Carlisle Companies Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Carlisle Companies Bundle

Carlisle Companies operates within a dynamic industrial landscape where buyer power and the threat of substitutes can significantly impact profitability. Understanding the intensity of these forces is crucial for strategic planning.

The complete report reveals the real forces shaping Carlisle Companies’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Carlisle Companies' diverse operations, spanning construction materials, weatherproofing, and interconnect technologies, mean supplier concentration varies greatly by segment. In specialized areas like certain interconnect components, where only a handful of suppliers exist, their bargaining power is considerably elevated.

The availability of substitute inputs significantly curtails the bargaining power of suppliers for Carlisle Companies. If Carlisle can easily switch between various raw materials or components, suppliers find themselves with less leverage. For instance, if aluminum can readily replace steel in certain applications without substantial cost increases or performance degradation, suppliers of steel will have diminished power.

In 2024, Carlisle's diversified product portfolio, spanning areas like building envelope solutions and aerospace components, means they often utilize a range of materials. The ease of integration for these substitutes is crucial. For example, if a new, cost-effective polymer emerges that can be used in place of a specific metal alloy in their aerospace division, the power of the original alloy's supplier is directly challenged.

The bargaining power of suppliers for Carlisle Companies is significantly influenced by switching costs. These costs encompass not only the direct financial outlays but also the operational disruptions and investments required to transition to a new supplier. For instance, if Carlisle relies on highly specialized components or materials that necessitate extensive retooling of its manufacturing lines or lengthy requalification processes, the supplier holds considerable leverage.

In 2024, the construction materials sector, where Carlisle operates, saw continued emphasis on supply chain resilience. Companies like Carlisle are actively seeking to standardize processes and explore diversified sourcing strategies to mitigate the impact of high switching costs. This proactive approach aims to reduce dependence on any single supplier, thereby diffusing supplier bargaining power.

Uniqueness of Supplier Offerings

Suppliers offering highly differentiated or critical components, especially in specialized areas, wield significant bargaining power. For Carlisle Companies, if their product quality or performance heavily relies on a specific supplier's unique technology or material, that supplier gains substantial influence. This is particularly true in sectors like advanced materials or niche manufacturing where few alternatives exist.

- Differentiated Offerings: Suppliers with proprietary technologies or unique materials that are difficult for Carlisle to replicate or source elsewhere possess higher bargaining power.

- Critical Inputs: If a supplier provides an essential component without which Carlisle's production would halt or be severely impacted, their leverage increases.

- Limited Substitutes: The fewer viable alternatives available for a particular input, the stronger the supplier's position.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Carlisle's business operations directly impacts their bargaining power. If suppliers can become competitors, they can dictate more stringent terms, potentially forcing Carlisle into less favorable supply agreements to secure necessary inputs. This is particularly relevant if suppliers possess unique capabilities or control critical raw materials.

However, the likelihood of this threat materializing depends on the specific industry dynamics and Carlisle's own competitive advantages. In highly specialized manufacturing sectors where Carlisle possesses significant proprietary technology, extensive R&D investment, and economies of scale, suppliers may find it prohibitively expensive and complex to replicate Carlisle's integrated operations and market reach. For instance, in 2024, the advanced materials sector, where Carlisle operates, often requires substantial capital expenditure and specialized knowledge, creating high barriers to entry for potential forward-integrating suppliers.

- Supplier Forward Integration Threat: Suppliers moving into Carlisle's market as competitors increases their leverage.

- Impact on Carlisle: This can lead to less favorable contract terms for Carlisle to maintain supply continuity.

- Mitigating Factors: Carlisle's specialized manufacturing expertise and significant scale in 2024 act as deterrents to supplier forward integration.

- Industry Context: High barriers to entry in specialized manufacturing, requiring substantial investment and unique know-how, reduce this threat.

The bargaining power of Carlisle Companies' suppliers is a nuanced factor, heavily dependent on the specific segment and the nature of the inputs. In 2024, while Carlisle's scale and diversification offer some leverage, suppliers of highly specialized or critical components, particularly those with proprietary technology and few substitutes, can command significant power. This is evident in niche markets where switching costs are high, potentially impacting Carlisle's operational flexibility and cost structure.

| Factor | Impact on Carlisle | 2024 Context |

|---|---|---|

| Supplier Concentration | High concentration in specialized segments grants suppliers more power. | Varies by segment; interconnect technologies may see higher concentration. |

| Availability of Substitutes | Low availability of substitutes increases supplier leverage. | Carlisle actively seeks substitutes to mitigate this in construction materials. |

| Switching Costs | High switching costs (retooling, requalification) empower suppliers. | Standardization efforts in 2024 aim to reduce these costs. |

| Input Differentiation | Highly differentiated or critical inputs give suppliers significant power. | Proprietary technologies in aerospace components are a key example. |

| Forward Integration Threat | Suppliers integrating forward can dictate terms. | High barriers to entry in specialized manufacturing (2024) limit this for Carlisle. |

What is included in the product

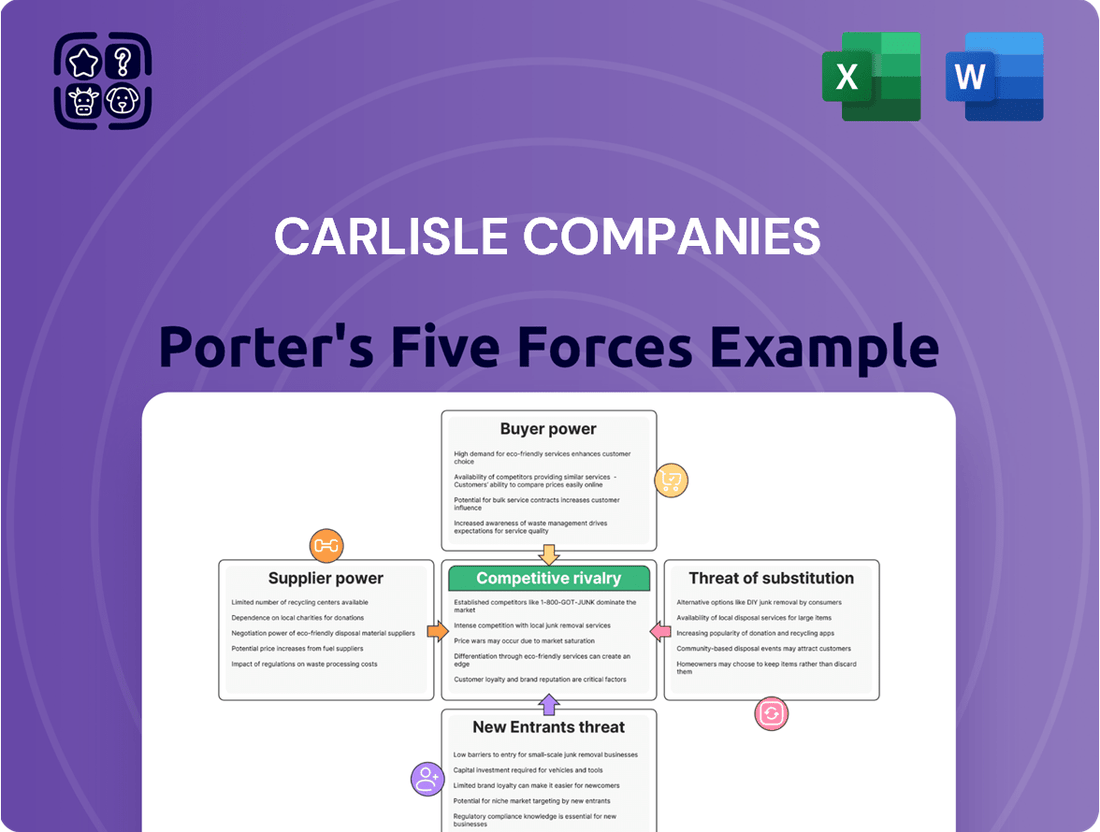

This analysis reveals the competitive intensity and profitability potential within Carlisle Companies' operating industries, detailing the power of buyers and suppliers, the threat of new entrants and substitutes, and the rivalry among existing competitors.

Effortlessly gauge competitive intensity with a visual representation of Carlisle's Porter's Five Forces, highlighting key strategic pressures.

Customers Bargaining Power

Carlisle Companies operates across a wide array of sectors, including commercial roofing, aerospace, and medical technologies. The degree of customer concentration within each of these distinct markets directly impacts their collective bargaining power. For instance, in the aerospace sector, where a few major manufacturers represent a significant portion of demand, these large customers typically wield more influence over pricing and terms.

Customers who buy significant quantities of Carlisle's products naturally have more leverage when it comes to negotiating prices and favorable terms. This is a common dynamic in many industries, where volume translates directly into purchasing power.

Carlisle Companies benefits from a broad revenue base, with sales spread across a diverse array of customers and projects. This diversification is a key strategy that softens the blow from any single large customer's demands, as no one buyer represents an overwhelming portion of their business. For instance, in 2023, Carlisle's net sales were approximately $5.2 billion, spread across its various segments, indicating a healthy distribution of revenue.

Conversely, when a customer base is smaller and more fragmented, individual buyers typically wield less bargaining power. Their ability to influence pricing or terms is diminished compared to those who purchase in bulk, making them less of a threat to Carlisle's profitability.

The ease with which Carlisle's customers can find alternative products or solutions from competitors directly impacts customer power. If customers have many viable options for roofing materials, insulation, or interconnect components, their bargaining power increases.

For instance, in the construction materials sector, the availability of numerous suppliers for standard roofing membranes or basic insulation can empower buyers. This often leads to price sensitivity and a greater ability to negotiate terms. In 2024, the global construction materials market saw continued competition, with many players offering comparable basic products.

Carlisle's strategy to mitigate this involves a strong emphasis on innovative and specialized solutions, such as advanced EPDM roofing systems or high-performance thermal management products. These differentiated offerings aim to reduce the attractiveness of substitutes and, consequently, lessen the bargaining power of customers by creating a unique value proposition.

Switching Costs for Customers

When it's difficult or expensive for customers to switch from Carlisle's products to a competitor's, their power to negotiate prices or demand concessions diminishes. This can stem from how deeply integrated Carlisle's solutions are into a customer's operations, the strength of existing supply chain ties, or if specialized training is needed to use alternative products.

Carlisle Companies actively works to make switching less appealing. For instance, their 'Carlisle Experience' initiatives are designed to foster robust customer loyalty. By providing exceptional service and integrated solutions, they aim to create a sticky customer base, thereby reducing the inclination for customers to explore alternatives.

High switching costs are a significant factor in maintaining Carlisle's competitive position. For example, in the commercial roofing sector, the complexity of integrating new materials with existing building structures and the need for certified installers can create substantial barriers to switching. This protects Carlisle's market share and pricing power.

- Reduced Customer Leverage: High switching costs directly limit customers' ability to bargain for lower prices or better terms.

- Carlisle's Loyalty Programs: Initiatives like the 'Carlisle Experience' are strategic tools to increase customer retention and minimize churn.

- Operational Integration: The degree to which Carlisle's products are embedded within customer workflows is a key determinant of switching costs.

Customer Price Sensitivity

Carlisle Companies' customers exhibit varying degrees of price sensitivity. In markets where Carlisle's products are more standardized or face intense competition, customers can more easily switch suppliers, thereby increasing their bargaining power. This is particularly true for less differentiated product lines.

However, Carlisle's strategic focus on specialized, high-performance solutions, especially in sectors like medical technologies or aerospace, significantly reduces customer price sensitivity. When customers rely on Carlisle for critical, engineered components where performance and reliability are paramount, the cost of the component becomes a smaller fraction of the overall value or risk, diminishing the customers' leverage.

For instance, in the aerospace sector, the stringent regulatory requirements and the critical nature of components mean that performance and safety often outweigh minor price differences. This allows Carlisle to command better pricing and reduces the bargaining power of customers in these specialized segments. In 2023, Carlisle's revenue from its aerospace segment demonstrated continued strength, reflecting the demand for its specialized offerings.

- Price Sensitivity Varies: Customers in commoditized markets have higher bargaining power due to easier supplier switching.

- Niche Market Advantage: In specialized areas like medical technologies, customers are less price-sensitive due to product criticality and performance needs.

- Value-Based Pricing: Carlisle leverages its engineered solutions to reduce price sensitivity, particularly in high-stakes industries.

- 2023 Performance: Carlisle's aerospace segment revenue in 2023 highlights the market's acceptance of value-based pricing for critical components.

The bargaining power of Carlisle Companies' customers is influenced by several factors, including customer concentration, switching costs, and price sensitivity. In markets with few large buyers, like aerospace, customers can exert more pressure on pricing. Conversely, a fragmented customer base generally means less individual customer leverage. The company's diversification across various sectors, with 2023 net sales of approximately $5.2 billion, helps to mitigate the impact of any single customer's demands.

High switching costs, often due to operational integration or specialized product requirements, significantly reduce customer power. Carlisle's focus on innovative and specialized solutions, such as advanced roofing systems, aims to create unique value propositions that make it harder for customers to switch to competitors. For example, in commercial roofing, the need for certified installers and integration with existing structures creates substantial barriers to switching.

| Factor | Impact on Customer Bargaining Power | Carlisle's Strategy/Mitigation |

|---|---|---|

| Customer Concentration | High in concentrated markets (e.g., aerospace), low in fragmented markets. | Diversified revenue base (2023 net sales ~$5.2B) dilutes impact of any single large customer. |

| Switching Costs | High when products are integrated or specialized; low for commoditized goods. | Focus on innovative, specialized solutions and customer loyalty programs ('Carlisle Experience'). |

| Price Sensitivity | High for standardized products; low for critical, high-performance components. | Emphasis on value-based pricing in niche markets (e.g., aerospace, medical technologies) where performance outweighs cost. |

Same Document Delivered

Carlisle Companies Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details Carlisle Companies' competitive landscape through Porter's Five Forces, analyzing the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within its industries. This comprehensive assessment provides actionable insights into the strategic positioning and profitability drivers for Carlisle.

Rivalry Among Competitors

Carlisle Companies operates in diverse markets, facing a mix of large, established competitors and smaller, specialized firms. For instance, in the commercial roofing sector, companies like Owens Corning and CertainTeed are significant players, while the insulation market also features substantial competition. This broad competitive landscape, with numerous comparable businesses, naturally escalates rivalry as each entity strives to capture market share.

The growth rate across Carlisle Companies' key markets, including commercial roofing, specialty insulation, aerospace, and medical technologies, directly influences competitive intensity. A robust growth rate in these sectors, such as the projected healthy CAGR for the insulation market, can attract new entrants and encourage existing players to expand aggressively.

Even in expanding markets, rivalry can become fierce if companies are heavily investing in market share defense or rapid expansion. For instance, the commercial roofing market is anticipated to experience steady growth, but this doesn't preclude intense competition as firms vie for dominance.

Carlisle Companies actively pursues product differentiation through highly engineered solutions, notably its energy-efficient building envelope products. This strategy aims to set its offerings apart in a competitive landscape. For instance, in 2023, Carlisle's construction materials segment, which includes these innovative products, generated over $3.5 billion in revenue, highlighting the market's receptiveness to differentiated offerings.

However, the intensity of rivalry hinges on how easily competitors can replicate these innovations or if the market trends towards commoditization. If competitors can quickly develop comparable technologies or if demand shifts towards more standardized, price-sensitive options, Carlisle's differentiation advantage could erode, leading to increased competitive pressure.

Switching Costs for Customers

Low switching costs for customers in the building materials and specialty products sectors can significantly fuel competitive rivalry. When it’s easy and inexpensive for customers to change suppliers, they are more likely to shop around, putting pressure on companies like Carlisle to offer competitive pricing and superior value. This dynamic means that any perceived advantage by a competitor can quickly erode market share.

Carlisle Companies actively works to mitigate these low switching costs by focusing on delivering a differentiated customer experience. Their strategy revolves around the ‘Carlisle Experience,’ which emphasizes integrated solutions and a high level of service. By bundling products and services, and ensuring seamless integration into customer projects, Carlisle aims to build stronger relationships and make the prospect of switching to another provider less appealing.

The effectiveness of this strategy is crucial, especially given the industry landscape. For instance, in the construction sector, where Carlisle operates, project timelines and reliability are paramount. A customer who has a positive experience with Carlisle's integrated solutions and reliable support is less likely to risk disruption by switching to a new, unproven supplier for future projects, even if initial price differences exist.

- Low Switching Costs: Customers can easily move to competitors, increasing price pressure and rivalry.

- Carlisle's Strategy: Focus on the 'Carlisle Experience' and integrated solutions to enhance customer loyalty.

- Value Proposition: Differentiating through service and product integration makes switching less attractive.

Exit Barriers

Carlisle Companies likely faces moderate exit barriers. While some specialized assets might exist, the company's diversified portfolio across various industries, including building envelope, aerospace, and technology, suggests that a complete divestiture of all segments simultaneously might be complex but not prohibitively difficult. The ability to sell off individual business units or product lines would mitigate the impact of high exit barriers.

High exit barriers can trap underperforming companies in the market, intensifying competitive rivalry. This can manifest as price wars or aggressive promotional activities as these firms strive to maintain market share and cover fixed costs. For Carlisle, this means that even if certain segments are struggling, the difficulty in exiting those operations could lead to sustained pressure from less efficient rivals.

Consider the implications of specialized assets. If Carlisle possesses unique manufacturing equipment or proprietary technology in a specific division, selling that particular asset might be challenging, thereby increasing the cost and time to exit that segment. This would, in turn, keep that business unit active, potentially competing aggressively even if profitability is low.

- Specialized Assets: The presence of highly specific machinery or intellectual property can make it difficult and costly to divest a business unit, potentially keeping it in operation longer than economically rational.

- Long-Term Contracts: Existing commitments with customers or suppliers can obligate a company to continue operations even in unfavorable market conditions, acting as a tether to the industry.

- Employee Severance Costs: Significant liabilities associated with laying off a large workforce can deter companies from exiting a market quickly, especially if those costs are substantial.

- Government or Regulatory Constraints: In some sectors, regulatory approvals or specific compliance requirements might need to be met before a company can cease operations, adding another layer of exit difficulty.

Carlisle Companies faces significant competitive rivalry due to numerous players in its diverse markets, from large established firms to specialized niche operators. The commercial roofing sector, for example, sees competition from giants like Owens Corning and CertainTeed, while the insulation market also hosts substantial players. This broad competitive landscape means companies must constantly innovate and compete for market share, especially as growth in sectors like commercial roofing and insulation attracts more attention.

Carlisle's strategy of product differentiation, particularly with its energy-efficient building envelope solutions, aims to counter this rivalry. In 2023, its construction materials segment, featuring these advanced products, generated over $3.5 billion in revenue, indicating customer interest in superior offerings. However, the threat of competitors replicating these innovations or a market shift towards commoditized, price-sensitive products could diminish this advantage and intensify direct competition.

Low switching costs for customers in Carlisle's key markets, such as building materials and specialty products, heighten competitive rivalry. When it is easy and inexpensive for customers to change suppliers, they are more inclined to seek better deals, forcing companies like Carlisle to maintain competitive pricing and value propositions. Carlisle counters this by emphasizing its 'Carlisle Experience,' focusing on integrated solutions and superior service to foster customer loyalty and make switching less appealing.

| Competitor Factor | Description | Impact on Carlisle |

|---|---|---|

| Number of Competitors | Many players in diverse markets (roofing, insulation, aerospace, medical). | High rivalry, pressure on market share. |

| Market Growth Rate | Healthy growth in key sectors like insulation. | Attracts new entrants, intensifies competition. |

| Product Differentiation | Carlisle's focus on energy-efficient building envelope products. | Helps mitigate rivalry, but replicability is a risk. |

| Switching Costs | Generally low for customers in building materials. | Increases price sensitivity and rivalry. |

SSubstitutes Threaten

The threat of substitutes for Carlisle Companies is significant, particularly in its core markets. Customers can often find alternative products or services that meet similar needs, impacting Carlisle's pricing power and market share. For instance, in the commercial roofing sector, while Carlisle offers advanced systems, other materials like TPO, PVC, and even traditional asphalt shingles serve the same fundamental purpose, with varying cost and performance profiles.

In the insulation segment, the availability of diverse materials such as fiberglass, mineral wool, spray foam, and rigid foam boards presents a constant substitute threat. Each offers different R-values, installation methods, and price points, allowing customers to choose based on their specific project requirements and budget. This broad range of alternatives means Carlisle must continually innovate and demonstrate superior value to retain customers.

The appeal of substitutes hinges on their price versus performance. If alternatives deliver similar or better results for less money, Carlisle faces a greater threat. For instance, in the building envelope market, lower-cost, less durable materials could lure customers away from Carlisle's premium offerings if the price gap widens significantly.

Carlisle Companies actively counters this by emphasizing its innovative solutions. Their focus on products that reduce labor costs and are environmentally sound presents a compelling value proposition. This strategy aims to demonstrate that the long-term benefits and operational efficiencies of Carlisle's products justify their price, making them a more attractive choice than cheaper, less capable substitutes.

Customer willingness to switch to substitutes is a key factor in understanding competitive pressure. This willingness is shaped by how aware customers are of available alternatives, their perception of the risks involved in switching, and the strength of their loyalty to existing brands. For instance, in the construction sector, where product malfunctions can lead to costly failures and safety concerns, customers often exhibit a lower propensity to adopt unproven substitutes, preferring the reliability of established solutions.

Technological Advancements in Substitute Industries

Technological advancements in industries that offer alternatives to Carlisle's core products pose a significant threat. Innovations in smart building materials and integrated systems, for example, could provide comparable or superior performance in areas like energy efficiency and weatherproofing, potentially reducing demand for traditional roofing and building envelope solutions. By mid-2024, the global smart building market was projected to reach over $100 billion, indicating substantial investment and rapid development in competing technologies.

Consider the impact of new construction methodologies. Advanced prefabrication techniques or the development of novel composite materials could offer faster installation and lower lifecycle costs, directly challenging Carlisle's established product lines. These emerging solutions might bypass the need for many of the specialized materials and systems Carlisle currently provides. For instance, the increasing adoption of modular construction, which saw significant growth in 2024, offers a compelling alternative to traditional on-site building methods.

- Emerging Smart Materials: Innovations in self-healing concrete or phase-change materials could reduce reliance on traditional sealants and insulation.

- Advanced Construction Techniques: Prefabricated building components and 3D printing in construction offer faster, potentially cheaper alternatives.

- Digital Integration: Smart sensors and building management systems can offer integrated solutions for energy efficiency and monitoring, potentially displacing standalone products.

- Material Science Breakthroughs: Development of new, lightweight, and highly durable materials in other sectors could find applications in construction, creating substitutes.

Regulatory or Environmental Shifts Favoring Substitutes

Changes in building codes or environmental regulations can significantly impact the demand for Carlisle's products. For instance, stricter energy efficiency mandates might push builders towards alternative insulation materials that offer superior R-values, potentially reducing the market share for Carlisle's existing offerings. In 2024, the global green building materials market was valued at approximately $250 billion, with a projected compound annual growth rate of over 10%, indicating a strong shift towards sustainable alternatives.

Sustainability trends are increasingly influencing material choices in construction. As awareness grows around embodied carbon and lifecycle assessment, materials with lower environmental footprints may gain favor. This could present a threat if Carlisle's product portfolio is perceived as less sustainable compared to emerging substitutes, especially as corporate sustainability reporting becomes more rigorous.

Consider specific examples: increased mandates for recycled content in building materials could boost the adoption of certain insulation types over others, impacting Carlisle's roofing and building envelope solutions. Similarly, a growing preference for bio-based or low-VOC (volatile organic compound) products could create challenges for traditional material suppliers.

- Regulatory Shifts: New building codes favoring energy efficiency or specific material compositions can directly impact demand for existing products.

- Environmental Trends: Growing consumer and industry preference for sustainable and low-carbon materials presents a competitive challenge.

- Material Innovation: Advances in alternative materials, such as advanced insulation or novel roofing membranes, can offer superior performance or cost advantages.

- Market Adoption: The rate at which alternative solutions gain traction due to regulatory support or consumer demand will determine the extent of the threat.

The threat of substitutes for Carlisle Companies is substantial, especially in its primary markets where alternative products can fulfill similar needs. This dynamic impacts Carlisle's ability to set prices and maintain its market share, as customers can often opt for different solutions with varying cost and performance profiles.

In the commercial roofing sector, for instance, while Carlisle offers advanced systems, traditional asphalt shingles and other membrane types like TPO and PVC serve the same basic function. Similarly, the insulation market presents a wide array of substitutes, including fiberglass, mineral wool, and spray foam, each with distinct R-values, installation requirements, and price points, allowing customers to select based on project specifics and budget constraints.

The attractiveness of substitutes is largely determined by their price-to-performance ratio; if alternatives provide comparable or superior results at a lower cost, Carlisle faces increased pressure. For example, in the building envelope market, cheaper but less durable materials could draw customers away from Carlisle's premium offerings if the price disparity becomes significant.

Carlisle addresses this threat by highlighting its innovative solutions, such as products designed to reduce labor costs and enhance environmental sustainability, thereby presenting a strong value proposition. This strategy aims to demonstrate that the long-term advantages and operational efficiencies of Carlisle's products justify their cost, making them a more appealing choice than less effective substitutes.

| Substitute Category | Examples | Key Differentiating Factors | Potential Impact on Carlisle | 2024 Market Trend/Data Point |

| Roofing Materials | Asphalt Shingles, TPO, PVC Membranes | Cost, Durability, Installation Ease, Lifespan | Price competition, potential market share erosion | Global roofing market growth estimated at 5-7% annually. |

| Insulation Materials | Fiberglass, Mineral Wool, Spray Foam, Rigid Foam Boards | R-value, Cost, Installation Method, Fire Resistance | Competition based on thermal performance and cost-effectiveness | Green building initiatives driving demand for high-performance insulation. |

| Building Envelope Components | Advanced Composites, Prefabricated Panels | Installation Speed, Lifecycle Cost, Integrated Functionality | Disruption of traditional material demand through new construction methods | Modular construction market projected to grow significantly in 2024. |

Entrants Threaten

Carlisle Companies, operating as a global diversified manufacturer, likely leverages substantial economies of scale across its production, procurement, and distribution networks. This scale allows them to reduce per-unit costs, a significant advantage. For instance, in 2023, Carlisle reported net sales of $7.3 billion, indicating a large operational footprint.

New companies entering Carlisle's markets would require massive capital outlays to match this scale, making it challenging to achieve comparable cost efficiencies. This high initial investment acts as a formidable barrier, deterring potential competitors from entering and disrupting the existing market structure.

Entering specialized manufacturing sectors like those Carlisle Companies operates in, such as commercial roofing or aerospace components, demands significant upfront investment. Companies need to fund extensive research and development, build state-of-the-art manufacturing facilities, acquire highly specialized machinery, and establish robust distribution channels. This considerable capital requirement acts as a substantial barrier, deterring many potential new players from entering the market.

Carlisle Companies benefits significantly from its deeply entrenched distribution channels, built over years of operation. These networks, encompassing strong ties with contractors, distributors, and direct clientele across its diverse business units, represent a substantial barrier for any potential new competitor seeking to enter the market.

New entrants would struggle to replicate Carlisle's established reach and market access. For instance, in the building materials sector, where Carlisle has a strong presence, securing shelf space with major distributors or building a loyal contractor base often requires extensive time, investment, and a proven track record.

Proprietary Product Technology and Expertise

Carlisle Companies' dedication to highly engineered products and the 'Carlisle Operating System' creates a substantial barrier for new entrants. This focus on innovation and continuous improvement, deeply embedded in their culture, signifies proprietary technology and specialized expertise that are difficult and costly to replicate. For instance, Carlisle's investment in R&D, which contributed to their strong performance in 2023, underscores the depth of their technological advantage.

Newcomers would face significant hurdles in developing or acquiring comparable intellectual property and operational efficiencies. This high upfront investment in technology and expertise acts as a strong deterrent.

- Proprietary Technology: Carlisle's advanced product designs and manufacturing processes are protected intellectual property.

- Specialized Expertise: Decades of experience in niche markets have cultivated unique operational know-how.

- High R&D Investment: Significant capital allocation towards innovation makes it challenging for new players to match technological capabilities.

- Operational Excellence: The Carlisle Operating System drives efficiency, a difficult benchmark for new entrants to achieve quickly.

Government Policy and Regulation

Government policy and regulation present a significant barrier to entry for new competitors in industries where Carlisle Companies operates. For instance, the aerospace sector, a key market for Carlisle's Fluid Technologies segment, is heavily regulated by bodies like the Federal Aviation Administration (FAA) in the US. In 2024, the FAA continued to emphasize stringent safety certifications and manufacturing standards, requiring substantial investment and time for any new entrant to achieve compliance.

Similarly, the medical technologies market, relevant to Carlisle's potential expansion, demands adherence to FDA regulations and ISO certifications. Navigating these complex approval processes can take years and millions of dollars, effectively deterring smaller or less capitalized new entrants. This regulatory burden extends to Carlisle's established commercial roofing business, where building codes and environmental standards, such as those from the Environmental Protection Agency (EPA) concerning roofing materials and energy efficiency, add layers of complexity for newcomers.

- Aerospace: FAA certification is a lengthy and costly process for new entrants.

- Medical Technology: FDA approval and ISO certifications are critical and time-consuming hurdles.

- Commercial Roofing: Building codes and EPA environmental standards increase market entry complexity.

The threat of new entrants for Carlisle Companies is relatively low due to significant barriers to entry. These include high capital requirements to match Carlisle's scale, established distribution networks, proprietary technology, and stringent government regulations in key sectors. For example, in 2023, Carlisle's substantial net sales of $7.3 billion underscore their operational scale, making it difficult for newcomers to compete on cost.

New companies face considerable challenges in replicating Carlisle's deeply entrenched distribution channels and specialized expertise. The need for substantial R&D investment, as demonstrated by Carlisle's performance in 2023, further deters potential competitors.

Regulatory hurdles, particularly in aerospace and medical technologies, demand significant time and financial investment for compliance. For instance, FAA certification in 2024 continues to be a complex and costly process for new entrants in the aerospace market.

| Barrier | Impact on New Entrants | Example for Carlisle |

|---|---|---|

| Economies of Scale | High cost to achieve comparable per-unit pricing. | Carlisle's $7.3 billion in net sales (2023) indicates significant cost advantages. |

| Distribution Channels | Difficulty in securing market access and customer relationships. | Strong ties with contractors and distributors in building materials. |

| Proprietary Technology & R&D | High investment needed to match product innovation and operational efficiency. | Carlisle Operating System and ongoing R&D investments. |

| Government Regulations | Lengthy and expensive compliance processes. | FAA certification (aerospace) and FDA approval (medical tech). |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Carlisle Companies leverages data from their annual reports, investor presentations, and SEC filings. We supplement this with industry-specific market research reports and economic data to gain a comprehensive understanding of the competitive landscape.