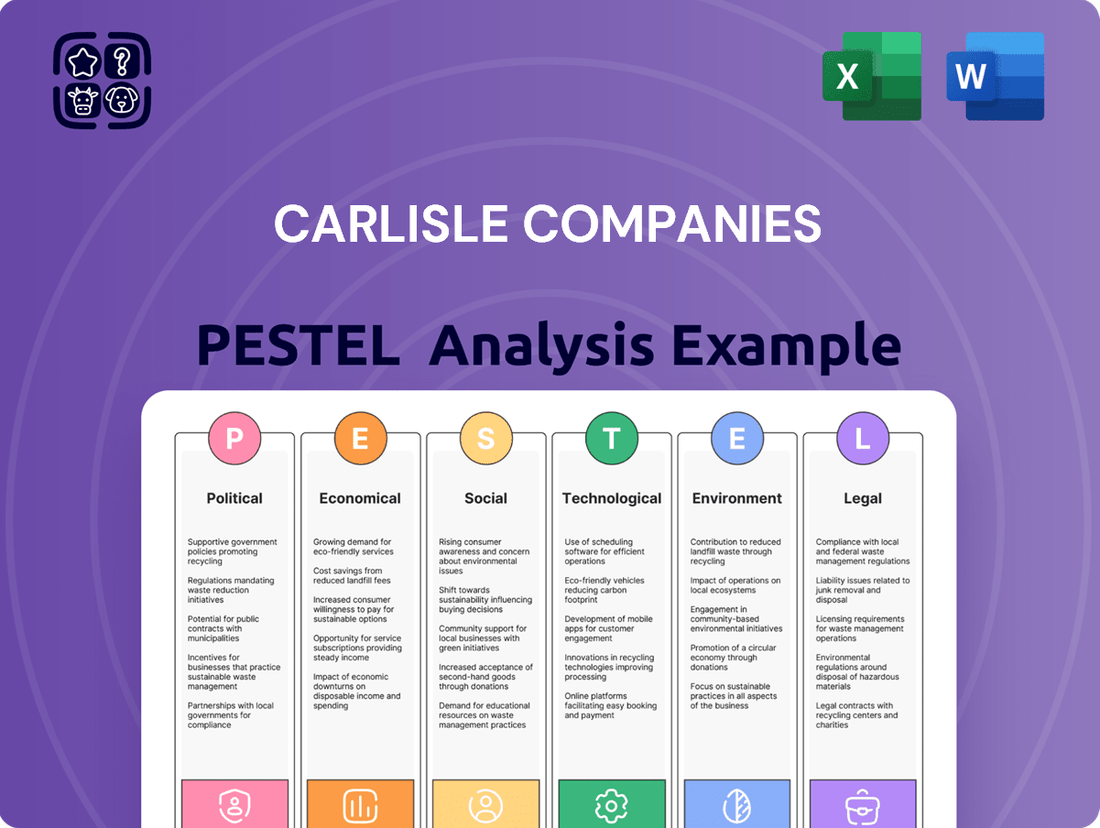

Carlisle Companies PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Carlisle Companies Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Carlisle Companies's trajectory. Our expertly crafted PESTLE analysis provides a comprehensive overview, highlighting potential opportunities and threats that could impact your investment or business strategy. Don't get left behind in a rapidly evolving market; download the full PESTLE analysis now for actionable intelligence.

Political factors

Government infrastructure spending significantly influences Carlisle's Construction Materials segment. For instance, the U.S. Infrastructure Investment and Jobs Act, enacted in late 2021, allocates substantial funds for repairing and upgrading roads, bridges, and public transit. This increased federal investment is projected to boost demand for Carlisle's roofing and insulation materials throughout 2024 and 2025, supporting project pipelines for their construction-related businesses.

Changes in international trade agreements and the imposition of tariffs on raw materials or finished goods can significantly impact Carlisle's global supply chain and cost of production. For instance, in early 2024, ongoing discussions around potential tariffs on steel and aluminum, key inputs for many manufacturing sectors, could increase Carlisle's material expenses.

As a diversified manufacturer with extensive international operations, tariffs on imported components or restrictions on exports could directly affect profitability and market access for its specialized products. For example, a 10% tariff on imported electronic components used in Carlisle's ventilation systems could add millions to their cost of goods sold, impacting their competitive pricing in key markets.

Evolving building codes, particularly those focused on energy efficiency and enhanced safety, are a significant political factor impacting Carlisle Companies. These regulations directly influence the material and design specifications for construction projects. For instance, the increasing adoption of stricter energy performance standards in major markets like the United States, with many states aiming for net-zero energy buildings by the late 2020s and early 2030s, necessitates advanced insulation and weatherproofing solutions.

Carlisle's Weatherproofing Technologies and Construction Materials segments must proactively adapt their product portfolios to meet these increasingly stringent requirements. Failure to do so can present challenges, but conversely, it creates substantial opportunities for companies like Carlisle that can innovate and offer compliant, high-performance materials. The company’s investment in research and development to create solutions that exceed current mandates, such as advanced roofing systems with higher R-values, positions them to capitalize on this evolving regulatory landscape.

Aerospace and Defense Spending

Government budgets for aerospace and defense are a crucial driver for Carlisle Interconnect Technologies (CIT). Increased defense spending, particularly in areas like fighter jets and surveillance systems, directly translates to higher demand for CIT's specialized wires, cables, and connectors. For instance, the U.S. Department of Defense's FY2025 budget request includes significant funding for modernization programs, which will likely benefit suppliers like Carlisle.

Conversely, periods of government budget austerity or delays in major defense procurement programs can negatively impact CIT's sales in this sector. The commercial aviation market also plays a vital role; new aircraft production programs, such as those from Boeing and Airbus, generate substantial orders for CIT's high-performance interconnect solutions. The ongoing recovery and expansion in global air travel, as seen in projections for 2024 and 2025, suggest a positive outlook for this segment.

- U.S. Defense Spending: The U.S. FY2025 defense budget proposal prioritizes modernization and readiness, potentially boosting demand for advanced aerospace components.

- Commercial Aviation Growth: Projections indicate continued growth in global air travel through 2024 and 2025, driving new aircraft production and demand for interconnect solutions.

- Programmatic Impact: Fluctuations in government defense spending and the success of new commercial aircraft programs directly influence Carlisle's order pipeline.

Healthcare Policy and Regulation

The medical technologies market, a key area for Carlisle Interconnect Technologies, is significantly shaped by evolving healthcare policies and regulatory landscapes. For instance, the U.S. Food and Drug Administration (FDA) plays a crucial role in approving new medical devices, impacting the speed at which Carlisle's components can reach the market. Changes in reimbursement policies, such as those from Medicare and Medicaid, directly affect demand for medical equipment, thereby influencing Carlisle's sales within this sector.

Public health initiatives and government spending priorities also create ripples. Increased focus on preventative care or telehealth, for example, could drive demand for specific types of interconnect solutions. Conversely, shifts in healthcare spending away from capital equipment could temper growth. In 2024, global healthcare spending was projected to reach approximately $10 trillion, showcasing the sheer scale of this market and the potential impact of policy shifts.

- Regulatory Approval Timelines: Delays in FDA or equivalent international body approvals for new medical devices can extend product development cycles for Carlisle's clients.

- Reimbursement Rates: Changes in how medical procedures and devices are reimbursed can directly impact the adoption and sales volume of Carlisle's specialized components.

- Government Healthcare Spending: National budgets allocated to healthcare, particularly for medical technology procurement, directly influence market demand.

- Public Health Trends: Initiatives focusing on areas like remote patient monitoring or advanced diagnostics can create new opportunities for Carlisle's advanced interconnect solutions.

Government infrastructure spending remains a key political driver for Carlisle's construction materials. The U.S. Infrastructure Investment and Jobs Act, with its substantial funding for infrastructure upgrades through 2025, directly supports demand for Carlisle's products. Furthermore, evolving building codes, particularly those emphasizing energy efficiency, necessitate advanced materials, creating opportunities for Carlisle's innovative solutions in the 2024-2025 period.

Political stability and trade policies significantly influence Carlisle's global operations. Trade agreements, tariffs on raw materials like steel, and export restrictions can impact production costs and market access. For instance, potential tariffs on key components in early 2024 could increase Carlisle's expenses, affecting its competitive pricing strategies.

Government budgets for aerospace and defense are critical for Carlisle Interconnect Technologies. The U.S. FY2025 defense budget proposal, focusing on modernization, is expected to boost demand for CIT's specialized components. Similarly, projected growth in commercial aviation through 2024 and 2025, driven by increased air travel, will likely lead to higher orders for interconnect solutions.

Healthcare policies and government spending on medical technologies directly shape Carlisle Interconnect Technologies' market. Regulatory approval timelines from bodies like the FDA and changes in reimbursement rates can impact product adoption. Public health initiatives and overall healthcare spending, projected to exceed $10 trillion globally in 2024, create both opportunities and challenges for Carlisle's medical segment.

What is included in the product

This PESTLE analysis comprehensively examines the external macro-environmental factors impacting Carlisle Companies, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights into how these global trends create both strategic opportunities and potential risks for Carlisle's diverse business segments.

A concise, actionable PESTLE analysis for Carlisle Companies, presented in a digestible format, alleviates the pain of sifting through overwhelming data by highlighting key external factors impacting strategy.

This PESTLE analysis serves as a pain point reliever by offering a clear, summarized view of external forces, enabling swift identification of opportunities and threats for Carlisle Companies without getting lost in granular details.

Economic factors

Interest rates significantly impact construction activity. For instance, the Federal Reserve's aggressive rate hikes throughout 2022 and 2023, pushing the federal funds rate to a range of 5.25%-5.50%, have made borrowing more expensive. This directly affects developers and homeowners, potentially leading to fewer new projects and a slowdown in renovation demand, which in turn impacts companies like Carlisle that supply essential building materials.

Higher borrowing costs translate to increased expenses for construction projects, from large commercial developments to individual home builds. When mortgage rates climb, as they have with average 30-year fixed rates hovering around 7% in late 2023 and early 2024, buyer affordability decreases. This reduced demand for new housing and commercial spaces can directly dampen the need for Carlisle's products, such as roofing and waterproofing systems.

The economic outlook for 2024 suggests continued sensitivity to interest rate movements. While some anticipate potential rate cuts later in the year, the elevated cost of capital remains a key consideration for the construction sector. This environment necessitates careful planning for companies like Carlisle, as fluctuations in construction starts and renovation spending directly correlate with their revenue streams.

Inflationary pressures continue to be a significant concern for Carlisle Companies, directly impacting the cost of essential raw materials such as polymers, metals, and chemicals. For instance, in early 2024, the price of aluminum, a key component in many of Carlisle's building products, saw fluctuations driven by global supply chain dynamics and energy costs, potentially adding to production expenses.

Carlisle's profitability hinges on its capacity to effectively manage these rising input costs. The company's strategy involves passing these increases along to customers through carefully considered price adjustments across its diverse product portfolio, aiming to protect its profit margins in a volatile economic environment.

The overall health of the global economy directly impacts Carlisle's performance by influencing industrial production, commercial investment, and consumer spending across all its segments. Strong global growth, like the projected 3.2% for 2024 by the IMF, generally leads to increased construction activity, higher demand in aerospace, and greater healthcare spending, all of which can boost Carlisle's sales volumes.

Supply Chain Stability and Logistics Costs

Disruptions in global supply chains, amplified by geopolitical tensions and extreme weather events, directly impact Carlisle Companies by causing material shortages and escalating logistics costs. For instance, the average cost to ship a 40-foot container globally saw significant fluctuations throughout 2023 and into early 2024, with some routes experiencing double-digit percentage increases compared to pre-pandemic levels.

Carlisle's diversified manufacturing base, encompassing segments like building solutions and aerospace, necessitates a robust and intricate supply chain. This inherent reliance makes the company susceptible to the ripple effects of these disruptions, potentially leading to delays in production schedules and impacting timely product delivery to customers.

- Increased Freight Rates: Global freight rates, a key component of logistics costs, have remained volatile. For example, the Drewry World Container Index, a benchmark for global shipping rates, indicated a notable uptick in late 2023 and early 2024 for key East-West trade lanes.

- Material Availability: Shortages of critical raw materials, such as specialized polymers or metals, can halt production lines. Reports from industry associations in late 2023 highlighted ongoing challenges in sourcing certain electronic components and construction materials.

- Inventory Management Challenges: To mitigate risks, companies like Carlisle may need to hold higher levels of inventory, tying up capital and increasing warehousing expenses.

Currency Exchange Rate Fluctuations

Carlisle Companies, as a global manufacturer operating across numerous countries, is significantly exposed to the impacts of currency exchange rate fluctuations. The company's financial performance can be notably affected by the relative strength or weakness of the U.S. dollar against other currencies in which it conducts business.

A stronger U.S. dollar can negatively impact Carlisle's reported international sales and profits, as earnings generated in foreign currencies translate into fewer dollars. Conversely, a weaker dollar can enhance the competitiveness of Carlisle's products in international markets and potentially increase the cost of raw materials sourced from abroad.

For instance, in 2024, many multinational corporations experienced varying impacts from currency movements. While specific Carlisle data for the full year 2024 regarding currency impact is still being reported, general market trends indicate that companies with substantial international operations, like Carlisle, must actively manage currency risks. Carlisle's own financial reports often detail the effects of foreign currency translation on its results, highlighting the importance of this factor in its overall strategy.

- Global Operations Exposure: Carlisle's diversified manufacturing footprint means it transacts in multiple currencies, making it inherently vulnerable to exchange rate volatility.

- Impact of USD Strength: A stronger U.S. dollar can diminish the value of Carlisle's overseas revenue and earnings when converted back into dollars.

- Impact of USD Weakness: A weaker U.S. dollar can make Carlisle's exports more affordable internationally, but it also raises the cost of imported components and materials.

- Strategic Hedging: Companies like Carlisle often employ financial instruments to hedge against adverse currency movements, aiming to stabilize earnings and manage costs.

Interest rates directly influence construction demand, a key market for Carlisle. As of early 2024, the Federal Reserve maintained a federal funds rate between 5.25%-5.50%, making borrowing more expensive for developers and homeowners. This increased cost of capital can lead to fewer new projects, impacting sales of Carlisle's building products.

Inflation continues to be a significant factor, driving up the cost of raw materials like polymers and metals for Carlisle. For example, the price of aluminum, crucial for many building components, experienced volatility in late 2023 and early 2024 due to global supply chain issues and energy costs, potentially increasing Carlisle's production expenses.

The global economic outlook for 2024, projected by the IMF at 3.2% growth, generally supports increased industrial and construction activity. This broader economic health is vital for Carlisle's diverse segments, including aerospace and healthcare, as it correlates with higher demand across its product lines.

| Economic Factor | Impact on Carlisle | Data Point (Early 2024) |

| Interest Rates | Affects construction financing and demand. | Federal Funds Rate: 5.25%-5.50% |

| Inflation | Increases raw material and production costs. | Aluminum price volatility noted. |

| Global Economic Growth | Drives demand across Carlisle's segments. | Projected IMF Global Growth: 3.2% |

Preview Before You Purchase

Carlisle Companies PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This PESTLE analysis for Carlisle Companies provides a comprehensive overview of the Political, Economic, Social, Technological, Legal, and Environmental factors influencing its operations. Understand the external forces shaping Carlisle's strategic landscape.

Sociological factors

Societal awareness regarding environmental impact is significantly shaping the construction industry, leading to a robust demand for sustainable and green buildings. This growing preference for eco-friendly structures, driven by a desire for energy efficiency and reduced carbon footprints, directly influences material selection and building design.

Carlisle Companies is well-positioned to capitalize on this trend. Their commitment to developing innovative weatherproofing and insulation solutions, such as their EPDM roofing systems and spray foam insulation, directly addresses the market's need for materials that enhance building performance and sustainability. For instance, the global green building materials market was valued at approximately $250 billion in 2023 and is projected to reach over $400 billion by 2028, indicating substantial growth potential for companies like Carlisle that offer relevant products.

The global population is getting older, with the World Health Organization reporting that by 2030, one in six people worldwide will be 65 years or older. This trend significantly boosts demand for sophisticated medical devices and healthcare services, a direct tailwind for Carlisle's Interconnect Technologies segment.

This demographic shift necessitates high-performance, dependable components for medical equipment, creating a sustained growth avenue for Carlisle. For instance, the global medical device market was valued at approximately $520 billion in 2023 and is projected to reach over $700 billion by 2028, according to Statista.

Global urbanization continues to accelerate, driving significant demand for new and upgraded infrastructure. By 2050, it's projected that 68% of the world's population will live in urban areas, a substantial increase from 57% in 2021, according to UN data. This surge fuels the need for commercial and residential construction, including multi-story buildings and essential public facilities.

This persistent urbanization directly benefits Carlisle Companies by increasing the market for their construction materials and weatherproofing solutions. As cities expand and densify, the demand for durable, high-performance building envelopes that can withstand diverse environmental conditions and contribute to energy efficiency becomes paramount. Carlisle's expertise in these areas positions them well to capitalize on this ongoing global trend.

Workforce Demographics and Skilled Labor

Changes in workforce demographics present a significant consideration for Carlisle Companies. An aging labor force in key sectors like manufacturing and construction could lead to potential shortages of skilled tradespeople, impacting operational efficiency and project execution timelines. For instance, the U.S. Bureau of Labor Statistics projected that by 2031, the median age of all workers would continue to rise, a trend that directly affects industries reliant on experienced labor.

To address these demographic shifts, Carlisle must proactively invest in robust training programs and implement effective talent retention strategies. Automation also plays a crucial role in mitigating potential labor gaps and enhancing productivity. Companies like Carlisle are increasingly exploring advanced manufacturing techniques and digital tools to upskill their existing workforce and attract new talent.

- Aging Workforce: The median age of the U.S. workforce continues to increase, potentially reducing the pool of experienced manufacturing and construction workers.

- Skills Gap: A persistent shortage of skilled tradespeople in the U.S. construction and manufacturing sectors, as highlighted by various industry reports, poses a challenge for companies like Carlisle.

- Investment in Training: Carlisle's commitment to employee development and apprenticeship programs is vital for bridging the skills gap and ensuring a pipeline of qualified talent.

- Automation Adoption: The increasing integration of automation in manufacturing processes can offset labor shortages and improve overall operational efficiency.

Consumer and Industry Preference for Performance

Consumers and industries increasingly demand products that perform exceptionally and stand the test of time. This societal shift directly impacts material choices and how products are engineered, favoring durability and reliability. Carlisle Companies is well-positioned to capitalize on this trend, given its established reputation for producing highly engineered solutions in sectors like aerospace and medical, where performance is paramount.

Carlisle's commitment to quality is evident in its consistent financial performance. For instance, in the first quarter of 2024, the company reported a revenue of $1.4 billion, demonstrating strong demand for its specialized products. This indicates a market that values and rewards superior engineering and long-lasting solutions, aligning perfectly with Carlisle's core strengths.

The preference for high-performance products translates into specific market opportunities for Carlisle:

- Aerospace: Demand for lightweight, durable materials in aircraft construction continues to grow, with the global aerospace market projected to reach $900 billion by 2025.

- Medical Devices: The need for reliable and sterile components in medical equipment drives demand for Carlisle's specialized sealing and medical-grade materials.

- Construction: Building owners and developers are prioritizing energy efficiency and longevity, favoring advanced roofing and sealing systems that offer superior performance and reduced lifecycle costs.

Societal values increasingly emphasize health and well-being, driving demand for safer and more comfortable living and working environments. This trend directly supports Carlisle's focus on products that improve indoor air quality and energy efficiency in buildings.

The growing awareness of environmental sustainability and the demand for green building practices are significant sociological factors impacting Carlisle Companies. Consumers and businesses alike are prioritizing eco-friendly construction materials and energy-efficient solutions, creating a robust market for Carlisle's weatherproofing and insulation products.

Demographic shifts, particularly an aging global population, are a key sociological driver for Carlisle. This trend fuels the need for advanced medical devices, a sector where Carlisle's Interconnect Technologies segment plays a crucial role by supplying high-performance components. The increasing demand for reliable medical equipment components directly benefits Carlisle's specialized offerings.

The ongoing global trend of urbanization continues to shape societal needs, directly benefiting Carlisle Companies. As more people move into cities, there's a greater demand for new construction and infrastructure, increasing the market for Carlisle's building materials and weatherproofing solutions. This sustained growth in urban development underscores the importance of durable and efficient building components.

| Sociological Factor | Impact on Carlisle Companies | Supporting Data/Trend |

| Environmental Awareness & Green Building | Increased demand for sustainable construction materials and energy-efficient solutions. | Global green building materials market projected to exceed $400 billion by 2028. |

| Aging Population | Growth in demand for medical devices and healthcare services. | By 2030, 1 in 6 people worldwide will be 65 years or older. |

| Urbanization | Higher demand for new construction and infrastructure, benefiting building materials. | By 2050, 68% of the world's population is projected to live in urban areas. |

| Demand for Durability & Performance | Market preference for long-lasting, high-quality engineered products. | Carlisle's Q1 2024 revenue of $1.4 billion reflects strong demand for specialized products. |

Technological factors

Carlisle Companies is heavily influenced by ongoing advancements in material science, particularly in areas like polymer science and composites. These innovations directly fuel the company's ability to enhance its product offerings, leading to better performance and increased durability. For instance, in 2024, Carlisle continued to invest in R&D for advanced insulation materials, aiming to improve energy efficiency in buildings, a key market driver.

These material science breakthroughs are critical for Carlisle's development of next-generation roofing, insulation, and connectivity solutions. Such progress is essential for meeting increasingly stringent market demands and evolving regulatory requirements, especially those focused on sustainability and environmental impact. The company's focus on lightweight yet strong composite materials, for example, is key to developing more efficient and long-lasting building envelope systems.

The construction sector is rapidly evolving with the integration of digital technologies, the Internet of Things (IoT), and smart sensors into building materials and systems. This digital transformation is creating opportunities for enhanced building performance and operational efficiency.

Carlisle Companies can capitalize on this trend by innovating intelligent weatherproofing and insulation solutions. These advancements can offer commercial buildings superior performance monitoring, enabling predictive maintenance and optimizing energy management, which is increasingly critical in 2024 and beyond.

The drive for miniaturization in aerospace and medical technology creates a strong market for smaller, lighter, and more powerful interconnect solutions. This trend is evidenced by the increasing complexity of electronics in modern aircraft and sophisticated medical devices, demanding advanced interconnects. Carlisle Interconnect Technologies must therefore focus on developing cutting-edge miniaturization technologies and robust high-speed data transmission capabilities to stay ahead in these evolving sectors.

Automation and Advanced Manufacturing

Carlisle Companies is increasingly leveraging automation and advanced manufacturing to boost its operational effectiveness. The company's strategic investments in robotics and sophisticated production techniques are designed to streamline processes, leading to substantial cost reductions and an uplift in product quality across its diverse portfolio. This technological integration is key to maintaining a competitive edge in the global marketplace.

By embracing these advancements, Carlisle aims to achieve higher production volumes with fewer imperfections. For instance, in 2024, the company continued to integrate advanced robotics in its building envelope solutions segment, targeting a 15% reduction in manufacturing cycle times for key product lines. This focus on efficiency directly translates to a more favorable cost structure, enabling Carlisle to offer competitive pricing while upholding stringent quality standards.

- Increased Production Efficiency: Automation reduces manual labor dependency, speeding up assembly and processing times.

- Cost Reduction: Lower labor costs and reduced material waste contribute to a more competitive cost base.

- Enhanced Product Quality: Precision robotics minimize errors, leading to more consistent and higher-quality products.

- Improved Safety: Automating hazardous tasks protects human workers and reduces workplace incidents.

Cybersecurity and Data Protection

Carlisle Companies' increasing reliance on digital operations and interconnected systems amplifies the need for strong cybersecurity. Protecting vital assets like proprietary designs, customer information, and operational continuity from cyber threats is paramount. This focus on data protection is crucial for maintaining stakeholder trust and ensuring uninterrupted business flow, especially as the company navigates evolving global data privacy laws.

The threat landscape continues to evolve, with sophisticated cyberattacks posing a significant risk. For instance, the global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, highlighting the substantial financial and reputational damage that can result from breaches. Carlisle's investment in advanced cybersecurity measures is therefore not just a compliance issue but a strategic imperative for safeguarding its competitive edge and operational resilience.

To address these challenges, Carlisle is likely implementing a multi-layered security approach. Key areas of focus would include:

- Enhanced Network Security: Implementing firewalls, intrusion detection/prevention systems, and secure network architecture.

- Data Encryption: Protecting sensitive data both in transit and at rest through robust encryption protocols.

- Employee Training and Awareness: Educating staff on cybersecurity best practices to mitigate human-factor risks.

- Incident Response Planning: Developing and regularly testing comprehensive plans to effectively manage and recover from cyber incidents.

Technological advancements, particularly in material science and automation, are reshaping Carlisle Companies' product development and operational efficiency. The company's investment in R&D for advanced insulation materials, for example, aims to improve energy efficiency, a key market driver in 2024. This focus on innovation allows Carlisle to create lighter, stronger composite materials for building envelopes and miniaturized interconnect solutions for aerospace and medical sectors.

Legal factors

Carlisle Companies, operating in sectors like commercial roofing and medical devices, faces significant legal hurdles due to product liability and safety regulations. In 2024, the company's commitment to adhering to these complex standards, which vary by jurisdiction and product type, remains paramount to prevent substantial financial penalties and operational disruptions.

Failure to meet these rigorous safety requirements, such as those mandated by the Consumer Product Safety Commission (CPSC) in the US or similar bodies globally, could lead to expensive product recalls and damage Carlisle's brand reputation, impacting its ability to secure new contracts and maintain customer trust.

Carlisle Companies heavily relies on its intellectual property, including patents, trademarks, and trade secrets, to maintain its competitive edge. Protecting these innovations is crucial for safeguarding their significant R&D investments, which amounted to $238 million in 2023, and preventing competitors from replicating their unique product designs and advanced manufacturing techniques.

Carlisle's manufacturing facilities operate under stringent environmental regulations, covering everything from air emissions and waste management to water consumption and chemical safety. Failure to comply can lead to significant financial penalties and operational shutdowns, impacting their ability to produce goods.

Securing and maintaining environmental permits is a crucial, ongoing process for Carlisle. For example, in 2024, companies in similar manufacturing sectors faced increased scrutiny on greenhouse gas emissions, with some regions implementing stricter reporting requirements and potential carbon taxes that could affect operational costs.

Labor Laws and Employment Regulations

Carlisle Companies, as a global employer, navigates a complex web of labor laws and employment regulations across its operating regions. These laws dictate crucial aspects of the employment relationship, including minimum wages, working hours, safety standards, and anti-discrimination policies. For instance, in the United States, the Fair Labor Standards Act sets federal minimum wage and overtime pay requirements, while the Occupational Safety and Health Administration (OSHA) mandates workplace safety standards. In Europe, the General Data Protection Regulation (GDPR) impacts how employee data is handled, and various directives govern working conditions and employee rights. Adherence to these diverse legal frameworks is paramount for Carlisle to ensure operational continuity, mitigate legal risks, and cultivate a positive and productive work environment.

Failure to comply with these labor laws can result in significant financial penalties, reputational damage, and operational disruptions. For example, in 2023, companies faced substantial fines for violations related to wage and hour disputes, workplace safety breaches, and discriminatory hiring practices. Carlisle's commitment to robust compliance programs and ongoing training for its HR and management teams is therefore critical. This proactive approach helps to maintain a stable and motivated workforce, which is a key enabler of the company's strategic objectives and overall business performance.

- Global Compliance Burden: Carlisle must adhere to varying labor laws in countries like the US, Germany, and China, covering wages, benefits, and working conditions.

- Risk Mitigation: Non-compliance can lead to costly lawsuits and fines; for instance, US wage and hour violations can result in back pay and penalties.

- Workforce Stability: Fair employment practices, aligned with local laws, are essential for employee retention and a motivated workforce.

- Reputational Impact: Strong labor law adherence enhances Carlisle's image as a responsible corporate citizen, crucial for attracting talent and maintaining customer trust.

Industry-Specific Certifications and Standards

Carlisle Companies operates in sectors like aerospace and medical, where stringent industry certifications are non-negotiable. For instance, AS9100 is a vital quality management standard for aerospace suppliers, and ISO 13485 is paramount for medical device manufacturers. Failure to meet these legal and regulatory requirements directly impacts market access and can severely damage product credibility.

These certifications are not merely optional badges; they are legal prerequisites for engagement in many of Carlisle's key markets. Adherence demonstrates a commitment to safety, quality, and reliability, which are legally mandated in these sensitive industries. In 2024, the aerospace sector continued to emphasize rigorous compliance, with ongoing audits and updates to AS9100 standards, impacting supply chain requirements for companies like Carlisle.

The medical technology landscape, similarly, sees continuous evolution in regulatory demands. For example, the EU's Medical Device Regulation (MDR) has imposed stricter conformity assessment procedures, requiring enhanced documentation and clinical evidence for devices. Carlisle's ability to navigate and maintain compliance with such evolving legal frameworks is crucial for sustained growth in its medical segment.

- AS9100: Essential for aerospace market entry, ensuring quality and safety in aviation and space.

- ISO 13485: Mandated for medical device operations, focusing on regulatory compliance and product safety.

- EU MDR: Increased regulatory scrutiny for medical devices, impacting market access and product lifecycle management.

Carlisle Companies must navigate a complex legal landscape, including product liability and safety regulations across its diverse business segments. Adherence to standards set by bodies like the CPSC is critical to avoid costly recalls and reputational damage.

Intellectual property protection is paramount, with R&D investments of $238 million in 2023 underscoring the need to safeguard patents and trade secrets against infringement.

Stringent environmental regulations govern Carlisle's manufacturing operations, with potential carbon taxes and stricter emissions reporting requirements impacting costs in 2024.

Labor laws and employment regulations, from minimum wage to safety standards, require diligent compliance to ensure workforce stability and mitigate risks of fines and lawsuits.

Environmental factors

Climate change is increasingly driving demand for Carlisle's advanced weatherproofing solutions. The company's focus on energy-efficient roofing, like its EPDM and TPO membranes, positions it to benefit from a growing market for resilient building materials. For instance, in 2024, the global market for green roofing is projected to reach over $15 billion, with significant growth driven by sustainability initiatives and the need for enhanced building performance against extreme weather.

The increasing global focus on sustainability directly impacts Carlisle Companies, fueling demand for its environmentally conscious building materials and solutions. This trend pressures the company to minimize its environmental impact, develop products with reduced embodied carbon, and support green building standards like LEED. For instance, in 2023, the global green building market was valued at over $1.1 trillion and is projected to grow substantially, indicating a significant opportunity for Carlisle's sustainable offerings.

Environmental regulations are tightening globally, pushing companies like Carlisle towards better waste management and circular economy practices. For instance, the European Union's Circular Economy Action Plan aims to reduce waste and boost recycling rates, with new targets expected to be announced in 2024 and 2025. This directly impacts manufacturers by increasing scrutiny on product lifecycles and material sourcing.

Carlisle's focus on product recyclability and the incorporation of recycled content is crucial. In 2023, many industrial sectors saw increased investment in recycling infrastructure, with global recycling rates for plastics, for example, showing a gradual upward trend, though still facing significant challenges. Minimizing waste in manufacturing is also a key area; Carlisle's efforts here can lead to cost savings and improved environmental performance, aligning with investor expectations for ESG (Environmental, Social, and Governance) compliance.

Energy Efficiency Demands for Products and Operations

There's a persistent push for greater energy efficiency across both buildings and industrial sectors. This is primarily to cut down on energy usage and lower greenhouse gas emissions. Carlisle's insulation and weatherproofing solutions are key to improving how energy-efficient buildings are, and the company itself faces energy efficiency goals for its manufacturing.

For example, the U.S. Department of Energy set a goal for buildings to reduce energy use by 50% by 2030 compared to 2005 levels. Carlisle Companies, through its Carlisle Construction Materials segment, directly addresses this by providing products like EPDM roofing and polyiso insulation, which are crucial for minimizing heat loss and gain. In 2023, Carlisle reported that approximately 74% of its revenue came from products that contribute to energy efficiency, highlighting its significant role in this environmental trend.

- Growing Demand for Energy-Efficient Building Materials: Global markets are increasingly prioritizing materials that reduce a building's energy footprint.

- Carlisle's Product Contribution: Products like high-performance insulation and roofing systems directly enhance building energy efficiency, helping meet regulatory and consumer demands.

- Operational Efficiency Targets: Carlisle's own manufacturing processes are under scrutiny to improve energy efficiency, aligning with broader corporate sustainability goals and reducing operational costs.

- Market Share in Energy-Saving Solutions: Carlisle's significant revenue derived from energy-efficient products in 2023 (74%) underscores its market position in this environmentally driven sector.

Resource Scarcity and Sustainable Sourcing

Growing concerns about resource scarcity and the environmental footprint of raw material extraction are increasingly influencing manufacturers like Carlisle Companies. This pressure is driving a significant shift towards sustainable sourcing practices across the industry. For instance, the global demand for critical minerals essential for manufacturing is projected to surge; the International Energy Agency reported in 2024 that demand for lithium could increase sixfold by 2040, and copper demand could nearly double.

Carlisle's strategic response involves diversifying its supply chains to mitigate risks associated with concentrated sourcing. Simultaneously, the company is actively exploring and integrating alternative, more environmentally friendly materials into its product lines. This proactive approach is crucial for securing long-term material availability and effectively managing associated environmental risks, ensuring business resilience in a changing global landscape.

Key initiatives and considerations for Carlisle in this area include:

- Supply Chain Diversification: Reducing reliance on single-source or geographically concentrated raw material suppliers.

- Material Innovation: Investing in research and development for sustainable and recycled material alternatives.

- Life Cycle Assessment: Evaluating the environmental impact of materials from extraction to disposal.

- Supplier Audits: Ensuring suppliers adhere to environmental and ethical sourcing standards.

Carlisle Companies is significantly influenced by evolving environmental regulations and increasing consumer demand for sustainable products. The company's commitment to energy efficiency, as evidenced by 74% of its revenue in 2023 coming from energy-saving products, directly addresses these trends. Furthermore, the growing emphasis on circular economy principles and responsible material sourcing is shaping Carlisle's operational strategies and product development.

| Environmental Factor | Impact on Carlisle | Supporting Data/Trend (2023-2025) |

|---|---|---|

| Climate Change & Extreme Weather | Increased demand for weatherproofing and resilient building solutions. | Global green roofing market projected over $15 billion in 2024. |

| Sustainability & Green Building | Drives demand for eco-friendly materials and adherence to green building standards. | Global green building market valued over $1.1 trillion in 2023. |

| Resource Scarcity & Material Sourcing | Necessitates supply chain diversification and use of alternative materials. | Lithium demand projected to increase sixfold by 2040 (IEA, 2024). |

| Energy Efficiency Mandates | Boosts demand for insulation and energy-saving building components. | Carlisle's 2023 revenue from energy-efficient products: 74%. |

| Waste Management & Circular Economy | Requires focus on product recyclability and waste reduction in manufacturing. | EU Circular Economy Action Plan targets evolving through 2024-2025. |

PESTLE Analysis Data Sources

Our Carlisle Companies PESTLE Analysis is grounded in a comprehensive review of official government publications, reputable financial news outlets, and industry-specific market research reports. This ensures that our insights into political, economic, social, technological, legal, and environmental factors are both current and authoritative.