Cathay Financial Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cathay Financial Bundle

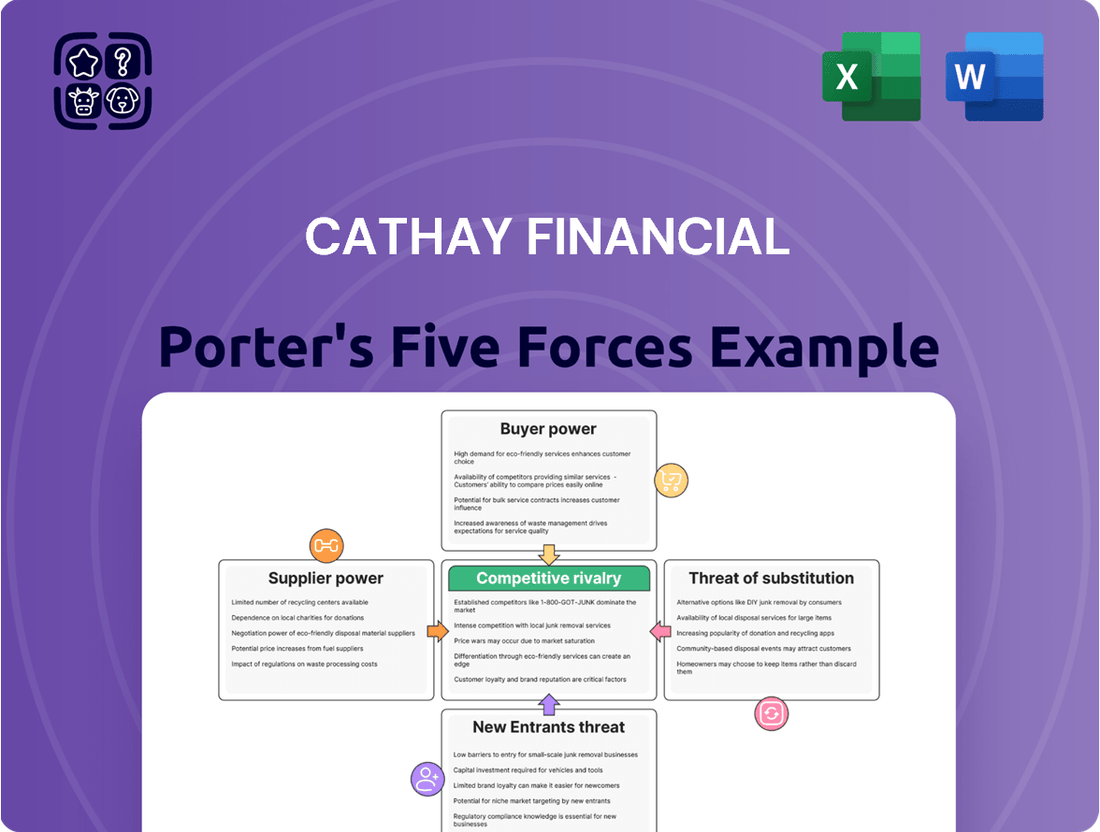

Cathay Financial operates within a dynamic financial services landscape, where understanding the interplay of competitive forces is paramount. Our analysis delves into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Cathay Financial’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Cathay Financial Holding depends on technology and software vendors for its digital operations across banking, insurance, and asset management. The leverage these suppliers possess can range from moderate to substantial, particularly when dealing with niche or proprietary fintech solutions. For instance, the global fintech market was projected to reach over $1.1 trillion by 2024, indicating a robust and competitive landscape where specialized providers can command significant influence.

Cathay Financial's reliance on data and information providers for crucial market intelligence and customer insights means these suppliers can hold moderate bargaining power. The availability of accurate and timely financial data, often sourced from credit bureaus and market data vendors, is essential for Cathay's operations and risk management. For instance, in 2024, the global financial data market was valued at over $30 billion, highlighting the significant investment in such resources.

The uniqueness, comprehensiveness, and regulatory necessity of the data supplied can amplify a provider's leverage. Firms that offer specialized analytics or data critical for compliance, like Know Your Customer (KYC) or anti-money laundering (AML) regulations, can command stronger terms. Ensuring the security and privacy of this sensitive information also adds to the importance of these supplier relationships, as breaches can have severe financial and reputational consequences for Cathay.

The availability of skilled professionals in finance, technology, risk management, and data analytics is a critical input for Cathay Financial. In 2024, the competition for top talent, particularly in areas like artificial intelligence and cybersecurity, remains fierce. This scarcity directly impacts the bargaining power of these highly sought-after individuals, potentially driving up salary expectations and creating recruitment hurdles for the company.

Reinsurance Providers

The bargaining power of reinsurance providers for Cathay Life Insurance and Cathay Century Insurance is a significant factor. These reinsurers are essential for managing large risks and ensuring stable profits. Their leverage can shift depending on global reinsurance market dynamics, the occurrence of major claims, such as those from natural catastrophes, and the variety of reinsurance choices available.

- Reinsurance Market Conditions: Global reinsurance capacity, influenced by factors like investment returns and underwriting profitability of reinsurers, directly impacts pricing and terms. For instance, following periods of significant insured losses, such as those seen in 2023 with major natural disasters, reinsurance capacity can tighten, leading to increased prices and potentially stronger bargaining power for reinsurers.

- Claim Frequency and Severity: The frequency and severity of large-scale claims, particularly those related to natural disasters or pandemics, can significantly influence the reinsurers' need to protect their capital. A surge in catastrophic events in 2024 could lead to higher demand for reinsurance, empowering reinsurers to negotiate more favorable terms.

- Availability of Alternatives: The number and diversity of reinsurers operating in the market affect their individual bargaining power. If Cathay Financial has access to a broad pool of reinsurers, including specialized providers, its ability to negotiate more competitive rates increases. Conversely, a concentrated market with fewer reinsurers can shift power towards the suppliers.

Infrastructure and Real Estate Providers

Cathay Financial, as a major financial institution, relies heavily on physical infrastructure such as office buildings, data centers, and extensive branch networks. The demand for these specialized facilities can grant providers a degree of bargaining power.

While real estate markets are often diverse, the need for secure, high-capacity data centers and widespread, accessible branch locations can concentrate this power among fewer providers. This is particularly true for locations crucial to Cathay's operations and customer reach.

However, compared to critical inputs like advanced technology or skilled human capital, the bargaining power of infrastructure and real estate providers for a large entity like Cathay Financial is generally considered moderate. For instance, in 2024, the global commercial real estate market saw varied performance, with office vacancy rates in major Asian financial hubs like Hong Kong and Singapore remaining a factor that could temper landlord pricing power, though prime locations and specialized facilities still command premiums.

- Demand for Specialized Infrastructure: Cathay Financial's need for secure data centers and extensive branch networks concentrates demand, giving providers of these specific services more leverage.

- Market Conditions Influence Power: The overall health of the real estate market, including vacancy rates in key financial centers, can affect the bargaining power of landlords.

- Comparison to Other Inputs: The bargaining power of real estate providers is typically less significant than that of suppliers of critical technology or specialized human talent.

Cathay Financial's suppliers of technology and specialized fintech solutions can wield substantial bargaining power, especially given the global fintech market's projected growth to over $1.1 trillion by 2024. This leverage is amplified by the critical nature of data providers, essential for market intelligence and risk management, with the global financial data market valued at over $30 billion in 2024. Furthermore, the intense competition for skilled professionals in AI and cybersecurity in 2024 empowers these individuals, increasing their bargaining leverage.

| Supplier Type | Bargaining Power Factor | 2024 Data Point |

|---|---|---|

| Technology & Fintech | Niche/Proprietary Solutions | Fintech Market: >$1.1 Trillion |

| Data & Information Providers | Data Uniqueness & Regulatory Necessity | Financial Data Market: >$30 Billion |

| Skilled Professionals (AI, Cybersecurity) | Talent Scarcity | High demand for specialized skills |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Cathay Financial's position in the financial services industry.

Instantly identify and address competitive threats with a visual breakdown of Cathay Financial's industry landscape.

Customers Bargaining Power

The bargaining power of individual retail customers for everyday banking and insurance products is typically quite low. This is because these services are often standardized, and financial institutions like Cathay Financial serve a vast number of individuals, making any single customer's impact minimal. For example, in 2024, the average retail bank customer in Taiwan might hold a few basic accounts, representing a small fraction of a bank's total customer base.

However, this dynamic shifts for customers seeking more sophisticated wealth management or investment services. Individuals with substantial assets under management can exert more influence. Their ability to move larger sums of money means financial institutions are more inclined to offer personalized terms or better rates to retain their business. This is particularly relevant as Cathay Financial Holdings, a major player in Taiwan, continues to expand its wealth management offerings.

Large corporate and institutional clients, such as other businesses and government bodies, wield significant bargaining power. Their substantial transaction volumes and need for bespoke solutions often grant them leverage.

These clients can more readily switch providers, compelling companies like Cathay Financial to offer competitive pricing and highly customized services to retain their business. For instance, in 2024, major institutional investors often negotiated lower management fees due to the sheer scale of assets they deploy.

Customers are increasingly embracing digital financial services and fintech, giving them more options and easier access to compare offerings. This transparency allows them to readily assess products and services from various providers, including newer, non-traditional players. For instance, a 2024 report indicated that over 70% of consumers surveyed used at least one fintech app for banking or investment services, highlighting this shift.

Price Sensitivity and Product Differentiation

In Taiwan's financial landscape, customers often exhibit significant price sensitivity, especially when dealing with standardized offerings like basic savings accounts or straightforward insurance plans. This sensitivity directly impacts Cathay Financial by increasing the bargaining power of its clientele, who can readily switch providers if better rates or lower fees are available.

Cathay Financial can effectively counter this by focusing on product and service differentiation. Innovations in digital banking, personalized financial advice, or exclusive loyalty programs can create unique value propositions that reduce the emphasis on price alone. For instance, in 2023, Cathay Financial Holdings reported a net profit after tax attributable to parent of NT$57.38 billion, demonstrating its scale, but the ability to maintain and grow this through customer loyalty hinges on perceived value beyond just cost.

- Price Sensitivity: Customers in Taiwan's financial sector are often swayed by price, particularly for commoditized products.

- Differentiation Strategy: Cathay Financial can leverage innovation, convenience, and unique value propositions to lessen customer price focus.

- Mitigating Power: Strong differentiation allows Cathay Financial to command loyalty and reduce the direct impact of customer price bargaining.

Regulatory Protections and Financial Literacy

Regulatory bodies in Taiwan, such as the Financial Supervisory Commission (FSC), actively promote consumer protection and financial inclusion. This oversight can bolster customer bargaining power by enforcing transparent pricing and fair treatment, as seen in initiatives aimed at simplifying investment product disclosures. For instance, in 2024, the FSC continued its efforts to enhance financial literacy through public campaigns and educational programs, empowering consumers to make more informed choices and negotiate better terms.

The growing financial literacy among Taiwanese consumers directly translates to increased bargaining power. As customers become more adept at understanding financial products, comparing options, and recognizing value, they are better positioned to demand favorable terms and services from financial institutions like Cathay Financial. This heightened awareness, fueled by accessible information and educational resources, allows customers to exert greater influence over pricing and service quality.

- Enhanced Consumer Protection: Taiwan's regulatory framework, enforced by bodies like the FSC, mandates fair practices and transparent pricing, indirectly strengthening customer bargaining power.

- Financial Inclusion Initiatives: Efforts to promote financial inclusion ensure a broader customer base is aware of their rights and options, increasing collective bargaining leverage.

- Impact of Financial Literacy: In 2024, increased financial literacy empowered customers to make more informed decisions, leading to greater demand for value and better service terms from financial providers.

- Dispute Resolution Mechanisms: Accessible and effective dispute resolution channels give customers recourse, further incentivizing financial institutions to offer competitive and fair services.

The bargaining power of customers for Cathay Financial is a significant factor, particularly influenced by price sensitivity and the increasing availability of digital alternatives. While individual retail customers have limited leverage on basic products, large institutional clients can negotiate favorable terms due to their substantial asset volumes. For instance, in 2024, many institutional investors secured lower management fees, reflecting their considerable influence.

The rise of fintech and enhanced financial literacy among Taiwanese consumers in 2024 has further amplified their bargaining power. Customers can now more easily compare offerings and demand better value, pushing financial institutions to innovate and differentiate their services beyond mere price. This trend is evident with over 70% of consumers surveyed in 2024 utilizing fintech apps, underscoring the shift towards informed and empowered customers.

| Customer Segment | Bargaining Power Level | Key Influencing Factors (2024) |

|---|---|---|

| Individual Retail Customers (Basic Services) | Low | Standardized products, low individual transaction volume |

| Individual Retail Customers (Wealth Management) | Moderate to High | High asset volume, potential for switching |

| Corporate & Institutional Clients | High | Large transaction volumes, need for bespoke solutions, ease of switching |

| Fintech-Savvy Consumers | Increasingly High | Easy comparison of offerings, price sensitivity, digital access |

What You See Is What You Get

Cathay Financial Porter's Five Forces Analysis

This preview shows the exact Cathay Financial Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. You'll gain a comprehensive understanding of the competitive landscape surrounding Cathay Financial, including detailed insights into buyer power, supplier power, the threat of new entrants, the threat of substitutes, and the intensity of rivalry within the industry. This professionally formatted document is ready for your immediate use and strategic planning.

Rivalry Among Competitors

Cathay Financial operates within a highly fragmented financial services landscape in Taiwan, with a significant number of banks, insurance providers, and other financial entities competing for customers. This sheer volume of players means intense rivalry, forcing companies like Cathay to constantly differentiate themselves and manage pricing pressures to maintain profitability.

The financial services landscape in Taiwan, while appearing fragmented, is actually dominated by a few major financial holding companies. Cathay Financial, Fubon Financial Holding, and CTBC Financial Holding are prime examples, each commanding substantial market share across banking, insurance, and securities sectors. This intense rivalry means these giants constantly vie for customer loyalty by offering integrated services and leveraging their considerable scale.

Competitive rivalry in the financial sector is intensified by relentless product and service diversification. Companies are actively developing innovative financial products, expanding wealth management solutions, and enhancing digital offerings to attract and retain diverse customer segments. This strategic push includes venturing into emerging areas such as green finance and leveraging AI for personalized services.

For instance, Cathay Financial, a major player, has been actively diversifying its portfolio. In 2023, its insurance segment saw a notable increase in premium income, driven by new annuity products and health insurance plans. Simultaneously, its banking arm reported growth in digital transaction volumes, reflecting a successful integration of technology into customer service.

Digital Transformation and Fintech Innovation

The financial services landscape is experiencing intensified competitive rivalry due to ongoing digital transformation and fintech innovation. Traditional players are racing to adopt new technologies, while agile fintech startups are disrupting established models.

Financial institutions are channeling significant capital into digital initiatives. For instance, in 2024, global investment in financial technology was projected to reach hundreds of billions of dollars, fueling advancements in areas like AI-driven customer service and blockchain-based transactions. This digital arms race is forcing all participants to innovate rapidly or risk losing market share.

- Digital Investment Surge: Global fintech investment saw a substantial increase in 2024, with projections indicating continued growth as institutions prioritize digital capabilities.

- AI Adoption: Many financial firms are integrating AI to personalize customer experiences and streamline operations, leading to a more competitive environment focused on efficiency and service quality.

- Fintech Disruption: Emerging fintech companies are challenging incumbents with specialized, user-friendly digital solutions, forcing established banks and insurers to adapt their strategies.

- Customer Experience Focus: Enhanced digital platforms and mobile banking are becoming key differentiators, driving rivalry as companies vie to attract and retain digitally-savvy customers.

Regulatory Environment and Market Concentration

The regulatory landscape significantly influences competitive rivalry within the financial services sector. While regulations often aim to promote fair competition and consumer protection, they can also create barriers to entry or favor certain business models. For instance, evolving anti-money laundering (AML) and Know Your Customer (KYC) requirements, as seen with ongoing updates in 2024, demand substantial investment in compliance technology and expertise, potentially disadvantaging smaller players.

Market concentration also plays a crucial role. In markets with a few dominant financial holding companies (FHCs), like Cathay Financial, the intensity of rivalry among these large entities can be less about aggressive price wars and more about strategic differentiation and service innovation. While outright mergers between major FHCs are infrequent, strategic partnerships or acquisitions of smaller, specialized firms can still alter the competitive balance, as observed in the ongoing consolidation trends in fintech integration throughout 2024.

- Regulatory Impact: New regulations in 2024, focusing on areas like digital asset oversight and data privacy, necessitate significant compliance investments, shaping competitive advantages.

- Market Concentration: A concentrated market structure among large FHCs can lead to less direct price competition and a greater emphasis on service innovation and niche market targeting.

- M&A Activity: While major FHC mergers are rare, strategic acquisitions of fintechs or specialized service providers by established players continue to reshape competitive dynamics, as seen in various regional markets in 2024.

Competitive rivalry at Cathay Financial is fierce, driven by a fragmented market and the dominance of a few large financial holding companies. This intense competition necessitates constant innovation in products, services, and digital offerings. For instance, in 2024, global fintech investment surged, pushing firms like Cathay to enhance AI-driven customer service and digital platforms to retain market share amidst a landscape where customer experience is a key differentiator.

| Key Competitor | Primary Business Areas | 2023 Revenue (Approx. USD Billion) | Key Competitive Strategy |

|---|---|---|---|

| Fubon Financial Holding | Banking, Insurance, Securities, Asset Management | 15.2 | Integrated financial services, digital innovation |

| CTBC Financial Holding | Banking, Insurance, Securities, Venture Capital | 12.5 | Digital transformation, customer-centric solutions |

| Mega Financial Holding | Banking, Insurance, Securities, Bills Finance | 9.8 | Diversification, risk management |

SSubstitutes Threaten

Cathay Financial faces a significant threat from direct substitutes in the financial product landscape. For instance, traditional bank savings accounts are increasingly challenged by money market funds, which in 2024 continued to attract substantial investor capital seeking slightly higher yields and liquidity.

Similarly, the insurance sector sees substitutes like self-insurance or alternative risk transfer mechanisms gaining traction. In 2023, the global alternative risk transfer market experienced robust growth, indicating a clear preference among some businesses to manage risk outside of conventional insurance policies, thereby reducing demand for Cathay's traditional offerings.

The most significant threat of substitutes for traditional financial institutions like Cathay Financial comes from the burgeoning fintech sector and digital platforms. These innovators are unbundling financial services, offering specialized solutions that can bypass established intermediaries. For instance, peer-to-peer lending platforms connect borrowers directly with lenders, while online payment services streamline transactions, often at lower costs.

Robo-advisors are also gaining traction in asset management, providing automated, algorithm-driven investment advice, a direct challenge to traditional wealth management. Furthermore, direct-to-consumer insurance platforms are simplifying the purchasing process for policies. In 2023, the global fintech market was valued at over $1.1 trillion and is projected to grow significantly, indicating a strong and increasing threat from these alternative service providers.

Non-financial companies, especially tech giants, are increasingly encroaching on financial services. For instance, in 2023, e-commerce platforms expanded their payment and lending offerings, capturing a larger share of transactional volume. These firms leverage their massive user bases, which in 2024 numbered in the hundreds of millions for leading players, to offer integrated financial solutions.

Self-Service and Disintermediation

The increasing prevalence of self-service platforms and the disintermediation of traditional financial advisory roles present a significant threat to Cathay Financial. Customers are empowered to manage their own investments, insurance, and banking needs directly through digital channels, bypassing intermediaries.

This trend is fueled by advancements in technology and a growing consumer preference for convenience and cost-effectiveness. For instance, robo-advisors, which offer automated investment management, have seen substantial growth. In 2024, the global robo-advisory market was projected to reach hundreds of billions of dollars, indicating a clear shift in how individuals approach financial management.

Cathay Financial faces pressure as clients can increasingly access investment products, research, and even basic financial planning tools online without engaging with a human advisor. This disintermediation can erode traditional revenue streams tied to advisory fees and product sales.

Key aspects of this threat include:

- Direct Digital Access: Customers can open accounts, trade securities, and purchase insurance policies directly via mobile apps and websites, bypassing branch networks and advisors.

- Rise of Fintech: Specialized financial technology firms offer niche services, often at lower costs, directly to consumers, fragmenting the market.

- DIY Investing: A growing segment of investors prefers to manage their portfolios independently, utilizing readily available online tools and information.

- Automated Advice: Robo-advisors and AI-powered platforms provide automated financial planning and investment advice, directly competing with traditional advisory services.

Cryptocurrencies and Decentralized Finance (DeFi)

While still developing, cryptocurrencies and Decentralized Finance (DeFi) present a growing threat of substitutes for traditional financial services offered by Cathay Financial. These technologies enable alternative methods for value storage, fund transfers, and financial transactions, bypassing conventional banking infrastructure. By mid-2024, the total value locked in DeFi protocols had surpassed $100 billion, indicating significant user engagement and a tangible alternative for financial activities.

These platforms allow for peer-to-peer lending, borrowing, and trading, potentially reducing reliance on established institutions for such services. The increasing accessibility and innovation within the DeFi space, evidenced by the launch of new protocols and the expansion of blockchain capabilities, continue to strengthen their position as viable substitutes.

- DeFi Market Growth: Total value locked in DeFi reached approximately $115 billion by June 2024, demonstrating substantial user adoption.

- Transaction Alternatives: Cryptocurrencies offer alternative remittance corridors, with global remittance flows projected to reach $1.2 trillion in 2024, some of which could utilize digital assets.

- Decentralized Services: The number of active DeFi users grew by over 100% in the year leading up to mid-2024, highlighting a shift towards decentralized financial solutions.

The threat of substitutes for Cathay Financial is significant, driven by the unbundling of services by fintech and digital platforms, offering specialized, often lower-cost solutions. Traditional offerings like savings accounts face competition from money market funds, which saw continued investor inflows in 2024. Furthermore, alternative risk transfer methods are gaining traction in the insurance sector, as evidenced by the robust growth in the global alternative risk transfer market in 2023.

The rise of robo-advisors and direct-to-consumer insurance platforms exemplifies this trend, providing automated and streamlined alternatives to traditional wealth management and insurance purchasing. The global fintech market, valued at over $1.1 trillion in 2023, underscores the expansive reach of these substitute providers.

Cryptocurrencies and Decentralized Finance (DeFi) also pose a growing threat, offering alternative avenues for value storage and transactions, bypassing conventional financial infrastructure. By mid-2024, the total value locked in DeFi protocols exceeded $100 billion, indicating substantial user engagement with these decentralized financial solutions.

| Substitute Area | Key Substitute | 2023/2024 Data Point | Impact on Cathay Financial |

|---|---|---|---|

| Savings & Liquidity | Money Market Funds | Continued strong investor inflows in 2024 | Reduced demand for traditional savings accounts |

| Risk Management | Alternative Risk Transfer | Robust growth in global market in 2023 | Decreased reliance on conventional insurance |

| Investment Advice | Robo-Advisors | Global market projected to reach hundreds of billions in 2024 | Erosion of traditional wealth management fees |

| Financial Transactions | DeFi Protocols | Total value locked exceeded $100 billion by mid-2024 | Potential disintermediation of banking services |

Entrants Threaten

The financial services sector in Taiwan presents formidable regulatory hurdles for newcomers. Significant capital is mandated, with specific licensing and ongoing compliance with intricate frameworks being essential. For instance, as of early 2024, the minimum paid-in capital for establishing a new bank in Taiwan can range from NT$10 billion to NT$20 billion, a substantial barrier for many potential entrants.

These stringent requirements, particularly within banking and insurance, create a powerful deterrent. The sheer scale of investment needed and the complexity of navigating compliance mean only well-resourced entities can realistically consider entering the market, thereby protecting incumbent players like Cathay Financial.

Established financial institutions like Cathay Financial possess significant advantages due to their deeply ingrained brand recognition and the trust they've cultivated over years of operation. This often translates into a loyal customer base that is hesitant to switch providers, especially for critical financial services.

New entrants must invest heavily in marketing and customer acquisition to even begin to match the credibility that established players, such as Cathay Financial with its extensive history, already command. For instance, in 2023, the global financial services sector saw significant marketing spend, with major banks allocating billions to brand building and digital transformation initiatives to retain and attract customers.

Building this level of trust and recognition is a slow, arduous process for newcomers. Cathay Financial's long-standing presence, evidenced by its decades of service and widespread branch network, creates a substantial barrier to entry, making it difficult for new entities to gain market share quickly.

While regulatory hurdles remain significant, technological advancements have notably reduced entry barriers for fintech startups. These nimble newcomers can harness cutting-edge technologies to deliver specialized services, carving out niches within the market without the extensive infrastructure of established players. For instance, the rise of digital-only banks and payment platforms demonstrates how technology can bypass traditional brick-and-mortar requirements.

Access to Distribution Channels and Customer Data

New entrants in the financial services sector, particularly those looking to compete with established giants like Cathay Financial, often face significant challenges in securing access to critical distribution channels and valuable customer data. Incumbent firms have spent years, if not decades, building extensive networks of branches, agents, and digital platforms, making it difficult for newcomers to replicate this reach effectively. For instance, in 2024, the cost of establishing a comparable distribution footprint for a new insurance provider could run into hundreds of millions of dollars, a substantial barrier to entry.

Furthermore, the wealth of customer data held by established players provides a distinct advantage in understanding market needs, personalizing offerings, and executing targeted marketing campaigns. New entrants must invest heavily in data acquisition and analytics to even begin to compete on this front. By mid-2024, the average cost for a financial institution to acquire a new customer through digital channels had risen by approximately 15% year-over-year, highlighting the escalating expense of building a customer base from scratch without leveraging existing data insights.

- Distribution Channel Barriers: Established firms like Cathay Financial benefit from extensive physical and digital distribution networks, making it difficult for new entrants to achieve comparable market penetration.

- Customer Data Advantage: Incumbents possess vast customer databases, enabling superior market analysis, product development, and personalized marketing, which new players lack.

- High Entry Costs: Building a comparable distribution infrastructure and acquiring the necessary customer data requires substantial capital investment, acting as a significant deterrent for potential new competitors.

- Regulatory Hurdles: Navigating complex financial regulations and compliance requirements further complicates market entry, often favoring firms with established operational frameworks and expertise.

Economies of Scale and Scope

Economies of scale and scope present a substantial barrier to entry in the financial services sector, particularly for established players like Cathay Financial. These large groups leverage their size to achieve lower per-unit costs in operations, marketing, and technology development, enabling them to offer competitive pricing across a broad spectrum of financial products. For instance, a diversified financial conglomerate can spread the significant costs of regulatory compliance and IT infrastructure across its banking, insurance, and asset management divisions.

New entrants often struggle to match these cost efficiencies and the breadth of services offered by incumbents. Building the necessary infrastructure and product suite to compete effectively requires immense capital investment, which can be difficult to recoup without an existing customer base and established brand recognition. In 2024, the average cost for a new fintech startup to acquire a customer in the banking sector often exceeded $100, significantly higher than established banks that can leverage existing relationships.

- Significant Capital Investment: New entrants require substantial upfront capital to build the infrastructure for banking, insurance, and investment services, a hurdle that existing giants like Cathay Financial have already overcome.

- Cost Advantages: Established firms benefit from lower operational costs per unit due to high transaction volumes and shared fixed costs across multiple business lines.

- Product Diversification: Large financial groups offer a comprehensive suite of products, from savings accounts to complex investment vehicles, which is difficult for new, specialized entrants to replicate quickly.

- Brand Trust and Reputation: Years of operation build trust, making it harder for new companies to attract customers away from established, reputable institutions.

The threat of new entrants for Cathay Financial is generally low due to significant barriers. Stringent regulatory requirements, such as substantial minimum capital mandates for banking and insurance operations, create a formidable financial hurdle. For example, in early 2024, establishing a new bank in Taiwan required paid-in capital ranging from NT$10 billion to NT$20 billion.

Furthermore, established players like Cathay Financial benefit from deeply ingrained brand recognition and customer trust, cultivated over decades. Newcomers must invest heavily in marketing and customer acquisition to build comparable credibility, a process that can take years. For instance, in 2023, global financial institutions allocated billions to brand building and digital transformation to retain customers.

Technological advancements, however, have somewhat lowered entry barriers for nimble fintech startups, allowing them to offer specialized services and carve out market niches by bypassing traditional infrastructure. Despite this, securing access to critical distribution channels and vast customer data remains a significant challenge for new entrants, with the cost of acquiring a new customer in banking rising by approximately 15% year-over-year by mid-2024.

Porter's Five Forces Analysis Data Sources

Our Cathay Financial Porter's Five Forces analysis is built upon a robust foundation of data, drawing from Cathay Financial's official annual reports, investor presentations, and public filings. We supplement this with industry-specific research from reputable financial news outlets and market intelligence providers to capture a comprehensive view of the competitive landscape.