Cargill Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cargill Bundle

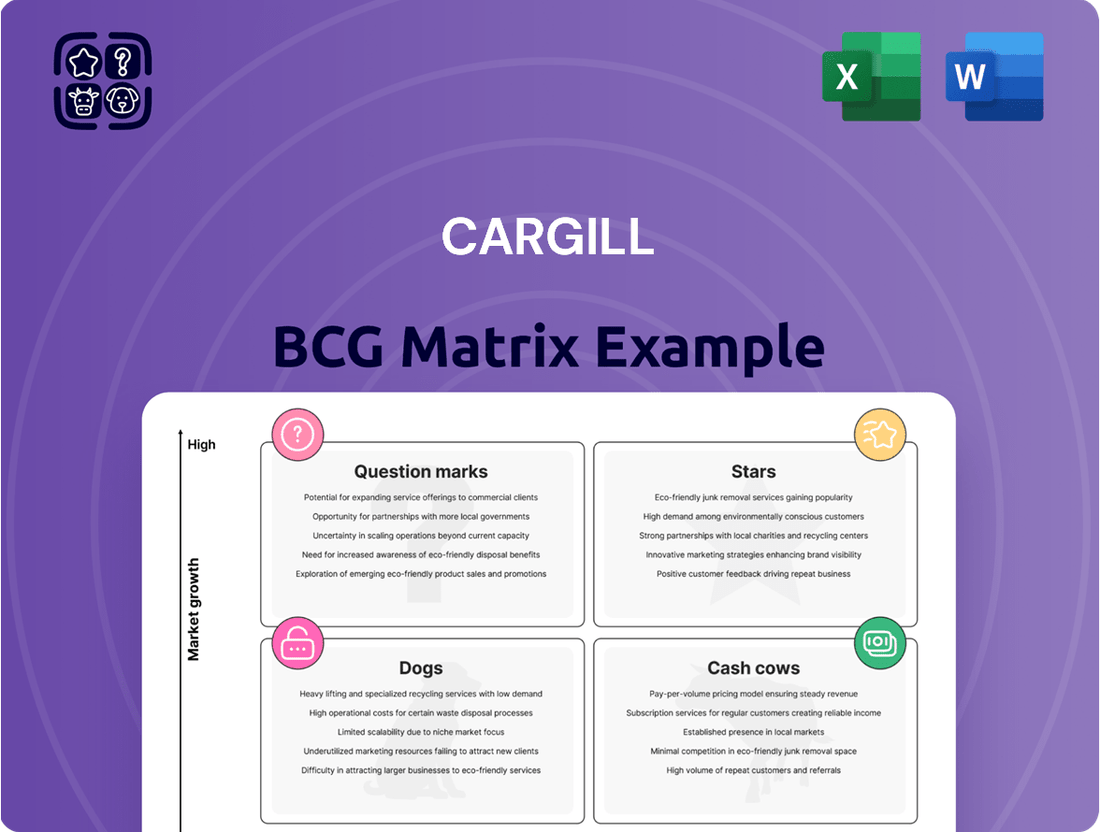

Explore how Cargill's diverse portfolio aligns with the BCG Matrix, identifying potential Stars for growth, Cash Cows for stable revenue, and Dogs that may need divestment. This initial glimpse offers a strategic framework for understanding their market position.

To truly unlock Cargill's strategic potential, dive into the full BCG Matrix. Gain detailed quadrant placements, data-driven insights into market share and growth rates, and actionable recommendations for optimizing their product portfolio.

Don't just guess where Cargill's investments should go; know with certainty. Purchase the complete BCG Matrix for a comprehensive breakdown, equipping you with the clarity needed to make informed decisions and drive future success.

Stars

Cargill's RegenConnect program is a prime example of a Star in the BCG Matrix, targeting 10 million acres of North American farmland by 2030. This initiative taps into the burgeoning market for sustainable agriculture, fueled by increasing consumer and regulatory demand for climate-friendly practices.

The company's substantial investments in promoting cover crops and reduced tillage are directly enhancing soil health and carbon sequestration, key drivers for this high-growth sector. Cargill's proactive stance solidifies its leadership in the rapidly expanding field of regenerative agriculture.

Cargill is significantly expanding its protein offerings, pouring resources into plant-based, cultivated meat, and mycoprotein innovations. This strategic move aligns with a global surge in demand for sustainable and healthier protein alternatives, a trend that saw the alternative protein market valued at approximately $15 billion in 2023 and projected to reach over $60 billion by 2030.

Cargill's aggressive 2025 deforestation-free targets for soy, corn, wheat, and cotton, extending to all agricultural supply chains by 2030, underscore their commitment to responsible sourcing. This proactive stance positions them favorably as consumer demand for ethically produced goods grows.

With 54% of its cocoa supply certified sustainable and a 2025 goal for 100% palm oil traceability, Cargill is actively addressing market expectations. This focus on sustainability is crucial for capturing market share among environmentally and socially conscious buyers.

Specialty and Functional Food Ingredients

Cargill is strategically investing in specialty and functional food ingredients to align with evolving consumer preferences. This includes a focus on healthier indulgence options and innovative sugar reduction technologies like their EverSweet stevia sweetener. The company is also expanding its portfolio of functional proteins, such as postbiotics, to cater to the growing demand for products offering specific health benefits and enhanced taste profiles.

These segments represent high-growth areas for Cargill, driven by consumers actively seeking foods that contribute to well-being and offer superior sensory experiences. For instance, the global functional foods market was projected to reach over $275 billion in 2023 and is expected to continue its upward trajectory. Cargill's commitment to innovation, evidenced by its dedicated innovation centers and strategic partnerships, is crucial for developing and launching new products that meet these dynamic market demands.

- Healthier Indulgence: Cargill is developing ingredients that allow for reduced sugar and fat content without compromising taste.

- Sugar Reduction: Investments in sweeteners like EverSweet aim to provide viable alternatives to traditional sugars.

- Functional Proteins: Expansion into areas like postbiotics addresses the growing consumer interest in gut health and immunity.

- Market Growth: These ingredient categories are experiencing robust growth, reflecting significant consumer demand for health-focused food options.

Digital Agriculture and Supply Chain Technologies

Cargill Ventures is strategically investing in digital agriculture and supply chain technologies, recognizing their transformative potential. Companies like Bushel, which offers data integration for grain origination, and Grão Direto, a Brazilian digital marketplace for agricultural commodities, exemplify this focus. These investments are designed to enhance operational efficiency and streamline the complex agricultural supply chain.

The digital agriculture market is experiencing robust growth, driven by the increasing adoption of data-driven solutions across the farming sector. This trend is crucial for boosting productivity and building resilience against climate and market volatility. For instance, the global digital farming market was projected to reach over $20 billion by 2024, indicating significant expansion and opportunity.

- Bushel: Provides a platform to connect farmers, elevators, and buyers, facilitating data flow and improving transaction transparency.

- Grão Direto: Operates a digital platform in Brazil that connects farmers directly with buyers, simplifying the commodity trading process.

- Market Growth: The digital agriculture sector is expanding rapidly, with investments pouring into agtech startups focused on efficiency and sustainability.

- Strategic Importance: These investments are vital for Cargill to maintain its competitive edge and drive innovation within its core agricultural business operations.

Cargill's investments in regenerative agriculture, exemplified by its RegenConnect program, position it as a Star in the BCG matrix. This initiative targets 10 million acres by 2030, capitalizing on the growing demand for sustainable farming practices. By promoting cover crops and reduced tillage, Cargill is enhancing soil health and carbon sequestration, key drivers in this expanding market.

Cargill's strategic expansion into alternative proteins, including plant-based and cultivated meat, also marks it as a Star. The alternative protein market, valued at approximately $15 billion in 2023, is projected to exceed $60 billion by 2030, reflecting strong consumer interest in sustainable and healthier protein sources. This diversification taps into a high-growth sector with significant future potential.

The company's focus on specialty and functional food ingredients, such as healthier indulgence options and sugar reduction technologies like EverSweet, further solidifies its Star status. The global functional foods market was projected to reach over $275 billion in 2023. Cargill's commitment to innovation in these areas aligns with evolving consumer preferences for health-conscious and superior-tasting products.

Cargill's ventures into digital agriculture and supply chain technologies, including investments in platforms like Bushel and Grão Direto, represent another Star. The digital farming market was projected to reach over $20 billion by 2024, highlighting the sector's rapid growth and Cargill's strategic positioning to enhance efficiency and resilience in its operations.

| Cargill's Star Business Areas | Market Trend | Cargill's Strategic Focus | Market Size (Approx.) | Growth Driver |

|---|---|---|---|---|

| Regenerative Agriculture (RegenConnect) | Sustainable Farming Demand | Cover crops, reduced tillage, soil health | Targeting 10M acres by 2030 | Consumer & regulatory pressure for climate-friendly practices |

| Alternative Proteins | Health & Sustainability in Food | Plant-based, cultivated meat, mycoprotein | $15B (2023) to $60B+ (2030) | Growing consumer preference for ethical and healthy protein |

| Specialty & Functional Food Ingredients | Health & Wellness in Food | Healthier indulgence, sugar reduction, functional proteins | $275B+ (2023) for functional foods | Consumer demand for well-being and enhanced taste |

| Digital Agriculture & Supply Chain Tech | Agtech Innovation | Data integration, digital marketplaces | $20B+ (2024) for digital farming | Increased adoption of data-driven solutions for efficiency |

What is included in the product

The Cargill BCG Matrix offers a strategic framework to analyze its diverse business units based on market share and growth potential.

It guides decisions on resource allocation, identifying units for investment, divestment, or harvesting.

The Cargill BCG Matrix provides a clear, one-page overview, relieving the pain of complex portfolio analysis by instantly categorizing business units.

Cash Cows

Cargill's global grain sourcing, processing, and distribution is a quintessential Cash Cow. This mature business boasts a dominant market share, leveraging an expansive international network for essential grains like corn, wheat, and soybeans.

Despite experiencing revenue declines in fiscal year 2024, this foundational segment continues to be a powerful cash generator. Its indispensable role in global food supply chains ensures consistent demand, even amidst fluctuating market conditions.

Cargill's traditional animal nutrition and feed production segment is a classic Cash Cow. This mature market, crucial for global food security, saw revenues in the tens of billions of dollars for Cargill in recent years, reflecting its established dominance. The segment consistently generates substantial, predictable profits due to ongoing demand for livestock and aquaculture feed, supported by robust, long-standing supply chains.

Cargill's bulk food ingredients, including starches, sweeteners, and oils, represent a classic Cash Cow within its portfolio. This segment serves the mature and stable food processing industry, a sector characterized by consistent, high-volume demand. Cargill's strong market position and operational efficiency in producing and distributing these essential commodities generate substantial and predictable cash flow.

The demand for these ingredients remains robust, underpinning their Cash Cow status. For instance, the global edible oils market was valued at approximately $230 billion in 2023 and is projected to grow steadily, reflecting ongoing consumer needs and industrial applications. Similarly, the starch derivatives market, crucial for food, paper, and textiles, continues its stable trajectory, demonstrating the enduring demand that fuels these cash-generating businesses.

Global Financial and Risk Management Services

Cargill's Global Financial and Risk Management Services operate as a classic Cash Cow within its diversified portfolio. This segment provides essential hedging and financial tools to agricultural producers and food companies, a market characterized by its necessity and stability, even amidst commodity price fluctuations.

Leveraging Cargill's unparalleled expertise in agriculture and its vast network of clients, this division generates substantial and reliable cash flow. While the growth potential in this mature market is relatively modest, its consistent profitability makes it a cornerstone for funding other, more dynamic business units.

In 2023, Cargill reported total revenue of $170 billion, with its financial services segment playing a significant role in stabilizing earnings. The company's deep integration into the agricultural supply chain allows it to offer highly specialized and effective risk management solutions.

- Stable Revenue Generation: Provides consistent cash flow due to the essential nature of agricultural risk management.

- Deep Industry Expertise: Leverages Cargill's extensive knowledge of agricultural markets and supply chains.

- Low Growth, High Profitability: Operates in a mature market, focusing on maximizing returns from existing services.

- Client Base Leverage: Benefits from Cargill's broad and established relationships with farmers and agribusinesses.

Conventional Meat and Poultry Processing

Cargill's conventional meat and poultry processing, a cornerstone of its business, continues to be a significant cash generator. Despite the growing interest in alternative proteins, this segment holds a substantial market share within a mature industry, demonstrating its enduring strength. For instance, in 2023, Cargill's protein division, which includes these operations, reported robust performance, contributing significantly to the company's overall financial health.

This mature business unit acts as a vital cash cow, providing the financial resources needed to invest in and explore newer, potentially high-growth areas like alternative proteins. While facing evolving consumer demands and specific challenges within the beef sector, the sheer volume and established market position of its traditional meat and poultry processing ensure consistent cash flow. In 2024, the company continued to focus on operational efficiencies and supply chain resilience within this segment to maintain its profitability.

- Dominant Market Share: Cargill maintains a leading position in the conventional meat and poultry processing sector.

- Mature Industry Strength: Operates within a well-established market, ensuring consistent demand and revenue.

- Cash Generation: This segment is a primary source of cash flow, funding other business initiatives.

- Strategic Importance: Continues to be a core component of Cargill's diversified portfolio, even amidst innovation in alternative proteins.

Cargill's established animal nutrition and feed production segment is a prime example of a Cash Cow. This segment benefits from consistent, high demand due to its essential role in global food supply chains, generating substantial and predictable profits. Its mature market position, supported by robust and long-standing operations, ensures its continued status as a reliable cash generator for the company.

| Segment | Market Position | Cash Flow Generation | Growth Potential |

| Animal Nutrition & Feed | Dominant | High & Stable | Low |

| Global Grain Sourcing | Leading | Significant | Low |

| Bulk Food Ingredients | Strong | Consistent | Low |

| Meat & Poultry Processing | Leading | Substantial | Low |

What You’re Viewing Is Included

Cargill BCG Matrix

The Cargill BCG Matrix preview you're examining is the identical, fully completed document you will receive upon purchase. This means you're seeing the actual strategic analysis, ready for immediate application without any alterations or missing sections. It’s a complete, professionally formatted report designed to provide actionable insights into Cargill's business portfolio.

Dogs

Cargill's recent workforce reduction, impacting around 5% of its global employees, points to the presence of underperforming regional operations or legacy facilities. These segments likely exhibit slow growth and a diminished market share, making them candidates for divestment or significant restructuring.

These underperforming areas, often characterized by older infrastructure and less adaptable business models, may be consuming resources without yielding commensurate returns. For instance, if certain legacy processing plants in a mature market are operating at lower capacity due to decreased demand or higher operational costs compared to newer facilities, they would fit this description.

In 2024, the agricultural and food giant's strategic shift to consolidate its business units signals a proactive approach to address these inefficiencies. By focusing on core, high-growth areas, Cargill aims to reallocate capital away from these potential cash traps towards more promising ventures, thereby improving overall profitability and market competitiveness.

In the current agricultural landscape, characterized by subdued commodity prices and an oversupply of crops, some of Cargill's less differentiated trading desks face significant headwinds. These desks, operating in highly competitive segments, are likely experiencing thin profit margins and a shrinking market presence. For instance, in 2024, global grain prices remained under pressure, with wheat futures trading around $6.00 per bushel for much of the year, reflecting ample supply.

These less differentiated commodity trading operations, while historically core to Cargill's business, may represent potential candidates for divestment or substantial internal restructuring. The limited profitability and intense competition in these areas suggest a strategic review is warranted to optimize resource allocation. For example, a desk focused on a single, widely traded commodity might struggle to achieve economies of scale or build a unique value proposition compared to more specialized units.

Cargill's vast operations encompass a range of industrial products, some of which operate within mature, low-growth sectors. When these niche industrial offerings lack significant market share or competitive advantage, they can be classified as Dogs in the BCG Matrix.

These products often represent areas where Cargill has limited dominance, potentially leading to stagnant revenue streams or even resource drain. For instance, a specific type of industrial lubricant or a specialized chemical additive might fall into this category if its market is shrinking and Cargill's position isn't strong enough to drive growth.

In 2024, while specific figures for individual "Dog" products are not publicly disclosed, Cargill's overall industrial segment performance provides context. The company continues to optimize its portfolio, divesting or de-emphasizing less profitable or non-strategic industrial assets to focus on core growth areas.

Outdated Agricultural Technologies or Practices

Segments of Cargill's business that continue to rely on outdated agricultural technologies or practices, failing to embrace modern efficiencies and sustainability, would likely be categorized as Dogs. For instance, regions where traditional farming methods persist without the integration of precision agriculture or advanced crop management techniques could represent this challenge. Cargill's significant investment in digital transformation, aiming to improve yields and reduce environmental impact, highlights the risk for those segments resisting change.

The agricultural sector in 2024 still sees pockets of low adoption for advanced technologies. For example, while global agricultural drone usage is projected to grow significantly, a substantial portion of smaller farms, particularly in developing economies, may still be operating with pre-digital tools. This gap in technological adoption can lead to lower productivity and higher operational costs compared to more modernized operations, directly impacting profitability.

- Low Adoption Rates: In 2024, an estimated 30% of global farmland still relies on manual labor and traditional plowing methods, indicating a significant segment lagging in technological advancement.

- Efficiency Gaps: Farms using outdated irrigation systems can experience water loss rates of up to 40%, directly impacting resource efficiency and yield potential compared to modern, sensor-driven systems.

- Sustainability Concerns: Practices that do not incorporate soil health management or reduced chemical inputs, common in older farming paradigms, face increasing regulatory scrutiny and market demand for sustainable alternatives.

Failed or Stagnant Venture Investments

Some ventures within Cargill's portfolio may have struggled to gain momentum or capture significant market share, potentially leading them to be classified as question marks or even dogs in the BCG matrix. For instance, a startup focused on a niche alternative protein source that didn't resonate with mainstream consumers might fall into this category. The agricultural technology sector, while promising, can also see investments falter if regulatory hurdles are too high or adoption rates are slower than anticipated. In 2024, the venture capital landscape saw a general slowdown, with many startups facing challenges in securing follow-on funding, increasing the risk of stagnation.

These ventures, failing to demonstrate a clear path to substantial returns or market leadership, could become anchors for the venture fund. For example, an investment in a novel biopesticide that proved less effective in large-scale field trials than initially projected might be re-evaluated. The key indicator is the lack of a compelling growth trajectory or a sustainable competitive advantage. Reports from late 2023 and early 2024 indicated that funding for early-stage agtech companies, particularly those with longer development cycles, became more selective.

- Stagnant Growth: Ventures exhibiting minimal or no revenue growth over extended periods.

- Low Market Share: Investments that have failed to capture a meaningful position within their target market.

- Uncertain Future Returns: Startups where the potential for significant profitability remains highly speculative.

- High Cash Burn Rate: Companies consuming capital without commensurate progress towards profitability or market traction.

Dogs in Cargill's portfolio represent business units or products with low market share in slow-growing industries. These segments often require significant investment to maintain but yield minimal returns, acting as cash drains. For example, certain legacy industrial ingredient lines with declining demand and intense competition would fit this description.

In 2024, the agricultural sector's consolidation and focus on efficiency highlight the pressure on these "Dog" segments. Cargill's strategic divestitures or restructuring of underperforming units aim to free up capital for more promising ventures, aligning with broader industry trends towards optimization.

These underperforming areas, potentially including some niche commodity trading desks or older processing facilities, are characterized by stagnant revenue and high operational costs. Their limited competitive advantage means they are unlikely to benefit from market growth, making them prime candidates for strategic review and potential exit.

Cargill's ongoing portfolio management, which includes divesting less strategic assets, directly addresses the presence of these "Dog" segments. The company's commitment to investing in high-growth areas like digital agriculture and sustainable food solutions underscores the rationale for shedding low-return businesses.

| Cargill Business Segment Example (Hypothetical Dog) | Market Growth Rate (Estimated 2024) | Market Share (Estimated 2024) | Profitability Trend | Strategic Consideration |

|---|---|---|---|---|

| Specialty Industrial Lubricants (Mature Market) | 1-2% | <5% | Declining | Divestment or Restructuring |

| Legacy Grain Trading Desk (Highly Competitive) | 0-1% | <3% | Thin Margins | Consolidation or Niche Focus |

| Outdated Crop Processing Facility (Low Demand) | -1-0% | <2% | Negative | Closure or Sale |

Question Marks

Cargill's investment in 3D-printed plant-based foods, exemplified by its backing of companies like Cocuus, places these products squarely in the question mark category of the BCG matrix. This segment represents a high-growth, but currently low-market-share arena, demanding significant R&D and consumer acceptance efforts. For instance, the global 3D food printing market was valued at approximately $500 million in 2023 and is projected to reach over $2 billion by 2030, indicating the substantial growth potential Cargill is targeting.

Cargill's investments in cultivated meat companies like Aleph Farms and Upside Foods place these ventures squarely in the question mark category of the BCG matrix. This segment represents high-growth potential but currently holds minimal market share, requiring significant investment for development and scaling.

The cultivated meat market, while nascent, is projected for substantial growth. For instance, Upside Foods secured $165 million in a Series B funding round in 2022, signaling investor confidence in the sector's future. However, widespread consumer adoption and regulatory approvals remain key hurdles for these innovative products.

Cargill's investment in novel aquafeed ingredients like insect protein and single-cell proteins positions these as potential stars within its BCG matrix. These ingredients, while currently representing a small portion of the market, are experiencing rapid growth due to aquaculture's demand for sustainable and efficient feed alternatives. For instance, the global insect protein market for animal feed was valued at approximately $440 million in 2023 and is projected to reach over $4 billion by 2030, showcasing this segment's significant upward trajectory.

Emerging Bioindustrial Applications (e.g., Semiconductors)

Cargill's exploration into emerging bioindustrial applications, such as advanced materials for semiconductors, positions them in a high-potential, yet nascent, market. This strategic direction, exemplified by their partnership with Arizona State University, suggests a significant investment in research and development for specialized bio-based solutions.

These ventures are characteristic of a 'Question Mark' in the BCG matrix, indicating substantial growth prospects but also considerable risk and an uncertain path to profitability. The semiconductor industry, for instance, is projected to reach $1 trillion by 2030, creating a compelling, albeit competitive, landscape for bio-innovations.

- High Growth Potential: The semiconductor market's rapid expansion offers fertile ground for novel bio-based materials.

- Low Market Share: Cargill's current position in this specialized niche is likely minimal, reflecting the early stage of their involvement.

- High Risk & Investment: Developing new materials for semiconductors requires substantial R&D funding and faces significant technical hurdles.

- Long-Term Viability: Commercial success is contingent on overcoming these challenges and achieving market acceptance, a process that can take many years.

New Market Entries for PetMaster Brand in China

Cargill's PetMaster brand in China represents a classic 'Question Mark' in the BCG matrix. The recent launch of a state-of-the-art pet food plant in China, specifically targeting the burgeoning fresh meat pet food segment, signifies a strategic move into a high-growth potential market. This aligns with the increasing pet ownership and spending in China, with the pet food market projected to reach approximately $23 billion by 2025, according to industry reports.

However, PetMaster is a new entrant facing intense competition from well-established domestic and international brands. Significant investment will be required to build brand awareness, establish robust distribution networks, and capture market share. This necessitates a careful evaluation of whether to invest further to turn these 'Question Marks' into 'Stars' or to divest if market penetration proves too challenging.

- Market Potential: China's pet food market is experiencing rapid growth, driven by rising disposable incomes and a growing pet population, with fresh pet food being a particularly strong sub-segment.

- Investment Needs: substantial capital is required for marketing, sales infrastructure, and product development to compete effectively against established players.

- Competitive Landscape: PetMaster faces competition from brands like Royal Canin, Hill's Science Diet, and domestic players such as Pedigree and Whiskas, which have strong brand recognition and distribution.

- Strategic Decision: Cargill must decide whether to commit significant resources to gain market share or consider alternative strategies given the high investment and competitive intensity.

Question Marks in Cargill's portfolio represent areas with high growth potential but currently low market share, demanding significant investment and strategic focus. These are often new ventures or emerging technologies where market acceptance and competitive positioning are still being established. Cargill must carefully analyze these segments to determine if they warrant further investment to become future stars.

These ventures often require substantial capital for research, development, and market penetration. Success hinges on navigating technological hurdles, regulatory landscapes, and evolving consumer preferences. The decision to invest heavily or divest is critical for optimizing the company's overall portfolio performance.

For example, Cargill's investments in cultivated meat and novel aquafeed ingredients are prime examples of Question Marks. The cultivated meat market, while experiencing rapid growth, is still in its infancy, facing challenges in scaling production and gaining widespread consumer trust. Similarly, insect and single-cell proteins for aquafeed are innovative solutions for a growing aquaculture industry, but their market share is still developing.

The company's foray into bio-based materials for semiconductors also falls into this category, targeting a high-growth industry with specialized, nascent bio-innovations. Each of these represents a calculated risk with the potential for significant future returns if market challenges are successfully overcome.

| Segment | Market Growth Potential | Current Market Share | Investment Required | Key Challenges |

| 3D-Printed Plant-Based Foods | High | Low | High | Consumer acceptance, scaling production |

| Cultivated Meat | Very High | Negligible | Very High | Regulatory approval, cost reduction, consumer acceptance |

| Novel Aquafeed Ingredients (Insect/Single-Cell Protein) | High | Low | Moderate to High | Scalability, cost-competitiveness, regulatory hurdles |

| Bio-based Semiconductor Materials | Very High | Negligible | Very High | Technological development, market adoption, competition |

| PetMaster (China) | High | Low | High | Brand building, distribution, intense competition |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.