Carlisle Companies Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Carlisle Companies Bundle

Unlock the strategic potential of Carlisle Companies with a deep dive into its BCG Matrix. Understand precisely which segments are driving growth, which are generating consistent cash, and which may require a strategic re-evaluation.

This preview offers a glimpse into Carlisle's market positioning, but the full BCG Matrix report provides the comprehensive data and actionable insights needed to make informed investment and resource allocation decisions. Purchase the complete analysis for a clear roadmap to optimizing your portfolio.

Stars

Carlisle Companies is making substantial investments in research and development, focusing on innovative building envelope solutions that promise energy and labor savings. These advanced products are strategically positioned to capture significant market share within the rapidly expanding construction sector.

The company's Vision 2030 strategy underscores a commitment to achieving growth above market averages, driven by these cutting-edge innovations. This focus on new product development for high-growth segments clearly places these building envelope solutions in the "Stars" category of the BCG matrix, indicating strong market growth and a promising future.

Carlisle Companies strategically employs its acquisition playbook to bolster its position in high-growth markets, emphasizing synergistic additions. For instance, the acquisition of MTL Holdings significantly strengthened its architectural metal capabilities, a key growth area.

Further demonstrating this strategy, Carlisle has recently integrated insulation businesses like Bonded Logic. These moves are designed to expand its footprint in expanding market niches, anticipating substantial future growth contributions from these newly acquired entities.

Carlisle's acquisition of Bonded Logic positions its sustainable insulation products as potential Stars in the BCG matrix. This move taps into the rapidly expanding eco-friendly building materials market, fueled by growing environmental consciousness and stricter building codes. For instance, the global sustainable building materials market was valued at approximately $230 billion in 2023 and is projected to grow significantly, with insulation being a key component.

If these sustainable insulation offerings, like those from Bonded Logic, quickly capture substantial market share and establish themselves as dominant players in this high-growth sector, they will firmly be classified as Stars. Carlisle's strategy here is to use this acquisition as a springboard to gain a stronger foothold in broader insulation markets, aiming for significant revenue growth and market leadership.

Advanced Roofing Technologies for Emerging Needs

Carlisle Companies is actively exploring advanced roofing technologies to meet emerging demands for better performance and sustainability. These innovations, if they secure significant market share in rapidly expanding segments, would be classified as Stars in the BCG Matrix. This strategic direction underscores Carlisle's dedication to pioneering comprehensive building envelope solutions.

For instance, their work on cool roofing materials, which reflect more sunlight and absorb less heat, addresses the growing need for energy efficiency in buildings. In 2024, the global cool roofing market was valued at approximately $25 billion and is projected to grow significantly. Technologies like advanced solar-integrated roofing systems also represent a potential Star, tapping into the increasing demand for renewable energy integration in construction.

- Advanced Cool Roofing: Addresses energy efficiency and sustainability goals, a market segment showing robust growth.

- Solar-Integrated Systems: Combines roofing with renewable energy generation, aligning with green building trends.

- High-Performance Membranes: Focuses on durability and longevity, reducing lifecycle costs for building owners.

- Smart Roofing Solutions: Incorporates sensors for monitoring building health and performance, offering predictive maintenance capabilities.

Blueskin® VPTech™ for Integrated Building Envelope

Blueskin® VPTech™, launched in 2024, is Carlisle Companies' innovative offering for the residential construction sector, providing a unified solution for weatherproofing, insulation, and sealing. Its focus on energy efficiency and reduced labor costs targets a market ripe for growth, suggesting a strong potential for it to become a Star in the BCG Matrix.

The product’s integrated nature addresses key industry demands for faster construction and enhanced building performance. With the global building envelope market projected to reach over $300 billion by 2029, products like Blueskin® VPTech™ are well-positioned to capture significant share if they demonstrate clear advantages in cost and application.

- Market Entry: Introduced in 2024 to the residential construction market.

- Key Features: Integrated weather resistance, insulation, and sealing.

- Growth Potential: High adoption and growth expected due to energy efficiency and labor savings.

- BCG Classification: Positioned as a Star due to its innovative approach in a high-potential market.

Carlisle's innovative building envelope solutions, including advanced cool roofing and solar-integrated systems, are positioned as Stars. These products target high-growth segments within the construction sector, driven by demand for energy efficiency and sustainability. For example, the global cool roofing market was valued at approximately $25 billion in 2024, with significant projected growth.

Blueskin® VPTech™, launched in 2024, exemplifies this Star classification. This integrated residential construction product offers weatherproofing, insulation, and sealing, addressing key market needs for efficiency and labor savings. Its potential is underscored by the global building envelope market's projected growth to over $300 billion by 2029.

The company's strategic acquisitions, such as Bonded Logic for sustainable insulation, further bolster its Star portfolio. These moves capitalize on the expanding eco-friendly building materials market, which was valued at around $230 billion in 2023. Carlisle aims to leverage these additions for substantial revenue growth and market leadership in these promising niches.

| Product Category | Key Features | Market Growth Driver | 2024 Market Value (Approx.) | BCG Classification |

|---|---|---|---|---|

| Advanced Cool Roofing | Energy efficiency, reduced heat absorption | Sustainability, energy cost savings | $25 billion | Star |

| Solar-Integrated Systems | Renewable energy generation, roofing | Green building trends, energy independence | N/A (Emerging Segment) | Star |

| Sustainable Insulation (e.g., Bonded Logic) | Eco-friendly materials, energy efficiency | Environmental consciousness, building codes | N/A (Segment within broader market) | Star |

| Blueskin® VPTech™ | Integrated weatherproofing, insulation, sealing | Labor savings, faster construction, energy efficiency | N/A (New Product) | Star |

What is included in the product

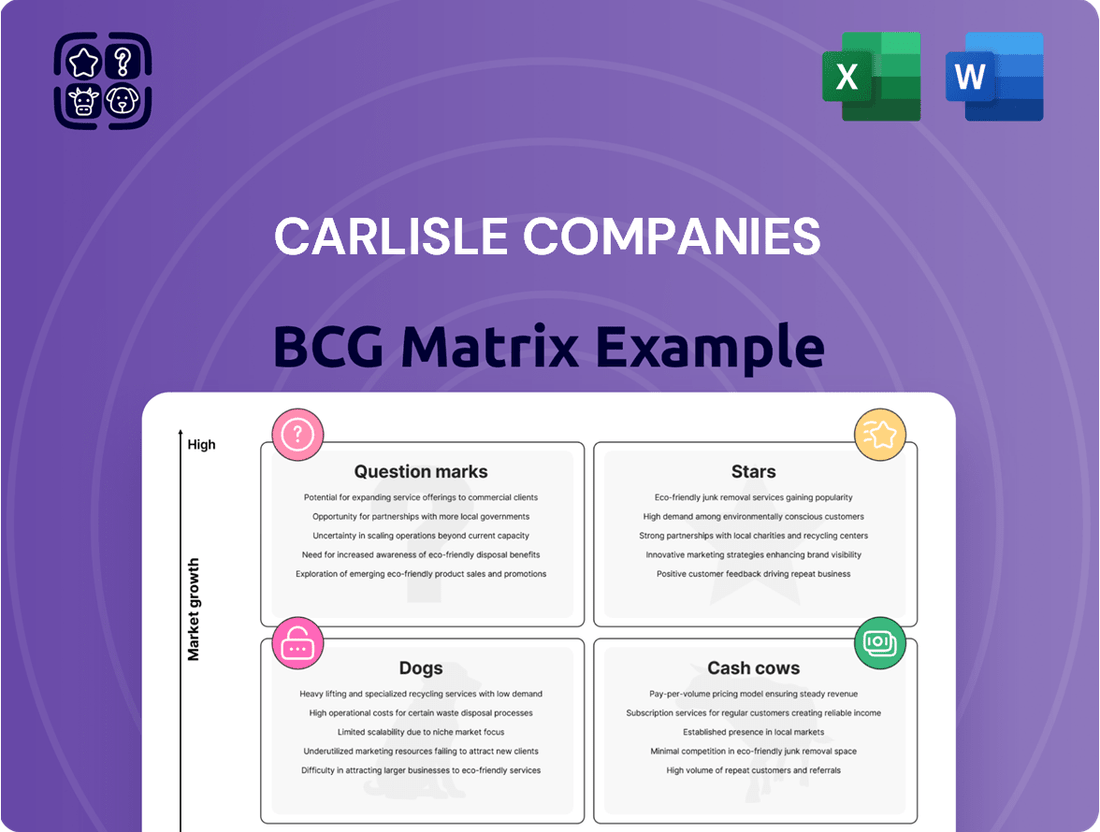

Strategic overview of Carlisle's portfolio, identifying Stars, Cash Cows, Question Marks, and Dogs.

Provides a clear, visual roadmap of Carlisle's portfolio, easing strategic decision-making.

Cash Cows

Carlisle Construction Materials (CCM), specifically its commercial re-roofing operations, stands out as a strong Cash Cow within Carlisle Companies. This segment boasts a significant multi-year backlog, ensuring predictable revenue streams.

CCM's commercial re-roofing business is expected to achieve consistent mid-single-digit growth. This segment is a cornerstone for generating robust and recurring revenue, contributing significantly to the company's overall profitability with its top-tier industry margins.

The stability of this Cash Cow is further underscored by the fact that approximately 70% of CCM's commercial business is derived from re-roofing projects, a testament to its dependable and essential nature in the construction market.

Carlisle's single-ply roofing systems, including EPDM, TPO, and PVC, represent significant cash cows. These established product lines have been market leaders for decades, demonstrating consistent strong cash flow due to their proven reliability and widespread adoption in a mature roofing market. Their foundational role contributes heavily to Carlisle Companies' overall profitability.

Carlisle Companies' established polyiso and expanded polystyrene (EPS) insulation lines are clear Cash Cows within their Construction Materials segment. These products boast high market share in mature markets, offering stable revenue streams and robust profit margins. For instance, in 2023, Carlisle Construction Materials saw significant contributions from its insulation products, which are integral to its overall roofing system offerings.

Carlisle Operating System (COS) Driven Efficiencies

The Carlisle Operating System (COS) is central to Carlisle Companies' strategy, fostering a culture of relentless improvement. This focus directly translates into enhanced operational efficiencies and expanded profit margins, especially within its already strong-performing business segments.

COS ensures that foundational segments, like Carlisle Construction Materials (CCM), continue to deliver robust profitability and substantial cash flow, even when operating in more mature market conditions. This sustained performance solidifies their position as Cash Cows within the BCG matrix.

- COS drives margin expansion: In 2023, Carlisle Companies reported an adjusted EBITDA margin of 20.3%, reflecting the impact of COS-driven efficiencies.

- CCM's strong performance: CCM, a key beneficiary of COS, generated approximately $5.0 billion in revenue in 2023, underscoring its market leadership and consistent cash generation.

- Focus on operational excellence: The company consistently reinvests in COS initiatives, aiming to further optimize its manufacturing processes and supply chain, thereby safeguarding its Cash Cow status.

Value-Based Pricing Strategies in CCM

Carlisle Construction Materials (CCM) has effectively leveraged value-based pricing, a hallmark of a Cash Cow. This strategy allows them to price products based on the perceived value to the customer rather than just cost, leading to enhanced profitability. For instance, in 2023, CCM reported strong margin performance, a direct result of these disciplined pricing approaches.

This success in pricing reflects CCM's robust market position and significant brand equity. Their ability to command premium pricing underscores their strength in core segments, allowing for consistent generation of substantial profits and cash flow, characteristic of a Cash Cow business unit.

- Value-Based Pricing: CCM prices based on customer value, not just cost.

- Margin Improvement: This strategy directly contributed to better profit margins.

- Market Power: Strong market position allows for favorable pricing.

- Cash Generation: High profit margins indicate strong cash flow generation.

Carlisle Construction Materials (CCM), particularly its commercial re-roofing and established insulation lines, functions as a prime Cash Cow for Carlisle Companies. These segments benefit from predictable revenue streams, strong market share in mature sectors, and the operational efficiencies driven by the Carlisle Operating System (COS). This consistent profitability, bolstered by value-based pricing strategies, solidifies their role as reliable cash generators.

| Segment | BCG Status | Key Characteristics | 2023 Revenue Contribution (Approx.) | 2023 Margin Indicator |

| CCM Commercial Re-roofing | Cash Cow | Multi-year backlog, mid-single-digit growth, essential service | Significant portion of CCM's $5.0B revenue | Top-tier industry margins |

| CCM Single-Ply Roofing Systems (EPDM, TPO, PVC) | Cash Cow | Market leaders, decades of adoption, proven reliability | Core to CCM's revenue | Strong cash flow |

| CCM Polyiso & EPS Insulation | Cash Cow | High market share, mature markets, stable revenue | Integral to CCM's offerings | Robust profit margins |

Full Transparency, Always

Carlisle Companies BCG Matrix

The Carlisle Companies BCG Matrix preview you are viewing is the identical, fully formatted document you will receive upon purchase. This means no watermarks, no demo content, and no surprises – just a comprehensive analysis ready for immediate strategic application. You're getting the exact same expert-crafted report, designed for clarity and actionable insights into Carlisle's business units. Once purchased, this professional BCG Matrix file will be instantly downloadable, allowing you to seamlessly integrate it into your business planning and decision-making processes.

Dogs

Carlisle Interconnect Technologies (CIT), divested in 2024, represented Carlisle Companies' final venture outside of building products. Its sale marked a decisive shift towards becoming a pure-play building products entity, suggesting CIT was classified as a Dog in the BCG Matrix due to a perceived low strategic fit and potentially weaker growth or market standing relative to the company's new core focus.

The divestiture of CIT, Carlisle's last non-building products segment, generated proceeds that were strategically allocated to share repurchases. This action underscores the company's commitment to streamlining its operations and enhancing shareholder value by exiting a business unit deemed non-core to its future strategic direction in the building products sector.

The residential new construction sector within Carlisle Weatherproofing Technologies (CWT) is currently facing headwinds. Macroeconomic factors, including elevated interest rates and persistent housing affordability issues, have led to a slowdown and reduced sales volumes in this segment.

This environment suggests a market characterized by low growth. Carlisle's position within this specific sub-segment may reflect a comparatively smaller market share, aligning with the characteristics of a Dog in the BCG matrix. For instance, new housing starts in the U.S. saw a notable decline in late 2023 and early 2024 compared to previous periods, directly impacting demand for weatherproofing materials.

The residential repair and remodel market, a key area for Carlisle Weatherproofing Technologies (CWT), is currently facing subdued expectations and persistent headwinds. This segment exhibits low growth, suggesting that Carlisle's position within it might not be dominant, potentially classifying CWT's residential repair and remodel business as a Dog in the BCG Matrix.

Underperforming or Undifferentiated CWT Product Lines

Within Carlisle Companies' Weatherproofing Technologies (CWT) segment, some older or less innovative product lines might be classified as Dogs. These are likely to have a small share of a market that isn't growing much. For instance, if a specific sealant or coating technology hasn't been updated to meet current building codes or environmental standards, its market relevance would diminish.

These underperforming product lines typically require significant investment to revitalize or are simply phased out. Their contribution to overall revenue and profit is minimal, often dragging down the segment's performance. Without clear differentiation or a strong market position, they represent a drain on resources.

- Low Market Share: Products lacking recent innovation or acquisition support struggle to gain traction.

- Low Market Growth: Older technologies often operate in mature or declining market segments.

- Minimal Returns: These lines contribute little to profitability and may even incur losses.

- Resource Drain: Continued support for underperforming products diverts capital from more promising ventures.

Niche Markets with Limited Scale and High Competition

Carlisle Companies might participate in niche markets characterized by limited scalability and intense competition. In these segments, Carlisle's market share could be quite small, and the potential for significant growth might be constrained by factors such as numerous competitors or localized market dynamics. These types of operations, which may not substantially impact overall revenue or profitability and demand considerable resources relative to their contribution, would fit the description of Dogs within the BCG Matrix framework.

- Niche Market Presence: Carlisle may hold a minimal share in highly fragmented markets.

- Low Growth Prospects: Limited expansion opportunities due to intense competition or regional constraints.

- Disproportionate Resource Allocation: Small-scale operations requiring significant effort for minimal returns.

- BCG Matrix Classification: Such segments align with the characteristics of Dogs, indicating low market share and low growth.

Carlisle's divestment of Carlisle Interconnect Technologies (CIT) in 2024, its last non-building products segment, signals a strategic move towards a pure-play building products focus, aligning with a potential "Dog" classification for CIT due to low strategic fit. The residential new construction market, particularly within Carlisle Weatherproofing Technologies (CWT), is experiencing a slowdown due to high interest rates and affordability issues, impacting sales volumes. This low-growth environment, coupled with potentially smaller market share in certain sub-segments like residential repair and remodel, suggests that some CWT product lines could be considered Dogs, especially older technologies with diminishing market relevance.

| Segment/Product Line | BCG Classification (Potential) | Reasoning | Relevant Data Point (2024 Context) |

|---|---|---|---|

| Carlisle Interconnect Technologies (CIT) | Dog | Divested in 2024, indicating low strategic fit and potential underperformance relative to core building products focus. | Sale completed in 2024, proceeds used for share repurchases. |

| CWT - Residential New Construction | Dog (Potential for specific sub-segments) | Facing headwinds from macroeconomic factors leading to reduced sales volumes. | U.S. housing starts saw a decline in late 2023 and early 2024, impacting demand for weatherproofing. |

| CWT - Older/Less Innovative Product Lines | Dog | Small market share in a mature or declining segment, diminished relevance due to lack of updates. | Products failing to meet updated building codes or environmental standards would see reduced demand. |

Question Marks

Carlisle Weatherproofing Technologies (CWT) has been actively expanding its footprint through strategic acquisitions. Recent additions like Plasti-Fab and ThermaFoam are key to this strategy, bolstering CWT's offerings and market reach. These moves are designed to capture growth in expanding or new markets.

While these acquisitions add to CWT's revenue, their market share is still in the growth phase. This positions them as potential stars in the BCG matrix, exhibiting high growth potential but currently holding a lower relative market share as they integrate and build momentum. For instance, the building envelope market, where CWT operates, is projected for significant growth, with some segments expected to expand at a compound annual growth rate of over 5% through 2025.

Carlisle Companies is strategically investing in emerging technologies for building envelope solutions, recognizing their significant potential to address future market demands. These innovations, such as advanced insulation materials and smart façade systems, are positioned for high growth due to increasing emphasis on sustainability and energy efficiency. For instance, the global building envelope market was valued at approximately $200 billion in 2023 and is projected to grow significantly, driven by these technological advancements.

Despite their promising growth trajectories, these cutting-edge building envelope technologies currently represent a small portion of Carlisle's overall market share. This is primarily because they are in the nascent stages of market adoption and penetration, facing challenges related to cost, awareness, and established industry practices. However, with continued R&D and market development, Carlisle anticipates these "question marks" will evolve into strong market contenders.

Carlisle Companies is strategically expanding into promising new niches within the sustainable building materials sector. A prime example is their acquisition of Bonded Logic, a company specializing in insulation made from recycled denim. This move directly targets high-growth markets where Carlisle aims to capture significant market share.

These emerging sustainable material segments are considered Carlisle's . While the company is actively investing and growing its presence, its current market penetration in these specific niches might still be relatively low compared to the total addressable market. This positions these ventures as key areas for future growth and development.

High-Performance Adhesives and Sealants for Specialized Applications

Carlisle Companies' focus on high-performance adhesives and sealants for specialized applications, exemplified by the launch of products like the dual-tank Flexible Fast Adhesive within its Construction Materials segment (CWT), signals a strategic move towards potentially high-growth, niche markets. This expansion suggests these offerings might be positioned as question marks in the BCG matrix, requiring substantial investment to build market leadership.

These specialized adhesives and sealants are designed for demanding environments and advanced manufacturing processes, areas experiencing significant technological advancement and increased adoption. For instance, the automotive and aerospace sectors, key consumers of such materials, are projected to see continued growth in demand for lightweight, durable bonding solutions. The global market for adhesives and sealants was valued at approximately $65 billion in 2023 and is anticipated to grow, with specialized segments often exhibiting even higher growth rates.

- Targeting High-Growth Niches: Carlisle's new products are aimed at sectors like electric vehicles and renewable energy infrastructure, which are experiencing rapid expansion.

- Investment Requirement: Establishing a strong market presence in these specialized areas often necessitates significant R&D and marketing expenditure.

- Market Share Potential: While not yet dominant, these product lines offer substantial opportunity for Carlisle to capture significant market share in emerging, high-value applications.

- Competitive Landscape: The specialized adhesives market is competitive, with established players and new entrants vying for innovation leadership.

Digital Integration and Service Offerings for the 'Carlisle Experience'

Carlisle Companies is actively investing in digital integration and automation to elevate the 'Carlisle Experience'. This strategic push aims to deliver more innovative solutions and deepen customer engagement. For instance, by the end of 2023, Carlisle's digital initiatives were already showing traction, with a reported increase in digital customer interactions across their platforms.

These advancements are paving the way for potential new service offerings, particularly in the burgeoning market for integrated construction solutions. If these digital enhancements evolve into platforms that address this rapidly expanding sector, they would likely represent a high-growth potential area for Carlisle. The company's focus on leveraging technology to streamline processes and offer value-added services positions them to capture emerging market opportunities.

- Digital Integration: Carlisle is enhancing customer interaction through digital platforms and automation.

- Emerging Service Offerings: Potential for new services targeting integrated construction solutions.

- Market Potential: These initiatives could tap into a rapidly growing market.

- BCG Matrix Placement: Likely positioned as a 'Star' or 'Question Mark' depending on market share capture and growth trajectory.

Carlisle's investments in emerging building envelope technologies and sustainable materials, such as recycled denim insulation, represent potential "question marks" in the BCG matrix. These ventures are in high-growth markets but currently hold a relatively low market share as they gain traction and adoption.

The company's strategic acquisitions and focus on specialized adhesives and sealants for sectors like automotive and aerospace also fall into this category. These areas offer significant growth prospects, but Carlisle needs to invest heavily to build market leadership and capture a larger share of these expanding niches.

Similarly, Carlisle's digital integration efforts, aimed at enhancing customer experience and potentially offering new integrated construction solutions, are positioned as question marks. While the market for such services is growing rapidly, Carlisle's market share in this nascent area is yet to be established.

These question mark segments require careful management and strategic investment to transition into stars, capitalizing on their high market growth potential. For example, the global building envelope market is projected to grow at a CAGR exceeding 5% through 2025, highlighting the opportunity for these investments.

| Segment | BCG Category | Growth Potential | Market Share | Strategic Focus |

|---|---|---|---|---|

| Emerging Building Envelope Tech | Question Mark | High | Low | R&D, Market Development |

| Sustainable Materials (e.g., Recycled Denim Insulation) | Question Mark | High | Low | Acquisition, Market Penetration |

| Specialized Adhesives & Sealants | Question Mark | High | Low | Product Innovation, Niche Targeting |

| Digital Integration & New Services | Question Mark | High | Low | Platform Development, Customer Engagement |

BCG Matrix Data Sources

Our Carlisle Companies BCG Matrix is built upon a foundation of robust data, incorporating financial disclosures, market share analysis, and industry growth projections to ensure strategic accuracy.