Cargill SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cargill Bundle

Cargill, a global leader in agriculture and food, navigates a complex landscape of opportunities and challenges. Their immense scale offers significant strengths in supply chain management and market influence, yet also presents vulnerabilities to global economic shifts and regulatory changes. Understanding these dynamics is crucial for any stakeholder looking to capitalize on their vast reach or mitigate potential risks.

Want the full story behind Cargill’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning, pitches, and in-depth research.

Strengths

Cargill's global market leadership is undeniable, with a commanding presence in agriculture and food. Its operations are incredibly diverse, spanning grain and oilseed processing, vital food ingredients, animal nutrition, and even financial services. This broad reach across sectors is a significant strength, allowing it to weather economic storms more effectively.

This diversification is key to its resilience. By not relying on just one area, Cargill can offset downturns in specific markets with successes elsewhere, ensuring a more stable financial performance. This strategy is evident in its vast operational footprint, reaching into 70 countries and serving an impressive 125 markets globally, a testament to its extensive network and market influence.

Cargill's dedication to sustainability is a significant strength, underscored by its achievement of a 15.8% reduction in operational emissions against its 2017 baseline, surpassing its 2025 target early.

The company is making substantial progress in regenerative agriculture, having already converted 1.1 million acres in North America since 2020, with an ambitious goal of reaching 10 million acres by 2030.

These forward-thinking environmental strategies not only bolster Cargill's supply chain resilience against future challenges but also cater to the increasing consumer preference for ethically and sustainably sourced products.

Cargill's commitment to innovation is a significant strength, earning it a spot on Fortune's America's Most Innovative Companies list for two consecutive years. This focus is backed by substantial investments in cutting-edge technologies like AI, IoT, and data analytics.

These technological advancements are strategically applied to enhance production, streamline supply chains, and create tailored solutions, particularly in areas like animal nutrition. For instance, their adoption of advanced Near-Infrared (NIR) technology for poultry processing exemplifies this forward-thinking approach.

Furthermore, Cargill is leveraging AI for sophisticated animal gut microbiome analysis, a move that boosts operational efficiency and reinforces its dedication to meeting stringent global food safety standards. This proactive embrace of technology positions Cargill to adapt and lead in a rapidly evolving market.

Strong Supply Chain Management and Infrastructure

Cargill's extensive global infrastructure, particularly its substantial grain handling capacity in North America, is a cornerstone of its operational strength. This allows for the efficient sourcing, processing, and distribution of agricultural commodities worldwide.

The company's commitment to supply chain resilience is demonstrated through strategic partnerships, such as its work with smallholders in palm oil production. Furthermore, Cargill's dedication to deforestation-free supply chains in crucial regions like Brazil, Argentina, and Uruguay, with a target of 2025, underscores its forward-thinking approach.

- Global Reach: Cargill operates in over 70 countries, leveraging its vast network to manage complex agricultural supply chains.

- North American Grain Capacity: The company boasts significant grain storage and handling facilities across North America, facilitating efficient commodity movement.

- Sustainability Focus: By 2025, Cargill aims for deforestation and conversion-free supply chains in key South American markets, enhancing long-term viability.

Financial Strength and Strategic Investments

Despite a reported revenue decrease to $160 billion for fiscal year 2024, Cargill maintains significant financial strength, underscoring its immense economic scale and resilience in the global market. This robust financial standing allows for strategic maneuvers that bolster its competitive edge.

Cargill actively pursues strategic investments to fortify its market position and expand its operational capabilities. A prime example is its recent acquisition of soy storage and crushing facilities in South America, a move designed to enhance market access and optimize its supply chain.

These targeted investments, coupled with a deliberate strategy to adapt and evolve its diverse business units, are foundational to Cargill's long-term growth trajectory. The company is clearly focused on future competitiveness.

- Financial Powerhouse: Reported $160 billion in revenue for fiscal year 2024, showcasing substantial economic scale despite a revenue decrease.

- Strategic Expansion: Acquired soy storage and crushing facilities in South America to improve market access.

- Future-Oriented: Clear plans to evolve business units for sustained growth and competitiveness.

Cargill's diversified business model across agriculture, food, and financial services provides significant resilience against market fluctuations. Its extensive global network, operating in 70 countries and serving 125 markets, allows for robust supply chain management and broad market penetration.

The company's proactive approach to sustainability, including early achievement of its 2025 operational emissions reduction target (15.8% reduction against a 2017 baseline) and a strong focus on regenerative agriculture (1.1 million acres converted in North America since 2020), positions it favorably with environmentally conscious consumers and stakeholders.

Cargill's commitment to innovation is a key strength, evidenced by its inclusion on Fortune's America's Most Innovative Companies list and investments in AI and IoT for operational enhancements, such as advanced poultry processing technologies.

Financially, Cargill demonstrated considerable strength in fiscal year 2024 with $160 billion in revenue, alongside strategic acquisitions like South American soy facilities, reinforcing its market position and future growth potential.

| Strength Category | Key Aspect | Supporting Data/Fact |

|---|---|---|

| Diversification & Global Reach | Broad operational scope and international presence | Operates in 70 countries, serves 125 markets; diverse segments include grain, food ingredients, animal nutrition. |

| Sustainability Leadership | Commitment to environmental responsibility | Achieved 15.8% operational emissions reduction (vs. 2017 baseline) ahead of 2025 target; 1.1 million acres converted to regenerative agriculture (North America, since 2020). |

| Innovation & Technology | Investment in advanced technologies | Recognized on Fortune's America's Most Innovative Companies list; utilizes AI for animal nutrition and IoT in processing. |

| Financial Strength & Strategy | Robust revenue and strategic investments | Reported $160 billion revenue (FY2024); acquired South American soy facilities for market access. |

What is included in the product

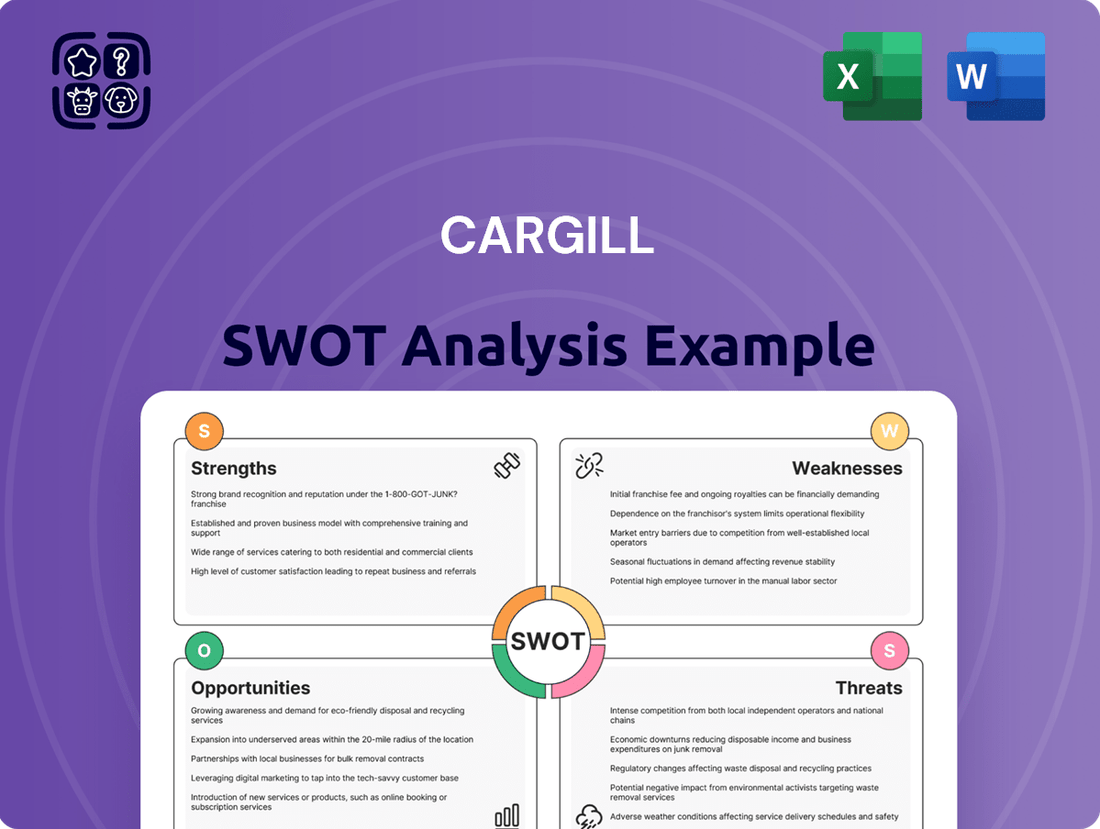

Analyzes Cargill’s competitive position through key internal and external factors, highlighting its strengths in global reach and diverse portfolio alongside potential weaknesses in supply chain complexity and market volatility.

Identifies Cargill's key strengths to leverage for competitive advantage and weaknesses to mitigate for improved performance.

Weaknesses

Cargill faced a significant revenue drop in fiscal year 2024, falling to $160 billion from $177 billion in fiscal 2023. This marks the first annual revenue decrease since 2019 and the largest in ten years.

The company cited an exceptionally difficult market environment as the primary driver for this decline. Key factors include depressed commodity prices and an oversupply of agricultural products worldwide.

Shrinking processing margins across its operations further exacerbated these challenges, impacting overall profitability and market position.

Cargill's significant role as a global agricultural commodity trader exposes it directly to the unpredictable swings in prices for key crops such as corn, soybeans, and wheat. This inherent volatility can significantly affect its earnings and overall financial health.

Rising costs for essential agricultural inputs, including fertilizers, seeds, and fuel, further compound the impact of commodity price fluctuations. These increased expenses directly eat into profit margins, creating a challenging operating environment for Cargill.

For instance, during the first half of fiscal year 2024, while Cargill reported strong performance in some segments, the agricultural services division, heavily influenced by commodity markets, experienced margin pressures. This highlights the direct correlation between market price movements and the company's profitability.

Cargill has faced ongoing criticism regarding its environmental and human rights record, with allegations of contributing to deforestation and poor labor conditions within its extensive supply chains. Reports from watchdog groups in 2024 highlighted concerns about the company's due diligence processes, suggesting they may not be robust enough to prevent such issues.

These persistent criticisms, particularly concerning deforestation linked to palm oil and soy production, present significant reputational risks for Cargill. Such scrutiny can lead to increased regulatory scrutiny and potential financial penalties, impacting investor confidence and market access.

Restructuring and Workforce Reductions

Cargill's significant restructuring, which involves consolidating its five business units into three and eliminating roughly 8,000 jobs, or about 5% of its global workforce, presents a notable weakness. While this move is designed to enhance operational efficiency and adapt to market shifts, it inherently carries risks of short-term disruption.

These large-scale workforce reductions can negatively impact employee morale across the organization, potentially leading to a decrease in productivity and engagement. Furthermore, the process of streamlining operations and consolidating business units could create temporary inefficiencies or affect the continuity of certain business functions.

- Workforce Reduction Impact: Approximately 8,000 job cuts, representing 5% of Cargill's global workforce, can lead to decreased morale and potential skill gaps.

- Operational Disruption: Consolidating five business units into three may cause temporary inefficiencies and affect the smooth running of operations.

- Integration Challenges: Merging different business units can present challenges in integrating cultures, systems, and processes, potentially slowing down execution.

- Loss of Institutional Knowledge: The departure of a significant number of employees could result in the loss of valuable institutional knowledge and experience.

Supply Chain Risks and Geopolitical Disruptions

Cargill's extensive global footprint, while a strength, also exposes it to significant supply chain risks. Geopolitical tensions and economic instability in key operating regions can disrupt the flow of goods, leading to increased costs and delays. For instance, ongoing conflicts in Eastern Europe have impacted grain and fertilizer markets, directly affecting agricultural supply chains worldwide.

Extreme weather events, exacerbated by climate change, pose another critical weakness. Droughts, floods, and unseasonal frosts can decimate crop yields, a core component of Cargill's business. The company's reliance on agricultural commodities means that localized weather disasters can have a ripple effect across its entire network, impacting pricing and availability. In 2023, severe droughts in parts of North America and Europe led to reduced harvests, a challenge that continued into early 2024.

- Geopolitical Volatility: Cargill's operations in over 70 countries mean it's susceptible to trade disputes, sanctions, and political unrest, as seen with disruptions stemming from the Russia-Ukraine conflict impacting global grain trade.

- Climate Change Impact: Adverse weather events like the 2023 drought in Argentina, a major soybean producer, directly affected Cargill's sourcing and pricing strategies for key commodities.

- Logistical Bottlenecks: Port congestion and transportation challenges, evident in global shipping disruptions throughout 2023-2024, increase operational costs and can hinder timely delivery of products.

- Commodity Price Fluctuations: Dependence on volatile agricultural markets means that sudden price swings, influenced by supply chain issues and global demand, can significantly impact profitability.

Cargill's significant revenue drop to $160 billion in fiscal year 2024, a decline from $177 billion in 2023, highlights its vulnerability to market volatility. This downturn, the first since 2019, was driven by depressed commodity prices and oversupply, directly impacting processing margins.

The company's extensive global operations, spanning over 70 countries, expose it to considerable supply chain risks, including geopolitical tensions and adverse weather events. For example, the 2023 drought in Argentina, a key soybean producer, directly impacted sourcing and pricing strategies.

Cargill's recent workforce reduction of approximately 8,000 employees, or 5% of its global staff, while aimed at efficiency, introduces weaknesses such as potential decreases in morale, skill gaps, and the loss of institutional knowledge.

Persistent criticisms regarding environmental and human rights records, particularly concerning deforestation linked to palm oil and soy, pose significant reputational risks. These allegations can lead to increased regulatory scrutiny and financial penalties, impacting investor confidence.

Full Version Awaits

Cargill SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual Cargill SWOT analysis, ensuring transparency and quality. Once purchased, you'll gain access to the complete, in-depth report.

Opportunities

The global population is on a steady upward trajectory, with projections indicating an increase of 500 million people by 2030. This growth translates directly into a greater need for food, requiring an estimated 50 million additional tonnes of agricultural commodities each year. Cargill is well-positioned to capitalize on this fundamental and ongoing demand surge.

This demographic shift presents a consistent growth avenue for Cargill, allowing for the expansion of its extensive production, processing, and distribution networks. By scaling its operations, Cargill can effectively address the escalating global appetite for food and essential agricultural products, reinforcing its role as a key player in the food supply chain.

The agri-food technology sector is booming, with innovations like precision farming, AI, and biotech leading the charge. For instance, the global agri-tech market was valued at approximately $22.5 billion in 2023 and is projected to reach over $40 billion by 2030, showcasing significant growth potential.

Cargill is well-positioned to leverage these advancements. By increasing investments in digital tools, sophisticated data analysis, and environmentally friendly methods, the company can boost its operational effectiveness, improve crop yields, and create novel products and services that meet evolving market demands.

Consumer desire for healthier, more natural, and sustainably sourced food and animal nutrition is on the rise. Cargill's strategic focus on regenerative agriculture and sustainable supply chains directly addresses this trend. For instance, in 2024, Cargill reported a 15% increase in sales for its plant-based protein offerings, demonstrating tangible market traction.

The company's ongoing investments in developing plant-based ingredients and functional feed additives are key to capturing these evolving preferences. This commitment not only opens new market segments but also significantly bolsters Cargill's brand image as a responsible and forward-thinking provider. By 2025, Cargill aims for 50% of its portfolio to be aligned with sustainability goals, a move expected to further capitalize on this demand.

Expansion into Emerging Markets and Value Chains

Emerging markets, especially in the Asia-Pacific region, are showing a growing interest in health and wellness, with consumers increasingly seeking out functional foods. Cargill can leverage this trend by expanding its footprint and product portfolio in these areas. For instance, in 2024, the global functional food market was projected to reach over $200 billion, with Asia-Pacific being a significant growth driver.

Further diversification can be achieved by exploring new value chains. Opportunities exist in alternative proteins, a market expected to grow substantially, and bio-industrial applications. Cargill's investment in plant-based ingredients and sustainable solutions positions it well to capitalize on these evolving consumer demands and industry shifts.

- Asia-Pacific Functional Food Market Growth: Projections indicate robust expansion driven by increased health consciousness.

- Alternative Protein Potential: This sector is rapidly gaining traction, offering new avenues for product development.

- Bio-Industrial Applications: Expanding into sustainable industrial solutions presents a significant diversification opportunity.

- Strategic Market Entry: Targeted expansion in emerging economies can unlock substantial revenue potential.

Strategic Partnerships and Collaborations

Cargill's strategic approach emphasizes deep collaboration across the food system. By partnering with farmers, governments, customers, and non-governmental organizations, Cargill aims to foster sustainable practices and tackle pressing global food security issues. This integrated strategy allows for the development and implementation of solutions that benefit all stakeholders.

Further strengthening its innovation pipeline, Cargill actively pursues collaborations with technology providers, startups, and leading research institutions. These partnerships are crucial for accelerating the development and adoption of cutting-edge solutions, enhancing supply chain resilience, and ultimately improving Cargill's competitive positioning. For instance, in 2024, Cargill announced a significant investment in AI-driven agricultural technology to optimize crop yields and resource management, highlighting this collaborative drive.

- Farmer Engagement: Cargill's farmer-centric approach in 2024 involved over 100,000 farmers in sustainability programs, aiming for a 30% reduction in greenhouse gas emissions from their operations by 2030.

- Technological Alliances: Collaborations with AgTech startups in 2024 focused on developing precision agriculture tools, leading to a pilot program that showed a 15% increase in water efficiency for participating farms.

- Supply Chain Innovation: Partnerships with logistics and data analytics firms in 2024 are enhancing supply chain transparency and efficiency, with a goal to reduce food loss by 20% across key product lines by 2027.

- Sustainable Sourcing: Joint initiatives with NGOs and governments in 2024 are targeting deforestation-free supply chains, with Cargill committing to 100% traceable palm oil by the end of 2025.

Cargill is strategically positioned to benefit from the increasing global demand for food, driven by population growth. The company's expansive operations in production, processing, and distribution are well-suited to meet this escalating need. Furthermore, the burgeoning agri-tech sector presents opportunities for Cargill to enhance efficiency and develop innovative products through investments in digital tools and sustainable practices.

Growing consumer preference for healthier, natural, and sustainably sourced products aligns with Cargill's focus on regenerative agriculture. The company's expansion into plant-based proteins and functional feed additives is already showing market traction, with a goal to align 50% of its portfolio with sustainability goals by 2025. Emerging markets, particularly in Asia-Pacific, offer significant potential for growth in functional foods, a sector expected to exceed $200 billion globally in 2024. Cargill can also explore diversification through alternative proteins and bio-industrial applications, tapping into evolving consumer demands and industry shifts.

Cargill's collaborative approach across the food system, engaging with farmers, governments, and NGOs, fosters sustainable practices and addresses food security. By partnering with technology providers and research institutions, Cargill accelerates innovation, strengthens supply chain resilience, and enhances its competitive edge. These alliances are crucial for adopting cutting-edge solutions, as seen in their 2024 investment in AI-driven agricultural technology to optimize crop yields and resource management.

| Opportunity Area | Description | Supporting Data/Initiative |

|---|---|---|

| Growing Global Food Demand | Increasing population necessitates higher agricultural output. | Global population projected to add 500 million by 2030, requiring 50 million additional tonnes of commodities annually. |

| Agri-Tech Innovation | Leveraging technology for improved efficiency and product development. | Global agri-tech market valued at $22.5 billion in 2023, projected to exceed $40 billion by 2030. Cargill invested in AI for crop yield optimization in 2024. |

| Consumer Preference for Sustainability & Health | Meeting demand for healthier, natural, and sustainably produced food. | Cargill saw a 15% increase in plant-based protein sales in 2024. Aiming for 50% of portfolio aligned with sustainability goals by 2025. |

| Emerging Market Expansion | Capitalizing on growth in regions like Asia-Pacific for functional foods. | Asia-Pacific is a significant growth driver in the functional food market, projected to exceed $200 billion globally in 2024. |

| Diversification into New Value Chains | Exploring growth in alternative proteins and bio-industrial applications. | Alternative protein market shows substantial growth potential. Cargill committed to 100% traceable palm oil by end of 2025. |

| Strategic Collaborations | Partnering for innovation and sustainable practices. | Cargill's 2024 farmer engagement involved over 100,000 farmers in sustainability programs. Collaborations with AgTech startups in 2024 led to a pilot program showing 15% water efficiency increase. |

Threats

Volatile commodity markets present a significant threat to Cargill. Fluctuations in prices for key agricultural products, coupled with escalating input costs for fertilizers and fuel, directly impact profitability. These pressures were evident in fiscal year 2024, where a global surplus in agricultural production and weaker demand contributed to a decline in Cargill's revenue.

Climate change is increasingly straining global food production. More frequent and intense extreme weather, like droughts and floods, directly threaten crop yields. For instance, the U.S. experienced widespread drought conditions impacting corn and soybean harvests in 2023, a trend expected to continue.

These weather disruptions create significant supply chain vulnerabilities for companies like Cargill. The unpredictability of raw material availability and quality escalates operational risks and can lead to volatile input costs, impacting profitability and the ability to meet market demand.

Cargill is experiencing heightened regulatory oversight, particularly concerning its environmental footprint. Stricter climate policies and requirements for sustainable operations are becoming more prevalent, impacting global supply chains.

Failure to adhere to these evolving environmental standards, such as commitments to deforestation-free sourcing, can result in significant penalties. For instance, in 2023, the EU's Deforestation Regulation (EUDR) came into effect, requiring companies like Cargill to demonstrate due diligence for commodities like palm oil, soy, and beef, with potential fines for non-compliance.

Such non-compliance not only leads to financial repercussions but also poses a substantial risk to Cargill's brand image. Reputational damage can erode consumer trust and investor confidence, affecting market position.

Geopolitical Instability and Trade Disruptions

Geopolitical instability, such as the ongoing conflict in Eastern Europe, continues to disrupt global food systems. This instability can result in trade restrictions and supply chain bottlenecks, directly impacting Cargill's ability to operate efficiently worldwide.

These disruptions increase operational complexity and can hinder market access, ultimately affecting profitability. For instance, in 2024, the World Bank reported that geopolitical tensions contributed to a significant increase in global food commodity prices, impacting import-dependent nations and creating uncertainty for agricultural traders like Cargill.

- Trade Restrictions: Geopolitical events can lead to sudden impositions of tariffs or outright bans on agricultural exports, limiting Cargill's sourcing and sales opportunities.

- Supply Chain Bottlenecks: Conflicts and political tensions can disrupt key shipping routes and transportation networks, slowing down the movement of essential goods.

- Increased Costs: Uncertainty and risk associated with geopolitical instability often translate into higher insurance premiums and transportation costs for companies like Cargill.

- Market Volatility: Shifting political landscapes create unpredictable price swings in commodity markets, making strategic planning and risk management more challenging.

Competition and Market Consolidation

Cargill faces intense competition from global giants such as Archer Daniels Midland (ADM), Bunge, and Louis Dreyfus Company, all vying for market share in the vast agricultural sector. These established players possess significant resources and extensive supply chains, making it challenging for Cargill to maintain its competitive edge. The sheer scale of these competitors means they can often leverage economies of scale to offer more competitive pricing and secure larger contracts.

The agricultural industry is also witnessing a trend of consolidation. Smaller farms and agribusinesses are increasingly merging or being acquired by larger entities. This consolidation can lead to the emergence of more formidable rivals with enhanced operational capabilities and greater market influence. For instance, ADM's acquisition of GFG Agribusiness in 2023, which expanded its grain origination and processing capabilities in Australia, exemplifies this consolidating trend and the creation of stronger competitors.

- Intense Rivalry: Major global competitors like ADM, Bunge, and Louis Dreyfus Company consistently challenge Cargill's market position.

- Market Consolidation: Ongoing mergers and acquisitions within the agricultural sector are creating larger, more powerful competitors.

- Economies of Scale: Larger competitors can often leverage their size for more competitive pricing and contract acquisition.

- Strategic Acquisitions: Competitors are actively acquiring smaller players to expand their reach and capabilities, as seen with ADM's Australian expansion.

Cargill's profitability is significantly threatened by volatile commodity markets and rising input costs. For example, the fiscal year 2024 saw revenue decline partly due to global agricultural surpluses and weaker demand. Climate change poses a direct risk to crop yields, as seen with the widespread U.S. drought conditions impacting corn and soybeans in 2023, a trend projected to persist.

Heightened regulatory oversight, particularly around environmental impact, presents another challenge. Stricter climate policies and sustainable sourcing requirements, such as the EU's 2023 Deforestation Regulation, can lead to penalties and reputational damage if not met. Geopolitical instability, including conflicts in Eastern Europe, disrupts global food systems, leading to trade restrictions, supply chain bottlenecks, and increased operational costs, as highlighted by the World Bank's 2024 report on rising food commodity prices due to geopolitical tensions.

Intense competition from major players like ADM, Bunge, and Louis Dreyfus Company, coupled with industry consolidation, further pressures Cargill. For instance, ADM's 2023 acquisition of GFG Agribusiness in Australia exemplifies the trend of larger competitors gaining enhanced capabilities and market influence, potentially leveraging economies of scale for more competitive pricing.

SWOT Analysis Data Sources

This Cargill SWOT analysis is built upon a robust foundation of data, drawing from publicly available financial statements, comprehensive market research reports, and expert industry analyses to provide a well-rounded perspective.