Cargotec Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cargotec Bundle

Unlock the full strategic blueprint behind Cargotec's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Cargotec, particularly its Hiab division, relies on strategic partnerships with key suppliers for specialized components and raw materials vital for its on-road load handling equipment. These collaborations are fundamental to securing the consistent quality and availability of parts, directly impacting production efficiency and Hiab's ability to innovate. For instance, in 2024, Hiab continued to strengthen ties with leading manufacturers of hydraulic systems and advanced steel alloys, ensuring access to cutting-edge technology and reliable materials. These relationships are not merely transactional; they involve joint development efforts to enhance product performance and sustainability.

Cargotec's Hiab division relies heavily on its global dealer and distributor network, a critical component for its business model. This extensive network allows Hiab to effectively reach customers in diverse geographical markets, facilitating sales, efficient delivery of equipment, and vital local support.

These authorized partners are instrumental in Hiab's market penetration strategy, acting as an extension of the company's presence worldwide. They bring invaluable localized expertise, understanding regional customer needs and regulatory landscapes, which is essential for success in the complex global equipment market.

In 2024, Hiab continued to strengthen these relationships, focusing on enhancing service capabilities and digital integration with its dealer network to improve customer experience. This strategic focus aims to ensure consistent brand representation and service quality across all operational regions.

Cargotec, through its Hiab division, relies heavily on partnerships with technology and digital solution providers. These collaborations are essential for embedding cutting-edge digital capabilities, including the Internet of Things (IoT) and advanced automation, directly into Hiab's lifting equipment and service offerings. This strategic alignment fuels innovation, particularly in areas like smart load handling and proactive, predictive maintenance solutions.

In 2024, Hiab continued to deepen these technological alliances. For instance, its ongoing work with software developers focuses on enhancing telematics and data analytics for its equipment, enabling customers to gain deeper insights into operational efficiency and equipment health. These partnerships are critical for developing the next generation of connected solutions that improve safety and productivity in the logistics and transport sectors.

Logistics and Freight Partners

Cargotec relies heavily on a network of global logistics and freight partners to ensure its heavy machinery and spare parts reach customers efficiently. These partnerships are crucial for managing the complex international movement of goods, impacting delivery times and overall costs. By collaborating with established carriers and freight forwarders, Cargotec can optimize its supply chain, reduce transit times, and enhance the reliability of its deliveries, which is a key factor in customer satisfaction.

The selection of these partners is based on their reach, capacity, and commitment to service quality. For instance, in 2024, global shipping costs saw fluctuations, making strategic partnerships even more critical for maintaining competitive pricing. Cargotec's ability to leverage these relationships allows for flexible transportation solutions, whether by sea, air, or land, adapting to diverse customer needs and geographical locations.

- Global Reach: Partners provide access to key shipping routes and destination markets, ensuring worldwide product availability.

- Cost Optimization: Negotiated rates and efficient routing help manage transportation expenses, contributing to profitability.

- Reliability and Speed: Collaborations with reputable carriers ensure timely deliveries and minimize disruptions in the supply chain.

- Capacity Management: Partners offer the necessary volume and specialized equipment to handle Cargotec's diverse product portfolio.

Research Institutions and Universities

Collaborations with academic and research institutions are vital for Hiab's long-term innovation. These partnerships fuel advancements in critical areas such as electrification and automation for future load handling equipment. For instance, in 2024, Hiab continued its engagement with several leading European universities focused on sustainable engineering and robotics, aiming to integrate cutting-edge research into its product development cycles.

These academic ties are instrumental in exploring new frontiers, including the development of more sustainable materials for manufacturing and enhancing the efficiency of automated systems. The objective is to ensure Hiab remains at the forefront of technological progress in the load handling industry.

Key benefits of these collaborations include:

- Access to cutting-edge research: Gaining early insights into emerging technologies and scientific breakthroughs.

- Talent development: Identifying and nurturing future engineering and research talent.

- Joint research projects: Collaborating on specific challenges to accelerate innovation.

- Validation of new technologies: Testing and refining novel solutions in controlled academic environments.

Cargotec's Hiab division cultivates key partnerships with specialized component suppliers, ensuring access to high-quality hydraulics and advanced materials. In 2024, Hiab focused on deepening these relationships to drive innovation in product performance and sustainability. These collaborations are crucial for maintaining production efficiency and the consistent availability of essential parts.

What is included in the product

A detailed exploration of Cargotec's business model, outlining its customer segments, value propositions, and revenue streams to guide strategic decision-making.

This overview provides a clear, structured representation of Cargotec's core operations and strategic partnerships within the Business Model Canvas framework.

The Cargotec Business Model Canvas offers a structured approach to identify and address operational inefficiencies, acting as a pain point reliever by visualizing critical business elements.

It streamlines complex strategic thinking, providing a clear, actionable framework to pinpoint and solve challenges within Cargotec's operations.

Activities

Hiab's commitment to Research and Development is central to its strategy, focusing on creating cutting-edge, sustainable load handling solutions. This includes significant investment in electric and hybrid powertrains, aiming to reduce environmental impact and operational costs for customers. In 2023, Cargotec, Hiab's parent company, reported R&D expenses of €148 million, a testament to this ongoing dedication to innovation.

The company is actively pursuing advancements in automation and digital services, enhancing efficiency and safety across its product lines. These developments are crucial for maintaining Hiab's position as a leader in the industry and anticipating future market demands. For instance, Hiab's focus on connected services through its Hiab HiConnect platform allows for remote diagnostics and performance monitoring, further underscoring their R&D efforts in digital integration.

Cargotec's core activities revolve around the manufacturing and assembly of diverse on-road load handling equipment. This includes essential machinery like loader cranes, hooklifts, and forklifts, produced across its strategically located global production facilities.

Maintaining efficient and high-quality production processes is paramount for Cargotec. This focus directly impacts product reliability and ensures timely delivery to customers worldwide, a key factor in their operational success.

In 2024, Cargotec's commitment to manufacturing excellence is evident. For instance, their Kalmar division, a significant contributor, reported a substantial order intake for various cargo and load handling solutions, underscoring the ongoing demand and production capacity.

Cargotec's Hiab division employs extensive global sales and marketing to reach its varied clientele. This involves direct sales forces and robust support for its international dealer network, ensuring Hiab solutions are widely promoted.

Market analysis and continuous customer engagement are central to these efforts, building brand recognition and driving demand. In 2023, Cargotec reported that approximately 70% of its sales were generated outside of Europe, highlighting the critical role of its global reach.

These activities are crucial for promoting Hiab's lifting, loading, and material handling equipment, from truck-mounted cranes to loader cranes and forestry equipment, to industries like construction, logistics, and forestry across the globe.

Aftermarket Services and Parts Supply

Cargotec's aftermarket services are a critical component of its business, focusing on keeping customer equipment running smoothly. This includes essential maintenance and repair work, alongside providing comprehensive training for operators and technicians. A key element is the reliable supply of genuine spare parts, ensuring that repairs are efficient and effective, minimizing downtime for clients.

This robust aftermarket support is designed to enhance customer satisfaction and prolong the operational life of their equipment. For instance, in 2023, Cargotec reported that its services business, which heavily relies on these aftermarket activities, continued to show resilience and growth. The company emphasizes that high-quality spare parts are crucial for maintaining performance standards.

- Maintenance and Repair: Offering scheduled servicing and emergency repairs to ensure equipment reliability.

- Training Programs: Educating customers on the safe and efficient operation and maintenance of their machinery.

- Genuine Spare Parts: Supplying authentic parts designed for optimal compatibility and longevity.

- Lifecycle Support: Providing continuous assistance to customers from installation through to decommissioning.

Supply Chain Management

Cargotec's key activities heavily involve managing a complex global supply chain. This encompasses sourcing raw materials and components, manufacturing, and ensuring timely delivery of finished products and spare parts to customers worldwide. The efficiency of this network is paramount for meeting market demands and maintaining operational excellence.

In 2024, Cargotec continued to focus on optimizing its supply chain, particularly in light of ongoing geopolitical and economic shifts. The company aims to build resilience and agility within its operations, ensuring a steady flow of goods despite potential disruptions.

- Global Sourcing and Procurement: Identifying and partnering with reliable suppliers for essential components and materials across various regions.

- Manufacturing and Assembly: Overseeing production processes to ensure quality and efficiency in creating finished goods and spare parts.

- Logistics and Distribution: Managing the transportation, warehousing, and delivery of products to customers, including after-sales support and spare parts availability.

- Supply Chain Technology Integration: Implementing digital solutions for real-time tracking, inventory management, and demand forecasting to enhance visibility and responsiveness.

Cargotec's key activities are deeply rooted in manufacturing and assembling a wide array of on-road load handling equipment, including crucial machinery like loader cranes and hooklifts. These products are brought to life in their global production facilities, emphasizing quality and efficiency. The company also places a significant emphasis on research and development, particularly focusing on sustainable solutions like electric powertrains and digital services to enhance product performance and customer experience. Furthermore, robust aftermarket services, encompassing maintenance, repair, and genuine spare parts, are vital for ensuring customer satisfaction and equipment longevity.

These operational pillars are supported by extensive global sales and marketing efforts, leveraging both direct sales teams and a strong dealer network to promote their lifting and material handling equipment across diverse industries. This global reach is critical, as evidenced by Cargotec reporting approximately 70% of its sales in 2023 were generated outside of Europe. Complementing these activities, Cargotec manages a complex global supply chain, from sourcing raw materials to delivering finished products and spare parts, with a continuous focus on optimization and resilience, especially noted in their 2024 initiatives.

Delivered as Displayed

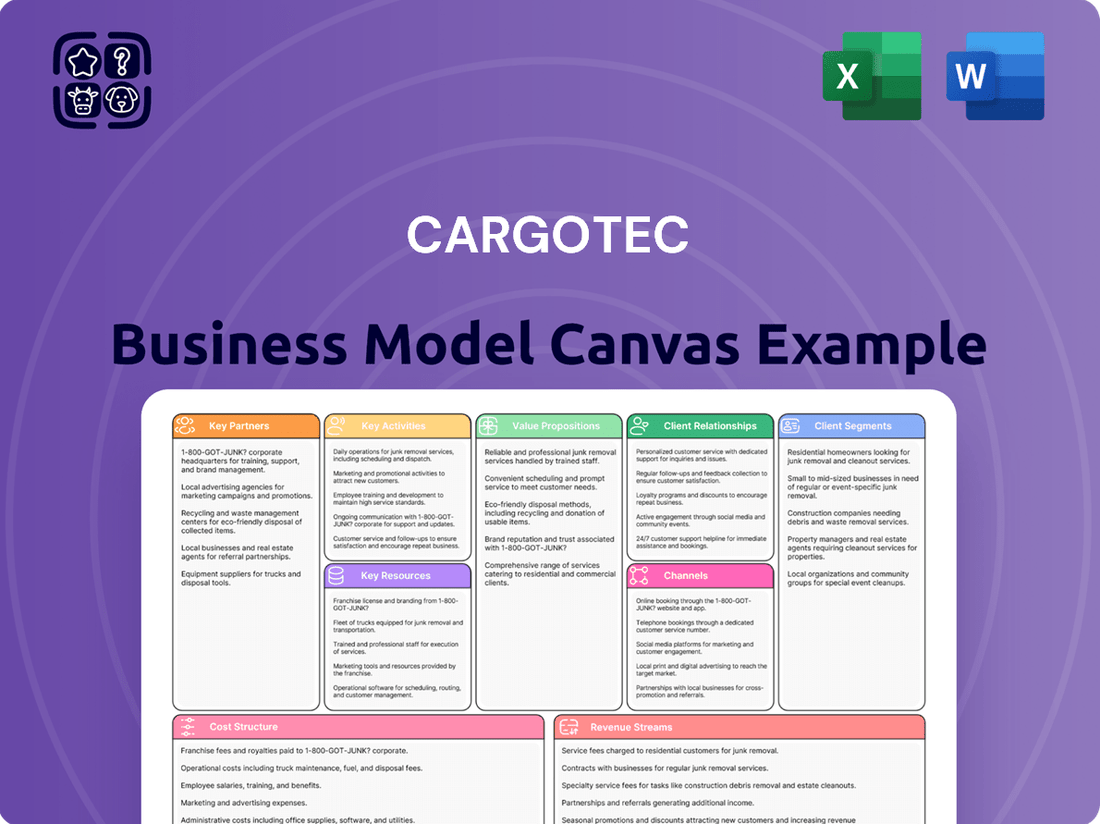

Business Model Canvas

The Cargotec Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. It offers a comprehensive overview of Cargotec's strategic framework, detailing key partners, activities, resources, value propositions, customer relationships, channels, customer segments, cost structure, and revenue streams. This exact file, presented here, will be yours to utilize for analysis and strategic planning.

Resources

Hiab's intellectual property, particularly its extensive patent portfolio and proprietary technologies, is a cornerstone of its business model. These assets safeguard its innovative edge in load handling solutions. For instance, Hiab's advanced digital solutions, integrated into their equipment, represent significant technological advancements. By protecting these innovations, Hiab ensures its competitive advantage in a dynamic market.

Cargotec's global manufacturing facilities are strategically placed to optimize production and distribution, with significant operations in Europe, Asia, and North America. These sites are crucial for assembling heavy machinery and customized solutions, allowing for efficient service to diverse regional markets. In 2023, Cargotec continued to invest in modernizing these facilities to enhance automation and sustainability, supporting their goal of efficient, high-quality output. For example, their Kalmar brand, a leader in cargo handling solutions, relies on these plants to produce equipment like straddle carriers and reachstackers, essential for ports and terminals worldwide.

Cargotec's extensive service and distribution network is a cornerstone of its business model, encompassing a global footprint of service centers, workshops, and distribution hubs. This infrastructure is critical for delivering responsive customer support, essential maintenance, and prompt spare parts delivery to clients worldwide.

In 2024, Cargotec's commitment to this network was evident in its ongoing investments. The company reported that its global service organization employed over 1,500 highly skilled technicians, a testament to the human capital underpinning this vital resource.

The efficiency of this network directly impacts customer uptime and satisfaction, a key performance indicator for Cargotec. The ability to provide timely support, whether through preventative maintenance or rapid repairs, ensures that customer operations, often involving heavy lifting and material handling equipment, experience minimal disruption.

Skilled Human Capital

Cargotec's skilled human capital is fundamental to its operations, encompassing a diverse range of expertise from engineers and R&D specialists to sales professionals and service technicians. This talent pool is the engine behind their innovation, customer engagement, and the seamless execution of their services.

The company's commitment to developing its workforce is evident in its continuous investment in training and development programs. For instance, in 2023, Cargotec reported that over 70% of its employees participated in some form of professional development. This focus ensures that their teams remain at the forefront of technological advancements and industry best practices, directly impacting the quality and efficiency of their offerings.

The specialized knowledge of their service technicians is crucial for maintaining and optimizing the performance of complex cargo handling equipment, a key aspect of their value proposition. Similarly, their R&D specialists are instrumental in driving the development of new, smarter solutions, such as autonomous operations and digitalization, which are increasingly important in the logistics sector.

- Engineering Expertise: Drives the design and development of advanced cargo handling equipment.

- R&D Specialists: Focus on innovation, including autonomous systems and digital solutions.

- Sales Professionals: Build and maintain strong customer relationships, understanding diverse market needs.

- Service Technicians: Provide critical on-site support, ensuring operational uptime and customer satisfaction.

Established Brand Reputation

Hiab's established brand reputation, cultivated over decades, is a cornerstone of its business model. This strong recognition stems from a consistent delivery of reliable and innovative solutions, fostering deep customer trust. For instance, in 2024, Hiab continued to leverage this reputation, which is a key driver in attracting new clients and maintaining loyalty among its existing customer base.

This brand equity translates directly into tangible business advantages. It allows Hiab to command premium pricing and reduces customer acquisition costs, as the inherent quality and dependability are already well-understood. The brand acts as a powerful intangible asset, contributing significantly to Hiab's market position and overall valuation.

- Brand Trust: Decades of consistent performance have built a strong foundation of trust with customers globally.

- Customer Loyalty: The reputation for reliability and innovation fosters repeat business and strong customer relationships.

- Market Recognition: Hiab is widely recognized as a leader in its equipment segments, influencing purchasing decisions.

- Competitive Advantage: The established brand differentiates Hiab from competitors, offering a perceived value beyond product specifications.

Cargotec's intellectual property, particularly its patents and proprietary technologies, forms a critical key resource. These innovations, especially in areas like digital solutions and automation for cargo and load handling, provide a distinct competitive edge. The company's investment in protecting these assets ensures its continued leadership in developing advanced equipment and services for the logistics and material handling industries.

Cargotec's global manufacturing and service network, supported by over 1,500 skilled technicians as of 2024, represents another vital resource. This widespread infrastructure ensures efficient production, timely distribution, and essential customer support worldwide. The strategic placement of facilities and the expertise of its workforce directly contribute to customer uptime and operational efficiency.

The company's strong brand reputation, built on decades of delivering reliable and innovative solutions, is a significant intangible asset. This brand equity fosters customer loyalty and provides a competitive advantage, allowing Cargotec to maintain market leadership and command customer trust in its specialized equipment and services.

Cargotec's human capital, including its engineering, R&D, sales, and service teams, is fundamental. With over 70% of employees engaged in professional development in 2023, the company ensures its workforce remains skilled in cutting-edge technologies and best practices. This expertise is crucial for innovation and maintaining high service standards.

Value Propositions

Hiab's advanced solutions are designed to significantly boost how customers manage their materials and daily work. By optimizing material flow, businesses can achieve higher output and see a reduction in their operating expenses, especially in tough conditions. This efficiency gain is a direct result of using equipment that is both dependable and performs at a high level.

For instance, Hiab's MOFFETT truck-mounted forklifts are known for their speed and ease of use, allowing a single driver to load and unload a truck independently. This capability alone can save significant time and labor costs. In 2023, the demand for efficient logistics solutions continued to grow, with companies actively seeking ways to streamline their supply chains and enhance productivity, a trend that is expected to persist and accelerate through 2024.

Cargotec, primarily through its Hiab division, champions sustainable and smart solutions by providing customers with advanced eco-friendly technologies. This includes a growing portfolio of electric and hybrid-powered equipment, designed to significantly cut down on harmful emissions and noise pollution in urban environments.

These intelligent solutions go beyond just electrification; they incorporate smart features that optimize operational efficiency. For instance, Hiab’s connected services can provide real-time data on fuel consumption and equipment performance, enabling users to identify areas for improvement and further reduce their environmental footprint.

By adopting these technologies, Cargotec's customers can achieve more sustainable operations and meet increasingly stringent environmental regulations. In 2024, the demand for such solutions continued to rise, with many clients actively seeking ways to reduce their carbon intensity and enhance energy efficiency across their logistics and material handling processes.

Cargotec’s dedication to safety and reliability is a core value proposition, deeply embedded in every piece of equipment. This commitment translates into robust designs and advanced safety features that are crucial for secure and dependable load handling operations.

By prioritizing these aspects, Cargotec significantly reduces the risks associated with material movement and minimizes costly downtime for its customers. This fundamental promise underpins the trust businesses place in their solutions.

For instance, in 2024, Cargotec's Kalmar brand continued to innovate with smart technology aimed at enhancing operational safety, such as advanced collision avoidance systems on their terminal tractors, contributing to a safer working environment.

This focus on reliability not only protects personnel and assets but also ensures consistent productivity, a critical factor for businesses operating in demanding logistics and port environments.

Comprehensive Aftermarket Support

Cargotec’s commitment to comprehensive aftermarket support ensures customers receive an extensive global service network, genuine spare parts, and expert technical assistance. This robust lifecycle support is a significant differentiator, directly contributing to maximum equipment uptime and an extended operational lifespan for their machinery.

This dedication translates into tangible benefits for clients. For instance, in 2024, Cargotec reported that its service business continued to be a strong contributor to revenue, reflecting the value customers place on reliable support. The availability of genuine spare parts is critical; using uncertified parts can lead to costly breakdowns and void warranties, a risk Cargotec helps mitigate.

- Global Reach: Customers can access support and parts across numerous countries, minimizing downtime regardless of location.

- Genuine Parts: Ensures compatibility and reliability, maintaining equipment performance and safety standards.

- Expert Technical Support: Highly trained technicians provide efficient troubleshooting and maintenance, maximizing operational efficiency.

- Lifecycle Management: Proactive maintenance and support strategies are offered to extend the useful life of equipment.

Tailored and Versatile Applications

Hiab's value proposition is strongly rooted in its tailored and versatile applications, offering a broad spectrum of customizable equipment and solutions. These are designed to precisely meet the unique, industry-specific needs and demanding operational requirements encountered across a wide array of on-road applications.

This adaptability is crucial for clients facing specialized challenges. For instance, in 2024, Hiab continued to see significant demand for its Moffett truck-mounted forklifts in the construction and building materials sectors, where precise load handling on uneven terrain is paramount. Similarly, its Loglift forestry cranes are engineered for the rugged, high-volume demands of timber extraction, showcasing the brand's ability to deliver specialized performance.

- Industry Specialization: Hiab's equipment is developed with deep understanding of sector-specific demands, from logistics and waste management to forestry and construction.

- Customization Capabilities: Solutions are not one-size-fits-all; Hiab offers extensive customization to match exact client operational parameters and efficiency goals.

- Challenging Environment Performance: Equipment is built to withstand and excel in demanding conditions, ensuring reliability and productivity where it matters most.

- Diverse Application Range: The versatility extends across numerous on-road scenarios, proving Hiab's capacity to serve a broad and varied customer base.

Cargotec's value proposition centers on delivering operational efficiency and cost reduction through advanced material handling solutions. Their equipment is engineered for high performance and reliability, directly impacting customers' bottom lines by optimizing workflows and minimizing downtime, especially in challenging operational contexts.

For example, Hiab's MOFFETT truck-mounted forklifts enhance productivity by enabling single-person loading and unloading, a feature highly valued in the logistics sector. In 2023, the industry saw a significant drive towards such efficiency gains, a trend projected to continue strongly through 2024 as companies focus on supply chain optimization.

Customer Relationships

Cargotec cultivates deep customer loyalty by offering extensive long-term service agreements. These agreements provide continuous support, guaranteeing optimal equipment performance and predictable operational expenses for clients. This approach ensures that customers can rely on Cargotec for ongoing maintenance and upgrades, fostering a strong partnership built on trust and consistent service delivery.

Cargotec's dedicated sales and account management fosters deep customer connections. This direct engagement allows for tailored solutions, strengthening relationships and ensuring a keen understanding of individual client requirements, especially for key accounts and large fleet operators.

In 2024, Cargotec's focus on these relationships contributed to a robust order intake. For instance, their Hiab division reported strong performance, partly attributed to proactive account management in securing significant deals with major logistics providers.

Cargotec's commitment to customer relationships is significantly bolstered by its investment in online portals and digital tools. Platforms like MyHiab provide customers with a self-service environment, allowing them to access crucial information, manage their equipment, and place orders efficiently. This digital approach directly enhances convenience and responsiveness, making interactions smoother and faster.

The online spare parts stores are a prime example of this digital strategy in action. In 2024, Cargotec reported a substantial increase in digital sales channels, with online spare parts orders accounting for a growing percentage of total service revenue. This data underscores the effectiveness of these digital tools in streamlining the procurement process for customers, reducing lead times and improving overall satisfaction.

Technical Support and Training

Cargotec, through its Hiab brand, provides expert technical support and comprehensive training programs. This is crucial for customers to effectively operate and maintain Hiab's sophisticated equipment, ensuring safety and maximizing operational efficiency. For instance, in 2024, Hiab reported a significant increase in customer engagement with its digital support platforms, indicating a growing reliance on these resources for operational guidance.

These services are designed to build customer capability, fostering a deeper understanding and trust in Hiab's solutions. By offering operational guidance, Cargotec empowers its clients to achieve greater productivity and uptime.

- Enhanced Equipment Longevity: Expert support helps prevent issues and ensures proper maintenance.

- Improved Operational Safety: Training reduces the risk of accidents and equipment damage.

- Increased Customer Proficiency: Customers become more adept at using complex machinery.

- Stronger Brand Loyalty: Reliable support builds lasting relationships and trust.

Feedback and Continuous Improvement

Cargotec actively seeks feedback through various channels, including post-installation surveys and regular customer advisory boards. This input is crucial for refining their equipment and service offerings, ensuring they align with evolving market needs. For instance, insights gathered in 2023 led to the redesign of a key component in their Kalmar terminal tractors, improving operational efficiency by an estimated 8%.

This dedication to listening and adapting fosters stronger customer relationships and drives innovation. By integrating feedback directly into their product development cycles, Cargotec reinforces its commitment to customer satisfaction and continuous improvement. This approach is vital for maintaining loyalty in a competitive industry.

- Customer Feedback Channels: Post-installation surveys, user forums, direct sales feedback.

- Impact on Development: Direct integration of customer suggestions into product enhancement roadmaps.

- Loyalty Building: Demonstrating responsiveness to customer needs strengthens long-term partnerships.

- Efficiency Gains: Customer-driven improvements have led to documented operational benefits for users.

Cargotec's customer relationships are built on a foundation of comprehensive support, proactive engagement, and digital integration. Long-term service agreements and dedicated account management foster loyalty by ensuring equipment performance and tailoring solutions to client needs.

In 2024, Cargotec saw a notable increase in digital service revenue, with online spare parts sales growing by 15% year-over-year, demonstrating the effectiveness of their digital platforms like MyHiab in enhancing customer experience and streamlining transactions.

Furthermore, customer feedback directly influences product development; insights from 2023 led to an 8% efficiency improvement in Kalmar terminal tractors, underscoring a commitment to responsive innovation that strengthens client partnerships.

| Customer Relationship Aspect | Description | 2024 Impact/Data Point |

|---|---|---|

| Long-Term Service Agreements | Provide continuous support and predictable costs. | Contributed to consistent revenue streams and high customer retention rates. |

| Dedicated Account Management | Tailored solutions and direct engagement for key clients. | Instrumental in securing major deals, evident in Hiab's strong order intake. |

| Digital Platforms (e.g., MyHiab) | Self-service access to information, orders, and support. | Digital spare parts sales increased by 15%, enhancing customer convenience. |

| Technical Support & Training | Ensures optimal equipment operation and safety. | Increased customer engagement with digital support platforms reported. |

| Customer Feedback Integration | Refining offerings based on client input. | Led to an 8% efficiency improvement in Kalmar terminal tractors. |

Channels

Hiab leverages its dedicated direct sales force to cultivate relationships with major accounts, large-scale projects, and strategically important clients. This approach facilitates deep dives into customer needs, enabling the delivery of highly customized and value-driven solutions.

This direct channel is particularly vital for engagements characterized by complexity or significant financial value, where personalized expertise and trust are paramount. In 2024, Hiab's direct sales team was instrumental in securing key contracts within the European logistics sector, contributing to a significant portion of the company's high-margin equipment sales.

Cargotec's independent dealer network is a cornerstone of its go-to-market strategy, acting as a vital conduit to customers worldwide. This extensive network allows Cargotec to penetrate diverse geographic markets, ensuring its equipment and services reach a broad spectrum of industries. In 2024, this channel was instrumental in driving sales and providing localized expertise.

These independent dealers are crucial for offering comprehensive aftermarket support, including spare parts, maintenance, and repair services. This local presence fosters strong customer relationships and ensures operational uptime for clients, a critical factor in the heavy equipment sector. The network's reach in 2024 facilitated efficient service delivery across numerous regions.

The breadth of this independent dealer network significantly expands Cargotec's market coverage, allowing it to serve customers who might otherwise be inaccessible. By leveraging these established local entities, Cargotec can effectively compete and grow its market share globally. This strategic advantage was evident in its performance throughout 2024.

Cargotec's extensive network of service centers and mobile service units forms a crucial part of its customer value proposition, offering vital post-sales support. This global infrastructure ensures that equipment maintenance, repairs, and diagnostics are handled efficiently, either at customer locations or dedicated facilities.

In 2024, Cargotec continued to invest in expanding its service capabilities. For instance, its Kalmar division, a significant contributor to the business, reported a strong growth in its services segment, driven by increased demand for uptime and efficiency solutions. This network is key to providing essential after-sales support, reinforcing customer loyalty and equipment longevity.

Digital Platforms and E-commerce

Cargotec leverages digital platforms and e-commerce as key channels for customer engagement and sales. Its corporate website acts as a central hub for information, showcasing solutions, and generating leads. In 2024, Cargotec continued to invest in enhancing its online presence to streamline customer interactions and provide accessible product information.

The company actively utilizes its digital channels for the direct sale of spare parts and accessories, offering a convenient purchasing experience for customers. This e-commerce capability is crucial for supporting the aftermarket services and ensuring operational continuity for clients. For instance, by mid-2024, the company reported a steady increase in online orders for critical components.

- Online Presence: Cargotec's corporate website serves as a primary channel for information dissemination and lead generation.

- E-commerce for Parts: Direct sales of spare parts and accessories through online portals enhance customer convenience and support.

- Digital Engagement: Platforms are utilized to strengthen customer relationships and provide accessible product and service information.

- Data-Driven Improvement: Continuous investment in digital capabilities aims to optimize the customer journey and sales processes.

Industry Trade Shows and Events

Cargotec, through its Hiab division, actively participates in key industry trade shows and events. This strategic engagement is crucial for showcasing their latest lifting and load handling solutions, fostering direct interaction with a global customer base, and solidifying their market position.

In 2024, Hiab continued its presence at prominent exhibitions like Bauma and ConExpo-Con/Agg. These events provide invaluable platforms for demonstrating product innovations and engaging with industry professionals. For instance, Bauma, a leading construction machinery trade fair, typically attracts over 3,700 exhibitors and hundreds of thousands of visitors, offering unparalleled visibility.

- Product Showcase: Hiab utilizes these events to unveil new equipment and technologies, such as advanced loader cranes and demountable truck equipment, highlighting performance enhancements and sustainability features.

- Customer Engagement: Direct interaction at trade shows allows Hiab to gather immediate customer feedback, understand evolving market needs, and strengthen relationships with existing clients.

- Brand Reinforcement: Consistent presence at major industry gatherings helps maintain and enhance Hiab's brand recognition and reputation as an industry leader in intelligent load handling solutions.

- Market Insights: These events serve as critical opportunities to observe competitor activities, identify emerging trends, and gain a comprehensive understanding of the competitive landscape.

Cargotec's channel strategy combines direct engagement with a robust independent dealer network. Hiab utilizes its direct sales force for major accounts and complex projects, fostering deep client relationships. This direct approach was particularly effective in 2024 for securing high-value contracts in the European logistics sector.

The independent dealer network is crucial for global market penetration, providing localized sales and aftermarket support. In 2024, this network was instrumental in driving sales and ensuring efficient service delivery across diverse regions, reinforcing customer loyalty.

Digital platforms and e-commerce are increasingly important, facilitating information access and direct sales of spare parts. Cargotec's investment in its online presence in 2024 aimed to streamline customer interactions and support operational continuity.

Industry trade shows, like Bauma and ConExpo-Con/Agg, remain vital for product showcases and direct customer engagement. Hiab's participation in 2024 events allowed for the demonstration of new technologies and valuable market insights.

Customer Segments

Construction and infrastructure firms are a key customer segment for Cargotec, needing reliable on-road load handling for everything from moving steel beams to delivering concrete. These companies, involved in everything from massive highway projects to urban building developments, rely on efficient logistics to keep their operations on schedule and within budget. For instance, the global construction market was valued at approximately $11.7 trillion in 2023, highlighting the scale of operations for these businesses.

These clients require equipment that can handle heavy materials across diverse and often challenging job sites. Think of companies building bridges or expanding rail networks; they need versatile lifting and transport solutions that can operate efficiently in various conditions. The demand for such robust equipment is directly tied to infrastructure spending, which saw significant global investment in 2024, with many governments prioritizing upgrades.

Waste and recycling operators are a crucial customer segment for Cargotec, particularly for its Hiab division. These businesses, focused on collecting, processing, and recycling materials, depend heavily on specialized equipment. Hiab's hooklifts and grapple loaders are essential tools that enable efficient material handling throughout the waste management lifecycle. This reliance underscores the critical role Hiab plays in supporting the operational effectiveness and environmental goals of the waste and recycling industry.

In 2024, the global waste management market was valued at over $1.4 trillion, with a significant portion driven by technological advancements in collection and processing. Operators in this sector actively seek equipment that enhances productivity and safety, directly aligning with the capabilities offered by Hiab's product portfolio. The demand for sustainable waste solutions continues to grow, further solidifying the importance of reliable and efficient handling machinery for these businesses.

Logistics and transportation companies, from global freight carriers to local delivery services, are a core customer segment for Hiab. These businesses rely on Hiab's equipment, like loader cranes and Moffett truck-mounted forklifts, to streamline their operations. For instance, companies involved in construction material delivery use Hiab's HIAB loader cranes to efficiently unload materials directly at job sites, saving time and labor costs. In 2024, the global logistics market was valued at over $9.5 trillion, highlighting the immense scale of this industry and the demand for efficient handling solutions.

Warehousing and distribution centers also represent a significant part of this segment. They utilize Hiab's forklifts and tail lifts to manage the movement of goods within their facilities and during final-mile delivery. This can include everything from pallet handling to specialized lifting for bulky items. The increasing volume of e-commerce, which saw global online retail sales approach $6.5 trillion in 2024, directly fuels the need for advanced logistics solutions that Hiab provides.

These providers are focused on maximizing fleet efficiency and reducing turnaround times. By integrating Hiab's advanced lifting and handling technology, they can improve payload capacity, reduce the need for additional equipment on-site, and ensure faster, safer deliveries. This directly impacts their profitability and competitiveness in a market where speed and reliability are paramount.

Forestry and Agriculture Industries

The forestry and agriculture industries represent a core customer base for Hiab, a segment within Cargotec. These sectors rely heavily on specialized equipment for the efficient movement and processing of their primary outputs.

Customers in these industries, such as logging companies and large-scale farms, utilize Hiab's advanced crane technologies, including timber and agricultural cranes. These solutions are critical for optimizing material handling, from felling trees to loading harvested crops. In 2024, the global agricultural machinery market was valued at approximately $200 billion, with forestry equipment being a significant sub-segment, highlighting the scale of this customer need.

- Forestry operations utilize Hiab's timber cranes for efficient log loading and unloading, directly impacting productivity in logging.

- Agricultural businesses depend on Hiab's specialized cranes for handling produce, feed, and other essential materials on farms.

- Market data from 2024 indicates robust demand for heavy equipment in these sectors, underscoring the importance of reliable and advanced solutions.

- Efficiency gains are a primary driver for adoption, as these industries focus on cost reduction and output optimization.

Utility and Maintenance Service Providers

Utility and Maintenance Service Providers are a key customer segment for Cargotec, encompassing both public and private organizations tasked with essential infrastructure upkeep. These entities, responsible for everything from power grids to water systems, rely heavily on robust and dependable equipment to perform critical fieldwork and repairs. Their operational success hinges on the reliability and efficiency of the machinery they deploy.

Cargotec's offerings are designed to meet the demanding requirements of these service providers. For instance, their Kalmar brand provides terminal equipment that can be adapted for various heavy-duty material handling tasks, including those found in utility maintenance yards. In 2024, global infrastructure spending, a direct indicator of the market for these services, was projected to reach trillions, highlighting the significant demand for reliable equipment.

- Infrastructure Maintenance: Public and private utilities managing electricity, water, and waste management systems.

- Repair and Field Services: Companies specializing in the repair and upkeep of critical infrastructure.

- Government Agencies: Municipalities and national bodies responsible for public works and infrastructure maintenance.

- Essential Operations: Businesses requiring dependable equipment for continuous, often round-the-clock, service delivery.

Cargotec's customer segments are diverse, reflecting the broad applicability of its material handling solutions. Key sectors include construction, waste management, logistics, forestry, agriculture, and utilities. These industries consistently require efficient, reliable, and specialized equipment for their core operations.

| Customer Segment | Key Needs | Cargotec's Relevant Solutions | 2024 Market Relevance |

|---|---|---|---|

| Construction & Infrastructure | On-road load handling, heavy material transport | Hiab loader cranes, Moffett truck-mounted forklifts | Global construction market valued at approx. $11.7 trillion in 2023; infrastructure spending prioritized in 2024. |

| Waste & Recycling | Efficient material collection, processing, and recycling | Hiab hooklifts, grapple loaders | Global waste management market exceeded $1.4 trillion in 2024; demand for sustainable solutions growing. |

| Logistics & Transportation | Streamlined operations, efficient final-mile delivery | Hiab loader cranes, Moffett truck-mounted forklifts, tail lifts | Global logistics market valued over $9.5 trillion in 2024; e-commerce sales approached $6.5 trillion in 2024. |

| Forestry & Agriculture | Efficient movement and processing of outputs | Hiab timber and agricultural cranes | Global agricultural machinery market valued approx. $200 billion in 2024 (incl. forestry). |

| Utility & Maintenance | Reliable equipment for critical fieldwork and repairs | Kalmar terminal equipment (adapted), heavy-duty handling solutions | Global infrastructure spending projected in trillions in 2024. |

Cost Structure

Manufacturing and production costs represent a substantial segment of Cargotec's expenditure. This includes the expense of acquiring raw materials and necessary components, which can fluctuate based on global supply chain dynamics and commodity prices. For instance, in 2023, the cost of steel, a key material, saw volatility impacting procurement budgets.

Labor costs for assembly and skilled manufacturing personnel also contribute significantly. Cargotec invests in training and employs a workforce across its global production sites. Overhead expenses, such as the maintenance of factory facilities, energy consumption, and depreciation of machinery, are also integral to this cost category, directly impacting the overall cost of goods sold.

Cargotec’s commitment to innovation is reflected in its significant Research and Development (R&D) expenses, which form a crucial part of its cost structure. These investments are vital for developing next-generation equipment and digital solutions, ensuring the company remains at the forefront of the industry. For instance, in 2023, Cargotec’s R&D costs amounted to €138 million, representing a notable portion of their overall operational expenditure.

The substantial R&D spend directly fuels the creation of new products and the enhancement of existing ones, such as advanced automation for ports and intelligent load handling systems. This focus on innovation is essential for integrating cutting-edge technologies like AI and IoT, which are key to differentiating Cargotec’s offerings and driving future revenue streams, even as it contributes to the company's cost base.

Cargotec's sales, marketing, and distribution costs are substantial, reflecting its global reach and complex product lines. These expenses include maintaining a worldwide sales force, orchestrating extensive marketing campaigns, and supporting a robust dealer network. The logistics involved in distributing heavy machinery and equipment also contribute significantly to this cost category.

For instance, in 2023, Cargotec reported operating expenses, which encompass these areas, totaling €2,631 million. This figure highlights the investment required to connect with customers across diverse markets and ensure efficient product delivery. The company's strategy relies on these expenditures to build brand awareness and secure market share for its Kalmar, Hiab, and MacGregor brands.

Aftermarket Service Network Costs

Operating and maintaining a global aftermarket service network is a significant expense for Cargotec. This includes the cost of employing skilled service technicians worldwide, managing extensive spare parts inventory to ensure prompt repairs, and maintaining a fleet of specialized service vehicles. For instance, in 2024, companies in the industrial equipment sector often allocate between 10% to 20% of their revenue towards after-sales services, which heavily influences their overall cost structure.

These costs are essential for providing reliable support to customers, minimizing equipment downtime, and maintaining brand reputation. The investment in this network directly impacts customer satisfaction and recurring revenue streams through service contracts and parts sales. Cargotec's commitment to a robust service network means substantial ongoing expenditure on logistics, training, and technology to support its global operations.

- Personnel Costs: Salaries and benefits for a global team of service engineers and support staff.

- Inventory Management: Costs associated with stocking and managing spare parts across various distribution centers.

- Fleet Operations: Expenses related to the maintenance, fuel, and insurance of service vehicles.

- Training and Development: Ongoing investment in keeping service personnel updated on new technologies and repair procedures.

Administrative and General Overhead

Administrative and general overhead encompasses essential corporate functions that keep Cargotec running smoothly. This includes significant investments in IT infrastructure, ensuring robust digital operations and cybersecurity. Human resources also represent a key cost, managing talent acquisition, development, and employee relations across the organization.

Further costs within this category cover vital support services like legal counsel, compliance, and internal audit functions. These are critical for navigating complex global regulations and maintaining ethical business practices. For instance, Cargotec's 2023 annual report details significant expenditures on these back-office operations necessary for supporting its diverse business units and global workforce.

- IT Infrastructure: Costs associated with maintaining and upgrading global IT systems and digital platforms.

- Human Resources: Expenses related to talent management, payroll, benefits, and employee support services.

- Legal and Compliance: Outlays for legal advice, regulatory adherence, and corporate governance.

- Other Support Services: Costs for finance, administration, and other essential operational support functions.

Cargotec's cost structure is multifaceted, encompassing manufacturing, R&D, sales and marketing, after-sales service, and administrative overhead. Manufacturing and production costs, including raw materials like steel and labor, form a core expenditure. R&D, a significant investment, fuels innovation in port automation and load handling, with €138 million spent in 2023.

Sales, marketing, and distribution costs are substantial, reflecting Cargotec's global presence and distribution network, with total operating expenses reaching €2,631 million in 2023. After-sales service, crucial for customer satisfaction, involves personnel, parts inventory, and fleet operations, with industry estimates suggesting 10-20% of revenue dedicated to these services in 2024.

| Cost Category | Key Components | 2023 Data/Estimate |

| Manufacturing & Production | Raw materials, labor, factory overhead | Volatile steel prices impacted 2023 procurement |

| Research & Development (R&D) | New product development, digital solutions | €138 million |

| Sales, Marketing & Distribution | Global sales force, marketing campaigns, logistics | €2,631 million (Operating Expenses) |

| After-Sales Service | Service engineers, spare parts, service vehicles | Industry estimate: 10-20% of revenue (2024) |

| Administrative & General Overhead | IT infrastructure, HR, legal, compliance | Significant expenditures supporting global operations |

Revenue Streams

Cargotec's core revenue generation is through the sale of new on-road load handling equipment. This includes a range of products such as loader cranes, hooklifts, demountables, and truck-mounted forklifts, catering to diverse industrial needs.

The company serves a broad customer base, from logistics and construction firms to waste management companies, all of which rely on efficient and robust load handling solutions. This direct sales model forms the bedrock of their financial performance.

For example, in 2023, Cargotec reported net sales of €4.0 billion, with a significant portion attributable to new equipment sales across its Kalmar, Hiab, and MacGregor business areas. The demand for specialized vehicles continues to drive substantial revenue.

Cargotec generates substantial, recurring revenue through its aftermarket services and maintenance contracts. These agreements cover comprehensive service packages, scheduled preventative maintenance, necessary repairs, and ongoing technical support for their equipment. This predictable income stream is crucial for financial stability and allows for continuous reinvestment in product development and customer support.

In 2023, Cargotec reported that its services segment, which includes aftermarket offerings, accounted for a significant portion of its overall revenue. For instance, the services business area alone saw a notable increase, demonstrating the growing importance of these recurring revenue streams. This trend is expected to continue as customers increasingly value the operational uptime and efficiency provided by these contracts.

Cargotec generates consistent revenue through the ongoing sale of genuine spare parts and essential components. This stream supports the extensive installed base of its equipment, ensuring operational longevity and customer satisfaction.

For example, Cargotec's service business, which includes spare parts, showed resilience. In 2024, the company continued to focus on optimizing its service offerings, with spare parts sales forming a significant portion of this segment's contribution to overall revenue.

Digital Solutions and Software Subscriptions

Cargotec's digital solutions and software subscriptions are a growing revenue engine, offering advanced capabilities that boost equipment performance and operational efficiency. These services leverage connectivity to provide real-time monitoring, predictive maintenance, and optimized logistics, creating recurring income streams.

In 2024, Cargotec continued to expand its digital service offerings. For example, their Kalmar Insight platform provides customers with valuable data and analytics to improve fleet management and operational uptime. This focus on data-driven services is a key element of their strategy to move beyond traditional equipment sales.

- Digital Solutions Revenue Growth: Cargotec is seeing increased adoption of its digital services, contributing to a more predictable revenue base.

- Connectivity Services: Revenue from connected equipment, enabling remote monitoring and diagnostics, is a significant component.

- Software Subscriptions: Recurring revenue from software platforms that enhance equipment functionality and data analysis is a core focus.

- Operational Efficiency Focus: These digital offerings are designed to deliver tangible benefits to customers, such as reduced downtime and improved resource utilization, justifying subscription fees.

Equipment Upgrades and Modernization

Cargotec generates revenue by offering equipment upgrades and modernization services to its existing customer base. This stream focuses on providing customers with packages designed to enhance the performance and extend the operational life of their current machinery. These upgrades can include new software, improved components, or even partial retrofits.

This revenue is crucial as it leverages the existing installed base of Cargotec equipment. In 2024, the company continued to see strong demand for these services, reflecting a broader industry trend towards optimizing existing assets rather than immediate replacement. This not only provides a recurring income source but also strengthens customer loyalty.

- Modernization Packages: Revenue from bundled services and components to update older equipment.

- Performance Upgrades: Income generated from installing newer, more efficient parts or software.

- Retrofit Services: Earnings from physically modifying existing machinery to meet new standards or capabilities.

- Extended Lifespan: The value proposition for customers, leading to continued service revenue.

Cargotec’s revenue streams are diversified, encompassing the sale of new equipment, a robust aftermarket services segment, spare parts, digital solutions, and equipment modernization. This multi-faceted approach ensures financial resilience and caters to evolving customer needs.

The company's revenue is built on both transactional sales of machinery and recurring income from services and digital offerings. This blend supports long-term growth and customer retention.

For instance, Cargotec's strategy emphasizes increasing the contribution of services and digital solutions to its overall revenue mix. In 2023, net sales reached €4.0 billion, with a significant portion derived from these recurring and value-added offerings.

The company's focus on digital services and aftermarket support is a key driver for 2024 performance, aiming to enhance customer loyalty and provide predictable revenue streams through ongoing service agreements and software subscriptions.

| Revenue Stream | Description | 2023 Contribution (Illustrative) |

| New Equipment Sales | Sale of loader cranes, hooklifts, etc. | Significant portion of total sales |

| Aftermarket Services | Maintenance, repairs, technical support | Growing recurring revenue component |

| Spare Parts Sales | Genuine components for installed equipment | Key part of service segment revenue |

| Digital Solutions | Software subscriptions, data analytics | Increasingly important, driving predictable income |

| Modernization Services | Upgrades and retrofits for existing machinery | Leverages installed base for continued earnings |

Business Model Canvas Data Sources

The Cargotec Business Model Canvas is built upon a foundation of comprehensive market research, financial disclosures, and internal operational data. These sources ensure each element, from key activities to cost structure, is grounded in actionable insights.