Capstone Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Capstone Bundle

The Capstone Porter's Five Forces Analysis reveals the intense competitive landscape, highlighting powerful buyer and supplier bargaining power. Understanding these forces is crucial for navigating Capstone's market. Ready to move beyond the basics? Get a full strategic breakdown of Capstone’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

The copper mining industry's dependence on specialized equipment and technology significantly concentrates supplier power. For Capstone Copper, this means a few key providers of advanced mining machinery, processing chemicals, or specialized technical services can dictate terms. For instance, if only a handful of companies offer the latest in autonomous drilling technology, their ability to charge premium prices or impose unfavorable contract conditions is amplified, directly impacting Capstone's operational costs.

Suppliers gain significant leverage when the inputs they provide are unique or highly differentiated, making them difficult for a company like Capstone Copper to substitute. This uniqueness can stem from patented technologies or specialized expertise crucial for efficient operations.

For Capstone Copper, this could manifest in proprietary leaching technologies that unlock value from specific ore bodies or advanced geological surveying services that pinpoint high-grade copper deposits. If these inputs offer a distinct competitive edge or are absolutely vital for extracting copper from particular ore types, the suppliers of these inputs will command greater bargaining power.

The cost and complexity associated with switching suppliers significantly influence their bargaining power over Capstone Copper. If Capstone needs to change suppliers for critical inputs like specialized mining equipment maintenance, proprietary software, or long-term energy contracts, the expenses and disruption involved can be substantial. This makes it difficult and costly for Capstone to move to a new provider, thus strengthening the position of existing suppliers.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Capstone Copper's operations significantly bolsters their bargaining power. If a key supplier, such as a major mining equipment manufacturer, could credibly enter and operate in the copper mining or processing sector, they could impose more stringent terms on Capstone. This forward integration by suppliers would allow them to capture more of the value chain, directly competing with Capstone and giving them leverage in negotiations for raw materials or services.

While less common in capital-intensive industries like mining, this remains a theoretical, yet potent, bargaining chip for suppliers. For instance, if a leading provider of specialized mining technology could demonstrate the financial and operational capability to run a mine, they could leverage this potential to demand better pricing or contract terms from Capstone. Such a threat can influence Capstone's purchasing decisions and overall cost structure.

- Supplier Forward Integration Threat: Suppliers entering Capstone's mining or processing operations increases their leverage.

- Example: A mining equipment manufacturer potentially operating mines themselves could dictate terms.

- Industry Context: While less frequent in capital-intensive mining, it's a strategic consideration.

Importance of Capstone Copper to Suppliers

The significance of Capstone Copper as a client directly impacts its suppliers' leverage. If Capstone Copper constitutes a substantial portion of a supplier's overall sales, that supplier might have less sway, as they would prioritize keeping Capstone as a customer.

Conversely, if Capstone is a minor client to a supplier who serves many larger customers, Capstone's bargaining power is reduced. For instance, if a key copper concentrate supplier, such as Glencore, has a broad customer base, Capstone's individual demand might not be critical to their business.

- Supplier Dependence: Capstone's reliance on specific suppliers for critical inputs like mining equipment, chemicals, or specialized services can shift power. If few alternatives exist for these essential goods or services, suppliers gain leverage.

- Concentration of Suppliers: A market with few suppliers for essential inputs grants those suppliers greater bargaining power. This is particularly relevant for specialized mining chemicals or advanced processing equipment where the supplier pool is limited.

- Cost of Switching: The expense and disruption associated with Capstone switching to a different supplier for key inputs directly influence supplier power. High switching costs empower the incumbent supplier.

- Availability of Substitutes: If there are readily available substitutes for the raw materials or services Capstone sources, suppliers' bargaining power is diminished.

The bargaining power of suppliers is a crucial element in Porter's Five Forces, directly impacting a company's profitability. For Capstone Copper, this power is amplified when suppliers offer unique or differentiated inputs, like specialized mining technology or proprietary chemical treatments, making them difficult to substitute. For example, in 2023, the global market for advanced mining automation systems was dominated by a few key players, allowing them to command premium pricing.

High switching costs further empower suppliers. If Capstone faces significant expenses or operational disruptions when changing providers for essential equipment maintenance or specialized software, the existing suppliers hold greater leverage. The cost of integrating new systems or retraining personnel can deter Capstone from seeking alternative suppliers, thus strengthening the position of current ones.

| Factor | Impact on Capstone Copper | Example Data (Illustrative) |

|---|---|---|

| Supplier Concentration | High if few suppliers for critical inputs | In 2023, the market for large-scale autonomous haul trucks had an estimated HHI of 2,500, indicating high concentration. |

| Input Differentiation | High if inputs are unique or proprietary | Patented leaching agents can be critical for specific ore types, with limited alternatives. |

| Switching Costs | High if changing suppliers is costly and disruptive | Implementing new geological modeling software can incur millions in costs and months of integration. |

| Threat of Forward Integration | Significant if suppliers can enter Capstone's business | A major equipment manufacturer could potentially acquire or develop its own mine. |

What is included in the product

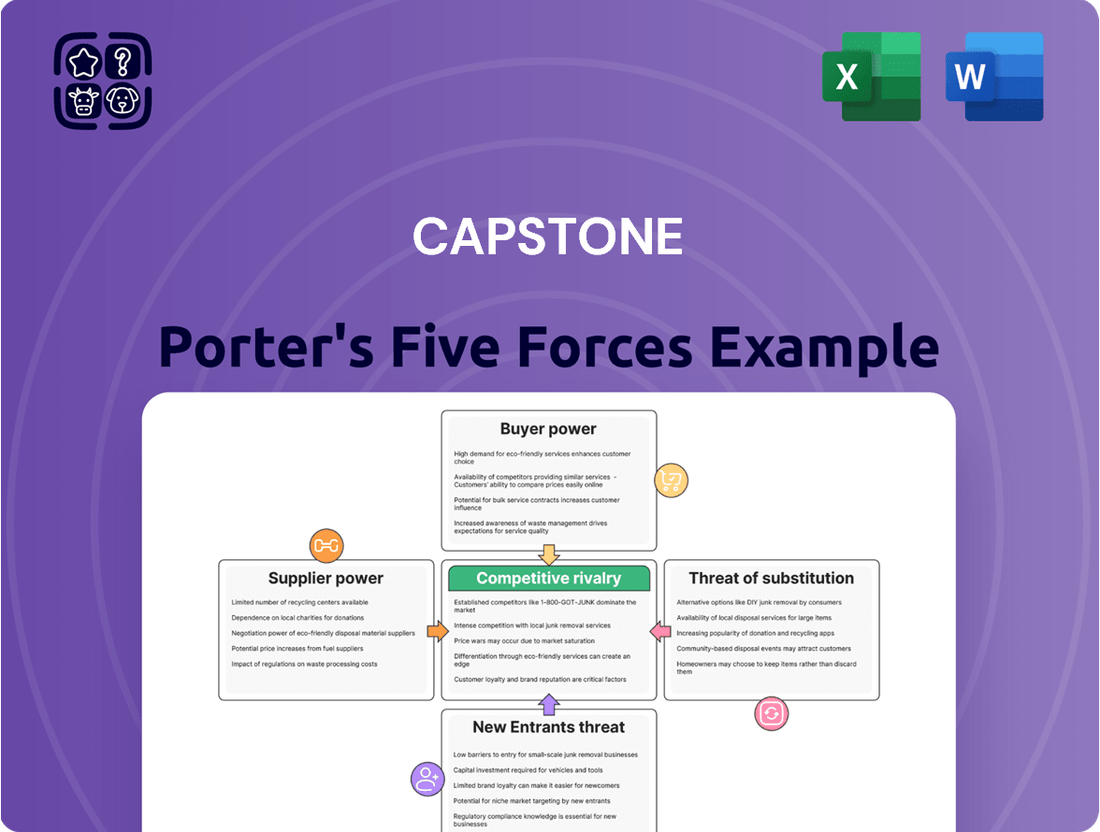

This analysis meticulously examines the five competitive forces impacting Capstone, revealing the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants and substitutes, and ultimately Capstone's strategic positioning.

Instantly identify and quantify competitive threats with a visual, easy-to-understand breakdown of each force.

Customers Bargaining Power

The copper market is characterized by a relatively concentrated customer base. Key buyers include large industrial manufacturers, major infrastructure development projects, and significant players in the electronics sector. This concentration means that a few substantial customers can wield considerable influence over pricing and contract negotiations.

For a company like Capstone Copper, if a significant portion of its sales volume is directed towards a small number of these large industrial buyers, those customers gain substantial bargaining power. For instance, if the top five customers represent over 40% of Capstone Copper's revenue, they can leverage this volume to demand lower prices or more favorable payment terms, directly impacting Capstone's profitability and operational flexibility.

Customers’ price sensitivity is notably high in commodity markets, such as the market for copper. This is because copper serves as a fundamental input across numerous vital sectors, including electronics, construction, electric vehicles, and renewable energy.

The direct impact of copper's price on the overall cost structures of these industries means buyers are actively seeking the most economical sources, particularly when the product from various suppliers appears largely similar.

For instance, in 2024, the price of copper experienced significant volatility, with LME copper futures trading around $8,000 to $10,000 per metric ton. This fluctuation directly influences the purchasing decisions of manufacturers, who will readily switch suppliers if a lower price point is available for comparable quality.

While copper boasts unique properties, buyers sometimes have alternative materials available for certain applications. The existence of these substitutes, even if not as performant, grants buyers more leverage. If copper prices climb too high, they can switch to these alternatives, thus increasing their bargaining power.

However, for critical functions where copper's electrical conductivity is paramount, such as in high-performance wiring or certain electronic components, the availability of direct substitutes is significantly limited. This scarcity reduces buyer power in these specific, high-demand sectors.

For instance, in 2024, while aluminum continues to be explored as a substitute in some lower-voltage electrical applications, its conductivity is roughly 60% that of copper. This means larger cross-sections are needed for equivalent performance, limiting its appeal in space-constrained or weight-sensitive designs where copper excels.

Buyers' Threat of Backward Integration

The threat of customers integrating backward into copper production significantly amplifies their bargaining power. If major buyers, especially large industrial conglomerates, can credibly threaten to produce their own copper, they gain leverage over existing suppliers.

While less prevalent in the highly capital-intensive mining sector, such a move becomes more attractive if market volatility or unfavorable pricing persists. For instance, a significant downturn in copper prices in late 2023 and early 2024 might have prompted some large-scale consumers to re-evaluate their reliance on external suppliers.

- Increased Leverage: The mere credible threat of backward integration gives buyers more power to negotiate lower prices or better terms.

- Reduced Supplier Dependence: If customers can produce their own copper, they become less dependent on existing mines, weakening the suppliers' position.

- Industry Capital Intensity: The high cost of establishing copper mining operations makes backward integration a substantial undertaking, limiting its feasibility for most customers.

- Market Volatility as a Trigger: Extreme price swings or supply disruptions can make the strategic advantage of securing raw material supply through integration more compelling.

Information Availability to Buyers

In transparent commodity markets, buyers have significant leverage due to readily available information on pricing, supply, and production costs. This transparency allows them to easily compare offers from various suppliers, including Capstone Copper, and understand prevailing market dynamics. For instance, in 2024, the global copper market saw increased price volatility, driven by factors like supply chain disruptions and demand fluctuations, making buyer information even more critical for effective negotiation.

This easy access to market intelligence empowers buyers to negotiate more aggressively, pressuring Capstone Copper to maintain competitive pricing and efficient operations. When buyers can readily identify lower-cost alternatives or understand the true cost of production, their bargaining power intensifies. Capstone Copper’s ability to manage its production costs and supply chain effectively becomes paramount in this environment.

- Information Transparency: Buyers can access real-time pricing data and supply availability for copper globally.

- Cost Benchmarking: Buyers can compare Capstone Copper's production costs against industry averages and competitors.

- Negotiating Strength: Informed buyers can demand better terms and pricing, impacting Capstone Copper's margins.

- Market Dynamics Awareness: Buyers understand the factors influencing copper prices, strengthening their position.

The bargaining power of customers in the copper market is significant due to a concentrated buyer base, high price sensitivity, and the availability of substitutes in some applications. These factors empower buyers to negotiate for lower prices and more favorable terms, directly influencing Capstone Copper's profitability.

The ability of large industrial buyers to switch suppliers or even consider backward integration, coupled with market transparency, further amplifies their leverage. Capstone Copper must therefore focus on cost efficiency and demonstrating value to mitigate this powerful force.

| Factor | Impact on Customer Bargaining Power | Relevance to Capstone Copper |

| Concentrated Customer Base | High | A few large buyers can dictate terms. |

| Price Sensitivity | High | Copper is a key input cost; buyers seek lowest prices. |

| Availability of Substitutes | Moderate to High | Depends on application; limits pricing power where alternatives exist. |

| Threat of Backward Integration | Low to Moderate | Feasible for very large consumers, especially during price downturns. |

| Information Transparency | High | Buyers easily compare offers and market dynamics. |

Full Version Awaits

Capstone Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive Porter's Five Forces analysis provides an in-depth examination of the competitive landscape, detailing the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. You'll receive this exact, professionally formatted analysis upon purchase, ensuring you have all the insights needed to understand and strategize effectively.

Rivalry Among Competitors

Capstone Copper navigates a competitive landscape populated by major global players such as BHP and Freeport-McMoRan, alongside state-owned giants like Codelco. These established entities possess significant scale, resources, and existing infrastructure, presenting a formidable challenge for any competitor. The industry also features a multitude of smaller, regional mining operations, further fragmenting the market.

The copper market is booming, with demand surging thanks to the global push for electrification and renewable energy. This robust growth, projected to see the global copper market reach an estimated $356.7 billion by 2027 according to Statista, generally eases direct rivalry as there's more than enough business for most participants.

However, this very growth creates its own competitive pressures. Companies aggressively compete for lucrative new projects and aim to capture a larger slice of this expanding market. This intense jockeying for position means that while the overall pie is getting bigger, the fight for the best pieces can still be fierce.

Copper's nature as a commodity means that, for the most part, consumers see little difference between the product from one mine or producer versus another. This lack of inherent product differentiation forces companies to compete intensely on factors beyond the copper itself.

Consequently, the competitive rivalry in the copper industry is significantly heightened. Companies must focus on operational efficiency, cost control, and securing favorable pricing to gain an edge. For instance, in 2024, the average all-in sustaining cost for copper production globally hovered around $2.00-$2.50 per pound, making even small improvements in efficiency critical.

Exit Barriers

High exit barriers are a significant factor in the mining industry, directly influencing competitive rivalry. These barriers are substantial, often involving massive sunk costs in exploration, mine development, and specialized infrastructure. For instance, establishing a new copper mine can cost billions of dollars, with much of this investment becoming unusable if operations cease. This makes exiting the market extremely difficult and costly.

The extended mine lives, often spanning decades, also contribute to high exit barriers. Companies are committed to these long-term projects, making it challenging to simply walk away. Furthermore, environmental rehabilitation obligations, which can run into hundreds of millions of dollars per mine, represent a substantial future cost that must be factored into any exit strategy. These factors can force companies to continue operating even when profitability is low, thereby sustaining intense competition.

In 2023, for example, several mid-tier mining companies reported operating at or near breakeven on certain commodities due to price volatility. Despite these conditions, significant capital expenditure continued for ongoing operations and environmental compliance, illustrating the sticky nature of these investments. This persistence in operations, even during downturns, fuels ongoing rivalry among established players.

- Sunk Costs: Billions invested in mine infrastructure and equipment become largely worthless upon closure.

- Long Mine Lives: Commitments to operate mines for 20-50 years lock in capital and operational focus.

- Environmental Obligations: Post-closure rehabilitation costs, often millions per site, deter premature closure.

- Specialized Assets: Mining equipment and processing plants are highly specialized and difficult to repurpose.

Cost Structure of Competitors

Capstone Copper's competitive standing is significantly influenced by the cost structures of its rivals. Companies that benefit from lower production expenses or possess exclusive access to superior ore grades inherently gain a substantial edge. This dynamic places a premium on Capstone's own efforts to manage costs effectively, whether through streamlined operations or securing high-quality mineral reserves, to remain competitive against industry peers with diverse cost bases.

In 2024, the global copper mining industry saw varied cost performances. For instance, some major producers, like Codelco, have historically faced challenges with declining ore grades, potentially increasing their per-unit production costs. Conversely, companies like Freeport-McMoRan, with significant operations in North America, might leverage different cost dynamics based on their asset mix and operational scale. Capstone's ability to maintain a competitive cost position, perhaps by focusing on efficient extraction or exploring new, high-grade deposits, is therefore a critical factor in its ongoing rivalry.

- Operational Efficiency: Competitors with highly automated and streamlined mining processes can achieve lower per-tonne costs.

- Ore Grade Advantage: Access to higher-grade copper deposits directly reduces the amount of material that needs to be processed, lowering overall costs.

- Geographic Location: Proximity to infrastructure, energy sources, and processing facilities can significantly impact a competitor's cost structure.

- Capital Investment: Companies that have recently invested in modern, efficient equipment may have a cost advantage over those with older, less productive assets.

The copper industry is characterized by intense rivalry among major global players, state-owned enterprises, and numerous smaller operations. While robust market growth generally tempers direct competition, the fight for prime projects and market share remains fierce, especially given the commodity nature of copper, where differentiation is minimal.

Companies must excel in operational efficiency and cost control to gain an advantage, with global average all-in sustaining costs for copper production in 2024 often falling between $2.00 and $2.50 per pound. High exit barriers, stemming from billions in sunk costs for infrastructure, long mine lives, and significant environmental rehabilitation obligations, further entrench existing players, forcing continued competition even in less profitable times.

Competitors with superior cost structures, often due to operational efficiency, higher ore grades, or advantageous geographic locations, possess a distinct edge. For example, in 2024, companies like Freeport-McMoRan might leverage scale and asset mix differently than Codelco, which has faced challenges with declining ore grades, highlighting the critical importance of Capstone's own cost management strategies.

| Factor | Impact on Rivalry | Example (2024 Data/Trends) |

|---|---|---|

| Major Competitors | High rivalry due to scale and resources (BHP, Freeport-McMoRan, Codelco) | Established players continue significant capital expenditure. |

| Market Growth | Generally eases rivalry, but intensifies competition for new projects. | Global copper market projected for continued strong demand due to electrification. |

| Product Differentiation | Low differentiation forces competition on cost and efficiency. | Copper is largely a commodity, making operational excellence key. |

| Exit Barriers | High sunk costs, long mine lives, and environmental liabilities lock in players. | Billions invested in infrastructure make exiting difficult and costly. |

| Cost Structures | Lower-cost producers gain a significant competitive advantage. | Operational efficiency and ore grade are critical differentiators. |

SSubstitutes Threaten

While copper is prized for its excellent conductivity and longevity, other materials can step in for specific uses. For example, aluminum is a viable substitute for copper in certain electrical wiring applications, offering a lighter and often more cost-effective alternative. In the realm of communication cables, plastics and fiber optics are increasingly replacing copper, especially where higher bandwidth and signal integrity are paramount.

The threat of substitutes for copper hinges on their ability to replicate copper's functionality at a competitive price point. If alternatives like aluminum or fiber optics can deliver similar performance for less, or even better performance at a comparable cost, the threat intensifies. For instance, while aluminum is often cheaper, its lower conductivity can necessitate larger, heavier conductors, impacting installation costs and space requirements in certain applications.

Buyers' willingness to switch to substitutes isn't automatic, even when alternatives are available. Factors such as the reliability of the substitute, how easily it can be adopted into existing systems, and the cost of switching all play a crucial role. For instance, in 2024, while renewable energy sources offer substitutes for fossil fuels, the significant investment required for grid modernization and the established infrastructure for oil and gas mean many buyers remain hesitant for widespread, immediate replacement.

Technological Advancements in Substitutes

Ongoing advancements in materials science present a growing threat of substitutes for copper. For instance, research into advanced polymers and composites is yielding materials with comparable conductivity and durability, often at a lower cost. This trend is particularly concerning for sectors heavily reliant on copper, such as the automotive industry, where lightweighting initiatives are driving the adoption of alternative materials.

Breakthroughs in areas like graphene and superconductivity could dramatically alter the competitive landscape. While still largely in development, these technologies promise superior performance characteristics. For example, advancements in room-temperature superconductors, if realized, could revolutionize energy transmission, directly challenging copper's long-standing dominance in this sector. The global market for advanced materials is projected to reach hundreds of billions of dollars by 2030, indicating significant investment and potential for disruptive innovation.

- Material Science Innovations: Continued R&D in materials like advanced polymers, composites, and novel alloys could yield cost-effective and high-performance substitutes for copper.

- Electronics Sector Impact: Innovations in conductive inks and nanomaterials offer potential replacements for copper wiring in certain electronic applications, driven by miniaturization and flexibility demands.

- Energy Transmission Potential: While still nascent, breakthroughs in superconductivity and improved aluminum alloys could significantly reduce copper's share in high-voltage power transmission.

- Cost-Performance Trade-offs: The economic viability of substitutes will hinge on achieving comparable or superior performance at a competitive or lower price point compared to copper.

Regulatory and Environmental Factors

Environmental regulations and sustainability initiatives can significantly impact the threat of substitutes for materials like copper. For instance, if copper production faces increasingly stringent environmental controls, such as stricter emissions standards or higher carbon taxes, it could make alternative materials more economically appealing. In 2024, the global focus on decarbonization continued to intensify, with many nations setting ambitious climate targets. This trend suggests a growing likelihood of policies that penalize carbon-intensive industries, potentially increasing the production costs for copper.

The threat of substitutes is amplified when these alternatives align with environmental goals. For example, if aluminum or fiber optic cables are perceived as more sustainable or have a lower environmental footprint throughout their lifecycle, they could gain market share. Regulatory bodies are increasingly scrutinizing the environmental impact of raw material extraction and processing. A shift towards a circular economy, where recycled materials are prioritized, could also favor substitutes that are more easily recycled or derived from renewable sources.

- Increased Carbon Pricing: Potential for higher carbon taxes on copper production could raise its cost relative to substitutes by 2025.

- Evolving Recycling Mandates: Stricter regulations favoring materials with higher recycled content could boost substitutes.

- Green Building Standards: New environmental certifications might prefer materials with demonstrably lower lifecycle emissions than copper.

- Water Scarcity Regulations: Copper extraction can be water-intensive; regulations in water-stressed regions could favor less water-dependent substitutes.

The threat of substitutes for copper is shaped by the availability and performance of alternative materials, coupled with buyer willingness to switch. Innovations in materials science, such as advanced polymers and composites, continue to present viable alternatives. For instance, aluminum remains a key substitute in electrical wiring due to its lighter weight and cost-effectiveness, though its lower conductivity requires larger conductors. Fiber optics are also increasingly displacing copper in telecommunications for their superior bandwidth and signal integrity.

The economic viability of these substitutes is crucial; if they offer comparable or better performance at a lower or equivalent price, the threat intensifies. While aluminum is often cheaper, its conductivity limitations can lead to higher installation costs. By 2024, the market for advanced materials was already substantial, with significant investment in research and development promising further disruptive innovations. For example, the global market for advanced materials was projected to exceed $100 billion by 2025, highlighting the potential for new substitutes to emerge and challenge copper's market share.

| Substitute Material | Key Applications | Advantages over Copper | Disadvantages compared to Copper |

|---|---|---|---|

| Aluminum | Electrical Wiring, Conductors | Lighter weight, Lower cost | Lower conductivity (requires larger conductors), Susceptible to oxidation |

| Fiber Optics | Telecommunications, Data Transmission | Higher bandwidth, Greater signal integrity, Immune to electromagnetic interference | More fragile, Higher installation cost, Requires specialized equipment |

| Advanced Polymers/Composites | Automotive, Aerospace, Electronics | Lightweight, Corrosion resistance, Potential for tailored properties | Lower conductivity (in many cases), Durability concerns in some applications, Higher R&D costs |

Entrants Threaten

The copper mining industry demands enormous upfront capital for exploration, land acquisition, and the construction of extraction and processing facilities. For instance, developing a new large-scale copper mine can easily cost billions of dollars, with some projects exceeding $5 billion in total investment.

These substantial capital requirements create a formidable barrier to entry, effectively limiting the number of new players who can realistically compete. Established companies with deep pockets and existing infrastructure have a significant advantage, making it difficult for smaller or less-funded entities to enter the market and challenge their position.

Securing access to economically viable copper ore deposits presents a significant hurdle for new entrants in the mining industry. Established players often hold long-term leases or outright ownership of the most promising and easily exploitable sites, leaving newcomers to compete for less desirable or more costly reserves.

By the end of 2023, the global copper market saw significant consolidation, with major mining corporations controlling a substantial portion of known high-grade reserves. This concentration means that new entrants face higher acquisition costs or the need for substantial investment in exploration and development for lower-grade or more challenging deposits.

Capstone Copper, like other established mining giants, leverages significant economies of scale. This means they can produce copper at a much lower cost per ton compared to a smaller, newer operation. For instance, their large-scale mining and processing facilities, optimized over years, allow for bulk purchasing of materials and more efficient use of labor and machinery.

New companies entering the copper market would find it incredibly difficult to match these cost advantages. Building a new mine and processing plant requires massive upfront capital, and without the existing volume of production that Capstone enjoys, the per-unit cost for a new entrant would be substantially higher. This cost disadvantage makes it challenging for them to compete on price with established players, acting as a strong barrier to entry.

Regulatory Hurdles and Permitting

The mining sector faces significant barriers to entry due to rigorous environmental, social, and governmental regulations. Obtaining the necessary permits is a complex and time-consuming process, often involving extensive environmental impact assessments and community consultations. For instance, in 2024, the average time to secure major mining permits in countries like Canada could extend to several years, adding considerable cost and uncertainty for new ventures.

These regulatory complexities act as a substantial deterrent for potential new entrants. The sheer volume of documentation, legal reviews, and adherence to evolving standards can be overwhelming for companies lacking established expertise and resources. In 2023, the Global Mining Guidelines Group reported that compliance costs for new mining projects in some jurisdictions increased by as much as 15% due to updated environmental protection mandates.

- Lengthy Permitting: Obtaining all required mining permits can take years, delaying project commencement and increasing upfront investment.

- Environmental Compliance: Strict adherence to environmental protection laws, including waste management and emissions control, demands significant capital expenditure.

- Social License to Operate: Gaining community acceptance and fulfilling social responsibility obligations is crucial and can be a protracted process.

- Regulatory Uncertainty: Changes in government policies and regulations can introduce unforeseen risks and costs for new market participants.

Brand Loyalty and Distribution Channels

Even though copper is largely a commodity, established players in the market benefit from deep-seated relationships with smelters, refiners, and end-users. These existing connections, coupled with well-oiled distribution networks, act as significant barriers for newcomers. For instance, securing reliable off-take agreements, crucial for consistent sales, can be a formidable hurdle in this mature industry.

New entrants must invest considerable time and resources to cultivate similar relationships and establish efficient supply chains. The capital expenditure required to build out these networks and gain market access is substantial. In 2024, the global copper market, valued at over $200 billion, demonstrates the scale of investment needed to compete effectively.

- Established Relationships: New entrants must forge connections with key players in the copper supply chain, a process that takes years and significant effort.

- Distribution Networks: Building efficient and cost-effective logistics for transporting copper from mines to smelters, refineries, and end-users presents a considerable challenge.

- Off-take Agreements: Securing guaranteed purchase agreements from smelters, refiners, and manufacturers is vital for profitability and can be difficult for new, unproven entities.

The threat of new entrants in the copper mining sector is significantly mitigated by immense capital requirements, with new mine development often costing billions of dollars. Established players, like Capstone Copper, benefit from economies of scale, allowing for lower production costs that new, smaller operations struggle to match. Furthermore, securing access to prime ore deposits and navigating complex, lengthy regulatory processes, which can take years and substantial investment in 2024, act as formidable barriers.

Established relationships within the supply chain, from smelters to end-users, and the development of robust distribution networks also present considerable challenges for newcomers. For instance, the global copper market, valued at over $200 billion in 2024, highlights the sheer scale of investment and established infrastructure required to compete effectively.

| Barrier Type | Description | Impact on New Entrants | Example Data (2023-2024) |

|---|---|---|---|

| Capital Requirements | Enormous upfront investment for exploration, land, and facilities. | High barrier; limits number of viable competitors. | New large-scale copper mine development can exceed $5 billion. |

| Economies of Scale | Lower per-unit production costs for established, high-volume producers. | Cost disadvantage for new entrants, impacting price competitiveness. | Established players leverage optimized facilities for bulk purchasing and efficiency. |

| Access to Resources | Control of prime, easily exploitable ore deposits by incumbents. | Newcomers must invest more in exploration or acquire less desirable reserves. | Major corporations control a substantial portion of known high-grade reserves. |

| Regulatory Hurdles | Complex and lengthy permitting, environmental, and social compliance. | Adds significant cost, uncertainty, and delays for new ventures. | Mining permit acquisition in Canada can take several years; compliance costs increased by 15% in some jurisdictions (2023). |

| Supply Chain Relationships | Deep-seated connections with smelters, refiners, and end-users. | Difficulty in securing off-take agreements and establishing distribution networks. | Cultivating similar relationships requires years and substantial investment. |

Porter's Five Forces Analysis Data Sources

Our Capstone Porter's Five Forces analysis is built upon a robust foundation of data, drawing from industry-specific market research reports, company annual filings, and regulatory databases to ensure comprehensive and accurate insights into competitive dynamics.