Cargotec PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cargotec Bundle

Navigate the complex external environment impacting Cargotec with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, and technological advancements are shaping the logistics and cargo handling industries. Discover the crucial social trends and environmental regulations that influence Cargotec's operations and strategic decisions.

Gain a competitive edge by leveraging these actionable insights. Our PESTLE analysis provides a deep dive into the factors driving change, allowing you to anticipate challenges and capitalize on emerging opportunities within Cargotec's market. Ready to make informed strategic choices?

Don't miss out on critical intelligence. Download the full PESTLE analysis for Cargotec now and equip yourself with the knowledge needed to excel in today's dynamic business landscape.

Political factors

Cargotec's extensive global footprint, reaching over 60 countries, makes it highly susceptible to geopolitical instability and shifts in trade policies. These external forces can introduce significant uncertainty, directly affecting customer confidence and investment decisions. For instance, in 2024, geopolitical tensions in several key regions demonstrably slowed down customer decision-making, impacting order growth for Cargotec's various business segments.

The introduction of tariffs and other trade barriers by major economic powers, such as the United States, presents a direct challenge to Cargotec's operating environment. This is particularly relevant for its North American operations, where such measures can disrupt supply chains and increase the cost of goods, leading to greater unpredictability in market dynamics and potential impacts on profitability.

Government regulations concerning port operations, logistics, and road transport significantly influence Cargotec's Kalmar and Hiab business areas. For instance, stricter emissions standards for vehicles directly impact demand for Hiab's loader cranes and trucks, pushing for more electric or alternative fuel options.

Government stimulus packages designed for infrastructure development and green transitions present a substantial opportunity for Cargotec. In 2024, many governments are allocating considerable funds towards modernizing ports and improving supply chain efficiency, which directly translates into increased demand for advanced, sustainable cargo handling equipment from Cargotec's Kalmar division.

These policy initiatives, such as the EU's €800 billion NextGenerationEU recovery plan, encourage investments in technologies that reduce environmental impact and enhance operational productivity. This creates a favorable environment for Cargotec's sustainable solutions, like automated guided vehicles and electric straddle carriers.

Cargotec, as a global entity headquartered in Finland, navigates a complex regulatory landscape, adhering to both European Union directives and national laws in all its operational territories. This involves strict compliance with financial reporting standards, insider trading prohibitions, and corporate governance principles, essential for maintaining its reputation and avoiding legal repercussions.

For instance, the EU's General Data Protection Regulation (GDPR) impacts how Cargotec handles customer and employee data across member states. Furthermore, national labor laws and environmental regulations in countries like Sweden or the United States impose specific operational requirements. Failure to comply could result in substantial fines, potentially impacting profitability; for example, significant fines have been levied against companies in the industrial sector for environmental non-compliance in recent years.

Decarbonization Policies and Green Deals

Globally, regulatory bodies are tightening decarbonization mandates, directly impacting industries that rely on heavy machinery like those served by Cargotec. For instance, the European Green Deal, with its ambitious climate targets, is a significant driver for customers to adopt more sustainable equipment. This policy environment pushes for investments in electric and automated solutions, areas where Cargotec is actively developing its product portfolio.

Cargotec itself is committed to these environmental goals. The company has set a target to achieve carbon neutrality in its own operations by 2030. Furthermore, it aims for a substantial 50% reduction in absolute Scope 1, 2, and 3 greenhouse gas emissions by the same year, using 2019 as its baseline. These internal targets demonstrate an alignment with the external pressure to reduce carbon footprints.

- Growing Demand for Eco-Efficiency: Stricter environmental regulations worldwide, exemplified by the European Green Deal, are increasing customer demand for Cargotec's eco-efficient and sustainable equipment solutions.

- Customer Investment in Green Technology: These policies incentivize clients to invest in electric, automated, and environmentally friendly machinery, directly benefiting Cargotec's product development and sales.

- Cargotec's Carbon Neutrality Goal: Cargotec is working towards achieving carbon neutrality in its own operations by the year 2030.

- Emission Reduction Targets: The company plans to cut its absolute Scope 1, 2, and 3 greenhouse gas emissions by 50% by 2030, compared to its 2019 emissions levels.

Divestment and Restructuring Impact

Cargotec's strategic shifts, such as the partial demerger of Kalmar and the planned divestment of MacGregor, represent substantial internal political decisions impacting its corporate structure and future direction. These moves are designed to enhance shareholder value and enable Hiab to operate more independently, though they hinge on regulatory approvals and board consensus. The Kalmar demerger was officially registered on June 30, 2024, with the MacGregor sale anticipated to conclude by July 1, 2025.

Political factors significantly shape Cargotec's operational landscape, from trade policies to government regulations. Geopolitical instability and shifts in trade agreements directly influence customer confidence and investment, as seen in 2024 when tensions in key regions slowed decision-making. Trade barriers, like tariffs, can disrupt supply chains and increase costs, impacting profitability, particularly in North America.

Government regulations on port operations, logistics, and transport are critical for Cargotec's business segments. For instance, stricter emissions standards necessitate the development of electric and alternative fuel options for equipment like Hiab's loader cranes. Conversely, government stimulus for infrastructure and green transitions in 2024 and beyond presents substantial opportunities for increased demand for advanced cargo handling solutions.

Cargotec's strategic internal political decisions, such as the demerger of Kalmar (registered June 30, 2024) and the planned divestment of MacGregor (expected by July 1, 2025), aim to enhance shareholder value and operational focus, though these moves require regulatory approvals.

What is included in the product

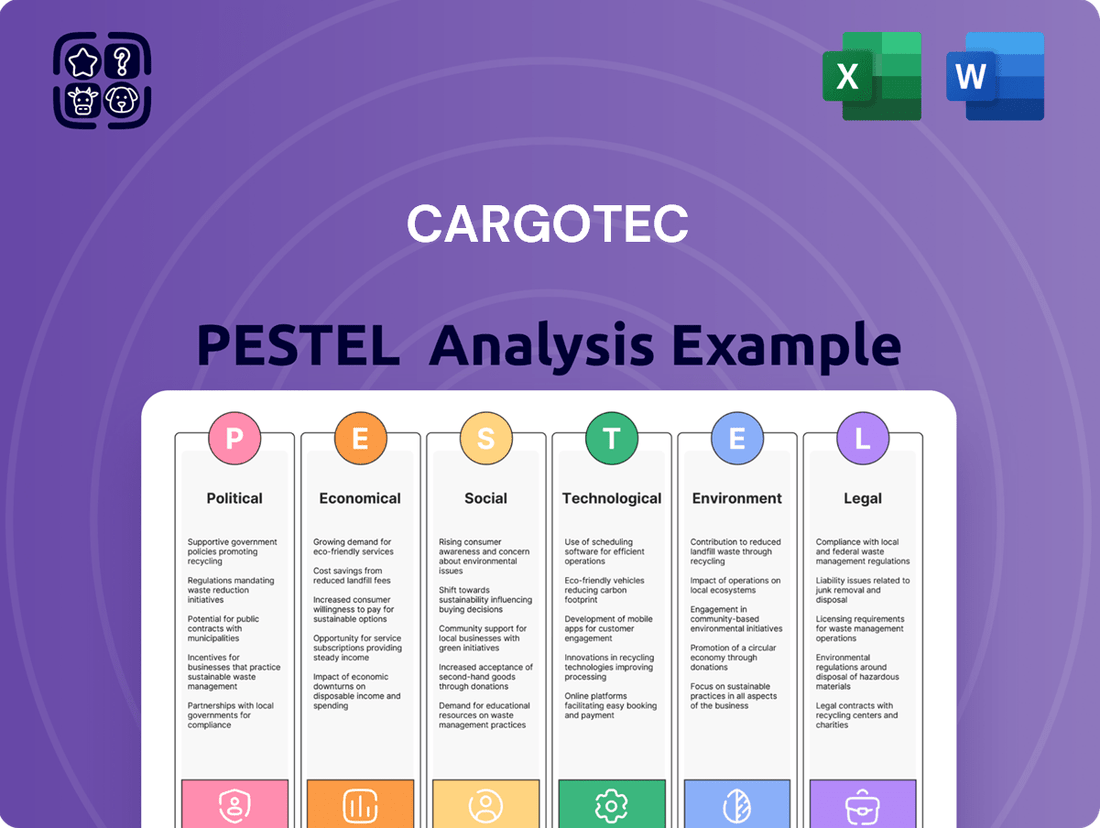

This comprehensive PESTLE analysis of Cargotec examines the influence of political, economic, social, technological, environmental, and legal factors on its operations and strategic planning.

The Cargotec PESTLE analysis serves as a readily available, summarized version of complex market forces, simplifying strategic planning and reducing the pain of information overload during critical decision-making processes.

Economic factors

Cargotec's performance is intrinsically linked to the health of the global economy, as robust growth fuels demand for cargo handling equipment and services. In 2024, the global economic landscape presented challenges, with heightened uncertainty and anticipation of interest rate adjustments causing customers to postpone significant investment decisions. Despite a 3% rise in orders received during 2024, the overall order book saw a notable 19% decrease by year-end, indicating a cautious market sentiment.

Elevated inflation and interest rates, surpassing levels seen in the preceding decade, continue to present a challenging operating environment for Cargotec. For instance, in late 2023 and early 2024, inflation in key markets like the Eurozone hovered around 2.5-3.0%, while benchmark interest rates were significantly higher than historical averages. This economic backdrop directly impacts the cost of capital for Cargotec and its customer base, influencing the feasibility of new equipment investments.

While there are expectations for interest rates to decline in 2024 and 2025, the precise timing and magnitude of these reductions remain uncertain. This uncertainty can lead customers to postpone crucial investment decisions, hoping for more favorable financing conditions. For example, if central banks signal a slower-than-anticipated path to rate cuts, customer investment activity in large capital goods, like those offered by Cargotec, could remain subdued for longer.

While global supply chains have largely normalized, a significant economic factor for Cargotec remains the persistent cost of raw materials and components, especially steel. This normalization has contributed to a reduction in Cargotec's substantial order book, but inflationary pressures on inputs continue to influence profitability.

Cargotec is actively addressing these economic realities by prioritizing early access to lower-emission steel and increasing the proportion of recycled steel in its production. This strategy not only aims to mitigate supply chain emissions but also offers a pathway to manage and potentially reduce material costs in the evolving economic landscape.

For instance, the price of steel, a critical input for Cargotec's heavy machinery, saw significant volatility in 2024, with benchmarks like the TSI North Europe Hot Rolled Coil price fluctuating. Efficiently managing these supply chain dynamics and material costs is paramount for maintaining Cargotec's competitive edge and profitability in the current economic climate.

Service Sales and Recurring Revenue Growth

Cargotec's strategic push towards service sales is a key economic factor, fostering a more predictable and recurring revenue stream. This shift helps to cushion the inherent cyclicality often seen in capital equipment sales.

The company's performance in 2024 underscores this trend, with service sales growing by 2%. Importantly, these services accounted for 28% of Cargotec's consolidated sales, demonstrating their increasing significance to the company's overall financial stability and growth.

- Service Sales Growth: Increased by 2% in 2024.

- Share of Consolidated Sales: Services represented 28% of total sales in 2024.

- Revenue Stability: Enhances financial resilience by diversifying income.

- Mitigation of Cyclicality: Balances equipment sales with predictable service revenue.

Currency Fluctuations and Exchange Rates

Currency fluctuations significantly impact Cargotec's global operations. As a company with a substantial international presence, changes in exchange rates directly affect the revenue generated from sales in foreign currencies and the cost of goods purchased from abroad. For example, a stronger Euro against the US Dollar would reduce the value of USD-denominated earnings when translated back into Euros.

Managing currency risk is a crucial financial strategy for Cargotec. The company actively employs hedging techniques to mitigate potential losses arising from adverse currency movements. This proactive approach helps to stabilize profitability and provide greater certainty in financial planning.

- Global Exposure: Cargotec's revenue streams are diversified across multiple currencies, creating inherent exposure to exchange rate volatility.

- Impact on Profitability: Fluctuations can either boost or erode profit margins depending on the currency pairs involved in transactions.

- Cost of Imports: A weaker domestic currency increases the cost of imported components and raw materials, affecting production expenses.

- Hedging Strategies: Cargotec utilizes financial instruments to lock in exchange rates for future transactions, thereby reducing uncertainty.

The global economic climate significantly influences Cargotec's demand. While order intake increased by 3% in 2024, the overall order book decreased by 19% by year-end, reflecting customer caution due to economic uncertainties and anticipated interest rate shifts. Persistent inflation and higher interest rates, notably around 2.5-3.0% in the Eurozone in late 2023/early 2024, continue to challenge capital investment decisions.

Despite potential interest rate reductions in 2024-2025, the uncertainty surrounding their timing and magnitude may prolong customer hesitation on major purchases. This economic environment, coupled with volatile raw material costs like steel, necessitates strategic cost management and supply chain optimization for Cargotec.

Cargotec's strategic pivot towards service sales is a vital economic factor, enhancing revenue stability. In 2024, service sales grew by 2%, representing 28% of consolidated sales, effectively mitigating the cyclical nature of equipment sales.

| Economic Factor | 2024 Impact/Data | Implication for Cargotec |

|---|---|---|

| Global Economic Growth | Uncertainty, potential rate adjustments | Cautious customer investment, order book contraction (-19%) |

| Inflation & Interest Rates | Elevated (Eurozone ~2.5-3.0% inflation, higher rates than past decade) | Increased cost of capital, impacts investment feasibility |

| Material Costs | Volatile steel prices (e.g., TSI North Europe HRC) | Pressures profitability, drives focus on recycled steel |

| Service Sales | Growth of 2%, 28% of consolidated sales | Diversifies revenue, enhances financial resilience |

What You See Is What You Get

Cargotec PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Cargotec PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions. You'll gain insights into market dynamics, competitive landscapes, and potential growth opportunities. The detailed breakdown ensures you have a thorough understanding of the external forces shaping Cargotec's future.

Sociological factors

The availability of skilled labor, especially in automation, digitalization, and green technologies, is a significant sociological consideration for Cargotec. A shortage of workers with expertise in these areas could hinder the company's growth and innovation efforts. For instance, in 2024, the International Labour Organization reported persistent gaps in digital skills across many European economies, directly impacting sectors like industrial equipment manufacturing.

An aging workforce in developed nations presents another challenge, potentially leading to a loss of institutional knowledge and a reduced pool of experienced employees. Conversely, younger generations may possess different skill sets, creating a potential gap in areas requiring deep technical experience. Reports from 2024 indicated that the average age of skilled tradespeople in several key Cargotec markets was nearing retirement age, highlighting this demographic shift.

Cargotec's international operations necessitate navigating varied labor market conditions and cultural expectations. Adapting to different workforce demographics, educational systems, and labor regulations across its global footprint is essential for talent acquisition and retention. For example, in 2025, emerging markets often present a younger, more digitally native workforce, but may lack the specialized engineering talent found in more established industrial regions.

Societal expectations for sustainability are increasingly shaping the cargo handling sector. Consumers and investors alike are prioritizing companies demonstrating a commitment to environmental responsibility. This growing awareness directly influences purchasing decisions and capital allocation, pushing businesses like Cargotec to adapt their strategies.

Cargotec is actively responding to these societal demands by focusing on reducing its environmental footprint. A key aspect of this is their development of eco-friendly solutions, such as electric truck-mounted forklifts and hooklifts specifically designed for electric trucks. These offerings are not just products; they represent a tangible effort to contribute to broader emission reduction goals and support customers in meeting their own sustainability targets.

For instance, Cargotec's 2023 sustainability report highlighted a 50% reduction in operational emissions compared to their 2019 baseline, a testament to their proactive approach. This aligns with global trends, where studies in 2024 indicated that over 70% of consumers are more likely to purchase from brands with strong sustainability credentials. Cargotec's investments in electrification and efficiency are therefore strategically positioned to meet both current and future market expectations.

Societal emphasis on workplace safety and ergonomics is a significant driver for Cargotec. There's a growing demand for heavy machinery that actively protects operators, leading companies like Cargotec to integrate advanced safety features into their port, terminal, and on-road handling equipment. This focus is not just about compliance; it directly influences product design and development, pushing for innovations that minimize risk and enhance user well-being.

Meeting these high safety standards is crucial for Cargotec's customers, as it directly impacts their operational efficiency and reduces potential liabilities. For instance, the International Labour Organization (ILO) consistently highlights the importance of safe working environments in logistics and transportation sectors, with accidents often stemming from poor ergonomic design or inadequate safety protocols in machinery operation. Cargotec's commitment to safety therefore enhances user acceptance and bolsters its reputation as a responsible provider.

Urbanization and Infrastructure Development

Global urbanization continues to accelerate, with the UN estimating that 68% of the world's population will live in urban areas by 2050. This trend directly fuels demand for efficient logistics and cargo handling solutions in increasingly congested cities. Cargotec's Hiab and Kalmar segments are responding by focusing on more compact, agile, and environmentally conscious equipment to navigate these complex urban environments.

The expansion of urban centers requires smarter material flow solutions to manage the increased volume of goods and materials. For example, the growth in e-commerce, heavily reliant on urban last-mile delivery, necessitates advanced automated systems and optimized fleet management, areas where Cargotec's Kalmar division plays a crucial role. In 2023, global container port throughput reached an estimated 870 million TEUs, with a significant portion of this volume moving through major urban hubs.

- Urban Population Growth: Projections indicate 68% global urban population by 2050 (UN).

- Logistics Demand: Increased urban density drives need for efficient, space-saving cargo handling.

- Product Adaptation: Cargotec's Hiab and Kalmar focus on agile, eco-friendly urban equipment.

- E-commerce Impact: Urban e-commerce growth spurs demand for smart, automated logistics solutions.

Impact of Automation on Employment

The increasing integration of automation and digitalization in cargo handling, exemplified by Cargotec's advancements, is a significant sociological factor impacting employment. While these technologies boost operational efficiency, they also prompt societal discussions about job displacement.

Cargotec, as a pioneer in intelligent cargo solutions, must proactively address these concerns by emphasizing the evolution of jobs rather than outright elimination. This involves showcasing how automation transforms existing roles and necessitates new skill sets.

The company's strategy should highlight investments in reskilling and upskilling programs to equip the workforce for these changing demands. For instance, by 2024, the global automation market was valued at over $150 billion, with significant growth projected in logistics.

- Job Transformation: Automation is shifting the nature of work in cargo handling, moving from manual labor to roles focused on technology operation, maintenance, and data analysis.

- Skill Development: There is a growing need for employees with digital literacy, problem-solving skills, and expertise in operating advanced automated systems.

- New Role Creation: While some tasks may be automated, new roles such as robotics technicians, AI system supervisors, and data scientists are emerging within the industry.

- Societal Impact: Addressing public perception and ensuring a just transition for affected workers are crucial for maintaining social license and workforce morale.

Societal expectations around sustainability are increasingly influencing the cargo handling industry, pushing companies like Cargotec to adopt greener practices. This trend is driven by consumer and investor demand for environmentally responsible businesses, directly impacting purchasing decisions and capital allocation. Cargotec's commitment to sustainability is evident in its development of eco-friendly solutions, such as electric forklifts and hooklifts designed for electric trucks, aiming to reduce emissions and support customer sustainability goals.

Workplace safety and ergonomics are also paramount, with a growing demand for heavy machinery that prioritizes operator well-being. Cargotec integrates advanced safety features into its equipment to minimize risk and enhance user experience, which is crucial for customer operational efficiency and reducing liabilities. The International Labour Organization consistently emphasizes the importance of safe working environments in logistics, and Cargotec's focus on safety enhances its reputation.

Urbanization is another key sociological driver, with a significant portion of the global population expected to reside in urban areas by 2050. This trend increases the need for efficient logistics and cargo handling solutions in congested cities, prompting Cargotec's Hiab and Kalmar divisions to focus on more compact and agile equipment. The rise of e-commerce further fuels demand for smart, automated systems and optimized fleet management in urban settings.

| Sociological Factor | Impact on Cargotec | Supporting Data/Trend |

| Sustainability Expectations | Drives demand for eco-friendly solutions, influences purchasing decisions. | 70%+ consumers prefer brands with strong sustainability credentials (2024 studies). |

| Workplace Safety & Ergonomics | Requires integration of advanced safety features in equipment. | ILO highlights safety as critical for reducing accidents in logistics. |

| Urbanization | Increases demand for efficient, space-saving urban logistics solutions. | 68% global urban population projected by 2050 (UN). |

| Automation & Digitalization | Transforms jobs, requiring new skill sets and addressing job displacement concerns. | Global automation market valued over $150 billion (2024), with growth in logistics. |

Technological factors

Cargotec is actively pursuing a vision to lead in intelligent cargo handling by embracing automation and digitalization. This strategic focus aims to revolutionize port and terminal operations, as well as on-road logistics. By connecting its entire fleet, Cargotec is building a foundation for advanced data analytics through the integration of Internet of Things (IoT) platforms.

Automation plays a crucial role in boosting productivity, enhancing safety, and driving overall operational efficiency across various segments of the cargo flow. For instance, automated container terminals can significantly reduce vessel turnaround times, a critical factor in global supply chains. In 2024, the global automation market for logistics was projected to reach over $15 billion, underscoring the significant investment and adoption trends.

Cargotec is heavily investing in electrification and alternative fuels, aiming to cut emissions significantly throughout its equipment's lifecycle. This technological shift is crucial for meeting stringent environmental regulations and capitalizing on growing customer demand for sustainable operations. By 2024, Cargotec reported that its electric equipment portfolio, particularly within Hiab's offerings like electric truck-mounted forklifts and hooklifts, was gaining traction, demonstrating a tangible market response to these innovations.

Hiab, a key Cargotec brand, is at the forefront of this transition, developing solutions specifically for electric trucks and exploring the use of low-emission steel in its manufacturing processes. This strategic focus directly supports global decarbonization targets and positions Cargotec as a leader in the sustainable logistics equipment sector. Early 2025 projections indicated a continued upward trend in the adoption of electric powered material handling equipment, with industry analysts forecasting a 15% year-over-year growth in this segment.

Cargotec's strategic investment in Internet of Things (IoT) platforms is transforming how it manages its equipment. By collecting and analyzing sensory data in real-time, the company gains unparalleled visibility into operational performance. This enables proactive measures like remote diagnostics and predictive maintenance, minimizing downtime and enhancing service reliability for customers.

These technological advancements are not just about efficiency; they're about unlocking new value. Improved operational insights directly translate to better customer service and the creation of innovative, data-driven services. For instance, Cargotec's focus on smart cargo flow, powered by integrated data analytics, aims to streamline logistics and optimize the movement of goods globally.

Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning (ML) are poised to significantly reshape cargo handling. Cargotec's emphasis on 'intelligent cargo handling' strongly suggests a future where these technologies optimize routes, predict equipment maintenance needs, and improve the efficiency of autonomous operations. For instance, AI can analyze vast datasets to identify the most efficient shipping routes, reducing transit times and fuel consumption.

These advancements extend beyond individual companies, having the potential to revolutionize material flow across entire industries. By enabling more predictive maintenance, AI can minimize downtime for critical cargo handling equipment, ensuring smoother operations. Cargotec's strategic direction indicates a commitment to leveraging these capabilities for enhanced decision-making and operational excellence.

- Route Optimization: AI algorithms can analyze real-time traffic, weather, and port congestion data to dynamically adjust cargo movement plans, leading to significant efficiency gains.

- Predictive Maintenance: ML models can forecast equipment failures based on usage patterns and sensor data, allowing for proactive maintenance and preventing costly disruptions.

- Autonomous Operations: AI is a key enabler for autonomous vehicles and machinery in ports and logistics hubs, further automating and streamlining cargo handling processes.

- Data-Driven Insights: The application of AI and ML allows for deeper analysis of operational data, providing actionable insights to improve overall supply chain performance.

Cybersecurity and Data Privacy

As Cargotec's offerings increasingly rely on connectivity and data, cybersecurity and data privacy are paramount technological factors. Protecting sensitive operational data and ensuring the reliability of connected equipment are crucial for maintaining customer confidence and uninterrupted operations. For instance, the increasing use of IoT devices in logistics, a key sector for Cargotec, heightens the risk of cyber threats. In 2024, the global cybersecurity market was valued at approximately $232 billion, underscoring the significant investment and focus in this area.

Robust cybersecurity measures are not just a protective shield but an enabler of secure digital services, which are becoming central to Cargotec's value proposition. Failure to adequately safeguard data can lead to significant financial and reputational damage. Reports from 2024 indicated that the average cost of a data breach reached $4.35 million globally, a stark reminder of the stakes involved for companies like Cargotec.

Cargotec's commitment to technological advancement must therefore be intrinsically linked to its cybersecurity strategy. This includes:

- Implementing end-to-end encryption for all data transmissions.

- Regularly updating software and firmware on connected equipment.

- Conducting rigorous penetration testing and vulnerability assessments.

- Ensuring compliance with global data privacy regulations like GDPR and CCPA.

Cargotec's technological trajectory centers on automation and digitalization to lead in intelligent cargo handling, revolutionizing port and road logistics. By integrating IoT platforms, the company is building a robust foundation for advanced data analytics, aiming to connect its entire fleet and unlock new value through data-driven services.

Automation, particularly in container terminals, is key to boosting productivity and reducing vessel turnaround times, a critical supply chain element. The global logistics automation market was projected to exceed $15 billion in 2024, highlighting significant industry investment. Cargotec's focus on electrification and alternative fuels, exemplified by Hiab's electric equipment, aligns with growing customer demand for sustainability and stringent environmental regulations.

AI and machine learning are set to transform cargo handling, with Cargotec's 'intelligent cargo handling' vision embracing these technologies for route optimization, predictive maintenance, and enhanced autonomous operations. The global cybersecurity market, valued at approximately $232 billion in 2024, underscores the critical importance of robust security measures for Cargotec's connected services and operational data.

| Technological Factor | Impact on Cargotec | Supporting Data (2024/2025 Projections) |

| Automation & Digitalization | Enhanced operational efficiency, reduced turnaround times, new data-driven services. | Global logistics automation market projected over $15 billion in 2024. |

| Electrification & Alternative Fuels | Meeting environmental regulations, meeting customer demand for sustainability, reducing emissions. | Electric equipment portfolio traction reported in 2024; 15% year-over-year growth projected for electric material handling equipment in early 2025. |

| AI & Machine Learning | Optimized routes, predictive maintenance, improved autonomous operations, deeper operational insights. | AI application in logistics for route optimization reduces transit times and fuel consumption. |

| IoT & Connectivity | Real-time data collection, remote diagnostics, predictive maintenance, enhanced service reliability. | Increased reliance on IoT devices in logistics heightens cyber threat risks. |

| Cybersecurity & Data Privacy | Protection of sensitive operational data, ensuring reliability of connected equipment, maintaining customer confidence. | Global cybersecurity market valued at ~$232 billion in 2024; average data breach cost ~$4.35 million globally in 2024. |

Legal factors

Cargotec operates globally, meaning it must strictly adhere to a web of international trade laws, customs procedures, and economic sanctions. Failure to comply with these varied legal systems can significantly disrupt its supply chains and limit market access. For instance, in 2023, the World Trade Organization reported a notable increase in trade-restrictive measures among its member nations, highlighting the dynamic nature of these regulations that directly affect companies like Cargotec.

Cargotec, as a global manufacturer of heavy machinery like cranes and load handling equipment, faces significant product liability and safety standard regulations. For instance, in the European Union, the Machinery Directive 2006/42/EC sets essential health and safety requirements for machinery, and non-compliance can lead to substantial fines and product recalls. Ensuring their products meet these rigorous standards, such as those set by OSHA in the United States or similar bodies in other key markets, is paramount to avoiding costly lawsuits and maintaining operational continuity.

Cargotec faces stringent environmental regulations, particularly concerning emissions standards for its industrial machinery and transport solutions. For instance, in 2024, the European Union continued to tighten its emissions targets for heavy-duty vehicles, directly influencing the design and technology integrated into Cargotec's equipment. Compliance with frameworks like the European Sustainability Reporting Standards (ESRS), which became mandatory for many companies in 2024, necessitates detailed reporting on environmental performance.

The company's commitment to sustainability is also shaped by voluntary targets, such as those set by the Science Based Targets initiative (SBTi). By 2025, many industries are expected to have aligned their operations with SBTi’s revised net-zero standard, a move that will undoubtedly accelerate Cargotec's adoption of eco-friendly technologies and processes to meet these ambitious goals.

Labor Laws and Employment Regulations

Cargotec navigates a complex web of labor laws and employment regulations across its global operations. Each country presents unique requirements concerning working conditions, minimum wages, and employee rights, necessitating meticulous compliance. For instance, in 2024, the European Union continued to emphasize worker protections through directives aimed at fair wages and work-life balance, impacting Cargotec's operations in its member states.

Managing a diverse international workforce demands strict adherence to these varied legal frameworks, including collective bargaining agreements and union relations. Failure to comply can lead to significant legal challenges and operational disruptions. Ensuring fair labor practices is paramount for maintaining positive industrial relations and ensuring the stability of Cargotec's global supply chain and manufacturing processes.

- Global Compliance Burden: Cargotec must adhere to over 50 different national labor law regimes.

- Unionized Workforce: Approximately 30% of Cargotec's global workforce is represented by unions, requiring active engagement on collective agreements.

- Wage Regulations: Minimum wage laws vary significantly, with countries like Finland and Sweden having notably higher statutory or collectively bargained minimums compared to others.

- Worker Protection Standards: Adherence to EU's Working Time Directive and similar national regulations on working hours and rest periods is a key operational consideration.

Intellectual Property Rights and Patents

Cargotec relies heavily on intellectual property rights, particularly patents, to safeguard its advancements in automation, electrification, and digital solutions. These protections are vital for maintaining a competitive edge in the global market. For instance, as of mid-2024, the company actively manages a significant patent portfolio, with recent filings focused on enhancing port automation efficiency and sustainable logistics technologies.

However, navigating the legal landscape also requires rigorous attention to avoiding infringement on the intellectual property of other entities. This necessitates continuous legal review and proactive management of its own patent portfolio to prevent disputes and ensure compliance. Cargotec's commitment to R&D, evidenced by its substantial investment in innovation throughout 2023 and into 2024, underscores the importance of robust IP strategy.

- Patent Protection: Cargotec secures patents for its core technologies in areas like automated guided vehicles (AGVs) and smart port software.

- Infringement Avoidance: The company conducts thorough freedom-to-operate analyses before launching new products.

- IP Portfolio Management: Ongoing review and strategic filing of patents are crucial for long-term competitive advantage.

- Regulatory Compliance: Adherence to international IP laws ensures smooth global operations and market access.

Cargotec's global operations necessitate strict adherence to international trade laws, customs, and economic sanctions. The World Trade Organization noted an increase in trade-restrictive measures in 2023, directly impacting companies like Cargotec and their market access.

Product liability and safety standards are critical, with regulations like the EU's Machinery Directive 2006/42/EC requiring compliance to avoid fines and recalls. Ensuring products meet standards from bodies like OSHA is paramount to preventing lawsuits.

Environmental regulations, particularly emissions standards for industrial machinery, are tightening, with the EU increasing targets for heavy-duty vehicles in 2024. Compliance with reporting standards like ESRS became mandatory for many in 2024, influencing technology integration.

Labor laws and employment regulations vary significantly across Cargotec's global sites, requiring meticulous compliance with working conditions, wages, and employee rights. The EU's continued emphasis on worker protections in 2024 impacts operations in member states.

Cargotec safeguards its technological advancements through intellectual property rights, with significant patent filings in areas like port automation and sustainable logistics as of mid-2024. Continuous legal review prevents infringement and maintains a competitive edge.

| Legal Factor | Relevance to Cargotec | 2024/2025 Data/Trend |

| International Trade Law | Global supply chain and market access. | Increased trade-restrictive measures globally (WTO, 2023). |

| Product Safety Standards | Equipment design and marketability. | Ongoing enforcement of EU Machinery Directive and OSHA standards. |

| Environmental Regulations | Equipment emissions and sustainability reporting. | Tighter EU emissions targets for heavy vehicles (2024); ESRS mandatory reporting. |

| Labor Laws | Workforce management and industrial relations. | Continued EU focus on worker protections and fair wages (2024). |

| Intellectual Property | Protection of innovation and competitive advantage. | Active patent portfolio management for automation and logistics tech (mid-2024). |

Environmental factors

Climate change is a major environmental force shaping Cargotec's operations and strategy. The company is actively pursuing its climate program to slash greenhouse gas emissions throughout its entire value chain. This includes a commitment to reduce absolute Scope 1, 2, and 3 emissions by a significant 50% by 2030, using 2019 as a benchmark year.

Cargotec also has an ambitious goal to achieve carbon-neutral status for its own operations by 2030. This focus is particularly important because the largest portion of emissions associated with Cargotec's business stems from the use of its products by customers.

Increasing scarcity of vital raw materials, such as steel, is pushing industries toward circular economy models. This shift is crucial for companies like Cargotec as it directly impacts their supply chains and operational costs.

Cargotec is actively exploring the integration of low-emission steel, often derived from recycled sources and produced using fossil-free energy. This strategy not only reduces their reliance on virgin materials but also mitigates the environmental footprint associated with traditional steel production, including mining and energy consumption.

For instance, the global steel industry accounted for approximately 7% of worldwide CO2 emissions in 2023. By prioritizing recycled and sustainably produced steel, Cargotec aims to significantly lower its embedded carbon and contribute to resource efficiency, thereby minimizing negative impacts on local ecosystems and biodiversity.

Cargotec's environmental impact stems from both its internal operations and the products it sells. Emissions from its own facilities and energy use, known as Scope 1 and Scope 2, are one part of this. However, the larger portion comes from the use of Cargotec's equipment by customers, classified as Scope 3 emissions. This is where the company's focus on sustainability, like developing electric solutions and more efficient machinery, plays a crucial role.

The company actively works to lessen its environmental footprint by decarbonizing its supply chain and promoting sustainable product choices, such as electric-powered vehicles and advanced hooklifts. These initiatives are designed to directly address the emissions generated throughout the lifecycle of their products. Cargotec reported a significant 21% reduction in greenhouse gas emissions from its continuing operations in 2024 compared to the previous year, largely attributed to a decrease in sales volume.

Biodiversity Impact and Land Use

While biodiversity isn't Cargotec's core business, the company recognizes its wider environmental footprint, especially concerning raw material sourcing and manufacturing within its extensive supply chain. This includes potential impacts on local ecosystems.

Cargotec is actively working to mitigate these effects. A key initiative is increasing the proportion of recycled steel used in its products. For instance, in 2023, Cargotec reported that 75% of the steel used in its Kalmar equipment was sourced from recycled materials, a significant step towards reducing the demand for virgin resources and thus lessening pressure on natural habitats.

This focus on a circular economy is becoming increasingly vital as global awareness of biodiversity loss grows. By prioritizing recycled materials, Cargotec aims to contribute to a more sustainable approach to industrial production, acknowledging that responsible land use and resource management are crucial for ecological health.

- Recycled Steel Usage: Cargotec utilized 75% recycled steel in Kalmar equipment in 2023.

- Supply Chain Focus: Environmental impact assessment extends to raw material extraction and manufacturing processes.

- Biodiversity Mitigation: Increasing recycled material content is a primary strategy to reduce negative biodiversity impacts.

- Holistic Approach: Cargotec views environmental responsibility as integral to its broader sustainability strategy.

Waste Management and Pollution Control

Effective waste management and pollution control are crucial for Cargotec's global manufacturing and service activities. While Cargotec identified pollution as a non-material topic in its 2024 sustainability reporting, the company actively manages other environmental impacts. This commitment extends to responsible disposal practices and minimizing overall environmental harm.

Cargotec meticulously monitors and addresses its environmental footprint, including emissions and resource consumption. For instance, the company tracks water withdrawal and air emissions at its assembly sites to ensure compliance and promote sustainability. This proactive approach underscores a dedication to operating responsibly, even for aspects deemed less material.

- Waste Management: Cargotec implements procedures for the responsible handling and disposal of waste generated from its operations.

- Pollution Control: Although classified as non-material in 2024, pollution control remains a focus area, with monitoring of emissions and environmental impacts.

- Water Withdrawal: The company tracks water usage at its assembly locations as part of its environmental management strategy.

- Air Emissions: Cargotec monitors and manages air emissions from its manufacturing facilities to mitigate environmental impact.

Climate change is a significant environmental concern for Cargotec, driving its commitment to reduce greenhouse gas emissions across its value chain. The company aims for a 50% reduction in Scope 1, 2, and 3 emissions by 2030 against a 2019 baseline, with a target of carbon neutrality for its own operations by 2030. This focus is critical as customer product usage accounts for the largest share of emissions. In 2024, Cargotec reported a 21% decrease in emissions from continuing operations compared to the previous year, partly due to reduced sales volume.

The increasing scarcity of raw materials like steel is pushing industries towards circular economy models, impacting supply chains and costs. Cargotec is actively integrating low-emission, recycled steel, a move that helps reduce its carbon footprint and reliance on virgin resources. The global steel industry's 7% CO2 emission contribution in 2023 highlights the importance of this shift. Cargotec reported that 75% of the steel used in its Kalmar equipment in 2023 was recycled, demonstrating progress in this area.

Cargotec also monitors and manages its environmental footprint through waste management and pollution control, including tracking water withdrawal and air emissions at assembly sites. While pollution was deemed non-material in 2024 reporting, the company maintains responsible disposal practices and aims to minimize environmental harm. This holistic approach to environmental responsibility is integral to its broader sustainability strategy.

| Environmental Factor | Cargotec's Action/Target | Key Data/Facts |

| Climate Change & Emissions | 50% reduction in Scope 1, 2, 3 emissions by 2030 (vs 2019); carbon neutral operations by 2030 | 21% GHG emission reduction in continuing operations in 2024 (vs prior year); 7% of global CO2 emissions in 2023 from steel industry |

| Raw Material Scarcity & Circular Economy | Increased use of recycled and low-emission steel | 75% recycled steel used in Kalmar equipment in 2023 |

| Biodiversity & Resource Management | Mitigating impact through increased recycled material content; responsible land use and resource management | Focus on reducing demand for virgin resources; minimizing pressure on natural habitats |

| Waste Management & Pollution Control | Responsible waste disposal; monitoring water withdrawal and air emissions | Pollution classified as non-material in 2024 sustainability reporting; active management of environmental impacts at assembly sites |

PESTLE Analysis Data Sources

Our Cargotec PESTLE analysis is built on a comprehensive review of data from official government publications, reputable financial institutions like the IMF and World Bank, and leading industry research firms. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors impacting Cargotec's operations and strategy.