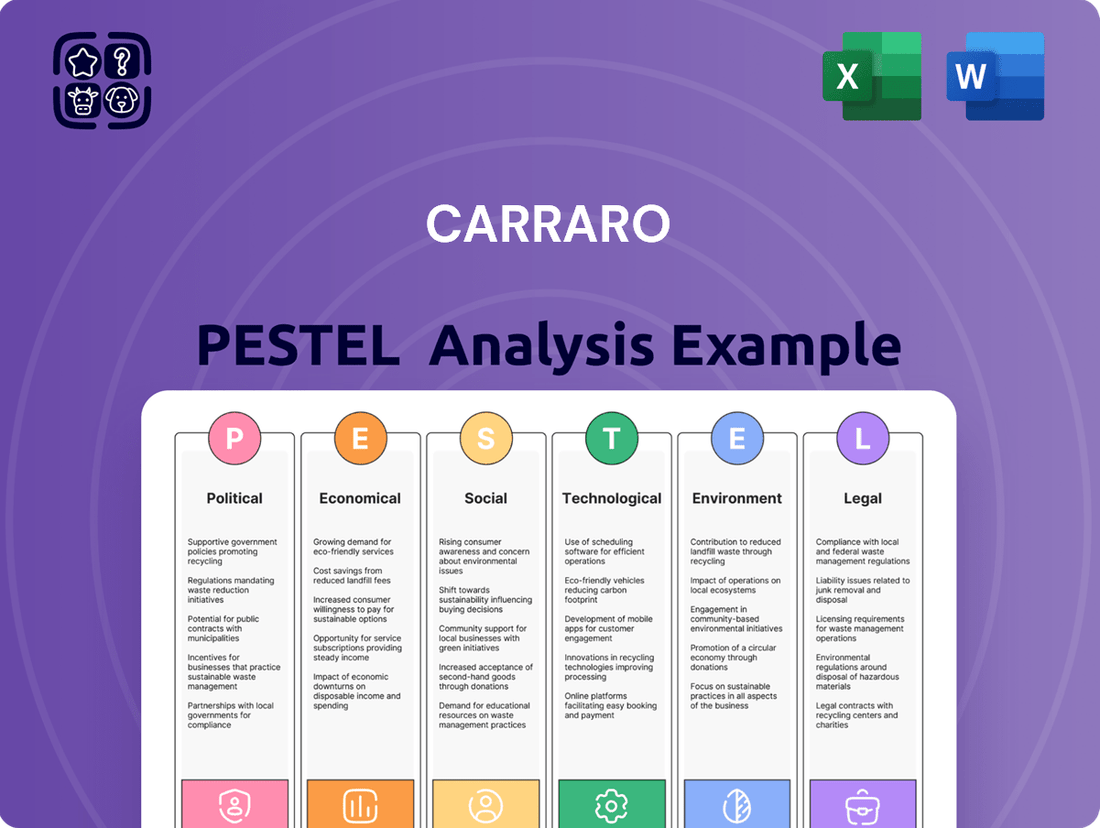

Carraro PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Carraro Bundle

Uncover the critical political, economic, social, technological, environmental, and legal factors shaping Carraro's future. Our expertly crafted PESTLE analysis provides actionable intelligence to help you anticipate market shifts and capitalize on emerging opportunities. Don't get left behind – download the full report now and gain a strategic advantage.

Political factors

Government infrastructure investments worldwide significantly boost demand for heavy construction equipment, Carraro's core market. Initiatives like the U.S. RAISE program, which allocated $1.32 billion in January 2025 for road and bridge modernization, directly translate into increased orders for machinery.

Europe's commitment to infrastructure is also substantial, with its Funds for Infrastructure, Climate, and Environment (2021-2027) dedicating $31.7 billion to road and railway projects. This extensive funding fuels a consistent need for the earthmoving and construction equipment that Carraro manufactures.

Changes in international trade policies and the potential for new tariffs, especially on key agricultural commodities like corn and soybeans, can significantly influence demand for and the value of agricultural equipment. While Carraro anticipates minimal impact on current year results from undefined protectionist shifts, these policies directly affect farming profitability, which in turn impacts farmers' capacity to invest in new machinery.

Government support for agricultural mechanization, like subsidies for new equipment and tax incentives, directly boosts demand for specialized machinery. For instance, in 2024, the EU's Common Agricultural Policy (CAP) continued to emphasize modernization, with a significant portion of its budget allocated to improving farm efficiency through technological adoption, benefiting companies like Carraro that supply critical components for tractors and other farm vehicles.

These initiatives, designed to enhance productivity and sustainability, encourage farmers to invest in advanced machinery. This trend is particularly strong in emerging markets where agricultural output is a key economic driver; many nations are actively promoting mechanization to bridge the gap with more developed agricultural sectors, creating new opportunities for Carraro's power transmission solutions.

Environmental Regulations and Emissions Standards

Stricter environmental regulations and ambitious emissions reduction targets are significantly influencing industries where Carraro operates, such as construction, mining, and agriculture. These regulations are compelling businesses to invest in and adopt more eco-friendly technologies to meet compliance requirements.

This growing regulatory pressure directly fuels the demand for electric and hybrid off-highway vehicles, which Carraro is actively developing. Such vehicles provide cleaner alternatives and are crucial for companies aiming to adhere to evolving environmental standards. For instance, by 2030, the European Union aims to reduce greenhouse gas emissions by at least 55% compared to 1990 levels, a target that necessitates a shift towards cleaner machinery in these sectors.

- Increased demand for electric and hybrid off-highway vehicles driven by emissions targets.

- Regulatory push for eco-friendly technologies in construction, mining, and agriculture.

- Carraro's strategic focus on developing sustainable powertrain solutions to meet these demands.

Political Stability in Key Markets

Political stability is a significant driver for Carraro, particularly concerning its export markets for agricultural equipment. The ongoing resolution of international conflicts, like the war in Ukraine, could see a positive uptick in demand as global trade normalizes. For instance, in 2023, agricultural equipment exports from the EU, a key market for Carraro, showed resilience despite geopolitical tensions, with total exports reaching approximately €17.5 billion, highlighting the sector's sensitivity to stability.

Conversely, any resurgence of political instability in Carraro's primary operational regions – Europe, North America, and Asia – poses a direct threat. Such disruptions can fracture supply chains, leading to increased lead times and costs for components, and can also dampen investment appetite, thereby reducing sales volumes for heavy machinery. For example, trade disputes or sudden policy changes in a major market like the United States, which accounted for roughly 20% of Carraro's revenue in 2023, could significantly impact its financial performance.

- EU Agricultural Equipment Exports (2023): Approximately €17.5 billion.

- US Market Share for Carraro (2023): Estimated at 20% of total revenue.

- Impact of Instability: Disruption of supply chains and reduced investment.

- Positive Outlook: Resolution of conflicts could boost export demand.

Government policies directly shape Carraro's operational landscape, influencing demand through infrastructure spending and agricultural support. For instance, the EU's continued emphasis on farm modernization via its Common Agricultural Policy in 2024 encourages investment in advanced machinery, directly benefiting Carraro's component sales for tractors and other farm vehicles.

Stricter environmental regulations, such as the EU's 2030 target for a 55% reduction in greenhouse gas emissions, are accelerating the adoption of electric and hybrid off-highway vehicles. Carraro's strategic development in these sustainable powertrain solutions positions it to capitalize on this regulatory-driven market shift.

Geopolitical stability is crucial for Carraro's export markets, with the normalization of trade after conflicts potentially boosting demand. In 2023, EU agricultural equipment exports reached approximately €17.5 billion, demonstrating the sector's sensitivity to global stability, while the US market represented about 20% of Carraro's 2023 revenue, highlighting the impact of potential trade disputes.

What is included in the product

This Carraro PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

A clear, actionable summary of external factors impacting Carraro, simplifying complex market dynamics for strategic decision-making.

Economic factors

The global off-highway vehicle market is navigating a period of adjustment, with projections indicating a slight contraction in unit sales for 2024, followed by anticipated long-term growth. This stabilization follows a period of significant volatility.

Carraro's financial performance in 2024 reflected these global trends, with consolidated revenues falling by 12.96% compared to 2023. This downturn was primarily driven by a substantial decrease in sales volumes, especially within the agricultural and earthmoving sectors in key Western markets like North America and Europe during the latter half of the year.

The economic climate in early 2025 continues to present challenges. However, the introduction of new products scheduled for the second half of 2025 offers a potential catalyst for revenue improvement compared to the 2024 figures.

Elevated interest rates have significantly impacted the agricultural equipment sector, leading to a noticeable decline in sales. This is primarily because higher borrowing costs make acquiring new machinery, which is often financed, a much less attractive proposition for farmers. This trend was evident in late 2023 and early 2024, where financing costs for agricultural loans saw increases, directly affecting purchasing power.

Looking ahead to 2025, a projected easing of interest rates could offer a much-needed boost. For the agricultural market, lower financing costs would likely encourage investment in new equipment, driving sales. Similarly, the construction sector, heavily reliant on financing for projects and equipment, could see a resurgence in housebuilding activity as borrowing becomes more affordable, benefiting construction equipment manufacturers.

Lower crop prices and elevated interest rates are significantly dampening demand for agricultural machinery. This trend is directly affecting farm income, which is a crucial driver for equipment purchases.

Net farm income is expected to decline in 2024, creating a financially constrained environment for farmers. For instance, the USDA's Economic Research Service projected a 15.8% decrease in net farm income in 2023 compared to 2022, and current projections for 2024 indicate a continued challenging financial landscape for producers, directly impacting their capacity to invest in new machinery.

Inventory Levels and Supply Chain Dynamics

The agricultural equipment market in 2024 experienced a notable surplus in inventory for major categories such as sprayers, combines, and row-crop tractors. This oversupply has shifted the market dynamics, creating a more favorable environment for buyers and consequently exerting downward pressure on equipment prices.

While supply chain disruptions that plagued the post-COVID era have largely subsided, the challenge for manufacturers and dealers in 2025 will be effectively managing this excess inventory. Strategies for inventory reduction will be paramount to restoring market balance and profitability.

- Inventory Surplus: Key agricultural equipment segments like sprayers, combines, and row-crop tractors faced significant inventory build-up in 2024.

- Buyer's Market: The surplus inventory has created a buyer's market, leading to increased negotiation power for purchasers and downward price trends.

- Supply Chain Recovery: Post-pandemic supply chain issues have eased, but the focus now shifts to internal inventory management for 2025.

- Strategic Inventory Management: Manufacturers and dealers must implement robust strategies to clear excess stock and optimize their supply chains for the upcoming year.

Emerging Market Growth

Emerging markets are a significant driver for the off-highway equipment sector. Persistent long-term growth is expected, largely due to increasing mechanization in these developing economies. This trend is particularly evident in regions like India, Southeast Asia, and Brazil, where rising wages and the imperative to boost food production are spurring greater adoption of machinery.

Carraro has directly benefited from this dynamic, reporting strong performance in Asian markets, especially China. This robust growth in Asia has been instrumental in counterbalancing slower demand observed in Western markets during recent periods. For instance, in the first half of 2024, Carraro's sales in Asia saw a notable increase, contributing significantly to the group's overall results.

- Increased mechanization in India, Southeast Asia, and Brazil is driving demand for off-highway machinery.

- Rising wages and the need to enhance food output are key catalysts for machinery adoption in these regions.

- Carraro's strong performance in China has helped mitigate slowdowns in Western markets, highlighting the importance of emerging economies.

- In 2024, Asian markets, led by China, represented a substantial portion of Carraro's revenue growth.

Economic headwinds are notably impacting the agricultural sector, with reduced farm incomes and high interest rates dampening demand for machinery. This has led to an inventory surplus in key equipment categories, creating a buyer's market. Conversely, emerging markets, driven by increasing mechanization and the need for greater food production, present a significant growth opportunity, with Carraro seeing strong contributions from Asian markets, particularly China, in 2024.

| Economic Factor | Impact on Off-Highway Vehicle Market | Data/Observation (2024/2025) |

|---|---|---|

| Interest Rates | Higher borrowing costs reduce affordability of new machinery, impacting sales, especially in agriculture. | Elevated rates in late 2023/early 2024 led to a decline in agricultural equipment sales. Projected easing in 2025 could boost demand. |

| Farm Income | Lower farm income directly limits farmers' capacity to invest in new equipment. | Net farm income projected to decline in 2024, following a 15.8% decrease in 2023 (USDA projection). |

| Inventory Levels | Surplus inventory shifts market dynamics towards buyers, exerting downward price pressure. | Notable surplus in sprayers, combines, and row-crop tractors in 2024. |

| Emerging Markets Growth | Increasing mechanization and food production needs drive demand in developing economies. | Carraro reported strong performance in Asian markets, especially China, in H1 2024, counterbalancing Western market slowdowns. |

Same Document Delivered

Carraro PESTLE Analysis

The preview shown here is the exact Carraro PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive look at Carraro's external environment.

The content and structure shown in the preview is the same Carraro PESTLE Analysis document you’ll download after payment, offering actionable insights.

Sociological factors

Persistent labor shortages across key industries, including agriculture and construction, are significantly accelerating the adoption of automation and AI in machinery. For instance, the U.S. construction industry faced an estimated shortage of over 500,000 skilled workers in 2023, pushing companies to explore robotic solutions and automated equipment.

Farmers are actively seeking technologies that lessen their reliance on manual labor. This trend is evident in the growing market for autonomous tractors and AI-powered agricultural machinery, which aim to enhance efficiency and control operational expenses. The global agricultural robotics market, valued at approximately $4.5 billion in 2023, is projected to grow substantially due to these labor pressures.

The global workforce is aging, with many traditional industries facing a shortage of skilled labor. This demographic shift underscores the critical need for advanced, user-friendly, and safe equipment that can attract and retain a new generation of workers. Carraro's commitment to enhancing operator comfort and safety in its machinery directly addresses this challenge.

For instance, by integrating features that reduce physical strain and improve the overall operating experience, Carraro can make roles in sectors like agriculture and construction more appealing. This focus on human-centric design is crucial for companies looking to bridge the skills gap and ensure operational continuity in the face of evolving workforce demographics.

The heavy construction equipment sector is witnessing a significant shift, with operator safety now a paramount concern. This heightened focus directly impacts how machinery is designed and the features it incorporates. For instance, advancements in cabin ergonomics and visibility systems are becoming standard, not just premium options.

Carraro's strategic alignment with this trend is evident in their product development. By prioritizing innovations that enhance operator well-being and reduce fatigue, Carraro positions its driveline components as integral to safer operations. This resonates strongly with companies that are increasingly held accountable for workplace safety metrics, a trend likely to intensify in 2024 and beyond.

Urbanization and Infrastructure Development

The world is seeing a significant shift towards urban living. By 2050, it's projected that 68% of the global population will reside in urban areas, a substantial increase from today. This rapid urbanization, especially pronounced in the Asia-Pacific region, fuels a massive demand for new infrastructure, from roads and bridges to housing and utilities.

This surge in construction activity directly translates into a greater need for the specialized equipment that builds our cities. Carraro, as a key provider of power transmission systems for off-highway vehicles, is well-positioned to capitalize on this trend. These robust systems are essential for the excavators, loaders, and other heavy machinery that are the backbone of infrastructure development projects worldwide.

Consider these key points:

- Growing Urban Populations: The United Nations estimates that by 2030, the world's urban population will reach 5.2 billion people.

- Infrastructure Investment: Global infrastructure spending is expected to reach trillions of dollars in the coming years, with a significant portion allocated to developing nations.

- Demand for Compact Equipment: Urban construction often requires smaller, more maneuverable machinery, a segment where Carraro's efficient power transmission solutions are particularly valued.

- Asia-Pacific Growth: This region is leading urbanization rates, driving substantial demand for construction equipment and, consequently, for Carraro's components.

Consumer and Societal Demand for Sustainability

Consumers and society are increasingly prioritizing sustainability, driving a demand for reduced environmental impact. This shift directly influences original equipment manufacturers (OEMs) and end-users to actively seek out eco-friendly technologies. Consequently, manufacturers like Carraro are compelled to innovate and develop electric and hybrid powertrain solutions for the off-highway vehicle sector.

The market for sustainable solutions is expanding rapidly. For instance, the global electric off-highway vehicle market was valued at approximately USD 15 billion in 2023 and is projected to reach over USD 45 billion by 2030, indicating a strong growth trajectory. This trend highlights the critical need for companies to adapt their product offerings to meet evolving environmental expectations and regulatory pressures.

- Growing Consumer Awareness: Surveys indicate that a significant majority of consumers, often exceeding 70%, are willing to pay more for products from sustainable brands.

- Regulatory Push: Governments worldwide are implementing stricter emissions standards and offering incentives for green technologies, further accelerating the adoption of sustainable solutions.

- Corporate ESG Goals: Many corporations are setting ambitious Environmental, Social, and Governance (ESG) targets, which directly impacts their procurement decisions, favoring suppliers with sustainable offerings.

- Technological Advancements: Innovations in battery technology, electric drivetrains, and alternative fuels are making sustainable options more viable and cost-competitive for heavy-duty applications.

Societal expectations are increasingly shaping the demand for advanced machinery. As populations age and labor pools shrink, there's a pronounced need for equipment that is not only efficient but also user-friendly and safe to attract new talent. Furthermore, the global trend towards urbanization fuels infrastructure development, creating a sustained demand for heavy construction equipment and, by extension, robust power transmission systems like those Carraro provides.

Technological factors

The electrification of off-highway vehicles is a major technological shift, with the global market projected to reach $11.5 billion by 2028, growing at a compound annual growth rate of 11.2% from 2023. This surge is fueled by a demand for sustainable operations and increasingly strict emissions standards worldwide. Carraro is positioned to capitalize on this trend by innovating in hybrid and fully electric propulsion systems, such as their e-axles and e-transmissions, designed for rugged off-road applications.

These advancements by Carraro aim to deliver emission reductions essential for compliance and environmental stewardship, while crucially maintaining the high levels of productivity and operational efficiency that users expect from heavy machinery. For instance, the company's focus on integrated electric drivetrains means they are not just supplying components but offering complete solutions for cleaner, more powerful off-highway equipment.

Technological advancements in precision agriculture, leveraging GPS, IoT, and data analytics, are revolutionizing farming by optimizing resource use and operational efficiency. Carraro's strategic focus on developing software-controlled mechanical-hydrostatic hybrid transmissions directly addresses this trend, enabling more precise control and fuel savings in agricultural machinery.

Carraro’s commitment to digital transformation, including significant investments in AI projects, further positions the company to capitalize on these technological shifts. This integration of advanced technologies within their machinery is crucial for meeting the evolving demands of modern, data-driven farming operations, with the global precision agriculture market projected to reach $15.7 billion by 2025.

Carraro is actively pushing forward with its digital transformation, with a significant focus on integrating artificial intelligence across its operations. This strategy aims to streamline business processes and boost both production efficiency and sustainability. For instance, the company is developing new treasury systems and applying AI to fine-tune factory operations. This includes retooling production lines to accommodate next-generation machinery, a move expected to enhance competitiveness.

Modular and Flexible Driveline Solutions

Carraro is actively developing modular driveline solutions designed for a range of off-highway machinery, such as compact wheel loaders and telescopic boom handlers. This strategic focus on modularity allows for greater adaptability across different vehicle types and operational requirements.

These flexible solutions empower customers by enabling the integration of various transmission types, including hydrostatic, torque converter, and emerging electric powertrains. Furthermore, the incorporation of adaptable electronic control units (ECUs) ensures that these drivelines can be precisely tailored to meet specific performance demands and customer preferences, enhancing efficiency and functionality.

- Modular Design: Carraro's approach allows for interchangeable components, reducing development time and costs for new vehicle platforms.

- Powertrain Flexibility: The ability to integrate hydrostatic, torque converter, and electric powertrains caters to evolving market demands for efficiency and emissions reduction.

- Customizable Control: ECUs can be programmed to optimize driveline performance based on specific application needs, improving fuel economy and operational effectiveness.

Battery Technology and Charging Infrastructure

Technological progress in battery efficiency and charging is fundamentally reshaping the off-highway electric vehicle (OHEV) market. Advancements in lithium-ion battery chemistry are directly boosting energy density and lifespan, making electric alternatives more viable for demanding industrial and agricultural tasks. For instance, by mid-2024, battery energy density for electric vehicles has seen a notable increase, with some manufacturers pushing beyond 250 Wh/kg, enabling longer operational times between charges.

The expansion of charging infrastructure is equally critical. The development of fast-charging solutions, capable of replenishing battery capacity significantly faster, is crucial for minimizing downtime in commercial operations. By early 2025, we are seeing a growing network of high-power charging stations, with some offering charging speeds that can add hundreds of kilometers of range in under 30 minutes for suitable vehicles. This infrastructure build-out directly supports the increasing adoption of Battery Electric Vehicles (BEVs) in sectors previously dominated by internal combustion engines.

- Battery Energy Density: Approaching and exceeding 250 Wh/kg in advanced lithium-ion chemistries by mid-2024.

- Charging Speed: High-power charging solutions capable of adding significant range in under 30 minutes by early 2025.

- Battery Lifespan: Improvements leading to extended cycle life, making BEVs more cost-effective over their operational period.

- Vehicle Performance: Enhanced torque and quieter operation are key benefits of electric powertrains in off-highway applications.

Technological factors are driving significant change in the off-highway sector, with electrification at the forefront. The global market for electric off-highway vehicles is projected for substantial growth, indicating a strong shift towards sustainable solutions. Carraro's investment in AI and digital transformation further solidifies its position to adapt to these evolving technological landscapes.

Carraro's modular driveline solutions offer crucial flexibility, allowing integration of various powertrains including electric options. This adaptability, combined with advanced electronic control units, ensures optimized performance for diverse off-highway applications. The company's focus on these technological advancements directly addresses market demands for efficiency and reduced environmental impact.

Advancements in battery technology, particularly increased energy density and faster charging capabilities, are making electric powertrains more viable for demanding off-highway use. By mid-2024, battery energy density has surpassed 250 Wh/kg, and by early 2025, fast-charging solutions are becoming more widespread, significantly reducing downtime.

| Technology Trend | Impact on Off-Highway Sector | Carraro's Response/Focus |

|---|---|---|

| Electrification | Growing demand for emission-free operation; market projected to reach $11.5 billion by 2028. | Development of e-axles and e-transmissions for hybrid and electric powertrains. |

| Precision Agriculture | Increased efficiency and resource optimization through data analytics and automation. | Software-controlled mechanical-hydrostatic hybrid transmissions for precise control. |

| Artificial Intelligence (AI) | Streamlining operations, enhancing production efficiency, and improving sustainability. | AI integration in treasury systems and factory operations for optimized performance. |

| Battery Technology | Improved energy density (e.g., >250 Wh/kg by mid-2024) and faster charging solutions (e.g., <30 min for significant range by early 2025). | Enabling longer operational times and reduced downtime for electric off-highway vehicles. |

Legal factors

Carraro operates within a legal landscape shaped by increasingly strict environmental regulations, particularly concerning emissions for off-highway vehicles. European Union Stage V regulations, for instance, mandate significant reductions in particulate matter and nitrogen oxides, directly impacting engine design and requiring substantial investment in anti-pollution technologies. This legal framework necessitates ongoing research and development to ensure compliance and maintain market access.

The company's strategic pivot towards electrified solutions is largely a response to these evolving legal mandates, both locally and internationally. As governments worldwide implement more aggressive climate policies and emissions targets, Carraro’s development of electric drivetrains and hybrid systems is crucial for future product viability and adherence to global environmental standards. Failure to comply can result in fines and market exclusion.

Manufacturers in the off-highway vehicle sector, including those like Carraro, must navigate stringent product safety and liability standards. These regulations are designed to protect operators and the public from harm, directly impacting vehicle design and manufacturing processes. For instance, in 2024, the European Union continued to emphasize safety directives for machinery, with ongoing reviews of standards like EN ISO 13849 for safety-related parts of control systems, influencing how components such as transmissions and axles are engineered.

Carraro's commitment to enhancing operator comfort and integrating advanced safety features into its machinery directly addresses these legal mandates. By proactively incorporating features that reduce fatigue and minimize the risk of accidents, Carraro not only complies with regulations but also mitigates potential liabilities. This proactive approach is crucial, as product liability claims can result in significant financial penalties and reputational damage, as seen in various sectors where recalls due to safety defects have cost companies millions.

International trade laws and the imposition of tariffs directly affect Carraro's operational costs. For instance, in 2024, the European Union maintained various tariffs on agricultural machinery components imported from outside the bloc, which could increase Carraro's sourcing expenses if it relies on non-EU suppliers for certain parts.

Navigating these complex global regulations is crucial for Carraro's supply chain. Changes in trade agreements, such as potential renegotiations of existing pacts or the introduction of new trade barriers, can force the company to re-evaluate its manufacturing locations and distribution networks to mitigate cost increases and ensure market access.

Intellectual Property Rights and Patents

Protecting its intellectual property, particularly patents for innovative power transmission systems and specialized tractor designs, is paramount for Carraro. These legal protections are vital for maintaining its competitive advantage in the global agricultural and construction machinery markets.

The legal frameworks surrounding intellectual property rights empower Carraro to safeguard its technological advancements and prevent unauthorized replication of its proprietary designs and manufacturing processes. This legal shield is fundamental to its strategy of continuous innovation and market leadership.

- Patent Portfolio Strength: As of early 2024, Carraro actively manages a significant portfolio of patents globally, covering key technologies in drivelines and axles for agricultural and construction vehicles.

- R&D Investment: The company consistently invests in research and development, with R&D expenditure representing a notable percentage of its annual revenue, underscoring its commitment to patentable innovation. For instance, in 2023, R&D spending was approximately 3.5% of total revenues.

- Enforcement Actions: Carraro has historically engaged in legal actions to defend its patents against infringement, demonstrating a proactive approach to safeguarding its intellectual assets.

- Global IP Strategy: The company maintains a strategic approach to patent filing across key manufacturing and sales regions, ensuring broad protection for its technological innovations.

Labor Laws and Employment Regulations

Carraro, with its global footprint, navigates a complex web of labor laws and employment regulations across its manufacturing and sales locations. These regulations dictate everything from minimum wage requirements to workplace safety standards, directly influencing operational expenses and human capital management. For instance, in 2024, the average minimum wage in several European countries where Carraro operates saw an uptick, potentially increasing labor costs.

Compliance with these diverse legal frameworks is crucial for maintaining smooth operations and avoiding costly penalties. The company must adapt its HR strategies to align with varying national labor agreements and collective bargaining stipulations.

- Varying Labor Costs: Minimum wage increases in key European markets in 2024, such as Germany and Italy, directly impact Carraro's labor expenditure.

- Union Relations: Strong union presence in some operating regions necessitates careful negotiation and adherence to collective bargaining agreements, influencing wage structures and working conditions.

- Workplace Safety Standards: Adherence to stringent occupational health and safety regulations, like those mandated by EU directives, requires ongoing investment in training and equipment.

- Employment Contracts: Diverse legal requirements for employment contracts across different jurisdictions necessitate tailored HR policies and documentation.

Carraro must adapt to evolving environmental regulations, such as the EU Stage V emissions standards, which require significant investment in cleaner engine technologies for off-highway vehicles. The company’s strategic focus on electrification is a direct response to these mandates and broader global climate policies aimed at reducing emissions, with non-compliance risking fines and market exclusion.

Product safety and liability laws are critical, with ongoing reviews of machinery safety standards like EN ISO 13849 in the EU impacting component design. Carraro’s integration of advanced safety features aims to mitigate liability risks, as product recalls due to safety issues can lead to substantial financial and reputational damage.

International trade laws and tariffs directly influence Carraro’s operational costs, with potential tariffs on imported components in 2024 affecting sourcing expenses. Navigating these global regulations is crucial for supply chain management and market access, requiring strategic adjustments to manufacturing and distribution networks.

Protecting its intellectual property, including patents for innovative power transmission systems, is vital for Carraro's competitive edge. The company actively manages a global patent portfolio, underscoring its commitment to innovation through significant R&D investment, with 2023 R&D spending at approximately 3.5% of revenues.

Carraro must also comply with diverse labor laws and employment regulations across its global operations, affecting labor costs and HR strategies. For instance, minimum wage increases in key European markets in 2024, such as Germany and Italy, directly impact the company's expenditure.

| Legal Factor | Impact on Carraro | 2024/2025 Data/Trend |

| Environmental Regulations | Increased R&D for emissions compliance, shift to electrification | EU Stage V emissions standards driving cleaner engine tech; focus on electric/hybrid drivetrains. |

| Product Safety & Liability | Investment in safety features, risk mitigation for design flaws | Ongoing review of EN ISO 13849 for safety-related control systems; proactive safety integration to avoid recalls. |

| International Trade Laws | Impact on sourcing costs, supply chain adjustments | Potential tariffs on components in EU; need to re-evaluate manufacturing and distribution networks. |

| Intellectual Property Rights | Protection of technological innovations, competitive advantage | Active management of global patent portfolio; 2023 R&D expenditure ~3.5% of revenue. |

| Labor Laws | Influence on operational costs and HR strategies | Minimum wage increases in Germany and Italy impacting labor expenditure; adherence to diverse employment contracts. |

Environmental factors

The global momentum towards decarbonization, exemplified by the European Union Green Deal, presents both challenges and opportunities for Carraro. This strategic shift necessitates significant investment in sustainable practices.

Carraro is actively addressing these environmental factors by investing in advanced production technologies and exploring self-generation of energy. These initiatives are designed to substantially reduce the company's CO2 emissions and overall environmental impact.

For instance, in 2023, Carraro reported a reduction in its Scope 1 and Scope 2 CO2 emissions by 8.7% compared to 2022, demonstrating tangible progress in its decarbonization efforts.

Carraro is actively working to lessen its environmental footprint by prioritizing efficient manufacturing processes and choosing sustainable materials. This commitment is demonstrated through smart management of solutions and the digitalization of operations, which aims to streamline workflows and cut down on resource usage.

The growing emphasis on waste management and circular economy principles is shaping manufacturing, pushing companies like Carraro to reduce waste and use resources more efficiently. This shift means minimizing scrap in production and actively seeking ways to recycle and reuse materials.

In 2023, the global waste management market was valued at over $1.1 trillion, with a projected compound annual growth rate of 5.5% through 2030, highlighting the increasing economic significance of these practices. Carraro's commitment to sustainability likely involves concrete actions to cut down production waste and develop strategies for material recovery and repurposing, aligning with these market trends.

Noise and Air Pollution Reduction

The push for quieter and cleaner operations, especially in urban settings, is a significant environmental driver. This trend is fueling the adoption of electric and hybrid off-highway vehicles. For instance, the European Union's emissions standards continue to tighten, pushing manufacturers towards electrification. Carraro's strategic investment in electrified drivetrains directly aligns with this demand, providing solutions that minimize both air and noise pollution.

Carraro's electrified product portfolio is designed to meet these evolving environmental regulations and market expectations. Their development of advanced hybrid and fully electric systems for agricultural and construction machinery offers a tangible pathway for customers to reduce their environmental footprint. This focus is crucial as cities worldwide implement stricter noise and emission zones, impacting the operational viability of older diesel equipment.

- Urban demand: Construction projects in densely populated areas increasingly require machinery that adheres to strict noise and emission limits.

- Regulatory pressure: Global environmental regulations, such as those from the EPA and EU, are mandating lower emissions, driving innovation in powertrain technology.

- Carraro's response: The company's focus on electrified axles and transmissions provides a direct solution for manufacturers seeking to build cleaner and quieter off-highway vehicles.

- Market shift: By 2025, it's projected that a significant percentage of new off-highway vehicle sales will incorporate some form of electrification, a trend Carraro is positioned to capitalize on.

Climate Change Impacts on Agriculture

Climate change presents significant environmental challenges that directly affect agricultural productivity and, consequently, the demand for farm equipment. Increasingly volatile weather patterns, including more frequent droughts and extreme rainfall events, can devastate crop yields. For instance, the UN's Food and Agriculture Organization (FAO) reported that extreme weather events caused an average of $30 billion in agricultural losses annually between 2000 and 2020. This instability makes it harder for farmers to plan and invest, potentially impacting their ability to purchase new machinery from companies like Carraro.

This indirect effect on Carraro's agricultural machinery business underscores the growing need for equipment that is not only robust but also adaptable to changing environmental conditions. Farmers are increasingly seeking technologies that can help them manage climate-related risks, such as precision farming tools that optimize water usage or machinery designed for diverse soil conditions. The agricultural sector's resilience is paramount, and manufacturers must innovate to support this adaptation.

- Increased Volatility: Climate change is leading to more unpredictable weather, impacting crop yields and farmer income.

- Investment Hesitation: Poor weather conditions can reduce farmers' purchasing power for new agricultural equipment.

- Demand for Adaptable Technology: There's a growing need for machinery that can mitigate climate risks and improve farm resilience.

- Industry Impact: Carraro's agricultural division may see shifts in demand towards more technologically advanced and adaptable equipment.

Carraro is strategically investing in electrified drivetrains and advanced production to align with global decarbonization trends, aiming to reduce its environmental footprint.

The company achieved an 8.7% reduction in Scope 1 and 2 CO2 emissions in 2023, showcasing tangible progress in its sustainability initiatives and waste reduction efforts.

Growing demand for quieter, cleaner off-highway vehicles in urban settings and stricter emissions regulations are driving Carraro's focus on hybrid and electric solutions.

Climate change impacts agricultural productivity, influencing farmer investment and increasing demand for adaptable, technologically advanced machinery, a trend Carraro is poised to address.

| Environmental Factor | Carraro's Response/Impact | Data/Trend |

|---|---|---|

| Decarbonization & Emissions | Investment in electrification, energy self-generation, reduced CO2 emissions. | 8.7% reduction in Scope 1 & 2 CO2 emissions (2023 vs 2022). |

| Waste Management & Circular Economy | Focus on efficient manufacturing, sustainable materials, waste reduction. | Global waste management market > $1.1 trillion (2023), growing at 5.5% CAGR. |

| Noise & Air Pollution | Development of electrified axles and transmissions for off-highway vehicles. | Increasing urban demand for low-emission/low-noise machinery; tightening EU emission standards. |

| Climate Change Impact on Agriculture | Need for adaptable machinery to mitigate climate risks. | Extreme weather events cause average annual agricultural losses of $30 billion (2000-2020). |

PESTLE Analysis Data Sources

Our PESTLE analysis for Carraro is meticulously constructed using data from reputable sources including international financial institutions, national statistical offices, and leading industry-specific research firms. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the company.