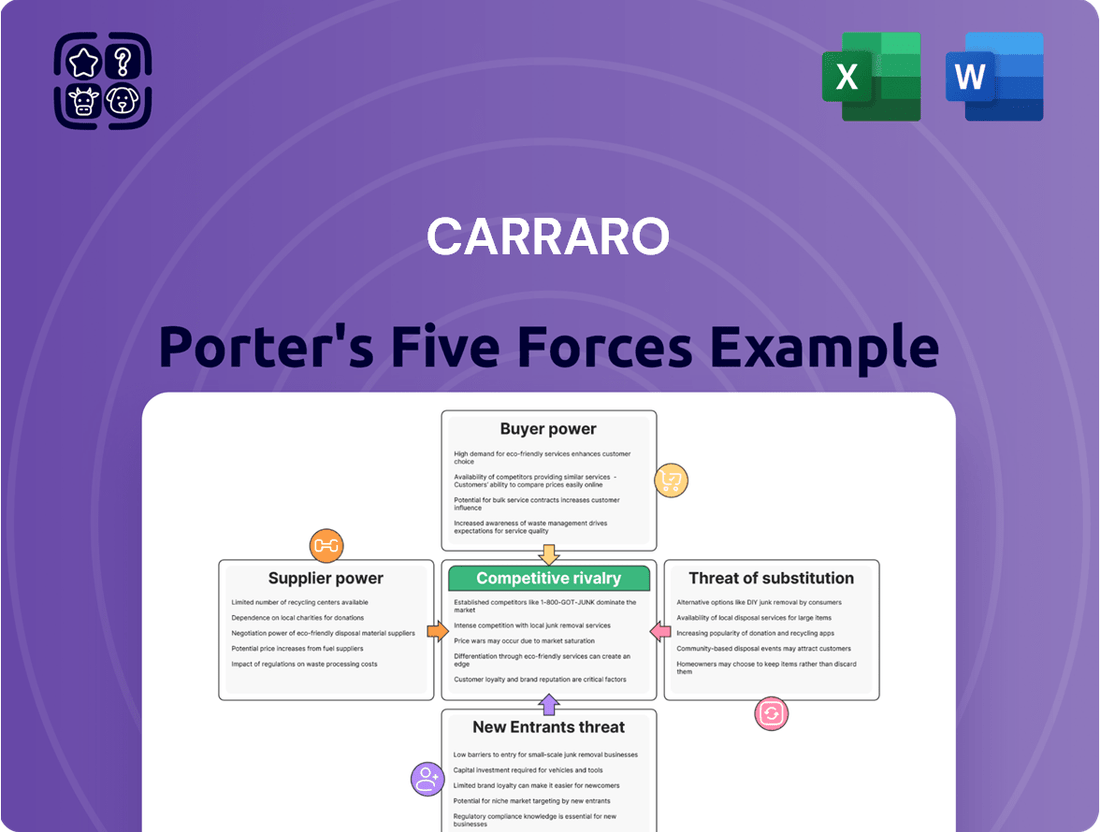

Carraro Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Carraro Bundle

Carraro's competitive landscape is shaped by intense rivalry, significant buyer power, and the constant threat of new entrants. Understanding these forces is crucial for navigating its market effectively.

The complete report reveals the real forces shaping Carraro’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Carraro's reliance on specialized component suppliers for critical parts like precision gears and advanced electronic controls significantly influences its operational costs and product innovation. The niche market for these highly engineered components means fewer suppliers can meet Carraro's stringent quality and performance demands.

In 2024, companies like Carraro often face situations where a limited number of suppliers for highly specialized parts can dictate terms, potentially leading to higher input prices. This concentration among suppliers for crucial elements in power transmission systems grants them considerable leverage, impacting Carraro's profitability and supply chain stability.

Suppliers offering proprietary or patented technologies, especially those critical for the performance and efficiency of advanced axles and transmissions, wield considerable influence. Carraro's reliance on these innovators for cutting-edge mechanical, hydraulic, and electronic solutions strengthens the bargaining power of these specialized suppliers.

For a company like Carraro, which relies on highly integrated and specialized components, the process of switching suppliers can be incredibly costly. Imagine needing to change a critical part in their agricultural or construction machinery; this isn't just a simple swap. It involves significant expenses for redesigning the component to fit, rigorous testing to ensure it meets performance standards, retooling entire production lines to accommodate the new part, and the lengthy process of requalifying the new supplier and their product. These substantial switching costs effectively lock Carraro into existing supplier relationships, giving those suppliers considerable leverage.

Supplier Concentration

When a few major suppliers control essential raw materials or specialized components, their influence over pricing and delivery terms significantly increases. This supplier concentration can directly affect Carraro's production expenses and timelines, as demonstrated by supplier negotiations throughout 2024.

For instance, in the automotive sector, which is relevant to Carraro's business, the semiconductor shortage experienced in 2021-2023, and its lingering effects into early 2024, highlighted the immense power of a concentrated supplier base. Companies like TSMC, a dominant player in advanced chip manufacturing, often dictate terms due to high demand and limited capacity.

- Supplier Concentration: A limited number of suppliers for critical inputs grants them greater leverage.

- Impact on Carraro: Increased input costs and potential disruptions to production schedules.

- 2024 Example: Negotiations with key component suppliers in 2024 illustrate this dynamic.

- Industry Trend: Concentration in sectors like semiconductors amplifies supplier bargaining power.

Forward Integration Threat

The threat of forward integration by suppliers, while not a frequent occurrence, represents a potential challenge for Carraro. If a supplier possesses the necessary financial strength and strategic vision, they could move into manufacturing complete axle or transmission systems. This would effectively turn them into direct competitors, potentially altering Carraro's standing in the market. However, established relationships with Original Equipment Manufacturers (OEMs) generally serve as a significant deterrent to such a move.

For instance, consider a major component supplier to the agricultural machinery sector. If this supplier were to acquire or develop the capabilities to produce entire integrated axle units, it would directly compete with Carraro's core business. While specific instances of this occurring in 2024 are not publicly detailed for Carraro's direct suppliers, the principle remains a key consideration in supply chain risk assessment. The capital investment required for such a transition is substantial, often making it an impractical strategy for most suppliers.

- Forward Integration Risk: Suppliers with significant financial resources could potentially manufacture complete axle or transmission systems, becoming direct competitors.

- Market Disruption: Such integration could disrupt Carraro's market position by introducing new, vertically integrated competitors.

- Mitigating Factors: Strong, long-term OEM relationships typically reduce the likelihood of suppliers pursuing forward integration.

Carraro's bargaining power with its suppliers is constrained by the specialized nature of its components. For critical parts like precision gears and advanced electronic controls, a limited pool of suppliers capable of meeting stringent quality demands exists. This concentration, coupled with the high switching costs involved in redesigning and retooling for new components, grants these suppliers considerable leverage over pricing and terms, as observed in market dynamics throughout 2024.

Suppliers offering proprietary technologies crucial for performance, such as those in advanced mechanical or electronic solutions for transmissions, hold significant influence. This reliance on innovation strengthens their position, potentially impacting Carraro's input costs and supply chain stability. For instance, the semiconductor industry, a parallel to critical electronic components, saw dominant players like TSMC dictating terms in 2024 due to high demand and limited capacity.

| Factor | Impact on Carraro | 2024 Relevance |

|---|---|---|

| Supplier Concentration | Higher input costs, potential disruptions | Key component negotiations |

| Switching Costs | Limited supplier flexibility | Significant investment in redesign/retooling |

| Proprietary Technology | Supplier leverage on innovation | Reliance on specialized electronic/mechanical solutions |

What is included in the product

This analysis dissects the competitive forces impacting Carraro, examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within its specific industry.

Effortlessly identify and address competitive pressures with a dynamic Porter's Five Forces model that highlights key vulnerabilities.

Customers Bargaining Power

Carraro's customer base is notably concentrated, with a significant portion of its revenue derived from a few large Original Equipment Manufacturers (OEMs). These key clients, prominent in the agricultural, construction, and material handling industries, often represent substantial order volumes. For instance, major players such as John Deere and CNH Industrial (which includes brands like New Holland and Case IH) are critical customers.

Carraro's customers, primarily Original Equipment Manufacturers (OEMs), exhibit high price sensitivity. This is driven by their own operational realities, particularly in sectors like agricultural and construction equipment. For instance, the agricultural equipment market faced challenging conditions in 2024, and North American construction equipment sales are projected to decline in 2025.

These market pressures compel OEMs to aggressively seek cost efficiencies. Consequently, they continuously negotiate for competitive pricing on components supplied by Carraro. This demand for lower prices directly impacts Carraro's ability to maintain its own profit margins.

Carraro's ability to offer highly specialized, technologically advanced solutions directly counters customer bargaining power. However, if certain components were more standardized across Original Equipment Manufacturer (OEM) platforms, it could open the door for customers to source from alternative suppliers, thereby increasing their leverage.

Yet, the bespoke nature of Carraro's tailored solutions for unique vehicle designs significantly strengthens its value proposition. This customization inherently raises customers' switching costs, making it more difficult and expensive for them to move to a competitor, which in turn diminishes their bargaining power.

Threat of Backward Integration

Large, well-resourced Original Equipment Manufacturers (OEMs) hold significant bargaining power. They possess the financial muscle and technical expertise to consider producing their own power transmission components. For instance, in 2024, major agricultural and construction equipment manufacturers continued to invest heavily in R&D, signaling a potential shift towards in-house production.

This latent threat of backward integration acts as a constant pressure on Carraro. It compels Carraro to remain competitive by offering attractive pricing, superior quality, and exceptional customer service to retain its OEM clients. The capital expenditure required for OEMs to establish such production lines is substantial, often running into hundreds of millions of dollars, making it a significant deterrent but not an impossible one.

- OEMs' Financial Capacity: Major OEMs in sectors like agriculture and construction reported strong revenue growth in 2023, with many reinvesting profits into vertical integration strategies.

- Technological Advancement: The increasing modularity and standardization of power transmission systems can lower the technical barrier for potential backward integration by OEMs.

- Competitive Landscape: The presence of multiple component suppliers intensifies the bargaining power of OEMs, as they can switch suppliers if terms are not met.

Global Sourcing Capabilities of Customers

Carraro's original equipment manufacturer (OEM) customers are significant players on the global stage. This means they can look for parts and components from suppliers all over the world.

This ability to source globally puts considerable pressure on Carraro to maintain its competitiveness on an international level. To succeed, Carraro must ensure its production processes and supply chain are highly efficient worldwide.

- Global Reach: Major OEMs, Carraro's clients, source components from numerous countries, leveraging international markets for competitive pricing and supply chain diversification.

- Competitive Pressure: This global sourcing power forces Carraro to continually benchmark its pricing, quality, and delivery against international competitors.

- Efficiency Demands: Carraro's global OEM customers expect seamless integration and reliable supply, pushing Carraro to optimize its own international manufacturing and logistics operations.

Carraro's customers, primarily large OEMs, wield significant bargaining power due to their concentrated nature and high price sensitivity, especially given market pressures in the agricultural and construction sectors. While Carraro's specialized solutions and high switching costs mitigate this, the potential for OEMs to vertically integrate or source globally necessitates Carraro's continuous focus on competitive pricing and efficiency.

| Customer Factor | Impact on Carraro | Supporting Data (2024/2025 Projections) |

|---|---|---|

| Customer Concentration | Increased leverage for key clients | Major OEMs account for a substantial portion of Carraro's revenue. |

| Price Sensitivity | Downward pressure on margins | Agricultural equipment market faced challenges in 2024; North American construction equipment sales projected to decline in 2025. |

| Backward Integration Threat | Need for competitive offerings | OEMs' R&D investments in 2024 signal potential for in-house production. |

| Global Sourcing Capability | Requirement for international competitiveness | OEMs source globally, compelling Carraro to optimize its worldwide operations. |

What You See Is What You Get

Carraro Porter's Five Forces Analysis

This preview showcases the complete Carraro Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the industry. The document you see here is the exact, professionally formatted analysis you will receive immediately upon purchase. You can be confident that no placeholders or sample content are present; this is the full, ready-to-use document for your strategic planning.

Rivalry Among Competitors

The power transmission systems market for off-highway vehicles is a battlefield for major global competitors, creating significant rivalry. Carraro faces direct competition from giants like ZF Friedrichshafen AG, Dana Incorporated, and Allison Transmission Holdings Inc.

These established players are relentlessly innovating, constantly introducing advanced axle and transmission solutions. For instance, ZF's 2023 revenue reached approximately €46.5 billion, showcasing its substantial market presence and investment capacity in research and development, which directly impacts competitive pressures on Carraro.

Carraro experienced a notable market downturn in 2024, especially in Western regions, which directly impacted its sales volumes. This contraction typically fuels more aggressive competition as businesses fight for a smaller piece of the market.

While projections suggest a volume recovery in the latter half of 2025, driven by new product introductions, the current competitive landscape remains intense. Companies are likely to engage in price wars or intensified marketing efforts to capture market share during this challenging period.

Manufacturing axles and transmissions demands significant upfront investment in factories and research, creating high fixed costs. For example, major players in the automotive component industry often have billions invested in their global production networks. This capital intensity pressures companies to run their facilities at high capacity to spread those fixed costs over more units.

When demand falters, or if the industry experiences oversupply, this drive for high capacity utilization can ignite intense price competition. Companies may resort to aggressive discounting to keep production lines running, even if it means lower profit margins. This dynamic was evident in 2023 when certain automotive supply chains grappled with fluctuating demand, leading to price adjustments among component manufacturers.

Continuous Technological Innovation

Competitive rivalry in the agricultural and construction machinery sectors is significantly intensified by a continuous race for technological supremacy. This drive is particularly evident in the burgeoning fields of electrification, automation, and the integration of smart systems. Companies are pouring resources into research and development to create more efficient, sustainable, and advanced machinery.

Carraro, for instance, is deeply involved in developing innovative driveline and transmission systems that cater to these evolving technological demands. Their focus on electrification, for example, aims to reduce emissions and improve operational efficiency, a key differentiator in a market increasingly scrutinized for its environmental impact. This commitment to R&D is crucial for maintaining a competitive edge.

- Technological Advancement Focus: Companies are heavily investing in R&D to lead in electrification, automation, and smart systems.

- Carraro's R&D Investment: Carraro prioritizes developing advanced driveline and transmission solutions for these new technologies.

- Market Differentiation: Innovation in efficiency and sustainability is key to standing out in the competitive landscape.

- Industry Trend: The push for greener and smarter machinery is a defining characteristic of current market rivalry.

Global and Regional Competitive Landscape

The competitive arena is a dynamic mix of established global giants and robust regional contenders, particularly evident in fast-expanding economies like Asia-Pacific. This intricate web of competition means that companies must constantly adapt to a multifaceted market.

The increasing influence of Chinese manufacturers on the global stage is a significant factor, amplifying competitive pressures across various sectors. Their growing market share and technological advancements are reshaping industry dynamics.

- Global Players: Dominant multinational corporations with extensive reach and resources.

- Regional Champions: Strong local companies with deep understanding of specific market needs and established distribution networks.

- Emerging Competitors: New entrants, often from rapidly developing economies, challenging established norms with innovation and cost-effectiveness.

- Market Concentration: Varying levels of concentration depending on the specific industry and geographic region, with some markets dominated by a few key players while others are more fragmented.

Competitive rivalry within the power transmission systems market for off-highway vehicles is intense, driven by major global players like ZF Friedrichshafen AG and Dana Incorporated, who are heavily investing in innovation. Carraro faces this pressure, especially as market downturns, like the one experienced in 2024 in Western regions, tend to intensify competition as companies vie for shrinking market share.

The industry's high capital intensity, requiring substantial investments in manufacturing and R&D, forces companies to maintain high capacity utilization. This can lead to aggressive pricing strategies, particularly when demand fluctuates, as seen in supply chain adjustments during 2023.

Technological advancement, particularly in electrification and automation, is a key battleground, with companies like Carraro investing heavily in R&D to differentiate themselves through efficiency and sustainability. The rise of emerging competitors, especially from Asia-Pacific, further amplifies these pressures, creating a dynamic and multifaceted competitive landscape.

| Competitor | 2023 Revenue (Approx.) | Key Focus Areas |

|---|---|---|

| ZF Friedrichshafen AG | €46.5 billion | Advanced axles, transmissions, electrification, automation |

| Dana Incorporated | Not publicly disclosed for 2023, but a major global supplier | Drivetrain systems, e-propulsion, thermal management |

| Allison Transmission Holdings Inc. | $3.0 billion (2023) | Automatic transmissions for commercial and defense vehicles, electrification |

SSubstitutes Threaten

The most significant threat to Carraro's traditional business comes from the rapid adoption of electrification and alternative fuels in off-highway machinery. Battery-electric, hybrid, and hydrogen fuel cell powertrains are increasingly seen as direct substitutes for conventional mechanical power transmission systems like axles and transmissions, directly impacting demand for Carraro's core products.

By 2024, the global market for electric off-highway vehicles was projected to reach over $30 billion, with significant growth anticipated in construction and agricultural sectors. This trend suggests a substantial portion of future demand will be met by electrified solutions, posing a direct substitution risk to Carraro's existing product portfolio.

Advancements in purely hydraulic systems or highly integrated solutions that bypass traditional mechanical transmissions pose a significant threat to Carraro's offerings. These alternatives can simplify designs and potentially reduce manufacturing costs. For instance, the automotive industry is increasingly exploring electric modules that directly integrate power into differential gearboxes, bypassing the complex hydraulic and mechanical linkages Carraro specializes in.

The rise of modular and fuel-agnostic powertrain platforms poses a significant threat of substitution for traditional transmission designs. These adaptable platforms can readily accommodate diesel, hybrid, battery-electric, and even hydrogen internal combustion engines, offering Original Equipment Manufacturers (OEMs) greater flexibility.

This adaptability means OEMs can more easily pivot to different power architectures, potentially lessening their dependence on specific, established transmission technologies. For instance, the automotive industry saw a notable shift towards electrification in 2024, with battery-electric vehicle sales projected to reach over 15% of the global market share, highlighting the increasing viability of alternative powertrains.

Evolving Cost-Performance Dynamics

The threat of substitutes is significantly shaped by how the cost and performance of alternative technologies change over time. This includes not only the upfront purchase price but also how much it costs to run, maintain, and how long the substitute product or service is expected to last.

As electric vehicles and other alternative transportation methods become more affordable and perform better, they present a stronger challenge to traditional internal combustion engine vehicles. For instance, by mid-2024, the average upfront cost of new electric vehicles in many markets has shown a downward trend, making them more competitive.

- Cost-Performance Trade-off: The attractiveness of substitutes hinges on their improving cost-performance ratio, encompassing purchase, operating, and maintenance expenses.

- Increasing Competitiveness of Alternatives: Electric and other alternative solutions are becoming more cost-effective and functionally superior, enhancing their appeal as substitutes.

- Impact on Traditional Markets: This evolving dynamic directly pressures industries relying on older technologies, forcing adaptation or risk losing market share.

Regulatory and Sustainability Pressures

The increasing focus on environmental, social, and governance (ESG) factors is a significant threat. For instance, in 2024, global investments in clean energy reached an estimated $2 trillion, signaling a strong market preference for sustainable solutions. This trend directly pressures industries to adopt cleaner technologies, making traditional, less eco-friendly options less attractive substitutes.

Stricter emissions standards, like those being implemented across the European Union and North America, further accelerate the shift to alternatives. By 2025, many regions aim for substantial reductions in vehicle CO2 emissions, making internal combustion engines less viable and promoting electric or hydrogen powertrains as more appealing substitutes.

Societal demand for sustainability is also a powerful force. Consumer surveys in late 2023 and early 2024 consistently show a growing willingness to pay more for environmentally friendly products and services. This consumer behavior creates a strong incentive for companies to innovate and offer substitutes that align with these values, thereby diminishing the appeal of older, less sustainable technologies.

- Regulatory Push: Governments worldwide are enacting stricter environmental regulations, driving demand for cleaner alternatives.

- Sustainability Imperative: A global push for sustainability encourages the adoption of energy-efficient and low-emission technologies.

- Consumer Preference: Growing consumer awareness and demand for eco-friendly products favor substitutes with improved environmental performance.

- Technological Advancement: Innovation in areas like electric vehicles and renewable energy provides viable and increasingly competitive substitutes.

The threat of substitutes for Carraro's traditional powertrain components is substantial, driven by the accelerating shift towards electrification and alternative energy sources in the off-highway sector. These emerging technologies directly challenge the demand for conventional mechanical transmissions and axles.

By 2024, the market for electric off-highway vehicles was projected to exceed $30 billion, indicating a significant portion of future demand will be met by electrified solutions, posing a direct substitution risk. Furthermore, advancements in purely hydraulic systems or integrated electric modules that bypass traditional mechanical designs present a viable alternative, potentially simplifying manufacturing and reducing costs.

The increasing competitiveness of electric and other alternative solutions, coupled with a growing societal demand for sustainability, further amplifies this threat. As of mid-2024, the cost-performance ratio of electric vehicles has been improving, making them more attractive substitutes for traditional internal combustion engine-based machinery.

| Substitute Technology | Key Characteristics | Impact on Carraro | Market Trend (2024 Data) |

|---|---|---|---|

| Battery-Electric Powertrains | Zero tailpipe emissions, potentially lower operating costs | Direct replacement for mechanical transmissions and axles | Global EV off-highway market projected over $30 billion |

| Hybrid Powertrains | Improved fuel efficiency, reduced emissions | Can reduce complexity of traditional systems | Growing adoption in construction and agriculture |

| Hydrogen Fuel Cell Powertrains | Zero emissions, longer range than battery-electric | Emerging alternative, potential long-term threat | Significant investment in hydrogen infrastructure |

| Advanced Hydraulic Systems | High torque density, robust in harsh environments | Can offer alternative to mechanical power transmission | Continuous innovation in efficiency and integration |

Entrants Threaten

The threat of new entrants in the advanced power transmission systems market, particularly for off-highway vehicles, is significantly mitigated by high capital investment requirements. Establishing state-of-the-art manufacturing facilities, acquiring specialized machinery, and scaling production for components like axles and transmissions necessitates substantial upfront capital. For instance, building a new, fully automated transmission manufacturing plant can easily cost hundreds of millions of dollars, a figure that deters many potential competitors.

The design, development, and production of high-performance axles and transmissions demand significant engineering know-how and sustained investment in research and development. This technological barrier is a substantial hurdle for any new company looking to enter the market.

Carraro's continuous commitment to innovation, seamlessly integrating complex mechanics, hydraulics, and electronics, establishes a formidable technological benchmark. This deep expertise makes it exceptionally challenging for new entrants to match the performance and sophistication of existing players.

Carraro benefits from long-standing, deeply embedded relationships with major global Original Equipment Manufacturers (OEMs). These partnerships, cultivated over years, are founded on trust, proven reliability, and a history of developing customized product solutions tailored to specific OEM needs.

New entrants would face significant hurdles in replicating these established connections. Gaining the confidence of these critical, often risk-averse customers requires demonstrating a track record of quality and dependability that takes considerable time and investment to build.

Economies of Scale and Experience Curve Benefits

Carraro, as an established player, leverages significant economies of scale. This translates to lower per-unit costs in manufacturing, raw material sourcing, and global logistics, creating a substantial barrier for newcomers. For instance, in 2024, major players in the agricultural and construction machinery component sector, where Carraro operates, often reported production volumes in the hundreds of thousands or even millions of units annually, enabling substantial cost advantages over smaller, emerging competitors.

The experience curve further solidifies this advantage. Years of refining production processes and product design lead to increased efficiency and reduced waste. This accumulated know-how, difficult to replicate quickly, allows Carraro to maintain higher quality standards at competitive price points, making it challenging for new entrants to achieve similar operational excellence without significant investment and time.

- Economies of Scale: Reduced per-unit costs in production, procurement, and distribution are key advantages for established firms like Carraro.

- Experience Curve Benefits: Accumulated operational knowledge and process improvements lead to greater efficiency and quality, posing a challenge for new entrants.

- Cost Competitiveness: The combined effect of scale and experience allows incumbents to offer more competitive pricing, deterring new market participants.

- Capital Investment Barrier: New entrants would need to make massive investments to match the scale and experience of existing leaders, presenting a significant financial hurdle.

Intellectual Property and Patent Barriers

The industry is shielded by a substantial network of intellectual property, encompassing proprietary designs, patents, and trade secrets crucial for advanced axle and transmission technologies. This complex web makes it challenging for newcomers to replicate existing innovations or develop competitive alternatives without infringing on existing rights.

Carraro's consistent commitment to innovation, evidenced by its significant R&D spending, which reached €61.8 million in 2023, and the active pursuit of intellectual property protection, erects formidable legal and technical hurdles. These barriers effectively discourage potential entrants from entering the market, as the cost and complexity of navigating and circumventing this IP landscape are substantial.

- Intellectual Property Landscape: The sector is characterized by a dense concentration of patents and proprietary technologies in areas like driveline systems and off-highway vehicle components.

- R&D Investment: Carraro's ongoing investment in research and development, a cornerstone of its strategy, fuels the creation of new IP and strengthens its competitive moat.

- Barrier to Entry: The extensive patent portfolio and trade secrets represent significant upfront costs and legal risks for any new company seeking to establish a foothold.

The threat of new entrants in Carraro's market is low due to substantial capital requirements and established brand loyalty. New companies would need significant financial backing to match Carraro's production scale and R&D investments. Furthermore, the deep relationships Carraro has cultivated with major OEMs over decades present a formidable barrier, as trust and proven performance are paramount for these critical partnerships.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Investment | High cost of establishing advanced manufacturing facilities and R&D centers. | Significant financial hurdle, requiring hundreds of millions of dollars. |

| Technological Expertise | Complex design, development, and integration of mechanical, hydraulic, and electronic systems. | Requires specialized engineering talent and sustained R&D investment, difficult to replicate quickly. |

| OEM Relationships | Long-standing partnerships built on trust, reliability, and customization. | New entrants need time and proven performance to gain OEM confidence and secure contracts. |

| Economies of Scale | Lower per-unit costs due to high production volumes. | New entrants struggle to match cost competitiveness without comparable scale. |

| Intellectual Property | Extensive patents and proprietary designs in driveline technologies. | Navigating and circumventing existing IP involves significant legal and development costs. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Carraro leverages data from annual reports, industry-specific market research, and financial databases to provide a comprehensive view of the competitive landscape.