Cargotec Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cargotec Bundle

Cargotec operates within a complex landscape shaped by powerful market forces. Understanding the threat of new entrants, the bargaining power of buyers and suppliers, the intensity of rivalry, and the threat of substitutes is crucial for strategic success.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Cargotec’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Cargotec’s dependence on a select group of suppliers for highly specialized parts, such as advanced hydraulics and sophisticated control electronics, grants these suppliers significant bargaining power. This is especially true for its Kalmar and MacGregor divisions, which often require unique, complex components. The limited number of manufacturers capable of producing these critical parts means Cargotec has fewer options, potentially leading to higher costs and less favorable contract terms. For instance, the average lead time for specialized industrial components can extend significantly, impacting production schedules.

While specialized components are critical, the cost of fundamental raw materials such as steel and other metals significantly impacts supplier bargaining power for Cargotec. Global commodity price swings directly affect manufacturing expenses. For instance, steel prices saw considerable volatility throughout 2024, presenting ongoing challenges.

Cargotec's substantial purchasing volumes for standardized materials can offer some leverage against suppliers. However, the persistent upward trend in input costs across the manufacturing sector in early 2025 remains a notable concern, potentially diminishing this countervailing power.

Supplier switching costs significantly impact Cargotec's bargaining power. For critical, custom-engineered components, the expense and time involved in re-tooling, re-designing, and re-certifying new parts after switching suppliers can be substantial. This acts as a deterrent, making it difficult for Cargotec to easily move away from existing suppliers, thus bolstering the suppliers' leverage.

Furthermore, long-standing partnerships and collaborative development initiatives often create deep integration between Cargotec and its suppliers. These established relationships and shared intellectual property can further elevate the costs and complexities associated with transitioning to alternative suppliers, reinforcing the bargaining power of incumbent providers.

Technological Dependence

Suppliers leading the charge in electrifying, automating, and digitizing heavy machinery development hold significant sway. Cargotec's need to incorporate these cutting-edge technologies to stay ahead in the market directly increases supplier bargaining power. For instance, suppliers developing advanced battery systems for electric-powered port equipment or sophisticated AI for autonomous vehicles are in a strong position to negotiate terms.

The industry's pivot towards sustainability, particularly low-emission technologies, further amplifies the power of suppliers who are pioneers in this space. Companies investing heavily in research and development for greener solutions, such as hydrogen fuel cells or advanced hybrid powertrains, can command higher prices and more favorable contract conditions. As of 2024, the global market for industrial automation and electrification solutions continues its robust growth, underscoring the increasing reliance on technologically advanced suppliers.

- Technological Advancement: Suppliers innovating in electrification and automation for heavy machinery gain leverage as Cargotec needs these technologies to remain competitive.

- Low-Emission Drive: Suppliers at the forefront of low-emission technologies, like electric powertrains, increase their influence in the market.

- Industry Trends: The increasing demand for automated and sustainable solutions means suppliers offering these capabilities are in a stronger negotiating position.

- Competitive Necessity: Cargotec's requirement to integrate advanced technologies translates into greater bargaining power for suppliers possessing them.

Consolidation Among Suppliers

Consolidation among suppliers significantly amplifies their bargaining power over companies like Cargotec. When fewer, larger players dominate key component markets, Cargotec faces a reduced supplier pool. This concentration means the remaining suppliers can dictate terms more effectively, potentially leading to higher prices and less favorable delivery schedules. For instance, if a critical electronic component supplier merges, the new entity can leverage its expanded market share to negotiate from a position of strength.

This scenario can directly impact Cargotec's operational costs and profitability. With fewer alternatives, the company may find it challenging to secure competitive pricing for essential parts. In 2024, reports indicated a trend of mergers and acquisitions within the industrial components sector, which could directly affect manufacturers relying on these specialized suppliers.

- Increased Supplier Leverage: Supplier consolidation reduces competition, giving dominant suppliers more control over pricing and terms.

- Reduced Sourcing Options: Fewer suppliers mean fewer choices for Cargotec, limiting its ability to negotiate favorable deals.

- Potential for Higher Costs: Concentrated markets often lead to increased component prices, impacting Cargotec's cost of goods sold.

- Impact on Profitability: Unfavorable pricing and delivery terms from consolidated suppliers can directly squeeze Cargotec's profit margins.

Suppliers of highly specialized components and advanced technologies, such as those for electrification and automation, wield considerable bargaining power over Cargotec. This is compounded by the high switching costs associated with custom-engineered parts and established supplier relationships, making it difficult for Cargotec to change providers easily. The industry's move towards sustainability further strengthens the hand of suppliers leading in low-emission solutions, with the global market for industrial automation and electrification expected to see continued robust growth through 2025.

| Factor | Impact on Cargotec | Example/Data Point (2024/2025) |

|---|---|---|

| Specialized Components | High supplier power due to unique requirements and limited manufacturers. | Average lead times for specialized industrial components can extend significantly, impacting production schedules. |

| Technological Innovation | Suppliers leading in electrification and automation have increased leverage. | The market for industrial automation and electrification solutions saw robust growth in 2024. |

| Switching Costs | High costs for re-tooling and re-designing make switching difficult, favoring incumbent suppliers. | Transitioning to new suppliers for custom-engineered parts can take months and incur substantial upfront investment. |

| Supplier Consolidation | Reduced supplier options increase bargaining power, potentially raising prices. | Mergers and acquisitions within the industrial components sector in 2024 reduced competition for key parts. |

What is included in the product

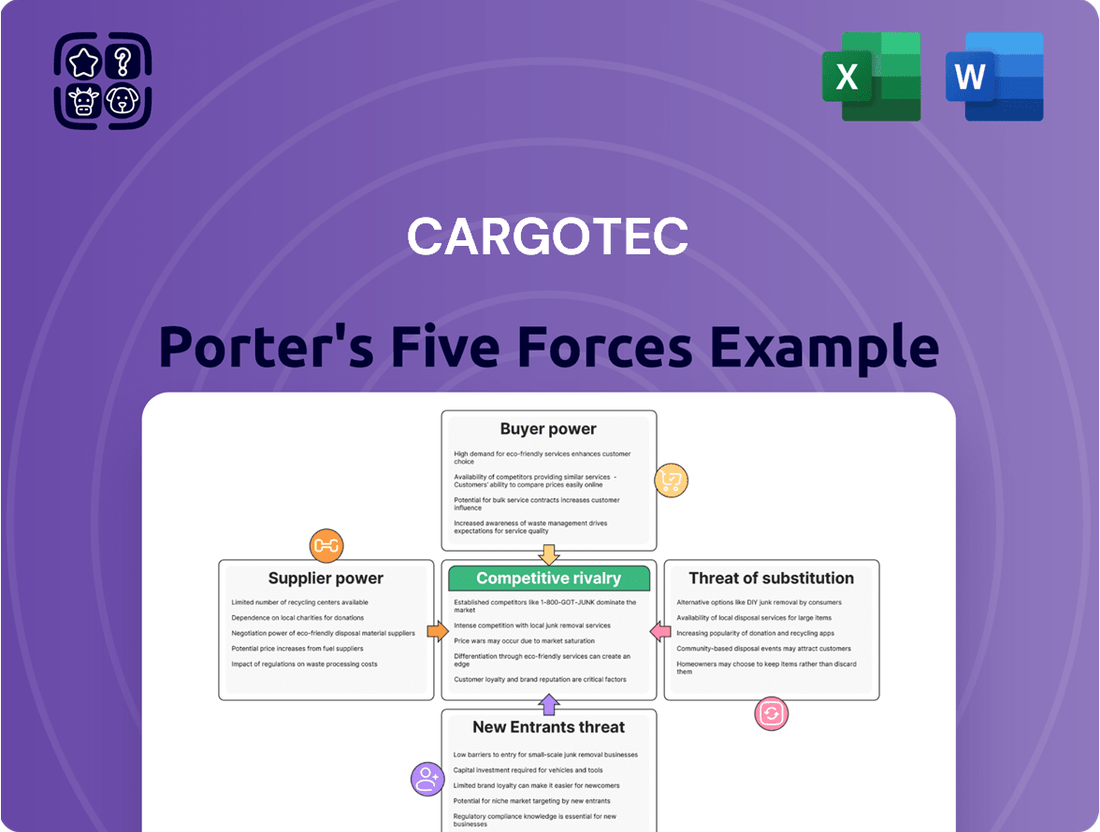

This analysis unpacks the competitive intensity within Cargotec's industry, examining the power of buyers and suppliers, the threat of new entrants and substitutes, and the overall rivalry among existing players.

Easily identify and prioritize strategic threats by visualizing the intensity of each of Porter's Five Forces on a dynamic spider chart.

Customers Bargaining Power

Cargotec's customer base is dominated by large, sophisticated entities such as major global ports, significant shipping lines, and major players in the construction and logistics sectors. These customers, often possessing substantial financial strength and deep industry knowledge, are adept at leveraging their purchasing power.

Given the considerable volumes of equipment purchased, these influential customers can exert significant pressure on pricing negotiations, demanding competitive quotes and favorable payment terms. For example, a single large port expansion project could involve orders for dozens of large-scale cargo handling machines, giving the port authority considerable leverage.

Beyond price, these sophisticated buyers also influence product customization to meet specific operational needs and dictate terms for after-sales service, including maintenance schedules and response times. This ability to demand tailored solutions and high-quality service directly impacts Cargotec's product development and service delivery strategies.

The bargaining power of these customers is further amplified by the availability of alternative suppliers and the potential for long-term contracts that lock in pricing and service levels, forcing Cargotec to remain highly competitive and responsive to market demands.

Customers face substantial switching costs when adopting Cargotec's advanced cargo handling systems. The initial capital investment in Kalmar equipment alone can run into millions, making a changeover prohibitively expensive. Furthermore, the deep integration of these solutions into a port's existing operations, coupled with the specialized training needed for staff, creates a significant barrier to switching to a rival. This lock-in effect diminishes the immediate bargaining power of these customers.

Cargotec's equipment, such as load transfer solutions and port automation systems, plays a crucial role in the daily operations of its customers, including logistics companies and port operators. The efficiency and reliability of these systems directly impact a customer's ability to move goods quickly and profitably. For instance, a port relying on Cargotec's automated cranes needs them to function seamlessly to avoid costly delays in ship turnaround times.

When Cargotec's offerings are integral to a customer's core business, any disruption can significantly hinder their productivity and revenue generation. This dependency means customers are inherently motivated to ensure the smooth operation of Cargotec's products. This criticality can, in turn, lessen their focus on price alone, as the cost of downtime often outweighs the initial purchase price of the equipment.

Customer Price Sensitivity and Budgetary Pressures

Customers, particularly those operating in sectors like logistics and shipping, often experience significant budgetary pressures. This sensitivity to price, even for critical equipment like cargo handling machinery, means they are inclined to explore ways to reduce overall expenditure. In 2023, for instance, many businesses were still navigating the economic headwinds from the previous year, leading to a heightened focus on cost optimization across their operations.

This price sensitivity translates into a desire to extend the useful life of existing assets. Instead of immediately purchasing new equipment, customers might opt for more frequent maintenance or refurbishment services to defer large capital outlays. This trend was evident as many companies prioritized operational efficiency and cost control throughout 2023, seeking to maximize the value from their current investments.

- Budgetary Constraints: Global economic uncertainty in 2023 led many logistics firms to scrutinize capital expenditure, increasing their sensitivity to the price of new cargo handling equipment.

- Lifecycle Extension: Customers are increasingly looking at maintenance and refurbishment options to delay the purchase of new, expensive machinery, potentially saving 20-30% compared to a new purchase.

- Demand for Cost-Effective Solutions: This behavior creates a stronger demand for Cargotec's service offerings, including repair, upgrades, and predictive maintenance, which are often more budget-friendly than outright replacement.

- Competitive Pricing Pressure: Cargotec faces pressure to offer competitive pricing and value-added services to retain customers who are actively seeking the most economical solutions.

Customer Industry Consolidation

Customer industry consolidation, particularly within the port, shipping, and logistics sectors, significantly amplifies buyer power. As these industries mature and merge, larger entities emerge, wielding greater purchasing leverage over suppliers like Cargotec.

This concentration of buyers means they can more effectively negotiate for better pricing, extended payment terms, and customized solutions. For instance, a major global shipping line, formed from a significant merger, could demand substantial discounts on terminal equipment, directly impacting Cargotec's profitability. In 2024, the logistics sector continued to see consolidation trends, with several mid-sized companies being acquired by larger players, indicating an ongoing shift towards fewer, more dominant customers.

- Increased Bargaining Power: Consolidated customers can negotiate more aggressively on price and terms.

- Margin Pressure: Higher demands from powerful buyers can squeeze Cargotec's profit margins.

- Contractual Leverage: Larger customers may insist on long-term, comprehensive contracts that favor their needs.

- Supplier Dependence: Cargotec could become more reliant on a smaller number of large, influential customers.

Cargotec's customers, primarily large port operators and logistics firms, wield considerable bargaining power due to their substantial order volumes and sophisticated negotiation tactics. These buyers often demand competitive pricing, favorable payment terms, and customized product features, directly influencing Cargotec's pricing strategies and product development roadmaps.

The criticality of Cargotec's equipment, such as automated cranes and straddle carriers, to customer operations means that reliability and uptime are paramount, sometimes outweighing initial cost considerations. However, customers also face budgetary pressures, leading them to explore lifecycle extensions through maintenance and refurbishment rather than immediate new purchases, a trend particularly pronounced in 2023.

Industry consolidation further amplifies customer power; for instance, mergers in the logistics sector in 2024 resulted in fewer, larger entities capable of negotiating more aggressively. This concentration can lead to increased margin pressure for Cargotec and a greater reliance on a smaller customer base.

| Customer Characteristic | Impact on Cargotec | Example/Data Point |

|---|---|---|

| High Purchase Volume | Increased price negotiation leverage | Large port expansion projects can involve dozens of machines. |

| Operational Criticality | Focus on reliability over price; potential for service revenue | Downtime in ship turnaround times is highly costly for ports. |

| Budgetary Constraints (2023) | Demand for lifecycle extension; price sensitivity | Companies focused on cost optimization, deferring capital outlays. |

| Industry Consolidation (2024) | Amplified buyer power, fewer major customers | Mergers in logistics creating larger, more influential buyers. |

Preview Before You Purchase

Cargotec Porter's Five Forces Analysis

The preview you are viewing is the exact Cargotec Porter's Five Forces analysis that you will receive immediately after purchase, containing a comprehensive breakdown of the competitive landscape. This document offers an in-depth examination of buyer power, supplier power, the threat of new entrants, the threat of substitutes, and the intensity of rivalry within Cargotec's industry. You can be confident that no placeholders or sample content are presented; you're seeing the complete, ready-to-use analysis as it will be delivered to you.

Rivalry Among Competitors

The global cargo and load handling market is a battlefield for major international companies. Think of players like Konecranes, Liebherr Group, Terex, and Sany Heavy Industry; they are all vying for dominance. These giants don't just stick to one area; they compete fiercely across Cargotec's diverse offerings, from the heavy machinery found in ports to the equipment used for on-road loads and solutions for the marine industry.

Competitive rivalry within the technology and innovation sphere is intensifying, fueled by rapid advancements in automation, digitalization, and electrification. Companies are channeling significant investments into developing smart port solutions, leveraging AI for enhanced automation, and pioneering low-emission technologies. These efforts are crucial for securing a competitive advantage and addressing the growing demand for sustainability in the logistics sector.

For instance, in 2024, major players in the port equipment and services industry continued to roll out innovative solutions. Cargotec's Kalmar division, a key player, has been a frontrunner in automated straddle carriers and terminal tractors. Competitors like Konecranes and Liebherr are also heavily invested in similar technologies, showcasing a clear trend towards smart and eco-friendly port operations. This innovation race means that companies must constantly adapt and invest to remain relevant.

The heavy machinery sector, where Cargotec operates, is characterized by substantial fixed costs. These include massive investments in research and development to innovate complex equipment, the establishment and maintenance of advanced manufacturing plants, and the creation of a widespread global service and spare parts network. For instance, major players often spend billions annually on R&D alone.

These significant upfront and ongoing expenditures translate into high exit barriers for companies. Once invested, it becomes economically challenging to withdraw from the market, compelling firms to continue operating and competing even when profitability is low. This dynamic encourages aggressive competition as companies strive to protect their market share and recover their fixed costs.

In 2024, the ongoing need for technological advancement in areas like automation and sustainability continues to drive these high R&D expenses. Companies are investing heavily to stay ahead, further solidifying the capital-intensive nature of the industry and reinforcing the competitive pressure to maintain sales volumes.

Product Differentiation and Service Offerings

Competitors in the cargo handling industry actively differentiate themselves through a variety of strategies. These often include the unique features of their equipment, the quality and responsiveness of their after-sales service, and the overall total cost of ownership rather than just the initial purchase price. Many also focus on providing integrated solutions that combine hardware, software, and services for a more comprehensive offering.

Cargotec, for instance, carves out its competitive advantage by emphasizing sustainable cargo flow and the development of intelligent, connected solutions. This focus on innovation and environmental responsibility, coupled with a robust suite of service offerings, serves as a significant differentiator in a market where operational efficiency and long-term value are paramount.

- Product Features: Competitors highlight advanced lifting capacities, energy efficiency, and specialized handling capabilities.

- After-Sales Service: Offering rapid spare parts delivery, predictive maintenance, and skilled technical support is crucial.

- Total Cost of Ownership: Emphasis is placed on lower operating expenses, fuel efficiency, and extended equipment lifespan.

- Integrated Solutions: Combining equipment with digital platforms for fleet management, automation, and data analytics provides a competitive edge.

Market Growth and Regional Dynamics

The competitive rivalry within the port and material handling equipment sector is significantly shaped by varying market growth rates across different regions and equipment types. While the global market is on an upward trajectory, intense competition often surfaces in high-growth areas, particularly Asia-Pacific, which is a key focus for major players like Cargotec.

- Asia-Pacific's Dominance: This region is anticipated to experience the highest growth in container throughput, driving demand for advanced handling equipment.

- Segment Specialization: Rivalry intensity also depends on the specific segment; for example, the market for advanced automated guided vehicles (AGVs) might see different competitive pressures than that for traditional reach stackers.

- Regional Investment Cycles: Significant infrastructure investments in emerging economies, especially in Asia, attract new entrants and intensify competition as established players vie for market share.

- Technological Advancements: Companies are competing not just on price and capacity but also on the integration of smart technologies and automation, creating a dynamic competitive landscape.

Competitive rivalry in the cargo handling sector is fierce, driven by a few dominant global players like Cargotec, Konecranes, and Liebherr. These companies battle across various segments, from port machinery to on-road and marine solutions, pushing innovation in automation and sustainability. For instance, in 2024, the focus on smart port technology and electrification intensified, with significant R&D investments from all major participants.

The industry's high fixed costs in R&D, manufacturing, and global service networks create substantial exit barriers, forcing companies to compete aggressively to maintain market share and recoup investments. Differentiation is key, with companies like Cargotec emphasizing sustainable solutions and intelligent connectivity. This means competition isn't just about initial price but also about total cost of ownership and advanced service offerings.

Market growth rates, especially in the booming Asia-Pacific region, further intensify this rivalry as companies vie for dominance in high-demand areas. This regional focus means players must constantly adapt their strategies and product portfolios to meet evolving market needs and technological advancements.

| Key Competitors | 2024 Focus Areas | Key Differentiators |

| Cargotec (Kalmar) | Automation, Sustainability, Digitalization | Intelligent connected solutions, sustainable cargo flow |

| Konecranes | Automation, Electrification, Port Solutions | Advanced lifting technologies, eco-efficient equipment |

| Liebherr Group | Port Equipment, Heavy Machinery, Marine Cranes | Broad product range, robust engineering, global service network |

| Terex | Material Processing, Port Equipment, Cranes | Diversified portfolio, strategic acquisitions |

| Sany Heavy Industry | Construction Machinery, Port Machinery, Mining Equipment | Cost-effectiveness, expanding global presence |

SSubstitutes Threaten

For less demanding tasks or smaller-scale operations, manual labor and simpler, more affordable equipment can indeed act as substitutes for Cargotec's sophisticated offerings. This is particularly true in regions where labor costs are lower or for businesses with less stringent operational requirements.

While these alternatives might present a lower upfront cost, they often lead to reduced operational efficiency and potentially lower safety standards. For instance, manual handling of goods, while a substitute for automated systems, is significantly slower and increases the risk of workplace injuries, a factor that impacts long-term cost-effectiveness.

Consider the logistics sector's reliance on technology. In 2024, the global warehouse automation market was valued at approximately $20 billion, demonstrating a clear preference for advanced solutions that boost productivity. Substitutes like manual labor, while present, cannot match the throughput or precision of automated systems.

The trade-off for using less specialized equipment is a compromise on performance, reliability, and the total cost of ownership over time. Cargotec's business model is built on providing solutions that deliver superior efficiency and safety, making direct substitution challenging for clients prioritizing these aspects.

Customers increasingly consider alternative logistics and transportation methods that bypass the need for specialized cargo handling equipment. For instance, a move towards air freight for urgent, high-value shipments or greater use of rail for domestic cargo movements can indirectly reduce demand for certain Cargotec solutions.

In 2024, the global air cargo market saw significant growth, with volumes increasing by an estimated 8% year-over-year, as reported by IATA. This trend, driven by e-commerce and supply chain resilience efforts, presents a scenario where time-sensitive goods might bypass traditional port handling, impacting demand for some of Cargotec's offerings.

Customers may choose to refurbish or extend the life of their current equipment rather than buying new from Cargotec. This is often driven by a need to save money or delay significant capital spending. For example, in the logistics sector, investing in upgrades for older forklifts or cranes can be significantly cheaper than purchasing entirely new units, presenting a direct substitute for new sales.

Outsourcing Logistics Functions

The rise of third-party logistics (3PL) providers presents a significant threat of substitution for equipment manufacturers like Cargotec. When customers opt to outsource their entire logistics and material handling, the 3PL becomes the primary decision-maker for equipment. This effectively bypasses the direct relationship and purchasing influence that Cargotec would typically have with the end-user.

While 3PLs may still incorporate Cargotec's equipment into their service offerings, the strategic decision-making power shifts. This indirect usage means Cargotec is no longer directly selling to the entity that ultimately chooses the machinery. The global 3PL market saw substantial growth, with revenue estimated to reach over $1.3 trillion in 2024, highlighting the scale of this substitution threat.

- Shift in Purchasing Power: 3PLs, not the end-user, dictate equipment choices.

- Indirect Usage: Cargotec's products might be used, but the direct customer relationship is diluted.

- Market Growth of 3PLs: The expanding 3PL sector (>$1.3 trillion revenue in 2024) amplifies this substitution risk.

- Reduced Brand Influence: Direct customer loyalty and brand preference are less impactful when a 3PL selects the equipment.

Technological Obsolescence and New Solutions

Technological obsolescence presents a significant threat to Cargotec's existing product lines. Rapid advancements in automation, robotics, and digital twin technology are continuously creating new and potentially more efficient methods for cargo handling. These innovations could eventually render current equipment, like traditional cranes and terminal tractors, less competitive or even obsolete.

For instance, the growing adoption of autonomous guided vehicles (AGVs) and automated stacking cranes in container terminals directly challenges the market for traditional manned equipment. Cargotec itself is investing heavily in these areas, but disruptive technologies originating from outside the traditional port equipment sector could emerge as powerful indirect substitutes. Imagine a scenario where drone technology or advanced logistics software significantly reduces the need for physical cargo movement equipment in certain supply chains.

- Automation & Robotics: The global industrial robotics market was valued at approximately $50 billion in 2023 and is projected to grow substantially, indicating a strong trend towards automated solutions that could substitute traditional cargo handling machinery.

- Digital Twins: While specific market figures for digital twins in cargo handling are emerging, the broader digital twin market is expected to reach over $100 billion by 2028, highlighting the increasing integration of virtual models for optimizing physical processes.

- Disruptive Technologies: Companies in the AI and software sectors are increasingly developing solutions that optimize logistics and supply chains, potentially reducing the reliance on heavy machinery for certain tasks.

The threat of substitutes for Cargotec is multifaceted. Simpler, less expensive equipment or even manual labor can serve as alternatives for less demanding tasks, though often at the cost of efficiency and safety. For example, while manual cargo handling is a substitute for automation, it's significantly slower and riskier, a stark contrast to the global warehouse automation market valued at around $20 billion in 2024.

Alternative logistics methods, such as increased reliance on air freight, can bypass traditional cargo handling needs. The air cargo market's estimated 8% year-over-year growth in 2024, driven by e-commerce, illustrates how certain goods might skip port handling altogether.

Furthermore, the growing trend of outsourcing logistics to third-party providers (3PLs) shifts equipment purchasing decisions away from end-users. The 3PL market's projected revenue exceeding $1.3 trillion in 2024 highlights how this sector can indirectly substitute direct equipment sales by dictating machinery choices.

Entrants Threaten

The threat of new entrants into the heavy cargo and load handling equipment sector, where Cargotec operates, is significantly mitigated by extremely high capital investment requirements. Establishing a presence necessitates vast sums for cutting-edge research and development, building state-of-the-art manufacturing plants, and creating a robust global sales and service infrastructure. For instance, major equipment manufacturers often invest hundreds of millions of dollars annually in R&D and capital expenditures to stay competitive and develop new technologies.

The development of advanced cargo handling solutions, particularly those integrating automation, artificial intelligence, and sustainable technologies, requires substantial technological expertise and ongoing research and development. New entrants face a significant hurdle in overcoming this knowledge gap, as well as existing intellectual property protections. For instance, in 2024, global investment in logistics automation was projected to reach billions, highlighting the high capital and knowledge investment required.

Cargotec and its established competitors benefit from strong brand recognition, long-standing customer relationships, and a proven track record of reliability and service.

Building such trust and reputation takes considerable time and resources, posing a significant hurdle for newcomers.

For instance, Cargotec’s brand equity, built over decades, contributes to customer loyalty, with many clients prioritizing established suppliers for mission-critical equipment.

This deep-rooted customer loyalty means that new entrants must not only offer competitive pricing but also demonstrate equivalent levels of trust and operational excellence to even begin chipping away at market share.

Extensive Global Service and Support Network

The extensive global service and support network possessed by established players like Cargotec represents a significant barrier to entry. Providing reliable after-sales service, readily available spare parts, and expert technical support is non-negotiable in an industry where equipment downtime directly impacts customer productivity and profitability. For instance, in 2023, the industrial equipment sector saw a surge in demand for proactive maintenance solutions, with companies investing heavily in predictive analytics and remote diagnostics to minimize operational disruptions. New entrants would need to replicate this sophisticated infrastructure, which involves substantial upfront investment and ongoing operational costs, making it a daunting challenge.

Establishing and maintaining such a comprehensive and responsive service network is a complex and costly undertaking for new entrants. This includes setting up regional service centers, training a skilled technical workforce, and managing global logistics for spare parts. The capital expenditure required to build this from scratch is immense, potentially running into hundreds of millions of dollars. Furthermore, the reputational risk associated with an inadequate service offering can be fatal for a new company trying to gain traction in a market where customer loyalty is often built on trust and reliability.

- High Capital Investment: New entrants face substantial upfront costs for building global service infrastructure.

- Operational Complexity: Managing a responsive international service network requires significant logistical and human resource expertise.

- Reputational Risk: Inadequate service can quickly damage a new entrant's credibility in a critical industry.

- Customer Dependency: Existing customers rely on established, proven service networks, making switching difficult.

Regulatory Hurdles and Safety Standards

The heavy machinery and marine sectors, where Cargotec operates, face significant regulatory barriers. New companies entering this space must contend with rigorous safety regulations, demanding environmental standards, and extensive certification processes. For instance, in 2024, the International Maritime Organization (IMO) continued to implement stricter emissions controls, requiring substantial investment in compliant technologies for any new vessel equipment.

Navigating this complex web of compliance adds considerable cost and extends the time to market for new entrants. These requirements often necessitate specialized engineering, testing, and validation, creating a high threshold for entry. Failure to meet these standards can result in significant fines or outright market exclusion.

- High Capital Investment: Compliance with safety and environmental regulations often requires upfront investment in specialized manufacturing facilities and R&D.

- Extended Product Development Cycles: Obtaining necessary certifications can add years to the product development timeline.

- Ongoing Compliance Costs: Maintaining compliance with evolving regulations incurs continuous expenses.

- Reputational Risk: Non-compliance can lead to severe damage to a new entrant's reputation.

The threat of new entrants for Cargotec is substantially low due to the immense capital required for research, development, and establishing a global manufacturing and service footprint. For example, in 2024, the logistics automation market alone was projected to see billions invested, underscoring the significant financial barriers. Furthermore, stringent regulatory compliance, including evolving environmental standards like those from the IMO in 2024, demands considerable upfront investment in compliant technologies and lengthy certification processes. Established brands also benefit from deep customer loyalty built over decades, making it difficult for newcomers to gain trust in mission-critical equipment sectors.

| Barrier Type | Description | Estimated Impact on New Entrants | Relevant 2024/2025 Data Point |

| Capital Requirements | High investment in R&D, manufacturing, and global service networks. | Extremely High | Logistics automation investment projected in billions (2024). |

| Technological Expertise | Need for advanced knowledge in automation, AI, and sustainability. | Very High | Global spending on industrial IoT solutions continues to grow significantly. |

| Brand Loyalty & Reputation | Established trust and proven reliability are critical. | High | Customer retention rates for established industrial equipment suppliers often exceed 90%. |

| Regulatory Compliance | Adherence to safety, environmental, and certification standards. | High | IMO's stricter emissions controls continue to drive investment in compliant marine technologies (2024 onwards). |

| Service & Support Network | Requirement for extensive global after-sales service and spare parts. | Very High | Companies investing heavily in predictive maintenance and remote diagnostics to minimize downtime. |

Porter's Five Forces Analysis Data Sources

Our Cargotec Porter's Five Forces analysis is built upon a robust foundation of data, including company annual reports, investor presentations, and industry-specific market research from leading firms. We also incorporate publicly available financial data and news releases to capture competitive dynamics and strategic shifts.