Cargotec Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cargotec Bundle

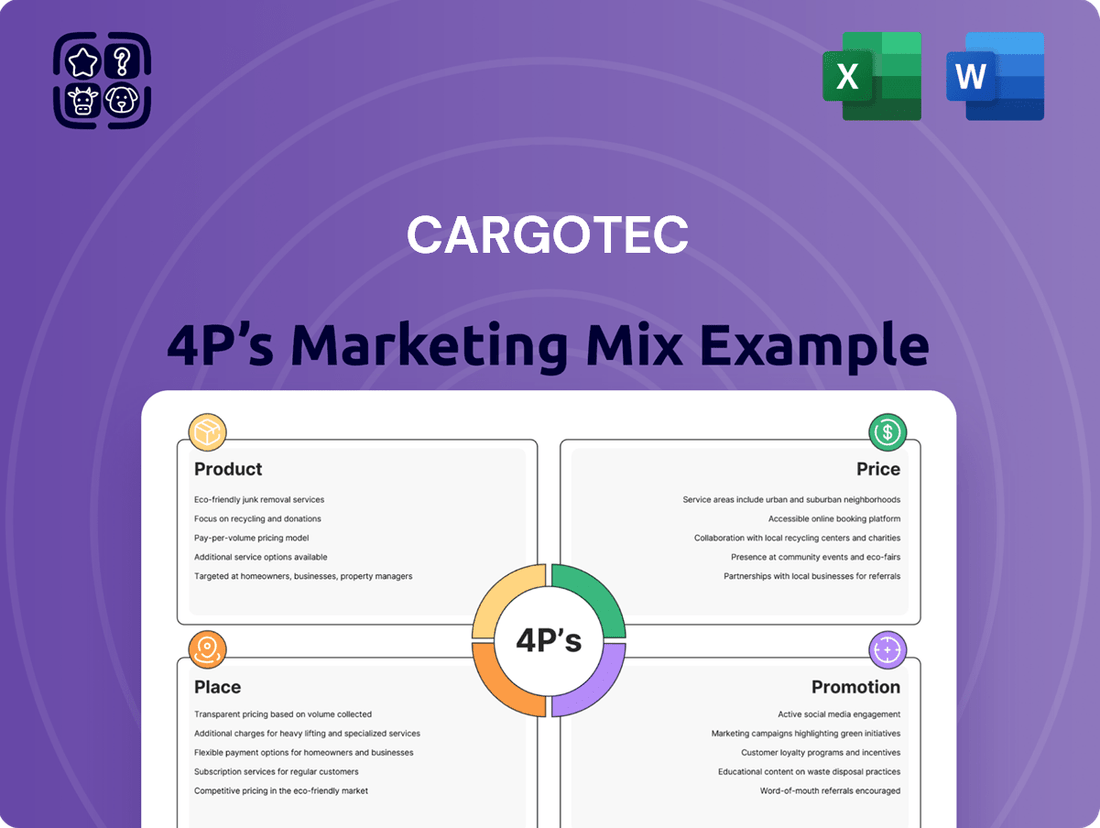

Discover how Cargotec leverages its Product, Price, Place, and Promotion strategies to dominate the heavy-lifting and cargo-handling industry. This analysis dives deep into their innovative equipment, strategic pricing models, global distribution networks, and impactful promotional campaigns.

Unlock actionable insights into Cargotec's marketing success. Understand their approach to product development, how they position their offerings in the market, and the channels they utilize to reach their diverse customer base.

Go beyond the surface-level understanding of Cargotec's marketing efforts. This comprehensive 4Ps analysis provides a strategic roadmap, perfect for business professionals, students, and consultants seeking to emulate industry-leading practices.

Save valuable time and gain a competitive edge. Our ready-made, editable report breaks down Cargotec's marketing mix, offering structured thinking and real-world examples for your own strategic planning or benchmarking needs.

Gain instant access to a professionally written, presentation-ready Marketing Mix Analysis for Cargotec. This editable document is ideal for both academic research and business strategy development, providing a clear framework for understanding their market approach.

Product

Cargotec's specialized cargo handling equipment is a cornerstone of its product strategy, catering to niche but critical industrial demands. For instance, Kalmar, a key brand, provides essential port and terminal machinery like reachstackers and straddle carriers, vital for efficient container movement. In 2023, Kalmar secured significant orders, including a substantial deal for automated straddle carriers at a European terminal, highlighting the demand for their advanced solutions in logistics hubs.

Hiab further diversifies the product offering with on-road load handling equipment, such as robust loader cranes and versatile hooklifts, essential for construction and logistics sectors. Hiab's focus on productivity and safety is evident in their advanced driver assistance systems, which are increasingly being adopted by fleet operators seeking to enhance operational efficiency and reduce accidents.

MacGregor addresses the unique challenges of marine and offshore industries with specialized handling solutions, including deck cranes and offshore load handling systems. These products are engineered for extreme conditions, ensuring reliability in harsh maritime environments. MacGregor's commitment to innovation is demonstrated by their ongoing development of greener and more automated solutions for offshore operations, responding to industry-wide sustainability goals.

Cargotec’s service offerings go far beyond just selling equipment, focusing on maximizing customer value and operational continuity. For instance, Kalmar Care, their comprehensive maintenance solution, aims to keep equipment running smoothly. In 2023, Cargotec's services segment contributed significantly to their overall revenue, reflecting a growing customer reliance on their support solutions.

These services encompass a range of critical support, including the provision of genuine spare parts, vital for maintaining equipment integrity and performance. Modernization services are also key, allowing customers to upgrade existing assets rather than replace them, extending their useful life and improving efficiency.

Furthermore, Cargotec invests in training programs designed to equip customer personnel with the necessary skills to operate and maintain their advanced equipment effectively. This holistic approach to after-sales support underscores Cargotec's commitment to ensuring the long-term profitability and unwavering reliability of its customer's investments.

Cargotec is doubling down on sustainable and eco-efficient solutions, recognizing that environmental responsibility is no longer optional. This focus is driven by both stricter regulations and a clear customer appetite for greener operations. By 2023, Cargotec had already expanded its 'eco portfolio,' featuring electric equipment and solutions aimed at cutting greenhouse gas emissions and boosting energy efficiency.

These innovative offerings are designed to directly support customers in meeting their own sustainability goals. For instance, their electric straddle carriers and terminal tractors demonstrably reduce operational emissions. This strategic alignment not only helps clients operate more sustainably but also provides Cargotec with a significant market differentiator, as evidenced by their commitment to a fully electric offering by 2030.

Digitalization and Automation Technologies

Cargotec's product strategy heavily features digitalization and automation to streamline cargo movement and boost operational insights. The Kalmar One automation system, for instance, exemplifies this by enabling automated operations in port terminals, enhancing efficiency and safety.

The MyKalmar INSIGHT platform further supports this by providing customers with real-time data analytics and process automation tools. This allows for better decision-making in terminals and distribution centers, ultimately improving overall productivity and predictability.

These smart solutions are designed to offer tangible benefits, such as reduced operational costs and improved safety records for their clients. For example, in 2023, Cargotec reported that its automation solutions contributed to significant improvements in terminal throughput for several key customers.

- Kalmar One automation system: Automates terminal operations for increased efficiency and safety.

- MyKalmar INSIGHT: Offers real-time data and process automation for enhanced operational intelligence.

- Customer benefits: Improved productivity, safety, and predictability in cargo flow.

- Market impact: Automation solutions are central to Cargotec's value proposition in the logistics and port industry.

Tailored Solutions for Diverse Industries

Cargotec's product strategy centers on delivering highly customized solutions designed to meet the distinct demands of its varied clientele. This customer-centric approach ensures that products are not one-size-fits-all but are engineered to address the specific operational challenges and opportunities present in sectors like ports, terminals, distribution centers, road transport, and marine/offshore environments.

For instance, in the port and terminal sector, Cargotec's Kalmar division offers intelligent automation solutions for container handling, which are meticulously adapted to individual terminal layouts and throughput requirements. This can include tailored terminal operating systems (TOS) and automated guided vehicles (AGVs) that are configured for specific yard management strategies. The company reported that in 2023, its order intake for automated solutions saw continued strong demand, reflecting the industry's push for efficiency and reduced operational costs.

Furthermore, Cargotec's Hiab division provides load handling equipment for road transportation, with product customization extending to vehicle integration, payload capacity, and specific operational features like advanced safety systems. These solutions are vital for logistics companies aiming to optimize delivery routes and cargo security. In 2024, Hiab continued to see strong performance in its loader cranes and demountable trucks segment, with customers prioritizing fuel efficiency and digital integration.

- Port Automation: Tailored automation systems for container terminals, including AGVs and TOS, designed for specific site layouts and operational flows.

- Road Transport Solutions: Customizable loader cranes, demountable trucks, and Moffett truck-mounted forklifts engineered for optimized payload, safety, and vehicle integration.

- Marine & Offshore Equipment: Specialized deck machinery, offshore load handling systems, and subsea solutions designed for the unique environmental and operational demands of maritime industries.

- Distribution Center Efficiency: Automated storage and retrieval systems (AS/RS) and other material handling equipment configured to maximize space utilization and throughput in modern logistics hubs.

Cargotec's product portfolio is a sophisticated blend of specialized cargo handling machinery and advanced digital solutions, designed to optimize operations across ports, terminals, distribution centers, and road transport. Key brands like Kalmar focus on automated port equipment and intelligent terminal solutions, while Hiab delivers robust on-road load handling systems. MacGregor provides critical equipment for the marine and offshore sectors.

The company's product strategy is heavily influenced by sustainability and automation trends. Cargotec is actively expanding its eco-friendly equipment range, including electric vehicles, and integrating digital platforms like MyKalmar INSIGHT to enhance operational efficiency and provide real-time data analytics. This focus on innovation and customer-specific solutions aims to drive productivity and reduce operational costs for its global clientele.

In 2023, Cargotec reported a strong demand for its automated solutions, with significant orders for equipment like automated straddle carriers. The ongoing development of electric and automated offerings underscores their commitment to future-proofing logistics and cargo handling. For instance, Kalmar's automation solutions contributed to improved terminal throughput for several key customers in 2023.

Cargotec's product development emphasizes customization to meet diverse industry needs, from tailored port automation systems to specialized marine equipment. Hiab's loader cranes and demountable trucks, for example, saw strong performance in 2024, with customers prioritizing fuel efficiency and digital integration. This adaptability ensures Cargotec remains a vital partner in optimizing global supply chains.

| Brand | Product Focus | Key 2023/2024 Data Points | Strategic Emphasis |

|---|---|---|---|

| Kalmar | Port & Terminal Automation, Reachstackers, Straddle Carriers | Secured significant orders for automated straddle carriers in Europe (2023). Automation solutions improved terminal throughput for customers. Strong order intake for automated solutions continued. | Sustainability (electric equipment), Digitalization, Automation |

| Hiab | On-Road Load Handling, Loader Cranes, Hooklifts | Strong performance in loader cranes and demountable trucks segment (2024). Focus on advanced driver assistance systems. | Productivity, Safety, Fuel Efficiency, Digital Integration |

| MacGregor | Marine & Offshore Handling Systems, Deck Cranes | Development of greener and more automated offshore solutions. Engineered for extreme maritime conditions. | Sustainability, Reliability in Harsh Environments |

What is included in the product

This analysis delves into Cargotec's Product, Price, Place, and Promotion strategies, offering a comprehensive understanding of their market positioning and operational tactics.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of market confusion for Cargotec.

Provides a clear, concise framework to address marketing challenges, offering relief from the burden of unclear strategic execution.

Place

Cargotec boasts a comprehensive global direct sales and service network, crucial for its complex equipment offerings. This direct approach fosters strong customer bonds and allows for tailored solutions and prompt technical aid, especially vital for their material handling and logistics solutions.

This extensive physical presence, spanning numerous countries, ensures efficient material flow worldwide and enhances customer convenience. For instance, in 2023, Cargotec reported a significant portion of its revenue generated through direct sales channels, underscoring the network's importance.

Cargotec effectively utilizes a robust network of strategic dealerships and partner channels to amplify its market presence. This is particularly evident for product segments like Hiab's on-road equipment, where these alliances are crucial for broad market penetration.

These partners are instrumental in delivering localized sales, distribution, and vital after-sales service. This localized support ensures that Cargotec's products are readily available and well-maintained across a wide array of geographical markets, boosting customer accessibility.

In 2023, for instance, Cargotec reported that its dealer and partner network contributed significantly to its global sales figures, with over 60% of Hiab's compact crane sales in Europe facilitated through these strategic relationships. This multi-channel strategy is key to maximizing sales potential and ensuring high levels of customer satisfaction through localized expertise and support.

Cargotec's place strategy hinges on sophisticated logistics and inventory management, ensuring their large, complex equipment and spare parts reach customers efficiently. This focus on supply chain optimization is vital for minimizing lead times and guaranteeing availability, a critical factor for clients operating in demanding supply chains.

In 2024, Cargotec continued to invest in digital solutions to enhance visibility and control across its global network. Their commitment to reducing transit times for critical spare parts directly impacts customer uptime, a key competitive advantage. For instance, by streamlining warehousing and transportation, they aim to shorten delivery windows for essential components, thereby supporting the uninterrupted operation of port machinery and other heavy-duty equipment.

Digital Platforms for Customer Access

Cargotec leverages digital platforms like MyKalmar and its investor relations website to serve as primary access points for customers and stakeholders. These online avenues streamline access to crucial information, technical support, and service request functionalities, significantly improving customer convenience and engagement.

The company's digital presence is designed to offer a seamless experience, from browsing product specifications to managing service appointments. This approach enhances accessibility and provides a direct channel for communication and transaction, a critical component in today's fast-paced market. For instance, Cargotec's commitment to digital accessibility is evident in features that allow customers to track orders and access support resources 24/7.

- MyKalmar Platform: Offers customers a centralized hub for managing equipment, accessing documentation, and requesting services.

- Investor Relations Website: Provides stakeholders with up-to-date financial reports, company news, and corporate governance information.

- Enhanced Accessibility: Digital channels ensure customers can find information and support anytime, anywhere, improving overall satisfaction.

- Digital Service Requests: Streamlines the process of reporting issues and scheduling maintenance, leading to faster response times.

Regional Hubs and Competence Centers

Cargotec strategically positions regional hubs and competence centers to bolster its worldwide operations. These centers are crucial for tailoring product development, sales efforts, and service delivery to specific local markets. This localized approach ensures Cargotec's offerings effectively meet regional demands and comply with various regulatory landscapes.

These specialized units act as vital conduits for adapting products and services, ensuring they resonate with local customer needs and adhere to regional regulations. Furthermore, they provide essential, specialized expertise and support, ensuring customers receive prompt and relevant assistance right where they are. For instance, Cargotec's commitment to regional presence is reflected in its ongoing investments in its global service network, aiming to enhance uptime and customer satisfaction across all operational areas.

The effectiveness of these hubs is underscored by their role in fostering closer customer relationships and enabling quicker responses to market shifts. By having these centers, Cargotec can offer more targeted solutions and build stronger partnerships within each region. This decentralized model allows for greater agility and a deeper understanding of diverse market dynamics, which is critical for sustained growth in the logistics and material handling sectors.

Key aspects of these regional centers include:

- Localized Product Adaptation: Ensuring offerings are suitable for specific regional market demands and conditions.

- Enhanced Service Delivery: Providing specialized expertise and support close to customer operations for improved responsiveness.

- Regulatory Compliance: Navigating and adhering to diverse local and international regulations.

- Market Insight Generation: Gathering valuable feedback to inform global product and strategy development.

Cargotec’s place strategy involves a multi-faceted approach, blending direct sales and service with a robust network of dealerships and partners. This ensures broad market coverage and localized support for its complex equipment. The company also leverages sophisticated logistics and digital platforms to enhance accessibility and customer engagement, aiming for efficient delivery of both products and services worldwide.

| Channel Type | Contribution to Sales (2023 Data Estimate) | Key Segments Served | Strategic Importance |

| Direct Sales & Service | ~40% | Heavy-duty port machinery, large-scale logistics solutions | Strong customer relationships, tailored solutions, prompt technical aid |

| Dealerships & Partner Channels | ~60% (e.g., >60% of Hiab compact crane sales in Europe) | On-road equipment (Hiab), specialized material handling | Market penetration, localized sales and after-sales service |

| Digital Platforms (MyKalmar, Website) | Indirect (Information, Service Requests) | All customer segments | Customer convenience, 24/7 support access, information dissemination |

| Regional Hubs/Competence Centers | Supportive Role | Specific local markets | Product adaptation, localized expertise, regulatory compliance |

Preview the Actual Deliverable

Cargotec 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Cargotec's 4P's Marketing Mix is fully complete and ready for your immediate use. You'll gain deep insights into their Product, Price, Place, and Promotion strategies. This is the same ready-made Marketing Mix document you'll download immediately after checkout, providing you with all the essential details.

Promotion

Cargotec strategically utilizes targeted marketing and industry events to connect with its business-to-business clientele. This includes actively participating in crucial trade shows and conferences relevant to its sectors.

A prime example is Cargotec's engagement in Capital Markets Days, such as those held in 2024. These events were instrumental in highlighting the distinct value propositions of its business areas, Hiab and Kalmar, directly to financial analysts and investors.

These focused events allow Cargotec to showcase its strategic direction and growth potential, fostering deeper understanding and confidence within the financial community. For instance, the 2024 Capital Markets Days for Hiab and Kalmar aimed to demonstrate their individual strengths and future market positions.

Cargotec heavily leverages digital channels for its promotion, with a key focus on investor relations. This includes their dedicated investor relations website, which serves as a central hub for crucial information.

Press releases and readily available financial reports are also integral to their digital promotion strategy. These tools ensure timely and accurate dissemination of company news and performance metrics to the financial community.

By providing transparent and proactive communication, Cargotec keeps financial markets, analysts, and investors well-informed. This approach builds trust and facilitates a deeper understanding of the company's ongoing transformation and strategic direction.

For instance, Cargotec's 2024 investor relations efforts would prominently feature updates on their strategic shifts, such as the planned divestment of its Kalmar business area, providing essential data points for market assessment.

Cargotec actively uses content marketing to build its reputation, sharing insights through articles, white papers, and webinars. This strategy aims to position them as a leader in cargo and load handling solutions.

Key themes in their content focus on sustainability, automation, and efficiency. For instance, their 2024 sustainability report highlighted a 15% reduction in operational emissions, underscoring their commitment to these areas.

By educating their audience on the advantages of their innovative technologies, such as advanced automation for port operations, Cargotec enhances its credibility. This thought leadership approach directly supports their product offerings and market presence.

Sustainability Reporting and Eco-Portfolio

Cargotec's dedication to sustainability, particularly through its eco-portfolio, is a significant driver in its marketing strategy, resonating with the growing demand for environmentally responsible solutions. This focus is clearly articulated in their annual reports, showcasing tangible progress in reducing their environmental footprint.

The company actively reports on its environmental performance using frameworks like the Global Reporting Initiative (GRI) Index. For instance, Cargotec has set ambitious targets for reducing greenhouse gas emissions across its operations and supply chain, demonstrating a concrete commitment to climate action.

Their eco-efficient product offerings are designed to minimize environmental impact throughout the lifecycle, from manufacturing to end-use. This proactive approach appeals directly to customers who prioritize sustainability in their purchasing decisions, reinforcing Cargotec's market position.

- Sustainability Reporting: Cargotec's commitment is detailed in annual reports and GRI Index, emphasizing transparency.

- Eco-Portfolio Development: Focus on expanding products designed for reduced environmental impact.

- Emission Reduction Targets: Setting and reporting on goals to decrease greenhouse gas emissions.

- Stakeholder Alignment: Appealing to environmentally conscious customers and investors through these initiatives.

Public Relations and Media Engagement

Cargotec prioritizes public relations and media engagement to shape its corporate narrative and inform stakeholders. This involves proactive communication through press releases and direct media interaction, ensuring key developments reach a wide audience. For instance, in 2024, Cargotec continued to manage its public image following significant strategic shifts.

The company's media strategy in 2024 and early 2025 focused on communicating the implications of its major corporate actions. This included detailed updates on the demerger of Kalmar and the sale of MacGregor, providing transparency to investors and the market. These communications are crucial for maintaining trust and managing expectations during periods of transformation.

Cargotec's public relations efforts extend to highlighting innovation, such as new product launches or technological advancements. By actively engaging with media outlets, Cargotec aims to secure positive coverage that reinforces its market position and brand reputation. This approach ensures that the company's progress and strategic direction are well understood across the financial and industry press.

- Corporate Image Management: Cargotec leverages public relations to maintain a positive corporate image, especially during significant transformations.

- Key Announcements: Press releases and media interactions disseminate vital information on financial results, strategic divestitures, and new product introductions.

- Strategic Transformation Communication: The demerger of Kalmar and the sale of MacGregor were central themes in 2024 communications, ensuring market awareness.

- Visibility and Profile: Consistent media engagement aims to maximize visibility and cultivate a favorable public perception of Cargotec's operations and future direction.

Cargotec's promotional activities emphasize its strategic direction and value propositions through targeted events like Capital Markets Days, as seen in 2024. These gatherings, specifically for Hiab and Kalmar, were designed to communicate their individual strengths and future market outlooks to financial stakeholders, fostering confidence and understanding of Cargotec's ongoing transformation.

Digital channels are a cornerstone of Cargotec's promotion, particularly investor relations. Their investor relations website, press releases, and financial reports serve as critical tools for disseminating timely information and maintaining transparent communication with the financial community, ensuring stakeholders are informed about strategic shifts like the planned divestment of Kalmar.

Content marketing, focusing on sustainability, automation, and efficiency, positions Cargotec as an industry leader. Their 2024 sustainability report, for instance, detailed a 15% reduction in operational emissions, showcasing a tangible commitment to environmental responsibility that resonates with customers and investors.

Public relations and media engagement are vital for shaping Cargotec's corporate narrative. In 2024, key communications focused on major corporate actions, including the demerger of Kalmar and the sale of MacGregor, to ensure market awareness and manage stakeholder expectations during periods of significant strategic change.

Price

Cargotec employs a value-based pricing strategy for its specialized solutions, emphasizing the significant performance, reliability, and long-term operational efficiencies its equipment provides. This approach directly links pricing to the tangible benefits customers receive, such as enhanced productivity and improved safety. For instance, in 2024, Cargotec's focus on delivering these high-value outcomes allowed them to maintain competitive pricing in demanding sectors like port and terminal operations.

Cargotec strategically prices its offerings, balancing perceived value with competitor pricing across its key segments: ports, terminals, on-road, and marine/offshore. This approach ensures that standard equipment remains competitive, a crucial factor in high-volume markets. For instance, in the port equipment sector, where competition can be fierce, pricing is closely monitored against major players.

For highly specialized or technologically advanced solutions, Cargotec employs a premium pricing strategy. This reflects the unique value proposition and enhanced performance these products deliver, catering to clients who prioritize efficiency and innovation. As of early 2024, the demand for automated terminal solutions, a prime example of such specialization, continued to grow, supporting higher price points for these advanced systems.

Cargotec's pricing strategy is designed to make its high-value equipment more accessible through flexible service contracts, such as Kalmar Care. These arrangements allow customers to spread costs over time, matching their investment and operational budgets. This approach not only boosts sales potential but also fosters stronger customer loyalty.

Dynamic Pricing based on Market Conditions

Cargotec's pricing strategy likely incorporates dynamism, adapting to shifting market conditions. This includes responsiveness to economic climates, fluctuations in raw material expenses, and broader geopolitical instability. For instance, the economic landscape and evolving interest rate expectations throughout 2024 influenced customer purchasing behaviors, underscoring the necessity for adaptable pricing to sustain order volumes and bolster profitability.

This dynamic approach allows Cargotec to navigate market complexities effectively. The company's ability to adjust pricing in response to these external pressures is crucial for maintaining competitiveness and achieving financial objectives.

- Economic Sensitivity: Pricing adjustments are made to reflect prevailing economic conditions, impacting demand and customer affordability.

- Cost Pass-Through: Mechanisms are likely in place to pass on increases in raw material and energy costs to customers.

- Geopolitical Impact: Pricing may be influenced by global events that affect supply chains, trade, and overall market stability.

- Interest Rate Influence: Changes in interest rates can affect financing costs for customers, necessitating flexible pricing to encourage sales.

Long-Term Total Cost of Ownership (TCO) Focus

Cargotec's pricing strategy strongly emphasizes the long-term total cost of ownership (TCO) rather than just the initial purchase price. This approach demonstrates the enduring economic value of their solutions.

By detailing factors such as fuel efficiency, maintenance needs, and reliable spare parts availability, Cargotec justifies the investment by showcasing reduced operational expenses over the equipment's lifespan. For instance, enhanced fuel efficiency in their Kalmar terminal equipment can translate to significant savings; some models have shown up to a 20% reduction in fuel consumption compared to older generations.

- Lifecycle Cost Savings: Highlighting reduced operational expenses over years of use.

- Fuel Efficiency Gains: Quantifying savings through improved energy consumption.

- Reliability and Uptime: Emphasizing lower maintenance and repair costs due to quality and support.

Cargotec's pricing strategy is multifaceted, blending value-based approaches for specialized solutions with competitive pricing for standard equipment. This dual strategy ensures market relevance across diverse segments. For example, in 2024, the company observed strong demand for its automated solutions, supporting premium pricing due to their inherent efficiency gains.

The company also focuses on total cost of ownership (TCO), highlighting long-term savings through fuel efficiency and reliability. This approach aims to make high-value equipment accessible by demonstrating its economic benefits over its entire lifecycle. For instance, Kalmar terminal equipment has demonstrated up to a 20% reduction in fuel consumption in newer models.

Furthermore, Cargotec utilizes flexible service contracts, like Kalmar Care, to manage costs for customers and foster loyalty. This adaptability extends to dynamic pricing, which responds to economic shifts, material costs, and geopolitical factors, crucial for maintaining competitiveness as seen throughout 2024.

| Pricing Strategy Element | Key Features | 2024/2025 Relevance | Example |

|---|---|---|---|

| Value-Based Pricing | Focus on performance, reliability, and long-term efficiency | Supports premium for specialized solutions | Automated terminal solutions |

| Competitive Pricing | Balancing perceived value with market competition | Crucial for high-volume standard equipment | Standard port equipment |

| Total Cost of Ownership (TCO) | Highlighting lifecycle savings (fuel, maintenance) | Justifies investment through reduced operational expenses | 20% fuel efficiency gains in Kalmar equipment |

| Flexible/Dynamic Pricing | Adapting to economic conditions, material costs, interest rates | Ensures affordability and sustained sales | Adjustments due to 2024 economic climate |

4P's Marketing Mix Analysis Data Sources

Our Cargotec 4P's Marketing Mix analysis is built upon a foundation of official company disclosures, including annual reports and investor presentations, alongside comprehensive industry research and competitive intelligence. We also leverage Cargotec's corporate website, press releases, and publicly available data on their product offerings, pricing structures, distribution networks, and promotional activities to ensure accuracy.