Cargill Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cargill Bundle

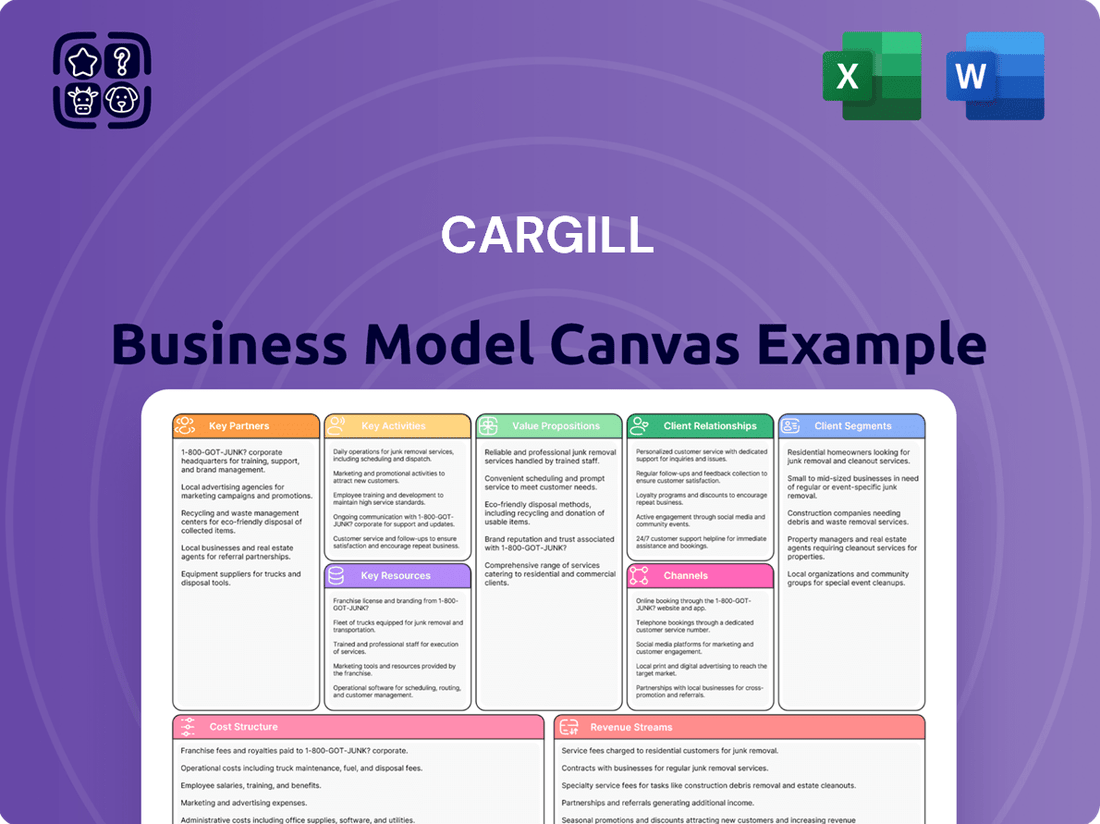

Explore the intricate workings of Cargill's global operations with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a powerful framework for understanding their success.

Ready to dissect Cargill's strategic advantage? Our full Business Model Canvas provides an in-depth look at their value propositions, cost structure, and competitive differentiators, making it an indispensable tool for strategic analysis and business development.

Unlock the secrets to Cargill's market dominance with the complete Business Model Canvas. This professionally crafted document reveals their core activities, key partners, and channels, empowering you to adapt and innovate within your own business landscape.

Partnerships

Cargill cultivates robust relationships with farmers worldwide, securing a steady flow of premium agricultural goods. These collaborations frequently feature extended agreements, expert guidance, and the promotion of eco-friendly farming methods.

This direct involvement streamlines procurement and reinforces the foundational element of Cargill’s vast network. For instance, in 2024, Cargill continued its commitment to supporting farmers through various initiatives aimed at improving yields and sustainability, recognizing that these partnerships are crucial for meeting global food demand.

Cargill leverages key partnerships with global logistics and shipping providers to ensure its vast array of products, from grains to processed foods, reach markets worldwide. These collaborations with major shipping lines, rail companies, and trucking firms are vital for managing complex international supply chains efficiently.

In 2024, the global shipping industry continued to navigate fluctuating demand and capacity. Cargill's reliance on these partnerships means that factors like freight rates and vessel availability directly impact its operational costs and delivery timelines. For instance, disruptions in major shipping lanes, such as those experienced in the Red Sea in early 2024, underscore the critical importance of a robust and diversified logistics network for a company of Cargill's scale.

Cargill actively forges technology and innovation alliances, partnering with tech firms and startups to embed cutting-edge solutions. These collaborations span precision agriculture, supply chain efficiency, and advanced food processing techniques. For instance, in 2024, Cargill continued its investment in AI-driven analytics for crop yield prediction, aiming to improve resource allocation and reduce waste.

These strategic partnerships are crucial for driving advancements in data analytics, automation, and sustainable farming practices. By tapping into external technological know-how, Cargill boosts operational efficiency and develops novel product offerings. This proactive approach to innovation ensures Cargill remains competitive in a dynamic global market, with a stated goal of enhancing sustainability metrics by 15% by 2025 through these technological integrations.

Research and Development Institutions

Cargill actively partners with universities and research institutions to drive innovation in food science, animal nutrition, and sustainable agriculture. These collaborations are crucial for developing new products and improving existing ones, ensuring Cargill stays ahead in scientific advancements. For example, in 2024, Cargill continued its extensive work with institutions like the University of Illinois and Wageningen University & Research, focusing on areas like precision agriculture and novel protein sources.

These alliances are instrumental in translating cutting-edge research into practical applications that benefit both consumers and the environment. Cargill's commitment to R&D, bolstered by these partnerships, allows it to offer innovative solutions that address evolving market needs and sustainability challenges. Their investment in these collaborative research efforts often yields breakthroughs in ingredient functionality and more efficient production methods.

- University Collaborations: Ongoing projects with leading agricultural universities in 2024 focused on enhancing crop yields and developing climate-resilient farming techniques.

- Animal Nutrition Research: Partnerships with animal science departments at universities aim to improve feed efficiency and animal welfare through scientific discovery.

- Sustainable Practices: Collaborations explore new methods for reducing environmental impact across the agricultural value chain, from soil health to waste reduction.

- Product Innovation: Research institutions contribute to Cargill's development pipeline, particularly in areas like plant-based proteins and functional food ingredients.

Financial and Risk Management Service Providers

Cargill partners with financial institutions and specialized risk management firms to bolster its financial operations and provide clients with comprehensive services. These collaborations offer crucial expertise in hedging strategies, market analytics, and financial advisory, enabling Cargill to better navigate volatile commodity markets and assist customers in managing their financial risks. For instance, in 2024, many agricultural firms relied on such partnerships to manage the impact of fluctuating global grain prices, which saw significant volatility due to geopolitical events and weather patterns.

These alliances are vital for maintaining robust financial stability and delivering tailored solutions. By leveraging the specialized knowledge of financial partners, Cargill can offer clients enhanced tools for managing price exposure and optimizing their financial performance. This symbiotic relationship ensures that both Cargill and its customers are better equipped to handle the complexities of global financial markets.

- Expertise in Hedging: Access to advanced hedging instruments and strategies to mitigate price risk.

- Market Analytics: Utilization of sophisticated data analysis for informed trading and investment decisions.

- Financial Advisory: Guidance on capital management, risk mitigation, and financial planning.

- Enhanced Client Services: Offering integrated financial solutions that complement core business offerings.

Cargill's key partnerships are foundational to its global operations, spanning farmers, logistics providers, technology innovators, research institutions, and financial experts. These alliances ensure a consistent supply of raw materials, efficient product distribution, and continuous innovation in agriculture and food processing. In 2024, the company's strategic focus on these relationships underscored its commitment to sustainability and market leadership.

These collaborations are not merely transactional; they represent deep-seated relationships that drive mutual growth and resilience. For example, Cargill's 2024 initiatives with farmers directly addressed climate challenges, aiming to improve soil health and reduce carbon footprints, demonstrating a commitment to long-term agricultural viability.

The company's engagement with technology partners in 2024, particularly in areas like AI for supply chain optimization and precision agriculture, highlights its drive for efficiency and data-driven decision-making. These partnerships are critical for navigating the complexities of global food systems and meeting evolving consumer demands.

| Partner Type | Focus Area | 2024 Impact/Initiative Example | Strategic Importance |

|---|---|---|---|

| Farmers | Supply Chain & Sustainability | Support for climate-smart agriculture practices, aiming for 15% sustainability metric improvement by 2025. | Ensures consistent, high-quality raw material sourcing and promotes responsible agricultural practices. |

| Logistics Providers | Global Distribution | Navigating Red Sea disruptions to maintain timely delivery of goods, highlighting network resilience. | Critical for efficient and cost-effective movement of products across international markets. |

| Technology Firms | Innovation & Efficiency | Investment in AI for crop yield prediction and supply chain analytics. | Drives operational improvements, reduces waste, and enhances competitive advantage. |

| Universities & Research Institutions | R&D and Product Development | Collaborations on novel protein sources and precision agriculture techniques. | Fosters scientific advancement, leading to new product offerings and improved production methods. |

| Financial Institutions | Risk Management & Advisory | Providing hedging strategies amidst volatile grain prices in 2024. | Strengthens financial stability and offers clients tools to manage market risks. |

What is included in the product

A comprehensive, pre-written business model tailored to Cargill's strategy, covering customer segments, channels, and value propositions in full detail.

Reflects Cargill's real-world operations and plans, organized into 9 classic BMC blocks with full narrative and insights for informed decision-making.

Provides a clear, visual framework to pinpoint and address inefficiencies in complex supply chains.

Helps to streamline operations by identifying and mitigating bottlenecks across diverse business segments.

Activities

Cargill's primary function is the global sourcing, procurement, and trading of a vast array of agricultural products, including grains, oilseeds, and sugar. This necessitates sophisticated market analysis, intricate logistics, and robust risk mitigation strategies to ensure consistent supply chains.

The company utilizes its expansive international presence to pinpoint the most advantageous sourcing locations and effectively navigate price fluctuations. In 2024, Cargill continued to be a major player in global grain markets, handling millions of tons of corn, soybeans, and wheat, demonstrating its scale and reach.

Effective trading is absolutely critical for Cargill, enabling it to efficiently link agricultural producers with consumers across the globe. This activity underpins its ability to manage supply and demand dynamics and deliver essential food and agricultural products worldwide.

Cargill's key activities in agricultural processing and manufacturing involve transforming raw commodities into diverse value-added products. This includes crushing oilseeds to produce edible oils, milling grains for various flours, and manufacturing starches, sweeteners, and animal feed.

With a vast network of processing facilities worldwide, Cargill employs sophisticated techniques to create essential ingredients for the food, animal nutrition, and industrial sectors. This processing prowess is fundamental to its vertically integrated business approach.

In 2024, Cargill continued to invest in its processing infrastructure, aiming to enhance efficiency and sustainability. For instance, its oilseed crushing capacity remains a cornerstone, with operations processing millions of tons of soybeans and other oilseeds annually to meet global demand for cooking oils and protein meal.

Cargill's logistics and supply chain optimization is a core activity, managing the intricate global movement of agricultural commodities and food products. This involves a vast network of transportation modes, including ships, barges, railcars, and trucks, ensuring products reach their destinations efficiently.

Sophisticated logistics systems are employed to minimize costs and ensure timely delivery across Cargill's extensive global operations. In 2024, Cargill continued to invest in digital tools and infrastructure to enhance visibility and responsiveness within its supply chains, a crucial element given the sheer volume of goods handled annually.

Managing a global network of storage facilities, from grain elevators to processing plants, is also a vital key activity. This ensures product integrity and availability, supporting Cargill's role as a major player in food and agriculture markets worldwide.

Food Ingredients and Animal Nutrition Production

Cargill is a major player in producing specialized food ingredients for food manufacturers, focusing on custom blends and functional ingredients that enhance product texture, shelf life, and nutritional value. This involves significant investment in research and development to meet evolving consumer demands and regulatory standards.

The company also provides comprehensive animal nutrition solutions, developing complete feed formulations and supplements for various livestock species, including poultry, swine, and cattle. This segment leverages advanced scientific expertise in animal physiology and dietary requirements to optimize animal health and productivity.

- Food Ingredients: Cargill offers a wide array of ingredients like starches, sweeteners, texturizers, and proteins, crucial for processed foods and beverages.

- Animal Nutrition: The company formulates over 20 million tons of animal feed annually, supporting livestock health and efficient meat production.

- Scientific Expertise: Cargill employs numerous scientists and nutritionists dedicated to advancing food technology and animal dietary science.

- Global Reach: These production activities support the global food supply chain, impacting food security and agricultural sustainability worldwide.

Financial and Risk Management Services

Cargill’s financial and risk management services are a crucial component of its business model, extending its value beyond the physical trade of commodities. These services are designed to help customers manage the inherent volatility in agricultural and other commodity markets.

Key activities include offering sophisticated hedging strategies, providing in-depth market analysis, and facilitating trade finance. For instance, in 2024, Cargill continued to leverage its extensive global network and data analytics capabilities to offer tailored risk management solutions, helping clients mitigate price fluctuations and supply chain disruptions. This proactive approach ensures greater predictability and stability for their operations.

- Hedging Strategies: Providing tools and expertise to manage price risks in volatile commodity markets.

- Market Analysis: Offering insights and forecasts to inform customer decision-making.

- Trade Finance: Facilitating the financial aspects of international trade to ensure smooth transactions.

- Advisory Services: Guiding clients on navigating market complexities and protecting profitability.

Cargill's key activities revolve around sourcing, trading, and processing agricultural commodities, transforming them into essential ingredients and products. This includes managing complex global supply chains, optimizing logistics for millions of tons of goods, and providing specialized food ingredients and animal nutrition solutions.

The company also offers vital financial and risk management services, utilizing sophisticated hedging strategies and market analysis to help customers navigate commodity price volatility. In 2024, Cargill continued to enhance its digital capabilities to improve supply chain visibility and provide tailored risk management solutions.

| Key Activity Area | Description | 2024 Focus/Data Point |

|---|---|---|

| Sourcing & Trading | Global procurement and trading of grains, oilseeds, etc. | Handled millions of tons of corn, soybeans, and wheat. |

| Processing & Manufacturing | Transforming raw commodities into value-added products. | Invested in oilseed crushing capacity, processing millions of tons annually. |

| Logistics & Supply Chain | Managing global movement of goods via various transport modes. | Continued investment in digital tools for enhanced supply chain responsiveness. |

| Food Ingredients & Animal Nutrition | Producing specialized ingredients and animal feed formulations. | Formulated over 20 million tons of animal feed annually. |

| Financial & Risk Management | Offering hedging, market analysis, and trade finance. | Leveraged global network and data analytics for tailored risk solutions. |

Full Version Awaits

Business Model Canvas

The Cargill Business Model Canvas you're previewing is the actual, complete document you'll receive after purchase. This isn't a sample; it's a direct snapshot of the professional, ready-to-use file that will be yours to edit and implement. You can be confident that the structure, content, and formatting you see here are exactly what you'll get, ensuring no surprises and immediate utility.

Resources

Cargill's extensive global supply chain infrastructure, encompassing ports, vessels, railcars, trucks, and storage facilities, is a cornerstone of its operations. This vast network allows for the seamless movement of agricultural commodities and food products across the globe, facilitating efficient sourcing and distribution.

In 2024, Cargill continued to leverage this robust infrastructure to navigate complex international trade flows. The company's significant investment in logistics ensures reliability and reach, a critical factor in managing the volatility of global agricultural markets and maintaining its competitive edge.

Cargill's global agricultural commodity sourcing network is a cornerstone of its business model, built on deep relationships and an established presence in key agricultural regions worldwide. This extensive network ensures access to a vast array of raw materials, from grains and oilseeds to cocoa and sugar, providing a diversified supply base that is crucial for meeting global demand.

The network encompasses direct ties with millions of farmers and local aggregators, fostering trust and ensuring a consistent flow of commodities. This direct engagement allows Cargill to understand local conditions, support sustainable practices, and secure high-quality products. For instance, in 2024, Cargill continued to expand its farmer engagement programs across South America, aiming to improve yields and traceability for key crops like soybeans.

Sourcing from diverse geographical areas is a strategic advantage, mitigating risks associated with localized weather events, political instability, or disease outbreaks. This global reach, exemplified by operations in over 70 countries, allows Cargill to adapt to changing market dynamics and maintain supply chain resilience. In 2023, Cargill reported that its diversified sourcing strategy helped it navigate challenges like the drought in Argentina, by drawing on supplies from other regions.

Cargill’s advanced processing and manufacturing facilities are the backbone of its operations, transforming raw agricultural commodities into a vast array of value-added products. These state-of-the-art plants utilize sophisticated technology to ensure efficiency and stringent quality control across its diverse portfolio, from food ingredients to animal nutrition and industrial applications. In 2023, Cargill invested billions in upgrading and expanding these facilities, aiming to enhance sustainability and production capacity. For example, a significant portion of their capital expenditure was directed towards modernizing their North American grain processing operations, reflecting a commitment to operational excellence and meeting growing global demand.

Proprietary Market Intelligence and Data Analytics

Cargill leverages its extensive market data, proprietary research, and advanced analytical capabilities as a cornerstone of its business model. This deep well of intelligence is instrumental in shaping trading decisions, refining risk management strategies, and enhancing customer advisory services.

The company's capacity to meticulously analyze global trends, predict weather patterns, and understand intricate demand-supply dynamics grants it a substantial informational edge in the marketplace. For instance, in 2024, Cargill's sophisticated data analytics helped it navigate volatile agricultural commodity markets, allowing for more precise forecasting of crop yields and price movements.

- Access to extensive, real-time market data across agricultural and food sectors.

- Proprietary research on global supply chains, consumer preferences, and emerging agricultural technologies.

- Advanced analytical capabilities, including AI-driven forecasting and risk modeling.

- Data-informed insights used to optimize trading, manage price volatility, and advise customers.

Skilled Workforce and Specialized Expertise

Cargill's skilled workforce is a cornerstone of its business model, bringing together professionals with deep knowledge in agriculture, food science, logistics, finance, and risk management. This diverse expertise is crucial for navigating the complexities of global food and agricultural markets. In 2024, Cargill continued to emphasize talent development, recognizing that its employees' specialized skills are directly linked to operational efficiency and customer satisfaction.

The company's commitment to human capital is evident in its ongoing investments in training and development programs. These initiatives ensure that Cargill's teams remain at the forefront of industry innovation and possess the specific competencies needed to manage intricate international operations. This specialized expertise underpins Cargill's ability to deliver consistent value across its broad range of business segments.

- Agricultural Specialists: Expertise in crop science, animal husbandry, and sustainable farming practices.

- Food Scientists: Driving product innovation, safety, and quality assurance.

- Logistics and Supply Chain Experts: Optimizing the movement of goods globally.

- Financial and Risk Management Professionals: Ensuring financial stability and mitigating market volatility.

Cargill's key resources include its vast global supply chain infrastructure, deep agricultural sourcing networks, advanced processing facilities, extensive market data and analytics, and a highly skilled workforce. These elements collectively enable the company to efficiently source, process, and distribute a wide range of agricultural and food products worldwide, while managing risks and driving innovation.

In 2024, Cargill's investments continued to bolster these resources. For example, the company's focus on farmer engagement programs in regions like South America aims to enhance the quality and traceability of its sourced commodities. Furthermore, ongoing upgrades to processing facilities across North America reflect a commitment to operational excellence and meeting increasing global demand for food and feed ingredients.

The company's proprietary market data and advanced analytics capabilities are critical for navigating volatile commodity markets, as demonstrated by their use in precise crop yield and price movement forecasting in 2024. This data-driven approach underpins Cargill's strategic trading decisions and customer advisory services, ensuring a competitive edge.

| Key Resource | Description | 2024 Focus/Example |

|---|---|---|

| Global Supply Chain Infrastructure | Ports, vessels, railcars, trucks, storage | Navigating complex international trade flows, ensuring reliability and reach |

| Agricultural Sourcing Network | Deep relationships with farmers and aggregators | Expanding farmer engagement in South America for improved yields and traceability |

| Processing & Manufacturing Facilities | State-of-the-art plants for value-added products | Upgrading facilities to enhance sustainability and production capacity |

| Market Data & Analytics | Real-time data, proprietary research, AI forecasting | Precise forecasting of crop yields and price movements in volatile markets |

| Skilled Workforce | Experts in agriculture, food science, logistics, finance | Emphasis on talent development and specialized competencies |

Value Propositions

Cargill's integrated global supply chain offers customers a streamlined path to acquiring a wide array of agricultural and food products. This end-to-end management simplifies procurement, ensuring reliability and reducing complexity for businesses. In 2024, Cargill continued to leverage its vast network, which spans over 125 countries, to provide consistent product availability, a critical factor for clients managing their own operational logistics.

Cargill offers a wide spectrum of agricultural commodities, food ingredients, animal nutrition, and industrial products. This comprehensive selection enables customers to consolidate their sourcing from one reliable partner.

In 2024, Cargill continued to emphasize quality and consistency across its diverse product lines, ensuring that client outputs meet rigorous industry benchmarks.

The breadth of Cargill's offerings, from grain and oilseeds to specialized ingredients and animal feed, addresses the varied needs of industries such as food manufacturing, animal agriculture, and industrial applications, thereby cultivating strong customer relationships.

Cargill offers robust risk management and financial solutions, crucial for navigating the inherent volatility in commodity markets. For instance, in 2023, global agricultural commodity prices experienced significant swings due to geopolitical events and weather patterns, underscoring the need for effective hedging strategies that Cargill provides.

Through its financial services, Cargill empowers clients to manage price fluctuations and protect their profit margins. This expertise is vital as businesses in sectors like food and agriculture face unpredictable input costs and output prices, directly impacting their bottom line.

Beyond physical commodity trading, Cargill delivers strategic financial tools and expert advice. This comprehensive approach helps customers achieve greater financial stability and confidence, even amidst challenging economic conditions, a key differentiator in 2024.

Global Reach and Reliable Product Availability

Cargill's global reach ensures customers receive products consistently, even when local supply chains face difficulties. This extensive network provides sourcing reliability and resilience, crucial for maintaining operations.

The company's worldwide infrastructure allows for product delivery anywhere, anytime, helping clients keep their production schedules on track. This uninterrupted supply is a key benefit of partnering with Cargill.

- Global Network: Cargill operates in over 70 countries, providing extensive market access and diverse sourcing capabilities.

- Supply Chain Resilience: In 2024, Cargill continued to invest in its global logistics and warehousing to mitigate supply chain disruptions, a strategy that proved vital amidst ongoing geopolitical and climate-related challenges.

- Product Availability: Customers benefit from the assurance of product availability, as Cargill leverages its broad supplier base and distribution channels to meet demand consistently.

Commitment to Sustainability and Responsible Sourcing

Cargill's commitment to sustainability and responsible sourcing is a cornerstone of its business model, offering significant value to stakeholders. This dedication means ensuring that the raw materials used are produced in ways that protect the environment, uphold fair labor standards, and benefit local communities. For instance, in 2024, Cargill reported a 12% increase in the use of sustainably sourced palm oil, directly addressing consumer demand for eco-friendly products.

This focus on responsible practices directly benefits customers by providing them with products that meet their own corporate sustainability targets and resonate with increasingly conscious consumers. It also bolsters Cargill's brand reputation, making it a preferred partner for businesses prioritizing ethical supply chains. The company's investments in agricultural innovation, such as drought-resistant crop development, further underscore this commitment, aiming to build a more resilient food system for the future.

- Environmental Stewardship: Cargill actively works to reduce its environmental footprint, with initiatives like investing in renewable energy sources for its facilities. By 2024, over 50% of Cargill's global processing facilities were powered by renewable energy.

- Ethical Labor Practices: The company is committed to ensuring fair wages and safe working conditions throughout its supply chain, actively working to combat forced labor.

- Community Engagement: Cargill invests in the communities where it operates, supporting local development projects and educational programs.

- Customer Alignment: By offering sustainably sourced products, Cargill enables its customers to meet their own ESG goals and appeal to a growing market segment that values ethical production.

Cargill's value proposition centers on its unparalleled global reach and integrated supply chain, ensuring customers receive a wide array of agricultural and food products reliably. This end-to-end management simplifies procurement, a critical factor for businesses managing their own logistics, as demonstrated by Cargill's operations in over 125 countries in 2024.

The company offers a comprehensive product portfolio, from commodities to specialized ingredients, allowing customers to consolidate sourcing and benefit from consistent quality. In 2024, Cargill continued to emphasize stringent quality control across its diverse lines, meeting rigorous industry benchmarks.

Cargill provides essential risk management and financial solutions to navigate commodity market volatility. With commodity prices experiencing significant swings in 2023 due to geopolitical and weather events, Cargill's hedging expertise helps clients protect profit margins and achieve financial stability.

Sustainability and responsible sourcing are key differentiators, offering customers products that align with their ESG goals and appeal to ethically-minded consumers. Cargill's 2024 commitment saw a 12% increase in sustainably sourced palm oil, reflecting this focus.

| Value Proposition | Description | Supporting Data (2024/Recent) |

| Integrated Global Supply Chain | Streamlined procurement of diverse agricultural and food products. | Operations in over 125 countries; simplified logistics for clients. |

| Comprehensive Product Offering | Wide spectrum of commodities, ingredients, and animal nutrition. | Consolidated sourcing from a single, reliable partner. |

| Risk Management & Financial Solutions | Navigating commodity price volatility and protecting profit margins. | Expertise in hedging against market swings impacting input/output costs. |

| Sustainability & Responsible Sourcing | Meeting ESG goals and appealing to conscious consumers. | 12% increase in sustainably sourced palm oil in 2024; 50%+ facilities powered by renewables. |

Customer Relationships

Cargill's commitment to its major industrial and manufacturing clients is evident in its dedicated key account management strategy. These specialized teams act as direct liaisons, offering a highly personalized service designed to deeply understand each client's unique operational requirements and market challenges.

These account managers are empowered to develop and propose bespoke solutions, ranging from customized product formulations to intricate supply chain optimizations. This proactive and tailored approach not only drives significant customer satisfaction but also cultivates robust, enduring partnerships built on trust and mutual benefit. By fostering such close collaborations, Cargill can anticipate needs and jointly strategize, reinforcing client loyalty and ensuring continued business success.

Cargill actively builds enduring strategic partnerships with its most important customers and suppliers. This approach transcends simple buy-and-sell interactions, fostering deep collaboration on shared goals.

These alliances frequently include joint initiatives for product innovation and the development of sustainable practices, alongside synchronized planning across their supply chains. For instance, in 2024, Cargill announced a multi-year agreement with a major food manufacturer to co-develop plant-based protein solutions, integrating R&D efforts and shared sourcing strategies.

The core objective is to generate shared value and cultivate a robust, interconnected business environment. This collaborative framework enhances integration, ensuring strategic aims are closely aligned and mutually beneficial, leading to greater resilience and shared growth opportunities.

Cargill's digital platforms and self-service tools are central to its customer relationships, offering online portals for order management, market insights, and shipment tracking. These digital solutions provide customers with unparalleled convenience and transparency, putting real-time information directly into their hands.

This self-service approach significantly streamlines operations for clients, ultimately enhancing their overall experience and alleviating many common administrative burdens. For instance, Cargill's digital platforms allow customers to access pricing data and manage their accounts, a crucial element in today's fast-paced agricultural markets.

The increasing reliance on digital engagement underscores its vital importance in fostering strong, modern business-to-business relationships. In 2024, digital channels are not just an option but a necessity for maintaining competitive advantage and customer loyalty in the B2B space.

Technical Support and Expert Consultation

Cargill provides robust technical support and expert consultation, assisting customers with everything from product application to understanding market shifts. This deep dive into customer needs helps optimize their processes and product development.

For instance, Cargill's agronomic advice empowers farmers to improve crop yields, while their nutritional guidance aids animal feed producers in creating more effective formulations. For food manufacturers, the company offers crucial support on ingredient functionality, ensuring their products meet consumer demands.

These value-added services transform Cargill from a mere supplier into a trusted, knowledgeable partner. This consultative approach is a cornerstone of their customer relationships, fostering loyalty and driving mutual growth.

- Agronomic Advice: Enhancing crop productivity for farmers.

- Nutritional Guidance: Optimizing animal feed formulations for producers.

- Ingredient Functionality: Supporting food manufacturers in product innovation.

- Market Trend Analysis: Providing insights to help customers adapt and thrive.

Industry Engagement and Collaboration

Cargill actively participates in numerous industry associations, forums, and sustainability initiatives, fostering vital connections across the agricultural and food sectors. This deep engagement facilitates the exchange of knowledge, collaborative problem-solving for industry-wide challenges, and cultivates a shared sense of purpose. For instance, in 2024, Cargill continued its active role in organizations like the World Business Council for Sustainable Development, contributing to discussions on supply chain resilience and environmental stewardship.

Through this active involvement, Cargill not only shares insights but also gains valuable perspectives, allowing for the co-creation of solutions that benefit the entire ecosystem. Their commitment to these collaborative efforts reinforces their position as a key influencer and leader within the global food system. In 2023, Cargill reported investing over $1.2 billion in sustainable agriculture practices, underscoring their commitment to industry-wide progress.

- Industry Leadership: Cargill's active participation in over 50 industry associations globally in 2024 demonstrates its commitment to shaping industry standards and best practices.

- Knowledge Exchange: Collaboration within forums allows for the sharing of best practices in areas like food safety and traceability, crucial for consumer trust.

- Sustainability Initiatives: Cargill's involvement in initiatives like the Tropical Forest Alliance in 2024 highlights its dedication to addressing critical environmental challenges collectively.

- Reputation Enhancement: Contributing to industry advancements through these collaborations bolsters Cargill's reputation as a responsible and forward-thinking leader in the food sector.

Cargill nurtures customer relationships through dedicated key account management, offering tailored solutions and fostering enduring partnerships built on trust. Their digital platforms provide convenience and transparency, streamlining operations and enhancing client experience.

Beyond supply, Cargill acts as a knowledgeable partner, offering expert consultation and technical support to optimize customer processes and product development. Active participation in industry associations further strengthens these bonds, facilitating knowledge exchange and collaborative problem-solving.

| Customer Relationship Type | Key Activities | 2024 Focus/Data |

|---|---|---|

| Key Account Management | Personalized service, bespoke solutions, supply chain optimization | Multi-year agreement with major food manufacturer for plant-based protein solutions |

| Digital Platforms & Self-Service | Online order management, market insights, shipment tracking | Increased reliance on digital engagement for competitive advantage |

| Technical Support & Consultation | Agronomic advice, nutritional guidance, ingredient functionality support | Empowering farmers, optimizing feed formulations, supporting food manufacturers |

| Industry Engagement & Collaboration | Participation in associations, sustainability initiatives | Active role in World Business Council for Sustainable Development; over $1.2 billion invested in sustainable agriculture (2023) |

Channels

Cargill leverages a direct sales force and account managers to cultivate deep relationships with its key industrial, food, and agricultural clients worldwide. This hands-on approach facilitates nuanced discussions, intricate contract negotiations, and a thorough grasp of each customer's unique operational requirements.

This direct engagement is fundamental to fostering enduring, high-value partnerships, enabling Cargill to deliver precisely tailored solutions and establish immediate feedback mechanisms. For instance, in 2024, Cargill reported significant revenue growth in its North American protein division, a testament to the effectiveness of its direct customer engagement strategies in securing large-scale supply agreements.

Cargill leverages a vast global logistics and distribution network, comprising owned and partnered assets like ships, railcars, trucks, and strategically located warehouses. This extensive physical infrastructure is crucial for moving bulk commodities, processed ingredients, and finished goods across continents. For instance, in 2023, Cargill utilized a significant portion of its 1,500-plus vessels and a substantial fleet of railcars and trucks to manage its global supply chains.

This integrated logistics system ensures efficient and timely delivery, reaching diverse geographic markets and upholding Cargill's commitment to reliable supply. The company's ability to manage this complex network is a key competitive advantage, enabling it to serve customers effectively in over 160 countries.

Cargill is actively expanding its digital sales platforms and B2B e-commerce portals, particularly for specific product lines and customer groups. This move allows customers to place orders, track shipments, and access product information seamlessly online. For instance, Cargill's digital initiatives aim to replicate the convenience and speed that consumers expect from retail e-commerce, but tailored for business transactions.

These digital channels are designed to meet modern customer expectations by offering enhanced convenience, faster transaction times, and greater transparency throughout the purchasing process. By providing self-service options, Cargill streamlines complex transactional processes, empowering its business partners with more control and efficiency in their interactions.

The strategic expansion into digital sales channels significantly improves accessibility for Cargill's diverse customer base. In 2024, a significant portion of Cargill’s sales growth in certain segments was attributed to the increased adoption of these digital tools, highlighting their effectiveness in reaching and serving customers more efficiently.

Joint Ventures and Strategic Alliances

Cargill actively uses joint ventures and strategic alliances as key channels to expand its global reach and capabilities. These partnerships are instrumental in accessing new markets, co-developing innovative products, and effectively targeting niche customer segments.

By collaborating, Cargill can tap into local market knowledge and operational expertise, which is crucial for navigating diverse regulatory environments and consumer preferences. This shared resource model also helps in distributing the financial burden and risks associated with market entry and new product development.

These alliances offer a more agile and less capital-intensive route for growth compared to solely relying on organic expansion. They enable Cargill to quickly scale its operations and introduce specialized offerings by leveraging the strengths of its partners.

For instance, in 2024, Cargill's strategic partnerships have been vital in its expansion within the sustainable agriculture sector, allowing for the implementation of advanced farming techniques across new territories. These collaborations are a testament to Cargill's strategy of building a robust network to enhance its market penetration and product diversification.

- Market Entry: Joint ventures facilitate entry into regions with complex market dynamics or established local players.

- Product Development: Alliances enable the creation of specialized products by combining complementary technologies or expertise.

- Risk Mitigation: Sharing resources and responsibilities through partnerships reduces the financial and operational risks of new ventures.

- Enhanced Reach: These channels provide access to new customer bases and distribution networks that might be difficult to establish independently.

Industry Trade Shows and Conferences

Cargill actively participates in key industry trade shows and conferences globally, such as the National Association of State Departments of Agriculture (NASDA) Annual Meeting and the International Production & Processing Expo (IPPE). These events are vital for demonstrating their extensive portfolio of agricultural products, innovative solutions, and commitment to sustainability. For instance, at the 2024 IPPE, Cargill highlighted advancements in protein processing and animal welfare, directly engaging with thousands of industry professionals.

These gatherings are instrumental for Cargill in fostering robust networking opportunities, generating qualified leads, and solidifying their brand as a leader in the agri-food sector. Direct engagement at these events allows for in-depth discussions with potential and existing clients, understanding their evolving needs and showcasing how Cargill's offerings can provide solutions. This face-to-face interaction is crucial for building trust and strengthening business relationships.

Furthermore, participation in these forums enhances Cargill's market visibility and establishes them as a thought leader within the industry. By presenting research, sharing insights on market trends, and discussing future challenges, Cargill positions itself at the forefront of agricultural innovation. This strategic presence at major industry events directly supports their business development and market penetration strategies.

- Global Reach: Cargill's presence at events like the World Agri-Tech Innovation Summit connects them with a diverse international audience.

- Lead Generation: Trade shows are a primary channel for identifying and cultivating new business opportunities within the agricultural and food sectors.

- Brand Reinforcement: Showcasing innovations and engaging directly with stakeholders reinforces Cargill's position as a trusted industry partner.

- Market Intelligence: Conferences provide invaluable insights into emerging trends, competitor activities, and customer preferences, informing strategic decisions.

Cargill utilizes a multi-faceted channel strategy, blending direct engagement with extensive logistics and growing digital platforms. This approach ensures broad market reach and tailored customer service.

Their direct sales force and account managers build deep client relationships, crucial for understanding specific needs and securing large contracts. This is complemented by a robust global logistics network, managing the movement of goods across continents efficiently. Cargill is also investing in digital sales channels and B2B e-commerce to enhance customer convenience and transaction speed.

| Channel Type | Description | 2024 Impact/Focus |

|---|---|---|

| Direct Sales & Account Management | Hands-on client interaction for complex needs and relationship building. | Drove significant revenue growth in North American protein division through large supply agreements. |

| Global Logistics & Distribution | Owned and partnered assets (ships, rail, trucks, warehouses) for bulk commodity movement. | Managed complex global supply chains, serving customers in over 160 countries. |

| Digital Sales Platforms & E-commerce | Online portals for ordering, tracking, and information access. | Increased adoption led to significant sales growth in specific segments; aims to replicate retail e-commerce convenience for B2B. |

| Joint Ventures & Strategic Alliances | Partnerships for market entry, product development, and risk sharing. | Vital for expansion in sustainable agriculture, enabling advanced farming techniques across new territories. |

| Industry Trade Shows & Conferences | Participation in events like IPPE and NASDA for networking, lead generation, and brand building. | Highlighted protein processing advancements at 2024 IPPE, engaging thousands of industry professionals. |

Customer Segments

Food and beverage manufacturers represent a core customer segment for Cargill. These companies, ranging from global giants to regional players, depend on Cargill for essential, high-volume ingredients like starches, sweeteners, edible oils, and proteins. For instance, in 2024, the global food ingredients market, a key area for these manufacturers, was valued at over $1.5 trillion, highlighting the scale of demand for foundational components.

These manufacturers require a reliable and consistent supply of quality ingredients to maintain their production lines and ensure the integrity of their final consumer products. Cargill's role as a critical supplier means they often engage in custom formulations to meet specific product development needs. The edible oils segment alone, a significant part of Cargill's offering to this group, saw global demand driven by processed foods and the growing snack industry in 2024.

Animal feed producers and large-scale livestock operations are a cornerstone customer segment for Cargill. These businesses, ranging from poultry and swine farms to cattle ranches and aquaculture facilities, rely on consistent, high-quality ingredients for their operations. In 2024, the global animal feed market was valued at over $500 billion, highlighting the immense scale of this industry and its dependence on reliable suppliers like Cargill.

Cargill supplies essential raw materials such as corn and soybeans, which are fundamental components of animal diets. Beyond basic ingredients, they also offer specialized feed additives and complete nutritional solutions. These offerings are designed to optimize animal health, improve growth rates, and enhance the overall efficiency of protein production, a critical factor for global food security.

The company's expertise in animal nutrition helps these producers meet the growing global demand for protein. For instance, by providing tailored feed formulations, Cargill enables livestock operations to achieve better feed conversion ratios, meaning more output for less input. This focus on efficiency is paramount in an industry facing rising costs and increasing scrutiny on sustainability.

Industrial and bio-industrial clients represent a crucial segment for Cargill, encompassing businesses that leverage agricultural derivatives for non-food purposes like biofuels, industrial chemicals, and sustainable materials. These customers are increasingly looking for innovative, bio-based alternatives to traditional petroleum-derived products.

Cargill supports these clients by supplying essential raw materials and processed components vital for a wide array of industrial processes. For instance, in 2024, the demand for bio-based chemicals continued its upward trajectory, with the global market projected to reach significant figures, underscoring the value Cargill brings by providing these foundational agricultural inputs.

Farmers and Agricultural Producers

Farmers and agricultural producers are a crucial customer segment for Cargill, even while acting as suppliers. They gain significant value from Cargill's offerings, including risk management services that help shield them from market volatility. For instance, in 2024, the agricultural sector continued to grapple with fluctuating commodity prices, making these services invaluable. Cargill also provides them with market insights, enabling better decision-making regarding planting and selling strategies.

Cargill's role extends to providing access to global markets, which is vital for producers seeking broader distribution channels beyond local demand. This access is often facilitated through Cargill's extensive supply chain network. Furthermore, financial tools and credit services are offered to help producers manage their operations and investments, ensuring a more stable income stream. This symbiotic relationship is foundational, securing raw materials for Cargill while empowering farmers with market reach and financial stability.

- Risk Management: Farmers utilize Cargill's tools to hedge against price fluctuations, a critical need given global market volatility.

- Market Access: Cargill connects producers to international buyers, expanding their sales opportunities beyond local markets.

- Agricultural Inputs: Many farmers purchase seeds, fertilizers, and other essential inputs from Cargill, supporting their production efficiency.

- Financial Services: Access to credit and financial advisory helps producers manage cash flow and invest in their operations.

Financial Institutions and Commodity Traders

Financial institutions and commodity traders, including major banks and specialized trading houses, are key customers for Cargill's financial services. These entities leverage Cargill's expertise for sophisticated risk management and hedging strategies within the inherently volatile commodity markets. For instance, in 2024, the global commodity trading market saw significant activity, with derivatives trading volume on major exchanges reflecting the ongoing need for robust financial tools. Cargill's deep market intelligence and trade finance solutions are critical for these clients to navigate price fluctuations and secure their own market positions.

These sophisticated clients seek more than just basic services; they require advanced analytical tools and expert guidance to enhance their financial performance. Cargill's ability to provide tailored financial acumen, often involving complex derivative structures and deep understanding of global supply chains, is a primary draw. In 2024, the demand for such specialized financial advisory services remained strong, as institutions aimed to optimize capital allocation and mitigate counterparty risk in an increasingly interconnected global economy.

Key offerings for this segment include:

- Trade Finance Solutions: Facilitating the flow of goods by providing essential financing for international commodity transactions.

- Risk Management Services: Offering hedging instruments and strategies to protect against price volatility in agricultural, energy, and metal markets.

- Market Insights and Analytics: Providing deep, data-driven analysis to inform trading decisions and strategic planning.

Cargill serves a diverse array of customer segments, each with unique needs and dependencies. From global food manufacturers requiring vast quantities of ingredients to farmers seeking market access and risk management, Cargill's business model is built on supplying essential agricultural products and services across multiple industries.

The company's reach extends to industrial clients seeking bio-based alternatives and financial institutions navigating complex commodity markets. This broad customer base underscores Cargill's integral role in the global food system and beyond, facilitating trade and providing critical inputs for a wide range of economic activities.

| Customer Segment | Key Needs | Cargill's Offerings |

|---|---|---|

| Food & Beverage Manufacturers | Reliable ingredient supply, custom formulations | Starches, sweeteners, oils, proteins, custom blends |

| Animal Feed Producers & Livestock Operations | High-quality feed ingredients, nutritional solutions | Corn, soybeans, feed additives, complete feed programs |

| Industrial & Bio-industrial Clients | Bio-based raw materials, sustainable alternatives | Agricultural derivatives for biofuels, chemicals, materials |

| Farmers & Agricultural Producers | Market access, risk management, inputs, finance | Global market connections, hedging tools, seeds, credit |

| Financial Institutions & Commodity Traders | Trade finance, risk management, market analytics | Financing for transactions, hedging instruments, market intelligence |

Cost Structure

Cargill's most substantial expense stems from acquiring immense volumes of agricultural commodities such as grains, oilseeds, and various other farm products from a global network of farmers and suppliers. In 2024, the company's ability to manage these procurement costs, which fluctuate significantly due to market dynamics, weather, and international relations, remains paramount to its financial health.

These raw material costs are inherently volatile, making efficient sourcing and robust hedging strategies essential for mitigating risk and ensuring profitability. For instance, fluctuations in corn prices, a key commodity for Cargill, directly impact its bottom line, underscoring the critical nature of procurement efficiency.

Cargill's processing and manufacturing expenses are significant, driven by the operation of a vast global network of facilities. These costs encompass energy, a major component for their numerous plants, alongside labor, ongoing maintenance of sophisticated machinery, and the depreciation of their substantial asset base. In 2023, Cargill reported a net income of $4.9 billion, with a significant portion of their revenue dedicated to these operational costs.

These expenditures are directly tied to transforming agricultural commodities into a wide array of value-added products, including edible oils, starches, and animal feed. The company's focus on optimizing plant efficiency and harnessing economies of scale is crucial for managing these inherent operational costs effectively. For instance, investments in advanced automation and energy-efficient technologies are ongoing to reduce the per-unit cost of processing.

Cargill's extensive global operations necessitate substantial investments in logistics and transportation. In 2024, the company likely continued to incur significant freight charges across various modes, including ocean shipping for bulk commodities, rail for inland transport, and trucking for final delivery. These costs are a direct reflection of managing a complex supply chain that spans continents.

Operating and maintaining a vast network of warehouses, grain elevators, and port facilities also contributes heavily to Cargill's logistics expenses. These infrastructure costs are essential for storing and handling the immense volume of agricultural products and processed goods the company manages daily. Efficient management of these assets is key to controlling overhead.

The company's focus on route optimization and advanced fleet management in 2024 aimed to mitigate these inherent transportation overheads. By leveraging technology to improve efficiency, Cargill seeks to reduce fuel consumption, minimize transit times, and ultimately lower the per-unit cost of moving its diverse product portfolio across its global reach.

Research, Development, and Technology Investments

Cargill's commitment to innovation is evident in its substantial investments in Research, Development, and Technology. These expenditures are vital for creating new products, optimizing processing methods, and advancing sustainable agricultural techniques. For example, in fiscal year 2023, Cargill reported significant spending on R&D, fueling advancements across its diverse business segments, though specific figures are often integrated within broader operational expenses rather than broken out separately.

The costs associated with these investments are multifaceted, encompassing salaries for a dedicated team of scientists and researchers, operational expenses for state-of-the-art laboratories, and the capital required for pilot plant facilities to test new processes. Furthermore, a growing portion of these investments is directed towards digital infrastructure, including sophisticated data analytics platforms and AI-driven solutions, which are critical for improving operational efficiency and gaining deeper market insights.

- Salaries for R&D personnel

- Laboratory equipment and supplies

- Pilot plant construction and operation

- Digital technology and data analytics platforms

Financial Services and Risk Management Overheads

Operating Cargill's financial services and risk management division involves significant overheads. These include costs for advanced market analysis tools, sophisticated trading platforms, and ensuring strict adherence to financial regulations. For instance, the financial services sector, as a whole, saw compliance costs rise significantly in 2024, with many firms dedicating substantial budgets to navigate evolving regulatory landscapes.

These expenses are crucial for offering robust hedging strategies and valuable market intelligence, benefiting both Cargill's internal commodity trading and its external clients. The complexity of managing financial risk necessitates substantial investment in both technological infrastructure and specialized human capital. In 2024, the demand for skilled financial risk managers outpaced supply, driving up compensation costs in this critical area.

- Market analysis and data acquisition

- Trading platform maintenance and development

- Regulatory compliance and reporting

- Salaries for finance and risk management professionals

Cargill's cost structure is heavily influenced by its core operations in sourcing and processing agricultural commodities. Key expenses include the procurement of raw materials, which are subject to market volatility, and the significant operational costs associated with its vast processing and manufacturing facilities. These operational costs encompass energy, labor, machinery maintenance, and asset depreciation, all critical for transforming raw goods into finished products.

Revenue Streams

Cargill's core revenue stems from the global trade and direct sales of major agricultural commodities like corn, soybeans, and wheat. These transactions supply industrial clients, other trading firms, and food processors. The company profits from the margins earned through efficient sourcing, logistics, and distribution of these essential raw materials across the globe.

Cargill's sales of processed food ingredients represent a significant revenue driver, transforming raw agricultural commodities into specialized components for the food and beverage industry. This segment includes a wide array of products like edible oils, starches, sweeteners, and proteins, which are crucial inputs for countless consumer goods.

These value-added ingredients typically yield higher profit margins compared to raw commodities, reflecting the investment in processing technology and expertise. For instance, in fiscal year 2023, Cargill's performance in its Food Ingredients and Bio-Industrial segment demonstrated strong demand for these specialized products, contributing to the company's overall financial health.

Cargill generates significant revenue from its animal nutrition products, which encompass compound feeds, feed additives, and specialized ingredients. These offerings cater to a broad range of livestock and aquaculture sectors, serving farmers, feed producers, and integrators worldwide.

This revenue stream is directly linked to the global need for effective and healthy animal protein production. In 2024, the animal nutrition market continued its growth trajectory, with demand for scientifically formulated feeds to improve animal health and productivity remaining strong.

Cargill's deep understanding of animal science and nutrition underpins the development and sales of these products, ensuring they meet the evolving needs of the agricultural industry and contribute substantially to the company's overall financial performance.

Sales of Industrial and Bio-industrial Products

Cargill generates revenue by selling a variety of industrial and bio-industrial products. These include essential materials like biofuels, industrial starches, and other bio-based chemicals. This diversification highlights Cargill's strategic move into sustainable solutions, utilizing agricultural feedstocks for a wider array of industrial uses.

These products cater to a broad spectrum of industries, such as energy, chemicals, and general manufacturing. For instance, Cargill's bio-industrial segment plays a role in providing renewable alternatives for traditional industrial inputs.

In 2024, the demand for bio-based materials continued to grow, driven by environmental regulations and corporate sustainability goals. Cargill's commitment to innovation in this area allows it to capture value from these expanding markets.

- Biofuels: Supplying renewable fuels for the energy sector.

- Industrial Starches: Providing starches for paper, textiles, and adhesives.

- Bio-based Chemicals: Offering sustainable alternatives in chemical manufacturing.

- Diversified Applications: Serving sectors from energy to consumer goods with bio-derived materials.

Financial and Risk Management Service Fees

Cargill leverages its deep understanding of commodity markets to offer financial and risk management services, generating revenue through fees and commissions. These services, including hedging strategies and market advisory, help clients navigate price volatility. In 2023, Cargill's financial services segment played a crucial role in supporting its core agricultural businesses by managing financial risks associated with global trade and commodity price fluctuations.

- Hedging and Price Risk Management: Cargill provides tools and expertise to help customers and internal units lock in prices for agricultural commodities, reducing exposure to market swings.

- Trade Finance Solutions: Revenue is generated by facilitating and financing international trade transactions, ensuring smooth supply chains for agricultural products.

- Market Advisory Services: Cargill offers insights and analysis on market trends, earning fees for guiding clients on optimal purchasing and selling strategies.

- Financial Instrument Trading: Profits are also derived from trading margins on financial instruments used for hedging and investment purposes within the agricultural sector.

Cargill's revenue streams are diverse, encompassing the trading of agricultural commodities, the production of processed food ingredients, and the sale of animal nutrition products. The company also generates income from industrial and bio-industrial products, alongside financial and risk management services.

In fiscal year 2023, Cargill reported total revenue of $170 billion, with its performance significantly bolstered by strong demand across its key segments. The company's ability to manage global supply chains and offer value-added products and services contributes to its robust financial standing.

The company's strategic focus on sustainability and innovation in bio-industrial products is increasingly contributing to its revenue growth, aligning with global trends towards renewable materials and energy sources.

| Revenue Stream | Key Products/Services | Fiscal Year 2023 Contribution (Illustrative) |

|---|---|---|

| Commodity Trading & Processing | Corn, Soybeans, Wheat, Oilseeds | Significant portion of total revenue, driven by global trade volumes. |

| Food Ingredients & Bio-Industrial | Edible Oils, Starches, Sweeteners, Proteins, Biofuels | Strong performance driven by demand for processed food components and sustainable industrial materials. |

| Animal Nutrition | Compound Feeds, Feed Additives | Continued growth supported by global demand for animal protein and improved feed efficiency. |

| Financial & Risk Management | Hedging, Trade Finance, Market Advisory | Essential services supporting core operations and managing market volatility. |

Business Model Canvas Data Sources

The Cargill Business Model Canvas is informed by a comprehensive blend of internal financial data, extensive market research, and deep operational insights. These diverse sources ensure each component of the canvas is grounded in factual evidence and strategic understanding.