CAPITEC SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CAPITEC Bundle

Capitec's innovative digital-first approach and strong customer loyalty are significant strengths, but potential regulatory shifts and intense competition present key challenges. Understanding these dynamics is crucial for anyone looking to invest or strategize within the South African banking sector.

Want the full story behind Capitec's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Capitec's digital banking leadership is a significant strength, evidenced by its substantial growth in active app clients. By the end of February 2024, the bank reported a 17% increase in active app clients, reaching 5.4 million. This robust digital adoption translates into operational efficiencies and enhanced customer convenience, lessening the need for extensive physical branch networks.

Capitec's ability to attract and retain clients is a significant strength, with its active client base exceeding 24 million. This figure signifies that the bank now serves over half of South Africa's adult population, demonstrating remarkable market penetration.

This extensive reach is a direct result of Capitec's successful strategy of making banking services accessible and affordable to the mass market. The bank's focus on simplicity and low fees has clearly resonated, driving substantial client growth.

Capitec's strength lies in its diversified revenue streams, moving beyond traditional lending. Non-interest income now forms a significant part of its earnings, demonstrating a robust and varied business model.

This diversification is fueled by strong growth in areas like insurance and value-added services. Furthermore, its expanding business banking segment is contributing substantially to this income mix, showcasing strategic expansion.

For the financial year ending February 2024, Capitec reported a notable increase in its net transaction and commission income, highlighting the success of its non-interest income strategy.

Strong Financial Performance

Capitec's financial performance is a significant strength, marked by consistent growth and impressive profitability metrics. This resilience is a testament to its effective operational strategies and market positioning.

The bank has demonstrated substantial increases in key financial indicators. For the financial year ending February 2025, headline earnings surged by 30%, reaching R13.7 billion. This robust growth underscores the strength and adaptability of Capitec's business model in the current economic climate.

- Headline Earnings Growth: 30% increase for FY25 to R13.7 billion.

- Return on Equity: Consistently strong, indicating efficient capital utilization.

- Resilient Business Model: Proven ability to deliver results across varying market conditions.

Simplified and Affordable Banking Model

Capitec's commitment to a simplified and affordable banking model is a significant strength, directly appealing to a large segment of the market seeking transparent and cost-effective financial services. This approach has cultivated strong customer trust and loyalty, a crucial asset in the competitive banking landscape.

This streamlined operational strategy translates into lower overheads and enhanced scalability, enabling Capitec to serve a wider customer base efficiently. For instance, as of the fiscal year ending February 2024, Capitec reported a notable increase in its active client base, reaching over 22 million clients, a testament to the appeal of its accessible banking model.

- Simplified Product Offering: Focus on essential banking services reduces complexity for customers and operational costs for the bank.

- Affordable Fee Structure: Competitive pricing on accounts and transactions attracts price-sensitive consumers.

- Transparent Operations: Clear communication about fees and services builds customer confidence.

- Scalable Business Model: The efficient, technology-driven approach allows for rapid expansion of services and customer reach.

Capitec's digital banking leadership is a significant strength, evidenced by its substantial growth in active app clients. By the end of February 2024, the bank reported a 17% increase in active app clients, reaching 5.4 million. This robust digital adoption translates into operational efficiencies and enhanced customer convenience, lessening the need for extensive physical branch networks.

Capitec's ability to attract and retain clients is a significant strength, with its active client base exceeding 24 million. This figure signifies that the bank now serves over half of South Africa's adult population, demonstrating remarkable market penetration.

This extensive reach is a direct result of Capitec's successful strategy of making banking services accessible and affordable to the mass market. The bank's focus on simplicity and low fees has clearly resonated, driving substantial client growth.

Capitec's strength lies in its diversified revenue streams, moving beyond traditional lending. Non-interest income now forms a significant part of its earnings, demonstrating a robust and varied business model.

This diversification is fueled by strong growth in areas like insurance and value-added services. Furthermore, its expanding business banking segment is contributing substantially to this income mix, showcasing strategic expansion.

For the financial year ending February 2024, Capitec reported a notable increase in its net transaction and commission income, highlighting the success of its non-interest income strategy.

Capitec's financial performance is a significant strength, marked by consistent growth and impressive profitability metrics. This resilience is a testament to its effective operational strategies and market positioning.

The bank has demonstrated substantial increases in key financial indicators. For the financial year ending February 2025, headline earnings surged by 30%, reaching R13.7 billion. This robust growth underscores the strength and adaptability of Capitec's business model in the current economic climate.

| Metric | FY24 Data | FY25 Data | Growth |

|---|---|---|---|

| Headline Earnings | R10.5 billion (approx.) | R13.7 billion | 30% |

| Active App Clients | 4.6 million (approx.) | 5.4 million | 17% |

| Total Active Clients | 22 million (approx.) | 24 million | ~9% |

What is included in the product

Delivers a strategic overview of CAPITEC’s internal and external business factors by examining its strong brand, digital innovation, and customer-centric approach, alongside potential challenges like increased competition and regulatory changes.

Uncovers key competitive advantages and potential threats for Capitec, enabling proactive strategy adjustments.

Weaknesses

Capitec's substantial client base, particularly those with lower incomes, makes it vulnerable to South Africa's economic challenges. High inflation and interest rates, prevalent in 2024 and projected into 2025, directly affect these clients' capacity to manage debt. This vulnerability can translate into a rise in loan defaults and a subsequent increase in credit impairments for the bank.

Capitec's pursuit of growth has led to elevated operating expenses, notably in IT infrastructure and cloud services. These investments, crucial for digital advancement, contributed to a 12% increase in operating expenses for the six months ending August 31, 2023, reaching R7.5 billion.

Furthermore, staff incentives aimed at retaining talent during this expansionary phase also added to the cost base. Balancing these necessary expenditures with profitability remains a key operational challenge for the bank.

Capitec's significant reliance on advanced technology and cloud infrastructure, while a key enabler of its digital banking model, introduces a notable technology concentration risk. This dependence means that any major system outage, cyberattack, or data breach affecting these core platforms could severely disrupt operations and impact a large customer base.

For instance, a widespread failure in their core banking system or a successful ransomware attack could halt transaction processing, mobile app functionality, and ATM services, leading to immediate financial losses and significant reputational damage. The concentration of critical functions within a few key technological domains amplifies the potential impact of any single point of failure.

Credit Impairment Pressures

Despite Capitec's efforts to refine its lending practices, the prevailing economic climate continues to exert pressure on credit quality. This can translate into a higher incidence of loan defaults and, consequently, increased loan losses for the bank.

While Capitec anticipates its credit loss ratio to stabilize and revert to its target levels, this remains a critical area requiring diligent risk management. For instance, in its financial results for the year ended February 29, 2024, Capitec reported a credit loss ratio of 6.5%.

- Challenging Economic Environment: Persistent inflation and interest rate volatility can strain borrowers' repayment capacity.

- Credit Quality Pressures: Even with tightened lending standards, economic downturns can lead to an uptick in non-performing loans.

- Loan Loss Provisions: The bank must maintain adequate provisions to cover potential future credit losses, impacting profitability.

- Risk Management Focus: Continuous monitoring and adaptation of credit policies are essential to mitigate these inherent risks.

Intensifying Competition in Business Banking

As Capitec broadens its business banking services, it encounters intense rivalry from both traditional large financial institutions and nimble fintech disruptors. This crowded marketplace demands continuous innovation and sharp pricing strategies to stand out.

The challenge is amplified as Capitec aims to capture market share in a segment where incumbents have long-standing customer relationships and extensive infrastructure. For instance, in the first half of 2024, South Africa's business banking sector saw major players like Standard Bank and FNB reporting robust growth in their business client numbers, indicating the entrenched nature of the competition.

- Established Banks: Incumbents possess deep pockets and established trust, making it difficult for new entrants to gain significant traction.

- Fintech Agility: Newer digital-first players can often offer more specialized or cost-effective solutions, appealing to specific business needs.

- Innovation Imperative: Capitec must consistently develop unique value propositions to attract and retain business clients amidst this dynamic landscape.

- Pricing Pressures: Competitive pressures can lead to margin erosion, requiring careful management of service costs and pricing models.

Capitec's reliance on a customer base with lower incomes makes it susceptible to economic downturns, potentially increasing loan defaults. For example, the bank's credit loss ratio stood at 6.5% for the year ended February 29, 2024, highlighting ongoing credit quality pressures. Furthermore, significant investments in IT infrastructure, contributing to a 12% rise in operating expenses to R7.5 billion in the six months ending August 31, 2023, strain profitability. This technological dependence also presents a concentration risk, where system failures could severely impact operations.

| Weakness | Description | Impact |

|---|---|---|

| Economic Vulnerability | Customer base with lower incomes sensitive to inflation and interest rates. | Increased loan defaults, higher credit impairments. |

| Elevated Operating Expenses | Investments in IT, cloud services, and staff incentives. | Pressure on profitability, need for cost management. |

| Technology Concentration Risk | Heavy reliance on core banking systems and cloud infrastructure. | Vulnerability to cyberattacks, system outages, and data breaches. |

| Credit Quality Pressures | Economic climate impacting borrower repayment capacity. | Potential for increased non-performing loans and loan losses. |

Preview the Actual Deliverable

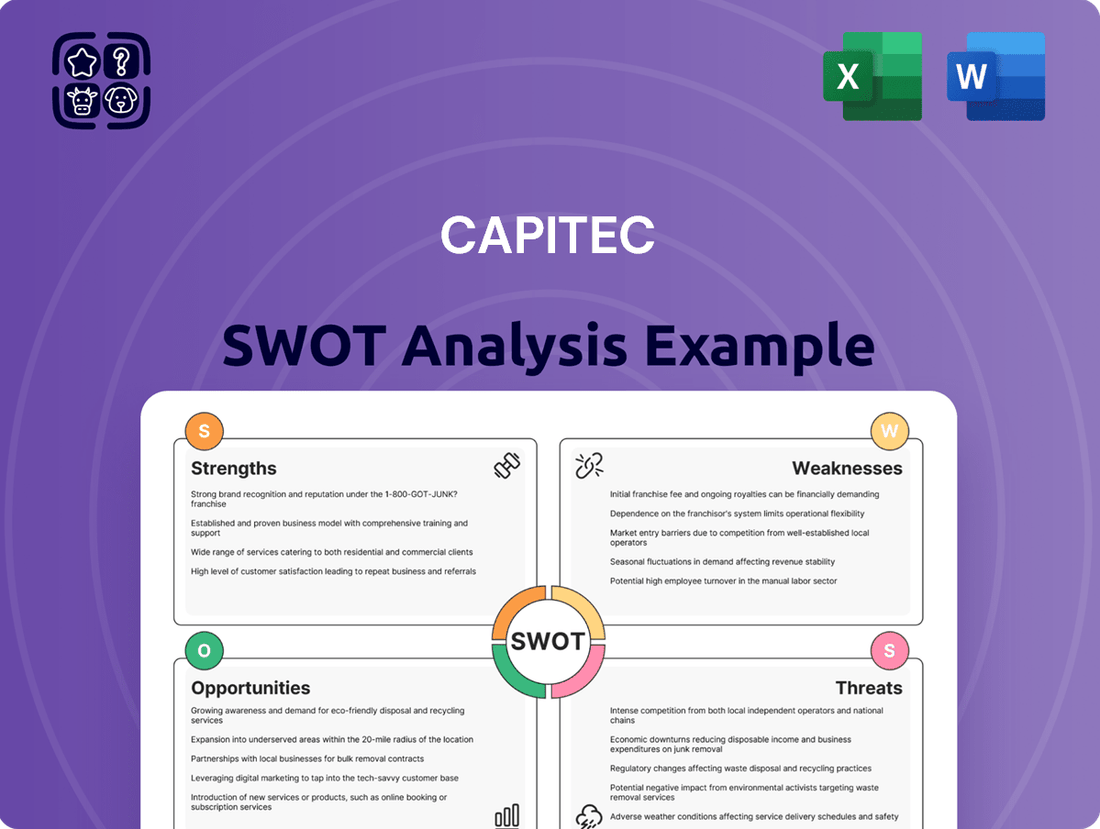

CAPITEC SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. It details Capitec's Strengths, Weaknesses, Opportunities, and Threats, providing a comprehensive overview. You’re viewing a live preview of the actual SWOT analysis file; the complete version becomes available after checkout.

Opportunities

Capitec is well-positioned to expand its reach into the business banking sector, particularly targeting the vast small, micro, and medium-sized enterprise (SME) market, including the often underserved informal economy. This represents a significant growth avenue.

Developing specialized digital lending solutions and establishing dedicated business centers could attract a substantial number of SMEs. For instance, in 2024, the SME sector in South Africa contributed significantly to the GDP, showcasing the immense potential market for Capitec's services.

Capitec's continued investment in advanced data analytics and AI presents a significant opportunity to gain deeper client insights. By leveraging these technologies, the bank can develop more personalized and proactive financial solutions, thereby enhancing the overall customer experience and improving operational efficiency.

For instance, in 2024, digital channels accounted for a substantial portion of Capitec's transactions, demonstrating the growing reliance on and effectiveness of their digital platforms. This trend is expected to continue, allowing for more sophisticated data-driven product development and service delivery.

Capitec's strategic push to broaden its insurance products under its own license is a significant growth opportunity. This allows for greater control and customization, potentially leading to higher customer uptake and retention.

The expansion of value-added services, such as the Capitec Connect mobile virtual network operator (MVNO), is another key avenue. These services not only diversify revenue streams by contributing to non-interest income but also strengthen the bank's ecosystem, fostering deeper customer engagement.

In 2024, Capitec reported a notable increase in its insurance contributions, with gross written premiums showing a healthy upward trend, indicating growing customer trust and adoption of their insurance solutions.

Deepening Financial Inclusion

Capitec's core mission to offer accessible and affordable banking services in South Africa is a significant opportunity to expand financial inclusion. By continuing to simplify financial products and reach underserved communities, the bank can onboard millions more individuals into the formal financial system.

This focus aligns with broader economic development goals, and Capitec is well-positioned to capitalize on this. For instance, in 2023, Capitec reported a 10% increase in its client base, reaching 21.6 million active clients, demonstrating its capacity to scale its inclusion efforts.

- Expanding reach to the unbanked: South Africa still has a significant portion of its population without formal banking access, presenting a large untapped market.

- Developing simplified products: Creating even more user-friendly and low-cost banking solutions can attract and retain new customers.

- Leveraging digital channels: Further enhancing mobile and online platforms can lower operational costs and increase accessibility for remote populations.

- Partnerships for impact: Collaborating with government initiatives or NGOs focused on financial literacy can amplify inclusion efforts.

Strategic Partnerships and International Exploration

Capitec's strategic vision includes exploring new avenues for growth through partnerships and international expansion. The bank is considering venturing into markets like Poland and Mexico, aiming to diversify its revenue streams beyond its core South African operations. This move aligns with a broader strategy of seeking new growth frontiers.

While South Africa remains Capitec's bedrock, geographical diversification is a key element of its long-term strategy. This approach offers significant future potential by tapping into different economic landscapes and customer bases.

- International Market Exploration: Targeting Poland and Mexico as potential expansion markets.

- Strategic Partnership Potential: Identifying opportunities for collaborations to enhance service offerings and reach.

- Diversification Benefits: Reducing reliance on a single market and capturing new growth opportunities.

Capitec's expansion into business banking, especially for SMEs and the informal sector, presents a substantial growth opportunity, given the sector's significant GDP contribution in 2024. The bank's ongoing investment in data analytics and AI allows for personalized solutions, building on the increasing digital transaction volumes seen in 2024. Furthermore, broadening its insurance offerings and developing value-added services like Capitec Connect are key to diversifying revenue and deepening customer engagement, as evidenced by increased insurance contributions in 2024.

Capitec can further enhance financial inclusion by simplifying products and reaching unbanked populations, mirroring its 2023 client base growth of 10% to 21.6 million. The bank's strategic exploration of international markets, such as Poland and Mexico, offers a pathway to diversify revenue streams beyond South Africa.

| Opportunity Area | Description | 2024/2025 Data/Context |

|---|---|---|

| SME Banking Expansion | Targeting small, micro, and medium-sized enterprises (SMEs) and the informal economy. | SME sector's significant GDP contribution in South Africa. |

| Data Analytics & AI | Developing personalized and proactive financial solutions. | Increasing reliance on digital channels for transactions. |

| Insurance & Value-Added Services | Broadening insurance products and offering services like MVNOs. | Notable increase in insurance contributions and gross written premiums. |

| Financial Inclusion | Expanding access to banking for unbanked and underserved communities. | 10% client base growth in 2023, reaching 21.6 million active clients. |

| International Market Exploration | Venturing into new geographical markets like Poland and Mexico. | Strategic diversification to capture new growth frontiers. |

Threats

Ongoing economic challenges in South Africa, such as persistent high inflation and volatile interest rates, present a substantial threat to Capitec. For instance, South Africa's headline inflation averaged 5.9% in 2023, remaining above the South African Reserve Bank's target range of 3-6%, which necessitates continued tight monetary policy.

These macroeconomic headwinds can directly dampen consumer spending power, leading to increased defaults on loans and a general slowdown in credit uptake, which are core to Capitec's business model. Furthermore, potential fiscal deterioration could lead to increased sovereign risk, impacting the broader financial sector's stability and Capitec's operating environment.

The South African financial sector is a battleground, with established players and agile fintech disruptors aggressively pursuing customers. This fierce rivalry can squeeze Capitec's profit margins and make it harder to attract new clients.

In 2024, the banking sector saw continued growth in digital offerings, with fintechs leveraging lower overheads to offer competitive pricing, potentially impacting Capitec's market share in certain segments.

As a digital-first bank, Capitec is constantly exposed to evolving cybersecurity threats, including sophisticated phishing attempts and malware. A significant data breach in 2024, for instance, could compromise millions of customer accounts, leading to direct financial theft and a severe erosion of confidence in the bank's security infrastructure.

The financial and reputational fallout from such a breach would be substantial, potentially costing millions in remediation and regulatory fines. For example, in 2023, a major bank faced over $50 million in fines for data security lapses, a figure Capitec would aim to avoid through robust defenses.

Regulatory and Compliance Challenges

The evolving regulatory landscape, particularly concerning financial crime prevention and the implications of South Africa's grey-listing by the Financial Action Task Force (FATF), poses significant compliance hurdles for Capitec. These ongoing challenges necessitate continuous investment in robust risk management frameworks and adherence to increasingly stringent requirements, potentially impacting operational costs and strategic agility.

Capitec must navigate a complex web of regulations designed to combat financial crime, money laundering, and terrorist financing. The grey-listing status, which was maintained through 2024 and continues to be a point of focus in early 2025, amplifies the scrutiny on South African financial institutions. This heightened oversight demands rigorous compliance measures and can affect international correspondent banking relationships, potentially increasing the cost of doing business.

- Increased Compliance Costs: Adhering to evolving anti-money laundering (AML) and know-your-customer (KYC) regulations requires significant investment in technology, personnel, and training.

- Reputational Risk: Failure to meet regulatory standards, especially in light of the grey-listing, can damage Capitec's reputation and erode customer trust.

- Operational Disruptions: Stricter regulatory enforcement could lead to operational adjustments, potentially impacting service delivery or product offerings.

- Potential Fines and Penalties: Non-compliance can result in substantial financial penalties, impacting profitability and shareholder value.

Credit Risk Management

Despite Capitec's robust credit assessment and collection strategies, the fundamental risk inherent in lending persists, especially given economic uncertainties. A significant economic downturn could unexpectedly elevate the rate of non-performing loans, impacting profitability.

For instance, during periods of economic stress, such as the global financial crisis or localized recessions, banks often see an uptick in defaults. Capitec, like its peers, must remain vigilant. In the fiscal year ending February 2024, Capitec reported a net credit impairment charge of R10.3 billion, indicating the ongoing management of potential loan losses.

- Economic Volatility: A sudden economic slowdown could increase the number of clients unable to repay loans.

- Rising Interest Rates: Higher interest rates can strain borrowers' ability to service debt, increasing default risk.

- Regulatory Changes: Evolving credit regulations could impose stricter lending criteria or increase compliance costs, indirectly affecting credit risk management.

- Competitive Pressures: Intense competition in the lending market might lead to a relaxation of credit standards to gain market share, thereby increasing credit risk exposure.

Capitec faces significant threats from South Africa's volatile economic climate, characterized by persistent inflation and fluctuating interest rates, which directly impact consumer spending and loan repayment capabilities. Intense competition from both traditional banks and agile fintech companies further pressures profit margins and customer acquisition. Cybersecurity vulnerabilities and evolving regulatory demands, including the implications of South Africa's grey-listing, present substantial compliance and reputational risks.

| Threat Category | Specific Threat | 2023/2024 Impact/Data | 2024/2025 Outlook |

|---|---|---|---|

| Economic Instability | High Inflation & Interest Rates | South Africa's headline inflation averaged 5.9% in 2023; interest rates remained elevated. | Continued economic uncertainty likely to strain consumer finances. |

| Competition | Fintech Disruption | Digital banking growth intensified in 2024, with fintechs offering competitive pricing. | Ongoing pressure on market share and pricing power. |

| Cybersecurity | Data Breaches | Major banks faced fines exceeding $50 million in 2023 for security lapses. | Constant threat of sophisticated attacks requiring significant investment in defense. |

| Regulatory Environment | Grey-listing & AML/KYC Compliance | South Africa remained grey-listed through 2024, increasing compliance burdens. | Heightened scrutiny and potential for increased operational costs and penalties. |

SWOT Analysis Data Sources

This CAPITEC SWOT analysis is built upon a robust foundation of verified financial statements, comprehensive market research reports, and informed industry expert commentary. This ensures a data-driven and accurate assessment of the company's strategic position.