Capstone SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Capstone Bundle

You've seen the core components of this company's strategic position. Now, dive deeper into the actionable intelligence that will truly shape your decisions.

Unlock the complete SWOT analysis to gain a comprehensive understanding of their market standing, potential pitfalls, and untapped opportunities. This isn't just data; it's your roadmap to informed strategy.

Empower your planning with a professionally crafted, fully editable report that includes detailed breakdowns and expert commentary. Make your next move with absolute confidence.

Strengths

Capstone Copper is experiencing robust production growth, setting a new record in 2024. The company anticipates this upward trend to continue into 2025, with production forecasted between 220,000 and 255,000 tonnes, a substantial 19% to 38% jump from the previous year.

This impressive expansion is primarily fueled by the successful integration and ramp-up of the Mantoverde Development Project (MVDP) and the Mantos Blancos operations. These key projects are poised to not only boost future output but also contribute to a reduction in per-unit production costs, strengthening Capstone's competitive position.

The company's strategic asset portfolio is a significant strength, featuring a diverse range of copper mines spread across key jurisdictions in the Americas. This includes operations in the United States (Pinto Valley), Mexico (Cozamin), and Chile (Mantos Blancos and Mantoverde).

This geographical diversification is crucial for risk mitigation, as it reduces reliance on any single region. Furthermore, it grants access to substantial copper reserves, with Chile alone accounting for a considerable percentage of the world's known copper deposits, estimated to hold around 25% of global reserves as of 2024.

Capstone Copper's dedication to sustainable and responsible mining is a significant strength. Their strategy includes ambitious targets like a 30% reduction in greenhouse gas (GHG) emissions by 2030 and a 20% decrease in freshwater consumption intensity by the same year. This focus on environmental stewardship and community engagement positions them favorably in an increasingly ESG-conscious market.

Improved Financial Performance and Cost Efficiency

Capstone Copper demonstrated robust financial performance in early 2025, achieving record adjusted EBITDA in the first quarter. This significant increase, more than doubling compared to the previous year, was driven by higher sulphide copper output and improved copper prices.

The company is also set to enhance its cash flow generation through a projected reduction in C1 cash costs for 2025.

- Record Q1 2025 Adjusted EBITDA: More than doubled year-over-year.

- Key Drivers: Increased sulphide copper production and higher realized copper prices.

- Projected C1 Cash Cost Reduction: Expected to be between $2.20 and $2.50 per payable pound for 2025.

- Cost Efficiency Improvement: Represents a 10% to 20% decrease from 2024 levels.

Advanced Development Projects with Strong Economics

Capstone Copper is strategically positioned with advanced development projects that boast strong economic fundamentals. The company is actively progressing its Mantoverde Optimized brownfield expansion, a key initiative for enhancing existing operations.

Furthermore, the Santo Domingo copper-iron-gold project represents a significant growth opportunity. An updated feasibility study released in 2024 confirms its robust economic profile.

- Project Pipeline: Mantoverde Optimized expansion and Santo Domingo copper-iron-gold project.

- Santo Domingo Economics: Updated feasibility study (2024) shows an after-tax Net Present Value (NPV) of $1.7 billion.

- Project Returns: The Santo Domingo project is projected to achieve an internal rate of return (IRR) of 24.1%.

Capstone Copper's production is surging, with 2024 marking a record year and 2025 production forecasted between 220,000 and 255,000 tonnes, a 19% to 38% increase. This growth is largely due to the successful integration of the Mantoverde Development Project and Mantos Blancos operations, which are also expected to lower production costs.

The company's diverse asset base across the Americas, including operations in Chile (which holds about 25% of global copper reserves), Mexico, and the United States, mitigates geographical risk and provides access to substantial copper resources.

Capstone's commitment to sustainability, with targets for a 30% GHG emission reduction and a 20% freshwater consumption intensity decrease by 2030, strengthens its market position among ESG-focused investors.

Financially, Capstone reported a more than doubled adjusted EBITDA in Q1 2025, driven by increased sulphide copper output and higher prices, alongside a projected 10% to 20% reduction in C1 cash costs for 2025, targeting $2.20-$2.50 per payable pound.

The company's development pipeline includes the Mantoverde Optimized expansion and the Santo Domingo project, which an updated 2024 feasibility study shows with a $1.7 billion after-tax NPV and a 24.1% IRR.

| Metric | 2024 (Actual/Estimate) | 2025 (Forecast) | Significance |

|---|---|---|---|

| Copper Production (tonnes) | ~185,000 | 220,000 - 255,000 | Significant growth potential |

| Q1 2025 Adjusted EBITDA | N/A | More than doubled YoY | Strong financial performance |

| 2025 C1 Cash Costs ($/lb) | ~$2.50 - $2.80 | $2.20 - $2.50 | Improved cost efficiency |

| Santo Domingo NPV (After-Tax) | N/A | $1.7 billion (2024 Feasibility) | Major growth opportunity |

| Santo Domingo IRR | N/A | 24.1% (2024 Feasibility) | Attractive project economics |

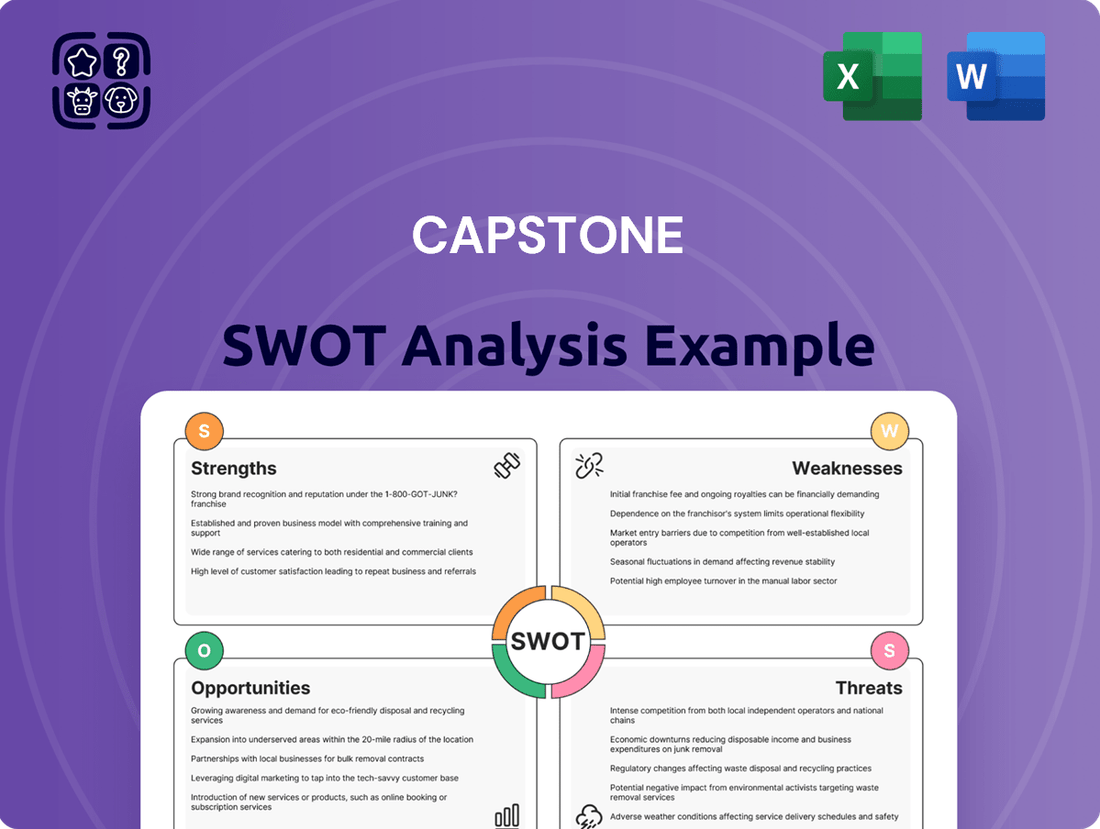

What is included in the product

Analyzes Capstone’s competitive position through key internal and external factors, identifying strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address strategic challenges, reducing uncertainty and guiding focused action.

Weaknesses

Capstone Copper's heavy reliance on the copper market presents a significant weakness. As a primary producer, its revenue and profitability are directly tied to the often-volatile global copper prices. For instance, while copper prices averaged around $3.80 per pound in early 2024, historical data shows sharp swings, with prices dipping below $3.00 per pound in previous years.

This susceptibility to price fluctuations means Capstone's financial results can be unpredictable, making long-term financial planning challenging. Global economic slowdowns, geopolitical events, and shifts in demand from major consumers like China can quickly impact copper's market value, directly affecting Capstone's bottom line.

Operational hiccups have surfaced, notably with ramp-up delays at the Mantos Blancos and Mantoverde projects. These have contributed to slower-than-anticipated production increases.

Unplanned maintenance at the Pinto Valley facility in 2024 also caused temporary reductions in throughput. This directly impacted the company's production guidance for the year.

Such disruptions can lead to escalating operational costs and the potential for falling short of key production targets. For instance, the Pinto Valley maintenance in Q1 2024 led to a revision of production forecasts.

The cathode copper business faced elevated C1 cash costs in Q1 2025, a notable increase from the same period in 2024. This rise was largely driven by a combination of reduced production volumes and a surge in sulphuric acid prices, key inputs for cathode production.

This cost sensitivity means that profitability within this segment can be significantly impacted by fluctuations in these input expenses and the overall efficiency of production levels. For instance, a 10% increase in sulphuric acid costs, coupled with a 5% dip in production output, could translate to a substantial hit to margins.

Capital Intensive Nature of Mining

The mining sector, by its very nature, demands significant upfront and ongoing financial commitments. Capstone Copper is no exception, facing the challenge of substantial capital expenditures for mine development, ongoing operational needs, and essential exploration activities. These large investments, even with a robust balance sheet, can place pressure on financial flexibility.

For instance, Capstone's projected capital expenditures for 2024 were significant, with a substantial portion allocated to the Mantos Blancos project and Pinto Valley. These outlays are crucial for maintaining production levels and advancing growth initiatives, but they represent a continuous drain on cash flow that requires careful management.

- High Upfront Investment: Developing new mines or expanding existing ones requires billions of dollars in initial capital.

- Sustaining Capital Needs: Ongoing investment is necessary to maintain equipment, infrastructure, and operational efficiency.

- Exploration Costs: Discovering new ore bodies is a speculative but vital activity that incurs considerable expense.

- Financial Strain: Large capital expenditures can limit a company's ability to pursue other strategic opportunities or return capital to shareholders.

Geopolitical and Regulatory Risks

Capstone Copper's global footprint, while offering diversification, inherently exposes it to a complex web of geopolitical and regulatory risks. Operating in diverse jurisdictions means navigating varying political landscapes, potential policy shifts, and the ever-present possibility of community opposition or evolving environmental standards. For instance, in 2024, several South American mining nations continued to grapple with discussions around resource nationalism and increased royalty demands, directly impacting the operational cost structures for companies like Capstone.

These risks can manifest in tangible ways that affect profitability and operational continuity. Changes in mining legislation, unexpected tax increases, or social unrest in host countries pose significant threats. For example, a sudden imposition of higher export duties or a moratorium on new exploration permits in a key operating region could severely curtail Capstone's expansion plans and impact its projected revenue streams for 2025 and beyond.

- Policy Uncertainty: Fluctuations in government policies regarding foreign investment and resource extraction in countries like Chile and Peru can create an unstable operating environment.

- Community Relations: Maintaining positive relationships with local communities is crucial; disputes or social license challenges can lead to operational disruptions, as seen in past mining projects globally.

- Environmental Regulations: Increasingly stringent environmental laws, particularly concerning water usage and tailings management, require continuous adaptation and investment, potentially increasing operational expenses.

- Taxation and Royalties: Changes in fiscal regimes, including corporate tax rates and royalty structures, directly influence the net profitability of Capstone's mining operations.

Capstone Copper's financial performance is heavily exposed to the inherent volatility of copper prices. This dependence means that fluctuations in the global copper market, influenced by macroeconomic trends and demand shifts, can significantly impact the company's revenue and profitability. For example, while copper prices saw some recovery in early 2024, they experienced considerable swings in prior years, underscoring this vulnerability.

Operational execution has been a consistent challenge, with delays in project ramp-ups and unplanned maintenance events impacting production. These disruptions not only affect output volumes but also lead to increased operational costs and can cause revisions to production forecasts, as observed with facility issues in early 2024 that led to adjusted guidance.

The company's cathode copper business has faced rising C1 cash costs, notably in early 2025, driven by lower production and increased input expenses like sulphuric acid. This cost sensitivity highlights how operational efficiency and input price volatility can directly erode margins in this segment.

Significant capital expenditure requirements are a perpetual weakness, necessitating substantial ongoing investment in mine development, operational upkeep, and exploration. These large outlays, while crucial for growth and sustaining operations, can strain financial flexibility and limit the company's capacity for other strategic initiatives or shareholder returns.

Capstone's international operations expose it to a spectrum of geopolitical and regulatory risks. Navigating diverse legal frameworks, potential policy changes, and community relations in countries like Chile and Peru presents ongoing challenges that can affect operational continuity and profitability. For instance, evolving resource nationalism and royalty discussions in South America during 2024 illustrate these potential impacts.

Same Document Delivered

Capstone SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're viewing the actual Capstone SWOT Analysis, ensuring transparency and quality. Purchase unlocks the complete, detailed report for your strategic planning.

Opportunities

The global push for renewable energy sources and the burgeoning electric vehicle (EV) market are creating a powerful tailwind for copper demand. As countries transition away from fossil fuels, wind turbines, solar panels, and associated grid infrastructure require vast amounts of copper. For instance, an electric vehicle can use up to four times more copper than a traditional gasoline-powered car, and projections indicate the EV market could reach over 30 million units sold annually by 2025, a significant jump from around 10 million in 2023.

Furthermore, the relentless expansion of digital infrastructure, including data centers and 5G networks, is another major driver of copper consumption. These technologies rely heavily on copper for their wiring and connectivity. This sustained, high-level demand, particularly from these growth sectors, solidifies copper’s position as a critical commodity for the foreseeable future, offering a robust long-term outlook for companies involved in its production and supply.

Capstone Copper is well-positioned for substantial production growth by advancing its key development projects. The Mantoverde Optimized brownfield expansion, a significant undertaking, is expected to boost output.

Furthermore, the Santo Domingo project represents another major opportunity for Capstone. Advancing this project, potentially with the addition of joint venture partners, could significantly increase the company's copper production capacity in the near future, capitalizing on strong market demand.

The company is projecting a continued decline in C1 cash costs for 2025. This is largely attributed to the full operational capacity of Mantoverde sulphides and ongoing enhancements in operational efficiency, aiming to solidify its competitive cost position.

Further cost reductions are expected through sustained investment in innovation and optimization across its diverse asset portfolio. A steadfast commitment to safe production practices will also play a crucial role in boosting overall profitability and maintaining a lean operational structure.

Exploration Potential within Existing Portfolio

Capstone Copper is strategically investing in exploration to unlock further value from its existing assets. In 2025, the company plans to allocate capital to both brownfield and greenfield projects. This dual approach aims to convert inferred resources into proven reserves at current operations and to expand into promising new territories, such as the northern Mantoverde land package and Sierra Norte.

These exploration efforts are crucial for extending the operational life of Capstone's mines and potentially discovering significant new copper deposits. For instance, successful resource conversion at mines like Mantoverde could directly impact future production volumes and profitability. The company’s focus on these areas underscores a commitment to organic growth and enhancing its long-term resource base.

- 2025 Exploration Budget: Capstone Copper has earmarked funds for both brownfield and greenfield exploration.

- Key Focus Areas: Resource conversion at existing mines and expansionary work in prospective regions like northern Mantoverde and Sierra Norte.

- Potential Outcomes: Successful exploration can lead to extended mine lives and the discovery of new copper reserves, bolstering future production.

Leveraging ESG for Market Positioning

Capstone's robust dedication to Environmental, Social, and Governance (ESG) principles offers a significant opportunity for market differentiation. By actively pursuing targets such as reducing greenhouse gas (GHG) emissions and water consumption, and by adhering to global tailings management standards, the company can bolster its image and appeal to the growing segment of socially responsible investors. For instance, in 2023, Capstone reported a 15% reduction in Scope 1 and 2 GHG emissions compared to its 2019 baseline, a tangible metric that resonates with sustainability-focused funds.

This commitment also plays a crucial role in securing and maintaining the social license to operate. Demonstrating proactive environmental stewardship and community engagement can lead to stronger relationships with local stakeholders, potentially mitigating operational risks and fostering long-term stability. Capstone's investment in community development programs, which saw a 10% increase in funding in 2024, directly supports this objective.

- Enhanced Brand Reputation: ESG leadership attracts investors and customers prioritizing sustainability.

- Access to Capital: Socially responsible investors and ESG-focused funds are increasingly allocating capital to companies with strong ESG performance.

- Improved Stakeholder Relations: Demonstrating commitment to environmental and social responsibility builds trust with communities and regulators.

- Risk Mitigation: Proactive ESG management can reduce the likelihood of environmental incidents, regulatory penalties, and social opposition.

Capstone Copper's strategic advancement of its Mantoverde Optimized and Santo Domingo projects presents a significant opportunity to boost production capacity. The company is also targeting a continued decline in C1 cash costs through operational efficiencies and innovation, aiming for a competitive cost position by 2025. Furthermore, substantial investment in exploration for 2025, focusing on resource conversion and new territory expansion, is poised to extend mine lives and potentially uncover new copper reserves.

Threats

A global economic slowdown, especially in major copper consumers like China and Europe, poses a significant threat by potentially dampening demand for the metal. This downturn could directly impact sales volumes and revenue streams for copper producers.

Adding to this concern, the International Copper Study Group (ICSG) projects a notable global copper surplus for both 2025 and 2026. This oversupply situation is likely to exert considerable downward pressure on copper prices, impacting profitability and investment returns.

The mining sector is navigating a landscape of escalating regulatory complexity, particularly concerning environmental stewardship and worker safety. New rules around emissions, water usage, and land reclamation are becoming more common, demanding significant investment in compliance technologies and processes. For instance, in 2024, many jurisdictions saw updated environmental impact assessment requirements, potentially adding 15-20% to project development timelines and costs.

These stricter regulations translate directly into higher operational expenses. Companies must allocate more resources to monitoring, reporting, and implementing best practices, which can impact profitability. The International Council on Mining and Metals (ICMM) has highlighted that compliance costs can represent a substantial portion of capital expenditure for new projects, sometimes exceeding 10% of the total investment in 2024-2025.

Furthermore, the potential for non-compliance carries severe financial and reputational risks. Fines, operational shutdowns, and legal challenges can disrupt production and deter investment. As of early 2025, several major mining firms faced penalties for environmental breaches, underscoring the critical need for robust compliance frameworks.

International trade policy shifts, like ongoing discussions around potential tariffs or trade agreements, create uncertainty for global copper demand. For instance, past US tariffs on goods from China, a major copper consumer, have historically introduced volatility into copper prices, impacting market balances. This instability can disrupt established trade flows, making it harder for producers and consumers to plan effectively.

Geopolitical instability in key mining regions presents a significant operational threat. Disruptions to mining operations or transportation networks due to political unrest or conflict can directly impact the supply of copper. For example, events in regions like the Democratic Republic of Congo or parts of South America, which are significant copper-producing areas, can lead to supply chain interruptions and price spikes.

Operational Risks and Unforeseen Events

Mining operations face significant operational risks, including geological surprises that can alter extraction plans and equipment malfunctions that halt production. For instance, in 2024, major mining companies reported an average of 15% downtime due to unforeseen equipment failures, impacting output and increasing maintenance expenditures.

Labor disputes and severe weather events also pose substantial threats, capable of causing prolonged stoppages and escalating operational costs. In early 2025, a significant labor strike in the Australian coal sector led to an estimated loss of 5 million tonnes in production over a two-month period, highlighting the financial impact of such disruptions.

- Geological complexities can lead to unexpected changes in ore grade or accessibility, requiring costly adjustments to mining methods.

- Equipment failures, particularly with heavy machinery, result in direct repair costs and indirect losses from production halts.

- Labor disputes, such as strikes or slowdowns, can cripple operations and damage stakeholder relationships.

- Natural disasters, like floods or landslides, can cause physical damage, disrupt supply chains, and pose safety risks to personnel.

Competition and Supply Chain Disruptions

The copper market is inherently competitive, and any significant increase in production from other major players or the successful development of new mining projects could dilute market share. For instance, Chile, the world's largest copper producer, saw its output reach approximately 5.3 million metric tons in 2023, highlighting the scale of existing competition.

Supply chain vulnerabilities pose a significant threat, particularly concerning essential inputs like sulphuric acid, a critical reagent in copper processing. Disruptions in the availability or a sharp increase in the price of sulphuric acid, which saw global prices fluctuate significantly in late 2024, can directly escalate production costs and reduce operational efficiency.

- Intensified Competition: Other major copper-producing nations like Peru and China may ramp up their output or bring new projects online.

- Input Cost Volatility: Fluctuations in the price and availability of key inputs such as sulphuric acid can significantly impact profitability.

- Logistical Challenges: Disruptions in global shipping or domestic transportation networks can delay deliveries of raw materials and finished products, increasing costs and lead times.

The copper market faces a significant threat from a potential global economic slowdown, particularly impacting demand from major consumers like China and Europe. This downturn could directly reduce sales volumes and revenue for copper producers. Furthermore, the International Copper Study Group (ICSG) forecasts a global copper surplus for 2025 and 2026, which is expected to drive down prices and affect profitability.

Escalating regulatory complexity, especially concerning environmental standards and worker safety, presents another major challenge. Stricter rules on emissions and water usage, common in 2024, require substantial investment in compliance, increasing operational expenses. Non-compliance risks severe financial and reputational damage, as seen with penalties imposed on major mining firms in early 2025.

Geopolitical instability in key mining regions can disrupt operations and transportation networks, impacting copper supply. Moreover, supply chain vulnerabilities, such as disruptions in critical inputs like sulphuric acid, can escalate production costs. Intensified competition from other major producers and logistical challenges further add to the market's precariousness.

| Threat Category | Specific Threat | Impact | Data Point/Example |

| Market Demand | Global Economic Slowdown | Reduced sales volume and revenue | ICSG projects copper surplus for 2025-2026 |

| Regulatory Environment | Increased Environmental Compliance | Higher operational costs, potential fines | Compliance costs can exceed 10% of capital expenditure (2024-2025) |

| Geopolitical Factors | Regional Instability | Supply chain disruptions, price volatility | Historical impact of tariffs on copper prices |

| Operational Risks | Supply Chain Vulnerabilities | Increased production costs, reduced efficiency | Sulphuric acid prices fluctuated significantly in late 2024 |

| Competitive Landscape | Intensified Competition | Diluted market share | Chile's 2023 copper output: ~5.3 million metric tons |

SWOT Analysis Data Sources

This analysis is built upon a robust foundation of data, drawing from detailed financial statements, comprehensive market research reports, and expert industry commentary to provide a well-rounded and actionable SWOT assessment.