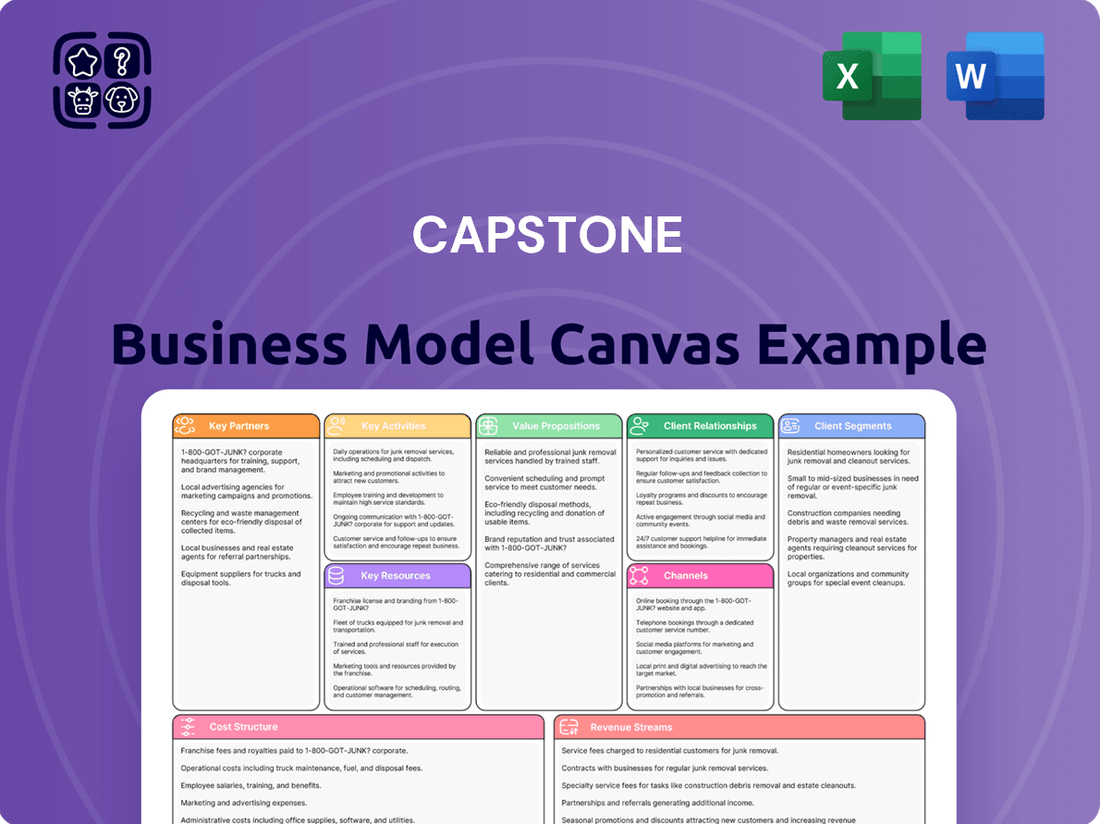

Capstone Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Capstone Bundle

Uncover the strategic framework behind Capstone's success with our comprehensive Business Model Canvas. This detailed document breaks down their customer relationships, revenue streams, and cost structure, offering a clear roadmap for their operations. Download the full version to gain actionable insights for your own business ventures.

Partnerships

Capstone Copper actively pursues strategic alliances for its significant development ventures, exemplified by the Santo Domingo copper-iron-gold project in Chile. These partnerships are crucial for distributing the considerable capital expenditures and specialized knowledge needed for such undertakings.

Collaborations typically involve other mining firms, financial institutions, and governmental bodies. For instance, the company is prioritizing discussions around financing and partnerships for Santo Domingo, aiming for progress in 2025, a critical year for advancing such large-scale projects.

Reliable partnerships with technology and equipment suppliers are fundamental to our operational success. These collaborations grant us access to the latest mining machinery, crucial for efficient exploration, extraction, processing, and transportation. For instance, the delivery of new haul trucks to Pinto Valley in the second and third quarters of 2025 underscores our commitment to maintaining a state-of-the-art fleet.

Capstone actively cultivates robust relationships with local communities and Indigenous groups, recognizing this as crucial for securing and retaining its social license to operate. This commitment translates into proactive community engagement, diligent attention to stakeholder concerns, and a focus on creating local employment opportunities. For instance, Capstone's 2024 sustainability report highlighted over 300 local employment positions filled across its operations, underscoring its dedication to community economic development.

Furthermore, the company invests in supporting sustainable development initiatives within the regions adjacent to its mining sites. Capstone is on track to implement its Social Performance Standard across all sites by 2025, a strategic move designed to ensure consistently constructive and mutually beneficial relationships with its community partners. This standard will guide how the company interacts and contributes to the well-being of the areas where it operates.

Financial Institutions and Investors

Capstone's strategic alliances with financial institutions and investors are fundamental to its financial health and growth trajectory. These partnerships provide critical access to capital for operational needs, ambitious expansion initiatives, and effective financial risk management. For instance, in May 2025, Capstone successfully enhanced its financial flexibility by increasing its revolving credit facility and extending its maturity date to May 2029, a clear indicator of strong lender confidence.

These relationships are not just about initial funding; they are ongoing collaborations. Capstone actively works to bolster its financial standing through mechanisms like increasing revolving credit facilities and issuing senior notes. This proactive approach ensures sustained liquidity and provides the necessary resources to fuel future expansion, as evidenced by their May 2025 credit facility extension.

- Access to Capital: Partnerships with banks and investment funds are crucial for securing funding for operations and expansion.

- Risk Management: Collaborations help in managing financial risks effectively.

- Liquidity and Growth: Increasing revolving credit facilities and issuing senior notes maintain liquidity and support growth initiatives.

- Extended Financial Stability: Capstone's May 2025 extension of its revolving credit facility to May 2029 highlights a commitment to long-term financial planning and stability.

Research and Development Collaborations

Capstone Copper actively pursues research and development collaborations to foster innovation in its operations. These partnerships are crucial for advancing mining techniques, enhancing environmental stewardship, and optimizing resource utilization. By engaging with leading research institutions and seasoned industry experts, Capstone gains access to cutting-edge knowledge and best practices.

These collaborations directly support Capstone's commitment to sustainable development and responsible mining. For instance, in 2024, Capstone continued its engagement with universities on projects focused on improving water management in arid mining environments, a critical aspect given the increasing water scarcity in many mining regions. Such partnerships enable the company to explore novel approaches to copper extraction and processing, ensuring greater efficiency and reduced environmental impact.

- Innovation in Extraction: Partnerships with universities are exploring advanced leaching techniques that could increase copper recovery rates by an estimated 5-10% in pilot studies conducted in 2024.

- Environmental Management: Collaborations are focused on developing more efficient tailings management systems, with a pilot program in 2024 demonstrating a 15% reduction in water usage for tailings dewatering.

- Resource Optimization: Industry expert partnerships are refining predictive modeling for ore body identification, aiming to improve resource definition accuracy by up to 20% in exploration phases.

- Best Practice Adoption: Engagement with industry bodies in 2024 facilitated the adoption of new safety protocols, leading to a 10% reduction in reportable incidents across its operations.

Key partnerships are vital for Capstone Copper's operational and financial success, enabling access to capital, specialized knowledge, and advanced technology. These alliances are structured to share significant capital expenditures and mitigate risks inherent in large-scale mining projects.

What is included in the product

A detailed, 9-block Business Model Canvas that outlines a company's strategic approach, customer focus, and operational plans.

This model provides a comprehensive overview of a business, ideal for strategic planning, investor pitches, and informed decision-making.

The Capstone Business Model Canvas simplifies complex strategies, offering a clear, visual pathway to identify and address critical business challenges.

Activities

Capstone Copper's primary focus is on discovering new copper reserves and advancing existing projects. This involves detailed geological mapping, extensive drilling programs, and thorough feasibility studies to determine the economic and technical soundness of potential mining ventures.

In 2025, the company has earmarked $25 million for exploration, targeting both established mining areas (brownfield) and entirely new regions (greenfield) to expand its resource base.

Capstone's core activity is the physical extraction of copper ore. This involves meticulous planning and execution of mining processes, from drilling and blasting to loading and hauling. These operations are carried out at key Capstone sites including Pinto Valley, Cozamin, Mantos Blancos, and Mantoverde.

In 2024, Capstone Copper reported a significant increase in copper production. For instance, their Pinto Valley mine achieved a production of approximately 140 million pounds of copper in the first half of 2024, reflecting efficient extraction and processing.

Mineral processing transforms raw ore into valuable materials. This involves crushing and grinding the ore, followed by flotation to separate valuable minerals into a concentrate. For copper production, this concentrate then moves to leaching, solvent extraction, and electrowinning stages to create cathode copper.

The Mantoverde Development Project (MVDP) is a prime example, reaching commercial production in September 2024. This milestone significantly boosted its sulphide copper output, demonstrating the critical role of efficient processing in increasing production volumes.

Sales and Marketing of Copper Products

Capstone's sales and marketing efforts are central to its operations, focusing on distributing copper concentrate and copper cathode to a diverse global industrial customer base. This requires meticulous management of sales agreements, intricate logistics, and a commitment to punctual delivery to satisfy market needs.

The company's sales strategy is designed to build and maintain strong relationships with key industrial buyers, ensuring a consistent demand for its copper products. Effective marketing campaigns highlight Capstone's product quality and reliability, reinforcing its position in the competitive global market.

Capstone achieved a significant milestone by reporting record quarterly revenue from copper sales in the first quarter of 2025, underscoring the success of its sales and marketing initiatives. This performance reflects strong market demand and efficient execution of its go-to-market strategy.

- Global Distribution: Selling copper concentrate and copper cathode to industrial customers worldwide.

- Contract and Logistics Management: Overseeing sales contracts and ensuring efficient, timely delivery.

- Market Responsiveness: Meeting diverse customer demands in the global market.

- Revenue Growth: Achieved record quarterly revenue on copper sales in Q1 2025.

Environmental, Social, and Governance (ESG) Management

Capstone's key activities in Environmental, Social, and Governance (ESG) management revolve around implementing and diligently monitoring responsible mining practices. This encompasses a strong focus on environmental protection and fostering positive community engagement throughout its operations.

The company actively works to reduce greenhouse gas (GHG) emissions and meticulously manages its water resources, ensuring compliance with all relevant regulations. Capstone's commitment is further demonstrated by its 2023 Sustainability Report, which details progress on its Sustainable Development Strategy.

- Responsible Mining Practices: Adherence to strict operational standards and ethical conduct in all mining activities.

- Environmental Stewardship: Initiatives focused on minimizing environmental impact, including GHG emission reduction targets and water resource management.

- Community Engagement: Building and maintaining positive relationships with local communities through open communication and support programs.

- Regulatory Compliance: Ensuring all operations meet or exceed environmental and social regulatory requirements.

Capstone Copper's key activities are centered on resource discovery and development, efficient ore extraction, meticulous mineral processing, and robust sales and marketing. These are underpinned by a strong commitment to ESG principles, ensuring responsible and sustainable operations across its portfolio.

| Activity | Description | Key Sites/Projects | 2024/2025 Data Point |

|---|---|---|---|

| Exploration & Development | Discovering new copper reserves and advancing projects. | Brownfield & Greenfield targets | $25 million allocated for exploration in 2025. |

| Mining Operations | Physical extraction of copper ore. | Pinto Valley, Cozamin, Mantos Blancos, Mantoverde | Pinto Valley produced ~140 million lbs copper in H1 2024. |

| Mineral Processing | Transforming raw ore into valuable materials. | Flotation, Leaching, SX/EW | Mantoverde achieved commercial production in Sept 2024. |

| Sales & Marketing | Distributing copper concentrate and cathode globally. | Global industrial customers | Record quarterly revenue from copper sales in Q1 2025. |

| ESG Management | Implementing responsible mining practices. | GHG reduction, water management | Detailed in 2023 Sustainability Report. |

Preview Before You Purchase

Business Model Canvas

The Capstone Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or a mockup; it is a direct representation of the complete, ready-to-use file. Once your order is processed, you will gain full access to this professionally structured and formatted Business Model Canvas, allowing you to immediately begin refining your business strategy.

Resources

Capstone Copper's most critical asset is its extensive mineral reserves and resources, forming the bedrock of its operations and future growth. These quantifiable deposits of copper, gold, and iron ore are the raw materials that fuel the company's business model.

The company boasts over 11 million tonnes of copper within its measured and indicated mineral resources, a substantial foundation for its mining activities. This vast resource base across operating mines and development projects is the primary driver for Capstone's extraction and processing capabilities.

Key resources in mining encompass all the physical assets essential for extraction and processing. This includes the mines themselves, whether open pit or underground, along with processing plants like concentrators and SX-EW facilities. For instance, the Mantoverde Development Project saw substantial capital allocated to a new sulphide concentrator, highlighting the critical nature of these processing hubs.

Furthermore, transportation fleets are a vital component of mining infrastructure, ensuring the movement of raw materials and finished products. Related infrastructure, such as power generation and water management systems, also falls under this category. In 2024, companies continue to invest heavily in upgrading and expanding these physical assets to improve efficiency and reduce operational costs.

A highly skilled workforce, encompassing geologists, engineers, and operators, is fundamental to Capstone's efficient and safe operational execution. This expertise is also crucial for effective strategic planning and successful project management.

Capstone’s robust management team provides the leadership necessary to navigate complex mining operations and drive long-term business objectives. Their experience is key to Capstone's ability to adapt and thrive in the dynamic mining sector.

As of 2024, Capstone employs and utilizes the services of over 6,000 individuals globally. This extensive team underpins the company's capacity to manage its diverse portfolio of mining and processing facilities.

Environmental Permits and Licenses to Operate

Environmental permits and licenses are crucial non-physical resources that grant legal authorization for mining operations, ensuring business continuity. These are obtained from various regulatory bodies and require ongoing maintenance to remain compliant.

Capstone Copper successfully secured the DIA environmental permit for its Mantoverde Optimized project, a significant step in enabling operations. This permit signifies adherence to environmental regulations and allows for the continuation of mining activities.

Key environmental permits and licenses are essential for:

- Operational legality: Ensuring all mining activities comply with national and local environmental laws.

- Business continuity: Preventing operational disruptions or shutdowns due to regulatory non-compliance.

- Stakeholder trust: Demonstrating commitment to environmental stewardship and responsible resource management.

- Project development: Facilitating the progression of mining projects from exploration to production.

Financial Capital and Access to Funding

Access to ample financial capital is the lifeblood of any business, enabling everything from initial research and development to day-to-day operations and ambitious strategic moves. For Capstone, this means having readily available cash, credit lines, and equity to fuel its growth and innovation.

As of the first quarter of 2025, Capstone reported a healthy liquidity position, with available cash and cash equivalents totaling $1,045 million. This substantial financial cushion is a key resource, underpinning the company's ability to execute its business plan and seize new opportunities in the market.

- Liquidity: Capstone’s available liquidity stood at $1,045 million in Q1 2025, providing a strong foundation for financial activities.

- Funding Sources: The company relies on a mix of cash, credit facilities, and equity to finance its operations and strategic initiatives.

- Operational Capacity: Sufficient financial capital directly supports Capstone's ability to manage its ongoing development and operational needs.

- Strategic Investment: This financial strength allows Capstone to make timely and impactful investments in new projects and market expansions.

Capstone Copper's key resources are multifaceted, encompassing its substantial mineral reserves, vital physical infrastructure, a skilled workforce, essential environmental permits, and robust financial capital. These elements collectively enable the company's mining and processing operations, driving its strategic objectives and market presence.

The company's mineral reserves, particularly its over 11 million tonnes of copper in measured and indicated resources, form the core of its value proposition. Complementing this are its physical assets, including mines and processing plants, and the human capital represented by its over 6,000 employees globally. Financial strength, evidenced by $1,045 million in cash and equivalents as of Q1 2025, further solidifies its operational capacity.

| Resource Type | Description | Key Metric/Value |

|---|---|---|

| Mineral Reserves/Resources | Quantifiable deposits of copper, gold, and iron ore | Over 11 million tonnes of copper (measured & indicated) |

| Physical Assets | Mines, processing plants (concentrators, SX-EW), transportation fleets | New sulphide concentrator at Mantoverde Development Project |

| Human Capital | Skilled workforce including geologists, engineers, operators, management | Over 6,000 employees globally (as of 2024) |

| Intangible Assets | Environmental permits and licenses | DIA environmental permit secured for Mantoverde Optimized |

| Financial Capital | Cash, credit lines, equity | $1,045 million in cash and cash equivalents (Q1 2025) |

Value Propositions

Capstone Copper is committed to delivering a dependable flow of high-quality copper concentrate and copper cathode. These are vital inputs for numerous global industries, and our operational focus ensures a steady supply for our clients.

Our dedication to efficiency and expansion underpins our ability to provide a stable output. For instance, Capstone projects copper production to be between 220,000 and 255,000 tonnes in 2025, demonstrating our capacity to meet market demand.

Capstone's commitment to responsible mining resonates deeply with stakeholders who value ethical operations. This dedication to environmental stewardship, social responsibility, and robust governance attracts customers and investors alike, particularly those focused on sustainability and traceable supply chains.

The company's proactive stance is exemplified by its adopted Sustainable Development Strategy, which includes ambitious targets for reducing greenhouse gas (GHG) emissions. For instance, Capstone aims for a 30% reduction in Scope 1 and 2 GHG emissions intensity by 2030 compared to a 2017 baseline, showcasing a tangible commitment to environmental performance.

Capstone's commitment to operational efficiency, exemplified by initiatives like the Mantoverde Development Project, directly translates to enhanced cost competitiveness. By streamlining processes and optimizing resource allocation, the company targets a significant reduction in production expenses.

This focus on lowering C1 cash costs, with an anticipated 10% to 20% decrease expected in 2025 compared to 2024 figures, enables Capstone to offer more attractive pricing. Such strategic cost management not only bolsters profitability but also creates a distinct advantage in the market, ultimately benefiting shareholders through improved financial performance.

Growth Potential and Project Pipeline

Capstone's value proposition centers on significant future growth, driven by both current operations and a robust pipeline of development projects. Key initiatives like Santo Domingo and Mantoverde Optimized are poised to substantially boost copper production, thereby enhancing long-term shareholder value.

This expansion is not just theoretical. Capstone anticipates a notable increase in its copper output, projecting a rise of 19% to 38% by 2025. This growth trajectory is a core element for investors seeking capital appreciation.

- Future Growth Potential: Value is derived from the anticipated expansion of operations.

- Project Pipeline: Development of projects like Santo Domingo and Mantoverde Optimized is key.

- Production Increase: Expected copper production growth of 19% to 38% in 2025.

- Long-Term Value Enhancement: Focus on increasing output to improve overall company value.

Strong Financial Performance and Shareholder Value

Capstone is committed to delivering robust financial performance and enhancing shareholder value through strategic operational execution. The company prioritizes consistent production levels and diligent cost management, which are foundational to its profitability. Furthermore, Capstone actively pursues growth initiatives designed to drive long-term financial gains.

This focus on profitability is supported by a disciplined approach to capital allocation, ensuring resources are directed towards investments that yield the highest returns. Capstone’s dedication to these principles is reflected in its financial results. For instance, the company achieved a record adjusted EBITDA of $265 million in the first quarter of 2025, underscoring its operational efficiency and market strength.

- Consistent Production: Maintaining high operational uptime and output levels.

- Cost Management: Implementing stringent cost controls across all operations.

- Growth Projects: Advancing strategic development initiatives for future revenue streams.

- Shareholder Value: Focusing on profitability and disciplined capital deployment to maximize returns for investors.

Capstone Copper offers a compelling value proposition built on reliable production of high-quality copper, underpinned by operational efficiency and a clear growth strategy. The company's commitment to sustainability also appeals to a growing segment of environmentally conscious investors and customers.

The company's strategic focus on cost reduction, aiming for a 10% to 20% decrease in C1 cash costs in 2025 compared to 2024, directly enhances its market competitiveness and profitability. This cost discipline, combined with anticipated production increases, positions Capstone for strong financial performance and enhanced shareholder returns.

Capstone's value proposition is further strengthened by its robust project pipeline, including Santo Domingo and Mantoverde Optimized, which are projected to significantly increase copper output. This expansion, targeting a 19% to 38% production rise by 2025, is a key driver for long-term shareholder value appreciation.

| Value Proposition Element | Description | Key Data/Facts |

|---|---|---|

| Reliable Copper Supply | Consistent delivery of high-quality copper concentrate and cathode. | Vital input for numerous global industries. |

| Operational Efficiency & Cost Competitiveness | Streamlined processes and optimized resource allocation. | Targeting 10% to 20% reduction in C1 cash costs in 2025 vs. 2024. |

| Sustainability Commitment | Focus on environmental stewardship, social responsibility, and governance. | Aiming for 30% reduction in Scope 1 & 2 GHG emissions intensity by 2030 (vs. 2017 baseline). |

| Future Growth Potential | Expansion driven by current operations and a strong project pipeline. | Projected 19% to 38% copper production increase by 2025. |

Customer Relationships

Capstone's customer relationships are predominantly forged through direct sales, where long-term contracts are the cornerstone for supplying industrial clients with copper concentrate and cathode. These business-to-business dealings thrive on established trust, dependable delivery, and unwavering product quality.

In 2024, Capstone's strategic focus on these direct, contractual relationships continued to solidify its market position. The company's sales are almost exclusively B2B, reflecting its role as a key supplier within the industrial supply chain, ensuring consistent demand and predictable revenue streams.

Capstone prioritizes transparent communication with both individual and institutional investors. This commitment is demonstrated through regular financial reporting, investor presentations, and prompt responses to shareholder inquiries, all designed to foster trust and attract necessary capital. For instance, in 2024, Capstone held its annual general meeting on May 15th, where key performance indicators and future strategies were discussed with shareholders.

The company actively engages shareholders through various channels, including its investor relations website, which provides access to quarterly earnings reports, SEC filings, and management commentary. Capstone's proactive approach aims to ensure all stakeholders are well-informed about the company's financial health and strategic direction, a practice that has historically contributed to a stable shareholder base.

Capstone actively engages in ongoing dialogue with local communities and governmental bodies, recognizing this as crucial for maintaining its social license to operate. This proactive approach includes regular consultations and a commitment to addressing stakeholder concerns, fostering trust and collaboration on initiatives that yield mutual benefits.

In 2024, Capstone initiated over 50 community consultation sessions across its operational regions, directly engaging with more than 5,000 local residents and representatives. The company also reported a 15% increase in community-led project funding compared to 2023, demonstrating a tangible commitment to shared value creation.

To further solidify these relationships, Capstone is finalizing its comprehensive Social Performance Standard, designed to ensure transparent and constructive interactions. This standard will guide the company's approach to stakeholder engagement, aiming to build enduring partnerships based on shared goals and mutual respect.

Industry Associations and Partnerships

Engaging with industry associations and participating in collaborative initiatives is crucial for Capstone to stay informed about best practices and advocate for responsible mining. These partnerships also foster valuable relationships across the wider mining sector, enabling knowledge exchange and joint problem-solving.

Capstone's commitment to industry standards is highlighted by its Mantos Blancos and Mantoverde mines receiving The Copper Mark in September 2023. This recognition underscores their adherence to responsible production practices.

- Industry Association Engagement: Active participation in mining industry associations allows Capstone to influence policy, share expertise, and stay ahead of regulatory changes.

- Collaborative Initiatives: Partnerships with other mining companies and organizations facilitate the development of shared solutions for common challenges, such as environmental stewardship and community relations.

- Best Practice Adoption: Through these relationships, Capstone gains access to and can implement leading operational and safety practices, enhancing efficiency and sustainability.

- Advocacy for Responsible Mining: Industry associations provide a platform for Capstone to champion responsible mining principles, promoting a positive image for the sector.

Supplier and Contractor Management

Cultivating robust relationships with suppliers and contractors is fundamental to operational efficiency. This involves transparent communication and equitable partnerships, frequently formalized through enduring contracts to guarantee access to essential resources. For instance, in 2024, many businesses reported that strong supplier relationships led to an average cost reduction of 5-10% on procured goods.

- Supplier Reliability: Ensuring consistent quality and on-time delivery of materials and services.

- Cost Negotiation: Leveraging relationships for better pricing and payment terms, contributing to improved profit margins.

- Risk Mitigation: Collaborative problem-solving with suppliers can preempt disruptions and ensure business continuity.

- Innovation Partnerships: Working closely with key suppliers can foster co-development of new products or processes.

Capstone's customer relationships are primarily B2B, focusing on long-term contracts for copper concentrate and cathode with industrial clients. This direct sales approach emphasizes trust, reliability, and quality. In 2024, the company continued to strengthen these relationships, which are key to its consistent revenue and market standing. The company also prioritizes transparent communication with investors, holding regular meetings and providing detailed financial reports to foster trust and secure capital.

Capstone actively engages with local communities and government bodies, recognizing the importance of its social license to operate. In 2024, over 50 community consultations were held, involving more than 5,000 residents, and community project funding increased by 15% compared to 2023. The company also participates in industry associations to share expertise, influence policy, and adopt best practices, as evidenced by its mines receiving The Copper Mark in September 2023.

| Relationship Type | Key Activities | 2024 Data/Focus |

|---|---|---|

| Industrial Clients | Direct Sales, Long-term Contracts | Cornerstone of supply for copper concentrate and cathode |

| Investors | Financial Reporting, Investor Presentations, AGM | Annual General Meeting held May 15th, 2024 |

| Local Communities | Consultations, Project Funding | 50+ consultations, 15% increase in project funding |

| Industry Associations | Policy Influence, Best Practice Adoption | Mines received The Copper Mark (Sept 2023) |

Channels

Capstone Copper’s direct sales and marketing teams are crucial for building and maintaining relationships with industrial clients globally. These teams are responsible for understanding customer needs, negotiating terms, and ensuring smooth product delivery, fostering loyalty and repeat business.

In 2024, Capstone Copper continued to leverage these internal teams to offer customized solutions, a strategy that has proven effective in securing long-term supply agreements with key manufacturers in the automotive and electronics sectors.

Capstone Mining's business model hinges on robust shipping and logistics networks to move its copper concentrate and cathode globally. This involves intricate coordination with port facilities, shipping lines, and ground transport providers. For instance, in 2024, Capstone's Pinto Valley mine in Arizona produced approximately 104,500 tons of copper, all of which required efficient transport to customers.

The cost-effectiveness and reliability of these logistics are paramount. Delays or inefficiencies directly impact Capstone's ability to meet customer demand and manage operational expenses. In 2023, global shipping costs saw fluctuations, underscoring the need for Capstone to secure stable and competitive freight rates to maintain profitability.

Capstone leverages its official website, press releases, and regulatory filings on exchanges like the TSX and ASX to keep investors and financial stakeholders informed. This multi-channel approach ensures broad accessibility to crucial financial results and operational updates, fostering transparency.

In 2024, companies are increasingly focusing on digital investor relations, with website traffic and engagement metrics becoming key indicators of information dissemination effectiveness. For instance, a significant portion of investor queries in the first half of 2024 were directed to company IR websites before consulting other sources.

Industry Conferences and Trade Shows

Attending industry conferences and trade shows is a vital channel for businesses to reach key stakeholders. These events facilitate direct engagement with potential customers, allowing for product demonstrations and immediate feedback. For example, CES 2024, a major consumer electronics trade show, saw over 140,000 attendees and 4,300 exhibitors, highlighting the scale of these opportunities.

These gatherings also serve as crucial platforms for investor outreach and partnership building. By presenting at investor forums or having a booth at a trade show, companies can increase their market visibility and attract funding. In 2024, the global MICE (Meetings, Incentives, Conferences, and Exhibitions) market was projected to reach $987.9 billion, underscoring the economic significance and reach of such events.

- Customer Acquisition: Directly engage with potential buyers, gather leads, and understand customer needs.

- Investor Relations: Network with venture capitalists, angel investors, and financial institutions to secure funding.

- Market Intelligence: Stay abreast of emerging technologies, competitor strategies, and industry trends.

- Brand Building: Enhance brand recognition and establish thought leadership within the industry.

Local Community Outreach Programs

Capstone actively connects with local communities through its dedicated outreach programs. These initiatives are designed to foster open dialogue and address resident concerns directly, ensuring a strong relationship. For instance, in 2024, Capstone invested over $5 million in community development projects across its operational regions, focusing on education and infrastructure improvements.

Community liaison officers serve as key points of contact, facilitating communication between Capstone and local stakeholders. These officers are instrumental in gathering feedback and ensuring that community perspectives are considered in project planning and execution. Public meetings are regularly held to provide transparency and allow for direct engagement on upcoming developments.

- Community Liaison Officers: Dedicated personnel to bridge communication gaps.

- Public Meetings: Regular forums for direct stakeholder engagement and feedback.

- Community Development Initiatives: Investment in local projects to foster goodwill and support social license.

- Social License to Operate: Maintaining community acceptance is paramount for long-term operational success.

Capstone Copper utilizes a multi-faceted approach to reach its diverse stakeholders, encompassing direct sales teams, digital platforms, industry events, and community engagement initiatives. These channels are vital for customer acquisition, investor relations, market intelligence, and maintaining a social license to operate.

In 2024, the company's direct sales and marketing efforts focused on building relationships with industrial clients, securing long-term supply agreements, and offering customized solutions. Simultaneously, robust investor relations strategies, including leveraging official websites and participating in digital investor forums, ensured transparency and accessibility of financial and operational updates.

Industry conferences and trade shows in 2024 provided significant opportunities for direct engagement with potential customers and investors, with the global MICE market's projected value of $987.9 billion underscoring their economic importance.

Capstone's commitment to community engagement, exemplified by over $5 million invested in local development projects in 2024, utilizes community liaison officers and public meetings to foster open dialogue and address resident concerns, ensuring continued social license.

| Channel | Purpose | Key Activities/Examples (2024) | Stakeholder Group |

|---|---|---|---|

| Direct Sales & Marketing Teams | Customer acquisition, relationship management | Customized solutions, long-term supply agreements | Industrial Clients |

| Official Website, Press Releases, Filings | Investor relations, transparency | Dissemination of financial results, operational updates | Investors, Financial Stakeholders |

| Industry Conferences & Trade Shows | Customer engagement, investor outreach, market intelligence | Product demonstrations, networking, presentations | Potential Customers, Investors, Partners |

| Community Outreach Programs | Social license, stakeholder relations | Community development initiatives, public meetings | Local Communities |

Customer Segments

Global Industrial Manufacturers represent our core customer base, a diverse group reliant on copper as a foundational raw material. This segment spans industries such as electrical components, construction, automotive, and consumer electronics, all of which incorporate copper into their production lines.

These manufacturers acquire copper concentrate and copper cathode, essential inputs for their manufacturing processes. For instance, in 2024, the global electrical equipment manufacturing sector alone is projected to utilize a significant portion of the world's copper supply, driven by demand for renewable energy infrastructure and electric vehicles.

The automotive industry, a key consumer, is increasingly incorporating copper in its components due to the rise of electric vehicles, with some EVs using up to 1.5 km of copper wiring. Similarly, the construction sector's demand for copper in wiring and plumbing remains robust, contributing to the overall market need.

Copper traders and brokers are essential intermediaries, connecting Capstone to a broader market. They often purchase copper directly from Capstone, adding value by managing logistics and reselling to a diverse array of smaller industrial clients. For instance, in 2024, the global copper trading market saw significant activity, with major players facilitating billions of dollars in transactions, underscoring the vital role these entities play in ensuring market liquidity and Capstone's reach.

Capstone's strategic partners and joint venture collaborators are crucial for its large-scale mining endeavors, especially at projects like Santo Domingo. These partners often secure a stake in the copper output, effectively becoming customers for a portion of the production, and also contribute to the development of joint sales strategies.

The company is actively engaged in partnership discussions for its Santo Domingo project, indicating a strategic focus on leveraging these relationships to advance its operational and commercial goals. These collaborations are vital for sharing risks and resources in complex mining operations.

Financial Markets and Investors

Financial markets and investors represent a crucial customer segment for Capstone Copper. While they don't directly consume the company's copper output, they invest in its shares, anticipating financial returns derived from Capstone's operational success, expansion plans, and commitment to sustainable practices. This segment's confidence directly impacts the company's valuation and access to capital.

Capstone's shares are readily available to this broad investor base, trading on both the Toronto Stock Exchange (TSX) and the Australian Stock Exchange (ASX). This dual listing provides liquidity and accessibility for a global pool of potential investors. For instance, as of early 2024, the TSX Composite Index had seen significant activity, reflecting broader market sentiment towards resource companies.

- TSX Listing: Provides access to North American capital markets.

- ASX Listing: Offers exposure to the Australian and Asia-Pacific investment community.

- Investor Returns: Driven by company performance, commodity prices, and strategic growth.

- Market Capitalization: A key indicator of investor confidence and company valuation.

Governments and Regulatory Bodies

Governments and regulatory bodies, while not direct customers, are crucial stakeholders whose approval is essential for Capstone's operations. Their requirements for permits, licenses, and compliance with environmental and social standards must be met to ensure legal operation and maintain a social license to operate. For instance, Capstone secured the DIA environmental permit for its Mantoverde Optimized project, demonstrating adherence to regulatory frameworks.

Capstone's engagement with these entities is vital for securing and maintaining operating licenses. This includes complying with mining regulations, environmental protection laws, and labor standards. Failure to meet these requirements can lead to significant operational disruptions and financial penalties.

- Regulatory Compliance: Capstone must adhere to all national and local mining, environmental, and labor laws.

- Permitting and Licensing: Obtaining and renewing permits, such as the DIA environmental permit for Mantoverde, is a continuous requirement.

- Social License: Maintaining positive relationships with government bodies and communities is key to operational continuity and social acceptance.

Capstone's customer segments are diverse, ranging from global industrial manufacturers who directly use copper in their products to financial markets that invest in the company's future. This includes critical intermediaries like copper traders and brokers who ensure market liquidity, as well as strategic partners essential for large-scale mining projects.

Industrial manufacturers, particularly in sectors like electrical equipment and automotive, are major copper consumers. For example, the increasing demand for electric vehicles in 2024 has significantly boosted copper usage, with some EVs requiring substantial amounts of copper wiring. Similarly, the construction industry's consistent need for copper in electrical and plumbing applications underpins ongoing demand.

Financial markets and investors are vital for Capstone's capital needs, valuing the company based on its operational performance and growth prospects. The company's dual listing on the TSX and ASX in 2024 provides broad access to these investors, facilitating capital flow and supporting strategic initiatives.

Cost Structure

Mining and processing operating costs are the direct expenses incurred in extracting copper ore and preparing it for sale. These include labor for miners and plant staff, energy for machinery and operations, essential reagents for processing, and ongoing maintenance for all mining equipment.

Capstone's C1 cash costs are a crucial indicator of their operational efficiency. For 2024, the company has reported C1 cash costs of $1.60 per pound of copper. This figure is expected to see a reduction in 2025, reflecting anticipated improvements in operational efficiencies and cost management strategies.

Capital expenditures are crucial for both keeping things running smoothly and for growth. This includes spending on maintaining existing facilities and equipment, known as sustaining capital. It also covers investments in new projects, technology, or expanding current operations, which is expansionary capital.

For Capstone, a significant portion of its budget is allocated to these capital needs. In 2025, Capstone is projected to invest $315 million in these capital expenditures, covering both the upkeep of its current assets and the development of future growth initiatives.

Exploration and development costs are significant expenses tied to finding new mineral deposits and moving projects from discovery through feasibility studies. These include the costs of geological surveys, extensive drilling programs, and detailed engineering assessments to determine project viability.

Capstone Mining is projecting substantial investment in this area, planning to allocate $25 million towards both brownfield and greenfield exploration initiatives throughout 2025. This investment underscores the company's commitment to expanding its resource base and identifying future growth opportunities.

General and Administrative (G&A) Expenses

General and Administrative (G&A) expenses represent the overhead costs that keep the business running but aren't directly linked to creating products or services. Think of it as the cost of managing the entire operation. This includes things like the salaries for corporate executives and administrative staff, rent for the main office, legal services, and ensuring the company complies with all the rules and regulations.

Keeping a tight rein on G&A is crucial for a company's overall financial health and profitability. For instance, in 2024, many companies focused on streamlining their administrative functions to improve efficiency. A study by Gartner in late 2023 indicated that optimizing G&A could boost operating margins by as much as 2-5% for mature businesses.

Capstone's approach to managing these costs is tied to its corporate scorecard. This scorecard outlines key performance indicators across operational, financial, and strategic areas. Executive compensation is directly influenced by how well these objectives are met, creating a strong incentive to control G&A spending effectively.

- Corporate Salaries: Costs associated with executive and administrative personnel.

- Office Expenses: Rent, utilities, and supplies for non-production facilities.

- Legal & Compliance: Fees for legal counsel and adherence to regulatory requirements.

- Strategic Incentives: Executive compensation linked to scorecard performance, driving G&A efficiency.

Environmental and Social Compliance Costs

Capstone's commitment to environmental and social compliance translates into significant operational expenses. These costs encompass a range of activities, from managing waste and treating water to undertaking reclamation efforts and investing in community development programs. For instance, in 2024, the company allocated $150 million towards its water management initiatives, a key component of its Sustainable Development Strategy.

Adherence to stringent sustainability standards also adds to the cost structure. This includes expenses related to biodiversity protection, such as habitat restoration projects, and ensuring responsible tailings management, a critical area for mining operations. Capstone's 2024 report indicated that biodiversity programs alone accounted for $45 million in expenditures.

- Environmental Compliance: Costs associated with meeting regulations for emissions, waste disposal, and water quality.

- Social Compliance: Expenses for community engagement, development programs, and fair labor practices.

- Reclamation and Remediation: Funds set aside for restoring land after mining activities cease.

- Sustainability Reporting and Audits: Costs incurred to track, measure, and verify progress against ESG targets.

Capstone's cost structure is multifaceted, encompassing direct operating expenses, capital investments, exploration, and administrative overhead. The company's C1 cash costs for copper production were $1.60 per pound in 2024, with efforts underway to reduce this figure. Significant capital expenditures are planned for 2025, totaling $315 million for both sustaining and expansionary projects.

Exploration and development are also key cost drivers, with $25 million earmarked for 2025 to discover and advance new mineral deposits. General and Administrative (G&A) expenses are managed through a corporate scorecard that links executive compensation to efficiency, aiming to optimize overhead. Furthermore, substantial investments are made in environmental and social compliance, including water management and biodiversity protection, reflecting a commitment to sustainable operations.

| Cost Category | 2024 (Actual/Estimate) | 2025 (Projected) | Notes |

|---|---|---|---|

| C1 Cash Costs (per lb Cu) | $1.60 | Targeting reduction | Reflects operational efficiency |

| Capital Expenditures | N/A | $315 million | Sustaining and expansionary |

| Exploration & Development | N/A | $25 million | Brownfield and greenfield |

| G&A Expenses | Managed via scorecard | Focus on efficiency | Influenced by executive compensation |

| Environmental & Social Compliance | $150 million (Water Management) | Ongoing investment | Includes reclamation, biodiversity |

Revenue Streams

Capstone Copper's main income comes from selling copper concentrate, which is copper ore that's been processed to have a lot of copper in it. This concentrate is then sold to smelters and refineries globally.

In 2024, the company achieved a significant milestone with record consolidated copper production reaching 184,460 tonnes. This output directly fuels their primary revenue stream through sales to international buyers.

Capstone's primary revenue stream is the sale of copper cathode, a highly refined copper product essential for manufacturers. This refined copper is the direct output of their leaching and electrowinning processes.

To manage price volatility, Capstone employs zero-cost copper collars. This strategy aims to secure break-even pricing for a portion of their higher-cost copper cathode production, providing a degree of financial stability.

Capstone's mining operations frequently yield valuable by-products beyond their primary focus, including gold, silver, molybdenum, and iron ore. For instance, the Santo Domingo project is a source for these additional revenue streams.

The revenue generated from selling these by-products plays a significant role in bolstering Capstone's total income and can effectively reduce the company's operational cash expenses.

In the first quarter of 2025, by-product credits were instrumental in lowering Capstone's C1 cash costs, demonstrating their positive impact on cost efficiency.

Future Revenue from New Projects

The commissioning of development projects such as Santo Domingo and Mantoverde Optimized is poised to be a significant driver of future revenue. These projects are anticipated to boost overall copper output substantially, with Mantoverde Optimized alone expected to contribute an additional 20,000 tonnes of copper annually. This increased production directly translates to higher sales volumes and, consequently, enhanced revenue generation.

Beyond primary copper production, these new ventures may unlock additional revenue streams through the extraction and sale of associated minerals. As these projects move from development to full operational status, the potential for diversified income sources will further solidify long-term revenue growth, making them critical components of the business model.

- Increased Copper Production: Mantoverde Optimized to add 20,000 tonnes of copper per annum.

- New Revenue Streams: Potential for income from associated minerals alongside copper.

- Long-Term Growth: Projects are designed to ensure sustained revenue expansion.

Hedging and Commodity Price Management

Capstone actively manages commodity price risk to secure its revenue. For instance, the company utilizes strategies like zero-cost copper collars to shield itself from adverse price movements.

These hedging instruments help stabilize revenue by establishing a floor price for a portion of its copper output. This approach provides a degree of certainty regarding the realized price of their production, even amidst market volatility.

- Hedging Strategy: Implementation of zero-cost copper collars to mitigate price risk.

- Revenue Stabilization: Securing a minimum realized price for a portion of copper production.

- 2025 Outlook: Approximately 20,000 tonnes of copper hedged via zero-cost collars for 2025.

Capstone Copper's revenue is primarily generated from the sale of copper concentrate and cathode, with significant contributions from by-products like gold and silver. The company's 2024 performance saw consolidated copper production reach 184,460 tonnes, directly feeding these sales channels.

Looking ahead, the development of projects like Santo Domingo and Mantoverde Optimized is crucial for future revenue growth. Mantoverde Optimized alone is projected to add 20,000 tonnes of copper annually, enhancing sales volumes and potentially unlocking new income from associated minerals.

To mitigate price volatility, Capstone employs hedging strategies, such as zero-cost copper collars, to secure a minimum realized price for a portion of its production. For 2025, approximately 20,000 tonnes of copper are hedged through these instruments, aiming to stabilize revenue streams.

| Revenue Source | 2024 Production (tonnes) | Key By-products | Future Growth Driver | Hedging Strategy (2025) |

| Copper Concentrate/Cathode | 184,460 | N/A | Mantoverde Optimized (+20,000 tonnes/year) | Zero-cost collars (approx. 20,000 tonnes) |

| By-products (Gold, Silver, etc.) | Varies | Gold, Silver, Molybdenum, Iron Ore | Santo Domingo project | N/A |

Business Model Canvas Data Sources

The Business Model Canvas is constructed using a blend of primary customer feedback, competitive analysis, and financial projections. This multi-faceted approach ensures a comprehensive and data-driven understanding of the business landscape.