Carraro Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Carraro Bundle

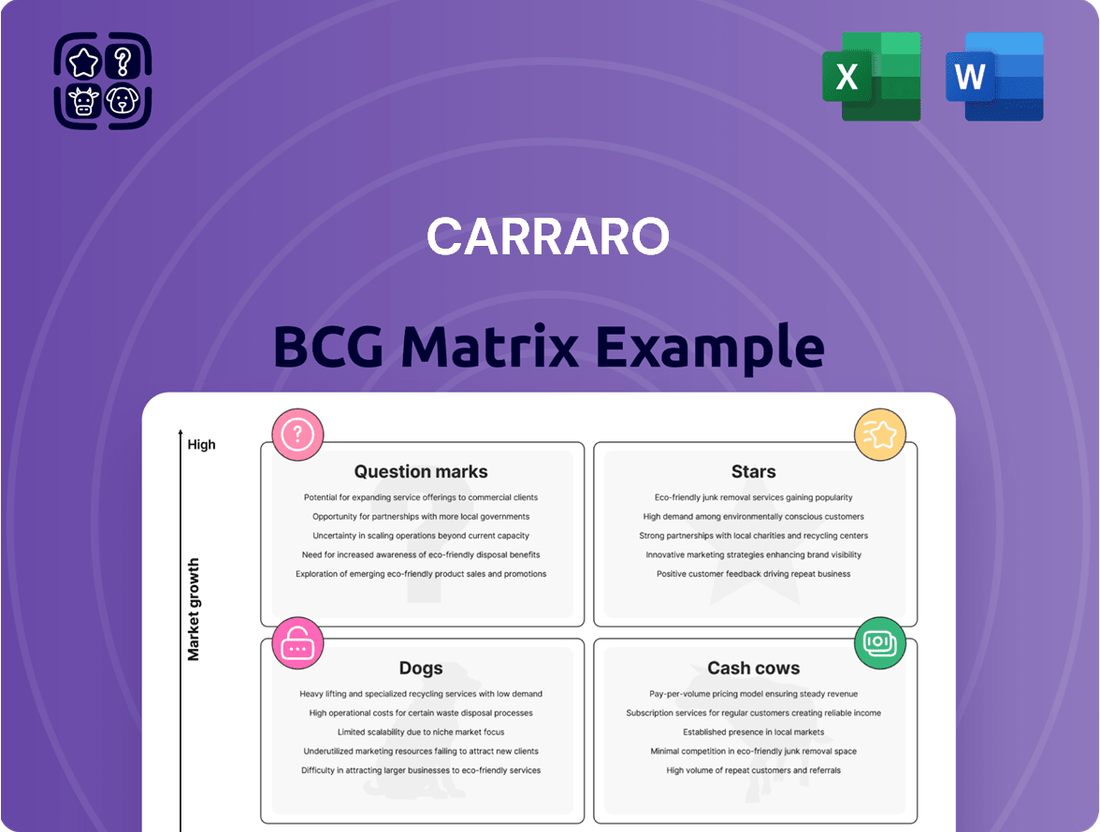

This preview offers a glimpse into the Carraro BCG Matrix, highlighting key product categories and their market positions. Understand which of Carraro's offerings are driving growth and which require careful consideration. Purchase the full BCG Matrix for a comprehensive analysis, including detailed quadrant placements and actionable strategies to optimize your portfolio.

Stars

Carraro is making substantial investments in hybrid and full-electric powertrains for off-highway machinery, targeting sectors like construction and agriculture. This strategic focus is evident in products such as their SRe electric tractor and advanced electric transmissions, showcasing a clear commitment to the burgeoning e-mobility market. The company's proactive development in this area is designed to secure a strong position in the industrial e-mobility sector, which is experiencing rapid expansion.

Carraro's strategic emphasis on advanced transmission systems with integrated electronics, including proprietary ECUs and AI in production, positions it strongly in the high-growth smart vehicle technology sector. This focus allows for enhanced driveline performance and efficiency, aligning with market trends towards intelligent and automated mobility solutions. In 2024, the global market for automotive electronics was projected to reach over $400 billion, highlighting the significant opportunity in this segment.

Carraro's introduction of new F28 engines, like the 11200 propulsion unit exceeding 100 hp, positions them to capture a high-growth segment. These units will be integrated into Cento and R series models starting in 2025, directly responding to market needs for more potent, eco-friendly machinery.

Expansion in Asian Construction Market Niches

Carraro's strategic focus on specific Asian construction market niches is yielding positive results. Despite broader market fluctuations, the company has observed a notable upswing in these areas, particularly within China. This targeted expansion indicates that these segments are indeed acting as stars within Carraro's portfolio, poised for continued growth and revenue generation.

The company's performance in 2024 highlights this trend. For instance, Carraro's components for off-highway vehicles, crucial for infrastructure development, saw a substantial demand increase in key Asian economies. This growth is directly linked to ongoing urbanization and infrastructure projects across the region.

- Targeted Asian Growth: Carraro is experiencing robust demand in specialized construction equipment sectors in Asia, especially China, outperforming general market trends.

- 2024 Performance Indicators: The company reported a significant year-over-year increase in sales for components used in construction machinery operating in these high-growth Asian markets.

- Future Revenue Potential: These expanding niches are identified as key drivers for future revenue, reflecting successful strategic positioning and market penetration.

Innovative Specialized Tractors (Antonio Carraro brand)

Antonio Carraro's innovative specialized tractors, such as the Tony series with its hydrostatic transmission and reversible steering, and the A series expanding their offerings, demonstrate a strong commitment to high-growth agricultural machinery. These advancements are geared towards meeting sophisticated customer demands and solidifying leadership in niche markets.

Carraro's strategic focus on these specialized tractors positions them as stars within the BCG matrix. For instance, the Tony series, introduced to cater to demanding vineyard and orchard operations, has seen significant interest. In 2024, the agricultural machinery market continued to see growth in specialized equipment, with companies like Carraro investing heavily in R&D to capture these segments.

- Tony Series: Features hydrostatic transmission and reversible steering for enhanced maneuverability in confined spaces.

- A Series: Broadens the product portfolio to address diverse agricultural needs and terrain types.

- Market Focus: Targets high-value niche segments like viticulture and horticulture.

- Investment: Significant R&D expenditure in 2023-2024 to drive innovation and market share.

Carraro's investments in hybrid and electric powertrains for off-highway machinery, particularly in construction and agriculture, position these segments as stars. Their SRe electric tractor and advanced electric transmissions are key indicators of this strong market presence. The company's commitment to industrial e-mobility is a significant growth driver.

The specialized agricultural machinery sector, exemplified by the Tony and A series tractors, also shines as a star. These innovative tractors, featuring advanced transmissions and reversible steering, cater to high-value niche markets like viticulture. Carraro's substantial R&D investment in 2023-2024 further solidifies their leadership in these growing agricultural segments.

| Product Segment | Key Features | Market Status | 2024 Growth Indicator |

|---|---|---|---|

| Electric Powertrains (Off-Highway) | Hybrid and full-electric systems | High Growth (E-mobility) | Increasing demand in construction & agriculture |

| Specialized Agricultural Tractors | Hydrostatic transmission, reversible steering | High Growth (Niche Markets) | Strong interest in Tony & A series |

| Advanced Transmission Systems | Integrated electronics, AI in production | High Growth (Smart Vehicles) | Global automotive electronics market > $400B in 2024 |

What is included in the product

The Carraro BCG Matrix analyzes business units based on market growth and share, offering strategic guidance.

It categorizes products into Stars, Cash Cows, Question Marks, and Dogs to inform investment decisions.

Quickly visualize your portfolio's strengths and weaknesses with a clear, quadrant-based Carraro BCG Matrix.

Cash Cows

Carraro's core business in axles and transmissions for off-highway original equipment manufacturers (OEMs) is their undisputed cash cow. This segment benefits from Carraro's established global leadership and deep relationships with major players in the agricultural, construction, and material handling industries.

The market for these components is mature but stable, allowing Carraro to maintain a high market share and generate substantial, consistent cash flow. For instance, in 2024, the Power Transmission segment, which includes these core products, continued to be the primary revenue driver for Carraro, demonstrating its resilience and profitability.

Carraro's SIAP, a center of excellence, manufactures a broad spectrum of gears and high-quality components. This diversification extends beyond off-highway to include automotive and material handling sectors, showcasing a robust and ingrained market position.

This diversified component manufacturing business is a significant contributor to the company's stable profit margins and consistent cash generation. In 2023, Carraro's sales in the automotive sector reached €432 million, highlighting the strength of this segment.

Carraro's Driveservice, its dedicated logistics hub for spare parts, is a prime example of a Cash Cow. This segment benefits from consistent demand for replacement parts and after-sales support, ensuring a steady and reliable revenue stream.

The profitability of Driveservice is further bolstered by high margins, a direct result of the essential nature of these components for maintaining the operational lifespan of equipment. For instance, in 2024, Carraro reported that its After Sales and Spare Parts division continued to be a significant contributor to overall profitability, demonstrating the enduring strength of this mature business.

Established Product Lines in Traditional Western Markets

Carraro's established product lines in traditional Western markets, specifically in agriculture and earthmoving, represent its Cash Cows. Despite some market slowdowns, these segments maintain substantial market share in Europe and North America.

These foundational business areas benefit from long-standing customer relationships and a reputation for reliability. This stability provides a consistent revenue stream and profitability, even as growth rates in these mature markets are lower.

- Market Share: Carraro holds a significant position in the European agricultural and earthmoving sectors.

- Revenue Stability: These product lines contribute a predictable and stable revenue base for the company.

- Profitability: Despite slower growth, the established nature of these operations ensures continued profitability.

Optimized Production Platform and Cost Efficiency

Carraro's optimized production platform and focus on cost efficiency are key drivers of its Cash Cow status. Significant investments in recent years have bolstered production capacity and streamlined operations, directly impacting profitability. For instance, the company has actively pursued initiatives to reduce both product and structural costs, enhancing its ability to generate strong margins even when market conditions are tough.

This efficient operational base provides a robust foundation, enabling Carraro to consistently generate substantial cash flow. This consistent cash generation is vital, allowing the company to fund other business segments and investments.

- Enhanced Profitability: Investments in production capacity and cost reduction initiatives have directly led to improved profitability for Carraro.

- Strong Margins: The streamlined operational base allows the company to maintain strong profit margins, even during periods of market volatility.

- Consistent Cash Flow: Carraro's efficient operations translate into robust cash flow generation, a hallmark of a Cash Cow.

- Foundation for Growth: This strong cash flow serves as a crucial financial resource, supporting other areas of the Group.

Carraro's established product lines in traditional Western markets, particularly in agriculture and earthmoving, are its primary cash cows. These segments benefit from long-standing customer relationships and a reputation for reliability, providing a consistent revenue stream and profitability despite lower growth rates.

The company's focus on an optimized production platform and cost efficiency further solidifies these segments' cash cow status. Investments in recent years have enhanced production capacity and streamlined operations, directly impacting profitability and enabling strong margins even in challenging market conditions.

Carraro's Power Transmission segment, encompassing axles and transmissions for off-highway OEMs, remains its undisputed cash cow. This segment leverages global leadership and deep OEM relationships, generating substantial and consistent cash flow from a mature but stable market.

The Driveservice, Carraro's spare parts logistics hub, also acts as a cash cow due to consistent demand and high-margin revenue from essential after-sales support, contributing significantly to overall profitability.

| Segment | Primary Role | Key Characteristics | 2023 Revenue (approx.) |

| Axles & Transmissions (Off-Highway) | Cash Cow | Global leadership, stable market, high share | €892 million (Power Transmission) |

| Driveservice (After Sales & Spare Parts) | Cash Cow | Consistent demand, high margins, essential service | Significant profitability contributor |

| Automotive Components | Strong Contributor | Diversified, robust market position | €432 million |

Delivered as Shown

Carraro BCG Matrix

The Carraro BCG Matrix preview you are currently viewing is precisely the final, unwatermarked document you will receive upon purchase. This means the strategic insights and visual representation of your business units are exactly as intended, ready for immediate implementation or presentation. You can be confident that no additional editing or formatting will be required, as this preview accurately reflects the complete and polished report. This ensures a seamless transition from preview to practical application of your strategic analysis.

Dogs

Carraro's legacy product lines, particularly older transmission systems and components not designed for electrification or advanced emission standards, likely fall into the Dogs category. These products face diminishing demand as the market pivots towards more modern, efficient, and environmentally compliant solutions. Without substantial upgrades or strategic repositioning, their market relevance will continue to erode.

Carraro's specialized tractor lines might include niche models that are currently underperforming. These could be tractors designed for very specific agricultural tasks or unique terrain that haven't captured enough market share. For instance, a specialized vineyard tractor with limited demand or a high-cost, low-volume model for a particular industrial application could be examples.

These underperforming niche products are likely situated in the Dogs quadrant of the BCG Matrix. They consume capital and management attention but generate minimal profits or market growth. In 2024, it's crucial for Carraro to identify these models, perhaps those with less than a 5% market share in their specific segment or those experiencing declining sales, to make strategic decisions about their future.

Products in severely contracted regional markets, like certain Western agricultural sectors experiencing a downturn, would fall into the Dogs category of the Carraro BCG Matrix. These are offerings where Carraro holds a low market share in a market that is not growing, or is even shrinking.

Consider Carraro’s traditional transmissions for agricultural machinery. If these specific product lines are heavily concentrated in regions like parts of Europe that saw a decline in agricultural equipment sales by an estimated 5% in 2023 due to economic headwinds and regulatory changes, and Carraro’s share in those specific segments is below 10%, they would be classified as Dogs.

Products Lacking Digital or Electrification Integration

Products that haven't embraced digital integration or electrification are increasingly vulnerable. As markets demand smarter, more connected, and cleaner solutions, these offerings face obsolescence. For instance, in the agricultural machinery sector, traditional, non-electrified tractors are seeing declining demand as advanced, GPS-enabled, and hybrid models gain traction. This shift means a product line lacking these crucial advancements is likely to become a Dog in the Carraro BCG Matrix.

The consequence of neglecting digital and electrical upgrades is a significant competitive disadvantage. Companies that continue to rely on purely mechanical systems may find their market share eroding rapidly. By 2024, the global market for agricultural machinery, a key sector for companies like Carraro, was projected to reach over $200 billion, with a significant portion of growth attributed to precision agriculture technologies and electrification.

- Declining Market Share: Products without digital or electric features will see their market share shrink as competitors offer more advanced alternatives.

- Reduced Competitiveness: The inability to integrate with digital ecosystems or offer electrified options severely hampers a product's ability to compete.

- Erosion of Profitability: As demand wanes, these products will likely face price pressures and reduced sales volumes, impacting profitability.

- Limited Future Investment: Companies may cease investing in product lines that are perceived as outdated, further accelerating their decline.

Non-Strategic or Divested Minor Business Units

Non-Strategic or Divested Minor Business Units in Carraro's portfolio would represent areas where the company has minimal market share and low growth prospects. These units likely consume resources without generating significant returns, prompting a strategic decision to divest or restructure. For instance, if Carraro were to exit a niche component manufacturing segment that accounted for less than 5% of its total revenue and showed no clear path for expansion, that segment would fall into this category.

These units are characterized by their limited contribution to overall profitability and a lack of competitive advantage. Carraro's focus in 2024 has been on optimizing its core businesses, particularly in transmissions and drive solutions for off-highway vehicles. Any minor segments not aligning with this strategic direction would be candidates for this quadrant.

- Low Market Share: Units with a negligible presence in their respective markets.

- Low Growth Prospects: Segments unlikely to experience significant expansion.

- Resource Drain: Businesses that require capital investment with minimal return.

- Divestiture Candidates: Operations identified for sale or closure to improve overall financial health.

Carraro's Dogs represent products or business units with low market share in low-growth industries. These offerings, such as older transmission systems not adapted for electrification, are unlikely to generate significant future returns. For example, if Carraro’s share in a specific legacy component market, which is projected to contract by 3% annually, is below 7%, it would be classified as a Dog. These segments often require significant capital for maintenance but offer minimal profitability, making them prime candidates for divestment or strategic pruning to reallocate resources to more promising areas.

| Product Category Example | Market Growth Rate (Est. 2024) | Carraro Market Share (Est.) | BCG Classification | Strategic Implication |

|---|---|---|---|---|

| Legacy Agricultural Transmissions | -2% | 6% | Dog | Divest or phase out |

| Niche Industrial Components | 1% | 4% | Dog | Evaluate for divestment |

| Older Off-Highway Axle Systems | 0% | 8% | Dog | Consider discontinuation |

Question Marks

Carraro's SRe and LifeAtena project represent early-stage electrified tractor prototypes. These innovations are positioned within the rapidly expanding market for electric agricultural machinery, a sector projected for significant growth. For instance, the global electric tractor market was valued at approximately USD 300 million in 2023 and is anticipated to reach over USD 1.5 billion by 2030, demonstrating a strong upward trend.

Given their current developmental stage and the substantial investment required for commercialization, these prototypes are categorized as Question Marks in the BCG matrix. Their future success hinges on market acceptance and technological advancements, with the potential to transition into Stars if they achieve widespread adoption and market leadership in the electrified farming segment.

Carraro's new digital transformation and AI projects for production represent significant investments in modernizing operations, aiming for enhanced efficiency and sustainability. These initiatives, while holding high potential, are currently in their nascent stages, demanding substantial capital outlay. Their direct contribution to market share and profitability is still in the process of being measured and realized.

Expanding Carraro's own-brand specialized tractors into emerging markets with low brand recognition is a classic Question Mark scenario. These markets, while offering high growth potential, demand substantial upfront investment in brand building, distribution networks, and localized product support to carve out a meaningful presence. For instance, while global agricultural machinery sales reached an estimated $210 billion in 2024, the penetration of specialized tractors in many developing regions remains nascent, presenting both opportunity and risk.

New Business Initiatives (e.g., Automotive Axles and eTruck)

Carraro's strategic focus on new business initiatives like Automotive Axles and eTruck highlights a forward-looking approach to diversify revenue streams and mitigate risks associated with traditional markets. These segments are positioned as growth engines, intended to counterbalance potential slowdowns in established Western markets.

While these new ventures show promise for high growth, their current market share in these nascent segments is likely modest. This necessitates ongoing investment to build brand recognition, expand production capacity, and secure a competitive position. For instance, in the rapidly evolving eTruck market, Carraro's ability to scale production efficiently will be critical to capturing market share against established and emerging players.

- High Growth Potential: Initiatives like eTruck and specialized automotive axles are targeted at sectors experiencing significant technological advancement and demand growth.

- Market Penetration: Initial market share in these new areas is expected to be low, requiring substantial investment in research, development, and market entry strategies.

- Investment Needs: Continued capital expenditure will be essential to scale operations, enhance product offerings, and compete effectively in these emerging markets.

- Strategic Diversification: These new businesses serve as a crucial element in Carraro's strategy to reduce reliance on mature markets and capitalize on future industry trends.

Ongoing Research and Development for Future Driveline Technologies

Carraro's commitment to ongoing research and development in driveline technologies, particularly for specialized tractors and innovative transmission systems, represents a significant investment in their future growth. This focus aligns with the 'Question Marks' category in the BCG matrix, where high investment is channeled into areas with uncertain future payoffs. For instance, in 2023, Carraro reported a substantial portion of its revenue dedicated to R&D, aiming to pioneer next-generation hybrid and electric drivetrains.

These capital-intensive projects are crucial for staying ahead in a rapidly evolving market, but their ultimate success hinges on technological breakthroughs, market adoption rates, and competitive responses. The potential for high returns exists if these new technologies gain traction and become industry standards, but the risk of failure or lower-than-expected profitability remains.

- High R&D Investment: Carraro consistently allocates significant capital to developing advanced transmission systems and specialized tractor drivelines.

- Focus on Future Technologies: Efforts are concentrated on innovations like hybrid and electric powertrains, aiming to capture future market demand.

- Capital Intensive Nature: These R&D initiatives require substantial financial outlay, characteristic of 'Question Marks' in strategic portfolio analysis.

- Uncertain Future Returns: While the potential for high returns is present, market acceptance and profitability are not yet guaranteed.

Carraro's investments in new electrified tractor prototypes and digital transformation initiatives are prime examples of Question Marks. These ventures require substantial capital for development and market penetration, with uncertain future outcomes. Their success depends heavily on technological advancements and market acceptance, potentially leading to future growth or obsolescence.

Expanding into new geographic markets with specialized tractors also falls into the Question Mark category. While these markets offer high growth potential, Carraro faces the challenge of building brand recognition and distribution networks, demanding significant upfront investment. The global agricultural machinery market, valued around $210 billion in 2024, presents varied opportunities for such expansion.

New business areas like eTruck and Automotive Axles are also classified as Question Marks. These are high-growth potential segments, but Carraro's current market share is likely low, necessitating ongoing investment to establish a competitive presence. The eTruck market, for instance, is rapidly evolving, requiring efficient scaling to compete.

Carraro's R&D in driveline technologies, particularly for hybrid and electric systems, represents significant investment in potential future market leaders. These capital-intensive projects, like the substantial R&D spending reported in 2023, carry inherent risks regarding technological breakthroughs and market adoption, characteristic of Question Marks.

| Initiative | Category | Market Growth Potential | Current Market Share | Investment Need |

| Electrified Tractor Prototypes (SRe, LifeAtena) | Question Mark | High (Electric agricultural machinery) | Low | High |

| Digital Transformation & AI in Production | Question Mark | Indirect (Operational Efficiency) | N/A (Internal) | High |

| Own-Brand Specialized Tractors in Emerging Markets | Question Mark | High (Developing regions) | Low | High (Brand Building, Distribution) |

| eTruck & Automotive Axles | Question Mark | High (New Mobility Segments) | Low | High (Scaling, Market Entry) |

| Advanced Driveline R&D (Hybrid/Electric) | Question Mark | High (Future Powertrains) | N/A (Developmental) | High (R&D Expenditure) |

BCG Matrix Data Sources

Our BCG Matrix leverages a blend of financial disclosures, market analytics, and industry growth projections to accurately position business units.