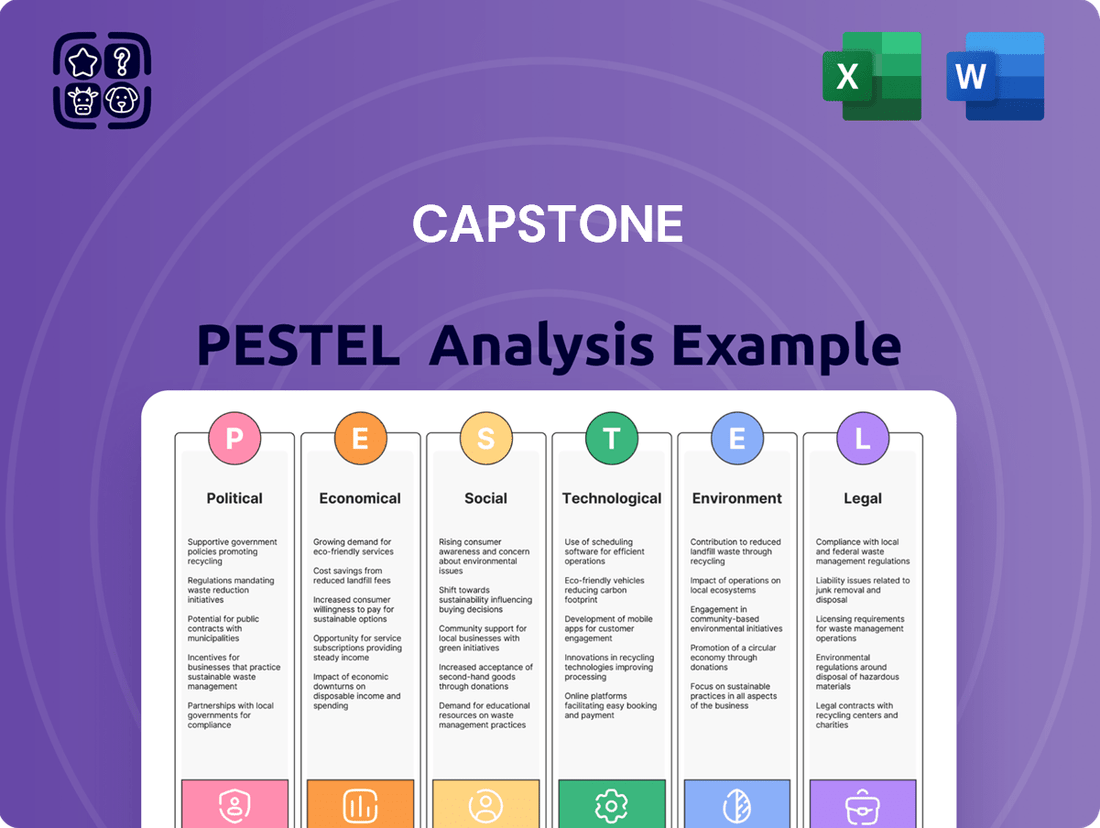

Capstone PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Capstone Bundle

Navigate the dynamic landscape surrounding Capstone with our comprehensive PESTLE analysis. Uncover the political, economic, social, technological, legal, and environmental factors that are shaping its trajectory. Arm yourself with this crucial intelligence to make informed decisions and gain a competitive edge. Download the full analysis now for actionable insights.

Political factors

Capstone Copper's operations in Chile, Mexico, and the USA are significantly influenced by government stability and policy. For instance, Chile's commitment to mining investment, as evidenced by its stable regulatory framework, supports Capstone's development of projects like Santo Domingo, which is slated for production in 2025.

However, shifts in government or policy, such as potential changes to mining royalties or environmental regulations in any of these regions, could impact operational costs and project economics. The risk of resource nationalism or nationalization, though currently low, remains a consideration for long-term foreign investment in the mining sector.

Capstone actively engages with governments to navigate these factors, aiming to ensure policy predictability. In 2024, ongoing discussions around fiscal policies in Latin America highlight the need for continuous monitoring to safeguard investments and maintain operational continuity.

Capstone Copper operates within a complex and dynamic regulatory landscape. Navigating diverse rules on land use, resource extraction, and operational permits across different jurisdictions, including Chile and Mexico, is crucial for their success.

The efficiency of permitting processes directly impacts project timelines and expansion capabilities. For instance, the Mantoverde Optimized project in Chile, a key growth driver for Capstone, relies heavily on timely approvals to maintain its development schedule and projected production increases.

In 2024, Capstone Copper reported that its Mantoverde project achieved significant progress, with construction advancing well and permitting for the expansion phase progressing as planned, underscoring the critical nature of these regulatory hurdles.

Global trade policies, particularly those impacting copper and its related materials, directly influence Capstone Copper's ability to access export markets and maintain profitability. For instance, the United States imposed tariffs on steel and aluminum imports in 2018, which, while not directly on copper, signaled a broader trend of protectionism that could extend to other commodities.

Capstone Copper must closely track evolving international trade agreements and any emerging trade disputes. Such developments can significantly alter demand for copper and affect its global pricing, thereby impacting the company's revenue streams and its overall market access. The ongoing trade tensions between major economies in 2024 continue to create uncertainty in commodity markets.

Geopolitical Risks and Supply Chain Security

Geopolitical tensions, particularly in regions like South America where significant copper mining occurs, pose a direct threat to Capstone Copper's supply chain. For instance, ongoing political instability in Peru, a major copper producer, can lead to operational disruptions and affect the availability of essential mining equipment and reagents. In 2023, Peru experienced significant social unrest which impacted mining operations, with some companies reporting temporary halts in production.

Capstone Copper must actively monitor and strategize against risks stemming from political volatility, conflicts, or the imposition of trade restrictions. Such events can severely hamper operational efficiency and the secure sourcing of critical materials. For example, the potential for new trade tariffs or export bans, as seen in past trade disputes, could significantly increase costs and delay shipments of both inputs and finished copper products.

- Geopolitical Risk: Increased political instability in key copper-producing nations, such as Chile and Peru, can lead to supply chain disruptions.

- Supply Chain Impact: These disruptions can affect the availability and cost of essential mining inputs like explosives, chemicals, and specialized machinery.

- Mitigation Strategy: Capstone Copper needs robust contingency plans to diversify sourcing and secure alternative logistics routes to maintain operational continuity.

- Trade Restrictions: Potential for new trade barriers or sanctions imposed by major economies could impact global copper demand and pricing, affecting Capstone's export markets.

Fiscal Policies and Taxation

Changes in fiscal policies, like corporate tax rates and export duties, significantly impact Capstone Copper's profitability. For instance, a nation's decision to increase corporate taxes could directly reduce the company's net income, requiring careful financial planning. Governments often adjust these policies in response to fluctuating commodity prices or their own revenue targets, making it crucial for Capstone to anticipate and adapt to evolving tax liabilities.

Capstone Copper's financial performance is directly tied to governmental fiscal decisions. For example, if a host country were to increase its corporate income tax rate from 25% to 30%, this would directly reduce the company's retained earnings. Similarly, changes in royalty payments or export duties can alter the cost structure and competitiveness of Capstone's operations. These policy shifts, often driven by national economic conditions or commodity market volatility, necessitate robust forecasting and strategic adaptation to manage the company's overall tax burden and operational costs.

- Corporate Tax Rates: Fluctuations in corporate tax rates in key operating jurisdictions directly affect Capstone Copper's net income. For example, a hypothetical 5% increase in a major operating country's corporate tax rate could reduce earnings per share by a significant margin.

- Royalties and Export Duties: Changes in royalty structures or the introduction of export duties can increase the cost of production and reduce the net revenue received from exported copper. These levies are often adjusted based on global commodity prices.

- Government Revenue Needs: Host governments may alter fiscal policies to meet national revenue targets, especially during periods of high commodity prices, potentially increasing the tax burden on mining companies like Capstone.

- Fiscal Stability Agreements: Capstone Copper may negotiate fiscal stability agreements with host governments to provide a degree of predictability in tax and royalty obligations over the long term, mitigating some policy-related risks.

Government stability and policy shifts in Chile, Mexico, and the USA significantly influence Capstone Copper's operations. Chile's supportive mining framework aids projects like Santo Domingo, targeting 2025 production. However, potential changes in mining royalties or environmental rules could escalate costs, while resource nationalism remains a long-term risk for foreign investment.

What is included in the product

This Capstone PESTLE Analysis provides a comprehensive examination of the external macro-environmental factors impacting the Capstone across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors into actionable insights.

Economic factors

Global copper demand is intrinsically linked to economic expansion, especially within burgeoning sectors like renewable energy, electric vehicles, and infrastructure projects. For instance, the International Energy Agency projected in 2024 that the energy sector alone could account for over half of total copper demand by 2030, driven by the clean energy transition. This strong correlation means that economic slowdowns can directly dampen copper consumption.

Copper prices experienced significant volatility in late 2023 and early 2024, with LME benchmark prices fluctuating around the $8,000 to $9,000 per tonne range. These shifts, influenced by supply disruptions in major producing regions like Chile and Peru, alongside robust demand from China, directly affect Capstone Copper's financial performance. Effective price forecasting and hedging strategies are therefore crucial for mitigating revenue and profit risks.

Rising inflation, particularly in energy, labor, and key raw materials like sulfuric acid, directly impacts Capstone Copper's operational expenses. For instance, global energy prices saw significant volatility in late 2024 and early 2025, directly affecting mining and processing costs.

Capstone Copper's financial performance hinges on its capacity to control these escalating input costs and boost operational efficiency. The company's stated goal of achieving cost reductions, with specific targets for 2025, is a crucial indicator of its strategy to mitigate these inflationary pressures and maintain profitability in a challenging economic environment.

Capstone Copper's global operations expose it to significant currency exchange rate fluctuations. For instance, during the first quarter of 2024, the Australian dollar (AUD) experienced a slight depreciation against the US dollar (USD), which can affect the reported value of Capstone's Australian assets and revenues when translated into USD.

These shifts directly impact Capstone's financial performance by altering the USD equivalent of its operating costs and revenues generated in local currencies like the Chilean peso (CLP) or the AUD. A stronger USD, for example, would make its Chilean operations appear less profitable in USD terms, even if local currency profitability remains stable.

The company's financial statements for 2024 will likely reflect these impacts, with analysts closely monitoring the hedging strategies Capstone employs to mitigate such currency risks. For example, a 5% adverse movement in the AUD/USD rate could reduce reported earnings by a material amount if unhedged.

Access to Capital and Financing Costs

A company's capacity to finance crucial exploration, development, and expansion initiatives hinges directly on its access to capital markets and the prevailing financing costs. Factors like fluctuating interest rates, shifts in investor confidence, and the overall liquidity within the global economy significantly impact both the expense and the sheer availability of debt and equity financing options.

For instance, in early 2024, many companies experienced rising borrowing costs as central banks continued to manage inflation. The Federal Reserve's target federal funds rate remained elevated, influencing broader lending rates. Similarly, equity market volatility in late 2023 and early 2024 made raising capital through stock offerings more challenging and potentially dilutive for many businesses.

- Interest Rate Environment: As of mid-2024, benchmark interest rates, such as the US Treasury yield curve, reflect ongoing monetary policy adjustments, impacting the cost of debt for businesses.

- Investor Sentiment: Global investor sentiment, influenced by geopolitical events and economic outlooks, directly affects the risk premiums demanded for equity investments.

- Liquidity Conditions: The availability of credit in the market, a measure of economic liquidity, can tighten or loosen based on central bank actions and financial institution health, affecting capital accessibility.

- Financing Costs: The average cost of capital for non-financial corporations in major economies has seen an upward trend in the 2023-2024 period compared to the preceding low-interest-rate environment.

Economic Growth in Operating Regions

The economic vitality of Chile, Mexico, and the United States, where Capstone Copper has significant operations, directly impacts its business. Robust economic expansion in these regions fuels local demand for goods and services, which can translate into increased opportunities for Capstone. For instance, Chile's economy, a major copper producer, experienced a GDP growth of approximately 2.5% in 2024, according to projections, supporting a stable operating environment. Similarly, Mexico's economic outlook for 2024 suggests a growth rate around 2.0-2.5%, bolstering labor availability and potential for local business collaborations.

Strong regional economic performance fosters a more predictable and supportive operational landscape for Capstone Copper. This growth can lead to greater availability of skilled labor, access to capital, and a more receptive environment for community development initiatives. The United States, a key market for many commodities, projected GDP growth of around 2.0% in 2024, contributing to overall stability and market demand that benefits Capstone's operations.

- Chile's GDP growth in 2024 projected around 2.5%

- Mexico's economic growth forecast for 2024 at 2.0-2.5%

- United States GDP growth anticipated at approximately 2.0% for 2024

- Economic health influences local demand, labor, and partnership opportunities

Global economic conditions significantly influence copper demand, with sectors like EVs and renewable energy driving growth. For example, the International Energy Agency projected in 2024 that the energy sector could account for over half of total copper demand by 2030. Economic slowdowns directly dampen copper consumption, as seen in price volatility around $8,000-$9,000 per tonne for LME benchmark prices in late 2023 and early 2024, influenced by supply disruptions and Chinese demand.

Inflationary pressures, particularly on energy and labor costs, directly impact Capstone Copper's operational expenses. Global energy prices showed volatility in late 2024 and early 2025, affecting mining and processing costs. Capstone's strategy to achieve cost reductions by 2025 is crucial for mitigating these pressures and maintaining profitability.

Currency fluctuations, such as the AUD depreciation against the USD in Q1 2024, affect Capstone Copper's reported asset values and revenues. A 5% adverse movement in the AUD/USD rate could materially reduce earnings if unhedged, highlighting the importance of hedging strategies.

Access to capital markets and financing costs are critical for company growth. Elevated interest rates, as seen with the Federal Reserve's target federal funds rate in early 2024, increase borrowing costs. Equity market volatility in late 2023 and early 2024 made capital raising more challenging.

| Economic Factor | 2024 Data/Projection | Impact on Capstone Copper |

|---|---|---|

| Global Copper Demand Driver | Energy sector to drive over 50% of copper demand by 2030 (IEA, 2024 projection) | Strong link between economic expansion and copper consumption. |

| Copper Price Range (LME Benchmark) | $8,000 - $9,000 per tonne (late 2023 - early 2024) | Volatility impacts revenue and profit; necessitates hedging. |

| Inflationary Impact | Volatile global energy prices (late 2024 - early 2025) | Increases operational expenses (energy, labor, materials). |

| Currency Exchange Rate Impact | AUD depreciation vs. USD (Q1 2024) | Affects reported USD value of Australian assets and revenues. |

| Financing Costs | Elevated US Federal Funds Rate (early 2024) | Increases borrowing costs and challenges equity raising. |

| Regional GDP Growth (Projections) | Chile: ~2.5% Mexico: ~2.0-2.5% USA: ~2.0% |

Supports stable operations, labor availability, and market demand. |

Same Document Delivered

Capstone PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive Capstone PESTLE analysis provides a detailed examination of the external factors impacting your chosen business. What you see is the complete, professionally structured report you'll download.

No placeholders, no teasers—this is the real, ready-to-use file you’ll get upon purchase, offering actionable insights for your capstone project.

Sociological factors

Capstone Copper's dedication to responsible mining and fostering positive community relationships is fundamental to securing its social license to operate. This involves actively listening to and addressing local concerns, ensuring transparency, and demonstrating tangible benefits that resonate with community needs.

In 2024, Capstone Copper continued its focus on community investment programs, contributing to local infrastructure and education initiatives. For instance, their operations in Chile saw continued engagement with indigenous communities, aiming to integrate traditional knowledge into their environmental management plans, a strategy that has historically proven effective in building trust and long-term partnerships.

The company's commitment to delivering socioeconomic benefits, such as employment opportunities and local procurement, directly impacts its operational continuity. By actively managing environmental and social impacts and fostering open dialogue, Capstone aims to mitigate potential disruptions and build a foundation of mutual respect, crucial for sustainable mining in 2025 and beyond.

Local employment creation is a significant sociological factor. For instance, in 2024, the manufacturing sector, a key area for many businesses, saw a 2.5% increase in job creation across the US, directly impacting local communities.

A company's commitment to local hiring and workforce development programs can foster strong community ties. Investing in training initiatives, such as apprenticeships or upskilling programs, not only addresses immediate labor needs but also contributes to long-term economic stability for residents, potentially reducing unemployment rates which stood at 3.9% in the US as of May 2024.

Capstone Copper recognizes that employee and community well-being is a critical social factor. In 2023, the company reported a Total Recordable Injury Frequency Rate (TRIFR) of 2.1, a figure they aim to further reduce through enhanced safety training and risk management. This commitment extends to ensuring safe operating practices that protect the environment and the health of nearby populations.

Proactive measures in occupational health, such as regular health screenings and ergonomic assessments, are integral to Capstone's operations. The company's investment in advanced ventilation systems and dust control technologies at its mines, like the Pinto Valley Mine, directly addresses potential respiratory hazards. This focus on safety not only safeguards individuals but also bolsters Capstone's reputation as a responsible corporate citizen.

Indigenous Relations and Cultural Heritage

Capstone Copper's operations are significantly influenced by its relationships with indigenous communities. In 2024, the company continued to focus on building trust and ensuring that its projects, such as the Santo Domingo project in Chile, align with the rights and cultural heritage of local indigenous groups. This involves ongoing dialogue and collaboration to foster mutual benefit and social license to operate.

Meaningful consultation and the establishment of benefit-sharing agreements are paramount. These processes are designed to empower indigenous communities, recognizing their traditional land rights and ensuring their cultural practices are respected throughout the project lifecycle. Capstone Copper's commitment to these principles is a key factor in its long-term sustainability and social acceptance.

- Indigenous Consultation: Capstone Copper actively engages with indigenous leaders and representatives to incorporate their perspectives into operational planning and impact mitigation strategies.

- Cultural Heritage Protection: Measures are in place to identify, protect, and preserve cultural heritage sites and practices within project areas, ensuring minimal disruption to traditional ways of life.

- Benefit Sharing: The company works towards establishing equitable benefit-sharing mechanisms, aiming to provide tangible economic and social advantages to indigenous communities impacted by its activities.

- Social License: Maintaining a strong social license to operate requires continuous engagement and demonstrable respect for indigenous rights, fostering positive and collaborative relationships.

Workforce Diversity and Inclusion

Capstone Copper's commitment to workforce diversity and inclusion is crucial for its social license to operate and its ability to attract top talent. By actively promoting an inclusive environment, the company can significantly boost its reputation. This focus also allows Capstone to tap into a wider range of skills and perspectives, which is increasingly valued in the global mining sector.

In 2024, many leading mining companies, including those in copper, are setting ambitious diversity targets. For instance, some have aimed to increase female representation in leadership roles to 30% by 2025. Capstone's efforts in this area can lead to better decision-making and innovation, directly impacting operational efficiency and community relations.

- Enhanced Reputation: A diverse and inclusive workforce strengthens Capstone's public image, making it more attractive to investors and stakeholders who prioritize ESG (Environmental, Social, and Governance) factors.

- Talent Acquisition and Retention: Companies with strong D&I initiatives, like those reporting over 25% higher employee engagement in 2024 surveys, tend to attract and retain a broader spectrum of skilled professionals.

- Improved Innovation and Problem-Solving: Diverse teams are often more creative and better at identifying solutions, a critical advantage in the complex mining industry.

- Community Relations: Reflecting the diversity of the communities in which Capstone operates fosters stronger relationships and greater social acceptance for its projects.

Sociological factors significantly shape Capstone Copper's operational landscape, emphasizing community relations and workforce dynamics. In 2024, a key focus remained on local employment, with the broader manufacturing sector seeing a 2.5% job creation increase in the US, highlighting the importance of such initiatives for community stability. Capstone's investment in training programs aims to reduce unemployment, which stood at 3.9% in the US as of May 2024, thereby strengthening local ties.

Capstone Copper's commitment to indigenous communities is also a critical sociological element. In 2024, ongoing dialogue and collaboration, particularly at projects like Santo Domingo in Chile, aimed to align operations with the rights and cultural heritage of local groups. This focus on mutual benefit and social license is essential for long-term project acceptance and sustainability.

Workforce diversity and inclusion are increasingly vital for Capstone's reputation and talent acquisition. By 2025, many mining firms are targeting 30% female representation in leadership, a trend Capstone is embracing to foster innovation and improve decision-making. Companies with strong diversity initiatives reported over 25% higher employee engagement in 2024 surveys, underscoring the positive impact on talent retention and overall performance.

| Sociological Factor | Capstone's Focus Area | 2024/2025 Relevance/Data |

|---|---|---|

| Community Relations | Local Employment & Training | US Manufacturing Job Growth: 2.5% (2024); US Unemployment Rate: 3.9% (May 2024) |

| Indigenous Engagement | Consultation & Benefit Sharing | Ongoing dialogue at Santo Domingo project (Chile) |

| Workforce Diversity | Inclusion & Representation | Target: 30% female leadership by 2025; Higher employee engagement in diverse firms (25%+ in 2024) |

Technological factors

Capstone Copper is actively adopting advanced mining technologies, a key technological factor. This includes a significant push towards automation to boost operational efficiency and safety. For instance, their Mantoverde project in Chile is a prime example, incorporating new equipment and processes designed to increase productivity.

These technological advancements aim to reduce human involvement in hazardous mining environments, directly improving worker safety. By investing in and implementing solutions like autonomous haulage systems and remote operation centers, Capstone Copper is positioning itself for more cost-effective operations. This strategic adoption of technology is crucial for maintaining a competitive edge in the evolving mining landscape.

Technological advancements in geological surveying, remote sensing, and data analytics are revolutionizing copper exploration. Capstone Copper can leverage these tools to pinpoint new deposits and refine existing mine operations. For instance, AI-powered data analysis of seismic and satellite imagery can identify potential ore bodies with greater precision than traditional methods. In 2024, investments in advanced exploration technology are expected to rise as companies seek to de-risk discovery and improve efficiency.

Innovation in sustainable mining is a major technological driver, focusing on areas like water management, energy efficiency, and waste reduction. These advancements are crucial for environmental stewardship and operational efficiency.

Capstone Copper's commitment to reducing freshwater consumption by 15% and increasing renewable energy use to 30% by 2025 highlights their proactive adoption of these technologies. Their improved tailings management systems are also a key part of this strategy.

Data Analytics and Digitalization

Capstone Copper can significantly enhance its operational efficiency by embracing data analytics and digitalization. This involves integrating advanced systems to gain real-time insights into every facet of its operations, from mining processes to equipment health. For instance, by analyzing production data, Capstone could identify bottlenecks and optimize resource allocation, potentially boosting output.

The adoption of digital tools allows for predictive maintenance, reducing costly downtime. Imagine a scenario where sensors on critical machinery can forecast potential failures, enabling proactive repairs rather than reactive, expensive breakdowns. This proactive approach is crucial in the mining sector where equipment reliability directly impacts profitability.

The benefits of digitalization extend to cost management as well. Detailed data analysis can pinpoint areas of inefficiency, allowing Capstone to implement targeted cost-saving measures. This could involve optimizing energy consumption or streamlining supply chain logistics.

- Real-time Production Monitoring: Implementing IoT sensors and advanced analytics platforms allows for immediate tracking of ore grades, extraction rates, and processing volumes, enabling swift adjustments to optimize output.

- Predictive Maintenance: Utilizing machine learning algorithms to analyze equipment sensor data can forecast potential failures, reducing unscheduled downtime by an estimated 15-20% in similar industrial operations.

- Cost Optimization: Digital tools can provide granular insights into energy usage, consumables, and labor allocation, identifying opportunities for cost reduction in areas like fuel efficiency and waste management.

- Enhanced Decision-Making: Access to comprehensive, up-to-the-minute data empowers management to make more informed strategic and operational decisions, improving overall business agility and responsiveness.

Processing and Metallurgy Innovations

Technological advancements in copper processing and metallurgy are significantly shaping the industry. Innovations are focused on enhancing copper recovery rates, which directly impacts profitability, and simultaneously minimizing the environmental footprint of extraction and refining operations. For instance, the development of advanced flotation reagents and more efficient grinding technologies can lead to higher concentrate grades.

Capstone Copper is actively leveraging these technological factors. The company's strategic emphasis on optimizing its concentrator plants, such as those at its Mantos Blancos and Santo Domingo projects, aims to boost operational efficiency. By exploring novel processing methods, Capstone Copper anticipates achieving higher metal yields and consequently reducing its overall operating costs, a critical advantage in the competitive copper market.

- Improved Recovery Rates: Innovations in comminution and flotation are pushing copper recovery rates higher. For example, some advanced grinding circuits are reporting recovery improvements of 2-3% in pilot studies.

- Environmental Impact Reduction: New metallurgical techniques are reducing water usage and waste generation. Some bioleaching processes, for example, can use up to 50% less water compared to traditional methods.

- Cost Optimization: Enhanced processing efficiency directly translates to lower per-unit production costs. Capstone Copper's focus on plant optimization is expected to contribute to a reduction in its all-in sustaining costs (AISC) in the coming years.

- New Processing Avenues: Research into areas like selective grinding and advanced sensor-based sorting offers pathways to process lower-grade ores more economically, expanding the potential resource base.

Technological factors are driving significant advancements in copper mining, from exploration to processing. Capstone Copper is actively integrating automation and digitalization to enhance efficiency, safety, and cost-effectiveness across its operations. Investments in AI for geological surveying and predictive maintenance for equipment are key strategies for 2024 and beyond.

Innovation in sustainable mining technologies, such as improved water management and renewable energy integration, is also a critical focus. Capstone Copper's targets, like increasing renewable energy use to 30% by 2025, underscore this commitment. These technological shifts are vital for maintaining a competitive edge and environmental responsibility.

Advancements in copper processing are leading to higher recovery rates and reduced environmental impact. Capstone Copper is optimizing its concentrator plants to achieve better metal yields, directly impacting its all-in sustaining costs (AISC). Exploring new processing avenues for lower-grade ores is also a significant technological trend.

| Technology Area | Capstone Copper's Focus | Industry Trend (2024-2025) | Impact on Capstone |

|---|---|---|---|

| Automation & Robotics | Autonomous haulage, remote operations | Increased adoption for safety and efficiency | Reduced operational costs, improved safety |

| Digitalization & Data Analytics | Real-time monitoring, predictive maintenance | Growing investment in AI and IoT | Enhanced decision-making, reduced downtime |

| Sustainable Mining Tech | Water management, renewable energy | Emphasis on ESG compliance and resource efficiency | Lower environmental footprint, potential cost savings |

| Processing & Metallurgy | Concentrator plant optimization, new reagents | Focus on recovery rates and processing lower-grade ores | Higher metal yields, reduced AISC |

Legal factors

Capstone Copper operates under a complex web of environmental laws, demanding strict adherence to standards for air quality, water usage, waste disposal, and habitat preservation across its global sites. For instance, in 2024, Chile, a key operational area for Capstone, continued to enforce rigorous environmental impact assessments for new mining projects, with potential penalties for non-compliance escalating significantly.

Failure to meet these environmental mandates can lead to severe financial penalties, such as the $1.5 million fine imposed on a peer mining company in Peru in late 2023 for improper wastewater management, or even outright operational shutdowns. Such non-compliance also carries substantial reputational risks, impacting investor confidence and community relations, which are crucial for long-term project viability.

Capstone Copper operates under stringent health and safety legislation designed to safeguard its workforce. For instance, in 2024, the mining industry globally saw continued focus on reducing incident rates, with many jurisdictions mandating specific safety protocols and reporting requirements.

Compliance involves rigorous adherence to these laws, including regular safety audits and the implementation of robust safety management systems. Capstone's commitment to preventing accidents and fostering a secure working environment is paramount, directly impacting operational continuity and employee well-being.

Compliance with labor laws, covering wages, working conditions, and employment equity, is non-negotiable for businesses. For instance, in the US, the Fair Labor Standards Act (FLSA) mandates minimum wage and overtime pay, with the federal minimum wage at $7.25 per hour as of mid-2024, though many states have higher rates. Failure to adhere can lead to significant penalties and legal challenges.

Labor disputes and non-compliance can severely disrupt operations and tarnish a company's reputation. In 2023, the US saw a notable increase in union activity and strikes across various sectors, highlighting the ongoing importance of fair labor practices and collective bargaining agreements. Such disruptions can result in lost productivity and revenue, impacting financial performance.

Corporate Governance and Reporting Standards

Capstone Copper, as a publicly traded entity, operates under stringent corporate governance and financial reporting mandates. Compliance with regulations from exchanges like the Toronto Stock Exchange (TSX), Australian Securities Exchange (ASX), and filing platforms such as SEDAR+ is paramount. This adherence ensures the company's operations are transparent and accountable to stakeholders.

The company's commitment to clear and precise reporting, evident in its sustainability disclosures and proceedings at annual general meetings, is crucial for fostering investor trust. For instance, Capstone's 2023 Sustainability Report detailed a 16% reduction in Scope 1 and 2 greenhouse gas emissions intensity compared to the 2021 baseline, showcasing a tangible commitment to environmental stewardship alongside financial reporting. This transparency is vital for maintaining regulatory standing and attracting investment.

- Regulatory Compliance: Adherence to TSX, ASX, and SEDAR+ reporting standards is mandatory.

- Investor Confidence: Transparent financial and sustainability reporting builds trust.

- Governance Practices: Upholding best practices in corporate governance is essential for long-term viability.

- Data Integrity: Ensuring accuracy in all public disclosures is a legal and ethical requirement.

Permitting and Licensing Laws

Capstone Copper's operations are heavily influenced by permitting and licensing laws, which form the bedrock of legal authorization for mining activities. Navigating these regulations is paramount for both existing operations and future growth, as demonstrated by the Mantoverde Optimized project, which required specific permits to proceed. These legal requirements ensure that mining activities adhere to environmental, safety, and operational standards set by governing bodies.

The complexity of obtaining and maintaining these permits can significantly impact project timelines and costs. For instance, securing environmental impact assessments and operational licenses involves rigorous review processes. In 2024, the mining sector globally continued to see increased scrutiny on permitting, with some jurisdictions experiencing longer lead times for approvals due to enhanced environmental and social governance (ESG) considerations.

- Regulatory Compliance: Capstone Copper must meticulously adhere to all national and local mining laws to maintain its operating licenses.

- Permit Acquisition: Obtaining necessary permits for new projects, like the Mantoverde Optimized expansion, is a critical legal hurdle.

- Timelines and Costs: Permitting processes can introduce significant delays and financial burdens, impacting project economics.

- Evolving Legal Landscape: Changes in environmental and labor laws can necessitate adjustments in operational strategies and compliance measures.

Legal factors are critical for Capstone Copper, encompassing environmental regulations, health and safety standards, labor laws, corporate governance, and permitting. Non-compliance can result in substantial fines, operational disruptions, and reputational damage, as seen with increased scrutiny on mining permits globally in 2024 and a $1.5 million fine for a peer in Peru in late 2023 for wastewater issues.

Adherence to TSX, ASX, and SEDAR+ reporting is mandatory, with transparency in financial and sustainability reporting, like Capstone's 16% Scope 1 & 2 GHG emission intensity reduction in 2023, vital for investor trust. Labor laws, including minimum wage mandates (e.g., US federal $7.25/hr as of mid-2024), also require strict observance to avoid disputes and disruptions, evidenced by increased US union activity in 2023.

| Legal Factor | Impact on Capstone Copper | Example/Data Point (2023-2024) |

|---|---|---|

| Environmental Regulations | Operational permits, potential fines, reputational risk | Chile's strict environmental impact assessments; Peru mining fine ($1.5M) for wastewater (late 2023) |

| Health & Safety Laws | Workforce protection, operational continuity | Global focus on reducing incident rates; mandated safety protocols |

| Labor Laws | Employee relations, operational stability, compliance costs | US federal minimum wage $7.25/hr (mid-2024); increased US union activity (2023) |

| Corporate Governance & Reporting | Investor confidence, regulatory standing | TSX, ASX, SEDAR+ compliance; Capstone's 16% GHG intensity reduction (2023) |

| Permitting & Licensing | Project timelines, costs, operational authorization | Increased global scrutiny on mining permits (2024); longer lead times for approvals |

Environmental factors

Climate change poses significant risks and opportunities for Capstone Copper. The company has set an ambitious target to slash its fuel and power related greenhouse gas (GHG) emissions by 30% by 2030, a crucial step in its decarbonization journey.

A key part of this strategy involves a substantial shift towards renewable electricity sources. Capstone Copper is actively developing comprehensive decarbonization plans to achieve these emission reduction goals.

The company is also preparing for potential climate-related disruptions, such as extreme weather events, which could impact operations and supply chains. This proactive adaptation is vital for long-term resilience.

Water scarcity is a major environmental challenge for Capstone Copper, particularly in Chile's arid regions where its operations are located. In 2023, the company reported a 12% reduction in freshwater consumption intensity year-over-year, a testament to its efforts in managing this critical resource.

Capstone is actively increasing its reliance on alternative water sources. By 2024, the company aims for 70% of its water needs at its Santo Domingo project to be met by desalinated and recycled water, significantly reducing its impact on local freshwater supplies.

Capstone Copper is prioritizing responsible tailings management, a critical environmental concern in mining. The company's commitment to adopting the Global Industry Standard for Tailings Management (GISTM) by 2026 underscores its dedication to minimizing environmental and social risks associated with mining waste.

This proactive approach includes ensuring independent assurance for its tailings storage facilities, a move that aligns with increasing global scrutiny on dam safety and environmental stewardship. Such measures are vital for maintaining operational continuity and stakeholder trust in the face of evolving environmental regulations and public expectations.

Biodiversity and Land Use Impacts

Mining, by its very nature, can significantly disrupt biodiversity and alter land ecosystems. Capstone Copper recognizes this, and as part of its commitment to sustainability, is developing a comprehensive Biodiversity Standard. This standard is slated for assessment across all its operational sites by 2025.

The core of this initiative involves applying a mitigation hierarchy, which means Capstone Copper will prioritize avoiding and minimizing harm to biodiversity before considering compensatory measures. This proactive approach aims to identify and address nature-related risks at each location. Furthermore, the company is committed to undertaking reclamation and habitat restoration projects, actively working to repair and enhance the ecosystems impacted by its activities.

- Biodiversity Standard Development: Capstone Copper is creating a new Biodiversity Standard.

- Site Assessments: All Capstone Copper sites will be assessed against this standard by 2025.

- Mitigation Hierarchy: The company will prioritize avoiding and minimizing biodiversity impacts.

- Reclamation Efforts: Projects for reclamation and habitat restoration are planned.

Waste and Pollution Control

Effective waste and pollution control is a critical environmental factor for mining, directly impacting operational sustainability and regulatory compliance. Companies must manage hazardous materials, prevent soil and water contamination, and mitigate dust and noise. For instance, in 2024, the global mining industry continued to face increasing scrutiny over its environmental practices, with stricter regulations being implemented in key mining regions like Australia and Canada regarding tailings dam safety and water discharge quality.

The financial implications of poor waste and pollution control can be substantial, leading to significant fines, remediation costs, and reputational damage. Innovations in waste management, such as dry stacking of tailings and advanced water treatment technologies, are becoming more prevalent. By 2025, it's projected that investments in these cleaner technologies will rise as companies aim to meet evolving environmental standards and stakeholder expectations.

- Regulatory Landscape: Mining operations in 2024 faced evolving environmental regulations, with countries like Chile and Peru tightening controls on water usage and waste disposal, impacting operational costs and requiring advanced compliance strategies.

- Technological Advancements: The development and adoption of technologies for waste minimization and pollution reduction, such as advanced filtration systems for acid mine drainage and dust suppression techniques, are key for operational efficiency and environmental stewardship.

- Financial Impact: Non-compliance with waste and pollution control standards can result in substantial fines. For example, several major mining incidents in recent years have led to multi-million dollar penalties and long-term remediation commitments for the responsible companies.

- Stakeholder Pressure: Increasing pressure from investors, communities, and environmental groups in 2024 and 2025 is driving mining companies to prioritize and invest more heavily in robust environmental management systems and transparent reporting on their pollution control efforts.

Capstone Copper is actively addressing environmental challenges, focusing on emissions reduction and resource management. The company aims to cut fuel and power-related greenhouse gas emissions by 30% by 2030, with a significant shift towards renewable electricity sources planned.

Water scarcity is a key concern, especially in Chile. Capstone Copper reduced freshwater consumption intensity by 12% year-over-year in 2023 and targets 70% of its Santo Domingo project's water needs to be met by desalinated and recycled water by 2024.

The company is also prioritizing responsible tailings management, committing to the Global Industry Standard for Tailings Management (GISTM) by 2026, and developing a comprehensive Biodiversity Standard to be assessed across all sites by 2025, emphasizing impact avoidance and minimization.

| Environmental Factor | Capstone Copper's Action/Target | Year/Timeline | Key Metric/Data |

|---|---|---|---|

| Greenhouse Gas Emissions | Reduce fuel and power related GHG emissions | By 2030 | 30% reduction target |

| Renewable Energy | Increase reliance on renewable electricity sources | Ongoing | Part of decarbonization strategy |

| Water Management | Reduce freshwater consumption intensity | 2023 | 12% reduction (YoY) |

| Water Management | Meet water needs with desalinated/recycled water (Santo Domingo) | By 2024 | 70% target |

| Tailings Management | Adopt Global Industry Standard for Tailings Management (GISTM) | By 2026 | Commitment to GISTM |

| Biodiversity | Develop and assess Biodiversity Standard | By 2025 | Assessment across all sites |

PESTLE Analysis Data Sources

Our Capstone PESTLE Analysis is meticulously constructed using a robust blend of primary and secondary data. We draw insights from reputable market research firms, government statistical agencies, and leading academic journals to ensure comprehensive and accurate macro-environmental understanding.