Cargill Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cargill Bundle

Discover how Cargill leverages its diverse product portfolio, competitive pricing, extensive global distribution, and integrated promotional strategies to maintain its market leadership. Understand the synergy between these elements and how they contribute to their overall success.

Go beyond the surface-level understanding of Cargill's marketing. Our comprehensive 4Ps analysis provides actionable insights into their product innovation, pricing architecture, channel management, and communication tactics, offering a strategic blueprint for your own business endeavors.

Save valuable time and gain a competitive edge. This ready-to-use, editable report offers a deep dive into Cargill's marketing mix, complete with real-world examples and structured analysis, perfect for students, professionals, and consultants seeking strategic intelligence.

Product

Cargill's product strategy centers on a vast global network for sourcing, processing, and distributing essential agricultural commodities like corn, soybeans, wheat, and sugar. They transform these raw goods into vital food ingredients, including vegetable oils, sweeteners, and starches, which are crucial for food and beverage producers. This broad product offering underscores Cargill's integral position within the worldwide food system.

In 2023, Cargill reported revenue of $170 billion, a testament to the sheer volume and diversity of its agricultural commodity and ingredient business. The company's commitment to innovation is evident in its development of specialized ingredients, such as high-stability oils and texturizing starches, catering to evolving consumer demands for healthier and more convenient food options.

Cargill's Animal Nutrition and Health division offers a wide array of products, from specialized feed additives and premixes to vital health solutions for both livestock and aquaculture. This extensive portfolio is designed to enhance animal well-being and boost productivity through precision nutrition strategies. The company's commitment to sustainability is a core element of these offerings, addressing the growing demand for responsible animal agriculture.

In 2024, this critical segment of Cargill's business achieved approximately $20 billion in revenue. This substantial financial performance underscores the division's significant market share and its ability to adapt and deliver value in the dynamic animal health and nutrition sector.

Cargill's bioindustrial and renewable solutions extend its reach far beyond traditional food and feed markets. This segment focuses on developing and supplying bio-based materials, ethanol, and other environmentally friendly alternatives. By offering these sustainable options, Cargill is tapping into a significant and growing demand from industries actively seeking to reduce their carbon footprint and embrace greener practices.

This strategic focus is exemplified by innovations like WindWings, a project aimed at decarbonizing commercial shipping. These advanced rotor sails can significantly reduce fuel consumption and emissions for large vessels. In 2024, the shipping industry continues to face intense pressure to meet emissions targets, making solutions like WindWings increasingly attractive and vital for the sector's sustainability goals.

Food and Beverage Solutions for Consumers and Foodservice

Cargill's product strategy in the food and beverage sector is broad, encompassing everything from traditional meats and poultry to innovative alternative proteins for both consumers and foodservice. They're investing heavily in areas like plant-based options, targeting a significant expansion in the precision fermented market, with a goal of 40% growth by 2030. This focus aims to enhance taste, texture, and nutritional profiles to meet evolving consumer demands.

Key product areas and strategic initiatives include:

- Diversified Portfolio: Offering a wide range of ingredients and finished products for manufacturers, foodservice, and retail.

- Alternative Proteins: Significant investment in plant-based and other novel protein sources.

- Precision Fermentation Growth: Aiming for 40% market growth by 2030 in this innovative sector.

- Consumer-Centric Innovation: Prioritizing improvements in taste, texture, and nutritional value across their product lines.

Financial and Risk Management Services

Cargill's product strategy extends beyond agricultural commodities to encompass vital financial and risk management services, specifically tailored for its commodity trading clientele. These offerings are designed to equip customers with the necessary tools and strategies to effectively manage price fluctuations and reduce exposure to the inherent risks within agricultural markets.

This integrated approach underscores Cargill's commitment to providing comprehensive support, going beyond the mere supply of physical goods to foster resilience and stability for its varied customer base. For instance, in 2024, Cargill's commodity trading divisions reported significant engagement with clients utilizing these financial tools to hedge against projected price volatility in key markets like corn and soybeans, which experienced notable swings throughout the year.

- Price Risk Management: Providing hedging instruments and market insights to protect against adverse price movements.

- Financial Solutions: Offering tailored financing and credit options to support trading activities.

- Market Intelligence: Delivering data-driven analysis to inform trading decisions and risk assessments.

Cargill's product strategy is a multifaceted approach, leveraging its vast agricultural network to offer a diverse range of ingredients, animal nutrition solutions, and bioindustrial products. The company actively innovates in areas like alternative proteins and precision fermentation, aiming for significant market growth. Furthermore, Cargill provides essential financial and risk management services to its commodity trading clients, enhancing market stability.

| Product Category | Key Offerings | 2023/2024 Data/Focus |

|---|---|---|

| Agricultural Commodities & Ingredients | Corn, soybeans, wheat, sugar, vegetable oils, sweeteners, starches | $170 billion revenue (2023); innovation in specialized ingredients |

| Animal Nutrition & Health | Feed additives, premixes, health solutions | Approx. $20 billion revenue (2024); focus on precision nutrition and sustainability |

| Bioindustrial & Renewable Solutions | Bio-based materials, ethanol, WindWings technology | Focus on decarbonizing shipping and reducing carbon footprints |

| Food & Beverage Sector | Meats, poultry, alternative proteins, plant-based options | Targeting 40% growth in precision fermentation by 2030; enhancing taste and nutrition |

| Financial & Risk Management | Price risk management, financial solutions, market intelligence | Supporting clients in managing price volatility for key commodities like corn and soybeans in 2024 |

What is included in the product

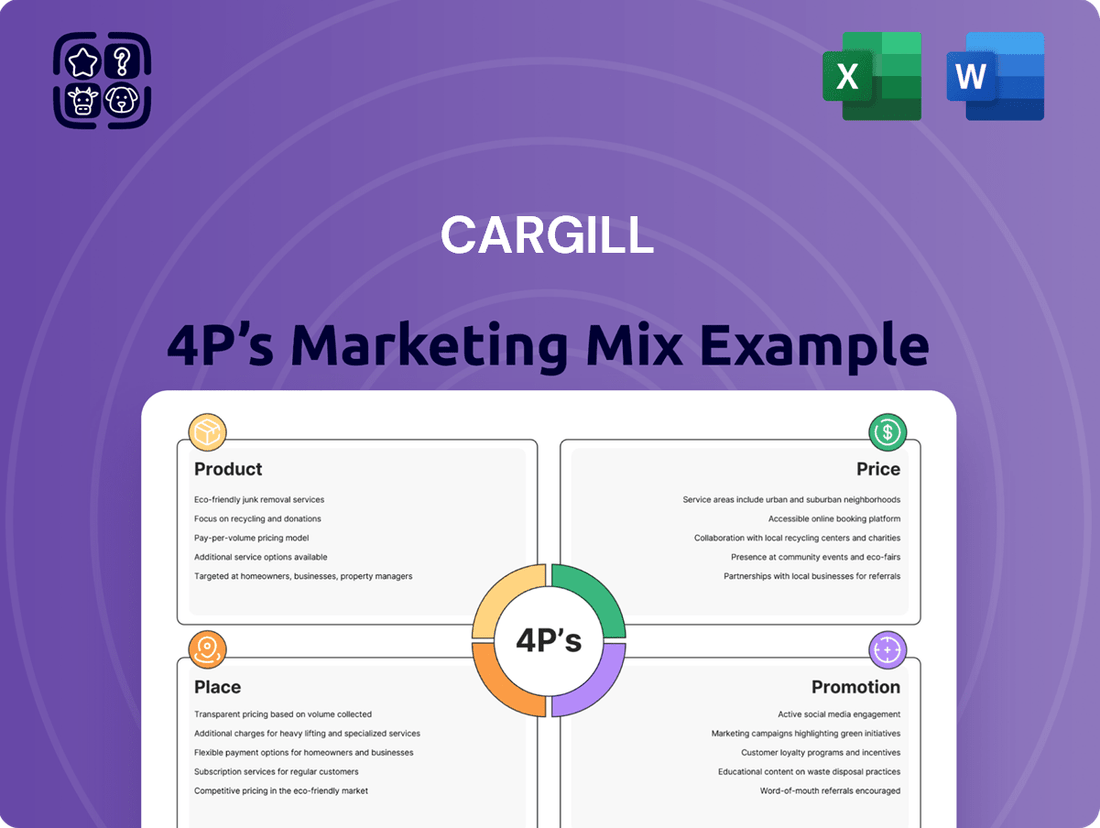

This analysis provides a comprehensive examination of Cargill's marketing strategies across Product, Price, Place, and Promotion, offering actionable insights for strategic planning.

It delves into Cargill's real-world marketing practices and competitive positioning, making it an invaluable resource for understanding their market approach.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of information overload for busy executives.

Provides a clear, concise overview of Cargill's 4Ps, easing the burden of understanding and communicating their marketing approach.

Place

Cargill's global sourcing and distribution network is a cornerstone of its market presence, reaching into 70 countries and serving 125 markets. This vast infrastructure ensures efficient access to agricultural commodities and finished goods, linking producers with consumers across the globe. In North America alone, Cargill maintained 196 facilities as of early 2024, underscoring its significant operational footprint and logistical capabilities.

Cargill's commitment to its Place strategy is evident in its continuous investment in and expansion of global storage and processing facilities. For instance, its acquisition of soy storage and crushing facilities in South America, including significant operations in Brazil, bolsters its capacity to handle and transform agricultural commodities. These infrastructure developments are vital for improving market access for producers and reinforcing Cargill's position in international agricultural trade.

Cargill's distribution strategy leans heavily on its direct sales force, particularly for its business-to-business (B2B) dealings. This direct engagement is key to building lasting client partnerships, offering tailored solutions, expert technical assistance, and valuable market intelligence.

In 2024, Cargill saw more than 70% of its income stem from B2B transactions, highlighting the critical role of these direct relationships in its overall success.

Strategic Distribution Partnerships

Cargill leverages strategic distribution partnerships to amplify its market presence and optimize its supply chain for a vast array of food ingredients. These collaborations are crucial for penetrating diverse global markets, ensuring efficient delivery, and elevating customer satisfaction. For instance, in 2024, Cargill's ongoing commitment to expanding its ingredient distribution network saw it solidify agreements with key regional players across North America and Europe, aiming to reach an additional 15% of small to medium-sized food manufacturers by year-end.

These alliances are instrumental in navigating the complexities of international trade, facilitating deeper market penetration, and delivering superior customer service. By working with established distributors, Cargill ensures its products reach a wider customer base more effectively. This strategy directly contributes to their expansive reach within the food ingredient sector and bolsters overall revenue streams.

Key aspects of Cargill's strategic distribution partnerships include:

- Expanded Market Access: Partnerships enable Cargill to reach new geographic regions and customer segments that might be difficult to access directly, particularly in emerging markets.

- Supply Chain Efficiency: Collaborating with distributors streamlines logistics, reduces lead times, and lowers transportation costs, enhancing the overall efficiency of ingredient delivery.

- Enhanced Customer Service: Local distributors often provide tailored support, technical assistance, and faster response times, improving the end-customer experience.

- Risk Mitigation: Sharing distribution responsibilities can also help mitigate risks associated with market volatility and logistical challenges in different regions.

Innovation Centers and Local Presence

Cargill's commitment to innovation is evident in its strategically located innovation centers, such as the recently transformed hub in Singapore. These facilities are crucial for developing products that resonate with specific regional tastes and demands, ensuring market relevance.

The company also operates a global innovation center in China, specifically targeting the livestock industry. This dual approach, combining localized development with global reach, allows Cargill to address diverse market needs effectively. For instance, in 2024, Cargill continued to invest in these centers, aiming to accelerate the launch of new food ingredients and solutions, reflecting a significant portion of its research and development budget.

- Singapore Innovation Center: Focuses on developing food and beverage solutions for the Asia-Pacific region, leveraging local consumer insights.

- China Livestock Innovation Center: Dedicated to advancing animal nutrition and health solutions for the rapidly growing Chinese market.

- Customer Collaboration: These centers foster direct collaboration with local customers, leading to co-created products and stronger partnerships.

- Market Responsiveness: By being physically present and investing in regional R&D, Cargill ensures its offerings are finely tuned to local preferences and regulatory environments.

Cargill's "Place" strategy is deeply rooted in its expansive global infrastructure, allowing it to serve 125 markets with operations in 70 countries as of early 2024. This network, featuring 196 facilities in North America alone, ensures efficient sourcing and distribution of agricultural products. Strategic investments in storage and processing, like those in Brazil, enhance its ability to manage commodities and connect producers with consumers worldwide.

What You See Is What You Get

Cargill 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This Cargill 4P's Marketing Mix Analysis is fully complete and ready for your immediate use. You're viewing the exact version of the analysis you'll receive, ensuring you know precisely what you're buying.

Promotion

Cargill leverages agribusiness branding and corporate communications to cultivate a distinct identity centered on sustainable agriculture and addressing evolving consumer demands. Their outreach consistently highlights a dedication to nourishing the world safely, responsibly, and sustainably, underscoring their 159 years of industry leadership and a clear purpose-driven mission.

In 2024, Cargill continued to emphasize its role in the global food system, aiming to build trust through transparent communication about its supply chains and sustainability initiatives. This focus is crucial as the company navigates a landscape where consumers increasingly seek assurance regarding the origin and environmental impact of their food.

Cargill's promotional efforts heavily lean on sustainable agriculture marketing and robust farmer outreach. Their Cargill RegenConnect platform is a prime example, offering farmers crucial resources and training to adopt climate-smart practices. This focus not only enhances soil health and boosts productivity but also cultivates enduring partnerships.

Cargill actively uses digital marketing to connect with customers worldwide, employing sophisticated strategies to highlight agricultural product advantages and foster brand loyalty. Their global campaigns, often featuring digital components, aim to communicate unique product benefits effectively.

Public Relations and Impact Reporting

Cargill leverages public relations through various channels, including press releases and news updates, to communicate its corporate initiatives. Their commitment to transparency is further demonstrated through detailed impact reports.

The company's 2024 ESG and Impact Report showcases progress on key sustainability targets. For instance, it details a reduction in absolute Scope 1 and 2 greenhouse gas emissions by 24% against a 2017 baseline, exceeding their initial goal. They also reported investing $100 million in nature-based solutions and regenerative agriculture practices in 2024.

- Community Engagement: Cargill's 2024 report highlights programs that supported over 1.5 million farmers in adopting sustainable practices.

- Environmental Stewardship: The company achieved a 15% reduction in water intensity across its operations compared to 2020.

- Social Responsibility: Cargill reported a 90% employee participation rate in volunteer activities focused on food security and community development.

- Supply Chain Transparency: Efforts to enhance traceability in key supply chains, such as palm oil and soy, were detailed, with 98% of sourced palm oil now certified sustainable.

Participation in Industry Events and Collaborations

Cargill actively engages in key industry events, such as the China International Supply Chain Expo (CISCE), to highlight its comprehensive supply chain capabilities and end-to-end strength. This participation allows them to connect with stakeholders and demonstrate their market presence.

Collaborations are a cornerstone of Cargill's strategy. For instance, their partnership with PepsiCo focuses on advancing sustainable agriculture practices, a critical area for the future of food production. In 2023, Cargill announced a significant investment of $50 million in a new corn processing facility in Illinois, underscoring their commitment to expanding operations and innovation within the agricultural sector.

Further solidifying their commitment to innovation, Cargill partners with universities on agricultural research. These academic collaborations are vital for developing new technologies and improving farming methods. For example, their ongoing research with the University of Minnesota aims to enhance crop resilience and reduce environmental impact, aligning with global sustainability goals.

These strategic engagements and partnerships underscore Cargill's dedication to leadership and innovation within the agricultural and food industries.

- Industry Event Presence: Participation in major events like CISCE showcases Cargill's full-chain strength in supply chain solutions.

- Strategic Collaborations: Partnerships with companies like PepsiCo drive advancements in sustainable agriculture.

- Research Partnerships: Collaborations with universities foster agricultural innovation and research.

- Investment in Growth: Cargill's $50 million investment in a new Illinois facility in 2023 demonstrates ongoing commitment to operational expansion and technological advancement.

Cargill's promotion strategy centers on building trust and showcasing its commitment to sustainability and innovation. They highlight their role in the global food system through transparent communication about supply chains and environmental initiatives, aiming to connect with a global audience increasingly focused on responsible sourcing.

Their 2024 ESG and Impact Report reveals significant achievements, including a 24% reduction in Scope 1 and 2 GHG emissions against a 2017 baseline and a $100 million investment in nature-based solutions in 2024. These figures underscore their dedication to environmental stewardship and regenerative agriculture.

Cargill actively engages in industry events and forms strategic partnerships, such as with PepsiCo for sustainable agriculture advancements and universities for agricultural research. These collaborations, alongside a $50 million investment in a new Illinois facility in 2023, demonstrate their commitment to growth and innovation.

| Promotional Focus | Key Initiatives/Data | Impact/Reach |

|---|---|---|

| Sustainable Agriculture | Cargill RegenConnect platform; $100M investment in nature-based solutions (2024) | Supports farmers in adopting climate-smart practices |

| Corporate Communications | ESG & Impact Report; Transparency in supply chains | 24% reduction in Scope 1 & 2 GHG emissions (vs. 2017 baseline) |

| Partnerships & Events | PepsiCo collaboration; University research; CISCE participation | $50M investment in Illinois facility (2023); 1.5M+ farmers supported (2024) |

Price

Cargill utilizes a value-based pricing strategy for its extensive portfolio of food ingredients and animal nutrition products. This means prices are determined by the benefits and value customers receive, not just the cost of production.

This customer-centric approach allows Cargill to capture more value by aligning its pricing with what customers perceive as worthwhile. For instance, specialized ingredients offering enhanced shelf-life or improved nutritional profiles command higher prices, reflecting their direct impact on the customer's end product and brand reputation.

This strategy has demonstrably benefited Cargill, reportedly leading to improved profit margins. By focusing on the value delivered, Cargill can differentiate its offerings and secure premium pricing in competitive markets, as seen in their strong performance in the global animal feed sector, which saw significant growth in 2024.

Cargill's flexible pricing contracts are crucial for managing the inherent volatility in commodity markets. For instance, in early 2024, agricultural commodity prices experienced significant swings due to geopolitical events and weather patterns, making predictable pricing a valuable service.

These solutions, like forward contracts and managed pricing options, allow farmers and traders to lock in prices, thereby reducing exposure to adverse market movements. This proactive risk management is essential for maintaining stable revenues and operational continuity in a fluctuating economic landscape.

In the intensely competitive agricultural commodity sector, Cargill's pricing is a delicate balancing act. They closely monitor global supply and demand trends, keeping a keen eye on what competitors are charging. Economic conditions also play a significant role in shaping their pricing decisions.

Despite the pressure for aggressive pricing, Cargill leverages its immense scale and operational efficiencies. This allows them to offer competitive prices while still maintaining a robust market presence, even when facing market volatility or economic headwinds.

For instance, in the first half of 2024, global soybean prices experienced fluctuations driven by weather patterns in key producing regions and strong demand from importing nations. Cargill's ability to secure supply at favorable terms and manage logistics efficiently enabled them to price competitively against other major traders during this period.

Pricing Reflecting Sustainability and Innovation

Cargill's pricing strategy increasingly incorporates the value derived from its commitment to sustainability and innovation. Products developed through regenerative agriculture or those demonstrating a reduced environmental impact can command premium pricing, aligning with growing market demand for eco-conscious solutions.

This approach is supported by market trends. For instance, a 2024 report indicated that over 60% of consumers are willing to pay more for products from brands with strong sustainability commitments. Cargill's investments in areas like traceable supply chains and lower-emission feed additives for livestock are examples of innovations that can justify these enhanced price points.

- Premium for Regenerative Agriculture: Products sourced from farms employing regenerative practices often carry a higher price due to the associated costs and enhanced environmental benefits.

- Innovation-Driven Pricing: Cargill's development of novel, sustainable ingredients or processing methods can enable premium pricing, reflecting the R&D investment and unique value proposition.

- Consumer Demand for Sustainability: Market data from 2024 shows a significant consumer willingness to pay more for sustainable goods, validating this pricing strategy.

- Reduced Environmental Footprint: Products with demonstrably lower carbon emissions or water usage can be priced higher, appealing to environmentally aware B2B and B2C customers.

Global Market Dynamics and Economic Conditions

Cargill’s pricing strategy is deeply intertwined with the ebb and flow of global markets. Factors like geopolitical tensions, evolving consumer demographics, and volatile economic and environmental landscapes directly influence their cost structures and, consequently, their product prices. For example, the agricultural sector experienced significant headwinds in 2024, with declining crop prices and squeezed processing margins impacting companies like Cargill. This environment necessitates constant strategic recalibration to manage costs effectively and stay competitive.

These market pressures translate into tangible impacts on Cargill's financial performance and pricing decisions. The company’s ability to maintain competitive pricing hinges on its operational efficiency and its capacity to navigate these complex global forces.

- Geopolitical Instability: Conflicts and trade disputes can disrupt supply chains and inflate input costs, forcing price adjustments.

- Demographic Shifts: Changing population growth and urbanization patterns influence demand for specific food products, impacting pricing power.

- Economic Fluctuations: Inflation, currency exchange rates, and consumer purchasing power directly affect the affordability and pricing of Cargill’s diverse product portfolio.

- Environmental Factors: Climate change, weather patterns, and resource availability significantly impact agricultural yields, driving commodity price volatility and influencing final product pricing.

Cargill's pricing reflects a value-based approach, aligning costs with customer-perceived benefits and market competitiveness. The company actively manages price volatility through flexible contracts, a crucial strategy given market fluctuations observed throughout 2024, such as the swings in soybean prices.

This strategic pricing allows Cargill to command premiums for innovative and sustainable offerings, a trend supported by 2024 consumer data showing a willingness to pay more for eco-conscious products. Their ability to leverage scale and operational efficiencies ensures competitive pricing even amidst economic headwinds and geopolitical instability impacting global commodity markets.

| Pricing Strategy Element | Description | 2024/2025 Relevance |

|---|---|---|

| Value-Based Pricing | Prices set based on customer-perceived value and benefits. | Drives premium pricing for specialized ingredients and sustainable products. |

| Flexible Contracts | Offers forward contracts and managed pricing to mitigate commodity price volatility. | Essential for stability given 2024 market swings in agricultural commodities. |

| Sustainability & Innovation | Premium pricing for products with reduced environmental impact or novel features. | Supported by 2024 consumer trends; over 60% willing to pay more for sustainable goods. |

| Competitive Benchmarking | Prices are set considering competitor pricing, supply/demand, and economic conditions. | Key to maintaining market share amidst 2024's challenging agricultural sector dynamics. |

4P's Marketing Mix Analysis Data Sources

Our Cargill 4P's Marketing Mix Analysis leverages a comprehensive blend of primary and secondary data. This includes internal company reports, sales data, and customer feedback, alongside external market research, competitor analysis, and industry trend reports.