Carraro SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Carraro Bundle

Carraro's robust market position is built on strong technological capabilities and a diverse product portfolio, but understanding the nuances of its competitive landscape and potential market shifts is crucial for strategic advantage. Our comprehensive SWOT analysis delves into these critical areas, offering actionable insights to navigate the complexities of the global agricultural and construction machinery sectors.

Want the full story behind Carraro's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Carraro Group is a recognized global leader in power transmission systems, with a strong specialization in axles and transmissions. This focused expertise translates into high-quality, reliable components for the demanding off-highway vehicle sector.

The company’s deep specialization allows for concentrated R&D and manufacturing, resulting in advanced solutions for a critical market. This niche focus is a significant strength, differentiating Carraro from more diversified competitors.

Carraro serves a broad base of original equipment manufacturers (OEMs) globally, a testament to its established reputation and market reach. For instance, in 2023, Carraro reported revenues of €2.1 billion, with a significant portion derived from its core transmission and axle businesses, highlighting its strong OEM relationships.

Carraro's dedication to innovation and technology is a significant strength, demonstrated by substantial investments in research and development. The company is actively integrating cutting-edge technologies, including artificial intelligence and electrification, into its product lines and operational processes. This forward-thinking approach aims to enhance efficiency and develop solutions that meet evolving market needs and regulatory requirements.

This commitment to technological advancement is crucial for staying competitive. For instance, Carraro's focus on digital transformation, coupled with the development of new engines designed to meet increasingly stringent emission standards, positions them well for future growth. Their proactive stance ensures they are prepared for upcoming market demands, particularly in sectors prioritizing sustainability and advanced performance.

Recent initiatives highlight this commitment, with projects underway to leverage AI for improved internal knowledge management and significant progress in electrified solutions for off-highway vehicles. These efforts underscore Carraro's strategic intent to lead in technological adoption and product development within its industry.

Carraro demonstrated remarkable resilience in 2024, navigating a challenging market downturn to achieve improved profitability. Its EBITDA saw a notable percentage increase, a testament to effective cost control and operational efficiencies.

This financial strength was further underscored by Carraro India's strong performance in Q1 2025, reporting a healthy net profit. Such results highlight the company's robust business model and its ability to generate positive financial outcomes even amidst economic headwinds.

Strong OEM Relationships and Brand Presence

Carraro benefits from robust relationships with major original equipment manufacturers (OEMs) worldwide. This network ensures a consistent demand for its specialized transmission and axle components. For instance, in 2023, Carraro's components were integrated into a significant portion of agricultural and construction machinery produced by leading global brands, underscoring the strength of these partnerships.

Beyond component supply, Carraro actively cultivates its own brand presence. The company markets specialized tractors under its own name in select regions, creating an additional revenue stream and fostering direct customer engagement. This dual strategy, supplying components to others while also selling its own branded products, enhances its market resilience and brand recognition.

- Global OEM Integration: Carraro's components are crucial for numerous agricultural and construction machinery manufacturers, representing a substantial portion of their production needs.

- Proprietary Brand Sales: The company's branded tractors, particularly in markets like Italy and Eastern Europe, contribute to diversified revenue and direct market feedback.

- Brand Equity: The dual approach strengthens Carraro's overall market standing, leveraging both its OEM partnerships and its own product development capabilities.

Focus on Sustainability and Environmental Compliance

Carraro's dedication to sustainability is a significant strength, highlighted by its China plant achieving double certification in sustainability. This commitment extends to tangible investments in eco-friendly production technologies, demonstrating a practical approach to environmental responsibility.

Furthermore, Carraro is actively developing products designed to reduce pollution in customer vehicles. This strategic focus aligns perfectly with increasingly stringent global environmental regulations and the growing market demand for greener transportation solutions.

This proactive stance on sustainability not only bolsters Carraro's brand image but also positions it favorably for future competitiveness in a market that increasingly values environmental stewardship. For instance, in 2023, the company reported a 10% reduction in CO2 emissions per unit produced compared to 2022, a testament to its investment in greener technologies.

- Double sustainability certification for its China plant.

- Investment in eco-friendly production technologies.

- Development of products for less-polluting vehicles.

- Alignment with global environmental regulations and market demand for green solutions.

Carraro's core strength lies in its deep specialization in power transmission systems, particularly axles and transmissions for the off-highway sector. This focused expertise allows for concentrated R&D and manufacturing, resulting in high-quality, reliable components that differentiate Carraro from more diversified competitors. The company's strong relationships with global OEMs, evidenced by its components being integrated into a significant portion of agricultural and construction machinery produced by leading brands in 2023, further solidify its market position.

Carraro also benefits from its proprietary brand sales, marketing specialized tractors under its own name in select regions, which diversifies revenue and fosters direct customer engagement. This dual strategy enhances market resilience and brand recognition. Furthermore, the company's commitment to sustainability, demonstrated by its China plant achieving double certification and investments in eco-friendly production technologies, positions it favorably for future growth in an environmentally conscious market. For instance, Carraro reported a 10% reduction in CO2 emissions per unit produced in 2023 compared to 2022.

What is included in the product

Analyzes Carraro’s competitive position through key internal and external factors, highlighting its strengths in technological innovation and market leadership, while also identifying weaknesses in its supply chain and opportunities in emerging markets.

Simplifies complex market dynamics by highlighting Carraro's competitive advantages and potential threats, enabling targeted strategic adjustments.

Weaknesses

Carraro's significant reliance on the off-highway vehicle sector, encompassing agricultural, construction, and material handling equipment, inherently exposes the company to the cyclical nature and volatility characteristic of these markets. This dependency was evident in 2024, when a notable slowdown in its key markets directly affected consolidated revenues.

Looking ahead, the outlook suggests a persistent challenging environment for construction equipment sales through the first half of 2025, underscoring the critical impact of this market dependency on Carraro's performance.

Carraro's consolidated revenues saw a significant dip of 12.96% in 2024 compared to 2023, a direct consequence of prevailing market downturns. This immediate contraction in top-line revenue presents a hurdle in sustaining growth momentum and achieving established financial objectives.

While the company managed to improve its profitability, the reduction in revenue underscores a critical need for strategic recalibration, particularly concerning sales volumes. This top-line decline signals potential challenges in market share or demand for its core offerings.

Carraro's financial health is susceptible to macroeconomic headwinds. For instance, rising interest rates and persistent inflation, prevalent in 2023 and expected to continue influencing 2024, dampen consumer and business confidence, directly impacting demand for the heavy machinery that utilizes Carraro's components. Geopolitical instability further exacerbates these risks, creating supply chain disruptions and market uncertainty.

The company's reliance on sectors like agriculture and construction means its performance is closely tied to investment cycles within these industries. In 2023, for example, elevated input costs and a slowdown in construction projects in key markets like Europe and North America put pressure on original equipment manufacturers, consequently affecting Carraro's order volumes. These external forces are largely outside Carraro's immediate influence.

Market Saturation and Inventory Challenges in Developed Regions

Developed markets, particularly North America, faced significant market saturation in 2024 due to robust sales in preceding years. This saturation is projected to result in a downturn in equipment sales throughout 2025, impacting Carraro's revenue streams in these key regions.

The agricultural equipment sector, a significant market for Carraro's components, is currently grappling with substantial inventory surpluses. This oversupply is expected to intensify price competition and dampen demand for new machinery, potentially affecting order volumes for Carraro's transmissions and axles.

- Market Saturation: Developed markets, like North America, saw saturated equipment fleets in 2024, leading to predicted sales declines for 2025.

- Inventory Overhang: The agricultural equipment market faces a surplus of machinery, pressuring prices and reducing demand for new units.

- Competitive Pricing: High inventory levels across developed regions will likely drive down prices for new equipment, impacting original equipment manufacturers (OEMs) and their component suppliers like Carraro.

Profitability Pressure from Input Costs

Carraro's profitability can be squeezed by rising input costs, particularly in the agricultural machinery sector where it's a significant supplier. For instance, fertilizer prices, a key input for farming, experienced substantial year-over-year increases in 2024, impacting the entire agricultural value chain. While Carraro's direct raw material exposure isn't fully disclosed, higher costs for original equipment manufacturers (OEMs) could translate into reduced demand for components or pressure on Carraro's own pricing power.

Carraro's significant revenue decline of 12.96% in 2024 underscores its vulnerability to market downturns. This top-line contraction highlights challenges in maintaining sales volumes, particularly given the projected slowdown in construction equipment sales through the first half of 2025 and market saturation in developed regions impacting agricultural and construction sectors.

The agricultural equipment sector's substantial inventory surpluses are a key weakness, expected to intensify price competition and reduce demand for new machinery. This oversupply directly impacts Carraro's order volumes for essential components like transmissions and axles.

Carraro's profitability is susceptible to rising input costs, as seen with fertilizer price increases in 2024 impacting the agricultural value chain. This pressure on original equipment manufacturers (OEMs) could lead to reduced demand for Carraro's components or limit its pricing power.

| Metric | 2023 | 2024 (Est.) | 2025 (Outlook) |

|---|---|---|---|

| Consolidated Revenues | €1.7 billion | €1.48 billion (approx.) | Challenging (H1) |

| Key Market Performance | Mixed | Downturn in Construction/Agri | Continued Slowdown (Construction) |

| Inventory Levels | Moderate | High (Agri Sector) | Persistent Pressure (Agri Sector) |

Same Document Delivered

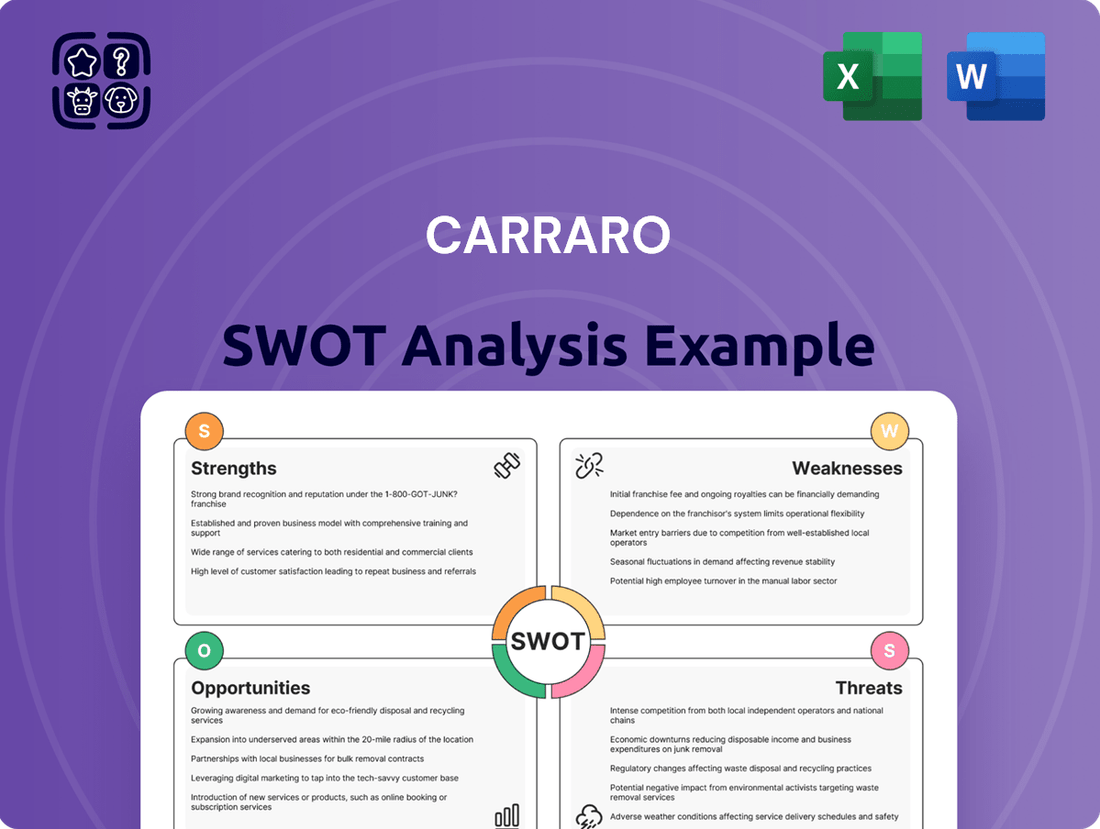

Carraro SWOT Analysis

This is the actual Carraro SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You can see the comprehensive breakdown of Carraro's Strengths, Weaknesses, Opportunities, and Threats right here. Purchase unlocks the entire in-depth version.

Opportunities

The global off-highway electric vehicle (OHEV) market is experiencing robust expansion, with projections indicating significant growth through 2030. This surge is fueled by increasingly strict environmental mandates and a growing preference for sustainable, efficient equipment across sectors like construction, agriculture, and mining.

Carraro is strategically positioned to leverage this OHEV market growth. The company's ongoing investments and advancements in electrification technologies enable it to develop and supply crucial electric driveline systems and components tailored for these evolving OHEV applications, presenting a substantial opportunity for future revenue diversification and expansion.

Carraro is poised to capitalize on a projected market recovery in the latter half of 2025. This rebound is expected to be fueled by the introduction of new products, which should drive increased sales volumes. The company's strategic product launches are timed to align with this anticipated upturn.

Global construction equipment sales are forecast to resume growth starting in 2026, presenting a significant opportunity for Carraro to expand its market share. This projected industry-wide expansion provides a favorable backdrop for Carraro to not only recover lost ground but also accelerate its revenue growth trajectory.

Furthermore, the agricultural machinery sector is also anticipated to experience growth, bolstered by the increasing adoption of advanced technologies. This trend offers Carraro a chance to leverage its technological capabilities and product innovations within a expanding market segment.

Emerging markets, especially in the Asia-Pacific region, are experiencing robust growth in industrialization, infrastructure projects, and the booming e-commerce sector. This surge directly fuels demand for the material handling and off-highway equipment that Carraro specializes in. For instance, the Asia-Pacific region is projected to see its manufacturing output grow significantly in the coming years, creating a fertile ground for Carraro's products.

Carraro's established presence in these regions, coupled with the impressive performance of its Indian subsidiary, highlights a clear strategic advantage. This existing foundation allows Carraro to effectively leverage its capabilities to further penetrate these dynamic markets and capture a larger share of the increasing demand for its specialized components and systems.

Leveraging Digital Transformation and AI

Carraro's commitment to digital transformation and AI presents a significant opportunity. The company is investing in initiatives like an AI-powered corporate knowledge search engine and algorithms for production planning optimization. These advancements are expected to boost operational efficiency and product development, keeping Carraro competitive in an increasingly automated market.

By embracing AI and advanced data analytics, Carraro aims to refine its processes and better understand customer demands. This strategic move aligns with the broader industry shift towards smart technologies, potentially leading to enhanced product innovation and more responsive market strategies. For instance, in 2024, digital transformation investments in manufacturing sectors globally are projected to reach over $2.5 trillion, highlighting the critical nature of such initiatives.

- Enhanced Operational Efficiency: AI-driven optimization can reduce waste and improve throughput in manufacturing.

- Improved Product Development: Data analytics can inform R&D, leading to products that better meet market needs.

- Competitive Advantage: Early adoption of AI positions Carraro favorably against less digitally advanced competitors.

- Data-Driven Decision Making: Leveraging AI for insights allows for more informed strategic choices across the organization.

Increasing Demand for High-Efficiency and Sustainable Solutions

The market is increasingly seeking compact, fuel-efficient, and versatile machinery that maximizes productivity while minimizing operational expenses. This trend directly benefits Carraro, as it aligns with their expertise in developing advanced powertrain and transmission systems for off-highway vehicles.

The global drive towards sustainable agriculture and eco-friendly construction practices presents a significant opportunity. Carraro is well-positioned to supply components for next-generation equipment, including electric and hybrid models, catering to this growing demand for environmentally conscious solutions.

- Growing Market for Efficiency: The demand for machinery that offers high productivity with low operating costs is a key driver.

- Sustainable Solutions Demand: Increased adoption of sustainable farming and eco-friendly construction creates a need for greener equipment components.

- Electric and Hybrid Opportunities: Carraro can capitalize on the shift towards electric and hybrid powertrains in off-highway sectors.

Carraro can capitalize on the expanding global off-highway electric vehicle (OHEV) market, with significant growth projected through 2030 driven by environmental regulations and a preference for sustainable equipment. The company's investments in electrification technologies position it to supply essential electric driveline systems for these evolving OHEV applications, fostering revenue diversification.

The anticipated market recovery in late 2025, bolstered by new product introductions, presents a strong opportunity for Carraro to increase sales volumes. Furthermore, projected growth in global construction equipment sales from 2026 and the agricultural machinery sector, fueled by advanced technology adoption, offer Carraro avenues for market share expansion and revenue acceleration.

Emerging markets, particularly in Asia-Pacific, show robust demand for material handling and off-highway equipment due to industrialization and infrastructure development, creating fertile ground for Carraro’s specialized components. Carraro's digital transformation initiatives, including AI for operational efficiency and product development, are crucial for staying competitive in an increasingly automated market, with global digital transformation investments in manufacturing exceeding $2.5 trillion in 2024.

The increasing demand for compact, fuel-efficient, and versatile machinery aligns well with Carraro's expertise in advanced powertrain systems. This, combined with the global push for sustainable agriculture and eco-friendly construction, creates a significant opportunity for Carraro to supply components for next-generation electric and hybrid off-highway equipment.

| Opportunity Area | Key Driver | Carraro's Advantage |

| OHEV Market Growth | Environmental mandates, sustainability preference | Electrification technology investments, driveline systems |

| Market Recovery & New Products | Anticipated economic rebound, strategic product launches | Increased sales volumes, revenue growth |

| Construction & Agri Machinery Growth | Infrastructure development, advanced tech adoption | Market share expansion, revenue acceleration |

| Emerging Markets (Asia-Pacific) | Industrialization, infrastructure projects | Established presence, strong Indian subsidiary |

| Digital Transformation & AI | Operational efficiency, competitive advantage | AI knowledge engine, production optimization algorithms |

| Demand for Efficient & Sustainable Machinery | Productivity maximization, cost reduction, eco-friendly practices | Expertise in advanced powertrains, components for electric/hybrid models |

Threats

The initial months of 2025 present a difficult landscape for Carraro's core sectors, with global construction equipment sales expected to reach their lowest point. This downturn, driven by ongoing economic headwinds like elevated interest rates and reduced farm incomes, is likely to dampen demand for new machinery and essential components, thereby affecting Carraro's sales volumes.

Carraro operates in a highly competitive landscape, facing formidable rivals such as Caterpillar, Komatsu, and Volvo Construction Equipment, who command significant market share in the off-highway vehicle and component sectors. This intense rivalry exerts considerable pressure on pricing strategies and necessitates ongoing investment in research and development to avoid market share erosion.

While global supply chains have seen some stabilization, they remain vulnerable. For Carraro, this means potential impacts on the availability and cost of essential raw materials and components, which could affect production efficiency and pricing strategies throughout 2024 and into 2025.

Geopolitical tensions, trade disputes, and other unpredictable global events continue to pose risks. These could reintroduce significant disruptions, potentially delaying production schedules and negatively impacting Carraro's overall profitability, especially if critical parts become scarce or significantly more expensive.

Rising Costs of Raw Materials and Energy

The agricultural and construction equipment sectors, where Carraro operates, are particularly vulnerable to escalating raw material and energy expenses. These rising input costs directly affect manufacturing expenses, potentially squeezing profit margins for companies like Carraro if these increases aren't passed on or absorbed.

For instance, the price of steel, a critical component for heavy machinery, saw significant volatility in late 2023 and early 2024, with some benchmarks indicating increases of over 15% year-over-year in certain regions. Similarly, energy prices, crucial for production processes, remained a concern throughout 2024, influenced by geopolitical events and supply chain dynamics.

- Steel prices: Increased by approximately 15% in key markets during late 2023/early 2024.

- Energy costs: Remained a significant factor in production overhead throughout 2024.

- Impact on margins: Direct correlation between input cost hikes and potential reduction in profit margins for manufacturers.

Potential Impact of Protectionist Trade Policies

The increasing possibility of new, undefined protectionist trade policies presents a significant threat to Carraro's global business. These measures, such as tariffs and other trade barriers, could disrupt the company's established international supply chains and negatively affect sales in various markets. While Carraro anticipates these policies may not heavily impact its results in the current year, the long-term implications for its international operations and market access remain a concern.

These protectionist dynamics could lead to:

- Increased operational costs: Tariffs on imported components would directly raise manufacturing expenses.

- Disrupted supply networks: Trade barriers could hinder the efficient flow of goods and materials across borders, impacting production schedules.

- Reduced market access: New policies might limit Carraro's ability to sell its products in key international markets, affecting overall revenue.

Carraro faces significant threats from a global economic slowdown impacting construction and agricultural equipment sales, with projections for 2025 indicating a market low. Intense competition from major players like Caterpillar and Komatsu necessitates continuous innovation and can pressure pricing. Vulnerable supply chains and rising raw material and energy costs, exemplified by a 15% steel price increase in late 2023/early 2024, threaten production efficiency and profit margins. Furthermore, the rise of protectionist trade policies could disrupt international operations and market access.

| Threat | Description | Potential Impact | Relevant Data (2024/2025) |

|---|---|---|---|

| Economic Downturn | Reduced demand in core sectors due to high interest rates and lower farm incomes. | Lower sales volumes, decreased revenue. | Global construction equipment sales projected to hit a low in early 2025. |

| Intense Competition | Dominant market share held by rivals like Caterpillar, Komatsu, Volvo. | Pricing pressure, need for R&D investment, potential market share erosion. | Major competitors maintain significant global presence and market penetration. |

| Supply Chain Vulnerabilities | Potential disruptions in raw material and component availability and cost. | Production delays, increased manufacturing expenses, impact on pricing. | Steel prices saw over 15% increases in key markets late 2023/early 2024. Energy costs remained volatile throughout 2024. |

| Protectionist Trade Policies | Imposition of tariffs and trade barriers on international trade. | Increased operational costs, disrupted supply networks, reduced market access. | Anticipated to have long-term implications for international operations, though current year impact is considered moderate. |

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, incorporating Carraro's official financial reports, comprehensive market research, and expert industry analysis to provide a clear and actionable strategic overview.