Cargotec Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cargotec Bundle

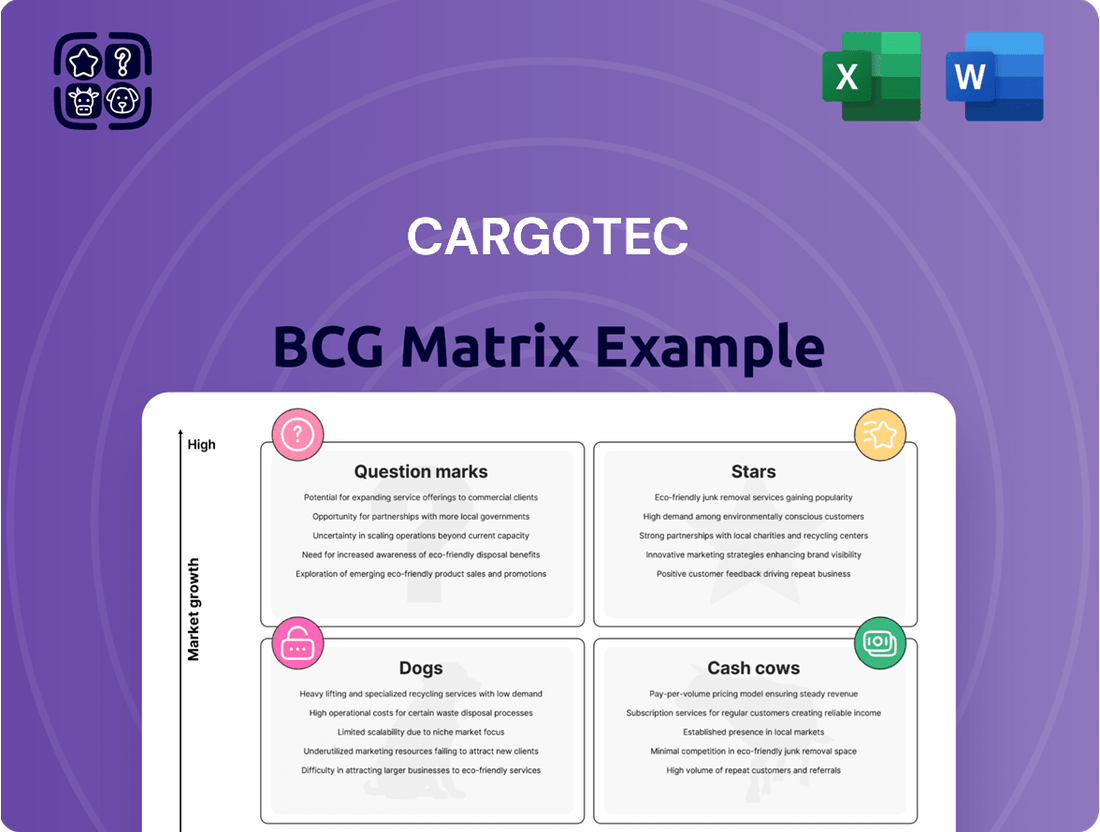

Curious about Cargotec's product portfolio performance? This glimpse into their BCG Matrix reveals the strategic positioning of their offerings, highlighting where growth and revenue generation truly lie. Understand which products are market leaders and which may require a closer look.

But this preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for Cargotec.

Stars

Hiab, as Cargotec's main business, is a global leader in on-road load handling, featuring popular loader cranes like HIAB, EFFER, and ARGOS, alongside truck-mounted forklifts such as MOFFETT and PRINCETON. These product lines consistently capture a significant market share.

The demand for Hiab's loader cranes and truck-mounted forklifts remains strong, fueled by essential sectors like construction, waste management, and logistics. This consistent demand positions these offerings for sustained growth.

Hiab's strong brand reputation and its comprehensive service network are key advantages, reinforcing its dominant standing in these expanding markets. For instance, Cargotec reported that Hiab’s sales in 2023 reached €3.1 billion, underscoring its market strength.

Kalmar's electric and hybrid cargo handling equipment exemplifies a strong position within the BCG matrix, likely categorized as a Star. Prior to its demerger from Cargotec, Kalmar was a pioneer, aggressively pursuing and adopting eco-friendly solutions for ports and terminals globally. This focus on sustainability wasn't just a trend; it represented a significant growth avenue as clients increasingly prioritized zero- or low-emission machinery.

The company's robust market standing in these advanced, sustainable technologies allowed it to capture a substantial share in a rapidly growing segment of the cargo handling sector. For instance, by the end of 2023, Kalmar reported a significant order intake for its eco-efficient solutions, reflecting strong customer demand. This segment is projected to continue its upward trajectory, driven by environmental regulations and corporate sustainability goals, further solidifying Kalmar's Star status.

Kalmar's SmartPort and its array of automation solutions, including automated shuttle carriers and stacking cranes, represented a significant high-growth segment for Cargotec. These offerings directly tackled the industry's drive for enhanced efficiency, improved safety, and greater productivity within port operations. The global momentum towards port automation solidified this as a robust growth market, a space where Kalmar held a prominent and well-invested position.

Digital Services and Connectivity

Cargotec, particularly through its Hiab division, has heavily invested in digital services and connectivity, recognizing their potential to transform cargo handling. These investments focus on IoT platforms and data analytics, aiming to unlock new revenue streams and boost customer value. For instance, predictive maintenance can significantly reduce downtime, a critical factor in logistics operations.

The market's increasing demand for smarter, more connected cargo handling solutions positions these digital offerings as significant growth drivers. By leveraging data, Cargotec can offer enhanced services like remote diagnostics and operational optimization, which directly address customer needs for efficiency and reliability. This strategic push into digital services is a key element in Cargotec's ongoing business evolution.

These digital services are becoming increasingly vital for maintaining a competitive edge. Cargotec's commitment is reflected in its ongoing development of platforms that integrate seamlessly with customer operations. The company aims to capture a larger share of the growing market for intelligent cargo solutions.

- Strategic Focus: Cargotec, primarily through Hiab, prioritizes digital services, IoT, and data analytics for enhanced customer value and new revenue.

- Customer Benefits: Offerings like predictive maintenance and remote diagnostics improve operational efficiency and reduce downtime for clients.

- Market Demand: Intelligent cargo handling solutions are experiencing rapid growth, indicating strong market penetration potential for Cargotec's digital initiatives.

- Revenue Streams: Digital services are designed to create recurring revenue and strengthen customer relationships through ongoing support and optimization.

Hiab's Advanced Forestry and Recycling Cranes

Hiab's advanced forestry and recycling cranes, including prominent brands like JONSERED and LOGLIFT, represent a robust segment within Cargotec's portfolio. These specialized cranes are engineered to meet the demanding needs of resource-intensive sectors focused on sustainability and efficient material handling. Their market leadership is a testament to Hiab's deep understanding of these niche yet expanding application areas.

These cranes are crucial for industries prioritizing resource management and the circular economy. For instance, in forestry, they enable efficient timber harvesting and transport, while in recycling, they facilitate the sorting and handling of various materials. This strategic focus allows Hiab to capitalize on growing global trends towards sustainability and efficient resource utilization.

- Market Position: Hiab's forestry and recycling cranes hold a significant market share, driven by innovation and specialized product offerings.

- Growth Drivers: Demand is fueled by increasing global emphasis on sustainable forestry practices and the expanding recycling industry.

- Technological Edge: Advanced features in JONSERED and LOGLIFT cranes enhance operational efficiency and safety in challenging environments.

- Strategic Importance: These product lines align with Cargotec's broader strategy of providing intelligent load handling solutions for essential industries.

Kalmar's electric and hybrid cargo handling equipment, along with its automation solutions, represented Stars in Cargotec's BCG matrix. These segments benefited from strong market growth and high market share, driven by the increasing demand for sustainable and efficient port operations. Cargotec's significant investments in these areas, including a robust order intake for eco-efficient solutions by the end of 2023, reinforced their Star status. The company's focus on advanced technologies like automated shuttle carriers and stacking cranes positioned it as a leader in a rapidly evolving industry.

Cargotec's digital services, powered by Hiab's investments in IoT and data analytics, also qualified as Stars. These services, such as predictive maintenance and remote diagnostics, addressed a growing market need for smarter, connected cargo handling. By offering solutions that enhance operational efficiency and reduce downtime, Cargotec aimed to capture a larger share of the intelligent cargo solutions market, generating recurring revenue and strengthening customer relationships.

Hiab's forestry and recycling cranes, including brands like JONSERED and LOGLIFT, were also considered Stars. These specialized cranes served growing industries focused on sustainability and efficient material handling, like forestry and recycling. Their strong market position, driven by technological innovation and alignment with global sustainability trends, made them key contributors to Cargotec's portfolio.

| Business Unit | BCG Category | Key Products/Services | 2023 Revenue (Approx.) | Market Trend |

|---|---|---|---|---|

| Hiab (Loader Cranes & Truck-Mounted Forklifts) | Stars | HIAB, EFFER, ARGOS, MOFFETT, PRINCETON | €3.1 billion (Hiab total) | Strong demand in construction, waste management, logistics |

| Kalmar (Electric/Hybrid & Automation) | Stars | Electric/hybrid cargo handling, automated shuttle carriers, stacking cranes | (Part of Cargotec's overall revenue, significant growth segment) | Growing demand for sustainable and automated port solutions |

| Hiab (Forestry & Recycling Cranes) | Stars | JONSERED, LOGLIFT | (Part of Hiab's revenue, specialized segment) | Increasing emphasis on sustainable forestry and recycling |

| Cargotec Digital Services | Stars | IoT platforms, data analytics, predictive maintenance, remote diagnostics | (Growing segment, contributing to overall revenue) | Rapid growth in intelligent cargo handling solutions |

What is included in the product

The Cargotec BCG Matrix analyzes its product portfolio by market share and growth rate.

It guides strategic decisions on investing, holding, or divesting each business unit.

The Cargotec BCG Matrix provides a clear, one-page overview, instantly relieving the pain of deciphering complex business unit performance.

Cash Cows

Hiab's established service business is a prime example of a Cash Cow within Cargotec's portfolio. Its extensive global service network and numerous maintenance contracts, built upon a large installed base of equipment, consistently generate stable and recurring revenue streams.

While this segment typically shows lower growth rates compared to new equipment sales, it boasts high profit margins. This profitability stems from the essential nature of its services and the strong loyalty of its customer base, who rely on Hiab for upkeep and repairs.

In 2023, Cargotec reported that its Services segment contributed significantly to profitability, with service revenues growing by approximately 10% year-on-year, demonstrating its resilience and consistent performance.

This reliable cash flow from the service business is crucial for Cargotec, as it provides the financial flexibility to support other strategic investments, research and development, and potential acquisitions across the broader company portfolio.

Kalmar's traditional terminal tractors and reachstackers, prior to Cargotec's demerger, were powerhouses in the global market, commanding substantial market share. These established products, while facing slower growth compared to newer electrified and automated options, benefit from consistent replacement demand and broad customer adoption, ensuring steady revenue streams and robust profitability.

These mature offerings were crucial cash generators for Cargotec, providing the financial fuel needed to invest in developing next-generation technologies like automation and electrification within the port and terminal equipment sector. For instance, in 2023, Kalmar's overall business, which included these traditional products, saw a significant contribution to Cargotec's revenue, underscoring their importance.

Hiab's standard loader cranes and MULTILIFT demountables represent a significant cash cow within Cargotec's portfolio. These are not new, flashy products, but rather the dependable workhorses that many industries rely on daily. Their long-standing market presence means they’ve built a massive installed base, ensuring a consistent stream of revenue from new sales and, crucially, ongoing demand for spare parts and servicing.

These established products, while not experiencing rapid growth, are vital for generating stable cash flow. In 2023, Hiab’s loader cranes and demountables continued to be a bedrock of revenue, demonstrating the sustained demand for these essential handling solutions. The sheer volume of these units in operation across logistics, construction, and forestry translates into predictable, recurring income for Hiab, solidifying their cash cow status.

Parts and Maintenance Services for Existing Equipment Fleet

The extensive global installed base of Cargotec's equipment, encompassing brands like Kalmar and Hiab, underpins a predictable and robust demand for spare parts and ongoing maintenance. This aftermarket business acts as a significant cash cow.

This segment benefits from high customer loyalty and consistent revenue generation, requiring less capital investment compared to the development of new machinery. It's a critical element in maintaining operational continuity for Cargotec's clients, contributing substantially to the company's financial stability.

For instance, Cargotec reported that its services segment, which includes parts and maintenance, generated €749 million in revenue in 2023, showcasing its importance as a steady income stream. This segment’s stability is crucial for funding other strategic initiatives within the company.

- Global Installed Base: A large fleet of Kalmar and Hiab equipment worldwide ensures continuous demand for services.

- Stable Revenue Streams: The aftermarket segment provides predictable income through parts sales and maintenance contracts.

- High Customer Retention: Existing customers rely on these services to keep their equipment operational, leading to strong loyalty.

- Lower Investment Needs: Compared to R&D for new products, maintaining and servicing existing equipment is less capital-intensive.

MacGregor's Legacy Marine Cargo Handling Solutions

Before its divestment, MacGregor's legacy marine cargo handling solutions represented a significant part of Cargotec's portfolio, fitting the description of a cash cow. This business offered established products in mature markets, ensuring a steady stream of revenue and contributing positively to Cargotec's cash flow. Despite facing slower growth in some areas, its robust market standing allowed for consistent earnings.

MacGregor's strong market share in its core segments meant it generated reliable cash flow for Cargotec. This consistent performance was crucial for funding other business units within the larger corporation. For instance, in 2023, the marine sector, which MacGregor largely served, saw continued demand, underpinning its cash-generating ability.

- Established Market Position: MacGregor held dominant positions in several niche marine cargo and offshore load handling segments.

- Consistent Revenue Generation: The mature nature of its product lines, coupled with strong demand, ensured predictable and substantial revenue streams.

- Cash Flow Contribution: These operations were vital contributors to Cargotec's overall financial health, providing ample cash for reinvestment or other corporate needs.

- Strategic Divestment: Cargotec's decision to divest MacGregor was a strategic move to focus on growth areas, recognizing the cash cow status of the divested business.

The services segment, encompassing spare parts and maintenance, is a clear cash cow for Cargotec. This business leverages Cargotec's vast global installed base of equipment, ensuring a continuous and predictable revenue stream. It requires less capital investment compared to developing new products, offering high profitability and customer loyalty.

In 2023, Cargotec's services revenue reached €749 million, highlighting its significant and stable contribution to the company's finances. This consistent income provides the necessary financial flexibility to support strategic investments and research and development across the organization.

The aftermarket business, driven by the extensive installed base of brands like Kalmar and Hiab, acts as a predictable income generator. High customer retention and lower capital needs solidify its position as a crucial cash cow, contributing substantially to Cargotec's financial stability.

This segment benefits from the essential nature of its offerings, ensuring that customers continue to rely on them for operational continuity. The stability of these services is paramount for funding other key initiatives within Cargotec's broader business strategy.

| Business Segment | BCG Matrix Category | 2023 Revenue (Millions EUR) | Key Characteristics |

|---|---|---|---|

| Hiab Services | Cash Cow | N/A (Included in Services Segment) | Established service network, recurring revenue from maintenance contracts, high profitability. |

| Kalmar Traditional Equipment | Cash Cow | N/A (Included in Kalmar's overall performance) | Large installed base, consistent replacement demand, strong market share in mature segments. |

| Aftermarket (Parts & Maintenance) | Cash Cow | 749 | Leverages global installed base, predictable income, high customer loyalty, lower investment needs. |

| MacGregor (Divested) | Cash Cow (Historically) | N/A (Divested) | Established products in mature markets, consistent earnings, strong market positions. |

What You’re Viewing Is Included

Cargotec BCG Matrix

The preview you see is the exact, unadulterated Cargotec BCG Matrix report you will receive upon purchase, ready for immediate strategic deployment. This means no watermarks, no sample content, and no alterations—just the complete, professionally formatted analysis you need to navigate Cargotec's product portfolio. The insights and structure presented here are precisely what you'll download, empowering you to make informed decisions about resource allocation and market focus. Consider this your direct gateway to actionable strategic intelligence on Cargotec's business units.

Dogs

MacGregor, within Cargotec's business portfolio, is classified as a Dog in the BCG Matrix. This classification stems from Cargotec's strategic decision to divest the business, with a sale agreement finalized in November 2024, targeting completion by July 2025. This move signals that MacGregor was viewed as an asset with limited growth potential or a poor strategic fit for Cargotec's future, which is increasingly focused on its Hiab division.

The divestment of MacGregor underscores its misalignment with Cargotec's core strategic objectives. While MacGregor might still hold profitability for a different owner, its operations were not central to Cargotec's envisioned growth trajectory. Consequently, management attention and resources previously dedicated to MacGregor could now be redirected towards more strategically aligned and potentially higher-return areas within the company.

Kalmar's heavy port cranes business, as part of Cargotec's strategic review, was identified as a segment potentially needing re-evaluation. Cargotec's announcement in 2022 regarding plans to exit this specific business line signals a deliberate shift in its strategic focus. This move suggests that, within the broader context of Cargotec's portfolio, the heavy port cranes segment might have exhibited characteristics aligning with a 'dog' in the BCG matrix: low market share and low growth potential.

The divestment of Kalmar's heavy port cranes business implies that the segment was not meeting Cargotec's desired growth or profitability targets, especially when compared to other business units. In 2023, Cargotec's overall strategic direction emphasized growth in automation and digital services, further contextualizing the decision to move away from capital-intensive, potentially slower-growing hardware segments like traditional heavy cranes.

Older, non-digital, and non-electric equipment models are increasingly becoming a declining segment within Cargotec’s portfolio, especially as the company, and its spun-off entities like Hiab and Kalmar, pivot towards sustainability and advanced technologies. These traditional machines, while still operational in some cases, are seeing reduced demand for new sales as the market shifts towards more efficient and connected solutions.

The focus on electrification and digitalization means that these legacy products are not aligned with future market expectations, leading to low-growth prospects. Cargotec's strategic direction, as evidenced by investments in electric and automated solutions, suggests a gradual phase-out of purely traditional equipment over time. For instance, in 2024, the company continued to highlight its progress in electric forklifts and digital services, further underscoring this trend.

These older models may also present a challenge in terms of support. As their market share diminishes, the resources required to maintain and service them might become disproportionately high compared to the revenue they generate. This economic reality often leads to the eventual discontinuation of support for such product lines, pushing customers towards newer, more technologically advanced alternatives.

Non-Core or Underperforming Niche Product Lines

Within Cargotec's diverse portfolio, certain niche product lines might fall into the Dogs category. These are typically smaller segments with low market share and little to no growth potential. For example, a specialized port equipment accessory line that never gained significant traction could be considered a Dog. Such offerings often consume valuable resources, including R&D and marketing spend, without yielding substantial returns.

These underperforming areas might merely break even, presenting a challenge for resource allocation. In 2024, companies like Cargotec are increasingly scrutinizing these segments to optimize their overall business strategy. Identifying and potentially divesting or phasing out these Dogs can free up capital and management focus for more promising ventures.

- Low Market Share: These niche products typically command only a small fraction of their respective markets.

- Stagnant or Declining Growth: The market for these offerings is often mature or shrinking, offering little prospect for expansion.

- Resource Drain: They can tie up capital, personnel, and management attention that could be better utilized elsewhere.

- Profitability Concerns: While not always losing money, they rarely contribute significantly to overall profitability and can sometimes become a net drain.

Geographical Markets with Persistent Low Demand or High Operational Challenges

Geographical markets exhibiting persistent low demand or significant operational hurdles represent Cargotec's 'Dogs' in the BCG Matrix. These are typically areas where geopolitical instability, such as ongoing conflicts or trade disputes, combined with persistent high interest rates and inflation, significantly dampens customer appetite for new investments. For instance, regions grappling with prolonged economic stagnation or unique logistical complexities often see Cargotec's market share stagnate at low levels, despite dedicated efforts and investments.

These challenging markets yield minimal returns, effectively diverting valuable resources and management attention away from more lucrative and high-growth opportunities. Cargotec's financial reports for 2024 might highlight specific regions where sales growth has been negligible or even negative. For example, if a particular South American market showed a less than 1% revenue increase in 2024 while operational costs remained high, it would exemplify this category.

- Low Growth Markets: Regions experiencing sustained economic contraction or minimal industrial expansion.

- High Operating Costs: Areas with substantial logistical, regulatory, or infrastructure-related expenses that erode profitability.

- Limited Market Share: Markets where Cargotec has not been able to gain significant traction despite strategic initiatives.

- Resource Drain: Segments that consume management time and capital without contributing proportionally to overall company performance.

Cargotec's divestment of MacGregor in November 2024, expected to finalize by July 2025, firmly places it in the 'Dog' category of the BCG Matrix. This signifies a business with low market share and low growth potential, no longer aligning with Cargotec's core strategy, which is increasingly focused on its Hiab division.

Similarly, the exit from Kalmar's heavy port cranes business, announced in 2022, also points to a 'Dog' classification due to its limited growth prospects and Cargotec's pivot towards automation and digital services in 2024. Legacy equipment models that are not electric or digital also fall into this category, facing declining demand and high support costs.

Niche product lines with minimal market traction and specialized, underperforming geographical markets with low demand and high operational costs also represent 'Dogs' within Cargotec's portfolio. These segments consume resources without significant returns, prompting strategic reviews for optimization.

The 'Dog' classification for these business segments reflects their low market share, stagnant or declining growth, and potential to drain resources. In 2024, Cargotec's focus on electrification and digital services further emphasizes the unsuitability of these legacy or underperforming areas for future investment.

| Business Unit/Segment | BCG Classification | Reasoning | Strategic Implication |

|---|---|---|---|

| MacGregor | Dog | Divested due to limited growth potential and strategic misalignment. Sale agreement finalized November 2024. | Resources redirected to core businesses like Hiab. |

| Kalmar Heavy Port Cranes | Dog | Planned exit due to low growth and Cargotec's shift towards automation. | Focus on more dynamic segments of the port solutions market. |

| Older, Non-Digital/Electric Equipment | Dog | Declining market demand, high support costs, and misaligned with sustainability focus. | Gradual phase-out and emphasis on advanced solutions. |

| Niche Product Lines | Dog | Low market share, minimal growth, and resource drain without substantial returns. | Potential divestment or discontinuation to optimize resource allocation. |

| Underperforming Geographical Markets | Dog | Persistent low demand, high operating costs, and limited market share. | Re-evaluation of market presence and resource deployment. |

Question Marks

Next-generation autonomous solutions, primarily represented by Kalmar's pioneering work, are positioned as a question mark within Cargotec's BCG matrix. While Kalmar has a solid foundation in existing automation, the truly next-generation, fully autonomous cargo handling equipment is a nascent market with immense growth potential but currently low market penetration.

Significant research and development investment is crucial for these advanced autonomous systems, alongside dedicated efforts to drive market acceptance and widespread commercialization. The transition from successful pilot programs to broad industry adoption remains a key challenge.

The future success of these fully autonomous solutions is inherently uncertain, given the technological hurdles and the need for significant infrastructure and regulatory alignment. However, their potential to revolutionize cargo handling operations and create substantial value is undeniable.

For instance, by 2024, the global autonomous vehicles market, including industrial applications like port automation, is projected to see substantial growth, fueled by advancements in AI and sensor technology. This trend underscores the potential for next-generation autonomous solutions to capture significant market share in the coming years.

Cargotec's strategic emphasis on its eco-portfolio, encompassing new electric and hybrid offerings for Hiab and formerly Kalmar, positions it to capitalize on increasing demand for sustainable solutions. These innovative products, while promising, may initially hold a modest market share as they enter the market.

Significant investment in marketing and sales is crucial to accelerate the adoption of these eco-friendly solutions and to effectively capture a larger market share. For instance, the global market for electric material handling equipment was projected to reach over $60 billion by 2024, indicating substantial growth potential.

Cargotec, through its ongoing digital transformation efforts, is actively investing in specific digital innovations like AI-powered optimization for logistics. These advanced solutions aim to streamline operations and enhance efficiency within the supply chain. For instance, AI can analyze vast datasets to predict optimal routing and delivery schedules, potentially reducing fuel consumption and transit times.

These innovative digital tools are currently in the early stages of market adoption, but the potential for growth in this space is significant. The digital landscape is evolving at an unprecedented pace, and companies that can leverage these technologies effectively are poised for competitive advantage. Cargotec's commitment to research and development in these areas is crucial for capitalizing on this high-growth potential.

The success of these advanced digital offerings hinges on sustained investment in their development and the ability to bring them to market effectively. Companies like Cargotec need to not only build cutting-edge technology but also create robust commercialization strategies to ensure widespread adoption and generate revenue. This requires a deep understanding of customer needs and the ability to demonstrate clear value propositions.

In 2024, the global market for AI in logistics was projected to reach over $7 billion, with a compound annual growth rate expected to exceed 20% in the coming years. This highlights the substantial opportunity for innovations like AI-powered optimization to gain traction and become integral to logistics operations worldwide.

Expansion into Nascent Segments of Defense Logistics Market for Hiab

Hiab's presence in defense logistics, while serving a critical sector, may currently occupy a relatively small niche within the broader defense supply chain, indicating a low market share. This segment is poised for growth, fueled by increasing global defense expenditures, which reached an estimated $2.29 trillion in 2023, according to the Stockholm International Peace Research Institute (SIPRI). Nascent segments within defense logistics, such as specialized equipment for remote operations or advanced secure transport solutions, represent potential growth avenues where Hiab's market share might be minimal.

Developing and expanding into these specialized, emerging areas of defense logistics would necessitate substantial strategic investment in research, development, and tailored product offerings. This investment is crucial to gain traction in a market characterized by stringent requirements and established players. For instance, the demand for advanced material handling solutions in military deployments is projected to rise as nations modernize their forces and enhance operational readiness.

- Low Market Share: Hiab's current penetration in specialized, nascent defense logistics segments is likely limited.

- High Growth Potential: Global defense spending, including logistics modernization, presents a significant growth opportunity.

- Strategic Investment Required: Capturing market share in these areas demands considerable investment in R&D and specialized solutions.

- Competitive Landscape: The defense logistics market involves established competitors, requiring Hiab to differentiate effectively.

Advanced Robotics in Cargo Handling

The application of advanced robotics in cargo handling, pushing beyond current automation, represents a significant growth opportunity for Cargotec. This includes sophisticated systems for ports and on-road logistics that can perform more complex tasks than today's automated equipment. Cargotec has actively signaled its strategic interest in leveraging robotics to drive future innovation within its operations.

While the potential is high, these advanced robotics initiatives are likely in their nascent stages of research and development. Consequently, their current market share is minimal, demanding considerable investment to validate their effectiveness and achieve scalable deployment. For instance, the global port automation market, which includes robotics, was valued at approximately $5.6 billion in 2023 and is projected to grow significantly, but the specific segment of advanced, beyond-current-automation robotics is still developing.

- Emerging Technology: Advanced robotics in cargo handling signifies a leap beyond current automated solutions, targeting more intricate and adaptable tasks.

- Cargotec's Interest: Cargotec has publicly acknowledged robotics as a key area for future business enhancement, indicating strategic focus.

- Early Stage Development: Most advanced robotics applications in this sector are in R&D, with minimal market penetration currently.

- Investment Requirements: Significant capital is needed to prove the viability and facilitate the scaling of these advanced robotic systems.

Next-generation autonomous solutions, like Kalmar's advanced cargo handling equipment, represent a question mark for Cargotec. These are high-potential, low-market-share ventures requiring substantial R&D. The global autonomous vehicles market, including industrial uses, is growing, with projections for significant expansion by 2024, indicating a strong future outlook for these technologies if successfully commercialized.

Cargotec's focus on its eco-portfolio, featuring electric and hybrid options for Hiab and Kalmar, places these offerings in the question mark category. Despite a promising market for sustainable equipment, with the electric material handling market expected to exceed $60 billion by 2024, these products likely have modest initial market shares. Aggressive marketing and sales are vital to accelerate their adoption and market penetration.

Cargotec’s digital innovations, such as AI-powered logistics optimization, are also question marks. While these tools offer significant efficiency gains, their adoption is in early stages. The AI in logistics market was projected to reach over $7 billion in 2024, with growth exceeding 20% annually, signaling substantial future potential for Cargotec's digital solutions.

Hiab's niche in defense logistics, particularly in emerging segments, positions it as a question mark. While global defense spending reached an estimated $2.29 trillion in 2023, Hiab's share in specialized defense logistics remains small. Significant investment in R&D and tailored solutions is necessary to capitalize on growth opportunities in this sector.

| Cargotec Business Area / Initiative | BCG Matrix Category | Market Share | Market Growth | Strategic Implications |

|---|---|---|---|---|

| Next-Gen Autonomous Solutions (Kalmar) | Question Mark | Low | High | Requires significant R&D and market development investment. |

| Eco-Portfolio (Hiab & Kalmar) | Question Mark | Modest | High | Needs strong marketing and sales to drive adoption. |

| Digital Innovations (AI Logistics) | Question Mark | Low | Very High | Focus on development and effective commercialization strategies. |

| Defense Logistics (Hiab) | Question Mark | Low | Moderate to High | Strategic investment in specialized solutions for growth. |

BCG Matrix Data Sources

Our Cargotec BCG Matrix leverages comprehensive market data, including financial reports, logistics industry research, and competitive analysis, to accurately position business units.