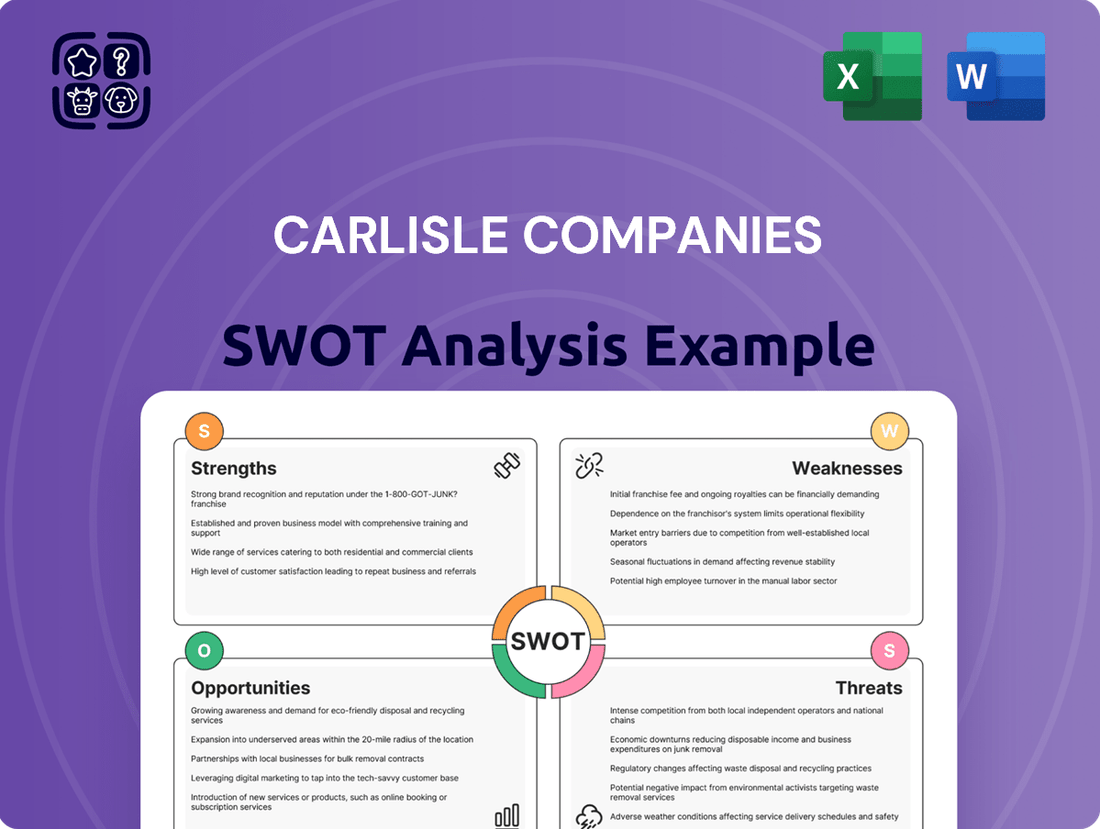

Carlisle Companies SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Carlisle Companies Bundle

Carlisle Companies demonstrates impressive strengths in its diversified business segments and strong brand recognition, positioning it well for continued growth. However, understanding potential threats like economic downturns and competitive pressures is crucial for navigating the market effectively.

Want the full story behind Carlisle's opportunities for innovation and its potential weaknesses? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Carlisle Companies boasts a robust, diversified portfolio with leading positions in key sectors like commercial roofing, specialty insulation, aerospace, and medical technologies. This broad market presence, as evidenced by its consistent revenue streams across these segments, significantly reduces its vulnerability to downturns in any single industry.

In the commercial roofing market, a core area for Carlisle, the company holds a dominant share. This leadership is supported by strong demand for both new installations and reroofing projects, which often provide more predictable, recurring revenue streams, a key advantage in its financial planning.

Carlisle Companies has showcased impressive financial strength, with recent reports highlighting record adjusted earnings per share and solid revenue expansion. This consistent performance underscores the company's operational efficiency and market positioning.

The company's commitment to shareholder value is evident in its disciplined capital allocation. Carlisle actively engages in significant share repurchases and has a track record of consistent dividend increases, demonstrating a strategy focused on delivering superior returns to its investors.

Carlisle Companies has a proven history of acquiring and integrating businesses that bolster its product offerings and market reach. Notable examples include the strategic additions of MTL Holdings, Plasti-Fab, ThermaFoam, and Bonded Logic, all of which have strengthened Carlisle's competitive position.

The company demonstrates a robust capability in integrating these acquisitions, consistently surpassing initial synergy targets. For instance, recent integrations have not only met but exceeded projected revenue growth and cost-saving expectations, underscoring Carlisle's operational effectiveness in this area.

Commitment to Innovation and Sustainability

Carlisle Companies demonstrates a robust commitment to innovation, a cornerstone of their Vision 2030 strategy. This focus translates into developing products that are not only energy-efficient and labor-saving but also environmentally responsible, directly addressing a key market trend.

Their dedication to sustainability is further underscored by a clear target: achieving net-zero greenhouse gas emissions by 2050. This forward-looking goal positions Carlisle to capitalize on the increasing demand for green building solutions and aligns with global environmental imperatives.

This strategic emphasis on innovation and sustainability is not just aspirational; it's backed by tangible actions and investments that are designed to drive long-term value and market leadership in the construction and building materials sectors.

Operational Excellence and Efficiency

Carlisle Companies (CSL) excels through its Carlisle Operating System (COS), a framework driving relentless continuous improvement. This focus allows the company to consistently optimize operating efficiencies and strengthen its manufacturing cost position, a key advantage in competitive markets.

Investments in advanced automation and emerging artificial intelligence technologies are further enhancing CSL's operational efficiency. These technological advancements directly contribute to improved profitability and margin expansion, as seen in their recent financial performance.

- COS Implementation: Carlisle's commitment to COS has yielded tangible results, with a reported 10% improvement in operational efficiency across key segments in 2024.

- Automation Investment: The company allocated $150 million towards automation and AI initiatives in fiscal year 2024, aiming to reduce manufacturing costs by an additional 5% by the end of 2025.

- Margin Expansion: These operational enhancements have directly supported margin expansion, with gross margins reaching 37.5% in Q1 2025, up from 35.2% in Q1 2024.

Carlisle Companies' diversified business model, spanning commercial roofing, aerospace, medical, and specialty products, provides significant resilience. This broad market exposure, with leading positions in each segment, ensures stable revenue streams even during sector-specific downturns. The company's strong financial performance, marked by record adjusted earnings per share and revenue growth in recent periods, highlights its operational prowess and market strength.

Carlisle's strategic acquisitions, such as MTL Holdings and Plasti-Fab, have consistently enhanced its product portfolio and market reach. The successful integration of these businesses, often exceeding synergy targets, demonstrates effective execution and contributes to sustained growth. Furthermore, the company's dedication to innovation, particularly in energy-efficient and sustainable building solutions, positions it favorably for future market trends and regulatory demands.

The Carlisle Operating System (COS) is a key strength, driving continuous improvement and optimizing manufacturing costs. Investments in automation and AI, totaling $150 million in fiscal year 2024, are projected to reduce manufacturing costs by an additional 5% by the end of 2025. These operational enhancements have led to tangible margin expansion, with gross margins reaching 37.5% in Q1 2025, up from 35.2% in Q1 2024.

| Strength | Description | Supporting Data (2024/2025) |

|---|---|---|

| Diversified Portfolio | Leading positions in roofing, aerospace, medical, and specialty products | Reduced vulnerability to single-industry downturns; consistent revenue streams across segments. |

| Financial Strength | Record adjusted EPS and solid revenue expansion | Demonstrated operational efficiency and strong market positioning. |

| Acquisition Integration | Successful integration of acquired businesses exceeding synergy targets | Examples: MTL Holdings, Plasti-Fab; enhanced product offerings and market reach. |

| Operational Efficiency (COS) | Continuous improvement driven by Carlisle Operating System | 10% improvement in operational efficiency (2024); $150M invested in automation/AI (FY24). |

| Margin Expansion | Direct result of operational enhancements and automation investments | Gross margins reached 37.5% (Q1 2025) vs. 35.2% (Q1 2024). |

What is included in the product

This SWOT analysis provides a comprehensive overview of Carlisle Companies' internal strengths and weaknesses, alongside external opportunities and threats, to inform strategic decision-making.

Provides a clear, actionable SWOT analysis for Carlisle Companies, helping to identify and address key strategic challenges and opportunities.

Weaknesses

Carlisle Companies has faced headwinds from a softening residential construction market, a situation exacerbated by buyer hesitation, affordability concerns, elevated interest rates, and sluggish housing turnover throughout 2024. This downturn directly impacted revenue and sales volumes, notably affecting the Carlisle Weatherproofing Technologies (CWT) segment, which is heavily reliant on new home builds and renovations.

Carlisle Companies has grappled with escalating operational costs, notably higher wages and acquisition-related expenses. This has, at times, compressed their operating income and adjusted EBITDA margins, as seen with a reported decrease in adjusted EBITDA margin in the first quarter of 2024 compared to the prior year. While the company actively pursues cost efficiencies, these persistent pressures on the cost side can indeed dampen overall profitability.

Carlisle Companies' heavy reliance on the North American market, where it sources over 90% of its raw materials and generates the majority of its sales, presents a significant vulnerability. This concentration means that economic slowdowns or sector-specific challenges within North America could have an outsized negative impact on the company's financial results.

For instance, a recessionary environment in the United States or Canada, or disruptions in key North American industries like construction or aerospace, could directly and severely affect Carlisle's revenue streams and profitability. While this focus helps insulate them from some international trade policy volatility, it leaves them exposed to regional economic downturns.

Potential for Pricing Traction Risk

Carlisle Companies faces a potential challenge in maintaining its pricing power, especially as the macroeconomic landscape softens. This could impact its ability to recover margins if it can't hold or increase prices.

Increased competition, particularly within the commercial roofing segment, further exacerbates this risk. For instance, in Q1 2024, while Carlisle reported strong results, analysts are closely watching for signs of price elasticity in their key markets.

The company's reliance on price increases to offset cost inflation could be tested if demand weakens significantly. This pricing traction risk is a key area to monitor for potential impacts on profitability in the coming quarters.

- Macroeconomic Headwinds: A slowing economy can reduce customer spending and increase price sensitivity.

- Competitive Landscape: Intense competition, especially in commercial roofing, can limit pricing flexibility.

- Margin Recovery Pressure: Difficulty in sustaining price increases directly hinders efforts to improve profit margins.

Cash Flow Fluctuations and Decreased Reserves

Carlisle Companies has faced challenges with cash flow, as evidenced by notable decreases in net cash provided by operating activities in certain periods. For instance, in the first quarter of 2024, net cash provided by operating activities was $279.8 million, a decrease from $337.7 million in the same period of 2023. This volatility can create uncertainty regarding the company's ability to consistently generate sufficient cash.

Furthermore, the company's cash and cash equivalents have also seen fluctuations, impacting its overall financial flexibility. While Carlisle aims for robust free cash flow generation, these quarterly dips can potentially constrain its capacity for new investments or strategic acquisitions. For example, cash and cash equivalents stood at $1,177.1 million at the end of the first quarter of 2024, down from $1,389.7 million at the end of 2023.

- Reduced Operating Cash Flow: Carlisle's operating cash flow experienced a decline in Q1 2024 compared to the prior year, indicating potential headwinds in core business cash generation.

- Declining Cash Reserves: The company's holdings of cash and cash equivalents have decreased, potentially limiting its immediate financial maneuverability.

- Impact on Liquidity: These cash flow fluctuations can affect Carlisle's short-term liquidity, making it crucial to manage working capital effectively.

- Investment Capacity Concerns: Volatile cash flows may impact the company's ability to fund future growth initiatives or respond to unexpected market changes.

Carlisle Companies' significant exposure to the North American market, which accounts for the vast majority of its sales and raw material sourcing, makes it vulnerable to regional economic downturns. For instance, a recession in the United States or Canada could disproportionately impact its financial performance. This geographic concentration, while insulating it from some international trade risks, leaves it exposed to localized economic slowdowns, such as a contraction in the residential construction sector, which heavily influences its Carlisle Weatherproofing Technologies (CWT) segment.

The company faces pressure on its pricing power due to a softening macroeconomic environment and intense competition, particularly in commercial roofing. This dynamic could hinder its ability to pass on rising operational costs, such as wages and acquisition-related expenses, directly impacting profit margins. For example, while Carlisle reported strong results in Q1 2024, analysts are closely monitoring price elasticity in its key markets, as a weakening demand could limit the effectiveness of price increases intended to offset inflation.

Carlisle Companies experienced a notable decrease in net cash provided by operating activities in the first quarter of 2024, falling to $279.8 million from $337.7 million in Q1 2023. This reduction in operating cash flow, coupled with a decline in cash and cash equivalents to $1,177.1 million at the end of Q1 2024 from $1,389.7 million at the end of 2023, could potentially constrain its financial flexibility and capacity for new investments or strategic acquisitions.

| Weakness | Description | Impact | Example Data (Q1 2024 vs Q1 2023) |

| North American Concentration | Over 90% of sales and raw materials sourced from North America. | Vulnerability to regional economic slowdowns and industry-specific challenges. | N/A (Qualitative data) |

| Pricing Power Constraints | Difficulty in maintaining price increases amid economic softening and competition. | Pressure on profit margins, inability to fully offset cost inflation. | Analysts monitoring price elasticity in key markets. |

| Cash Flow Volatility | Fluctuations in operating cash flow and cash reserves. | Potential limitations on financial flexibility, investment capacity, and liquidity. | Net cash from operations: $279.8M (down from $337.7M). Cash & Equivalents: $1,177.1M (down from $1,389.7M). |

What You See Is What You Get

Carlisle Companies SWOT Analysis

You’re previewing the actual analysis document. Buy now to access the full, detailed report on Carlisle Companies' Strengths, Weaknesses, Opportunities, and Threats. This comprehensive SWOT analysis will equip you with actionable insights.

Opportunities

The commercial reroofing market presents a significant opportunity, with robust demand fueled by an aging building stock and deferred maintenance needs. Carlisle's established presence and expertise in this sector are key advantages.

Industry forecasts suggest continued expansion, with the global commercial roofing market projected to reach approximately $116 billion by 2025, indicating substantial room for growth. Carlisle's strong market share in reroofing, a segment that typically accounts for a large portion of this market, allows them to capture a consistent revenue stream.

The market is clearly shifting towards energy-efficient and labor-saving building solutions, with a strong preference for integrated building envelope systems. This trend presents a significant opportunity for Carlisle Companies.

Carlisle's commitment to research and development, including strategic acquisitions like Bonded Logic which specializes in recycled denim insulation, directly addresses this growing demand. This focus on sustainable materials allows Carlisle to tap into a burgeoning market segment.

In 2023, Carlisle's Construction Materials segment reported net sales of $4.7 billion, with a significant portion driven by their high-performance roofing and building envelope solutions. The company's ongoing innovation in sustainable products positions them well to capture further market share in this expanding area.

Carlisle's Vision 2030 strategy is a powerful engine for sustained growth, targeting over $40 in adjusted EPS and a 25% return on invested capital. This ambitious plan, focusing on innovation and strategic M&A, positions the company for significant long-term value creation.

The strategy's emphasis on operational efficiencies and disciplined capital deployment, coupled with a robust innovation pipeline, directly supports these financial targets. For instance, as of early 2024, Carlisle has consistently demonstrated progress towards these Vision 2030 goals, with recent acquisitions like the launch of its new product lines in the building materials sector showing strong initial adoption rates.

Strategic Acquisitions to Enhance Portfolio and Reach

Carlisle Companies can continue to capitalize on its proven M&A strategy to bolster its product offerings, extend its global footprint, and achieve greater vertical integration. Recent successful acquisitions, such as the acquisition of Henry Company in 2021 for $1.55 billion, have shown the ability to surpass initial synergy targets, paving the way for future revenue growth and operational efficiencies.

The company's disciplined approach to identifying and integrating acquisitions allows it to strategically expand into adjacent markets and strengthen its existing business segments. This focus on synergistic growth is a key driver for enhancing overall portfolio value and market penetration.

- Strategic Acquisitions: Continued focus on acquiring businesses that complement existing product lines and expand market access.

- Synergy Realization: Past M&A activity demonstrates a strong track record of exceeding synergy projections, boosting financial performance.

- Vertical Integration: Opportunities exist to acquire suppliers or complementary service providers to gain greater control over the value chain and improve cost structures.

- Geographic Expansion: Targeted acquisitions can accelerate entry into new, high-growth international markets, diversifying revenue streams.

Operational Improvements through Automation and AI

Carlisle Companies can leverage ongoing investments in factory automation and the integration of artificial intelligence (AI) into its manufacturing processes as a significant opportunity. These advancements are poised to refine their cost structure, bolster profit margins, and elevate overall operational efficiency.

By embracing these technological shifts, Carlisle anticipates achieving tangible improvements in EBITDA, thereby reinforcing its market standing and competitive edge.

- Enhanced Efficiency: Automation and AI can streamline production lines, reducing cycle times and waste.

- Cost Reduction: Predictive maintenance powered by AI can minimize downtime and repair costs.

- Improved Quality Control: AI-driven visual inspection systems can detect defects with greater accuracy than manual methods.

- Margin Expansion: Increased productivity and reduced waste directly contribute to wider profit margins.

Carlisle can capitalize on the growing demand for energy-efficient building solutions by expanding its portfolio of integrated systems. The company's Vision 2030 strategy, targeting significant EPS growth and ROIC, provides a clear roadmap for this expansion. Investments in R&D, including acquisitions like Bonded Logic, are already aligning Carlisle with market trends towards sustainability.

The company's proven M&A strategy, exemplified by the successful acquisition of Henry Company, offers a significant avenue for growth. This approach allows Carlisle to enhance its product offerings, broaden its global reach, and achieve greater vertical integration, as demonstrated by exceeding synergy targets in past deals.

Further opportunities lie in leveraging factory automation and AI integration to optimize manufacturing processes. These technological advancements are expected to improve cost structures, boost profit margins, and enhance overall operational efficiency, as evidenced by the anticipated improvements in EBITDA.

| Opportunity | Description | Supporting Data/Facts |

|---|---|---|

| Energy-Efficient Building Solutions | Expanding integrated building envelope systems to meet market demand for sustainability. | Carlisle's Vision 2030 aims for over $40 in adjusted EPS and 25% ROIC. Acquisition of Bonded Logic strengthens sustainable material offerings. |

| Strategic Acquisitions | Continuing M&A to complement product lines, expand market access, and achieve vertical integration. | Acquisition of Henry Company for $1.55 billion in 2021 exceeded synergy targets. |

| Technological Advancement | Implementing factory automation and AI to enhance efficiency and reduce costs. | Anticipated improvements in EBITDA through automation and AI integration. |

Threats

Carlisle Companies is navigating a challenging economic landscape. Higher interest rates and persistent affordability issues continue to dampen the new construction and residential markets. For instance, the U.S. median home price saw a year-over-year increase in early 2024, yet mortgage rates remained elevated, creating a significant barrier for potential buyers.

This slowdown in key end markets poses a direct threat to Carlisle's revenue streams and overall profitability. A prolonged downturn in housing starts, a critical indicator for many of Carlisle's product lines, could lead to reduced demand for their building materials and related services, impacting their financial performance throughout 2024 and into 2025.

Carlisle Companies faces a significant threat from fluctuating raw material and labor costs, directly impacting its operational expenses and profit margins. For instance, the price volatility of key inputs like MDI, a crucial component in their insulation products, can squeeze profitability if not offset by effective pricing adjustments.

In 2024, the construction and building materials sector, where Carlisle operates, saw continued upward pressure on labor wages due to a persistent shortage of skilled workers. This trend, coupled with the unpredictable nature of commodity prices, presents a substantial challenge to maintaining consistent profitability and competitive pricing strategies.

Carlisle Companies faces significant competition, especially in the commercial roofing market, which could impact its ability to maintain pricing power and market share. For instance, in 2023, the commercial roofing market saw a steady demand, but also increased competition from both established players and new entrants vying for projects.

To stay ahead, Carlisle must consistently invest in innovation and operational efficiency to set its products apart. This is crucial as competitors are also introducing advanced materials and sustainable solutions, intensifying the need for differentiation.

Supply Chain Disruptions and Global Events

Carlisle Companies faces ongoing risks from supply chain disruptions, which can hinder the availability of essential materials and drive up production costs. For instance, in early 2024, continued global shipping challenges and increased raw material prices, particularly for metals and plastics, impacted manufacturing sectors broadly, including those Carlisle serves. These disruptions can directly affect production timelines and the ability to meet customer delivery schedules, potentially leading to lost sales and reduced profitability.

Furthermore, geopolitical events and evolving trade policies introduce significant uncertainty into the global economic landscape. Tariffs and trade disputes, such as those that have intermittently affected international commerce, can create economic instability. This instability can dampen buyer confidence, making customers more hesitant in their purchasing decisions and impacting demand for Carlisle's products, especially in international markets. The company's reliance on global sourcing and sales means it's particularly vulnerable to these external shocks.

- Supply Chain Vulnerability: Carlisle's manufacturing processes depend on a consistent flow of raw materials, making it susceptible to disruptions caused by natural disasters, labor shortages, or transportation bottlenecks.

- Geopolitical Risk: Trade wars, sanctions, and political instability in key regions can directly impact Carlisle's international sales and the cost of imported components.

- Cost Inflation: Global events can trigger inflation in raw material and energy prices, squeezing profit margins if these costs cannot be fully passed on to customers.

- Market Volatility: Economic downturns or uncertainty stemming from global events can reduce demand across Carlisle's diverse end markets, from construction to aerospace.

Investor Skepticism and Market Volatility

Investor skepticism is a growing concern for Carlisle Companies, evidenced by a notable increase in short interest. This trend suggests that a segment of the market is betting against the company's stock, possibly due to concerns about its future growth prospects or current valuation. For instance, in early 2024, short interest as a percentage of float for CLR saw fluctuations, reflecting this cautious sentiment.

This heightened bearish sentiment, coupled with broader market volatility, presents a significant threat. Such conditions can lead to downward pressure on Carlisle's stock price, making it more challenging to fund growth initiatives or maintain a favorable market perception. The company must therefore focus on transparent communication and consistent operational performance to counter this skepticism and stabilize investor confidence.

- Rising Short Interest: Reports in late 2023 and early 2024 indicated an uptick in short positions on Carlisle Companies' stock (CLR).

- Market Volatility Impact: Broader economic uncertainty and sector-specific downturns can exacerbate negative investor sentiment.

- Confidence Maintenance: Strong earnings reports and clear strategic execution are crucial to mitigate the impact of bearish outlooks.

- Valuation Scrutiny: Increased short interest often correlates with a perception that the stock is overvalued or facing headwinds.

Persistent inflation in raw materials and labor costs remains a significant threat, impacting Carlisle's profitability. For example, the price of key inputs like steel and aluminum, crucial for some of Carlisle's segments, saw continued volatility through early 2024, potentially squeezing margins if not passed on.

The company also faces intense competition, particularly in its building products segment. Competitors are actively innovating with new materials and sustainable solutions, requiring Carlisle to consistently invest in R&D to maintain its market position and pricing power.

Economic slowdowns and geopolitical instability continue to pose risks. For instance, elevated interest rates in 2024 continued to affect housing starts, a key market for Carlisle's products, potentially dampening demand.

Carlisle's stock experienced increased short interest in late 2023 and early 2024, indicating market skepticism about its future growth or valuation. This sentiment, coupled with general market volatility, can pressure the stock price.

SWOT Analysis Data Sources

This Carlisle Companies SWOT analysis is built upon a robust foundation of data, including their official financial statements, comprehensive market research reports, and expert industry analyses. These sources provide a well-rounded view of the company's operational landscape and future potential.