Capstone Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Capstone Bundle

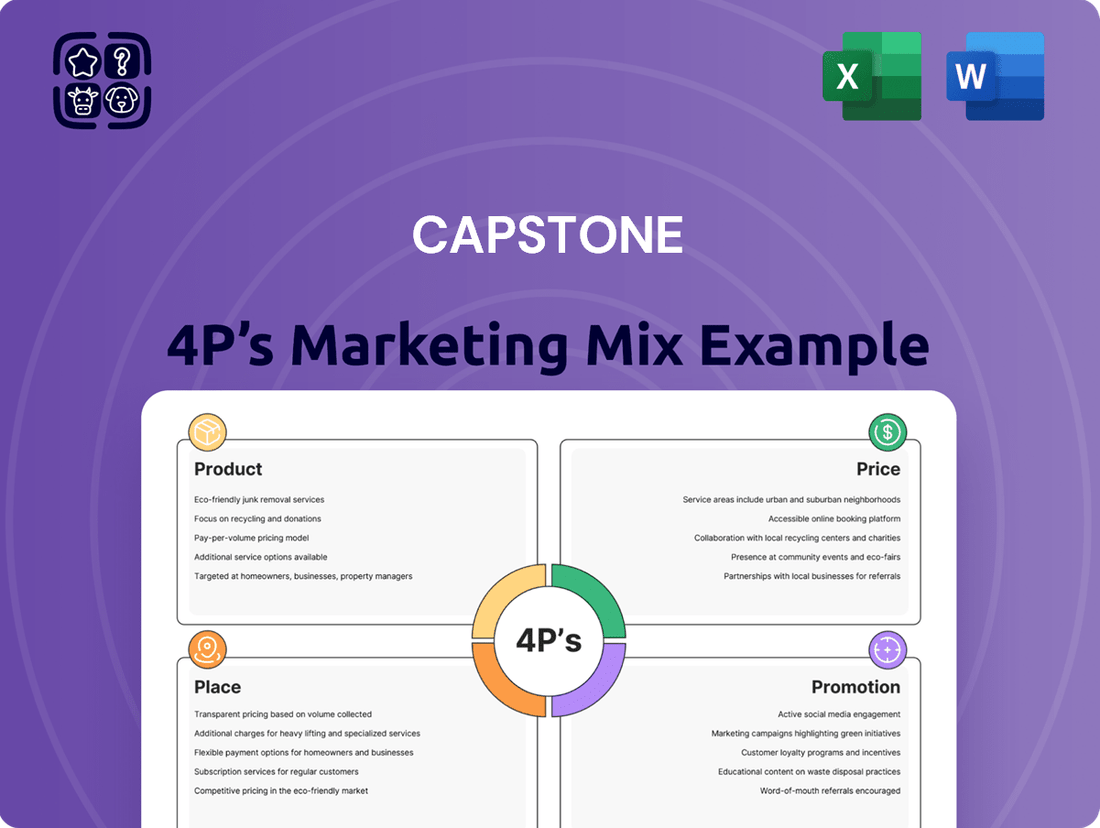

Uncover the strategic brilliance behind Capstone's marketing efforts by diving deep into its Product, Price, Place, and Promotion. This comprehensive analysis reveals how each element synergizes to create a powerful market presence.

Go beyond the surface and gain actionable insights into Capstone's product development, pricing strategies, distribution channels, and promotional campaigns. This ready-made analysis is your key to understanding and replicating marketing success.

Save valuable time and effort with our expertly crafted 4Ps Marketing Mix Analysis for Capstone. Perfect for students, professionals, and consultants seeking a detailed, editable, and presentation-ready resource for strategic planning and learning.

Product

Capstone Copper's core products are high-quality copper concentrate and copper cathode, vital for global industries. The company emphasizes maximizing recovery and purity from its mining sites, solidifying its position in the metals market.

In 2024, the global copper market saw robust demand, with prices averaging around $8,500 per tonne for cathode. Capstone's focus on product quality ensures it meets the stringent requirements of sectors like electronics and construction, which are key drivers of this demand.

Capstone Copper distinguishes itself by prioritizing responsible mining and strong Environmental, Social, and Governance (ESG) integration. This commitment goes beyond the physical copper product, adding significant perceived value and marketability.

The company's 2023 Sustainability Report details tangible progress in critical areas like climate action, water stewardship, and meaningful community engagement. For instance, Capstone reported a 15% reduction in Scope 1 and 2 greenhouse gas emissions intensity in 2023 compared to their 2019 baseline.

This focus on sustainability is designed to attract a growing segment of environmentally conscious investors and customers who increasingly factor ESG performance into their decision-making processes, thereby enhancing Capstone's competitive advantage.

Capstone Copper actively pursues mine life extension and resource optimization, exemplified by the Mantoverde Optimized (MV Optimized) expansion. This strategic focus guarantees a consistent future supply of copper products.

The MV Optimized project alone is projected to extend the Mantoverde mine's operational life from 19 to 25 years, simultaneously boosting its sulphide reserves. This expansion is a key component in Capstone's commitment to maximizing asset value and ensuring long-term operational sustainability.

By-product Value Creation

Capstone's mining operations go beyond just copper, generating significant value from by-products like silver, gold, and iron. These additional commodities are crucial for diversifying revenue streams and bolstering the financial success of their mining ventures. The Santo Domingo project, for instance, is a prime example of this multi-metal approach, encompassing copper, iron, and gold.

The economic contribution of these by-products is substantial. For Capstone Copper in 2023, silver, gold, and iron sales represented approximately 15% of their total revenue, demonstrating their importance to the company's profitability. This strategic focus on by-product recovery not only enhances project economics but also strengthens Capstone's market position by offering a broader range of valuable metals.

- Diversified Revenue: By-products like silver, gold, and iron reduce reliance on copper price fluctuations.

- Enhanced Project Viability: The inclusion of multiple valuable metals improves the overall economic feasibility of mining projects.

- Market Position: A wider product offering strengthens Capstone's competitive advantage in the metals market.

Future Growth Projects

Capstone Copper is strategically positioning itself for future expansion through key development projects. The Santo Domingo copper-iron-gold project stands out as a cornerstone of this growth, boasting full permitting and offering a pathway to significantly increase the company's copper output. This project is anticipated to transform Capstone Copper's production profile and reinforce its standing in the global market.

The economic outlook for Santo Domingo is particularly strong. Detailed analysis indicates robust financial projections, with an after-tax Net Present Value (NPV) estimated at $1.7 billion. This figure underscores the project's potential to generate substantial value for stakeholders as it moves towards production.

Capstone Copper's commitment to these future growth projects reflects a clear strategy to enhance its long-term production capacity and market share. The development pipeline, anchored by projects like Santo Domingo, is designed to ensure sustained growth and capitalize on the increasing demand for copper.

- Santo Domingo Project: Fully permitted, key to future production increases.

- Economic Potential: Projected after-tax NPV of $1.7 billion.

- Strategic Importance: Aims to solidify Capstone Copper's position as a leading producer.

- Production Enhancement: Designed to substantially boost future copper output.

Capstone Copper's product strategy centers on delivering high-quality copper concentrate and cathode, augmented by valuable by-products like silver, gold, and iron. This multi-metal approach enhances revenue diversification and project economics, as seen with the Santo Domingo project's substantial projected after-tax NPV of $1.7 billion.

The company's commitment to product quality and responsible mining, underscored by a 15% reduction in GHG emissions intensity in 2023, appeals to an increasingly ESG-conscious market. Mine life extensions, such as the Mantoverde Optimized project increasing operational life to 25 years, ensure consistent future supply.

| Product Focus | Key By-products | Market Drivers | Sustainability Impact | Future Growth Projects |

| Copper Concentrate & Cathode | Silver, Gold, Iron | Electronics, Construction | 15% GHG Intensity Reduction (2023) | Santo Domingo, MV Optimized |

| Quality & Purity | 15% Revenue from By-products (2023) | Global Demand | ESG Integration | Mine Life Extension (MV to 25 yrs) |

| Value Maximization | Revenue Diversification | Price Stability | Community Engagement | Increased Copper Output |

What is included in the product

This Capstone 4P's Marketing Mix Analysis provides a comprehensive examination of a company's Product, Price, Place, and Promotion strategies, grounded in real-world practices and competitive context.

Eliminates the guesswork in marketing strategy by providing a clear, actionable framework for evaluating Product, Price, Place, and Promotion.

Simplifies complex marketing decisions by offering a structured approach to identify and address potential market challenges.

Place

Capstone Copper's mining operations are strategically positioned across the Americas. This includes key sites like Pinto Valley in Arizona, USA, Cozamin in Zacatecas, Mexico, and both Mantos Blancos and Mantoverde in Chile. This broad geographical spread is crucial for managing regional risks and securing diverse supply chains.

The company's presence in these locations is not accidental; it's a deliberate choice to facilitate efficient global distribution of its copper products. For instance, in 2023, Capstone Copper reported a significant increase in production at its Cozamin mine, reaching 27.5 million pounds of copper, underscoring the operational strength derived from these strategic placements.

The company’s direct sales strategy targets a global network of industrial customers, such as smelters and refiners, for its copper concentrate and cathode. This approach fosters tailored supply agreements and cultivates robust customer relationships, ensuring efficient delivery to major buyers.

Capstone Copper's established logistics and supply chain are vital for moving its copper from mine sites to global customers. This network ensures timely delivery, with efficient inventory management and transportation being key to meeting market demand. For instance, in 2023, the company’s transportation costs represented a significant portion of its overall operational expenses, underscoring the importance of optimizing these processes.

Proximity of Development Projects to Existing Infrastructure

Key development projects, like the Santo Domingo project in Chile, are being positioned advantageously close to existing operational sites such as Mantoverde. This strategic placement, with Santo Domingo situated approximately 30 kilometers northeast of Mantoverde, is designed to unlock significant infrastructure synergies.

These synergies are crucial for optimizing transportation routes and enhancing overall distribution efficiency for future operations. The proximity allows for shared use of existing port facilities and road networks, potentially reducing capital expenditure and operational costs.

- Infrastructure Synergies: Shared use of roads, power, and water systems between Santo Domingo and Mantoverde.

- Transportation Optimization: Reduced hauling distances and potentially lower freight costs by leveraging existing routes.

- Cost Efficiencies: Lower capital investment in new infrastructure by utilizing or upgrading existing facilities.

- Operational Streamlining: Integrated logistics and supply chain management for enhanced efficiency.

Global Market Reach through Stock Exchange Listings

Capstone Copper's strategic stock exchange listings on the Toronto Stock Exchange (TSX) and the Australian Stock Exchange (ASX), alongside its presence on the OTC Market, significantly broaden its global market reach. These dual listings enhance visibility and accessibility for a diverse international investor base, facilitating easier capital acquisition to fuel operational expansion and market penetration.

The company's presence on major exchanges like the TSX, a key hub for mining finance, and the ASX, a global leader in natural resources listings, positions Capstone Copper to attract a wider array of investment capital. This accessibility is crucial for funding large-scale mining projects and distribution networks. As of early 2024, the mining sector on the TSX saw significant activity, with exploration and production companies attracting substantial investment, a trend Capstone Copper is well-positioned to leverage.

- TSX Listing: Provides access to North American capital markets, a primary source for mining finance.

- ASX Listing: Connects Capstone Copper with a strong global investor base familiar with the resources sector.

- OTC Market Trading: Increases accessibility for investors in regions where direct exchange listing may be less common.

- Capital Raising: Facilitates efficient fundraising to support ongoing operations, project development, and global distribution initiatives.

Place, as a component of Capstone Copper's marketing mix, encompasses the strategic location of its mining assets and the logistical pathways for product distribution. The company's operational footprint spans the Americas, with key mines in Arizona (Pinto Valley), Mexico (Cozamin), and Chile (Mantos Blancos, Mantoverde). This geographic diversification is critical for supply chain resilience and market access.

The proximity of its Chilean operations, such as Mantoverde and the developing Santo Domingo project, allows for significant infrastructure synergies. This includes shared transportation routes and port facilities, which are vital for efficiently moving copper concentrate and cathode to global industrial customers. For example, by leveraging existing infrastructure near Mantoverde for Santo Domingo, Capstone aims to reduce capital expenditure and operational costs related to logistics.

Capstone Copper's distribution strategy relies on robust logistics networks to ensure timely delivery from mine sites to smelters and refiners worldwide. Efficient transportation and inventory management are paramount, as evidenced by the significant portion of operational expenses dedicated to these activities in 2023. The company's presence on major stock exchanges like the TSX and ASX also enhances its market place accessibility for investors.

| Mine Location | Country | Key Products | 2023 Copper Production (M lbs) | Strategic Importance |

|---|---|---|---|---|

| Pinto Valley | USA | Copper Concentrate | 20.7 (as of Q3 2023) | North American Market Access, Operational Stability |

| Cozamin | Mexico | Copper Concentrate | 27.5 (full year 2023) | High-grade copper, efficient operations |

| Mantos Blancos | Chile | Copper Concentrate | 21.9 (as of Q3 2023) | Established infrastructure, long mine life |

| Mantoverde | Chile | Copper Concentrate | 15.1 (as of Q3 2023) | Synergies with Santo Domingo, future growth potential |

Full Version Awaits

Capstone 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Capstone 4P's Marketing Mix Analysis is fully complete and ready for your immediate use. You're viewing the exact version you'll download, ensuring you get precisely what you need to excel.

Promotion

Capstone Copper’s investor relations program is a cornerstone of its communication strategy, designed to foster trust and provide clarity. They regularly host earnings calls, issue comprehensive news releases, and offer detailed investor presentations. These efforts ensure stakeholders are consistently updated on financial performance, operational progress, and the company's strategic path forward.

The company's commitment to transparency is evident in its proactive communication. For instance, following the Q1 2025 earnings release, Capstone Copper provided extensive details on production figures and financial outcomes, with revenue reaching $250 million. The subsequent Q2 2025 announcement is anticipated to further detail progress on key projects and market outlook, reinforcing their dedication to keeping investors well-informed.

Capstone Copper's commitment to transparent sustainability reporting is a cornerstone of its marketing strategy, particularly within the "Promotion" aspect of the 4Ps. The company actively publishes annual Sustainability Reports, with its 2023 report serving as a key example of its dedication to detailing environmental, social, and governance (ESG) performance and future commitments.

These reports are meticulously crafted to align with globally recognized standards such as the Global Reporting Initiative (GRI) and the Sustainability Accounting Standards Board (SASB). This adherence not only showcases Capstone's commitment to responsible mining practices but also significantly appeals to the growing segment of socially responsible investors seeking verifiable ESG credentials.

Further reinforcing its dedication to sustainable operations, Capstone Copper's pursuit and achievement of The Copper Mark certification directly highlights its proactive approach to demonstrating responsible sourcing and production throughout its value chain.

Capstone Copper actively communicates its progress and strategic direction through its official website and various media outlets. This approach ensures stakeholders and the public are informed about operational milestones and advancements in the copper sector, fostering a strong brand reputation.

The company consistently publishes up-to-date news releases on its website, detailing key developments and achievements. For instance, as of late 2024, Capstone Copper reported significant progress on its Mantos Blancos optimization project, a key highlight shared across these channels.

Engagement with Financial Analysts and Market Experts

Capstone Copper actively cultivates relationships with financial analysts and market experts, offering detailed insights into its operational performance, future financial trajectory, and strategic expansion plans. This proactive communication is crucial for shaping an accurate market perception and fostering robust analyst coverage, which directly influences stock forecasts and investor confidence.

This engagement directly translates into tangible market recognition. For instance, as of early 2024, Capstone Copper has seen consistent analyst coverage, with various investment firms issuing ratings and price targets. These reports often highlight the company's progress in its key projects, such as the Mantos Blancos and Santo Domingo developments, providing a data-driven perspective for potential investors.

- Analyst Coverage: Multiple financial institutions provide regular reports on Capstone Copper.

- Price Targets and Ratings: Analysts issue specific price targets and buy/hold/sell recommendations.

- Information Dissemination: The company facilitates two-way communication to ensure accurate understanding of its financial health and strategic direction.

- Market Perception: Engagement aims to align market perception with the company's actual performance and future potential.

Participation in Industry Events and Conferences

Capstone Copper actively engages in key industry events and conferences, such as the Prospectors & Developers Association of Canada (PDAC) convention, a premier global mining event. These gatherings are crucial for Capstone to highlight its flagship projects, like the Mantos Blancos and Santo Domingo projects in Chile, and its progress in advancing copper extraction technologies. For instance, at PDAC 2024, discussions often revolve around responsible mining practices and technological innovation, areas where Capstone aims to demonstrate leadership.

These industry forums provide invaluable opportunities for Capstone to connect with a wide array of stakeholders. This includes forging partnerships with technology providers, attracting potential investors, and engaging with regulatory bodies and community representatives. By maintaining a strong presence at these events, Capstone reinforces its brand, cultivates relationships, and scouts for new business development avenues.

Capstone leverages these platforms to clearly articulate its strategic vision for expansion and operational excellence, particularly within its focus on high-quality, mining-friendly jurisdictions. The company's participation underscores its commitment to transparency and its proactive approach to shaping the future of copper mining.

- Showcasing Projects: Capstone Copper uses industry events to present its mining portfolio, including advancements at its Chilean operations.

- Networking and Partnerships: Participation facilitates connections with peers, potential investors, and strategic partners.

- Promoting Sustainability: Events serve as a venue to communicate Capstone's dedication to sustainable development and responsible mining.

- Communicating Growth Strategy: Capstone outlines its plans for expansion in favorable mining jurisdictions to industry leaders and stakeholders.

Capstone Copper's promotional efforts are multifaceted, aiming to build investor confidence and market awareness. They leverage detailed financial reporting, sustainability disclosures, and active participation in industry events to communicate their value proposition. This proactive approach ensures stakeholders receive timely and transparent information regarding operational progress and strategic objectives.

Price

Capstone Copper's product pricing is intrinsically linked to the global commodity markets, with the London Metal Exchange (LME) copper price serving as the primary benchmark. This direct correlation means that shifts in LME copper prices have a significant and immediate effect on Capstone's revenue streams and overall profitability. For instance, the company's first quarter 2025 performance highlighted this, with an elevated realized copper price of $4.36 per pound contributing positively to its adjusted EBITDA.

Capstone Copper is laser-focused on optimizing its C1 cash costs per payable pound of copper, a crucial metric for staying competitive and profitable, even when copper prices fluctuate. This strategic emphasis ensures the company's resilience in a dynamic market.

The company is actively pursuing operational enhancements and efficiently managing project ramp-ups, both of which are key drivers for reducing these per-pound production costs. These efforts are designed to streamline processes and boost output efficiency.

Looking ahead, Capstone Copper has provided guidance for 2025, projecting a substantial reduction in its C1 cash costs. This forecast indicates a significant improvement in operational efficiency and cost management strategies coming to fruition.

Capstone Copper actively manages price volatility by implementing hedging strategies, including zero-cost copper collars. These financial tools are designed to secure a minimum profitable price for a portion of their copper production, thereby mitigating the impact of adverse price fluctuations.

A key example of this strategy in action is Capstone's Q4 2024 activity, where they entered into approximately 20,000 tonnes of zero-cost copper collars specifically for their 2025 production. This proactive measure aims to provide a degree of price certainty for a significant volume of their output in the upcoming year.

Project Economics and Capital Allocation

Pricing strategies for future production from development projects, such as the Santo Domingo project, are directly tied to their projected economic viability. Key metrics like Net Present Value (NPV) and Internal Rate of Return (IRR) are crucial in determining this viability. These economic assessments inform how future output will be priced to ensure profitability and return on investment.

Capital allocation decisions for projects like Santo Domingo are heavily influenced by the long-term price outlook and the anticipated cost structures. A project's ability to generate sufficient returns over its lifespan dictates the capital it will receive for development and ongoing operations. This strategic allocation ensures resources are directed towards the most economically sound ventures.

The Santo Domingo project itself demonstrates strong economic potential, boasting an impressive after-tax NPV of $1.7 billion. This substantial NPV indicates that the project is expected to generate significant value above its initial investment, supporting a favorable pricing strategy for its future production.

- Projected Economic Viability: Influences pricing strategies for future production.

- Key Metrics: NPV and IRR are critical for assessing project viability.

- Capital Allocation: Driven by long-term price outlook and cost structures.

- Santo Domingo NPV: Stands at $1.7 billion after tax, highlighting robust economic potential.

Market Demand and Supply Dynamics

The global copper market is experiencing robust demand, fueled by the accelerating pace of electrification and ongoing infrastructure development worldwide. This strong demand, coupled with supply constraints, creates a dynamic pricing environment. Capstone Copper is strategically positioned to capitalize on these trends, forecasting significant production growth to meet the escalating global copper requirements.

Capstone Copper's production is projected to increase substantially, with a key forecast indicating significant growth in 2025. This expansion is crucial for addressing the world's increasing need for copper, a vital component in renewable energy technologies and modern infrastructure projects.

- Electrification Trends: The global shift towards electric vehicles and renewable energy sources is a primary driver of copper demand.

- Infrastructure Development: Major infrastructure projects, particularly in emerging economies, require substantial amounts of copper.

- Production Growth: Capstone Copper anticipates significant production increases, aiming to contribute to meeting global supply needs.

- 2025 Forecast: The company has projected notable production growth for the year 2025, underscoring its expansion plans.

Capstone Copper's pricing strategy is deeply intertwined with the global copper market, primarily referencing the London Metal Exchange (LME) price. This direct link means that fluctuations in LME copper prices significantly impact the company's revenue and profitability. For instance, in Q1 2025, an elevated realized copper price of $4.36 per pound positively influenced Capstone's adjusted EBITDA.

To navigate price volatility, Capstone employs hedging strategies like zero-cost copper collars. A notable example is their Q4 2024 action, where they secured approximately 20,000 tonnes of their 2025 production through these collars, aiming to ensure a minimum profitable price and provide price certainty.

The company's focus on optimizing C1 cash costs per payable pound of copper is crucial for maintaining competitiveness. They are actively pursuing operational enhancements and efficient project ramp-ups to lower these per-pound production costs, with guidance for 2025 projecting a substantial reduction in these costs, signaling improved operational efficiency.

Future pricing for projects like Santo Domingo is directly tied to their economic viability, assessed through metrics such as Net Present Value (NPV) and Internal Rate of Return (IRR). The Santo Domingo project, with an after-tax NPV of $1.7 billion, demonstrates strong economic potential, supporting a favorable pricing strategy for its future output.

| Metric | Value | Period | Significance |

|---|---|---|---|

| Realized Copper Price | $4.36/lb | Q1 2025 | Positive impact on adjusted EBITDA |

| Zero-Cost Collars | 20,000 tonnes | Q4 2024 (for 2025 production) | Price certainty for future output |

| Santo Domingo NPV (after-tax) | $1.7 billion | Projected | Indicates robust economic potential |

| C1 Cash Costs | Projected reduction | 2025 Guidance | Improved operational efficiency |

4P's Marketing Mix Analysis Data Sources

Our Capstone 4P's Marketing Mix Analysis is meticulously constructed using a blend of primary and secondary data. We leverage official company websites, product documentation, and direct customer feedback for Product insights, while Price analysis draws from competitor pricing, sales promotions, and publicly available pricing structures.