Carraro Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Carraro Bundle

Carraro's marketing success hinges on a meticulously crafted 4Ps strategy, from their innovative product offerings to their strategic pricing, efficient distribution, and impactful promotions. Understanding how these elements interlock provides invaluable insights into their market dominance.

Dive deeper into the specifics of Carraro's marketing mix and unlock actionable strategies. Get the full, editable analysis to understand their competitive edge and apply similar principles to your own business.

Product

Carraro's specialized power transmission systems, including high-efficiency axles and transmissions, are foundational for off-highway vehicles. These systems are engineered for demanding environments, ensuring optimal performance in agricultural, construction, and material handling machinery.

The company's commitment to innovation is evident in its product development, which directly supports major Original Equipment Manufacturers (OEMs) globally. For instance, in 2023, Carraro Group reported revenues of €777.3 million, with a significant portion attributed to its Drive Tech division, which encompasses these power transmission solutions, demonstrating their vital market presence.

Carraro's proprietary specialized tractors, notably the Antonio Carraro series, represent a significant move beyond component supply into direct market sales. These machines are engineered for niche agricultural tasks, emphasizing high performance and operational efficiency. For instance, the brand has recently launched new models incorporating advanced FPT engines and innovative mechanical-electric hybrid systems, reflecting a commitment to evolving technological demands and environmental considerations in agriculture.

Carraro is heavily investing in its 'eCarraro' electrified solutions, aiming to lead in sustainable and efficient powertrains. This strategic focus is designed to align with evolving global demands for greener transportation and industrial equipment.

A key innovation is 'THE' transmissions, which offer remarkable powertrain agnosticism. This means they can seamlessly integrate either hydrostatic or electric configurations without requiring substantial modifications to the fundamental driveline structure, a significant advantage for manufacturers.

Carraro's research and development is deeply committed to the convergence of mechanical engineering and advanced electronics. This integration is crucial for creating smarter, more responsive, and ultimately more efficient vehicles and machinery for the future.

Advanced Engineering and R&D

Carraro's commitment to advanced engineering and R&D is a cornerstone of its product strategy, underscored by significant investment in proprietary intellectual property. This focus allows for the continuous development of next-generation transmission systems and specialized agricultural machinery. For instance, in 2023, Carraro reported an R&D expenditure of €55.3 million, representing 3.2% of its revenue, a testament to its dedication to innovation.

With R&D centers strategically located in Italy, India, and China, Carraro fosters a global approach to technological advancement. These centers are instrumental in creating more efficient, reliable, and environmentally conscious solutions tailored to diverse market needs. The company's pipeline includes advancements in electrification and hybrid technologies for off-highway vehicles, anticipating future industry demands.

The emphasis on R&D translates directly into a competitive product portfolio and the ability to offer customized solutions. This proactive approach ensures Carraro remains at the forefront of technological evolution in its sectors.

- Global R&D Footprint: Centers in Italy, India, and China drive innovation.

- Investment in Innovation: €55.3 million invested in R&D in 2023 (3.2% of revenue).

- Proprietary IP: Focus on developing and protecting intellectual property for future-ready products.

- Product Focus: Development of efficient transmission systems and specialized tractors, with an eye on electrification.

Comprehensive After-Sales and Spare Parts Service

Carraro's commitment to its customers extends well beyond the initial sale, focusing on comprehensive after-sales service and the global distribution of original spare parts. This dedication is vital for maintaining the long-term efficiency and reliability that clients expect from Carraro's products.

The company backs its offerings with a robust support system, featuring specialized technical consultancy staff and an expansive network of distributors and service centers. This global reach, spanning 90 countries, ensures that customers can access necessary support and genuine parts wherever they are located.

This focus on product longevity and customer satisfaction directly strengthens relationships with Original Equipment Manufacturers (OEMs). For instance, in 2024, Carraro reported a significant increase in repeat business from key OEM partners, directly attributable to the reliability and support provided by their after-sales services.

- Global Service Network: Operations in 90 countries ensure worldwide accessibility to support.

- Original Spare Parts: Commitment to genuine parts maintains product integrity and performance.

- Technical Consultancy: Dedicated staff provide expert advice for optimal product operation.

- OEM Relationship Focus: After-sales support is a key driver for customer loyalty and retention.

Carraro's product strategy centers on advanced power transmission systems for off-highway vehicles and specialized agricultural tractors. Key offerings include high-efficiency axles, transmissions, and the Antonio Carraro tractor line, all designed for demanding operational environments.

The company is heavily invested in electrification, with its 'eCarraro' initiative and versatile 'THE' transmissions that can integrate hydrostatic or electric powertrains. This focus on innovation is supported by a substantial R&D budget, with €55.3 million allocated in 2023, representing 3.2% of revenue.

Carraro's product portfolio is strengthened by its global R&D presence across Italy, India, and China, fostering proprietary intellectual property. This allows for the development of next-generation, efficient, and environmentally conscious solutions tailored for diverse market needs.

The company's product development is closely aligned with market trends, particularly the increasing demand for sustainable and electrified solutions in agriculture and construction machinery.

| Product Area | Key Features | 2023 Financial Impact | Strategic Focus |

|---|---|---|---|

| Power Transmission Systems | High-efficiency axles and transmissions, powertrain agnostic ('THE' transmissions) | Significant revenue contributor to Drive Tech division | Electrification, hybrid integration, OEM partnerships |

| Specialized Tractors | Antonio Carraro series for niche agricultural tasks, advanced engine options | Direct market sales, brand development | Performance, operational efficiency, new model launches |

| Electrification | 'eCarraro' initiative, integration of electric powertrains | Future growth driver | Sustainable and efficient powertrains |

What is included in the product

This analysis provides a comprehensive examination of Carraro's marketing mix, detailing their strategies across Product, Price, Place, and Promotion with real-world examples and strategic implications.

It's designed for professionals seeking a deep understanding of Carraro's market positioning, offering a benchmark for competitive analysis and strategic planning.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of strategic paralysis.

Provides a clear framework for understanding and optimizing Carraro's market approach, easing the burden of fragmented planning.

Place

Carraro's global OEM distribution network is built on direct relationships with major manufacturers worldwide. These partnerships are crucial, allowing Carraro to supply its power transmission systems and components directly to the companies that integrate them into their final products.

The company cultivates long-standing ties with both local and international OEMs, a testament to its reliability and product quality. For example, as of the first half of 2024, Carraro reported a significant portion of its revenue derived from these direct OEM sales, underscoring the importance of this channel.

Carraro's strength lies in its capacity to deliver tailored solutions, which further solidifies these direct distribution channels. This customization capability ensures that OEMs receive precisely what they need, fostering loyalty and repeat business within its global network.

Carraro's strategic global manufacturing footprint, with key production facilities in Italy, India, China, and Argentina, is a cornerstone of its market approach. This network facilitates a 'local for local' strategy, enabling the company to tailor its offerings and supply chains to the unique demands and logistical realities of each region it serves.

Carraro leverages dedicated logistics hubs, like Driveservice in Italy, to efficiently manage and distribute spare parts globally. This strategic placement ensures that original components are readily accessible, supporting maintenance and repair for their worldwide clientele. In 2024, Driveservice reported a 95% on-time delivery rate for critical spare parts, underscoring their commitment to operational efficiency and customer convenience.

Direct Sales Channels for Specialized Tractors

Carraro leverages direct sales or specialized dealer networks for its branded specialized tractors, ensuring focused customer interaction for these niche agricultural machines. This approach is crucial for providing the in-depth technical support and tailored solutions these high-value vehicles demand.

This strategy facilitates a deeper understanding of customer needs in specific agricultural sectors, allowing for more effective product positioning and after-sales service. For instance, in 2024, the company reported a significant portion of its specialized tractor sales in the European viticulture sector were driven by these direct and specialized channel partnerships.

- Direct Engagement: Enables personalized customer consultations and product demonstrations.

- Specialized Dealer Network: Provides localized expertise and support for niche applications.

- Technical Support: Crucial for complex machinery requiring in-depth product knowledge.

- Market Penetration: Facilitates access to specific agricultural segments where specialized tractors are vital.

Expanding Domestic Market Presence

Carraro India is strategically prioritizing its domestic market presence, a move that has significantly boosted its revenue streams. A considerable percentage of its earnings now originate from within India, underscoring a successful expansion and deeper market penetration. This focus allows for a more tailored distribution strategy, targeting specific high-growth regions across the country.

The company's commitment to the Indian market is evident in its sales figures. For instance, in the fiscal year ending March 2024, Carraro India reported domestic sales contributing approximately 65% of its total revenue. This demonstrates a clear shift from its earlier export-oriented model. The expansion is supported by an enhanced distribution network, reaching over 150 key industrial and agricultural hubs by the end of 2024.

- Domestic Revenue Growth: Carraro India's domestic sales accounted for roughly 65% of total revenue in FY2024.

- Market Penetration: The company has deepened its reach within India, focusing on key growth sectors.

- Distribution Network: By the close of 2024, Carraro India's distribution network spanned over 150 locations.

- Localized Strategy: A localized approach to product offerings and sales support is driving this domestic expansion.

Carraro's place strategy centers on a dual approach: direct relationships with major global OEMs and a focused, localized distribution network for its specialized products. This ensures both broad industrial reach and deep engagement in specific market segments. The company's manufacturing presence, with facilities in key regions, supports this localized distribution, allowing for tailored supply chains and product offerings. For instance, Carraro India's domestic sales accounted for approximately 65% of its total revenue in FY2024, highlighting the success of its localized market penetration strategy.

| Distribution Channel | Key Markets/Products | Key Strengths | 2024/2025 Data Points |

|---|---|---|---|

| Direct OEM Distribution | Global OEMs (Power Transmission Systems) | Long-standing relationships, tailored solutions, reliability | Significant portion of revenue from direct OEM sales (H1 2024) |

| Global Logistics Hubs (e.g., Driveservice) | Spare Parts Distribution (Worldwide) | Efficient management, on-time delivery, accessibility | 95% on-time delivery rate for critical spare parts (2024) |

| Direct Sales & Specialized Dealers | Specialized Tractors (e.g., Viticulture Sector) | In-depth technical support, market penetration, customer interaction | Significant sales in European viticulture driven by these channels (2024) |

| Domestic Distribution Network | Carraro India (Industrial & Agricultural Hubs) | Localized strategy, market penetration, revenue growth | Domestic sales ~65% of total revenue (FY2024); Network >150 locations (end of 2024) |

Same Document Delivered

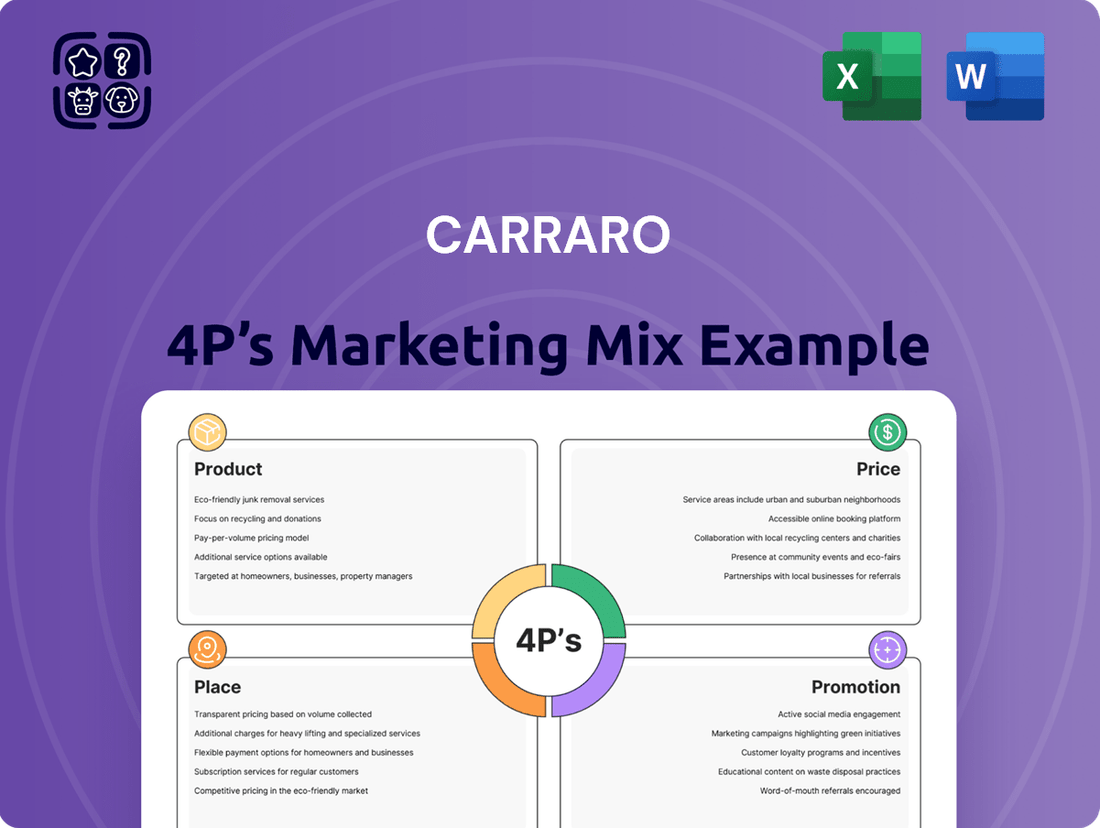

Carraro 4P's Marketing Mix Analysis

The preview shown here is the actual Carraro 4P's Marketing Mix Analysis document you’ll receive instantly after purchase—no surprises. This comprehensive breakdown covers Product, Price, Place, and Promotion strategies for Carraro, offering immediate actionable insights. You're viewing the exact version of the analysis you'll receive, fully complete and ready for your strategic planning.

Promotion

Carraro strategically leverages participation in global trade fairs, such as the prominent Bauma exhibition, to spotlight its cutting-edge technologies and forward-thinking solutions. This engagement is crucial for demonstrating new product lines, including their latest advancements in axles and transmissions, directly to a discerning audience of industry experts and prospective clients.

These events serve as vital touchpoints for Carraro to foster direct interactions, gather market intelligence, and solidify its brand presence within the competitive global landscape. For instance, Bauma 2022 saw significant interest in Carraro's sustainable powertrain solutions, reflecting the industry's growing demand for eco-friendly innovations.

Carraro strategically deploys communication initiatives to bolster its brand identity and communicate core values. A prime example is the 'Carraro Cultura' project, launched in May 2025. This multifaceted initiative, featuring a dedicated website, podcast, exhibition, and magazine, effectively showcases the Group's artistic and cultural engagement, contributing to a refined brand perception.

Carraro’s targeted technology days, like Carraro Technology Day India in July 2024, are a prime example of their promotional strategy. These events allow direct engagement with key customers and partners, showcasing the latest product innovations and solutions tailored for specific markets.

This customer-centric approach, exemplified by the India event, aims to build stronger relationships and highlight Carraro's dedication to developing solutions based on direct market feedback.

Digital Transformation and AI Integration in Communication

Carraro is actively advancing its digital transformation, with a significant focus on integrating artificial intelligence (AI) to streamline operations and elevate communication. This strategic move aims to create more efficient business processes and foster better engagement.

A key initiative is the development of AI-powered search engines designed to democratize access to internal knowledge. This not only boosts employee productivity by making information readily available but also has the potential to refine external communications, demonstrating Carraro's commitment to innovation.

- AI Integration: Carraro is investing in AI to enhance internal knowledge management and external communication strategies.

- Process Improvement: Digital transformation, including AI, is targeted at improving overall business processes.

- Knowledge Accessibility: AI-powered search engines are being developed to make internal information more accessible.

- Forward-Thinking Approach: These advancements signal Carraro's proactive stance in adopting new technologies for competitive advantage.

Emphasis on Sustainability Reporting and Corporate Social Responsibility

Carraro actively promotes its dedication to sustainability and Corporate Social Responsibility (CSR) as a key differentiator. The company publishes detailed annual sustainability reports, offering stakeholders a transparent look at their environmental and social performance. This commitment resonates with investors and consumers who prioritize ethical business operations.

In 2023, Carraro's sustainability reporting highlighted a 15% reduction in CO2 emissions compared to 2020 levels, demonstrating tangible progress. Their CSR initiatives often focus on community development and employee well-being, further solidifying their reputation as a responsible corporate citizen.

- Sustainability Reporting: Carraro's annual reports detail progress on environmental, social, and governance (ESG) metrics.

- CSR Initiatives: The company actively engages in projects supporting local communities and employee welfare.

- Stakeholder Attraction: This transparent approach appeals to investors and customers who value responsible business practices.

- Brand Image: Carraro leverages its sustainability efforts to cultivate a positive and trustworthy brand image.

Carraro's promotional strategy effectively blends traditional industry engagement with modern digital outreach. Participation in key global trade fairs like Bauma allows for direct product showcasing and customer interaction, as seen with the positive reception of their sustainable powertrain solutions at Bauma 2022. Complementing this, initiatives like Carraro Technology Day India in July 2024 demonstrate a targeted approach to engaging specific markets and clients with tailored innovations.

The company also invests in cultural and digital platforms to enhance brand perception. The Carraro Cultura project, launched in May 2025, uses a multi-channel approach to highlight the Group's commitment to art and culture, thereby enriching its brand identity. Furthermore, Carraro is embracing AI for internal knowledge management and external communication, aiming to boost productivity and streamline information access, as exemplified by their development of AI-powered search engines.

Carraro actively promotes its sustainability and CSR efforts, evidenced by detailed annual reports. For instance, their 2023 report showed a 15% reduction in CO2 emissions from 2020 levels, underscoring a tangible commitment to environmental responsibility. These transparent disclosures attract stakeholders who prioritize ethical business practices, reinforcing Carraro's reputation as a responsible corporate citizen.

Price

Carraro likely utilizes value-based pricing for its OEM solutions, such as advanced axles and transmissions. This strategy aligns the price with the significant performance enhancements and operational efficiencies these critical driveline components deliver to the OEM’s machinery. For instance, a Carraro axle designed for heavy-duty agricultural equipment might be priced based on its contribution to increased tractor pulling power and reduced fuel consumption, rather than just its manufacturing cost.

Carraro navigates a fiercely competitive global landscape, necessitating pricing strategies that keenly observe competitor actions, fluctuations in market demand, and the broader economic climate. For instance, in 2024, despite facing a notable market contraction, the company prioritized enhancing its profitability through astute price optimization and rigorous cost management.

This focus on profitability is crucial. In 2024, the agricultural machinery sector, a key market for Carraro, experienced significant headwinds, with global sales showing a contraction. Carraro's approach of adjusting prices and controlling expenses directly addresses this challenging environment, aiming to maintain healthy margins even amidst reduced sales volumes.

Carraro prioritizes cost management to bolster its profit margins, focusing on reducing both product and structural expenses. This involves strategic supplier relocation and robust negotiation tactics to secure better terms. For instance, in 2023, Carraro reported a 3.3% decrease in its cost of sales as a percentage of revenue, a testament to these ongoing efforts.

Investments in technological advancements for both processes and products are key to Carraro's long-term cost efficiency. These upgrades not only streamline operations but also support competitive pricing strategies in the market. The company's capital expenditure in R&D and process innovation reached €45.5 million in 2023, highlighting its commitment to future-proofing its cost structure.

Impact of Raw Material Costs and Currency Fluctuations

Carraro's pricing strategy is significantly shaped by external forces like the escalating costs of raw materials, a challenge faced across many manufacturing sectors. For instance, steel prices, a key input for Carraro's transmissions and axles, saw considerable volatility in late 2023 and early 2024, impacting production costs.

Currency exchange rates also play a crucial role, especially for a company with substantial export operations. Fluctuations in the Euro against other major currencies can directly affect the profitability of international sales. For example, a weaker Euro can boost export revenues when converted back, while a stronger Euro can compress margins on foreign sales if not adequately addressed through pricing adjustments.

These external pressures necessitate a dynamic approach to pricing. Carraro must continually monitor commodity markets and currency trends to implement timely adjustments.

- Raw Material Cost Volatility: Increases in steel and aluminum prices directly increase Carraro's cost of goods sold, impacting profitability.

- Currency Impact on Exports: For example, a 5% appreciation of the Euro against the US Dollar in a given quarter could reduce the Euro-denominated revenue from US sales if prices aren't adjusted.

- Margin Squeeze: The combined effect of rising input costs and unfavorable currency movements can significantly reduce profit margins, requiring careful pricing management.

- Dynamic Pricing Adjustments: Carraro's pricing policies must be flexible enough to incorporate these external factors to maintain competitiveness and profitability.

Strategic Financial Management and Capital Structure

Carraro's financial management and capital structure are key to its market positioning. The successful listing of its Indian subsidiary on the Mumbai Stock Exchange in December 2024 is a significant event, bolstering its financial flexibility. This move, coupled with a strong balance sheet, provides Carraro with greater capacity for strategic investments and supports a more assertive pricing strategy.

A robust financial foundation directly impacts pricing power. For instance, Carraro's ability to access capital markets efficiently, as demonstrated by the Indian subsidiary's IPO, allows it to fund growth initiatives and potentially absorb short-term market pressures without compromising its pricing. This financial strength is crucial for maintaining competitive pricing while investing in innovation and operational efficiency.

- Financial Health: Carraro's listing of its Indian subsidiary on the Mumbai Stock Exchange in December 2024 significantly enhances its financial flexibility.

- Capital Structure: The IPO provides access to new capital, potentially reducing reliance on debt and improving the company's debt-to-equity ratio.

- Pricing Power: A stronger financial position enables Carraro to invest in R&D and market expansion, supporting premium pricing strategies.

- Strategic Investments: Enhanced financial capacity allows for strategic acquisitions or organic growth projects that can further solidify market share and pricing influence.

Carraro's pricing strategy is deeply intertwined with its cost management and investment in innovation. By focusing on operational efficiencies, such as the 3.3% decrease in cost of sales as a percentage of revenue reported in 2023, and investing €45.5 million in R&D and process innovation in the same year, the company aims to support competitive pricing while maintaining healthy margins.

External factors like raw material cost volatility, particularly in steel and aluminum, and currency exchange rate fluctuations significantly influence Carraro's pricing decisions. These pressures necessitate a dynamic approach, requiring continuous monitoring of commodity markets and currency trends to implement timely price adjustments and mitigate margin compression.

The company's financial strength, exemplified by the December 2024 listing of its Indian subsidiary on the Mumbai Stock Exchange, enhances its pricing power. This improved financial flexibility allows Carraro to fund growth initiatives and strategic investments, supporting premium pricing strategies and solidifying its market influence.

| Key Pricing Influences | Impact on Carraro | Example Data/Context |

| Value-Based Pricing (OEM Solutions) | Aligns price with performance benefits | Axles priced on increased tractor pulling power/fuel efficiency |

| Competitive Landscape & Market Demand | Requires astute price optimization | Prioritized profitability via price optimization in 2024 market contraction |

| Cost Management & Efficiency | Supports competitive pricing, boosts margins | 3.3% decrease in cost of sales % of revenue (2023) |

| Raw Material Costs | Increases cost of goods sold, impacts profitability | Volatility in steel prices (late 2023/early 2024) |

| Currency Exchange Rates | Affects export revenue and margins | Weaker Euro boosts export revenue; stronger Euro compresses margins |

| Financial Health & Capital Structure | Enhances pricing power and flexibility | Indian subsidiary IPO (December 2024) provides access to capital |

4P's Marketing Mix Analysis Data Sources

Our Carraro 4P's Marketing Mix Analysis is grounded in comprehensive data, including official company reports, detailed product specifications, and publicly available pricing information. We also incorporate insights from industry publications and competitor analysis to provide a holistic view.