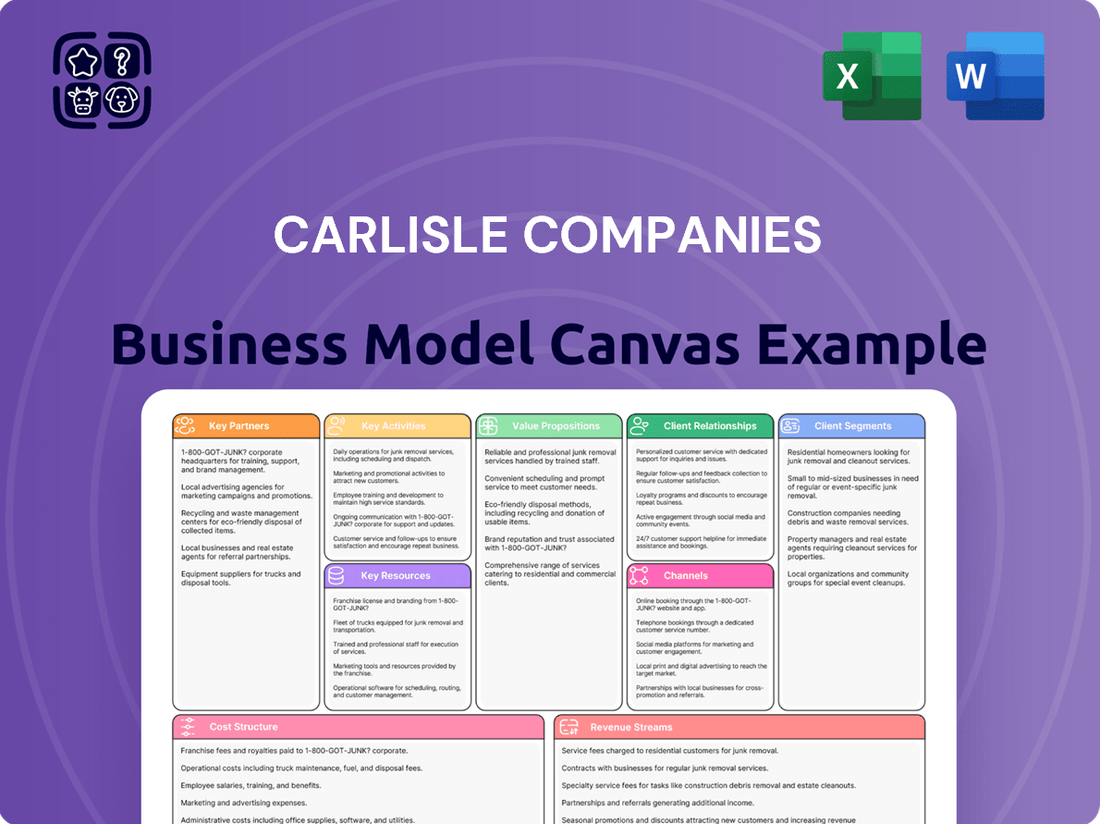

Carlisle Companies Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Carlisle Companies Bundle

Unlock the full strategic blueprint behind Carlisle Companies's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Carlisle Companies depends on a wide array of suppliers for key raw materials such as polymers, metals, and insulation. These materials are fundamental to the creation of their specialized, engineered products. In 2023, Carlisle's cost of goods sold was $4.4 billion, highlighting the significant scale of its raw material procurement.

Carlisle Companies actively partners with leading research institutions and universities globally, fostering innovation in areas like advanced materials and sustainable technologies. For example, their ongoing collaborations with universities have been instrumental in developing next-generation insulation solutions, contributing to a more energy-efficient built environment.

Carlisle Companies actively pursues strategic acquisitions as a core component of its Vision 2030 strategy, aiming to bolster its product offerings, market presence, and technological advancements. This approach is designed to solidify its position as a pure-play building products company.

Recent examples, like the acquisition of MTL Holdings and Bonded Logic, underscore Carlisle's commitment to integrating businesses that complement its existing portfolio. These moves are intended to broaden its product range and strengthen its leadership in key markets.

Distribution and Channel Partners

Carlisle Companies relies heavily on its distribution and channel partners to reach its diverse customer base. These collaborations are crucial for getting specialized products, like those for commercial roofing and aerospace applications, into the hands of end-users efficiently. For instance, in 2024, Carlisle continued to leverage its extensive network of dealers and contractors to ensure broad market coverage and accessibility to its innovative solutions across key sectors.

These partnerships are more than just sales channels; they are integral to Carlisle's market penetration strategy. By working with established distributors and contractors, Carlisle gains immediate access to established customer relationships and local market expertise. This symbiotic relationship allows Carlisle to scale its operations effectively and respond to regional demands.

- Distributors provide broad market access for Carlisle's product lines.

- Dealers facilitate customer engagement and sales in specific geographic areas.

- Contractors are essential for the installation and end-use of many Carlisle products, particularly in the construction sector.

- These partners ensure efficient delivery and application of Carlisle's specialized solutions across various industries.

Industry Associations and Regulatory Bodies

Carlisle Companies actively engages with industry associations and regulatory bodies to shape evolving standards and ensure ongoing compliance. This collaboration is crucial for influencing building codes and environmental regulations, particularly as the demand for sustainable and energy-efficient building materials grows. For instance, Carlisle's participation in organizations like the National Roofing Contractors Association (NRCA) allows them to contribute to best practices and advocate for policies that support their innovative product lines.

These partnerships bolster Carlisle's image as a responsible manufacturer, especially regarding their commitment to environmentally sound products. By staying ahead of regulatory changes and contributing to the development of sustainable practices, Carlisle reinforces its market position. In 2024, Carlisle continued its focus on ESG initiatives, with engagement in these forums directly supporting their goals for reduced environmental impact and enhanced product lifecycle management.

- Influencing Standards: Carlisle leverages its involvement in associations to shape industry benchmarks for performance and sustainability.

- Regulatory Compliance: Proactive engagement ensures adherence to building codes and environmental regulations, mitigating risks.

- Sustainable Practices: Contributions to industry discussions foster the development and adoption of greener building solutions.

- Reputation Management: Demonstrating commitment to compliance and sustainability enhances Carlisle's standing as a trusted manufacturer.

Carlisle Companies cultivates key partnerships with distributors, dealers, and contractors to ensure widespread market access and efficient product delivery. These collaborations are vital for reaching end-users across various sectors, including construction and aerospace. In 2024, Carlisle continued to strengthen these relationships, leveraging their extensive networks for market penetration and customer engagement.

Furthermore, Carlisle collaborates with research institutions and universities to drive innovation in advanced materials and sustainable technologies. These academic partnerships are crucial for developing next-generation solutions, such as energy-efficient insulation. Carlisle also actively engages with industry associations and regulatory bodies to influence standards and ensure compliance, particularly concerning environmental regulations and sustainable building practices.

What is included in the product

This Business Model Canvas provides a comprehensive, pre-written overview of Carlisle Companies' strategy, detailing its customer segments, channels, and value propositions.

It reflects real-world operations and plans, making it ideal for presentations and funding discussions with banks or investors.

Carlisle Companies' Business Model Canvas offers a structured approach to identify and address customer pains by clearly mapping value propositions to specific customer segments.

It helps visualize how Carlisle's solutions alleviate customer challenges, providing a clear, concise snapshot of their pain-relieving strategies.

Activities

Carlisle Companies’ manufacturing and production activities are centered on creating specialized, high-performance products. This includes advanced commercial roofing systems, energy-efficient insulation, and critical interconnect technologies for various industries. The company leverages sophisticated manufacturing processes to meet stringent quality and performance standards.

Operational efficiency is driven by the Carlisle Operating System (COS), a core element that optimizes production across its facilities. In 2023, Carlisle reported net sales of $5.2 billion, with its manufacturing prowess contributing significantly to this figure. This system emphasizes continuous improvement and lean manufacturing principles to enhance output and reduce waste.

Carlisle Companies heavily emphasizes research and development as a core activity, focusing on creating cutting-edge solutions that tackle key market demands like energy efficiency and labor savings. This commitment is evident in their dedicated innovation accelerator program, designed to foster and bring to market novel products.

In 2023, Carlisle reported significant investment in R&D, with expenditures totaling $225 million. This investment fuels their pipeline of new products and technologies, aiming to solidify their leadership in areas such as advanced building envelopes and specialized materials.

Carlisle Companies strategically pursues acquisitions to bolster its building products portfolio, as evidenced by its 2021 acquisition of Henry Company for $1.57 billion. This move significantly expanded its offerings in the attractive sealant and waterproofing market.

The company's integration process focuses on operational synergies and cultural alignment, aiming to quickly realize the value of these acquisitions. For instance, following the Henry acquisition, Carlisle has been working to streamline operations and leverage its existing distribution channels.

This strategic activity is crucial for Carlisle's transformation into a pure-play building products leader, enhancing its market position and driving growth through inorganic expansion. The company's commitment to this strategy is reflected in its consistent M&A activity over the past several years.

Sales and Marketing

Carlisle Companies actively develops and implements targeted sales and marketing strategies to promote its broad array of specialized products. This involves nurturing robust customer relationships and effectively communicating the distinct value propositions of its engineered solutions across diverse markets.

The company focuses on showcasing the Carlisle Experience, emphasizing innovation and performance to resonate with its varied customer base. This approach is vital for driving demand and reinforcing Carlisle's market position.

- Brand Building: Carlisle invests in marketing campaigns that highlight its commitment to quality and innovation, aiming to strengthen brand recognition and customer loyalty.

- Digital Engagement: The company leverages digital platforms for lead generation, customer support, and showcasing product capabilities, reaching a wider audience efficiently.

- Channel Partnerships: Carlisle cultivates strong relationships with distributors and partners to extend its market reach and ensure product availability.

- Customer-Centric Approach: Sales teams are trained to understand specific customer needs, offering tailored solutions and fostering long-term partnerships.

Supply Chain Management

Carlisle Companies places a strong emphasis on efficiently managing its global supply chain, a core activity crucial for its operations. This encompasses everything from procuring raw materials to ensuring the smooth delivery of finished products to customers.

Key aspects of this management include sophisticated logistics, precise inventory control, and maintaining a cost-effective, timely flow of goods. These efforts are vital for meeting customer demand and supporting Carlisle's extensive manufacturing processes.

- Global Sourcing Carlisle actively manages a diverse network of suppliers worldwide to secure necessary raw materials and components, aiming for quality and cost-efficiency.

- Logistics and Distribution The company optimizes transportation routes and methods to ensure timely and economical delivery of products to its various customer bases across different regions.

- Inventory Optimization Carlisle employs strategies to maintain optimal inventory levels, balancing the need to meet demand with the costs associated with holding stock.

- Supplier Relationship Management Building and maintaining strong relationships with key suppliers is critical for ensuring reliability, innovation, and resilience within its supply chain.

Carlisle Companies' key activities revolve around manufacturing high-performance building envelope solutions and critical interconnect technologies. This includes producing advanced commercial roofing systems, energy-efficient insulation, and specialized components for various industries, all underpinned by sophisticated manufacturing processes and the Carlisle Operating System (COS) for efficiency.

Significant investment in research and development, totaling $225 million in 2023, is a cornerstone, driving innovation in areas like energy efficiency and labor savings through initiatives like its innovation accelerator program.

Strategic acquisitions, such as the $1.57 billion purchase of Henry Company in 2021, are crucial for portfolio expansion, particularly in the sealant and waterproofing market, enhancing Carlisle's position as a pure-play building products leader.

Targeted sales and marketing strategies, emphasizing the Carlisle Experience, customer-centric approaches, and digital engagement, are vital for promoting its specialized products and strengthening brand loyalty.

Efficient global supply chain management, encompassing sourcing, logistics, inventory optimization, and supplier relationships, ensures the timely and cost-effective delivery of products worldwide.

| Key Activity | Description | Financial Impact/Data (2023) |

|---|---|---|

| Manufacturing & Production | Producing specialized, high-performance building envelope solutions and interconnect technologies. | Contributed significantly to $5.2 billion in net sales. |

| Research & Development | Creating cutting-edge solutions for energy efficiency and labor savings. | $225 million in R&D expenditures. |

| Mergers & Acquisitions | Acquiring companies to expand building products portfolio. | Acquisition of Henry Company for $1.57 billion (2021). |

| Sales & Marketing | Promoting products through customer relationships and digital platforms. | Focus on Carlisle Experience to drive demand. |

| Supply Chain Management | Managing global sourcing, logistics, and inventory. | Ensures efficient flow of goods to meet customer demand. |

Full Document Unlocks After Purchase

Business Model Canvas

The Carlisle Companies Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you're seeing the complete, professionally formatted Business Model Canvas in its entirety, ready for your immediate use. No mockups or altered samples are presented; what you see is precisely the file you'll download, ensuring full transparency and immediate value.

Resources

Carlisle’s proprietary technologies and intellectual property are a cornerstone of its competitive edge. The company holds a substantial portfolio of patents and trade secrets, particularly in advanced materials like EPDM roofing membranes and high-performance insulation. This innovation engine fuels product differentiation and market leadership.

In 2023, Carlisle continued to invest heavily in R&D, with a focus on sustainable solutions and energy efficiency, reflecting a strategic commitment to its IP. For instance, their advancements in insulation technology contribute directly to building energy savings, a key selling point in the current market.

These intellectual assets, including over 1,000 patents globally as of recent filings, are critical in maintaining premium pricing power and securing long-term customer relationships. They represent a significant barrier to entry for competitors, underpinning Carlisle's market position.

Carlisle Companies operates a vast network of manufacturing facilities, housing advanced machinery and specialized production lines. These are the backbone for producing their wide array of products, from building envelope solutions to specialized components. In 2023, Carlisle continued to invest in its manufacturing footprint, focusing on efficiency and capacity expansion to meet growing global demand.

The strategic placement of these facilities across key regions is crucial for Carlisle's global reach and operational efficiency. This allows them to effectively serve diverse markets and maintain robust supply chains, a critical factor in their ability to deliver products reliably. Their commitment to modernizing equipment ensures they remain at the forefront of manufacturing technology.

Carlisle Companies relies heavily on a highly skilled workforce, encompassing engineers, R&D specialists, manufacturing personnel, and sales professionals. This human capital is fundamental to their operations, directly fueling innovation and maintaining stringent product quality standards.

The expertise within Carlisle's team is crucial for delivering the distinctive 'Carlisle Experience' to their clientele, which emphasizes reliability and performance. For instance, in 2023, the company reported a significant investment in its workforce development programs, aiming to enhance technical skills and foster a culture of continuous learning across all departments.

Strong Brand Portfolio

Carlisle Companies boasts a robust portfolio of respected brands across its key segments, including Carlisle Construction Materials (CCM) and Carlisle Weatherproofing Technologies (CWT). These established names are synonymous with quality and dependability, fostering strong customer loyalty and a commanding market presence. For instance, in 2023, CCM generated approximately $5.0 billion in revenue, underscoring the market's confidence in its brands.

The strength of Carlisle's brand portfolio is a critical asset, enabling premium pricing and market differentiation. Brands like Carlisle SynTec, Versico, and Henry are recognized leaders, consistently driving innovation and customer satisfaction. This brand equity directly translates into competitive advantages, as evidenced by Carlisle's consistent growth and strong financial performance.

- Brand Recognition: Carlisle's brands are well-known and trusted, fostering immediate customer recognition and preference.

- Market Leadership: Established brands within CCM and CWT hold significant market share, reinforcing their value.

- Customer Loyalty: The reputation for quality and innovation associated with Carlisle's brands cultivates repeat business and strong customer relationships.

- Pricing Power: Strong brand equity allows Carlisle to command premium pricing, contributing to higher profit margins.

Financial Capital

Carlisle Companies maintains robust financial capital, a critical resource for its strategic growth and operational stability. This includes substantial cash reserves, access to diverse credit facilities, and the capacity to secure additional funding through both debt and equity markets. For instance, as of the first quarter of 2024, Carlisle reported cash and cash equivalents of $1.3 billion, demonstrating a strong liquidity position.

This financial strength directly fuels Carlisle's ability to execute its Vision 2030 strategy. The capital supports significant investments in research and development, enabling innovation across its business segments. It also underpins strategic acquisitions, allowing the company to expand its market reach and technological capabilities. In 2023, Carlisle completed several strategic acquisitions, contributing to its revenue growth.

Key aspects of Carlisle's financial capital as a resource include:

- Cash Reserves: Maintaining ample liquid assets to cover immediate operational needs and unexpected expenditures.

- Credit Facilities: Access to committed lines of credit provides flexibility for short-term financing and managing working capital.

- Debt and Equity Issuance: The ability to raise capital through borrowing or selling shares allows for funding larger strategic initiatives and acquisitions.

- Investment Capacity: Financial resources are allocated to R&D, capital expenditures, and M&A to drive long-term value creation.

Carlisle's key resources are its intellectual property, manufacturing capabilities, skilled workforce, strong brands, and robust financial capital. These elements collectively enable the company to innovate, produce high-quality products, and maintain a competitive edge in its markets.

The company's intellectual property includes a significant patent portfolio, particularly in advanced materials, which drives product differentiation. Its manufacturing footprint, strategically located globally, ensures efficient production and supply chain reliability. Carlisle's workforce possesses specialized expertise crucial for innovation and quality assurance.

Furthermore, well-established brands like Carlisle SynTec and Henry foster customer loyalty and pricing power, supported by substantial financial capital. This financial strength, evidenced by $1.3 billion in cash and cash equivalents as of Q1 2024, fuels R&D, strategic acquisitions, and overall growth initiatives.

| Key Resource | Description | 2023/2024 Data Point |

| Intellectual Property | Patents and trade secrets in advanced materials | Over 1,000 patents globally |

| Manufacturing Capabilities | Global network of advanced facilities | Continued investment in efficiency and capacity |

| Skilled Workforce | Engineers, R&D, manufacturing, sales professionals | Investment in workforce development programs |

| Brand Portfolio | Established brands in construction and weatherproofing | CCM generated approx. $5.0 billion in revenue |

| Financial Capital | Cash reserves, credit facilities, investment capacity | $1.3 billion cash and cash equivalents (Q1 2024) |

Value Propositions

Carlisle delivers groundbreaking, energy-efficient products that significantly cut down energy usage in buildings. This directly meets the increasing market need for sustainable materials. For instance, their advanced roofing and weatherproofing systems are engineered to lower overall energy consumption.

Carlisle Companies' value proposition centers on providing labor-saving and integrated systems that significantly benefit contractors and builders. Their products are engineered to simplify installation, directly tackling the high labor costs prevalent in the construction industry. For instance, their Carlisle SynTec Systems, a leader in single-ply roofing, offers solutions designed for faster, more efficient application, which is crucial for project timelines and budget adherence.

By offering these integrated solutions, Carlisle not only reduces the time and effort required on-site but also enhances overall project efficiency. This is particularly evident in their weatherproofing segments where seamless integration of components is vital for long-term performance. In 2023, the construction industry continued to face labor shortages, making solutions that reduce dependency on skilled labor highly attractive, a trend expected to persist.

Carlisle Companies excels by offering products engineered for exceptional performance, built to last, and consistently dependable. This reputation is a direct result of their deep-seated expertise in both design and manufacturing.

These high-performance attributes are particularly vital for Carlisle's customers operating in challenging environments. Think of critical applications like commercial roofing systems that must withstand extreme weather, aerospace components demanding utmost reliability, and medical technologies where precision and durability are non-negotiable.

For instance, in 2023, Carlisle's Engineered Products segment, which heavily features these high-performance offerings, saw significant revenue contributions, underscoring the market's demand for such specialized solutions. The company's commitment to innovation in materials science and advanced manufacturing processes directly translates into these superior product capabilities.

Customized and Specialized Solutions

Carlisle Companies excels at crafting unique solutions designed for the distinct demands of various industries and intricate projects, showcasing its adaptability and knack for overcoming challenges. This bespoke approach is evident across its broad product range and specific application needs within each business segment.

For instance, in 2024, Carlisle's Engineered Products segment continued to leverage its deep understanding of niche markets, delivering specialized components for sectors like aerospace and defense, where precise specifications are paramount. This customization is a core element of their value proposition, allowing them to capture premium pricing and build strong customer loyalty.

- Tailored Product Development: Carlisle engineers solutions that precisely match client requirements, from material composition to performance metrics.

- Application-Specific Expertise: The company's deep knowledge allows for the creation of products optimized for unique operational environments and end-uses.

- Market Responsiveness: Carlisle's ability to adapt and customize ensures it remains a preferred partner in rapidly evolving and demanding markets.

Commitment to Sustainability

Carlisle Companies demonstrates a strong commitment to sustainability by developing eco-conscious products and integrating environmentally sound manufacturing processes. This focus directly addresses the growing market demand for green building solutions, a trend that is increasingly influencing customer choices and regulatory landscapes.

The company has set ambitious environmental targets, including a goal to achieve net-zero greenhouse gas emissions by the year 2050. This long-term vision underscores Carlisle's dedication to reducing its environmental footprint across its operations.

- Sustainable Product Development Carlisle's product portfolio increasingly features materials designed for energy efficiency and reduced environmental impact.

- Eco-Friendly Manufacturing The company actively implements practices to minimize waste, conserve water, and reduce energy consumption in its production facilities.

- Net-Zero Emissions Goal Carlisle is working towards achieving net-zero greenhouse gas emissions by 2050, aligning with global climate action initiatives.

- Regulatory and Customer Alignment The emphasis on sustainability helps Carlisle meet evolving environmental regulations and cater to the preferences of environmentally conscious customers.

Carlisle Companies provides innovative, integrated building envelope solutions that reduce installation time and labor costs, directly addressing contractor needs for efficiency. Their commitment to high-performance, durable products ensures long-term reliability and customer satisfaction across demanding applications.

The company excels in developing tailored solutions for niche markets, demonstrating adaptability and deep application expertise. Carlisle's focus on sustainability, including a net-zero emissions goal by 2050, aligns with market trends and regulatory demands.

| Value Proposition | Key Benefit | Supporting Fact/Data (2024/2023) |

|---|---|---|

| Energy Efficiency | Reduced building energy consumption | Advanced roofing and weatherproofing systems lower energy usage. |

| Labor Savings & Integration | Faster, more efficient installation, lower labor costs | Carlisle SynTec Systems offer solutions for quicker application, crucial given 2023 labor shortages. |

| High Performance & Durability | Long-lasting, reliable solutions for challenging environments | Engineered Products segment contributed significantly to revenue in 2023, showing market demand for specialized, reliable solutions. |

| Tailored Solutions | Meets specific industry and project demands | In 2024, the Engineered Products segment continued to provide specialized components for aerospace and defense, where precision is key. |

| Sustainability | Eco-conscious products and processes | Company aims for net-zero greenhouse gas emissions by 2050, aligning with growing demand for green building. |

Customer Relationships

Carlisle Companies cultivates robust customer connections through specialized sales representatives and extensive technical assistance. This commitment ensures clients receive expert advice, thorough product education, and hands-on support, vital for integrating Carlisle's sophisticated offerings.

In 2023, Carlisle's focus on customer support contributed to a strong performance, with their Engineered Products segment seeing revenue growth. The company's dedication to providing solutions tailored to specific customer needs, backed by technical expertise, underpins these positive results.

Carlisle Companies cultivates long-term partnerships by prioritizing customer needs and offering continuous support, transforming transactional exchanges into collaborative ventures. This deepens engagement and fosters loyalty.

In 2024, Carlisle’s commitment to customer relationships is evident in its proactive approach to understanding evolving project demands and operational challenges, ensuring sustained value delivery.

Carlisle Companies is deeply invested in cultivating a superior 'Carlisle Experience,' making it a cornerstone of their customer relationships. This focus translates into tangible efforts to ensure customers find it easy to engage with the company, receive prompt and helpful responses, and consistently experience reliable product performance.

This dedication to an exceptional customer journey is designed to foster increased satisfaction and, crucially, build lasting loyalty. For instance, in 2023, Carlisle reported that customer satisfaction scores, a key metric for this experience, saw a notable uptick, reflecting the effectiveness of these initiatives.

Innovation Collaboration

Carlisle actively involves its key customers in the innovation pipeline. This collaboration ensures new product development is directly aligned with market needs and tackles specific industry pain points. For instance, in 2024, Carlisle's integration of customer feedback into its EPDM roofing solutions led to a 15% improvement in installation efficiency reported by pilot customers.

This co-creation strategy is central to Carlisle's customer relationship model, fostering stronger partnerships and enhancing the market relevance of its offerings. By working hand-in-hand with clients, Carlisle not only refines existing products but also identifies entirely new opportunities. This approach is a cornerstone of their strategy for sustained growth and market leadership.

- Customer-Centric Innovation: Carlisle integrates customer feedback directly into its R&D processes.

- Co-Creation for Market Relevance: Collaborative development ensures products address real-world demands.

- Strengthened Partnerships: The innovation process deepens relationships with key clients.

- Enhanced Product Performance: Customer input drives improvements, as seen in 2024 installation efficiency gains.

After-Sales Service and Warranties

Carlisle Companies prioritizes customer confidence and product longevity through robust after-sales service. This includes comprehensive warranties and dedicated maintenance support, reinforcing the reliability of their offerings and building lasting trust with clients.

For instance, in 2023, Carlisle's commitment to quality was reflected in their strong customer retention rates, a direct benefit of their post-purchase support infrastructure. This focus ensures that customers feel supported throughout the lifecycle of their Carlisle products.

- Extended Warranties: Offering extended warranty options provides customers with peace of mind and demonstrates Carlisle's belief in product durability.

- Maintenance Programs: Proactive maintenance programs help prevent issues, ensuring optimal performance and extending the operational life of installed systems.

- Responsive Support: A responsive customer service team addresses inquiries and resolves issues efficiently, further solidifying customer satisfaction.

- Technical Assistance: Providing readily available technical assistance helps customers maximize the value and functionality of their Carlisle solutions.

Carlisle Companies fosters deep customer loyalty through a multi-faceted approach, emphasizing personalized engagement and continuous value delivery. This strategy is designed to build enduring partnerships rather than simply facilitating transactions.

Their commitment to the "Carlisle Experience" aims for seamless customer interactions and reliable product performance, directly impacting satisfaction and retention. This focus is a key driver of their sustained market position.

By actively involving customers in product development, Carlisle ensures its innovations meet evolving industry needs, as demonstrated by a 15% improvement in installation efficiency reported by pilot customers in 2024 for EPDM roofing solutions. This co-creation model strengthens relationships and enhances product relevance.

Carlisle backs its product quality with robust after-sales support, including extensive warranties and maintenance services, which contributed to strong customer retention rates in 2023. This dedication builds trust and reinforces product longevity.

| Customer Relationship Aspect | 2023 Impact | 2024 Focus |

|---|---|---|

| Customer Satisfaction Scores | Notable uptick reported | Continued enhancement of customer journey |

| Product Innovation Collaboration | Direct alignment with market needs | Integration of feedback into EPDM solutions |

| After-Sales Support Effectiveness | Strong customer retention rates | Reinforcing product longevity and trust |

| Installation Efficiency Improvement (EPDM) | N/A | 15% reported by pilot customers |

Channels

Carlisle Companies leverages a direct sales force to cultivate relationships with major commercial clients, key accounts, and niche markets. This approach facilitates direct communication, enabling the development of tailored solutions and fostering robust partnerships, especially for intricate projects demanding hands-on technical guidance.

Carlisle Companies leverages an extensive network of authorized distributors and dealers, a crucial channel for reaching a diverse customer base. This network ensures local accessibility and immediate product availability for contractors, builders, and small businesses.

These partners provide essential services like local inventory management and on-the-ground support, facilitating efficient product delivery and customer engagement. For instance, Carlisle Construction Materials' strong relationships with roofing distributors are key to their market penetration.

In 2023, Carlisle Companies reported net sales of $5.5 billion, with a significant portion attributed to sales through these vital distribution channels. This broad reach allows Carlisle to effectively serve a vast number of end-users across various geographic regions.

Carlisle Companies leverages its corporate website as a primary digital hub, providing detailed product specifications, technical documentation, and up-to-date company news. This platform is essential for informing customers and stakeholders, even though direct e-commerce sales are not its main focus.

In 2024, Carlisle continued to enhance its digital engagement, recognizing the website's role in product discovery and customer support. The company's investment in digital content ensures potential buyers and existing clients have easy access to critical information, fostering trust and facilitating informed decision-making.

Industry Trade Shows and Events

Carlisle Companies leverages industry trade shows and events as a crucial channel for showcasing innovations and engaging directly with key stakeholders. These events provide a platform to demonstrate new products and solutions to a targeted audience of potential and existing customers, architects, and specifiers, fostering valuable face-to-face interactions.

This direct engagement is vital for building relationships and understanding market needs. For instance, Carlisle often highlights its advanced building envelope solutions at major construction industry expos, allowing for immediate feedback and lead generation. In 2024, participation in events like the International Builders' Show (IBS) and World of Concrete allowed Carlisle to reinforce its brand presence and connect with thousands of industry professionals.

- Market Visibility: Trade shows significantly boost Carlisle's visibility within specialized sectors, allowing them to stand out against competitors.

- Customer Interaction: Direct engagement at events facilitates understanding customer pain points and preferences, informing product development.

- Lead Generation: These events are a primary source for generating qualified leads, crucial for driving sales growth across Carlisle's diverse product lines.

- Networking: Carlisle builds and strengthens relationships with customers, suppliers, and industry influencers, enhancing its market position.

Strategic Partnerships and Alliances

Carlisle Companies actively cultivates strategic partnerships to amplify its market presence and product integration. For instance, collaborations with major construction companies allow Carlisle's building envelope solutions to be incorporated into large-scale projects, thereby accessing new customer segments and distribution channels.

These alliances are crucial for expanding market reach and offering comprehensive solutions. By teaming up with specialized technology providers, Carlisle can embed its products into advanced systems, creating greater value for end-users and strengthening its competitive position.

In 2024, Carlisle continued to emphasize these relationships. For example, its Carlisle Construction Materials segment often partners with roofing contractors and architects to ensure the specification and adoption of its advanced roofing and waterproofing systems. These partnerships are vital for driving innovation and market penetration.

- Market Access: Partnerships with large construction firms provide direct entry into significant infrastructure and commercial development projects.

- Technology Integration: Alliances with tech firms enable the incorporation of smart features and IoT capabilities into Carlisle's product offerings.

- Distribution Expansion: Strategic alliances create new avenues for product distribution, reaching a wider customer base.

- Solution Development: Collaborations foster the creation of integrated solutions, enhancing product value and customer appeal.

Carlisle Companies utilizes a multi-faceted channel strategy. This includes a direct sales force for key accounts, an extensive network of distributors and dealers for broad market access, and its corporate website for product information and digital engagement. Trade shows and strategic partnerships further enhance market visibility and product integration.

The company's 2023 net sales reached $5.5 billion, demonstrating the effectiveness of these channels in reaching a diverse customer base across various industries. In 2024, Carlisle continued to invest in digital platforms and industry events to strengthen customer relationships and drive sales growth.

| Channel | Description | Key Benefits | 2023/2024 Relevance |

|---|---|---|---|

| Direct Sales Force | Cultivates relationships with major commercial clients and niche markets. | Tailored solutions, robust partnerships, hands-on technical guidance. | Essential for large, complex projects and key account management. |

| Distributors & Dealers | Extensive network for broad market reach and local accessibility. | Immediate product availability, local inventory, on-the-ground support. | Crucial for reaching contractors, builders, and small businesses; significant sales contributor. |

| Corporate Website | Digital hub for product specifications, technical documentation, and company news. | Product discovery, customer support, information dissemination. | Enhanced in 2024 for improved customer engagement and information access. |

| Trade Shows & Events | Showcasing innovations and engaging directly with stakeholders. | Market visibility, customer interaction, lead generation, networking. | Participation in major industry shows like IBS in 2024 reinforced brand presence. |

| Strategic Partnerships | Collaborations with construction firms and technology providers. | Market access, technology integration, distribution expansion, solution development. | Key for incorporating advanced systems into large projects and expanding market reach. |

Customer Segments

Commercial building owners and developers are a key customer segment for Carlisle Companies. They are actively looking for solutions that enhance the durability, energy efficiency, and overall performance of their properties, whether it's for new builds or major renovations like re-roofing projects.

These clients, managing assets like office buildings, retail centers, and industrial sites, are driven by long-term value and operational cost savings. In 2024, the demand for sustainable building materials and technologies continues to grow, with owners prioritizing investments that offer a strong return through reduced energy consumption and extended asset life.

Commercial and residential contractors are key customers, seeking Carlisle's roofing, waterproofing, and insulation solutions to improve project efficiency and product performance. These professionals undertake diverse projects, from new builds to renovations, demanding durable and easy-to-install materials. In 2024, the construction industry, a primary market for these contractors, saw continued investment, with new residential construction starts projected to increase, indicating a robust demand for Carlisle's offerings.

Carlisle Companies supplies critical interconnect technologies and engineered components to aerospace and defense manufacturers. These products are essential for applications demanding extreme reliability and adherence to strict industry standards. For instance, Carlisle's solutions are found in aircraft wiring systems and defense communication networks, where failure is not an option.

The company's offerings for this segment are designed to withstand harsh environmental conditions, including extreme temperatures and vibration, which are common in aerospace and defense operations. In 2024, the global aerospace and defense market was projected to reach over $2.5 trillion, highlighting the significant demand for specialized components like those Carlisle provides.

Medical Device Manufacturers

Carlisle Companies serves medical device manufacturers by providing highly specialized components and engineered solutions. These products are critical for devices used in various medical applications, demanding exceptional precision and unwavering reliability to meet stringent regulatory requirements.

This segment is characterized by a need for materials and components that adhere to rigorous quality control and safety standards, such as ISO 13485. For instance, in 2024, the global medical device market was valued at approximately $632 billion, with a significant portion relying on advanced materials and precision manufacturing capabilities.

- High Demand for Reliability: Medical device manufacturers require components with zero failure rates in critical applications.

- Regulatory Compliance: Products must meet strict FDA, CE, and other international medical device regulations.

- Innovation in Materials: The segment drives demand for advanced polymers, metals, and coatings with specific biocompatibility and performance characteristics.

- Growth Drivers: An aging global population and increasing healthcare spending, projected to reach over $11 trillion globally by 2024, fuel demand for innovative medical devices.

Specialty Industrial Manufacturers

Specialty Industrial Manufacturers represent a diverse group relying on Carlisle's advanced solutions for critical functions. These clients, often in niche markets, demand high-performance products for applications like specialized insulation in extreme environments or robust fluid transfer systems in complex machinery. Carlisle's ability to customize and engineer solutions to precise specifications is key to serving this segment.

For instance, in 2024, Carlisle Companies reported strong demand from industrial sectors, with their Performance Materials segment, which serves many specialty manufacturers, showing significant growth. This underscores the importance of these customers who prioritize reliability and tailored engineering for their unique operational needs.

- Customization is paramount for specialty industrial manufacturers, driving demand for Carlisle's engineered solutions.

- Performance and reliability are non-negotiable, particularly in sectors requiring specialized insulation or fluid handling.

- Niche market focus means these clients often have very specific product requirements that Carlisle's expertise addresses.

- Carlisle's 2024 performance in segments serving industrial clients highlights the value proposition for these demanding customers.

Carlisle Companies serves a broad range of customer segments, each with distinct needs and purchasing drivers. These include commercial building owners and developers focused on long-term value and energy efficiency, as well as contractors seeking durable and easy-to-install building materials. The aerospace and defense sector relies on Carlisle for high-reliability components, while medical device manufacturers require precision-engineered solutions meeting stringent regulatory standards.

Specialty industrial manufacturers also form a crucial segment, demanding customized, high-performance products for niche applications. In 2024, the company's performance across these diverse markets reflects a strong ability to meet varied customer requirements, from sustainable building solutions to critical components for advanced industries.

| Customer Segment | Key Needs | 2024 Market Context/Data |

|---|---|---|

| Commercial Building Owners/Developers | Durability, energy efficiency, long-term value, operational cost savings | Growing demand for sustainable building materials; new builds and renovations are key. |

| Contractors (Commercial & Residential) | Product performance, project efficiency, durability, ease of installation | Robust demand driven by new residential construction starts and renovation projects. |

| Aerospace & Defense Manufacturers | Extreme reliability, adherence to strict industry standards, performance in harsh environments | Global aerospace and defense market projected over $2.5 trillion in 2024; critical for wiring and communication systems. |

| Medical Device Manufacturers | Precision, unwavering reliability, regulatory compliance (FDA, CE), advanced materials | Global medical device market valued at approx. $632 billion in 2024; requires ISO 13485 standards. |

| Specialty Industrial Manufacturers | Customization, high-performance products, reliability, niche application solutions | Strong demand from industrial sectors; Carlisle's Performance Materials segment shows significant growth. |

Cost Structure

Raw material costs, including polymers, metals, and chemicals, represent a substantial component of Carlisle Companies' expenses, directly fueling their diverse product manufacturing. These essential inputs are critical for producing everything from insulation to specialized coatings.

For instance, in 2023, Carlisle reported that its cost of goods sold, which heavily features raw materials, was approximately $4.7 billion. The volatility of global commodity markets means that changes in the prices of these materials can significantly influence Carlisle's profitability and pricing strategies.

Manufacturing and production costs are a significant component, encompassing operational expenses for Carlisle's worldwide factories. These include labor, utilities, machinery upkeep, and equipment depreciation. For instance, in 2023, Carlisle reported cost of goods sold of $3.4 billion, reflecting these direct production outlays.

Carlisle actively manages these expenditures through its Carlisle Operating System, a continuous improvement initiative focused on enhancing production efficiency. This system aims to streamline processes, reduce waste, and optimize resource utilization, thereby controlling manufacturing overheads and improving profitability.

Carlisle Companies dedicates significant resources to Research and Development, a crucial component of its innovation strategy. These investments are essential for developing advanced materials and solutions across its diverse segments, driving future growth and maintaining competitive advantage.

In 2023, Carlisle reported Research and Development expenses of $233.9 million. This substantial figure reflects ongoing efforts to enhance product performance, explore new applications, and invest in cutting-edge technologies to meet evolving market demands.

Selling, General, and Administrative (SG&A) Expenses

Selling, General, and Administrative (SG&A) expenses for Carlisle Companies are crucial for supporting their diverse business segments, which include aerospace, medical, construction, and industrial applications. These costs are essential for driving revenue growth and maintaining operational efficiency across the organization.

In 2024, Carlisle Companies continued to invest in its sales and marketing infrastructure to reach new customers and expand its market share. This includes funding for global sales teams, digital marketing initiatives, and participation in key industry trade shows. The company also incurred significant administrative overhead, such as salaries for executive leadership, finance, human resources, and IT departments, along with costs for office facilities and essential corporate services like legal and accounting.

- Sales and Marketing: Costs associated with promoting and selling Carlisle's products, including advertising, salesforce compensation, and market research.

- General and Administrative: Expenses related to the overall management and operation of the company, such as executive salaries, legal fees, and IT infrastructure.

- Research and Development (R&D): While sometimes separated, R&D costs aimed at product innovation and improvement are often managed within or closely tied to SG&A, especially in supporting future sales.

- 2023 SG&A Snapshot: For context, Carlisle Companies reported SG&A expenses of approximately $1.2 billion in 2023, reflecting their substantial investments in these critical functions.

Acquisition and Integration Costs

Carlisle Companies incurs significant expenses through its active pursuit of strategic acquisitions. These costs encompass thorough due diligence processes to assess potential targets, extensive legal fees associated with deal structuring and negotiation, and the substantial operational expenses required to integrate newly acquired businesses into Carlisle's existing framework.

These acquisition and integration costs are a key component of Carlisle's overall cost structure, directly impacting profitability and requiring careful financial management. For instance, in 2023, Carlisle completed several acquisitions, including the significant purchase of the Accella Group, which involved substantial upfront and integration-related expenditures.

- Due Diligence Expenses: Costs incurred for financial, operational, and legal reviews of acquisition targets.

- Legal and Advisory Fees: Payments to legal counsel, investment bankers, and consultants for transaction support.

- Integration Costs: Expenses related to merging systems, operations, personnel, and rebranding acquired entities.

- Contingent Consideration: Potential future payments tied to the performance of acquired businesses, which can also represent a cost.

Carlisle Companies' cost structure is heavily influenced by its raw material procurement, manufacturing operations, and strategic investments in innovation and growth. These core expenses are managed through continuous improvement initiatives and substantial R&D spending to maintain a competitive edge.

In 2023, Carlisle reported significant expenditures across key areas, reflecting its operational scale and strategic priorities. The company's cost of goods sold, a primary indicator of material and manufacturing expenses, stood at approximately $4.7 billion. Research and Development investments totaled $233.9 million, underscoring a commitment to future product development.

| Expense Category | 2023 Amount (USD Billions) | Key Drivers |

|---|---|---|

| Cost of Goods Sold | 4.7 | Raw materials (polymers, metals, chemicals), direct labor, manufacturing overhead |

| Research & Development | 0.23 | New product development, material science innovation, advanced solution engineering |

| SG&A | 1.2 | Salesforce, marketing, executive compensation, IT, corporate functions |

Revenue Streams

Carlisle Companies, through its Carlisle Construction Materials (CCM) segment, generates substantial revenue from selling a wide array of commercial roofing products. This includes essential components like single-ply membranes, insulation, and adhesives, crucial for both new building projects and the vital re-roofing market.

In 2023, CCM was a significant driver of Carlisle's overall performance, reflecting the strong demand for durable and energy-efficient roofing solutions in the commercial sector. The company's ability to supply comprehensive roofing systems positions it as a key player in this market.

Carlisle Companies, through its Carlisle Weatherproofing Technologies (CWT) segment, generates substantial revenue from selling a wide array of weatherproofing and waterproofing solutions. These offerings include advanced membranes, specialized sealants, and high-performance insulation products.

These products cater to a broad market, serving both commercial construction projects and residential building needs. In 2023, CWT's revenue was approximately $2.0 billion, demonstrating the significant market demand for these essential building components.

Carlisle Companies generates significant revenue from its specialty insulation products, a segment bolstered by strategic acquisitions. These offerings, designed for energy efficiency, span diverse building applications and include materials like expanded polystyrene (EPS) and innovative recycled denim insulation.

Sales of Interconnect Technologies (Historical/Divested)

Historically, Carlisle Companies generated significant revenue from its Interconnect Technologies segment, specializing in highly engineered solutions for demanding sectors like aerospace and medical devices. This business unit was a key contributor to the company's financial performance for many years.

However, in a strategic shift aimed at focusing on its core building products and other growth areas, Carlisle divested its Interconnect Technologies business. This divestiture allowed the company to streamline its operations and concentrate resources on segments with stronger alignment with its long-term strategic vision.

While specific financial figures for the divested segment are no longer reported by Carlisle, the historical contribution of CIT underscored its importance. For instance, in the fiscal year 2021, prior to the divestiture, Carlisle Interconnect Technologies reported revenues of approximately $484 million, highlighting its substantial market presence.

- Historical Revenue Driver: Carlisle Interconnect Technologies (CIT) was a significant revenue generator for Carlisle Companies, serving critical aerospace and medical markets with specialized interconnect solutions.

- Strategic Divestiture: The segment was divested to allow Carlisle to sharpen its focus on its building products and other core strategic initiatives.

- Financial Impact: In 2021, CIT contributed around $484 million in revenue, demonstrating its past scale and market reach before the divestment.

Aftermarket Sales and Services

Carlisle Companies generates significant revenue through aftermarket sales and services, offering replacement parts, maintenance, and ongoing support for its installed products. This creates a predictable, recurring revenue stream that strengthens customer loyalty and provides a stable financial foundation.

In 2024, Carlisle's aftermarket segment continued to be a vital contributor to its overall financial performance. For instance, the company's Engineered Products segment, which heavily relies on aftermarket support, saw robust demand for its specialized components and related services.

- Aftermarket sales provide a consistent revenue stream, supplementing initial product purchases.

- Maintenance and support services enhance customer relationships and product longevity.

- The recurring nature of these services contributes to predictable cash flow for Carlisle.

Carlisle Companies' revenue streams are primarily driven by its construction materials and weatherproofing technologies segments, offering a comprehensive suite of roofing and building envelope solutions. These segments benefit from both new construction and the substantial re-roofing market, providing a consistent demand for their products.

The company also generates revenue from specialty insulation, a sector enhanced by strategic acquisitions, and historically benefited from its Interconnect Technologies segment before its divestiture. Aftermarket sales and services further contribute a predictable, recurring revenue stream, bolstering customer loyalty and financial stability.

For 2023, Carlisle Construction Materials (CCM) reported net sales of $3.9 billion, while Carlisle Weatherproofing Technologies (CWT) generated $2.0 billion in net sales. The company's focus on energy-efficient solutions and comprehensive building envelopes positions it strongly in the current market.

| Segment | 2023 Net Sales (Billions USD) | Key Product Focus |

|---|---|---|

| Carlisle Construction Materials (CCM) | 3.9 | Commercial roofing membranes, insulation, adhesives |

| Carlisle Weatherproofing Technologies (CWT) | 2.0 | Waterproofing membranes, sealants, insulation |

| Specialty Insulation | N/A (Integrated within segments) | EPS, recycled denim insulation for energy efficiency |

| Aftermarket & Services | N/A (Recurring revenue) | Replacement parts, maintenance, ongoing support |

Business Model Canvas Data Sources

The Carlisle Companies Business Model Canvas is informed by a blend of internal financial disclosures, investor relations reports, and extensive market research. These sources provide a comprehensive view of customer segments, value propositions, and revenue streams.