Skill Areas: Expertise in AI, blockchain, cybersecurity, and data science are becoming non-negotiable for financial institutions.

- Talent Acquisition Challenges: Competition for top talent in these specialized fields remains intense, driving up compensation and requiring innovative recruitment strategies.

- Cathay's Investment: Cathay Financial Holding's commitment to upskilling its workforce and attracting new talent in these areas is a critical component of its long-term strategy.

Taiwan's aging population presents a significant opportunity for Cathay Financial, as demand for retirement planning and specialized insurance products grows. This demographic shift, coupled with government initiatives to boost financial literacy and digital adoption, creates a favorable environment for Cathay's digital-first strategy. The increasing comfort with mobile banking, evidenced by a 75% digital payment penetration rate by the end of 2023, underscores the potential for growth in digital financial services.

Societal emphasis on ESG principles is reshaping investment preferences, with global sustainable investment assets reaching approximately $37.4 trillion by the end of 2023. Cathay Financial's commitment to ESG, including investments in renewable energy, aligns with this trend and attracts socially conscious investors. Furthermore, the demand for skilled professionals in AI and data analytics within finance is surging, with job postings for these roles up by an estimated 30% by late 2024, highlighting the need for Cathay to invest in talent development.

| Sociological Factor | Description | Impact on Cathay Financial | Relevant Data (2023-2025) |

| Demographic Shift | Aging population in Taiwan | Increased demand for retirement and long-term care products | Taiwan's elderly population share continues to rise. |

| Financial Literacy & Inclusion | FSC initiatives for digital finance | Growth in digital payment adoption and mobile banking | Digital payment penetration rate ~75% (end of 2023). |

| Consumer Behavior | Preference for digital and mobile-first solutions | Opportunity for Cathay's digital platforms (e.g., CUBE app) | Smartphone penetration rate >90% (early 2024). |

| ESG Consciousness | Growing demand for sustainable investments | Attracts socially conscious investors; drives green product development | Global sustainable investment assets ~$37.4 trillion (end of 2023). |

| Talent Demand | Need for tech-savvy financial professionals | Requires investment in talent acquisition and upskilling | AI/ML job postings in finance up ~30% (late 2024). |

Technological factors

Taiwan's financial sector is embracing fintech, with many institutions leveraging AI for customer service, robo-advisory, and risk management. For instance, a notable portion of financial firms are integrating AI to streamline operations and personalize customer experiences.

Government backing is also crucial, exemplified by initiatives like the Financial Technology Development and Innovation Sandbox, which fosters fintech growth. This supportive environment encourages experimentation and the rollout of new financial technologies.

Cathay Financial Holding is actively participating in this digital shift, making strategic investments in fintech to bolster its service offerings. This focus on digital transformation aims to improve efficiency and customer engagement across its platforms.

The Financial Supervisory Commission (FSC) in Taiwan has issued guidelines for AI use in finance, focusing on robust governance and clear accountability, a crucial step for institutions like Cathay Financial Holding. This regulatory framework ensures that AI adoption proceeds responsibly.

Financial institutions are actively integrating AI across their operations. For instance, AI is being deployed to bolster risk management frameworks and streamline regulatory compliance processes, aiming for greater accuracy and efficiency. This trend is evident across the sector.

Cathay Financial Holding is strategically adopting AI to elevate operational efficiency and enrich customer experiences. By developing innovative financial products powered by AI, Cathay aims to meet evolving market demands and adhere to the FSC's forward-looking regulatory expectations.

As financial services rapidly digitize, cybersecurity and data protection are critical. The Financial Supervisory Commission's (FSC) Financial Cybersecurity Action Plan, released in 2023, aims to ensure the financial system's continuous operation. This plan underscores the growing need for robust IT security measures.

Cathay Financial Holding must therefore invest heavily in advanced security protocols and compliance frameworks. Protecting sensitive customer data is not just a regulatory requirement but also essential for maintaining customer trust and brand reputation in an increasingly interconnected digital landscape. By adhering to these plans, Cathay Financial can mitigate risks associated with cyber threats.

Digital Banking and Mobile Payments

Taiwan is aggressively promoting mobile payment adoption, aiming for a 90% penetration rate by 2025. This national push creates a fertile ground for financial institutions that can offer seamless digital experiences. Cathay Financial Holding is well-positioned to capitalize on this trend through its innovative digital offerings.

Cathay United Bank's CUBE app is a prime example of this digital-first strategy. It embodies the 'one card, one app, one account' philosophy, simplifying financial management for users. The app's ability to provide flexible rewards and highly personalized experiences is key to attracting and retaining customers in this increasingly digital landscape.

The emphasis on digital channels and mobile-centric solutions is paramount for Cathay Financial Holding's future growth. By meeting consumers where they are – on their mobile devices – the company can effectively capture a larger share of the expanding digital consumer base and maintain a competitive edge.

Key aspects of this technological shift include:

- Government Mandate: Taiwan's target of 90% mobile payment penetration by 2025 underscores the significant market opportunity.

- Customer-Centric Innovation: Cathay United Bank's CUBE app demonstrates a commitment to user experience with its integrated approach.

- Personalization and Rewards: The app's flexible reward system and personalized features are designed to enhance customer loyalty.

- Digital Channel Dominance: Success hinges on effectively leveraging mobile platforms to serve the evolving needs of the digital consumer.

Blockchain and Virtual Assets

Taiwan's financial sector is actively investigating how licensed institutions can engage with virtual assets. This includes exploring the feasibility of a central bank digital currency (CBDC) and establishing a task force focused on tokenizing Real World Assets (RWA).

While cryptocurrencies are not recognized as legal tender, Cathay Financial Holding is positioned to assess opportunities within this dynamic landscape. The upcoming implementation of new regulations for Virtual Asset Service Providers (VASPs) will further shape the operational framework for such ventures.

- Regulatory Exploration: Taiwan's financial authorities are actively exploring pathways for licensed financial institutions to participate in the virtual asset ecosystem.

- CBDC and RWA Focus: Key areas of exploration include the potential for a central bank digital currency (CBDC) and a task force dedicated to Real World Assets (RWA) tokenization.

- Cathay's Strategic Position: Despite crypto not being legal tender, Cathay Financial Holding is poised to evaluate opportunities in this evolving virtual asset space, especially with new VASP regulations on the horizon.

Technological advancements are reshaping Taiwan's financial landscape, with a strong push towards digital integration and AI adoption. Cathay Financial Holding is actively participating in this transformation, investing in fintech solutions to enhance customer service and operational efficiency.

The government's support for fintech, including initiatives like the Financial Technology Development and Innovation Sandbox, is fostering a dynamic environment for new technologies. Furthermore, Taiwan's ambitious goal of achieving 90% mobile payment penetration by 2025 highlights the increasing reliance on digital channels.

Cathay United Bank's CUBE app exemplifies this digital-first approach, offering a streamlined and personalized financial experience. The company's strategic focus on mobile-centric solutions is crucial for capturing market share in an increasingly digital consumer base.

Taiwan is also exploring the potential of virtual assets, with authorities investigating CBDC and RWA tokenization. Cathay Financial Holding is strategically positioned to evaluate opportunities in this evolving space, especially with forthcoming regulations for Virtual Asset Service Providers.

| Technology Area | Key Developments | Cathay Financial Holding's Involvement | Impact/Opportunity |

|---|---|---|---|

| Artificial Intelligence (AI) | AI adoption for customer service, robo-advisory, risk management. FSC guidelines for AI use. | Investing in AI for operational efficiency and customer experience. Developing AI-powered financial products. | Enhanced service personalization, improved risk assessment, streamlined compliance. |

| Mobile Payments | Target of 90% mobile payment penetration by 2025. | Launching customer-centric digital platforms like the CUBE app. | Increased digital transaction volume, expanded customer reach, competitive advantage through user experience. |

| Virtual Assets | Exploration of CBDC and RWA tokenization. Upcoming VASP regulations. | Poised to assess opportunities in the virtual asset market. | Potential for new revenue streams, innovation in digital asset services, navigating regulatory landscape. |

Legal factors

Taiwan's financial regulatory environment is dynamic, with ongoing adjustments to align with global standards like Basel III. These changes, particularly those aimed at bolstering capital adequacy and risk management for financial institutions, directly shape how companies like Cathay Financial operate and strategize. For instance, the Financial Supervisory Commission (FSC) has been actively promoting initiatives to develop Taiwan into a regional hub for asset management, which involves streamlining regulations for wealth and investment management sectors. This evolving framework necessitates constant adaptation in product offerings and operational models for Cathay Financial.

The Money Laundering Control Act in Taiwan underwent a significant amendment in July 2024, expanding the scope of entities obligated to report suspicious transactions and imposing harsher penalties for non-compliance. This update directly impacts Cathay Financial Holding by necessitating a thorough review and enhancement of its existing anti-money laundering and counter-terrorism financing frameworks.

A key aspect of the July 2024 amendment is the explicit inclusion of Virtual Asset Service Providers (VASPs) under stricter AML registration and reporting mandates. For Cathay Financial Holding, this means ensuring that any engagement with or provision of services related to virtual assets aligns with these new, more rigorous requirements, potentially involving enhanced due diligence for customers operating in this space.

Adherence to these strengthened AML/CFT regulations is paramount for Cathay Financial Holding to mitigate legal and reputational risks. The company must implement robust customer due diligence (CDD) processes, including Know Your Customer (KYC) procedures, and conduct comprehensive risk assessments to identify, assess, and manage money laundering and terrorism financing risks effectively. Failure to comply could result in substantial fines, with the amended act introducing penalties that could reach up to NT$50 million for severe violations.

Taiwan's regulatory landscape is increasingly focused on Environmental, Social, and Governance (ESG) disclosures. By 2025, listed companies must submit ESG reports, aligning with global standards such as the Global Reporting Initiative (GRI), the Task Force on Climate-related Financial Disclosures (TCFD), and the Sustainability Accounting Standards Board (SASB).

To combat misleading environmental claims, the Financial Supervisory Commission (FSC) has introduced specific guidelines targeting greenwashing prevention within financial institutions. This proactive stance aims to foster greater transparency and investor confidence in sustainable financial products and corporate practices.

Cathay Financial Holding must therefore prioritize the accuracy, verifiability, and consistent updating of its sustainability disclosures. Adherence to these evolving legal mandates is crucial not only for regulatory compliance but also for safeguarding its reputation and maintaining trust among stakeholders in the competitive financial market.

Data Privacy and Cybersecurity Regulations

Data privacy and cybersecurity regulations are increasingly critical for financial institutions like Cathay Financial Holding. The Financial Supervisory Commission (FSC) in Taiwan has been emphasizing enhanced information security governance. This means Cathay Financial must consistently upgrade its IT infrastructure and data protection protocols to meet evolving standards. For instance, in 2024, global cybersecurity spending by financial services firms was projected to exceed $30 billion, highlighting the significant investment required.

These stringent regulations necessitate continuous adaptation. Cathay Financial needs to ensure robust data handling practices and invest in advanced cybersecurity measures to safeguard sensitive customer information. Failure to comply can result in substantial penalties and reputational damage, making proactive management of these legal factors essential for operational integrity and trust.

- FSC Focus: The FSC's ongoing emphasis on strengthening information security governance directly impacts Cathay Financial's operational requirements.

- Investment Needs: Financial institutions are increasingly allocating significant budgets towards cybersecurity, with global spending in the sector reaching tens of billions of dollars annually.

- Compliance Risk: Non-compliance with data privacy and cybersecurity laws can lead to severe financial penalties and a loss of customer confidence.

Consumer Protection Laws

Taiwan's Financial Supervisory Commission (FSC) is actively strengthening investor and financial consumer protections. For instance, the FSC has been refining financial inclusion indicators, signaling a commitment to ensuring fair treatment, product transparency, and robust dispute resolution processes for all financial consumers. Cathay Financial Holding must meticulously align its operations with these evolving consumer protection mandates to maintain regulatory compliance and foster trust.

This regulatory focus translates into tangible actions impacting financial institutions like Cathay Financial. The FSC's drive for enhanced consumer rights means that institutions need to be particularly vigilant about clear disclosure of product features, fees, and risks. In 2024, reports indicated an increased number of consumer complaints related to complex financial products, prompting the FSC to further scrutinize sales practices and product suitability assessments.

- Enhanced Disclosure Requirements: Financial firms must provide clearer, more accessible information about products and services.

- Fair Treatment of Customers: Regulations emphasize preventing predatory practices and ensuring equitable service for all consumers.

- Dispute Resolution Mechanisms: The FSC is promoting more efficient and accessible channels for resolving customer grievances.

- Financial Inclusion Initiatives: Adjustments to financial inclusion indicators reflect a broader goal of making financial services accessible and understandable to a wider population.

Taiwan's legal framework, particularly concerning financial services, is undergoing significant evolution, driven by both domestic policy and global trends. Cathay Financial Holding must navigate these changes diligently to ensure compliance and maintain its competitive edge.

Key legal developments in 2024 and projected into 2025 include stricter anti-money laundering (AML) and counter-terrorism financing (CTF) regulations, especially with the amendment to the Money Laundering Control Act in July 2024. This amendment explicitly includes Virtual Asset Service Providers (VASPs), imposing robust registration and reporting mandates. Cathay Financial must enhance its Know Your Customer (KYC) and Customer Due Diligence (CDD) processes to align with these stricter requirements, facing potential fines up to NT$50 million for non-compliance.

Furthermore, the push for enhanced ESG disclosures by 2025, with mandatory ESG reports for listed companies, necessitates meticulous attention to sustainability reporting standards like GRI, TCFD, and SASB. The Financial Supervisory Commission (FSC) is also actively combating greenwashing, requiring financial institutions to ensure the accuracy and verifiability of their environmental claims.

Data privacy and cybersecurity remain paramount, with the FSC emphasizing robust information security governance. Global cybersecurity spending in the financial sector exceeded $30 billion in 2024, underscoring the substantial investment required for compliance and risk mitigation. Finally, the FSC's focus on strengthening investor and financial consumer protections, including refining financial inclusion indicators and scrutinizing sales practices for complex products, demands greater transparency and fair treatment from institutions like Cathay Financial.

Environmental factors

The escalating frequency of extreme weather events, such as typhoons and floods, presents a significant hurdle for Cathay Financial Holding's asset and risk management. For instance, the devastating impacts of Typhoon Haikui in Taiwan in September 2023, which caused widespread damage and disruptions, underscore the tangible financial implications of climate change on physical assets and operational continuity.

Financial institutions, including Cathay Financial, are increasingly expected to provide transparent disclosures regarding their exposure to climate-related financial risks. This aligns with global trends and regulatory pressures, encouraging a more proactive approach to understanding and communicating these vulnerabilities.

Cathay Financial Holding must diligently assess and manage the physical risks stemming from climate change. These risks can directly affect its properties, infrastructure, and the value of assets held within its banking and insurance portfolios, necessitating robust adaptation and mitigation strategies.

Taiwan's commitment to decarbonization is solidified by its '2050 Net Zero Pathway' and the Climate Change Response Act, which actively promote green finance. This regulatory environment encourages financial institutions to channel funds into corporate sustainability and low-carbon initiatives. For instance, as of early 2024, the Taiwan government has allocated significant resources to support green energy projects, with financial institutions playing a crucial role in project financing.

Cathay Financial Holding is well-positioned to capitalize on this shift by offering a range of green financial products, such as green bonds and sustainability-linked loans. By directing its investments towards sustainable projects, Cathay Financial can align its portfolio with national net-zero goals and meet the growing demand for environmentally conscious financial solutions. This strategic focus can unlock new revenue streams and enhance its reputation as a responsible corporate citizen.

Growing global awareness of environmental, social, and governance (ESG) issues is compelling companies like Cathay Financial Holding to embed these values into their core strategies and daily operations. This shift reflects increasing pressure from investors, regulators, and the public for more sustainable business practices.

Cathay Financial is actively enhancing its ESG investment processes and championing sustainable finance. This proactive approach involves integrating environmental factors into its lending, investment, and insurance underwriting, alongside efforts to reduce its own operational environmental impact.

In 2023, Cathay Financial's commitment to sustainable finance saw its ESG-themed funds reach NT$1.1 trillion (approximately US$34 billion), demonstrating a significant market presence and investor confidence in its sustainable offerings.

Carbon Pricing and Emissions Reporting

Taiwan is implementing stricter environmental regulations, including the collection of carbon fees and mandatory annual reporting of greenhouse gas (GHG) emissions for regulated sources. This means companies like Cathay Financial Holding must actively manage and disclose their carbon footprint.

Listed companies are now required to integrate GHG emissions data into their Environmental, Social, and Governance (ESG) reports. For Cathay Financial, this necessitates robust systems for tracking and reporting emissions to ensure compliance with these evolving environmental mandates.

- Carbon Fee Collection: Taiwan's Environmental Protection Administration (EPA) began collecting carbon fees in 2024, with rates varying by emission volume.

- Annual GHG Reporting: Regulated entities must submit their annual GHG emissions data by March 31st each year, starting with the 2023 reporting period.

- ESG Report Integration: Publicly traded companies, including Cathay Financial, are expected to include Scope 1 and Scope 2 emissions data in their 2024 ESG reports.

- Mitigation Strategies: Cathay Financial may need to invest in energy efficiency or renewable energy sourcing to manage potential carbon fee liabilities and enhance its ESG profile.

Resource Scarcity and Environmental Regulations

Beyond the widely discussed climate change, Cathay Financial Holding, like any major corporation, must navigate a complex web of environmental regulations. These rules often target resource scarcity, pollution control, and waste management, directly affecting operational efficiency and supply chain stability. For instance, stricter water usage regulations in certain regions could increase operational costs for facilities or necessitate investments in water-saving technologies.

The financial sector, while not directly consuming vast physical resources, is significantly impacted by the environmental performance of its clients and investee companies. Cathay Financial Holding's commitment to sustainability, as evidenced by its ESG (Environmental, Social, and Governance) initiatives, means it must assess and manage the environmental risks embedded within its loan portfolios and investments. This includes ensuring compliance with evolving environmental laws and standards across its diverse markets.

Consider the impact of regulations on the energy sector, a key area for financing. As governments worldwide push for decarbonization, financial institutions like Cathay need to adapt their lending practices. For example, many nations are setting ambitious renewable energy targets. In 2023, global renewable energy capacity additions reached a record 510 gigawatts (GW), a 50% increase from 2022, according to the International Energy Agency (IEA). This trend necessitates careful evaluation of investments in fossil fuel-dependent industries and a strategic shift towards greener financing options.

- Resource Management: Evolving regulations on water usage, raw material sourcing, and waste disposal can increase compliance costs and operational complexities for businesses within Cathay Financial's client base.

- Pollution Control: Stricter emission standards and pollution discharge limits require significant investment in abatement technologies, potentially impacting the profitability and financial health of industrial clients.

- Circular Economy Initiatives: Growing emphasis on waste reduction and recycling may necessitate new business models and supply chain adjustments for companies, influencing their creditworthiness and investment appeal.

- Biodiversity Protection: Regulations aimed at preserving biodiversity and preventing habitat destruction can affect land use and development projects, requiring thorough environmental impact assessments for financed activities.

Taiwan's commitment to sustainability, exemplified by its 2050 Net Zero Pathway and the Climate Change Response Act, drives green finance initiatives. Cathay Financial's ESG-themed funds reached NT$1.1 trillion (approximately US$34 billion) in 2023, showcasing strong investor demand for sustainable options and aligning with national decarbonization goals.

The introduction of carbon fees in Taiwan from 2024 onwards, coupled with mandatory annual greenhouse gas (GHG) emissions reporting for regulated entities, necessitates robust data management and compliance for companies like Cathay Financial. This regulatory shift encourages investments in energy efficiency and renewable energy to mitigate liabilities and enhance ESG profiles.

Environmental regulations concerning resource management, pollution control, and biodiversity protection can significantly impact Cathay Financial's clients and investment portfolios. For instance, the global surge in renewable energy capacity, with a 50% increase in 2023 to 510 GW, highlights the need for financial institutions to adapt lending practices and shift towards greener financing options.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Cathay Financial draws from a comprehensive blend of official government publications, reports from international financial institutions like the IMF and World Bank, and reputable market research firms. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental landscapes impacting the company.